When choosing a cryptocurrency exchange, it’s crucial to compare your options carefully. Bybit and Bitunix are two popular platforms that offer both spot and derivatives trading, but they have different features that might appeal to you depending on your needs.

Bitunix stands out with its proof of reserves system, which adds an extra layer of security that many traders value. While Bybit is often ranked among the top cryptocurrency derivatives exchanges globally alongside giants like Binance and OKEx, Bitunix has been gaining attention for its security features and growing selection of over 270 cryptocurrencies.

Your choice between these platforms will likely depend on specific factors like trading fees, available trading pairs, and user interface preferences. Both exchanges offer competitive services, but understanding their key differences will help you determine which one better suits your cryptocurrency trading strategy.

Bybit vs Bitunix: At A Glance Comparison

When choosing between Bybit and Bitunix for your crypto trading needs, several key differences stand out. Both platforms offer cryptocurrency trading services but with unique features.

Bitunix is a centralized exchange that offers both spot and derivatives trading. It supports over 270 cryptocurrencies, making it quite diverse in its offerings.

Some Reddit users have expressed positive opinions about Bitunix, noting that it compares favorably to top-tier exchanges. A security advantage of Bitunix is its proof of reserves feature, which adds transparency.

Bybit, on the other hand, is known for its derivatives trading focus, particularly in futures and options markets. It has built a reputation for its trading interface and liquidity.

| Feature | Bybit | Bitunix |

|---|---|---|

| Exchange Type | Centralized | Centralized |

| Trading Options | Spot, Derivatives | Spot, Derivatives |

| Cryptocurrencies | 200+ | 270+ |

| Proof of Reserves | Yes | Yes |

| Target Users | Both beginners and advanced traders | Varied trading levels |

Fees are an important consideration when choosing an exchange. Both platforms have competitive fee structures, though they vary based on trading volume and membership tiers.

Security features differ between the two exchanges, with both implementing standard protections like two-factor authentication and cold storage for funds.

Trading volume and liquidity can impact your trading experience. These factors may vary between specific trading pairs on each platform.

Bybit vs Bitunix: Trading Markets, Products & Leverage Offered

Bybit offers a wide range of trading options for crypto enthusiasts. You can access spot trading, futures, options, and copy trading on this platform. Bybit stands out by providing up to 100x leverage on futures trading for experienced traders.

Bitunix focuses primarily on spot and derivatives trading. While not as extensive as Bybit’s offerings, Bitunix provides essential trading products for both beginners and experienced traders.

When comparing available cryptocurrencies, Bybit typically has more assets available to trade. This gives you more options and flexibility in your trading strategy. Bybit is often quicker to list new and trending cryptocurrencies.

Leverage Comparison:

- Bybit: Up to 100x on futures

- Bitunix: Moderate leverage options (typically lower than Bybit)

Bybit also features various “Earn” programs where you can stake your crypto for passive income. These products allow you to earn interest on your holdings when you’re not actively trading.

Both platforms offer mobile apps for trading on the go. You can monitor markets, place trades, and manage your portfolio from your smartphone with either exchange.

For margin trading specifically, Bybit offers up to 5x leverage on spot markets. This feature lets you amplify potential returns while trading spot cryptocurrencies, though it comes with increased risk.

Bybit vs Bitunix: Supported Cryptocurrencies

When choosing between Bybit and Bitunix, the range of available cryptocurrencies is an important factor to consider.

Bitunix supports over 270 cryptocurrencies according to recent data. This extensive selection gives you access to both popular coins and smaller altcoins, providing diverse trading options.

Bybit also offers a substantial cryptocurrency selection, though specific numbers weren’t provided in the search results. It’s known primarily as one of the top cryptocurrency derivatives exchanges alongside Binance, Huobi Global, and others.

Both exchanges support major cryptocurrencies like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Ripple (XRP)

The key difference lies in their focus areas. Bybit has established itself as a strong derivatives exchange, while Bitunix emphasizes both spot and derivatives trading.

If you’re looking for more niche or recently launched cryptocurrencies, Bitunix’s larger selection might be advantageous. However, most traders primarily use the major cryptocurrencies, which both platforms support well.

Before choosing either exchange, it’s worth checking if they support the specific cryptocurrencies you want to trade. Availability can change as exchanges regularly add new coins and occasionally remove others.

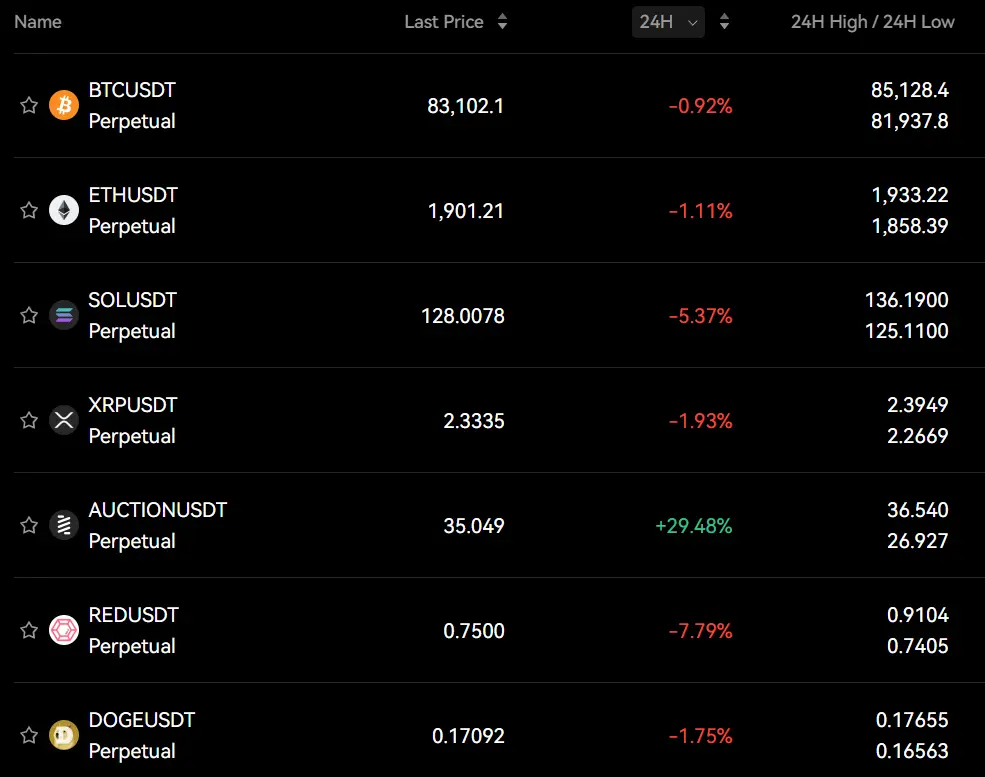

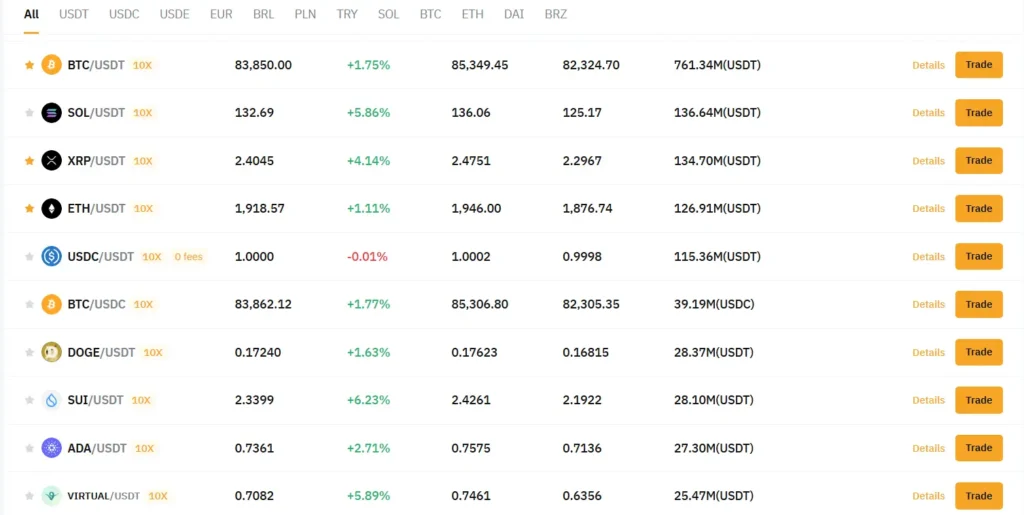

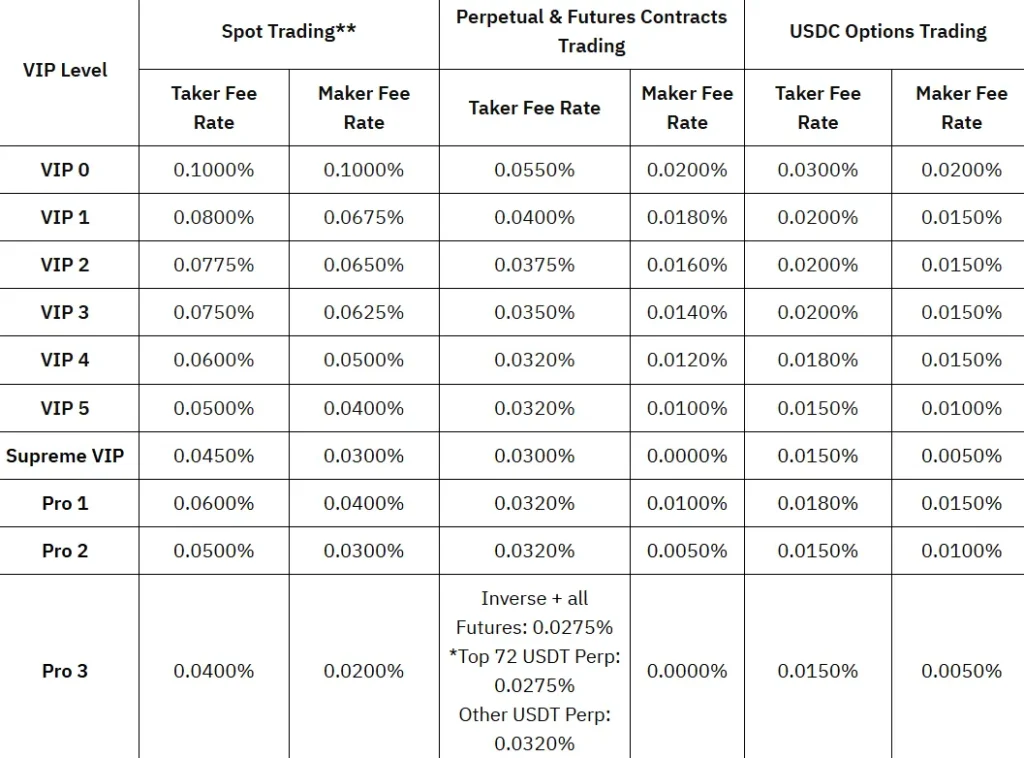

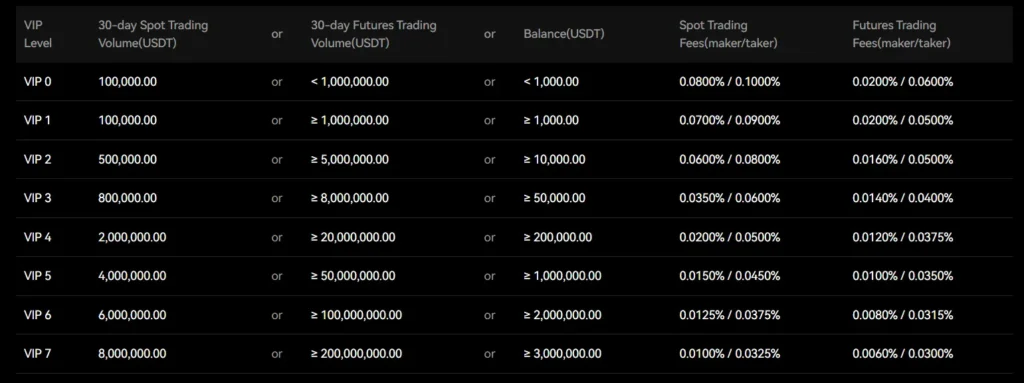

Bybit vs Bitunix: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and Bitunix, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

Bybit is known for having some of the lowest fees in the industry. According to recent information, Bybit does not overcharge for transactions.

Bitunix charges a trading fee of 0.01%, which is quite competitive compared to other exchanges in 2025.

Fee Comparison Table

| Exchange | Trading Fee | Notable Features |

|---|---|---|

| Bybit | Low (exact % varies by tier) | Does not overcharge for withdrawals |

| Bitunix | 0.01% | Focuses on both spot and derivatives trading |

Both exchanges offer tiered fee structures where your costs decrease as your trading volume increases.

Deposit Fees

Most cryptocurrency deposits on both platforms are free, which is standard across the industry.

Withdrawal Fees

Bybit has earned a reputation for reasonable withdrawal fees compared to other major exchanges. This makes it a good choice if you frequently move funds off the exchange.

Bitunix’s withdrawal fees vary by cryptocurrency but are generally competitive with other centralized exchanges.

When comparing these two exchanges, consider how often you’ll trade and withdraw funds. High-volume traders might benefit more from Bybit’s tiered structure, while occasional traders might find Bitunix’s straightforward 0.01% fee attractive.

Bybit vs Bitunix: Order Types

Both Bybit and Bitunix offer various order types to help you trade effectively. Understanding these options can make a big difference in your trading strategy.

Bybit provides both basic and advanced order types. Their platform supports standard market and limit orders for immediate execution or specific price targets. According to search results, Bybit also offers up to 200x leverage with zero risk of liquidation before settlement.

Bitunix also features market and limit orders for spot and derivatives trading. The platform supports over 270 cryptocurrencies, making it versatile for different trading needs.

Common Order Types on Both Platforms:

- Market Orders (execute immediately at current price)

- Limit Orders (execute only at your specified price)

- Futures Trading Orders

Bybit may have a slight edge with more advanced order types, though specific details about Bitunix’s advanced orders aren’t fully covered in the search results.

When choosing between these platforms, consider how the order types match your trading style. If you need high leverage, Bybit’s 200x option might appeal to you. For those wanting access to many cryptocurrencies, Bitunix’s support for 270+ coins could be more attractive.

Remember to practice with different order types on both platforms to find which one feels more intuitive for your trading needs.

Bybit vs Bitunix: KYC Requirements & KYC Limits

When choosing between Bybit and Bitunix, KYC (Know Your Customer) requirements might influence your decision.

Bybit uses KYC to identify customers and analyze risk profiles. This verification helps prevent money laundering and other illegal activities. You’ll need to complete their verification process to access full platform features.

Bitunix takes a different approach. You can trade on Bitunix without mandatory KYC verification. This creates a more privacy-focused experience for users who prefer anonymity.

For withdrawals, Bitunix sets a daily limit of ≤500,000 USDT without KYC. If you need higher limits, you can complete their Basic KYC level by providing personal information, ID, and a selfie.

KYC Comparison at a Glance:

| Feature | Bybit | Bitunix |

|---|---|---|

| KYC Required for Trading | Yes | No |

| KYC Required for Withdrawals | Yes | Only for higher limits |

| Withdrawal Limit Without KYC | Not available | Up to 500,000 USDT daily |

Many users find Bitunix’s interface simple and user-friendly with reasonable transaction fees, making it an attractive option for those seeking minimal verification requirements.

Your choice between these platforms may depend on how much you value privacy versus the security that comes with stricter verification procedures.

Bybit vs Bitunix: Deposits & Withdrawal Options

When choosing between Bybit and Bitunix exchanges, understanding deposit and withdrawal options is essential for managing your crypto assets efficiently.

Bybit offers more diverse deposit methods, including $0 fee deposit options through third-party integrations. This can save you money when funding your account.

Bitunix provides standard deposit options but may have fewer zero-fee pathways compared to Bybit.

Withdrawal Methods Comparison:

| Feature | Bybit | Bitunix |

|---|---|---|

| Bank Transfers | Limited | Yes |

| Crypto Withdrawals | Multiple networks | Standard options |

| Withdrawal Fees | Competitive | Standard market rates |

Bybit supports multiple cryptocurrency networks for withdrawals, giving you flexibility when moving your assets. This can help you avoid high gas fees on congested networks.

For fiat options, Bitunix appears to have better bank transfer support than Bybit. This might be important if you frequently move between crypto and traditional currency.

Processing times for withdrawals are comparable between both platforms, with crypto withdrawals typically processing faster than fiat ones.

You should check both platforms’ current fee structures before deciding, as cryptocurrency exchanges occasionally update their fee policies.

Bybit vs Bitunix: Trading & Platform Experience Comparison

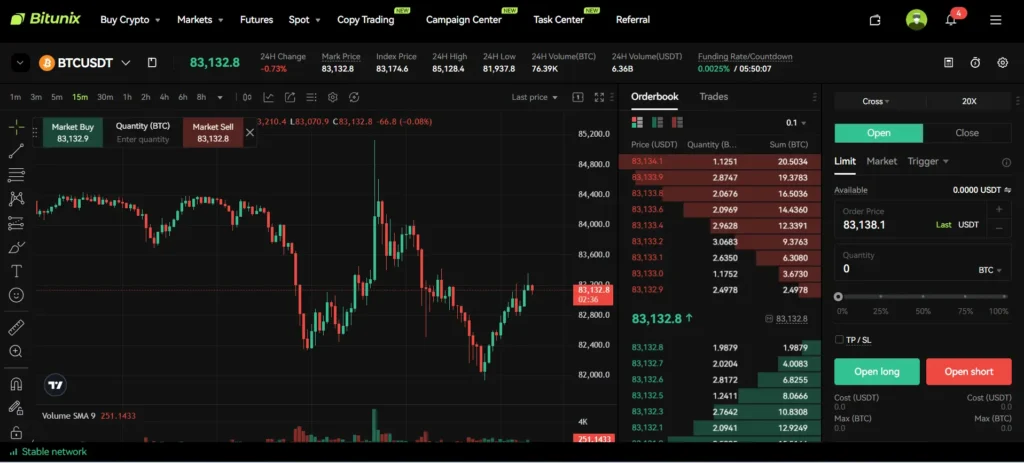

When choosing between Bybit and Bitunix, the trading interface plays a key role in your experience. Bybit offers a more modern, high-grade trading platform that many users find intuitive.

Bitunix positions itself as a centralized exchange focusing on both spot and derivatives trading. It supports over 270 cryptocurrencies, giving you plenty of options for diversifying your portfolio.

Bybit’s platform tends to feel more polished and professional. The charts, order book, and trading tools are arranged in a user-friendly way that both beginners and advanced traders appreciate.

Some Reddit users claim Bitunix is better compared to top-tier exchanges. They also note that Bitunix has proof of reserves, which adds to its security credentials.

Trading Options Comparison:

| Feature | Bybit | Bitunix |

|---|---|---|

| Spot Trading | Yes | Yes |

| Derivatives | Yes | Yes |

| Supported Coins | 300+ | 270+ |

| User Interface | Modern, polished | Functional |

| Security Features | Industry standard | Proof of reserves |

When considering fees, both platforms compete with other exchanges in the market. You’ll want to check their current fee structures as these change regularly.

The trading experience on either platform will depend on your specific needs. If you value a more refined interface, Bybit might be your preference. If having proof of reserves is important for your security concerns, Bitunix offers that advantage.

Bybit vs Bitunix: Liquidation Mechanism

Liquidation is a critical feature to understand when trading on crypto platforms. It happens when your margin falls below required levels, forcing the closure of your position.

Bybit offers leverage up to 200x with what they claim is “zero risk of liquidation before settlement.” However, some users report getting liquidated despite having stop losses in place.

Bybit’s liquidation process varies based on margin modes:

- Isolated Margin (Unified Trading Account only)

- Cross Margin

- Portfolio Margin

Bitunix provides an Estimated Liquidation Price feature that shows you exactly at what price your position would be closed due to insufficient margin. This transparency helps you manage risk better.

Both platforms carry liquidity risks. You might face restrictions on withdrawing funds, or market conditions could make it difficult to quickly sell your assets.

When choosing between these platforms, consider your trading style and risk tolerance. Higher leverage like Bybit’s 200x option can mean higher profits but also faster liquidations if markets move against you.

Always set appropriate stop losses and monitor your positions carefully. Understanding each platform’s liquidation mechanism can help you avoid unexpected losses and trade with more confidence.

Bybit vs Bitunix: Insurance

When trading cryptocurrencies, insurance protection is a key factor to consider. Both Bybit and Bitunix offer insurance options, but they differ in coverage and implementation.

Bitunix has partnered with an insurance provider that secures user funds with a $5 million insurance policy. This coverage helps protect traders against unexpected risks and potential losses.

The insurance acts as a safety net for your assets on the Bitunix platform. This feature may give you peace of mind, especially if you’re concerned about security risks.

Bybit also offers protection for user funds, though their approach differs. They provide various security measures and fund safeguards, including their Earn programs which are designed to protect and maximize your cryptocurrency holdings.

A recent hack on Bybit highlighted the importance of insurance and security measures. Such incidents remind traders to consider exchange security when choosing where to trade.

When deciding between these exchanges, consider:

| Feature | Bitunix | Bybit |

|---|---|---|

| Insurance Coverage | $5 million policy | Various safeguards |

| Focus | Direct insurance partnership | Security measures and Earn protections |

| Transparency | Offers proof of reserves | Multiple security layers |

Your risk tolerance and the amount you plan to store on an exchange should guide your decision. The insurance offering may be particularly important if you keep large amounts of cryptocurrency on the platform.

Bybit vs Bitunix: Customer Support

When trading cryptocurrencies, good customer support can make a big difference in your experience. Both Bybit and Bitunix offer customer support services, but they differ in some ways.

Bybit provides 24/7 customer support through multiple channels. You can reach their team via live chat, email, and social media platforms. Their response times are generally quick, with most inquiries addressed within minutes to a few hours.

Bybit also offers an extensive knowledge base with articles, tutorials, and FAQs that can help you solve common issues without contacting support directly.

Bitunix, while newer to the market, has invested in building a responsive support system. They offer support through live chat and email options. Based on user feedback, their team is knowledgeable about their platform and cryptocurrency trading.

Support Comparison Table:

| Feature | Bybit | Bitunix |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Social Media Support | Yes | Limited |

| Knowledge Base | Extensive | Growing |

| Response Time | Minutes to hours | Generally within 24 hours |

Both exchanges offer support in multiple languages, which is helpful if English isn’t your first language.

For complex issues, Bybit may have an edge due to their longer time in the market and more established support infrastructure. However, Bitunix continues to improve their support services as they grow.

Bybit vs Bitunix: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bybit and Bitunix offer strong security features, but they differ in several ways.

Bitunix stands out with its Proof of Reserves system. This means you can verify that the exchange actually holds all user funds it claims to have. This transparency gives users extra peace of mind about their assets.

Bybit focuses on comprehensive security through multiple layers of protection. The exchange uses cold storage for most user funds, keeping them offline and safe from hackers.

Both exchanges provide two-factor authentication (2FA) to protect your account. This extra security step makes it much harder for unauthorized people to access your funds.

Key Security Features Comparison:

| Feature | Bitunix | Bybit |

|---|---|---|

| Proof of Reserves | ✓ | Limited |

| Cold Storage | Partial | Most funds |

| 2FA | ✓ | ✓ |

| 24/7 Support | Multilingual | Available |

Bitunix offers 24/7 multilingual customer support, which can be crucial during security emergencies. Quick response times matter when dealing with potential security issues.

Bybit has built a strong reputation for security over time, with no major hacks reported. Their security team regularly updates protocols to address new threats.

For maximum protection, you should use all available security features regardless of which platform you choose. Enable 2FA, use strong passwords, and keep your recovery phrases in a secure location.

Is Bybit A Safe & Legal To Use?

Bybit has established itself as one of the more secure cryptocurrency exchanges in the market. It implements robust security measures to protect user funds and data, giving traders peace of mind when using the platform.

Security is a primary focus for Bybit, with the exchange incorporating various protective features to safeguard your assets. According to search results, Bybit is considered “one of the most highly respected, secure, long-standing and reputable exchanges in the space.”

For US users, the legality question is important. While Bybit operates internationally, users from the United States face some restrictions. The legal status varies depending on your specific location and current regulations.

Before using Bybit, you should check the most current regulatory information for your region. Cryptocurrency regulations change frequently, and what’s permitted today might change tomorrow.

Key security features of Bybit include:

- Multi-factor authentication (MFA)

- Cold storage for majority of funds

- Regular security audits

- SSL encryption for data protection

The exchange has built a strong reputation for reliability over time. Many users trust Bybit with significant trading volumes, which speaks to the platform’s perceived security and trustworthiness.

Remember to always use strong passwords and enable all available security features when using any cryptocurrency exchange, including Bybit.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to be a legitimate cryptocurrency exchange with several security measures in place. According to search results, the platform has not experienced any hacks so far, which is a positive sign for users concerned about security.

The exchange offers proof of reserves, providing an additional layer of protection for your funds. This means you can verify that the platform actually holds the assets it claims to have.

Bitunix also operates with complete licensing and funds custody. This regulatory compliance helps protect you from potential fraud or mismanagement issues that can affect unregulated exchanges.

The platform follows anti-money laundering (AML) policies, showing commitment to ethical trading practices. This compliance is important for the long-term stability of any exchange you choose to use.

However, it’s important to remember that all cryptocurrency platforms carry inherent risks. Your funds could potentially be at risk due to:

- Hacking attempts

- Platform insolvency

- Technical failures

- Market volatility

While Bitunix is described as “fast-growing” and “legitimate” in the search results, you should still exercise caution. Using security features like two-factor authentication and keeping most of your crypto in cold storage are wise practices regardless of which exchange you choose.

Frequently Asked Questions

Traders often have specific questions when comparing Bybit and Bitunix. These questions help clarify the strengths and weaknesses of each platform before making a choice.

What are the key differences between Bybit and Bitunix trading platforms?

Bybit offers options trading, which is not currently available on Bitunix. This gives Bybit an edge for traders who want more variety in their trading strategies.

Bybit also has a more established reputation in the market with higher tier levels that provide better fee structures. The platform is known for its user-friendly interface.

Bitunix, meanwhile, emphasizes its proof of reserves system, which adds an extra layer of security for users concerned about exchange transparency.

How do user reviews compare the performance of Bybit versus Bitunix?

User reviews suggest Bybit performs well in terms of platform stability and execution speed. Traders frequently mention the reliable performance during high market volatility.

Bitunix receives positive mentions for security features, with users appreciating the proof of reserves system. Some reviews indicate Bitunix is considered better than “top tier exchanges” by certain users.

However, overall user sentiment seems to favor Bybit’s more comprehensive feature set and established track record.

What are the top-rated features when comparing Bybit with Bitunix?

Bybit’s top-rated features include its options trading capabilities, lower long-term fee structure, and high liquidity pools. The platform also receives praise for its intuitive user interface.

Users highlight Bybit’s advanced charting tools and variety of order types as standout features for serious traders.

Bitunix’s most appreciated features center on security, with its proof of reserves system receiving particular attention from security-conscious users.

Which platform, Bybit or Bitunix, offers a more reliable trading experience?

Bybit tends to offer a more reliable trading experience based on its established infrastructure and higher liquidity. This translates to fewer slippage issues during volatile market conditions.

The platform’s longer history in the market has allowed it to refine its systems and address common reliability issues.

Bitunix, while growing in popularity, doesn’t have as extensive a track record for reliability during extreme market conditions or high-volume trading periods.

How do Bybit and Bitunix rank in terms of trading volume and liquidity?

Bybit ranks higher in terms of trading volume and liquidity compared to Bitunix. This difference is significant for traders executing larger orders.

Higher liquidity on Bybit means tighter spreads and less price impact when entering or exiting positions. This is especially important during fast-moving markets.

Bitunix is working to increase its liquidity pools but currently cannot match the depth offered by Bybit across most trading pairs.

Between Bybit and Bitunix, which one is considered the best for crypto derivatives trading?

Bybit is widely considered superior for crypto derivatives trading due to its broader range of derivative products, including futures, perpetual contracts, and options.

The platform offers more advanced tools specifically designed for derivatives traders, such as partial close functions and better risk management features.

Bitunix’s derivatives offering is more limited in scope, making it less attractive to traders focused specifically on this market segment.

Bitunix vs Bybit Conclusion: Why Not Use Both?

Both Bitunix and Bybit offer solid cryptocurrency trading experiences with user-friendly interfaces and strong security measures. Each platform has unique strengths that might appeal to different aspects of your trading strategy.

Bitunix stands out with its proof of reserves system, adding an extra layer of security for your funds. Many users find this transparency reassuring when choosing where to trade.

Bybit, meanwhile, has established a strong reputation in the crypto exchange market with a robust feature set and reliable performance.

The good news is you don’t have to choose just one platform. Many experienced traders use multiple exchanges to take advantage of:

- Different fee structures

- Varying liquidity across trading pairs

- Unique features on each platform

- Risk distribution of your assets

Using both Bitunix and Bybit gives you flexibility to choose the right platform for specific trades or investment strategies. This approach also lets you compare their real-world performance firsthand.

Remember to consider your specific needs when deciding which platform to use for a particular transaction. Factors like fees, available trading pairs, and interface preferences might guide your choice for each trade.

As always, practice good security habits regardless of which exchange you use. Enable two-factor authentication, use strong passwords, and only keep trading funds on exchanges.