Choosing the right cryptocurrency exchange can be hard with so many options. If you’re looking at Bybit and BYDFi, you need to understand how they compare in terms of fees, available cryptocurrencies, and trading features. Both platforms offer different strengths, with Bybit known for its competitive fees and strong customer support, while BYDFi has its own set of features that might better match your trading needs.

When comparing these exchanges, you’ll want to consider aspects like security measures, trading types, and user experience. The differences between Bybit and BYDFi can significantly impact your trading success and overall satisfaction. As of March 2025, both platforms continue to evolve their offerings in the competitive crypto exchange marketplace.

Bybit vs BYDFi: At A Glance Comparison

When choosing between Bybit and BYDFi, it helps to see their key differences side by side. Both platforms offer cryptocurrency trading services but have distinct features that might make one more suitable for your needs.

Trading Features Comparison:

| Feature | Bybit | BYDFi |

|---|---|---|

| User Interface | More advanced | User-friendly |

| Trading Types | Spot, futures, options | Spot, futures |

| Fee Structure | Competitive maker/taker fees | Generally competitive fees |

| Supported Cryptocurrencies | Wide selection | Moderate selection |

| Mobile App | Robust functionality | Basic functionality |

BYDFi (formerly BitYard) focuses on creating a simple trading experience. You’ll find it easier to navigate if you’re new to crypto trading.

Bybit offers more advanced trading options and tools. This makes it potentially better for experienced traders who need sophisticated features.

Security Measures:

Both exchanges implement strong security protocols to protect your assets. They use two-factor authentication (2FA) and cold storage solutions to safeguard funds.

Geographical Availability:

Availability varies by region. You should check if either platform serves your country before creating an account.

The right choice depends on your trading style and experience level. New traders might prefer BYDFi’s simpler approach, while experienced traders could benefit from Bybit’s advanced features.

Bybit vs BYDFi: Trading Markets, Products & Leverage Offered

Bybit and BYDFi both offer crypto leverage trading, but with notable differences in their offerings. Understanding these differences can help you choose the platform that best suits your trading needs.

Bybit provides traders with up to 100x leverage on major cryptocurrency pairs. The platform features spot trading, futures contracts, options, and copy trading functionality. It has gained popularity among experienced traders for its advanced charting tools and deep liquidity.

BYDFi, on the other hand, offers more aggressive leverage options of up to 200x on certain trading pairs. This higher leverage potential might appeal to traders looking to maximize position sizes with minimal capital.

Trading Products Comparison:

| Feature | Bybit | BYDFi |

|---|---|---|

| Maximum Leverage | Up to 100x | Up to 200x |

| Spot Trading | Yes | Yes |

| Futures | Yes | Yes |

| Options | Yes | Limited |

| Copy Trading | Yes | No |

BYDFi stands out for its compliance with U.S. regulations, making it accessible to American traders, unlike many high-leverage platforms. This regulatory compliance gives you an additional layer of security when trading.

Both platforms offer a variety of trading pairs, though Bybit typically provides a wider selection of altcoins and trading options. Your choice might depend on whether you prioritize variety (Bybit) or higher leverage potential (BYDFi).

For advanced traders, Bybit offers more sophisticated trading tools and deeper liquidity pools, while BYDFi provides a more straightforward approach with higher leverage possibilities.

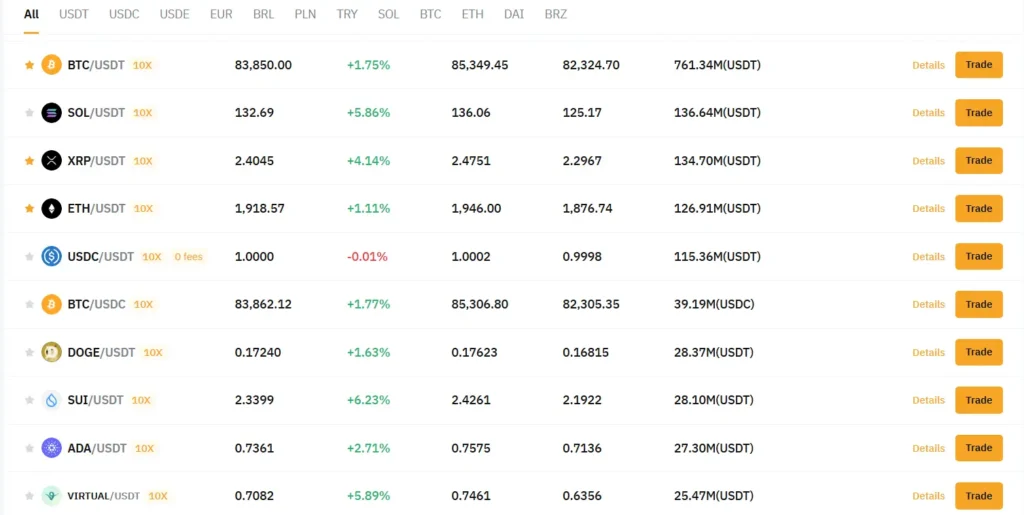

Bybit vs BYDFi: Supported Cryptocurrencies

Bybit and BYDFi both offer a variety of cryptocurrencies for trading, but they differ in the number and types of coins available on their platforms.

Bybit supports over 300 cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). You’ll also find many altcoins and emerging tokens on their platform.

BYDFi offers a smaller selection with approximately 200+ cryptocurrencies. While this is fewer than Bybit, BYDFi still covers all the major coins and popular altcoins that most traders look for.

Key Cryptocurrency Support Comparison:

| Feature | Bybit | BYDFi |

|---|---|---|

| Total cryptocurrencies | 300+ | 200+ |

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Stablecoins (USDT, USDC) | ✓ | ✓ |

| DeFi tokens | Wide selection | Limited selection |

| New coin listings | Frequent | Less frequent |

Bybit typically adds new cryptocurrencies more quickly than BYDFi. This makes Bybit a better choice if you want to trade newly launched or trending tokens.

Both exchanges support cryptocurrency pairs with stablecoins like USDT and USDC. However, Bybit offers more trading pairs overall, giving you more flexibility in how you trade your crypto.

If you’re interested in DeFi tokens or newer cryptocurrencies, Bybit’s larger selection might better suit your needs. For traders focused on mainstream cryptocurrencies, both platforms provide sufficient options.

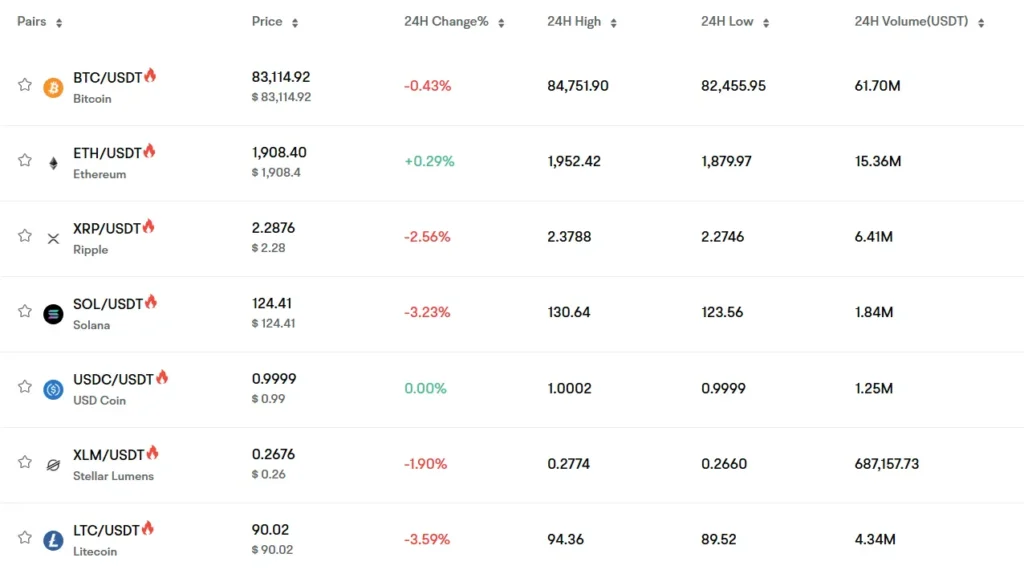

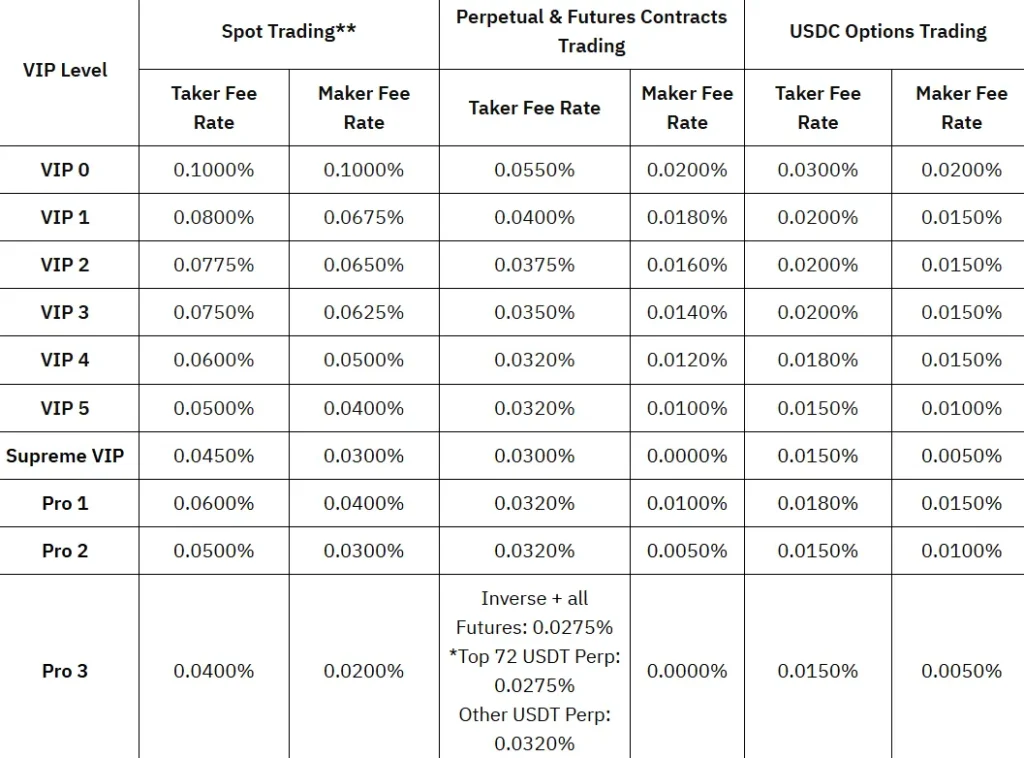

Bybit vs BYDFi: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and BYDFi, understanding their fee structures can help you make a better decision for your trading needs.

Bybit maintains a straightforward fee structure with a maker fee of 0.025% and a taker fee of 0.075%. These competitive rates apply across their trading options.

For perpetual contracts on Bybit, you’ll also need to account for funding fees paid every 8 hours. This is standard for perpetual futures trading.

BYDFi also offers competitive trading fees, though they differ slightly from Bybit. Both platforms aim to keep costs reasonable for regular traders.

| Fee Type | Bybit | BYDFi |

|---|---|---|

| Maker Fee | 0.025% | Similar competitive rates |

| Taker Fee | 0.075% | Similar competitive rates |

| Funding Fee | Every 8 hours (perpetuals) | Applies to perpetual contracts |

Both exchanges offer various deposit methods, though specifics may vary. You should check the current deposit options on each platform before deciding.

Withdrawal fees differ based on the cryptocurrency you’re withdrawing. These fees can change based on network conditions and token values.

Both platforms understand the importance of reasonable fees to attract and retain traders. They regularly update their fee structures to stay competitive in the market.

Before choosing either exchange, review their current fee schedules directly on their websites, as these can change over time.

Bybit vs BYDFi: Order Types

Both Bybit and BYDFi offer various order types to help you execute trades according to your strategy. Understanding these options can improve your trading experience.

Bybit provides a comprehensive range of order options. You can use basic order types like market orders, limit orders, and stop orders. For more advanced trading, Bybit offers conditional orders that execute only when certain market conditions are met.

Conditional orders on Bybit give you more control over trade entry and exit points. These differ from traditional limit orders because they remain inactive until your specified price condition is triggered.

BYDFi also supports essential order types including market, limit, and stop orders. These allow you to execute trades with precision based on your preferred price points.

The main difference between the platforms lies in their advanced order options. Bybit generally offers more sophisticated conditional orders and advanced trading tools compared to BYDFi.

Bybit Order Types:

- Market orders

- Limit orders

- Stop orders

- Conditional orders

- Take profit/stop loss orders

BYDFi Order Types:

- Market orders

- Limit orders

- Stop orders

- Basic conditional options

If you prioritize advanced order execution methods, Bybit might better suit your needs. However, BYDFi covers all the essential order types that most traders regularly use.

Bybit vs BYDFi: KYC Requirements & KYC Limits

Both Bybit and BYDFi implement Know Your Customer (KYC) procedures to verify user identities and prevent illegal activities. These requirements affect your trading experience on each platform.

Bybit requires users to complete KYC verification to access full platform features. Their verification system helps identify customers and analyze risk profiles, which is essential for preventing money laundering and other illicit activities.

BYDFi also employs KYC and Anti-Money Laundering (AML) security measures to protect users and prevent fraudulent transactions. Their verification process is designed to be straightforward for new traders.

Geographic Restrictions:

- Bybit: Does not allow US citizens to trade on their platform. They use strict KYC procedures to enforce this restriction.

- BYDFi: Has fewer geographic restrictions, making it more accessible to a wider range of users.

Verification Levels:

Both exchanges offer different verification tiers that unlock higher trading limits and features. Higher verification levels typically require more documentation but provide greater account flexibility.

The verification processes generally require personal information, government-issued ID, and sometimes proof of address or a selfie with your ID.

For most traders, completing at least basic KYC verification is recommended to avoid sudden account limitations and ensure smooth withdrawals of your funds.

Bybit vs BYDFi: Deposits & Withdrawal Options

When choosing between Bybit and BYDFi, understanding how you can move your funds in and out of each platform is crucial. Both exchanges offer various methods for deposits and withdrawals, but they differ in key aspects.

Bybit features a fast and efficient deposit and withdrawal process. Your funds are credited to your account quickly, which is essential during volatile market conditions. Bybit supports cryptocurrency deposits with no fees, though withdrawal fees vary by cryptocurrency.

BYDFi also offers cryptocurrency deposit options but may have different fee structures. The platform supports various cryptocurrencies for both deposits and withdrawals.

Supported Payment Methods:

| Method | Bybit | BYDFi |

|---|---|---|

| Cryptocurrency | ✓ | ✓ |

| Bank Transfer | ✓ | Limited |

| Credit/Debit Cards | ✓ | Limited |

| Third-party Payment | ✓ | ✓ |

Processing Times vary between the platforms. Bybit typically processes crypto withdrawals within 30 minutes. BYDFi’s processing times may differ based on the cryptocurrency and network congestion.

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication. Bybit adds an extra layer of security with withdrawal address whitelisting.

You should consider withdrawal limits when choosing an exchange. Bybit tends to offer higher withdrawal limits for verified users compared to BYDFi, though both have KYC requirements for larger transactions.

Remember that withdrawal fees can significantly impact your overall trading costs, especially if you make frequent withdrawals. Compare the specific fees for your preferred cryptocurrencies before deciding.

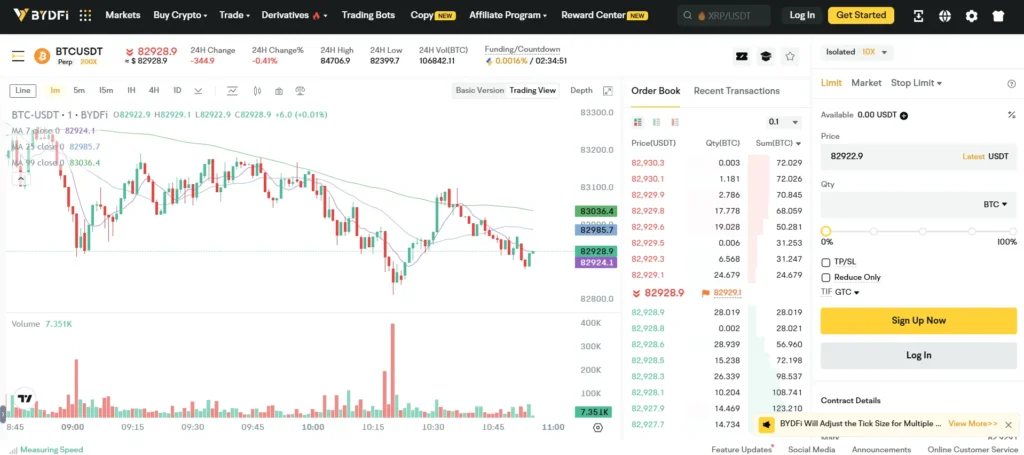

Bybit vs BYDFi: Trading & Platform Experience Comparison

When choosing between Bybit and BYDFi, the trading platform experience can make a big difference in your success.

Bybit offers a more polished interface that many traders find easier to navigate. Its platform supports both spot and futures trading with advanced charting tools.

BYDFi (formerly BitYard) provides a simpler platform that might appeal to beginners. However, it still includes essential trading features you need.

Trading Features Comparison:

| Feature | Bybit | BYDFi |

|---|---|---|

| Interface | More sophisticated | Simpler, beginner-friendly |

| Trading Types | Spot, Futures, Options | Spot, Futures |

| Charting Tools | Advanced | Basic to intermediate |

| Mobile App | Highly rated | Functional but less robust |

Bybit has a slightly lower fee structure compared to BYDFi. This can save you money, especially if you trade frequently or with larger amounts.

Both platforms offer demo accounts where you can practice trading without risking real money. This is helpful if you’re new to crypto trading.

Bybit’s platform handles high trading volume better, with fewer reports of lagging during market volatility. This reliability is crucial when prices move quickly.

BYDFi stands out with its copy trading feature, letting you automatically follow experienced traders’ moves. This can be valuable if you’re still learning trading strategies.

Choose Bybit if you want more advanced tools and can handle a steeper learning curve. Pick BYDFi if you prefer simplicity and social trading features.

Bybit vs BYDFi: Liquidation Mechanism

Liquidation is when your trading position is forcibly closed because you lack enough funds to maintain it. Both Bybit and BYDFi have liquidation mechanisms to protect their platforms.

Bybit’s liquidation process is often described as strict. When your margin ratio falls below a certain threshold, Bybit will close your position to prevent further losses. This helps protect the exchange and other traders, but can be harsh if you’re not prepared.

Some traders have reported confusion with Bybit’s liquidation process, especially when stop losses were set but positions were still liquidated. This can happen during high volatility periods.

BYDFi appears to have similar liquidation mechanisms in place, though detailed information is more limited. Like Bybit, they implement liquidations to maintain platform stability.

Key factors affecting liquidation on both platforms:

- Market volatility

- Position size

- Leverage used

- Available margin

- Stop loss settings

To avoid liquidation on either platform, consider using lower leverage and setting appropriate stop losses. Always maintain sufficient margin in your account.

Both exchanges provide liquidation warnings, but these may come too late during fast market movements. It’s your responsibility to monitor positions closely when using leverage.

Remember that high leverage increases both potential profits and the risk of liquidation. Start with smaller positions until you understand how each platform’s liquidation system works.

Bybit vs BYDFi: Insurance

When trading cryptocurrency, insurance coverage is crucial for your protection. Both Bybit and BYDFi offer insurance funds, but they differ in significant ways.

Bybit maintains a substantial insurance fund to protect users against auto-deleveraging (ADL) during market volatility. As of 2025, Bybit’s insurance fund exceeds $300 million, providing strong protection for traders.

BYDFi also offers an insurance fund, though it’s considerably smaller than Bybit’s. BYDFi’s fund is designed primarily to cover losses from liquidations that occur below bankruptcy price.

Here’s a comparison of their insurance coverage:

| Feature | Bybit | BYDFi |

|---|---|---|

| Insurance Fund Size | $300M+ | Smaller (exact amount undisclosed) |

| Coverage Type | Protects against ADL | Covers liquidation losses |

| Transparency | Regular public updates | Limited disclosure |

| User Protection Level | High | Moderate |

Neither platform offers FDIC-like insurance for cryptocurrency holdings. This is standard in the industry, as government-backed insurance typically doesn’t cover digital assets.

You should note that both platforms use their insurance funds differently during extreme market events. Bybit tends to have more resources to handle large market swings without affecting users.

For added security, both platforms recommend using two-factor authentication and other security measures to protect your account.

Bybit vs BYDFi: Customer Support

Customer support is a key factor when choosing a crypto exchange. Both Bybit and BYDFi offer support options, but there are notable differences between them.

Bybit places a strong emphasis on customer support. They provide 24/7 assistance through multiple channels including live chat, email, and an extensive help center. You can expect quick responses, usually within minutes for live chat.

Their support team is available in several languages, making it accessible for global users. Bybit also maintains active community forums where you can find answers to common questions.

BYDFi’s customer support system is less comprehensive. They offer email support and a basic help center, but response times can be longer compared to Bybit. You might wait several hours or even a day for email responses.

Live chat support on BYDFi is available but not 24/7, which could be problematic if you encounter issues during off-hours. Their documentation is adequate but not as extensive as Bybit’s.

Support Comparison

| Feature | Bybit | BYDFi |

|---|---|---|

| 24/7 Support | Yes | No |

| Live Chat | Yes | Limited hours |

| Email Support | Yes | Yes |

| Response Time | Minutes | Hours |

| Languages | Multiple | Fewer options |

| Help Center | Extensive | Basic |

If customer support is a priority for you, Bybit generally offers the more robust option. Their faster response times and around-the-clock availability give them an edge in this category.

Bybit vs BYDFi: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bybit and BYDFi offer strong security features to protect your assets.

Bybit implements multi-signature wallets and cold storage solutions for user funds. This approach keeps most assets offline, away from potential online threats.

Two-factor authentication (2FA) is available on both platforms, adding an extra layer of protection to your account. This feature requires a second verification step when logging in.

BYDFi also uses cold storage for user funds, similar to Bybit. This security measure helps protect your crypto from hacking attempts.

Both exchanges conduct regular security audits to check for vulnerabilities. These proactive measures help identify and fix potential issues before they become problems.

Bybit has built a solid reputation for security with no major breaches reported. The platform takes a comprehensive approach to keeping user assets safe.

BYDFi offers similar security protocols but has less history in the market compared to Bybit. Their security features appear comparable on paper.

Key Security Features Comparison:

| Feature | Bybit | BYDFi |

|---|---|---|

| Cold Storage | Yes | Yes |

| Two-Factor Authentication | Yes | Yes |

| Multi-signature Wallets | Yes | Limited info available |

| Security Audits | Regular | Regular |

| Track Record | Strong history | Newer platform |

Remember to enable all available security features when setting up your account on either platform. This includes using strong passwords and activating 2FA immediately.

Is Bybit A Safe & Legal To Use?

Bybit has established itself as a reputable cryptocurrency exchange with strong security measures. However, its legal status varies depending on where you live.

For US Citizens: Bybit is not legal to use if you’re in the United States. The platform was banned in the US due to regulatory concerns and non-compliance with US financial laws.

For Non-US Users: Trading on Bybit is generally considered safe. The platform implements strict security protocols to protect user assets and information.

If you want to use Bybit, you’ll need to complete their KYC (Know Your Customer) verification process. This is one of several restrictions the platform has in place.

Legal Alternatives for US Users:

- BYDFi and other US-compliant exchanges

- Regulated platforms that have proper licensing

It’s worth noting that using Bybit while in the US could put your funds at risk. US authorities have taken action against non-compliant exchanges in the past.

Before choosing any exchange, you should verify its legal status in your country. Trading on unauthorized platforms might expose you to unnecessary legal and financial risks.

As of March 2025, the regulatory landscape continues to evolve. Always check the most current regulations before making trading decisions.

Is BYDFi A Safe & Legal To Use?

BYDFi prioritizes security for its users, implementing strong measures to protect funds and personal information. The platform guards against unauthorized access and potential cyber threats, making it a trustworthy option for traders.

One of BYDFi’s advantages is its regulatory compliance. Unlike Bybit, which faces restrictions in the United States, BYDFi operates legally in more jurisdictions, including the US.

The platform holds multiple licenses, enhancing its legitimacy and trustworthiness. This regulatory compliance means you can trade with greater confidence regarding the platform’s legal status.

For new traders specifically, BYDFi offers a demo trading option. This feature allows you to practice without risking real money while learning the platform’s features.

When comparing user experience, BYDFi generally provides a smoother interface than competitors like Bybit. This user-friendly design makes navigation easier, especially if you’re new to cryptocurrency trading.

Key Security Features:

- Protection against unauthorized access

- Safeguards for personal information

- Cyber threat prevention systems

- Regulatory compliance in multiple jurisdictions

You should always use two-factor authentication (2FA) and strong passwords regardless of which platform you choose. While BYDFi implements strong security measures, practicing good security habits remains essential for protecting your digital assets.

Frequently Asked Questions

Here are answers to the most common questions about the key differences between Bybit and BYDFi trading platforms. These answers cover everything from features and fees to security measures and supported cryptocurrencies.

What are the primary differences in features between Bybit and BYDFi platforms?

Bybit offers more advanced trading features compared to BYDFi, including futures trading with higher leverage options and a wider range of order types. Bybit also provides a more robust set of tools for technical analysis.

BYDFi, while newer to the market, focuses on user-friendly interfaces that make cryptocurrency trading more accessible to beginners. BYDFi’s simplified dashboard and guided trading processes help new users navigate the crypto market.

Both platforms offer spot trading, but Bybit typically has higher trading volumes, which can result in better liquidity for major cryptocurrency pairs.

How do the fees for trading on Bybit compare to those on BYDFi?

Bybit typically charges a maker fee of 0.1% and a taker fee of 0.1% for spot trading, which is standard in the industry. Their derivatives trading fees are slightly lower at 0.06% for takers and 0.01% for makers.

BYDFi often offers more competitive fees, especially for new users, with promotional rates and volume-based discounts. Their standard spot trading fees start around 0.1% but can go lower based on trading volume.

Both platforms offer fee discounts when using their native tokens for fee payment, similar to other major exchanges like Binance or Coinbase.

What are the security measures implemented by Bybit and BYDFi to protect users’ assets?

Bybit employs multi-signature cold wallets for storing most user funds, with only a small portion kept in hot wallets for daily operations. They also use two-factor authentication (2FA) and advanced encryption protocols to protect user accounts.

BYDFi implements similar security standards with cold storage solutions and regular security audits. They focus on compliance with regulatory requirements in multiple jurisdictions to ensure safe trading environments.

Both platforms offer insurance funds to protect users against extreme market volatility and potential losses during exceptional market conditions.

How do Bybit and BYDFi differ in terms of their user interface and trading experience?

Bybit features a more technical interface designed for experienced traders with advanced charting tools, multiple order types, and comprehensive market data. The platform can seem overwhelming for beginners but provides everything advanced traders need.

BYDFi offers a cleaner, more intuitive interface aimed at making cryptocurrency trading accessible to newcomers. Their simplified order process and educational resources help users understand trading concepts.

Mobile app experiences differ as well, with Bybit offering a feature-rich but complex app, while BYDFi focuses on simplicity and essential functions that work well on smaller screens.

What customer support options are available for Bybit and BYDFi users?

Bybit provides 24/7 customer support through live chat, email, and an extensive knowledge base. Their support team typically responds within minutes for urgent issues and within 24 hours for standard queries.

BYDFi offers similar customer support channels but places special emphasis on helping new users with guided support options. They provide tutorial videos and step-by-step guides for common procedures.

Both platforms maintain active community forums and social media presence where users can find additional help from both staff and other traders.

What cryptocurrencies are available for trading on Bybit and BYDFi, and how do they compare?

Bybit supports over 150 cryptocurrencies for spot trading and offers futures contracts for major tokens like Bitcoin, Ethereum, and other large-cap altcoins. Their selection covers most major projects in the crypto space.

BYDFi offers a more limited selection of around 100 cryptocurrencies, focusing on established projects rather than newer, riskier tokens. This curation can be helpful for beginners who might be overwhelmed by too many options.

Both platforms regularly add new tokens after security and compliance reviews, with Bybit typically adding new cryptocurrencies faster than BYDFi due to their larger operation scale.

BYDFi vs Bybit Conclusion: Why Not Use Both?

After comparing BYDFi and Bybit, it’s clear that each platform has unique strengths. BYDFi offers a smoother user experience according to recent 2025 comparisons, making it more accessible for beginners.

Bybit, on the other hand, has established itself with robust trading features that many experienced traders appreciate. Its interface might have a steeper learning curve but provides more advanced tools.

Why choose just one platform? Using both exchanges gives you the best of both worlds. You can take advantage of BYDFi’s user-friendly interface when you want simplicity, and switch to Bybit when you need more advanced trading options.

This dual approach also helps with:

- Risk management: Spreading your assets across platforms reduces exposure

- Fee optimization: Use whichever platform offers better rates for specific transactions

- Feature access: Enjoy unique tools from both platforms

- Promotional benefits: Access special offers and bonuses from both exchanges

You might find BYDFi better for daily trading while Bybit works better for complex strategies. The crypto market changes fast, and having access to multiple platforms keeps your options open.

Many successful traders use multiple exchanges rather than limiting themselves to just one. This flexibility can be a strategic advantage in your crypto journey.