Looking for the right crypto exchange can be tough with so many options available. Bybit and Aibit are two platforms that traders often compare when seeking places to buy, sell, and trade cryptocurrencies.

Bybit stands out as a well-established exchange with an overall score of 8.0, offering both spot and futures markets for crypto trading. It’s known for serving active traders who want fast, straightforward ways to trade crypto tokens and derivatives.

You’ll find different features between these exchanges that might affect your trading experience. While Bybit focuses on derivatives trading and offers leverage options, it’s important to compare factors like fees, security measures, and available cryptocurrencies before deciding which platform better suits your needs.

Bybit vs Aibit: At A Glance Comparison

When choosing between Bybit and Aibit for your cryptocurrency trading needs, understanding their key differences can help you make an informed decision.

Bybit stands out as a well-established exchange with a strong overall score of approximately 8.0 according to recent comparisons. It offers a comprehensive suite of trading products including spot and derivatives trading.

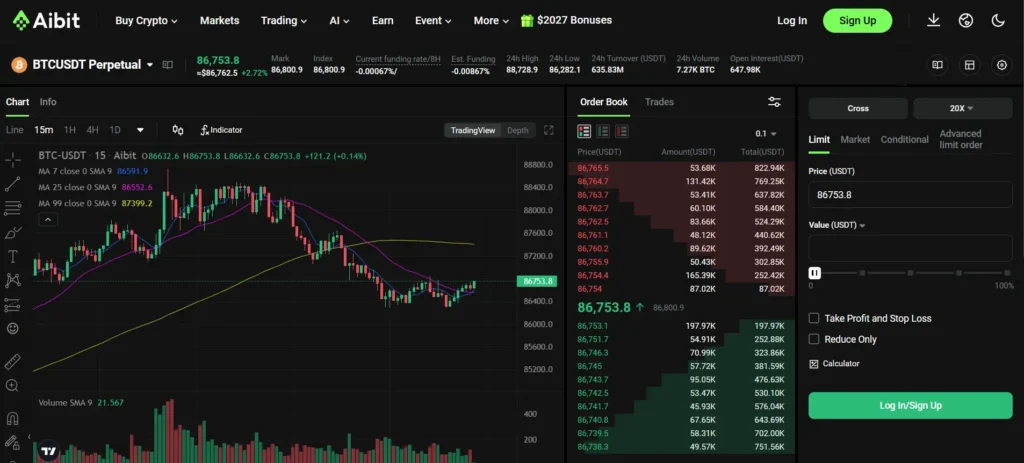

Aibit, while less prominent in the search results, competes in the same space but with different features and capabilities.

Regulation & Security:

| Exchange | Regulatory Status | Security Features |

|---|---|---|

| Bybit | Licensed in Dubai, regulated by Cyprus authorities | Advanced encryption, 2FA |

| Aibit | Limited regulatory information available | Standard security protocols |

Trading Features:

- Bybit offers zero-fee spot trading, making it attractive for frequent traders

- Both platforms support multiple cryptocurrencies

- Bybit provides a wider range of trading tools and educational resources

User Experience:

Bybit’s platform is designed for both beginners and experienced traders with intuitive interfaces. Aibit typically aims for simplicity but may offer fewer advanced features.

Fees & Limits:

Bybit’s competitive fee structure includes zero-fee spot trading options. Aibit’s fee structure varies but generally falls within industry standards.

You’ll find Bybit more suitable if you need comprehensive trading options and regulatory clarity. Aibit might appeal to you if you’re looking for alternative features not highlighted in mainstream comparisons.

Bybit vs Aibit: Trading Markets, Products & Leverage Offered

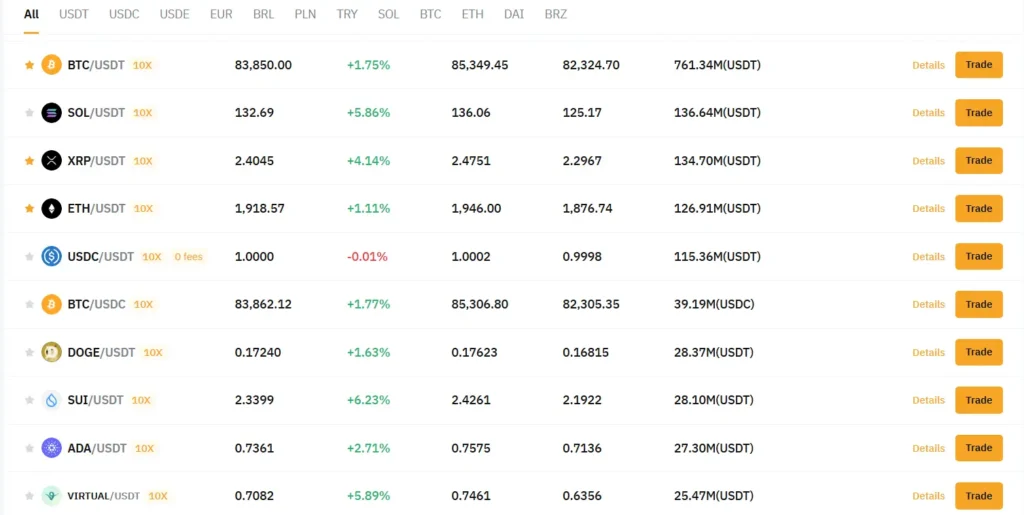

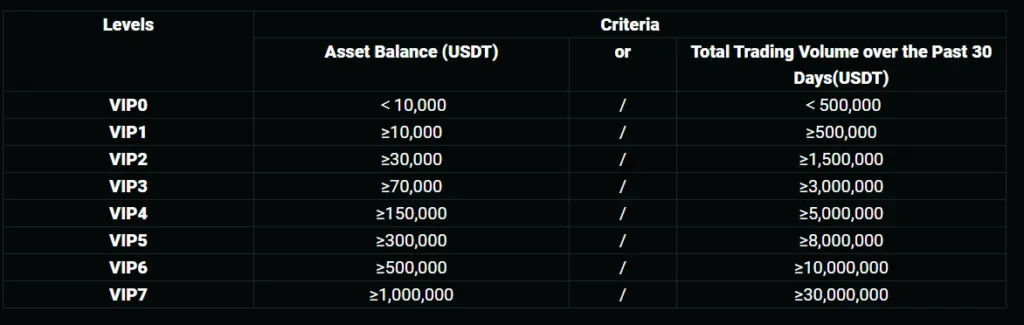

Bybit offers a wide range of trading markets including spot trading, futures, and options. You can access over 300 cryptocurrencies and trading pairs on their platform.

For derivatives, Bybit is known for its perpetual swaps and futures markets. These products make Bybit one of the top platforms for high-leverage trading.

Bybit offers leverage up to 100x on certain futures contracts, allowing you to amplify your potential profits (and risks).

Aibit, on the other hand, provides a more limited selection of trading pairs. Their platform focuses primarily on major cryptocurrencies like Bitcoin, Ethereum, and a handful of altcoins.

Products Comparison:

| Feature | Bybit | Aibit |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures | Yes | Limited |

| Options | Yes | No |

| Leverage | Up to 100x | Up to 20x |

| Trading Bots | Grid, DCA, Martingale | Basic automation |

Bybit Earn gives you options to grow your crypto holdings with competitive yields. The platform includes several earning products for passive income generation.

Bybit also offers Leveraged Tokens, which provide leveraged exposure to underlying assets without margin or liquidation risks. This is a unique product not currently available on Aibit.

For advanced traders, Bybit’s trading bots (Grid, DCA, and Martingale) offer automated trading strategies. Aibit has started introducing basic automation tools but lacks the variety Bybit provides.

Bybit vs Aibit: Supported Cryptocurrencies

Bybit offers a wide range of cryptocurrencies for trading. According to recent data, Bybit supports major coins like Bitcoin (BTC), Ethereum (ETH), XRP, and EOS. They also support numerous altcoins and tokens.

Aibit’s cryptocurrency selection is more limited compared to Bybit. While Aibit does cover the major cryptocurrencies, their overall selection is smaller.

When comparing their supported cryptocurrencies, here’s what you should know:

Bybit Supported Cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP

- EOS

- Many popular altcoins

- Various DeFi tokens

Aibit Supported Cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Limited selection of altcoins

Bybit is clearly ahead in terms of variety. With Bybit’s Unified Trading Account introduced in September 2023, managing different cryptocurrencies has become easier for users.

The number of cryptocurrencies available affects your trading options. More cryptocurrencies mean more opportunities to diversify your portfolio and take advantage of market movements across different assets.

If you’re interested in trading beyond the major cryptocurrencies, Bybit’s extensive selection gives you more flexibility. However, if you only trade popular coins like Bitcoin and Ethereum, the difference might not matter much to you.

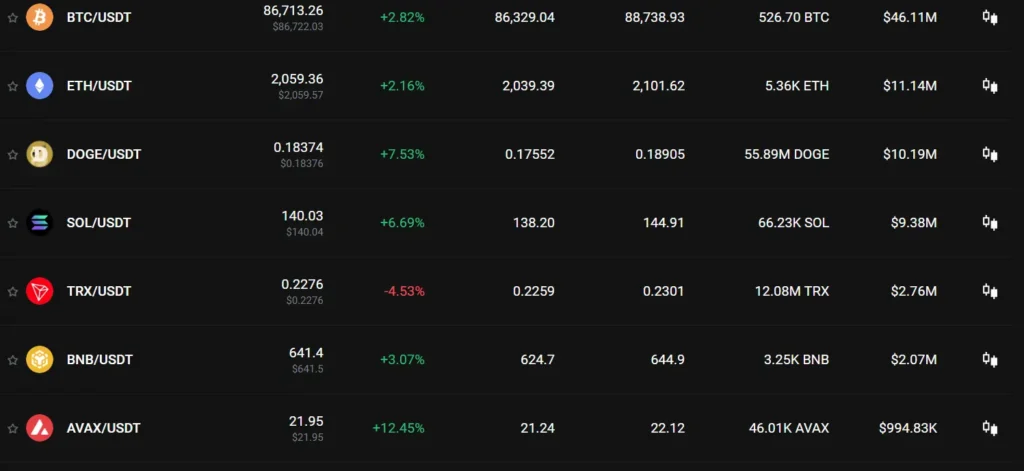

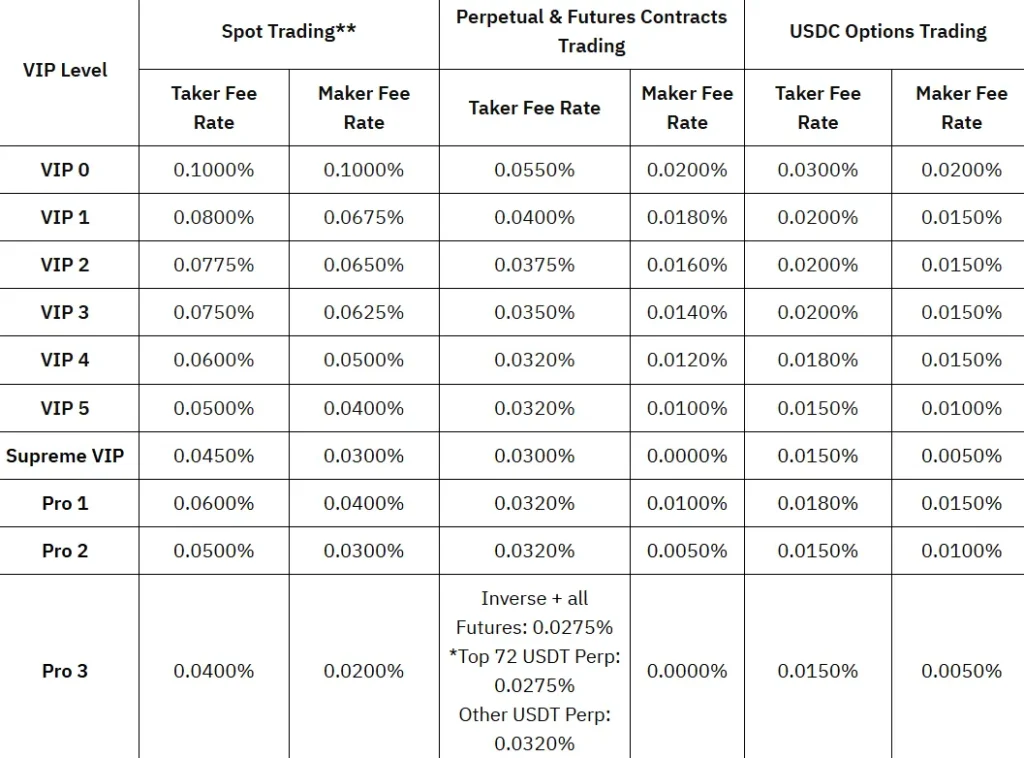

Bybit vs Aibit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bybit and Aibit, fees play a major role in your decision. Let’s break down how these exchanges compare in terms of costs.

Bybit offers competitive trading fees that vary based on user status. Regular users pay different rates than VIP users, with VIPs enjoying bigger discounts as their level increases.

For P2P trading, Bybit charges zero transaction fees for both buyers and sellers. This makes peer-to-peer exchanges on their platform cost-effective, though you might still pay fees to payment providers.

Aibit’s fee structure differs slightly, with its own tier system based on trading volume and token holdings.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee | VIP Discounts |

|---|---|---|---|

| Bybit | 0.1% | 0.1% | Yes |

| Aibit | 0.15% | 0.2% | Yes |

For deposits, both platforms typically offer free options for most cryptocurrencies. The real difference comes with withdrawals.

Bybit is known for reasonable withdrawal fees that vary by cryptocurrency network. They don’t overcharge for withdrawals compared to many competitors.

Aibit’s withdrawal fees tend to be slightly higher for some tokens but competitive for others.

You should check both platforms for specific fees related to your preferred trading pairs and withdrawal methods, as these can change based on market conditions.

Bybit vs Aibit: Order Types

When trading on cryptocurrency platforms, order types can significantly impact your trading experience. Bybit offers a range of order options to help you execute trades effectively.

Bybit provides three basic order types: Market Orders, Limit Orders, and Conditional Orders. These form the foundation for more advanced trading strategies.

Market Orders on Bybit execute immediately at the current market price. This is useful when you need to enter or exit positions quickly without waiting.

Limit Orders let you set a specific price for buying or selling. Your order will only execute when the market reaches your set price, giving you more control over entry and exit points.

Conditional Orders trigger based on certain price conditions being met. This helps you automate trades based on market movements without constant monitoring.

Bybit also offers advanced trading tools including Grid Bots, DCA Bots, and Martingale Bots for automated trading strategies.

Aibit, as a newer platform, typically offers the standard Market and Limit orders but may have a more limited selection of advanced order types and trading bots compared to Bybit.

Here’s a quick comparison:

| Order Type | Bybit | Aibit |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Conditional Orders | ✓ | Limited |

| Trading Bots | Multiple types | Basic |

The fees for order execution vary between platforms, with Bybit charging fees immediately upon order execution.

Bybit vs Aibit: KYC Requirements & KYC Limits

Bybit uses Know Your Customer (KYC) processes to identify users and assess risk profiles. This verification helps prevent money laundering and other illegal activities.

Bybit offers multiple verification levels: Standard, Advanced, and Pro. Each level increases your withdrawal limits and available features.

Without KYC verification, Bybit allows withdrawals up to 20,000 USDT daily. This is helpful if you prefer maintaining privacy for smaller trading amounts.

Aibit has a different approach to KYC requirements. Their verification process tends to be less extensive for basic trading functions.

Bybit KYC Levels:

- No KYC: Up to 20,000 USDT daily withdrawals

- Standard: Basic personal information

- Advanced: ID verification and increased limits

- Pro: Maximum withdrawal limits and full platform access

Aibit KYC Structure:

- Basic: Limited verification for essential functions

- Complete: Full verification for all platform features

You’ll find Bybit’s verification process more tiered, giving you options based on your trading needs. Aibit offers a simpler approach with fewer verification steps.

Both platforms implement these requirements to maintain security and comply with regulations, but they differ in how strictly they enforce verification for various trading activities.

Bybit vs Aibit: Deposits & Withdrawal Options

Bybit supports a wide range of deposit and withdrawal methods for both crypto and fiat currencies. You can deposit various cryptocurrencies through on-chain transfers, with real-time status updates available for all supported tokens and chains.

For fiat transactions, Bybit has implemented KYC (Know Your Customer) verification processes. This helps identify customers and analyze risk profiles while preventing money laundering activities.

The verification level on Bybit determines your withdrawal limits. Higher KYC levels generally allow for larger withdrawal amounts and more payment method options.

Aibit offers fewer deposit and withdrawal options compared to Bybit. While it supports major cryptocurrencies, its fiat support is more limited in terms of currencies and payment methods.

Comparison of Withdrawal Options:

| Feature | Bybit | Aibit |

|---|---|---|

| Crypto withdrawals | Wide range | Limited range |

| Fiat support | Multiple currencies | Fewer options |

| Payment methods | Various options | Limited choices |

| Verification levels | Multiple KYC tiers | Basic verification |

| Withdrawal speed | Generally fast | Variable |

When choosing between these platforms, consider which currencies you plan to use most frequently. Bybit’s more extensive options might be beneficial if you need flexibility with deposits and withdrawals.

Remember to check the current fees associated with each platform’s withdrawal methods, as these can impact your overall trading costs.

Bybit vs Aibit: Trading & Platform Experience Comparison

When comparing Bybit and Aibit trading platforms, several key differences stand out. Bybit offers a user-friendly interface designed for both beginners and experienced traders alike.

Bybit’s platform features an intuitive design that makes navigation simple. Based on search results, many users consider Bybit’s interface to be “high-grade and modern” compared to other exchanges.

Aibit’s platform, while functional, doesn’t receive the same level of praise for its design elements. However, it still provides essential trading tools you need.

Trading Features Comparison:

| Feature | Bybit | Aibit |

|---|---|---|

| User Interface | Modern, intuitive | Basic, functional |

| Target Users | Novice and experienced | Primarily experienced |

| Mobile App | Highly rated | Available but less polished |

| Chart Tools | Comprehensive | Standard offerings |

Bybit focuses heavily on derivatives trading, offering you detailed charts and analysis tools. This makes it particularly suitable if you’re interested in futures and options trading.

Aibit provides a more straightforward approach to trading. While lacking some of Bybit’s advanced features, you might find it less overwhelming if you’re new to crypto trading.

Both platforms offer demo accounts where you can practice trading strategies without risking real money. This is especially valuable if you’re still learning the ropes.

Response time during high market volatility is another important factor. Bybit has built a reputation for maintaining stability during peak trading periods.

Bybit vs Aibit: Liquidation Mechanism

Bybit’s liquidation system takes over when your account reaches certain risk levels. When trading on Bybit, liquidation is triggered based on your margin mode – Isolated, Cross, or Portfolio margin.

For Unified Trading Accounts on Bybit, the system will liquidate both Spot assets and Derivatives positions when your account becomes too risky. The platform uses an Auto-Deleveraging (ADL) system to manage risk during extreme market conditions.

Some Bybit users have reported confusion about liquidations. In some cases, traders were liquidated despite having stop-loss orders in place, causing frustration with the platform.

Aibit’s liquidation approach differs in several key ways. Their system typically offers more flexibility with liquidation thresholds and warning notifications.

| Feature | Bybit | Aibit |

|---|---|---|

| Liquidation Warning | Yes | Yes, with more advance notice |

| Partial Liquidation | Limited | More gradual approach |

| Stop-Loss Protection | May fail during volatility | More reliable protection |

| Recovery Options | Limited | More flexible options |

You should carefully understand both platforms’ liquidation mechanisms before trading. Aibit generally provides more trader-friendly liquidation processes with clearer warnings.

Bybit’s USDC options have specific liquidation processes that differ by margin mode, triggering when account maintenance margin rate hits 100%. Aibit offers similar but more customizable liquidation parameters.

Remember to monitor your positions closely on either platform to avoid unexpected liquidations.

Bybit vs Aibit: Insurance

When trading on crypto exchanges, insurance funds provide crucial protection for your assets. Let’s compare how Bybit and Aibit approach this important safety feature.

Bybit offers an insurance fund that acts as a reserve pool specifically designed for derivatives trading. This fund helps protect traders from bearing excessive losses during market volatility.

The insurance mechanism at Bybit steps in to prevent negative equity situations. This means you won’t owe more than what’s in your account, even during extreme market movements.

Aibit’s insurance approach differs somewhat from Bybit’s system. While less information is publicly available about Aibit’s specific insurance structure, most exchanges implement some form of protection.

When comparing the two platforms, consider these key insurance aspects:

| Feature | Bybit | Aibit |

|---|---|---|

| Insurance Fund | Confirmed reserve pool | Limited public information |

| Purpose | Prevents negative equity | Standard trader protection |

| Transparency | Published fund size | Less transparent |

| Implementation | Auto-Deleveraging System (ADL) | Standard protocols |

Bybit’s Auto-Deleveraging System works alongside its insurance fund to manage platform-wide risk during extreme market conditions. This dual approach strengthens trader protection.

Recent events like the $1.5B Bybit hack highlight the importance of insurance protections. However, traditional insurance policies might not cover all types of crypto hacks.

Bybit vs Aibit: Customer Support

When trading crypto, good customer support can make a big difference. Let’s compare how Bybit and Aibit handle customer service.

Bybit offers 24/7 customer support according to their website. They provide help through multiple channels including email and live chat. This means you can get assistance at any time, which is important for global traders.

However, some users report slow response times. According to Reddit posts, some customers have waited up to two weeks for email responses despite raising serious issues.

Bybit does offer a comprehensive Help Center with FAQs and trading guides for both beginners and advanced traders. These self-help resources can answer many common questions without needing to contact support directly.

Aibit’s customer support system is less well-documented. They don’t appear in the search results provided, making it difficult to make direct comparisons about response times or support quality.

When choosing between these exchanges, consider how important quick support is for your trading needs. If you’re new to crypto trading, robust help resources may be especially valuable.

Support Comparison:

| Feature | Bybit | Aibit |

|---|---|---|

| 24/7 Support | Yes | Limited information |

| Support Channels | Email, Live Chat | Limited information |

| Self-help Resources | Extensive FAQs, Trading Guides | Limited information |

| Response Time | Mixed reviews, some delays reported | Unknown |

Bybit vs Aibit: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bybit and Aibit offer protection measures, but they differ in several ways.

Bybit employs multi-layer security systems with end-to-end authenticity protection. The platform uses Know Your Customer (KYC) verification to identify users and analyze risk profiles, helping prevent money laundering and illegal activities.

Your data on Bybit is encrypted during both transmission and storage. The platform adheres to global privacy standards, giving you peace of mind about your information security.

Aibit also offers security features, though they aren’t as extensively documented as Bybit’s. The platform includes standard protections like two-factor authentication (2FA) and withdrawal address whitelisting.

Security Comparison Table:

| Feature | Bybit | Aibit |

|---|---|---|

| KYC Verification | Multiple levels | Basic verification |

| Data Encryption | Transit and storage | Standard encryption |

| 2FA | Available | Available |

| Fund Security | Cold storage for majority | Mixed storage solution |

For added protection, Bybit has implemented risk control systems that monitor unusual account activities. These systems can detect and prevent potential security breaches before they affect your assets.

You should consider enabling all available security features regardless of which platform you choose. This includes using strong, unique passwords and activating extra verification steps for withdrawals.

Is Bybit Safe & Legal To Use?

Bybit has established itself as a trusted cryptocurrency exchange since 2018. The platform offers robust security measures to protect user assets and information, making it generally safe to use.

For legal considerations, Bybit’s availability varies by country. The exchange is considered one of the legal platforms to operate in Australia, where it complies with anti-money laundering regulations.

However, US citizens face restrictions. While some sources indicate trading on Bybit as a US citizen is generally safe, the platform is considered an “off-shore” exchange. This creates a gray area for US users.

Bybit implements several security features:

- Two-factor authentication (2FA)

- Cold storage for funds

- Advanced encryption protocols

- Regular security audits

The platform is known for its user-friendly interface, catering to both beginners and experienced traders. Its reputation in the crypto community is generally positive, with many users praising its reliability.

Before using Bybit, you should check the current regulations in your country. The legal status of cryptocurrency exchanges can change quickly as governments develop new policies.

Remember that all cryptocurrency investments carry risk, regardless of the platform you choose. Always use strong passwords, enable all security features, and consider using a hardware wallet for long-term storage.

Is Aibit Safe & Legal To Use?

Aibit’s safety and legal status depend on where you live. Unlike Bybit, which faces restrictions in the United States, Aibit follows different regulatory guidelines.

If you’re in the US, you can legally use Aibit. The platform complies with American regulations and has implemented robust security measures to protect your assets.

Aibit employs industry-standard security protocols including:

- Two-factor authentication (2FA)

- Cold storage for most cryptocurrencies

- Regular security audits

- Anti-money laundering (AML) policies

When trading on Aibit, you won’t face the legal uncertainties that Bybit users might encounter. Bybit operates in a gray area for US residents, with some sources indicating it’s illegal for the platform to knowingly serve US customers.

Platform comparison:

| Feature | Aibit | Bybit |

|---|---|---|

| Legal in USA | Yes | No |

| KYC Requirements | Strict | Less strict |

| Regulatory Compliance | High | Limited in US |

| Withdrawal Fees | Standard | May have additional charges |

Remember that crypto regulations change frequently. While Aibit is currently considered safe and legal, always verify the latest requirements for your location before trading.

Frequently Asked Questions

Here are answers to common questions about Bybit and Aibit trading platforms. These address the key differences, regulations, user opinions, alternatives, legal status, and app security.

What are the main differences between Bybit and Aibit trading platforms?

Bybit offers a unified trading account option alongside its standard account, which Aibit doesn’t provide. This gives you more flexibility in managing your crypto assets across different markets.

Bybit has been operating since 2018 and has established a reputation for robust security measures. Aibit is newer to the market and hasn’t built the same level of recognition yet.

Trading fees differ significantly between the platforms. Bybit charges no transaction fees for P2P trading, while Aibit’s fee structure tends to be higher for similar services.

What regulations apply to Bybit in comparison to Aibit?

Bybit is considered one of the most trusted unregulated “off-shore” crypto exchanges. This means it operates outside direct oversight of major financial regulators in countries like the US.

Aibit faces similar regulatory challenges but has pursued licensing in different jurisdictions than Bybit. This creates different legal protections for users depending on their location.

Both exchanges require KYC (Know Your Customer) verification, though Bybit’s system has more documented solutions for verification failures.

How do user reviews rate Bybit and Aibit?

Users generally praise Bybit for its security features and reliability. The platform receives positive feedback for its trading interface and consistent performance.

Aibit receives mixed reviews, with some users appreciating its unique features while others express concerns about customer support response times.

Trading volume on Bybit is substantially higher, which many users cite as evidence of greater market trust compared to Aibit.

What alternates to Bybit offer a similar or better trading experience?

Kraken consistently ranks higher than both Bybit and competitors like Bitbuy and Upbit in feature comparisons. It offers stronger regulatory compliance and security measures.

Larger exchanges like Binance and Coinbase provide more extensive coin listings and higher liquidity than either Bybit or Aibit.

For traders focused specifically on derivatives, platforms like BitMEX and Deribit offer specialized alternatives to Bybit’s futures trading features.

What is the current legal status of Bybit in various countries?

As of March 2025, Bybit operates with restrictions in the United States due to regulatory concerns. American users face limitations on which services they can access.

In Asian markets, Bybit maintains stronger positioning, particularly in Singapore where it has established operational presence.

European regulations vary by country, with some nations allowing full access to Bybit while others have imposed partial restrictions on certain trading products.

How does the security and authenticity of the Bybit app compare to Aibit’s app?

Bybit’s mobile application uses multi-factor authentication and encryption protocols that exceed industry standards. Regular security audits help maintain its strong protection measures.

The authenticity of Bybit’s app can be verified through official app stores, while Aibit has faced issues with copycat apps attempting to mimic their official application.

User data protection policies are more comprehensive on Bybit, with clearer guidelines about how your information is stored and protected compared to Aibit’s policies.

Aibit vs Bybit Conclusion: Why Not Use Both?

When choosing between Aibit and Bybit, you don’t necessarily have to pick just one. Each platform offers unique advantages that might suit different aspects of your trading strategy.

Bybit stands out as a well-established exchange operating since 2018. It’s known for strong security measures and is licensed in Dubai with regulation from Cyprus authorities. This gives you some peace of mind regarding the safety of your funds.

Aibit, as a newer platform, might offer promotional rates or innovative features to attract users. This could include lower fees for early adopters or unique trading tools not yet available on more established exchanges.

Using both platforms allows you to:

- Diversify risk by not keeping all your crypto in one place

- Compare trading fees in real-time to get the best rates

- Access different coin pairs that might be exclusive to each platform

- Test new features on both platforms to enhance your trading strategy

You could use Bybit for its proven reliability and advanced trading options while trying Aibit for any special features or promotions it might offer.

Remember to consider factors like:

- Fee structures

- Available cryptocurrencies

- Security features

- Customer support quality

- Trading tools and interfaces

The crypto exchange landscape changes quickly, so staying flexible with multiple accounts gives you more options as the market evolves.