Choosing the right cryptocurrency exchange can make a big difference in your trading experience. BloFin and WhiteBIT are two exchanges that have gained attention in the crypto world. Each platform offers unique features that might suit different types of traders.

When comparing BloFin and WhiteBIT, you should consider factors like available cryptocurrencies, fees, security measures, and user interface to determine which platform better meets your needs. BloFin has been providing cryptocurrency prices and analytics since 2018, helping users navigate market uncertainties with ratings and real-time updates.

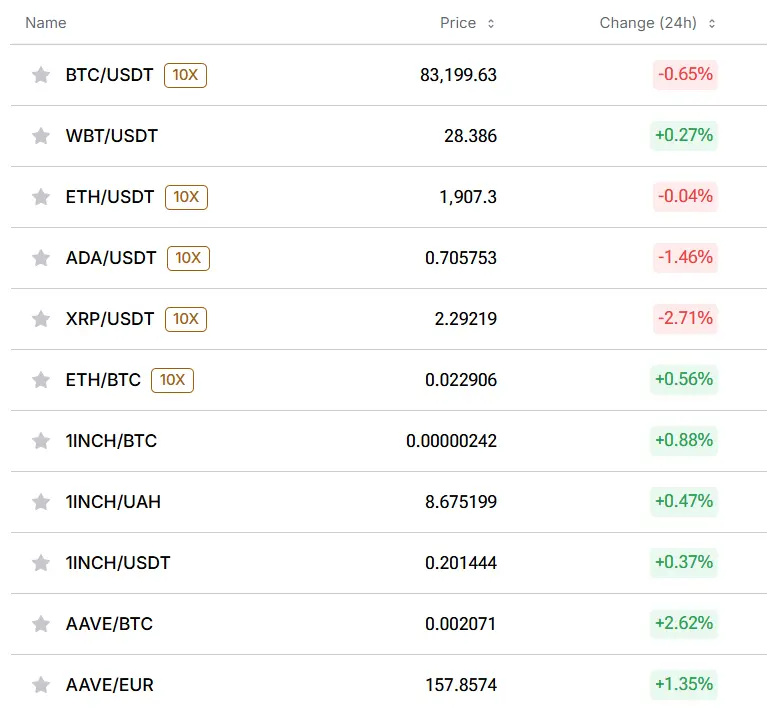

WhiteBIT is known for its native token, WBT, which was valued at approximately $28.49 as of recent data, showing a 1.36% increase. Both exchanges are ranked based on various factors including trust scores, trading volume, and available trading pairs, which can help you make an informed decision about where to conduct your cryptocurrency transactions.

BloFin Vs WhiteBIT: At A Glance Comparison

When choosing between BloFin and WhiteBIT for your cryptocurrency trading needs, several key factors should be considered.

Security Features:

- WhiteBIT: Achieved CCSS Level 3 certification (highest standard in crypto security)

- BloFin: Offers standard security protocols but lacks the same level of certification

Trading Options:

| Feature | BloFin | WhiteBIT |

|---|---|---|

| Number of cryptocurrencies | 100+ | 400+ |

| Trading pairs | 150+ | 500+ |

| Fiat options | Limited | Flexible deposit methods |

WhiteBIT stands out for its excellent interest rates on most coins, especially beneficial if you’re looking to earn passive income on your crypto holdings.

BloFin offers a more streamlined interface that might be preferable for beginners, while WhiteBIT provides more advanced trading tools for experienced traders.

Fee Structure:

- BloFin typically charges 0.1-0.2% per trade

- WhiteBIT offers a tiered fee structure starting at 0.1%, with discounts for higher trading volumes

Both platforms provide mobile apps, but user reviews suggest WhiteBIT’s app has better performance and reliability.

For customer support, WhiteBIT offers 24/7 assistance through multiple channels, while BloFin’s support has more limited availability.

Your trading volume and specific cryptocurrency needs should guide your final decision between these platforms.

BloFin Vs WhiteBIT: Trading Markets, Products & Leverage Offered

BloFin and WhiteBIT offer various trading options for cryptocurrency enthusiasts, though they differ in their specific offerings.

BloFin focuses primarily on crypto futures trading, making it a specialized platform for derivative traders. Based on available information, BloFin is gaining recognition among US-based traders looking for futures trading options.

WhiteBIT, in contrast, operates as a more comprehensive exchange with spot trading, futures, and other financial products. It has established itself as a general cryptocurrency trading platform with a broader range of market options.

Leverage Comparison:

| Platform | Max Leverage | Markets Available |

|---|---|---|

| BloFin | Up to 100x (on select pairs) | Futures, Perpetuals |

| WhiteBIT | Up to 50x (varies by asset) | Spot, Futures, Margin |

Both platforms support major cryptocurrencies like Bitcoin and Ethereum, along with various altcoins. WhiteBIT typically offers a larger selection of trading pairs overall.

BloFin appears to be developing specialized tools for crypto-index trading, with mentions of “Crypto Tradable Indices” in promotional materials. This suggests a focus on more sophisticated trading products.

When choosing between these platforms, consider your specific trading needs. If you’re primarily interested in futures trading with high leverage, BloFin might be worth exploring. For a more diverse trading experience with multiple product types, WhiteBIT offers a wider range of options.

Trading fees differ between the platforms, with BloFin potentially offering reduced fees through their token system for certain trading activities.

BloFin Vs WhiteBIT: Supported Cryptocurrencies

When choosing between BloFin and WhiteBIT, the range of supported cryptocurrencies is a key factor to consider for your trading strategy.

BloFin offers a solid selection of cryptocurrencies with detailed price analytics and ratings. They’ve been providing cryptocurrency data since 2018, helping traders navigate market uncertainties.

WhiteBIT supports a wide variety of coins, including their native WhiteBIT Coin (WBT), which was trading at approximately $28.49 as of recent data. WBT showed a 1.36% increase with a trading volume of $23,442,681.

Both exchanges support major cryptocurrencies like Bitcoin and Ethereum, but their offerings for altcoins and newer tokens may differ.

Key Comparison Points:

| Feature | BloFin | WhiteBIT |

|---|---|---|

| Native Token | No | Yes (WBT) |

| Major Coins | Bitcoin, Ethereum, etc. | Bitcoin, Ethereum, etc. |

| Analytics | Comprehensive price data | Standard market data |

| Trading Pairs | Various options | Multiple trading pairs |

You should check each platform’s current listings before deciding, as cryptocurrency exchanges frequently update their supported coins based on market conditions and regulatory requirements.

Both platforms aim to help you navigate cryptocurrency markets, but your specific trading needs will determine which selection of supported cryptocurrencies better suits your strategy.

BloFin Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BloFin and WhiteBIT, understanding their fee structures is crucial for maximizing your trading profits.

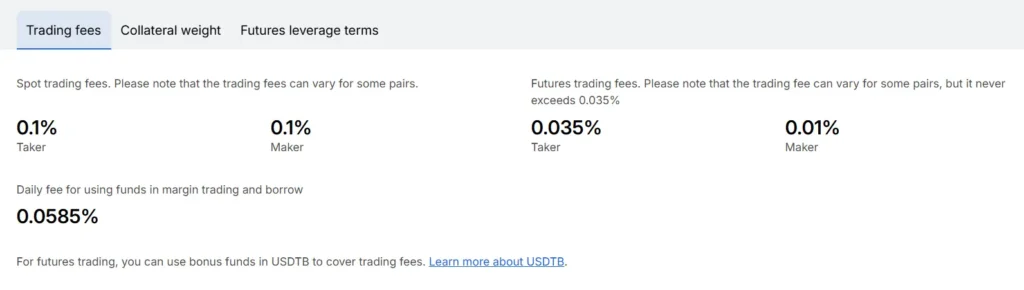

WhiteBIT Trading Fees

- Maker Fee: 0.10%

- Taker Fee: 0.10%

WhiteBIT maintains a straightforward fee structure that’s competitive in the crypto exchange market. These fees apply to standard accounts without any VIP status or token holdings.

BloFin Trading Fees

- Standard trading fees typically range between 0.075% to 0.10% depending on trading volume and user level

BloFin offers slightly lower fees for high-volume traders and those who hold the platform’s native token.

Deposit Fees Comparison

Both exchanges offer free cryptocurrency deposits, which is standard across most reputable platforms. Fiat deposits vary based on payment method:

| Exchange | Crypto Deposit | Bank Transfer | Credit Card |

|---|---|---|---|

| WhiteBIT | Free | 0-1% (varies) | 3-5% |

| BloFin | Free | 0-0.5% (varies) | 3-4% |

Withdrawal Fees

Withdrawal fees differ by cryptocurrency. BloFin generally charges network fees plus a small processing fee. WhiteBIT has fixed withdrawal fees for each cryptocurrency.

For popular coins like Bitcoin and Ethereum, WhiteBIT’s withdrawal fees tend to be slightly higher than BloFin.

You should consider your trading volume and preferred cryptocurrencies when choosing between these platforms. High-volume traders might benefit more from BloFin’s tiered fee structure.

BloFin Vs WhiteBIT: Order Types

When trading cryptocurrency, the types of orders available on your exchange platform can significantly impact your trading strategy. Both BloFin and WhiteBIT offer various order types to help you execute trades effectively.

BloFin provides three main order types: Market orders, Limit orders, and position-closing options. Market orders execute immediately at the current market price. Limit orders allow you to set a specific price at which you want to buy or sell.

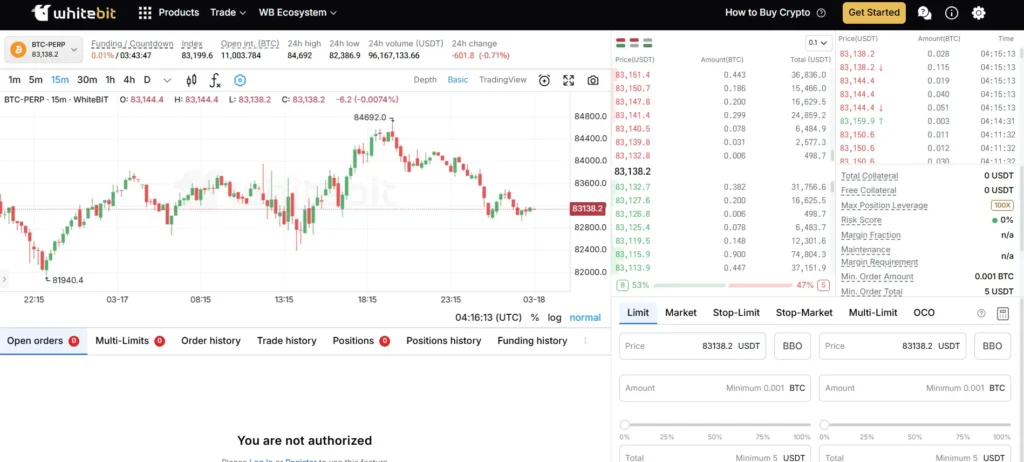

WhiteBIT offers a more extensive selection with six order types: Market, Limit, Multi-Limit, Stop-Limit, Stop-Market, and OCO (One Cancels the Other). This variety gives you more flexibility in your trading approach.

Here’s a comparison of the order types available on both platforms:

| Order Type | BloFin | WhiteBIT |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Position Close | ✓ | — |

| Multi-Limit | — | ✓ |

| Stop-Limit | — | ✓ |

| Stop-Market | — | ✓ |

| OCO | — | ✓ |

If you’re a beginner, the three basic order types on BloFin might be sufficient for your needs. The platform’s simplicity can help you focus on learning the fundamentals of crypto trading.

For more advanced traders, WhiteBIT’s additional order types provide tools for implementing complex strategies. The Stop-Limit, Stop-Market, and OCO orders are particularly useful for risk management.

BloFin Vs WhiteBIT: KYC Requirements & KYC Limits

BloFin operates as a no-KYC crypto exchange, allowing you to trade without sharing personal details or verification documents. This privacy-focused approach appeals to users who prefer to keep their identity private while trading.

For unverified BloFin users, there’s a daily withdrawal limit of 20,000 USDT. This limit applies to anyone who hasn’t completed the KYC process.

BloFin still maintains Anti-Money Laundering (AML) measures despite not requiring KYC. These measures help prevent financial crimes while still preserving user privacy.

WhiteBIT, in contrast, requires KYC verification to access its full range of features. You’ll need to submit personal information and verification documents to use the platform beyond basic functions.

KYC Tiers Comparison:

| Exchange | No KYC Limit | Basic KYC | Full KYC |

|---|---|---|---|

| BloFin | 20,000 USDT daily | N/A | N/A |

| WhiteBIT | Very limited | Moderate limits | Full access |

WhiteBIT implements a tiered KYC system. Higher verification levels grant you increased withdrawal limits and access to additional features like margin trading and lending products.

The choice between these exchanges often comes down to your privacy preferences. BloFin offers greater anonymity, while WhiteBIT provides more features for those willing to complete verification.

Remember that regulatory requirements can change quickly in the crypto space. Always check the latest policies before choosing an exchange based on KYC requirements.

BloFin Vs WhiteBIT: Deposits & Withdrawal Options

When choosing between BloFin and WhiteBIT, deposit and withdrawal options play a crucial role in your trading experience.

WhiteBIT offers flexible deposit methods, making it convenient for users with various payment preferences. As of 2025, WhiteBIT has earned recognition for its security standards, achieving CCSS Level 3 certification—the highest standard in crypto security.

BloFin integrates both centralized and decentralized crypto functionalities, giving you diverse options for managing your funds. This hybrid approach allows for greater flexibility in how you deposit and withdraw your assets.

Deposit Methods Comparison:

| Platform | Bank Transfer | Credit/Debit Card | Crypto | P2P |

|---|---|---|---|---|

| BloFin | ✓ | ✓ | ✓ | ✓ |

| WhiteBIT | ✓ | ✓ | ✓ | ✓ |

Both exchanges support major cryptocurrencies for deposits, but their fiat currency options differ slightly. WhiteBIT supports more international currencies, while BloFin excels with faster processing times for crypto deposits.

Withdrawal speeds vary between the platforms. WhiteBIT typically processes crypto withdrawals within minutes, while fiat withdrawals can take 1-3 business days. BloFin offers similar timeframes but may have higher minimum withdrawal amounts.

Fee structures also differ between the platforms. WhiteBIT is known for competitive fee rates, which may appeal if you’re looking to maximize your investment returns. Remember that crypto deposits generally offer better yields than traditional savings accounts, with APYs ranging from 4.5% upward.

BloFin Vs WhiteBIT: Trading & Platform Experience Comparison

When choosing between BloFin and WhiteBIT, your trading experience will vary significantly between these platforms.

BloFin offers a streamlined trading interface that many users find intuitive. According to recent feedback, BloFin doesn’t require KYC (Know Your Customer) verification to start trading, which appeals to users who value privacy and quick onboarding.

WhiteBIT, on the other hand, has achieved CCSS Level 3 certification – the highest standard in crypto security. This makes it an excellent choice if security is your top priority.

Trading Features Comparison:

| Feature | BloFin | WhiteBIT |

|---|---|---|

| KYC Requirements | Minimal | More comprehensive |

| Security Rating | Good | CCSS Level 3 (highest) |

| Liquidity | High with minimal spread | Strong |

| Special Features | Trading competitions, automated grid | Flexible deposit methods |

BloFin’s liquidity pools help reduce the spread between buy and sell prices, potentially saving you money on trades. The platform also offers bonuses and automated grid trading tools.

WhiteBIT ranks highly on trust scores from sites like CoinGecko and CER.live. The exchange stands out for its variety of deposit methods, giving you more flexibility in funding your account.

Your choice will ultimately depend on your priorities. If you value quick setup and trading incentives, BloFin might be your preference. If security certification and deposit flexibility matter more, WhiteBIT could be the better fit.

BloFin Vs WhiteBIT: Liquidation Mechanism

When trading on cryptocurrency exchanges like BloFin and WhiteBIT, understanding liquidation is crucial for your success. Liquidation occurs when an exchange forcibly closes your position because you lack sufficient margin to keep it open.

BloFin uses an Insurance Fund to protect against mass liquidation events. This fund combines resources from BloFin itself and collected liquidation fees, creating a safety net for the platform and its users.

WhiteBIT also employs forced position closures when your margin falls below required levels. Their system prioritizes platform stability while offering competitive lending rates up to 18.64% annually.

Both exchanges utilize similar liquidation processes but with key differences:

| Feature | BloFin | WhiteBIT |

|---|---|---|

| Liquidation Buffer | Insurance Fund | Standard margin calls |

| Order Matching | Price and time priority | Market-based execution |

| Risk Management | Focuses on preventing cascading liquidations | Emphasizes individual position management |

BloFin’s USDT-Margined perpetual contracts follow a specific matching mechanism where orders are matched based on price priority first, then time priority.

You should monitor your positions closely on both platforms to avoid unexpected liquidations. Setting appropriate stop-losses and maintaining adequate margin levels can help protect your funds.

Both exchanges provide liquidation warning systems, but the specific thresholds and notification methods differ. Familiarize yourself with these mechanisms before placing leveraged trades.

BloFin Vs WhiteBIT: Insurance

When comparing cryptocurrency exchanges, insurance coverage is a crucial factor that can protect your assets in case of security breaches or platform failures.

BloFin offers a comprehensive insurance fund that helps protect traders against unexpected market volatility and liquidations. This insurance mechanism is designed to cover potential losses during extreme market conditions.

WhiteBIT provides insurance protection through its Security Control System. The exchange maintains a reserve fund that can compensate users in case of security incidents. This adds an extra layer of protection for your assets stored on the platform.

Both exchanges implement cold storage solutions for the majority of user funds. This practice significantly reduces the risk of large-scale hacks by keeping most assets offline.

Insurance Coverage Comparison:

| Feature | BloFin | WhiteBIT |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Cold Storage | Majority of funds | Majority of funds |

| Third-Party Insurance | Limited | Available |

| Compensation History | No major incidents | No major incidents |

Neither exchange offers complete insurance coverage for all user funds. It’s important to understand that both platforms have limitations on what their insurance policies cover.

You should consider keeping only trading amounts on these exchanges and transferring larger holdings to personal wallets for maximum security. This practice reduces your risk exposure regardless of the exchange’s insurance protections.

BloFin Vs WhiteBIT: Customer Support

When choosing between BloFin and WhiteBIT exchanges, customer support can make a big difference in your trading experience.

BloFin offers 24/7 customer support through multiple channels including live chat, email, and social media. Their team typically responds within minutes for urgent issues, giving you peace of mind during trading emergencies.

WhiteBIT provides customer support through similar channels but with varying response times. While they offer comprehensive help center articles, some users report waiting several hours for responses to tickets.

Both platforms offer multilingual support, though WhiteBIT edges out with more language options (15+) compared to BloFin’s support for major languages only.

Support Channel Comparison:

| Feature | BloFin | WhiteBIT |

|---|---|---|

| Live Chat | 24/7 | Business hours |

| Email Support | Yes | Yes |

| Response Time | Minutes | Hours |

| Languages | Major languages | 15+ languages |

| Help Center | Basic | Extensive |

BloFin focuses on personalized support with dedicated account managers for higher-tier users. This can be especially helpful if you’re new to crypto trading.

WhiteBIT’s strength lies in their detailed documentation and tutorial videos, which can answer many questions without needing to contact support directly.

Your trading habits should influence which support system works better for you. If you need quick responses, BloFin might be preferable. If you prefer self-service resources, WhiteBIT’s extensive knowledge base could better meet your needs.

BloFin Vs WhiteBIT: Security Features

When choosing a crypto exchange, security should be your top priority. Both BloFin and WhiteBIT have implemented strong security measures to protect your assets.

BloFin prioritizes security and transparency with robust protection mechanisms. The platform uses two-factor authentication (2FA) to add an extra layer of security to your account.

WhiteBIT also offers 2FA and employs end-to-end data encryption to keep your information safe from potential threats. This encryption ensures that your data remains private throughout all transactions.

Key Security Features Comparison:

| Feature | BloFin | WhiteBIT |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| End-to-End Encryption | ✓ | ✓ |

| Real-Time Monitoring | Limited | ✓ |

| Transparent Security Practices | ✓ | Partial |

BloFin has gained recognition for its transparent security practices. You can easily find information about how they protect your assets and what measures they have in place.

WhiteBIT focuses on real-time monitoring of suspicious activities, which helps detect and prevent potential security breaches before they affect your account.

You should consider enabling all available security features regardless of which platform you choose. Both exchanges allow you to customize security settings to match your comfort level.

Remember that no exchange is completely immune to threats, so always use strong passwords and keep your authentication methods secure.

Is BloFin Safe & Legal To Use?

BloFin operates as a legitimate cryptocurrency exchange regulated by relevant financial authorities. According to recent information, the platform follows strict security protocols to protect user assets and data.

The exchange implements standard security measures like two-factor authentication (2FA) and encryption to safeguard your funds. These features help prevent unauthorized access to your account.

However, some users have reported concerns about BloFin’s practices. There have been claims about the platform adjusting margin requirements and liquidation thresholds without proper notice, which affected some traders negatively.

When considering safety, remember these key points:

- BloFin appears to follow regulatory requirements

- The platform uses standard security protocols

- Some users have experienced issues with sudden policy changes

- As with any exchange, you should enable all security features

While BloFin seems generally safe, you should stay vigilant with your crypto assets. This means using strong passwords, enabling all security features, and not keeping large amounts on any exchange for extended periods.

Always verify the platform’s current regulatory status before trading, as this can change. The crypto regulatory landscape continues to evolve rapidly in 2025.

Remember to conduct your own research before committing significant funds to any cryptocurrency exchange, including BloFin.

Is WhiteBIT Safe & Legal To Use?

WhiteBIT ranks among the most secure cryptocurrency exchanges available today. It has achieved Level 3 certification under the Cryptocurrency Security Standard (CCSS), which is the highest level of security recognition in the industry.

The exchange implements strong security measures including a Web Application Firewall (WAF) that detects and blocks common online attacks like cross-site scripting and SQL injection.

WhiteBIT takes fraud prevention seriously. The platform has frozen over $150 million in assets as part of its efforts to combat suspicious activities, demonstrating their commitment to security.

For legal compliance, WhiteBIT follows Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. This ensures the platform operates within regulatory frameworks in the jurisdictions it serves.

When you use WhiteBIT, your assets benefit from secure storage solutions that protect your investments from potential threats. The exchange has earned its reputation as one of the five most secure crypto platforms according to CER.live.

While WhiteBIT is generally considered legal to use, you should verify the specific regulations in your country. Cryptocurrency regulations vary widely across different regions, and what’s permitted in one location may be restricted in another.

The exchange offers a reliable trading environment with multiple security layers to protect your funds and personal information.

Frequently Asked Questions

Traders often need quick answers when comparing crypto exchanges. These questions address the most important aspects of BloFin and WhiteBIT to help you make informed decisions about which platform might better suit your trading needs.

What are the main differences in services between BloFin and WhiteBIT?

BloFin offers a wider range of trading options including futures, spot, copy trading, and bot trading. This variety gives traders more flexibility in how they approach the market.

WhiteBIT focuses primarily on spot trading and currency exchange services. Their platform is designed to be straightforward for purchasing cryptocurrency directly.

The exchanges also differ in their token offerings. WhiteBIT has its native WhiteBIT Coin, which serves as the platform’s utility token with specific use cases within their ecosystem.

How do users rate their experiences with BloFin compared to WhiteBIT on review platforms?

WhiteBIT has mixed reviews on platforms like Trustpilot. Some users report issues with account blocking during withdrawals, which has led to concerns about fund accessibility.

Some reviews specifically warn against trading on WhiteBIT, citing concerns about account restrictions and withdrawal problems.

BloFin’s user reviews are less prominent in the search results, making it difficult to make a direct comparison based solely on user feedback.

What are the trading volume differences between BloFin and WhiteBIT?

WhiteBIT positions itself as one of the biggest European cryptocurrency exchanges, which suggests it maintains substantial trading volumes in the European market.

BloFin’s exact trading volume metrics weren’t specified in the search results, making direct comparison difficult.

Trading volumes can fluctuate based on market conditions, so current figures would need to be checked on live tracking sites like CoinMarketCap or CoinGecko.

Which exchange offers better security and trustworthiness, BloFin or WhiteBIT?

WhiteBIT describes itself as offering a “secure, reliable, and feature-rich trading platform.” However, some user reviews contradict this claim with reports of account freezes.

The security concerns raised in WhiteBIT reviews suggest some users have experienced trust issues with the platform, particularly around withdrawals.

BloFin’s security features weren’t prominently mentioned in the search results, making it necessary to research their security practices separately.

What are the top derivatives trading platforms, and how do BloFin and WhiteBIT compare?

BloFin specifically mentions futures trading as part of its offering, positioning it as a derivatives trading option. This makes it suitable for traders interested in leveraged positions.

WhiteBIT appears to focus less on derivatives and more on spot trading, though complete details about their derivatives offerings weren’t clear from the search results.

Among top derivatives platforms globally, BloFin and WhiteBIT compete with major players like Binance Futures, Bybit, and OKX in the derivatives space.

Between BloFin and WhiteBIT, which exchange is considered tier 1 or tier 2, and what defines these tiers?

Exchange tiers typically relate to factors like trading volume, liquidity, regulatory compliance, and market reputation. Tier 1 exchanges are generally the largest and most established platforms.

WhiteBIT describes itself as “one of the biggest European cryptocurrency exchanges,” suggesting it may hold tier 1 or tier 2 status within the European market specifically.

BloFin’s tier classification wasn’t explicitly mentioned in the search results, which may indicate it hasn’t yet achieved the widespread recognition of the largest tier 1 global exchanges.

BloFin Vs WhiteBIT Conclusion: Why Not Use Both?

Both BloFin and WhiteBIT have unique strengths that can benefit different aspects of your trading strategy. BloFin offers excellent liquidity pools with minimal spreads and doesn’t require KYC verification, making it accessible for quick entry.

WhiteBIT stands out for its affordable fees and accessible derivatives markets. The platform has positioned itself to be cost-effective compared to many competitors.

Instead of choosing just one exchange, you might consider using both platforms strategically. BloFin could be your go-to for deep liquidity needs and advanced trading features, while WhiteBIT might serve you better for cost-sensitive transactions.

Many experienced traders maintain accounts on multiple exchanges to:

- Reduce risk through platform diversification

- Take advantage of different fee structures

- Access unique features specific to each platform

- Capitalize on arbitrage opportunities between exchanges

You can use BloFin’s trading competitions and automated grid features for certain strategies while leveraging WhiteBIT’s affordability for other trades.

The crypto market changes quickly, and having options gives you flexibility. As of March 2025, both exchanges continue to develop their offerings to stay competitive in the market.

Your specific needs will ultimately determine which platform—or combination of platforms—works best for your trading style.