When choosing a cryptocurrency derivatives exchange, understanding the key differences between platforms can be crucial for your trading success. BloFin and BitMEX are two popular options that offer different features, fee structures, and user experiences.

Both exchanges provide cryptocurrency derivative trading, but they differ significantly in their regulatory approach, available trading pairs, and platform interfaces. BitMEX has been around longer and faced regulatory challenges, including a $100 million fine for Bank Secrecy Act violations between 2015 and 2020.

BloFin is a newer player in the market, and comparing these platforms can help you decide which one might better suit your trading needs. Your choice may depend on factors like security measures, trading fees, available leverage options, and the specific cryptocurrencies you want to trade.

BloFin vs BitMEX: At A Glance Comparison

When choosing between BloFin and BitMEX, you need to understand their key differences. Both platforms offer cryptocurrency derivatives trading but have distinct features that set them apart.

| Feature | BloFin | BitMEX |

|---|---|---|

| Founded | 2023 | 2014 |

| Trading Focus | Spot and derivatives | Primarily derivatives |

| Leverage Options | Up to 100x | Up to 100x |

| User Interface | Modern, beginner-friendly | Complex, advanced traders |

| Available Assets | 50+ cryptocurrencies | 15+ cryptocurrencies |

| Security Features | 2FA, cold storage | 2FA, multi-sig wallets |

| Fee Structure | 0.05-0.1% maker-taker | 0.075-0.25% maker-taker |

BloFin is the newer platform, offering a more user-friendly interface that works well for beginners and experienced traders alike. You’ll find a wider selection of cryptocurrencies on BloFin compared to BitMEX.

BitMEX has established itself as an industry veteran with a proven track record. It offers robust trading tools that appeal particularly to professional traders who need advanced charting and analysis features.

Trading fees vary between the platforms, with BloFin generally offering slightly lower trading fees for most transaction types. However, BitMEX may provide better liquidity for certain trading pairs.

Both exchanges implement strong security measures, but their approach to customer support differs significantly. BloFin offers 24/7 live chat support, while BitMEX relies more heavily on ticket-based systems and documentation.

BloFin vs BitMEX: Trading Markets, Products & Leverage Offered

BloFin and BitMEX are popular platforms for cryptocurrency derivatives trading, but they differ in several key aspects.

BitMEX is well-known for offering up to 100x leverage on Bitcoin contracts, allowing traders to amplify potential profits. They also provide high leverage options for various altcoin contracts.

BloFin offers perpetual contracts, which are traded directly on exchanges with standardized contract terms. These contracts don’t have expiration dates, making them attractive for long-term positions.

Leverage Comparison:

- BitMEX: Up to 100x for Bitcoin, high leverage for altcoins

- BloFin: Competitive leverage offerings, though typically not as high as BitMEX

Trading Products:

- Perpetual contracts

- Futures contracts

- Options (varies by platform)

- Spot trading (BloFin)

BitMEX uses technology comparable to investment banks for its trading engine, which helps ensure fast execution speeds even during high market volatility.

When choosing between these platforms, you should consider your risk tolerance and trading style. BitMEX might appeal to you if you’re seeking very high leverage opportunities.

Trading fees are another important consideration. BitMEX has established a reputation for keeping fees relatively low compared to some competitors in the cryptocurrency derivatives space.

Both platforms offer mobile apps so you can trade on the go, though user interface quality varies.

BloFin vs BitMEX: Supported Cryptocurrencies

BloFin offers an impressive range of cryptocurrency options for traders. According to recent data, BloFin supports 379 coins and 388 trading pairs for spot trading. For futures trading, it provides access to 491 pairs.

BitMEX has a more limited selection compared to BloFin. It focuses primarily on Bitcoin and a select number of major altcoins. BitMEX specializes in cryptocurrency derivatives rather than offering a wide variety of spot trading options.

Here’s a quick comparison of their cryptocurrency support:

| Feature | BloFin | BitMEX |

|---|---|---|

| Total coins supported | 379 | 15-20 (approximate) |

| Spot trading pairs | 388 | Limited |

| Futures trading pairs | 491 | 15+ |

| Major coins supported | BTC, ETH, SOL, etc. | BTC, ETH, XRP, etc. |

BloFin clearly leads in the variety of cryptocurrencies available to trade. You’ll find practically all major cryptocurrencies and many smaller altcoins on their platform.

BitMEX takes a more focused approach, specializing in Bitcoin derivatives and futures contracts. If you’re mainly interested in trading BTC with leverage, BitMEX has strong offerings despite fewer coins.

Your choice between these exchanges may depend on whether you prioritize variety (BloFin) or specialized Bitcoin derivatives trading (BitMEX).

BloFin vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BloFin and BitMEX, understanding their fee structures can help you make a better decision for your trading needs.

BitMEX offers competitive rates with taker fees starting at 0.075% for spot trading. For futures trading, fees can go as low as 0.02% for makers and 0.06% for takers when you reach higher VIP levels and trading volumes.

BloFin’s fee structure is tiered based on your trading volume and VIP status. Their rates are designed to be competitive in the market, though specific numbers may vary by market conditions.

Trading Fee Comparison:

| Exchange | Spot Maker Fee | Spot Taker Fee | Futures Maker Fee | Futures Taker Fee |

|---|---|---|---|---|

| BitMEX | 0.025% | 0.075% | 0.02% (min) | 0.06% (min) |

| BloFin | Varies by tier | Varies by tier | Varies by tier | Varies by tier |

For deposits, both platforms typically offer free crypto deposits. However, withdrawal fees differ based on the cryptocurrency network used.

BitMEX withdrawal fees are generally based on network conditions and can fluctuate with blockchain congestion. BloFin similarly adjusts withdrawal fees to reflect network costs.

Both exchanges offer fee discounts for high-volume traders and those holding their native tokens. You should check their current promotions before deciding, as special offers can significantly reduce your trading costs.

BloFin vs BitMEX: Order Types

When trading on cryptocurrency exchanges, order types can significantly impact your trading strategy. Both BloFin and BitMEX offer various order options to help you execute trades effectively.

BitMEX provides a comprehensive range of order types designed for different trading strategies. These include standard market and limit orders, plus more advanced options like stop-loss, take-profit, and trailing stop orders.

BloFin keeps things simpler with basic order types including market orders and limit orders. The platform also offers position-closing options directly from the price chart (K line), making it convenient for quick exits.

If you’re an advanced trader looking for sophisticated order execution, BitMEX might better suit your needs with its wider selection of order types. These tools can help you implement complex trading and hedging strategies.

BloFin’s straightforward approach makes it more accessible for beginners or those who prefer simplicity. You won’t face a steep learning curve with basic order types that handle most common trading scenarios.

Both platforms allow you to manage existing positions, but they differ in complexity and available tools. Your choice should align with your trading style and experience level.

Consider how important advanced order types are to your strategy when choosing between these exchanges. More options provide flexibility but may add complexity that isn’t necessary for all traders.

BloFin vs BitMEX: KYC Requirements & KYC Limits

When choosing between BloFin and BitMEX, understanding their KYC (Know Your Customer) requirements is crucial for your trading experience.

BloFin KYC Requirements:

- Complete KYC verification is mandatory

- You must submit valid government-issued ID

- A selfie is required

- Proof of address documentation is necessary

- Without KYC, you cannot access all features or change limits

BloFin takes a stricter approach to verification. You won’t be able to use the platform’s full functionality until you complete their verification process.

BitMEX KYC Requirements:

- Historically, BitMEX operated with minimal KYC requirements

- Email verification is typically required

- Full KYC was not mandatory for basic trading in the past

- They have been moving toward stronger compliance measures

BitMEX faced significant consequences for their previous loose approach to verification. In 2021, they paid a $100 million penalty related to anti-money laundering compliance issues.

The difference in KYC approaches reflects each platform’s regulatory strategy. BloFin emphasizes compliance from the start, while BitMEX has been transitioning to stricter requirements after regulatory pressure.

Your choice between these platforms might depend on how quickly you need to start trading and your comfort with sharing personal information.

BloFin vs BitMEX: Deposits & Withdrawal Options

When choosing between BloFin and BitMEX, understanding their deposit and withdrawal options can help you make the right decision for your trading needs.

BloFin supports multiple payment methods to fund your account. You can use bank transfers, credit/debit cards, and potentially third-party payment processors to deposit funds.

BitMEX, on the other hand, traditionally focuses on crypto deposits only. This means you’ll need to already own cryptocurrency to start trading on their platform.

Withdrawal Fees:

- BitMEX charges standard withdrawal fees

- Bybit (a competitor mentioned in search results) charges no withdrawal fees and has 41% lower mining withdrawal fees than industry average, including BitMEX

Deposit Options Comparison:

| Platform | Bank Transfer | Credit/Debit Cards | Crypto Deposits |

|---|---|---|---|

| BloFin | ✓ | ✓ | ✓ |

| BitMEX | ✗ | ✗ | ✓ |

BloFin’s variety of deposit options makes it more accessible if you’re new to crypto or prefer traditional payment methods. This flexibility can be valuable when you need to quickly add funds to your account.

Processing times may vary between platforms. BitMEX typically processes crypto withdrawals within a few blockchain confirmations, while BloFin’s processing times might depend on the payment method you choose.

BloFin vs BitMEX: Trading & Platform Experience Comparison

When comparing BloFin and BitMEX trading platforms, several key differences stand out for crypto traders. Both platforms offer cryptocurrency derivatives trading but with distinct user experiences.

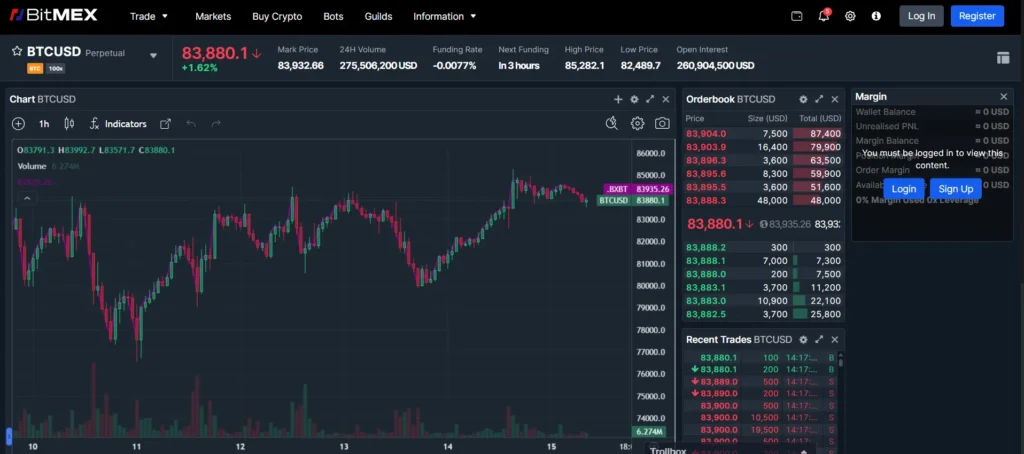

BitMEX has been around longer and is known for its advanced trading interface. You’ll find a robust platform with powerful charting tools and technical analysis options. BitMEX caters more to experienced traders who understand leverage and margin trading.

BloFin, as a newer platform in 2025, offers a more streamlined interface that many beginners find easier to navigate. You get access to modern trading tools without the overwhelming complexity.

Trading Features Comparison:

| Feature | BloFin | BitMEX |

|---|---|---|

| User Interface | Modern, streamlined | Technical, data-heavy |

| Mobile Experience | Well-optimized app | Functional but complex |

| Order Types | Standard + conditional | Extensive advanced options |

| Charting Tools | Integrated, user-friendly | Professional-grade |

BitMEX typically offers higher leverage options for experienced traders. You can access up to 100x leverage on some contracts, though this comes with significant risk.

BloFin limits leverage to safer levels for most traders. This protection helps you avoid catastrophic losses, especially if you’re newer to crypto trading.

Platform speed matters for active traders. BitMEX has improved its performance over the years, but some users report that BloFin offers faster execution times in 2025.

BloFin vs BitMEX: Liquidation Mechanism

When trading on margin platforms, understanding the liquidation mechanism is crucial for your risk management. Both BloFin and BitMEX have developed systems to handle positions that fall below maintenance margin requirements.

BitMEX employs a sophisticated liquidation process that aims to protect traders from complete loss. Their system attempts to avoid immediate liquidation by first increasing users’ maintenance margin when positions approach dangerous levels.

BloFin, as one of the larger non-KYC futures platforms, handles liquidations differently than BitMEX. While specific details about BloFin’s liquidation mechanism are limited in the search results, it has gained popularity as an alternative to more established exchanges.

The liquidation process on both platforms follows these general steps:

- Warning notification – When your position approaches liquidation levels

- Maintenance margin increase – Attempt to save the position

- Partial liquidation – Reducing position size if possible

- Complete liquidation – Closing the entire position if necessary

BitMEX’s liquidation engine is known for its efficiency in highly volatile markets. This can be particularly important when trading perpetual contracts, which both platforms offer.

Your choice between these platforms may depend on your trading style and risk tolerance. BitMEX might offer more sophisticated liquidation protections, while BloFin could provide different advantages as a newer alternative in the market.

When trading on either platform, always monitor your positions closely and use stop-loss orders to manage risk before reaching liquidation points.

BloFin vs BitMEX: Insurance

When trading on cryptocurrency platforms, insurance protection is a key factor to consider. Both BloFin and BitMEX offer insurance features, but they work differently.

BloFin provides an actual insurance policy that covers cryptocurrency stored on their servers. This gives traders peace of mind knowing that their assets have some protection against potential security issues.

BitMEX, on the other hand, offers an Insurance Fund rather than traditional insurance. This fund helps ensure that winning traders receive their expected profits, even if losing traders cannot cover their losses.

The BitMEX Insurance Fund acts as a buffer in volatile market conditions. When markets move quickly, this fund prevents winning traders from getting less than they earned due to bankrupt trading counterparties.

Key Insurance Differences:

| Platform | Type of Protection | Coverage |

|---|---|---|

| BloFin | Insurance Policy | Cryptocurrency stored on servers |

| BitMEX | Insurance Fund | Ensures winning traders get profits |

BitMEX created this system specifically for their high-leverage trading environment, where they offer up to 100x leverage for Bitcoin contracts.

The effectiveness of these insurance methods depends on your trading style. If you’re more concerned about asset security, BloFin’s approach might appeal to you. If you worry about receiving your profits during extreme market volatility, BitMEX’s fund addresses that concern.

BloFin vs BitMEX: Customer Support

When trading cryptocurrencies, reliable customer support can make a significant difference in your experience. Both BloFin and BitMEX offer support services, but they differ in important ways.

BitMEX provides 24/7 customer support through email and a ticket system. Their response times typically range from a few hours to 24 hours depending on query complexity. They also maintain a comprehensive knowledge base for self-help.

BloFin, as a newer platform in 2025, has invested heavily in customer support infrastructure. They offer live chat support alongside email tickets, with most users reporting response times under 6 hours.

Support Channels Comparison:

| Feature | BloFin | BitMEX |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Email Support | Yes | Yes |

| Live Chat | Yes | No |

| Phone Support | No | No |

| Knowledge Base | Yes | Yes |

| Community Forum | Yes | Yes |

BitMEX support team consists of experienced staff who can handle technical trading questions. Their knowledge base is particularly detailed on margin trading mechanics and platform features.

BloFin’s support team offers assistance in more languages (8 compared to BitMEX’s 4). Their live chat feature is especially useful for resolving urgent issues during active trading sessions.

Both platforms provide regular updates through social media channels when system maintenance or issues occur. This transparency helps you plan your trading activities accordingly.

BloFin vs BitMEX: Security Features

When choosing a crypto exchange, security should be your top priority. Both BloFin and BitMEX offer strong security features, but they differ in several key areas.

BloFin emphasizes comprehensive security with two-factor authorization (2FA), SSL encryption, and cold storage for assets. These features help protect your funds from unauthorized access and potential cyber threats.

BitMEX utilizes advanced multi-factor security technology similar to what investment banks and hedge funds use. This provides institutional-grade protection for traders concerned about account safety.

Key Security Features Comparison:

| Feature | BloFin | BitMEX |

|---|---|---|

| Two-Factor Authentication | ✅ | ✅ |

| Cold Storage | ✅ | ✅ |

| SSL Encryption | ✅ | ✅ |

| Multi-factor Security | Basic | Advanced |

BitMEX has been in the market longer, which has given them time to refine their security protocols and address vulnerabilities that might have been discovered over the years.

BloFin, being a newer platform, has had the advantage of building their security systems with awareness of the latest threats and vulnerabilities in the crypto space.

Both exchanges require identity verification to comply with regulatory standards, helping to prevent fraud and money laundering activities on their platforms.

You should enable all available security features regardless of which platform you choose. This includes using strong, unique passwords and enabling 2FA for all transactions.

Is BloFin a Safe & Legal To Use?

BloFin appears to have a moderate to high level of trust and stability based on current reviews. The platform offers top-tier security features to protect user assets and information.

However, some users have reported concerning incidents. According to Reddit discussions, BloFin has allegedly adjusted margin requirements and liquidation thresholds without proper notice, resulting in some traders being liquidated unexpectedly.

When considering safety, remember these important factors:

- Regulation status: BloFin operates as a cryptocurrency exchange, though specific licensing details vary by region

- Security measures: The platform emphasizes advanced security features

- User experiences: Mixed reviews exist, with some positive experiences and others reporting issues

You should remain vigilant about protecting your account by:

- Using strong passwords

- Enabling two-factor authentication

- Starting with smaller amounts until you’re comfortable

BloFin offers trading services for cryptocurrencies, which is legal in many jurisdictions. However, cryptocurrency regulations differ significantly between countries.

Before using BloFin, verify that cryptocurrency trading is permitted in your location. Some countries have banned or severely restricted crypto trading activities.

The exchange appears legitimate based on available information, but exercise caution. The cryptocurrency exchange landscape continues to evolve, and platforms can change their policies or security practices over time.

Is BitMEX a Safe & Legal To Use?

BitMEX has established itself as a major cryptocurrency exchange with a mixed reputation for safety. The platform offers several security features to protect user accounts and funds.

BitMEX implements wallet security measures and trading safeguards that many users find adequate. Their system security appears to be taken seriously by the company.

However, BitMEX has faced significant controversy over the years. The exchange has been involved in scandals, investigations, and regulatory issues that raise legitimate concerns.

User reviews about BitMEX safety are mixed. Some traders consider it trustworthy enough for active trading but caution against storing large amounts of cryptocurrency on the platform.

Key Safety Features:

- Two-factor authentication

- Cold storage for most funds

- Address whitelisting

- Email confirmations

Legal Considerations:

- BitMEX has faced regulatory challenges in multiple countries

- The company has worked to improve compliance in recent years

- Always check if BitMEX is legally allowed to operate in your jurisdiction

For your protection, treat BitMEX like any exchange – use it for trading but avoid keeping more funds than necessary on the platform. The exchange works for many traders, but its troubled history suggests exercising caution.

Always use strong passwords, enable all security features, and consider if the platform’s risks align with your trading needs.

Frequently Asked Questions

Traders comparing BloFin and BitMEX often have specific questions about how these platforms differ. Below are answers to common questions about their features, costs, and security measures.

What are the comparative advantages of BloFin over BitMEX in terms of derivatives trading features?

BloFin offers up to 125x leverage on futures and perpetual contracts, which is higher than BitMEX’s 100x maximum leverage.

BloFin also provides more trading pairs with over 45 options available, giving you more diversity in your trading portfolio.

BitMEX specializes in Bitcoin-based contracts, while BloFin has expanded its offerings to include more altcoin trading pairs.

How do BloFin and BitMEX differ in their fee structures for crypto futures trading?

BitMEX uses a maker-taker fee model where market makers receive rebates, while takers pay fees ranging from 0.075% to 0.25% depending on contract type.

BloFin’s fee structure is similarly competitive but may offer promotional rates for new users.

Both platforms reduce fees for higher-volume traders, though the tier structures differ between them.

Can users in the USA legally trade on BloFin and BitMEX, and how does each platform ensure compliance?

Neither BitMEX nor BloFin officially allows USA-based traders due to regulatory restrictions.

Both platforms use KYC (Know Your Customer) procedures and IP-based restrictions to maintain compliance with international regulations.

BitMEX faced regulatory issues in 2020 and has since strengthened its compliance measures, while BloFin has implemented compliance protocols from its launch.

What user security measures do BloFin and BitMEX employ to protect trader assets?

Both platforms use cold storage for the majority of user funds, keeping assets offline and safe from potential hacks.

BitMEX has a longer track record with security and employs multi-signature wallets for withdrawals.

BloFin, being newer, has implemented modern security protocols including two-factor authentication and advanced encryption standards.

How do the liquidation protocols compare between BloFin and BitMEX during market volatility?

BitMEX pioneered the auto-deleveraging system that liquidates positions gradually to prevent market crashes.

BloFin uses a similar liquidation engine but claims to have optimized it to reduce unnecessary liquidations during temporary price wicks.

Both platforms maintain insurance funds to cover liquidations that occur at prices worse than bankruptcy price, but the size of these funds differs.

Which platform between BloFin and BitMEX offers better customer support and user experience for traders?

BitMEX offers support primarily through email and its knowledge base, with relatively slower response times but detailed documentation.

BloFin provides more modern support options including live chat and a comprehensive Help Center with quicker response times.

The BloFin interface is generally considered more intuitive for beginners, while BitMEX’s platform might appeal more to experienced traders who value advanced charting tools.

BloFin vs BitMEX Conclusion: Why Not Use Both?

After comparing these two platforms, there’s no clear winner. Each exchange offers unique benefits that might suit different trading needs.

BitMEX stands out as a pioneer in perpetual contracts. This means you don’t need to worry about rolling positions at fixed future dates. Their high trading volume also provides good liquidity for your trades.

BloFin, on the other hand, focuses on user-friendly design. Their platform works well for traders with varying experience levels in digital asset management.

You might consider using both platforms for different purposes. BitMEX could be your go-to for high-volume trading and innovative contract types. BloFin might serve better for daily management and simpler trades.

This dual-platform approach lets you:

- Diversify risk across exchanges

- Access different features unique to each platform

- Compare fees in real-time for better value

- Maintain backup trading options if one site experiences issues

Many experienced traders already use multiple exchanges. This strategy maximizes advantages while minimizing the drawbacks of any single platform.

Remember to consider your own trading style, volume needs, and comfort with different interfaces. The best choice depends on your specific goals and preferences.