Choosing between Bybit and BloFin for your crypto trading needs can be confusing with both platforms offering competitive features in 2025. Each exchange has its own strengths that might appeal to different types of traders.

Bybit scores higher overall with a 7.9 rating compared to BloFin, offering one of the highest leveraged trading options in the market along with strong security features. BloFin, while available in over 150 countries, has a slightly smaller global reach than Bybit.

You’ll find different fee structures, trading tools, and user experiences between these exchanges. Their approaches to security, supported cryptocurrencies, and special features vary in ways that might make one more suitable for your specific trading style and goals.

Bybit Vs BloFin: At A Glance Comparison

When choosing between Bybit and BloFin for your crypto trading needs in 2025, understanding their key differences can help you make the right decision.

Trading Options

| Feature | Bybit | BloFin |

|---|---|---|

| Leverage Trading | Up to 100x | Available with 300+ perpetual swap contracts |

| Copy Trading | Available | Featured as a highlight |

| Security | Near-foolproof security | Advanced security features |

Bybit stands out as a well-regarded exchange with deep liquidity, especially in leveraged trading markets. Its user-friendly platform makes it accessible even if you’re new to crypto trading.

BloFin positions itself as an advanced centralized crypto exchange. Its standout features include extensive futures trading options and copy trading capabilities that let you follow successful traders.

User Experience

Both platforms offer accessible trading experiences, but they target slightly different user needs. Bybit focuses on providing a balance of advanced features while maintaining ease of use.

BloFin emphasizes its advanced trading capabilities, making it potentially more appealing if you’re looking for sophisticated trading options.

When comparing overall scores, some reviews indicate Bybit has scored higher (around 7.9) in comprehensive evaluations of crypto exchanges. However, both platforms continue to evolve their offerings to meet trader demands in 2025.

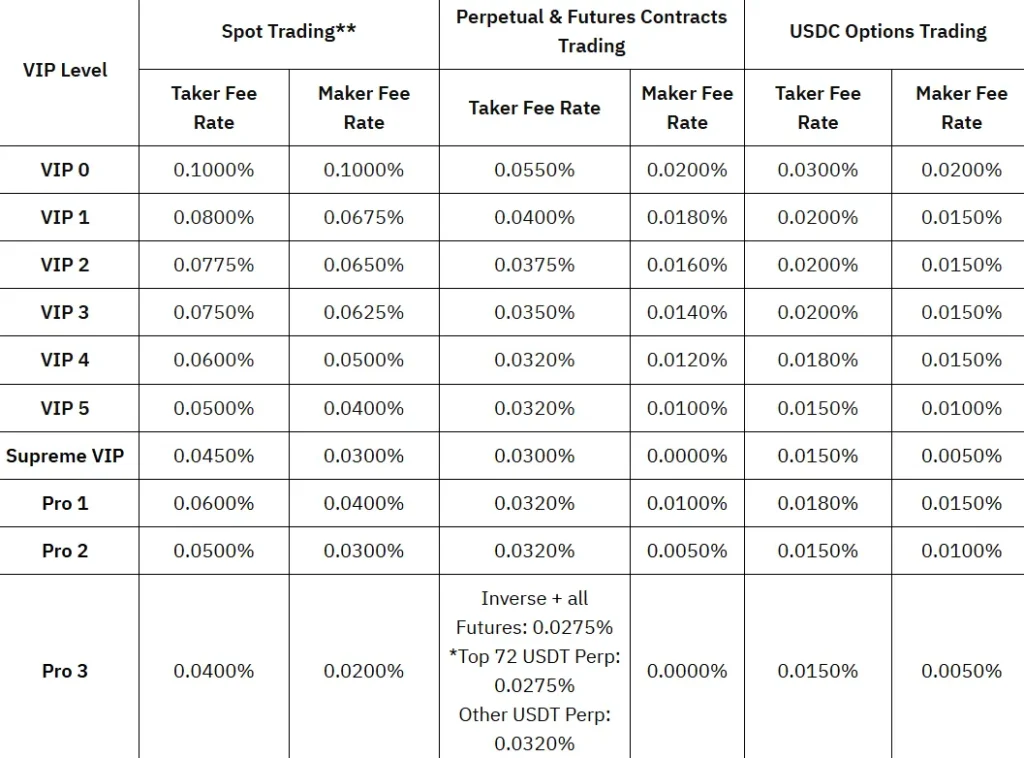

Bybit Vs BloFin: Trading Markets, Products & Leverage Offered

Bybit and BloFin offer various trading options for crypto investors. Let’s compare what each platform provides.

Bybit features extensive market options with spot trading, futures, and options. You can access hundreds of cryptocurrencies on their platform, making it suitable for diverse trading strategies.

BloFin similarly offers spot trading and futures markets but with a slightly different selection of assets. Both platforms support major cryptocurrencies like Bitcoin and Ethereum.

Leverage options differ significantly between these exchanges:

| Exchange | Maximum Leverage | Special Features |

|---|---|---|

| Bybit | Up to 200x | No liquidation before entry, zero fees, flexible redemption |

| BloFin | Up to 150x (on Bitcoin futures) | Similar to other top-tier exchanges |

Bybit’s higher leverage allows for potentially larger positions with less capital. However, remember that higher leverage means higher risk of losses.

Both platforms provide contract options including perpetual contracts and delivery futures. You can choose between USDT-margined or coin-margined contracts depending on your preference.

The trading interfaces on both platforms include advanced charting tools and order types. You’ll find limit, market, and stop orders available to execute your trading strategies effectively.

For beginners, Bybit may offer a more intuitive experience with its user-friendly interface. BloFin targets traders looking for specific features in futures trading.

Bybit Vs BloFin: Supported Cryptocurrencies

Bybit and BloFin both offer a wide range of cryptocurrencies for trading, but there are some notable differences in their offerings.

Bybit supports over 150 cryptocurrencies for spot trading, including major coins like Bitcoin, Ethereum, and Solana. You can trade these assets directly or through perpetual contracts.

BloFin, while newer to the market, provides access to over 300 perpetual swap contracts as highlighted in the search results. This gives you more options for futures trading compared to many competitors.

Key Cryptocurrency Categories Available:

| Category | Bybit | BloFin |

|---|---|---|

| Major Coins (BTC, ETH) | ✓ | ✓ |

| Altcoins | 150+ | 200+ |

| Perpetual Contracts | 100+ | 300+ |

| DeFi Tokens | ✓ | ✓ |

Both platforms regularly add new cryptocurrencies to their listings. You’ll find that BloFin has made expanding their perpetual swap offerings a priority.

For US-based traders, it’s worth noting that both platforms appear in searches about crypto futures trading platforms available in the United States, though regulations may affect available coins.

If you’re interested in leverage trading, both exchanges offer this feature. Bybit provides leverage of up to 100x on popular cryptocurrencies like Bitcoin and Ethereum.

Bybit Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and BloFin, fees play a crucial role in your decision-making process. Both exchanges have different fee structures that can impact your trading profits.

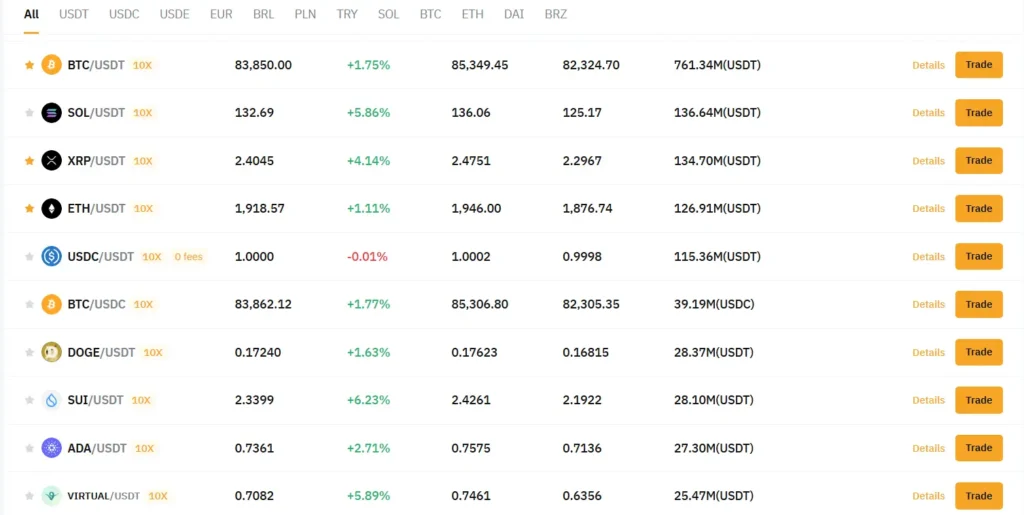

Bybit offers competitive rates with spot trading fees at 0.1% for both makers and takers. For futures trading, the fees are even lower at 0.055% for takers and 0.02% for makers.

BloFin also charges trading fees, though specific rates aren’t detailed in the search results. What we do know is that BloFin charges for withdrawals, with fixed fees that vary by cryptocurrency.

Bybit stands out with its 12+ VIP tier system, allowing frequent traders to access progressively lower fees. The exchange is also noted for not overcharging on withdrawals, making it cost-effective for moving your assets.

Fee Comparison Table:

| Fee Type | Bybit | BloFin |

|---|---|---|

| Spot Trading (Maker) | 0.1% | Not specified |

| Spot Trading (Taker) | 0.1% | Not specified |

| Futures Trading (Maker) | 0.02% | Not specified |

| Futures Trading (Taker) | 0.055% | Not specified |

| Withdrawals | Low, varies by crypto | Fixed fees, varies by crypto |

| VIP Tiers | 12+ tiers | Not specified |

You should consider these fee structures alongside other factors like available trading pairs, security features, and platform usability when deciding which exchange better suits your needs.

Bybit Vs BloFin: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading experience. Both Bybit and BloFin offer various order options to help you execute trades effectively.

Bybit provides a comprehensive set of order types divided into basic and advanced categories. Their basic options include market and limit orders that let you buy or sell at current prices or set specific price points.

BloFin also offers market and limit orders as fundamental trading tools. According to the search results, BloFin allows you to close positions directly on the K-line chart or place reverse orders if you already have a position open.

Basic Order Types Available on Both Platforms:

- Market orders (execute at current market price)

- Limit orders (execute at a specified price or better)

For advanced traders, Bybit includes conditional orders and other sophisticated options to help manage risk and automate trading strategies.

BloFin supports over 300 perpetual swap contracts for futures trading, making it attractive for derivative traders. Their platform includes real-time charts and technical indicators to help you make informed decisions when placing orders.

Both exchanges provide tools to help you visualize and execute trades efficiently. Your choice between them might depend on which specific advanced order types better suit your trading style.

Bybit Vs BloFin: KYC Requirements & KYC Limits

When trading crypto, KYC (Know Your Customer) requirements can impact your experience. Both Bybit and BloFin have different approaches to user verification.

Bybit requires KYC to identify customers and analyze risk profiles. This helps prevent money laundering and other illegal activities. Bybit may request KYC verification at any point to approve withdrawal requests.

BloFin takes a more relaxed approach to KYC. You can trade without completing verification initially. However, if you want to withdraw more than 20,000 USDT, you’ll need to provide personal verification.

KYC Comparison Table:

| Platform | Initial KYC | Withdrawal Limits Without KYC |

|---|---|---|

| Bybit | Required | May be restricted |

| BloFin | Not required | Up to 20,000 USDT |

For US-based traders, it’s important to note that Bybit faces regulatory challenges. Due to strict US requirements, Bybit’s availability and features may be limited in your region.

BloFin operates as a centralized exchange with some features similar to hybrid exchanges. You can access advanced trading tools while maintaining some privacy at lower withdrawal amounts.

Your choice between these platforms may depend on how much personal information you’re comfortable sharing and what withdrawal limits you need for your trading activity.

Bybit Vs BloFin: Deposits & Withdrawal Options

Both Bybit and BloFin offer multiple ways to fund your account and withdraw your assets. Understanding these options can help you choose the platform that best fits your needs.

Bybit Deposit Methods:

- Cryptocurrency deposits

- Bank transfers

- Credit/debit cards

- Third-party payment processors

Bybit supports a wide range of cryptocurrencies for deposits, making it convenient for users who already hold digital assets. Withdrawal processing on Bybit typically takes 24-48 hours with multiple signature verification for enhanced security.

BloFin Deposit Methods:

- Cryptocurrency deposits

- Bank transfers

- Credit/debit cards

BloFin also offers cryptocurrency deposits as their primary funding method. The platform supports over 300 trading pairs, which means you have flexibility in which assets you can deposit and withdraw.

| Feature | Bybit | BloFin |

|---|---|---|

| Crypto deposits | Yes | Yes |

| Fiat deposits | Yes | Yes |

| Withdrawal time | 24-48 hours | 1-3 days |

| Withdrawal fees | Variable | Variable |

Both exchanges implement two-factor authentication (2FA) for withdrawals to protect your funds. This adds an extra layer of security when you’re moving assets off the platform.

Transaction fees vary depending on the cryptocurrency and withdrawal method you choose. It’s worth checking the current fee structure on both platforms before making your decision.

Bybit Vs BloFin: Trading & Platform Experience Comparison

Both Bybit and BloFin offer strong trading experiences, but they differ in key areas that might matter to you.

Bybit stands out with its leverage options of up to 200x, allowing you to amplify your trading potential. The platform has a robust risk management system that includes both isolated and cross-margin trading options.

BloFin excels with over 300 perpetual swap contracts, giving you more variety in futures trading. Their copy trading feature is particularly helpful if you want to follow successful traders’ strategies.

User Interface Comparison:

- Bybit: Intuitive, user-friendly design with clear navigation

- BloFin: Advanced interface with comprehensive trading tools

Bybit offers zero fees and flexible redemption options, which can save you money on frequent trades. Their “no liquidation before entry” feature provides an extra layer of security for your investments.

Trading Features:

| Feature | Bybit | BloFin |

|---|---|---|

| Leverage | Up to 200x | Competitive leverage options |

| Contracts | Multiple options | 300+ perpetual swaps |

| Copy Trading | Limited | Robust system |

| Risk Management | Isolated & cross-margin | Standard protection features |

BloFin’s centralized exchange model focuses on advanced trading capabilities. You’ll find their platform particularly suitable if you’re interested in sophisticated trading strategies.

Your experience will depend on your priorities. Choose Bybit for high leverage and straightforward trading, or BloFin for wider contract selection and copy trading features.

Bybit Vs BloFin: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation process is crucial for managing risk. Both Bybit and BloFin have mechanisms to protect their platforms when trades go against users.

Bybit’s Liquidation Process:

Bybit uses a mark price system to trigger liquidations. This helps protect traders from sudden market spikes that could cause premature liquidations.

The platform offers different margin modes including:

- Isolated Margin (for Unified Trading Accounts)

- Cross Margin

- Portfolio Margin

Your account enters liquidation when your position falls below the maintenance margin requirement. Bybit is known for deep liquidity in leveraged trading markets, which can help with more orderly liquidations.

BloFin’s Liquidation Approach:

BloFin also implements a structured liquidation process for leveraged positions. The exchange focuses on maintaining stability during volatile market conditions.

Your positions on BloFin will face liquidation when they fall below the required margin thresholds.

Key Differences:

| Feature | Bybit | BloFin |

|---|---|---|

| Margin Types | Multiple options (Isolated, Cross, Portfolio) | Standard margin system |

| Liquidation Trigger | Mark Price | Market conditions |

| Liquidity | Deep liquidity for smoother liquidations | Growing liquidity pool |

Understanding these differences can help you choose the platform that best fits your trading style and risk tolerance. Both platforms aim to maintain fair liquidation processes while protecting their ecosystems.

Bybit Vs BloFin: Insurance

When choosing a crypto exchange, insurance protection is crucial for your peace of mind. Both Bybit and BloFin offer insurance options, but with some key differences.

BloFin stands out with its comprehensive insurance for customer funds. According to recent reviews, BloFin maintains a strict 1:1 proof of reserve policy that ensures your assets are fully backed.

Bybit also offers insurance protection, though their coverage details aren’t as prominently featured in the search results. Their insurance fund works to protect traders against bankruptcy and unexpected market movements.

Here’s a quick comparison of their insurance features:

| Feature | BloFin | Bybit |

|---|---|---|

| Proof of Reserve | 1:1 policy | Available but less emphasized |

| Customer Funds Insurance | Comprehensive coverage | Basic protection |

| Insurance Transparency | Highly transparent | Moderate transparency |

BloFin adds extra security through its wallet-as-a-service system. This provides an additional layer of protection for your assets beyond standard insurance.

Both exchanges use KYT (Know Your Transaction) processes, but BloFin specifically mentions this as part of their security infrastructure to identify and prevent suspicious activities.

You should consider insurance as one of several factors when choosing between these platforms. Remember that strong insurance policies can make a significant difference if the exchange faces security issues or financial troubles.

Bybit Vs BloFin: Customer Support

When choosing between crypto exchanges, customer support quality can make a big difference in your trading experience. Both Bybit and BloFin offer various support options, but they differ in some key areas.

Bybit provides 24/7 customer support through live chat, email, and an extensive help center. Their response times typically range from a few minutes on live chat to 24 hours for email inquiries. Many users report positive experiences with Bybit’s support team.

BloFin also offers round-the-clock support, primarily through their chat system and help articles. Based on user feedback, BloFin’s response times can be slightly longer than Bybit’s during peak trading hours.

Support Channels Comparison:

| Feature | Bybit | BloFin |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Phone Support | Limited | No |

| Help Center | Comprehensive | Basic |

| Multilingual Support | 13+ languages | 8+ languages |

Bybit seems to have an edge with more comprehensive documentation and tutorials for beginners. Their help center contains detailed guides on platform features, trading strategies, and troubleshooting.

BloFin’s support team receives positive marks for technical knowledge, especially regarding futures trading issues. However, their documentation isn’t as extensive as Bybit’s.

Both exchanges offer community support through social media channels and forums where you can find answers to common questions from other users.

Bybit Vs BloFin: Security Features

When choosing between Bybit and BloFin, security should be at the top of your priority list. Both exchanges have implemented strong measures to protect your assets.

Bybit features a robust escrow system that acts as your best friend when trading. This system holds funds securely until transactions are completed. The platform also offers traditional security options comparable to industry leader Binance.

BloFin promotes itself as having top-tier security for traders seeking advanced features. The exchange has built its reputation around protecting high-volume trading activities.

Key Security Features Comparison:

| Feature | Bybit | BloFin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Escrow System | Advanced | Standard |

| Security Audit History | Extensive | Growing |

Bybit’s triple-layer security approach gives you extra protection against potential threats. This multi-layered defense helps safeguard your crypto assets even during high trading volumes.

BloFin focuses on centralized security protocols designed for advanced traders. Their system is particularly tailored to protect futures trading and perpetual swap contracts.

You should consider enabling all available security features regardless of which platform you choose. This includes using strong passwords, activating 2FA, and regularly monitoring your account for unusual activity.

Is Bybit Safe & Legal To Use?

Bybit maintains strong security measures including two-factor authentication (2FA) and multi-signature requirements for withdrawals. The platform conducts regular security audits to protect user funds and accounts.

For U.S. residents, Bybit’s legal status is complicated. Based on search results, Bybit has “cracked down on Americans” and faces “harsh regulatory requirements in the US.” This suggests U.S. citizens may face restrictions when trying to use the platform.

Bybit may require KYC (Know Your Customer) verification at any point to approve withdrawal requests. This means you might need to verify your identity even if initial signup doesn’t require it.

Important considerations for U.S. users:

- American users appear to be seeking alternatives to Bybit for leverage trading

- Regulatory compliance issues make Bybit legally questionable for U.S. residents

- Your access could be limited or terminated if identified as a U.S. user

Security features:

- Two-factor authentication (2FA)

- Multi-signature withdrawal process

- Regular security audits

Before using Bybit, you should research the current legal status in your country. Regulations change frequently in the crypto space, and what’s permitted today might not be tomorrow.

Is BloFin Safe & Legal To Use?

BloFin appears to be a legitimate cryptocurrency exchange platform that follows regulatory requirements. According to search results, it is regulated by relevant financial authorities and adheres to strict security protocols.

The platform implements KYC (Know Your Customer) verification, which is a standard security measure in the financial industry. This verification process helps prevent users from restricted countries from accessing the platform.

BloFin accepts users from over 150 countries and regions. However, this coverage is more limited compared to competitors like Bybit and BingX.

If you’re considering using BloFin, you should check if your country is on their approved list. The platform’s KYC verification will block access if you’re residing in a restricted location.

Key security features include:

- Regulatory compliance

- KYC verification

- Security protocols

It’s important to note that cryptocurrency exchanges operate in a rapidly evolving regulatory landscape. Rules can change quickly in different jurisdictions.

Before trading on BloFin, you should:

- Verify it’s legal in your jurisdiction

- Understand the platform’s security measures

- Research their customer protection policies

- Review their terms of service carefully

Always practice proper security measures when using any cryptocurrency exchange, such as enabling two-factor authentication and using strong passwords.

Frequently Asked Questions

Traders comparing BloFin and Bybit often have specific concerns about features, costs, and usability. Both platforms offer distinctive advantages that may appeal to different types of cryptocurrency traders.

What are the key differences between the services offered by Bybit and BloFin?

Bybit and BloFin differ primarily in their specialized offerings. BloFin excels with over 300 perpetual swap contracts and advanced copy trading functionality, making it attractive for futures traders.

Bybit has traditionally focused on derivatives trading but has expanded its spot market offerings. The platform is known for its institutional-grade infrastructure.

BloFin supports deposits and withdrawals in more than 80 fiat currencies, providing greater flexibility for international users. Both platforms offer mobile apps, but their feature emphasis reflects their target audiences.

How do the fees and pricing structures compare between Bybit and BloFin?

BloFin offers competitive trading fees that decrease with higher trading volumes. Their fee structure rewards active traders through a tiered system.

Bybit typically charges maker-taker fees that are industry standard. Both platforms offer fee discounts for users who hold or stake their native tokens.

BloFin may have an advantage with its support for numerous fiat currencies, potentially reducing conversion costs for international traders. Always check current fee schedules, as both exchanges update their pricing regularly.

Which platform, Bybit or BloFin, offers better security and reliability for its users?

Both exchanges implement strong security measures including two-factor authentication, cold storage for funds, and regular security audits. Neither platform has experienced major security breaches recently.

BloFin emphasizes its security infrastructure in its marketing materials, though specific details about their security protocols are limited in the search results.

Bybit has been operating longer, which gives it a more established track record for reliability. Both platforms experience occasional downtime during extreme market volatility.

Is there a significant difference in the variety of trading options between Bybit and BloFin?

BloFin stands out with its extensive selection of over 300 perpetual swap contracts. This variety gives traders more options for diversification and specialized trading strategies.

Bybit offers a solid range of cryptocurrencies and derivatives but may not match BloFin’s breadth in certain contract types. Both platforms support spot trading, futures, and options.

BloFin’s copy trading feature allows less experienced traders to mimic successful trading strategies. This represents a significant difference in the trading experience between the platforms.

What are the customer service experiences like on Bybit compared to BloFin?

BloFin provides comprehensive customer support and maintains an extensive FAQ section covering over 70 topics. This self-service option helps users find answers quickly.

Their support resources range from account registration guidance to advanced API-based trading tutorials. This suggests a commitment to supporting traders at all experience levels.

Bybit offers 24/7 customer support through multiple channels including live chat and email. Response times can vary during periods of high market volatility on both platforms.

How do the user interfaces and ease of use differ between Bybit and BloFin?

BloFin features a well-structured interface with a comprehensive FAQ section that makes navigation straightforward for beginners. Their layout prioritizes access to their core features.

Bybit’s interface tends to focus on providing professional trading tools and advanced charting capabilities. This can create a steeper learning curve for newcomers.

Both platforms offer mobile apps, but their designs reflect their target users. BloFin appears to balance accessibility with advanced features, while Bybit may prioritize functionality for experienced traders.

BloFin Vs Bybit Conclusion: Why Not Use Both?

Both BloFin and Bybit offer valuable services for crypto traders in 2025. Each platform has unique strengths that might suit different aspects of your trading strategy.

BloFin stands out with over 300 perpetual swap contracts and copy trading features. However, some users have reported issues with margin requirement changes without proper notice.

Bybit provides a reliable alternative with its own set of trading options and features. Its interface and customer support are frequently praised in reviews.

Instead of choosing just one platform, consider using both exchanges strategically. This approach lets you take advantage of each platform’s strengths while minimizing exposure to their weaknesses.

You can use BloFin for its wide range of perpetual contracts when those markets interest you. Then switch to Bybit when you need its specific features or during times when BloFin might be making policy changes.

Using multiple exchanges also helps spread your risk. If one platform experiences technical issues or makes sudden policy changes, your entire trading strategy won’t be disrupted.

Just remember to keep track of your positions across both platforms. Having accounts on multiple exchanges requires more attention to detail with your overall portfolio management.

Many experienced traders already use this multi-exchange approach to maximize opportunities and reduce platform-specific risks.