Looking for the right crypto exchange can be tough. BloFin and Bitget are two popular options that many traders consider. These platforms offer different features, fee structures, and trading experiences that matter when you’re deciding where to put your money.

Bitget charges 0.20% for spot trading (both makers and takers), which can drop to 0.14% when using their native token, while BloFin positions itself as an alternative for those seeking different options. Both exchanges appear in cryptocurrency ranking lists based on factors like trust scores, trading volume, and available trading pairs.

When comparing these exchanges, you’ll want to consider not just fees but also security measures, available cryptocurrencies, and user experience. Some traders prefer one platform over the other based on specific needs, such as derivatives trading options or liquidity requirements.

BloFin vs Bitget: At A Glance Comparison

When choosing between BloFin and Bitget, you need to understand their key differences. Both platforms offer cryptocurrency trading, but they have unique features that set them apart.

Fee Structure:

- Bitget: Low withdrawal fees at 0.05%

- BloFin: Competitive fee structure (specific rates vary)

Trading Features:

| Feature | Bitget | BloFin |

|---|---|---|

| Copy Trading | Yes | Limited |

| Number of Cryptocurrencies | High | Moderate |

| User Interface | User-friendly | Modern design |

Bitget stands out with its copy trading feature, allowing you to mimic successful traders’ strategies. This makes it appealing if you’re new to crypto trading or want to learn from others.

Bitget also maintains a customer protection fund, which adds an extra layer of security for your assets. Their proof of reserve system is healthy, giving you more transparency about their holdings.

Both exchanges offer mobile apps so you can trade on the go. Your choice might depend on which cryptocurrencies you want to trade, as the selection differs between platforms.

Trading volume can affect liquidity, with Bitget generally handling higher volumes. This means you can usually buy or sell assets quickly without major price impacts.

You should check both platforms’ verification requirements before signing up, as they follow different KYC (Know Your Customer) procedures.

BloFin vs Bitget: Trading Markets, Products & Leverage Offered

Both BloFin and Bitget offer a variety of trading options for crypto enthusiasts. When comparing these platforms, you’ll find differences in their available markets, products, and leverage capabilities.

Bitget provides spot trading with numerous cryptocurrency pairs. You can trade popular coins like Bitcoin and Ethereum, along with a wide selection of altcoins. Their futures trading also allows you to speculate on price movements without owning the actual assets.

BloFin similarly offers spot and futures markets, though their coin selection may differ slightly from Bitget. Both platforms cater to traders looking for variety in their trading options.

For leverage trading, Bitget offers competitive multipliers that appeal to experienced traders. This allows you to amplify potential gains, though it also increases risk.

Here’s a quick comparison of their offerings:

| Feature | Bitget | BloFin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ | ✓ |

| Leverage Options | High multipliers | Competitive leverage |

| Fee Structure | Low (0.05% withdrawal) | Comparable to industry standards |

Both platforms support various order types including limit, market, and stop orders. This gives you flexibility in how you execute your trading strategy.

When choosing between these exchanges, consider which specific cryptocurrencies you want to trade and how much leverage you’re comfortable using in your trading activities.

BloFin vs Bitget: Supported Cryptocurrencies

When choosing between BloFin and Bitget, the range of supported cryptocurrencies is an important factor to consider.

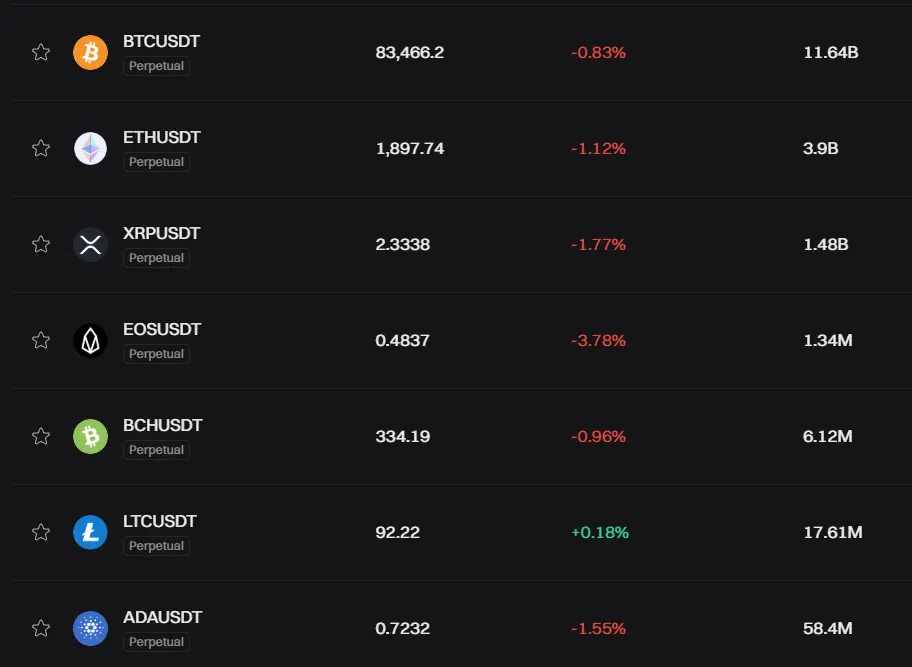

Bitget offers a comprehensive selection of cryptocurrencies for trading. The platform supports major coins like Bitcoin (BTC) and Ethereum (ETH), as well as a wide variety of altcoins and emerging tokens.

BloFin also provides access to popular cryptocurrencies, though its selection may differ slightly from Bitget. Both exchanges allow you to trade the most established digital assets on the market.

Bitget Cryptocurrency Support:

- Major cryptocurrencies (BTC, ETH, XRP, etc.)

- Wide range of altcoins

- New and emerging tokens

- Various trading pairs

BloFin Cryptocurrency Support:

- Popular cryptocurrencies

- Focus on derivatives trading

- Global accessibility without KYC requirements

If you’re looking to trade specific altcoins or newer tokens, you’ll want to check both platforms directly for their current listings. Cryptocurrency offerings can change as exchanges add new coins or remove others.

Bitget appears to have a slightly more extensive range of cryptocurrencies based on available information, making it potentially better for traders seeking variety in their digital asset options.

For derivative traders, both platforms offer futures trading options across multiple cryptocurrencies, though their specific contract types and leverage options may vary.

BloFin vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BloFin and Bitget, understanding their fee structures is crucial for your trading strategy.

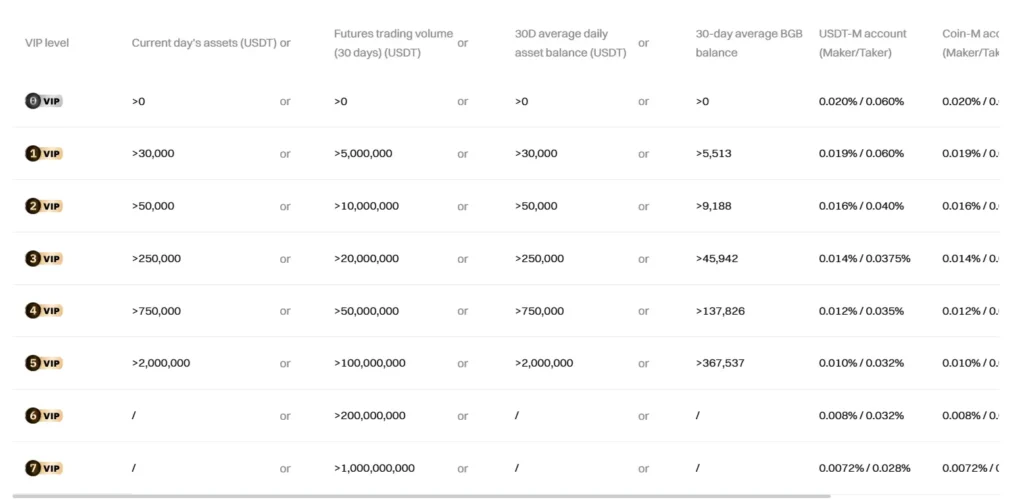

Bitget Trading Fees:

- Spot trading: 0.20% for both makers and takers

- Reduced to 0.14% when using Bitget’s native token

- Futures trading can go as low as 0.02% (maker) and 0.06% (taker) with high volume and VIP status

BloFin Trading Fees:

BloFin also offers competitive rates, though they typically vary based on trading volume and user tier level.

Deposit Fees:

- Bitget: No crypto deposit fees

- BloFin: Generally no deposit fees for most cryptocurrencies

Withdrawal Fees:

Both exchanges charge withdrawal fees that vary by cryptocurrency. These fees typically cover network transaction costs.

Bitget stands out for having no account fees and supporting free bank transfers. This makes it more accessible for traders who prefer fiat on/off ramps.

Both platforms may offer fee discounts through loyalty programs, trading volume tiers, or by using their native tokens. Your actual costs will depend on your trading habits and preferred payment methods.

Remember that fee structures can change, so it’s worth checking the exchanges’ official websites for the most current information before making your decision.

BloFin vs Bitget: Order Types

When trading on cryptocurrency exchanges, order types play a crucial role in your trading strategy. Both BloFin and Bitget offer various order types to meet different trading needs.

BloFin provides advanced order types along with detailed charting tools. This makes managing your trades more efficient. Their platform is designed to be user-friendly for traders of all experience levels.

Bitget also offers a comprehensive range of order types. Their Trading 101 resources help you understand when to use different orders for better returns.

Common Order Types on Both Platforms:

- Market Orders: Execute immediately at current market price

- Limit Orders: Set a specific price for execution

- Stop Orders: Trigger at a certain price point

- Take Profit Orders: Automatically close positions at profit targets

Both platforms provide tools to help manage risk in volatile markets. You can set stop-losses to protect your investments from significant downturns.

The interfaces for placing orders on both exchanges are relatively intuitive. However, some users find BloFin’s charting tools more advanced for technical analysis.

Neither platform has a significant advantage over the other in terms of order execution speed. Both process trades efficiently under normal market conditions.

For beginners, both exchanges offer educational resources about different order types. This helps you make informed decisions about which orders to use in various market situations.

BloFin vs Bitget: KYC Requirements & KYC Limits

BloFin operates as a KYC-free exchange, allowing you to trade without submitting personal identification documents. This means you can start trading immediately after creating an account, offering more privacy and a faster onboarding process.

In contrast, Bitget requires KYC verification to comply with regulations. You’ll need to submit personal information to access full platform features.

Withdrawal Limits Based on KYC Status:

| Exchange | Without KYC | With KYC |

|---|---|---|

| BloFin | Full access | N/A (KYC not required) |

| Bitget | 20,000 USDT daily | Higher limits |

Without completing KYC on Bitget, you face several restrictions. You won’t be able to access earn products, and your daily withdrawal limit is capped at 20,000 USDT.

BloFin’s no-KYC approach makes it appealing if you value privacy and want to start trading quickly. The platform aims to provide a globally accessible trading experience without identity verification barriers.

Your choice between these exchanges might depend on your privacy preferences and withdrawal needs. If you require higher withdrawal limits or access to earning features, Bitget with KYC completion might be more suitable.

Remember that regulatory requirements can change, so always check the latest policies on both platforms before making your decision.

BloFin vs Bitget: Deposits & Withdrawal Options

When choosing between BloFin and Bitget, deposit and withdrawal options play a crucial role in your trading experience.

Bitget offers a variety of funding methods. You can deposit via bank transfers, which typically process within one day. They also support major payment cards like Visa and Mastercard for quick deposits.

For withdrawals, Bitget keeps fees competitive at around 0.05%, making it an affordable option compared to many exchanges.

BloFin positions itself as a no-KYC platform, which means fewer verification steps when depositing funds. This can make the deposit process faster for users who prefer privacy.

Both exchanges support cryptocurrency deposits and withdrawals for major coins like Bitcoin and Ethereum, as well as various altcoins.

| Feature | Bitget | BloFin |

|---|---|---|

| Bank Transfers | Yes | Limited |

| Card Payments | Visa, Mastercard | Limited |

| Withdrawal Fee | Approximately 0.05% | Varies |

| KYC Requirements | Required | No KYC |

| Processing Time | ~1 day for bank transfers | Varies |

The right choice depends on your priorities. If you value traditional payment methods and don’t mind KYC, Bitget might suit you better. If privacy and minimal verification are important to you, BloFin’s no-KYC approach could be more appealing.

Remember to check the current fee structures as they may change over time.

BloFin vs Bitget: Trading & Platform Experience Comparison

When choosing between BloFin and Bitget for your crypto trading needs, the platform experience makes a big difference in your success.

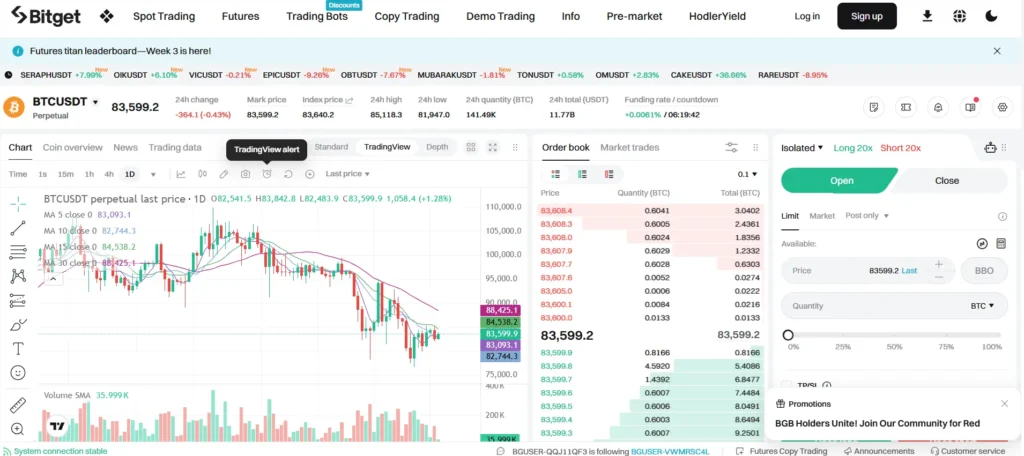

Bitget offers a user-friendly interface designed for both Windows and MacOS devices. It provides customizable features that help you set up your trading workspace to match your preferences.

BloFin has gained attention as a newer platform focusing on futures trading. Its interface is clean and straightforward, making it accessible for traders at different skill levels.

Fee Structure Comparison:

- Bitget: Low withdrawal fees (0.05%), making it cost-effective for frequent traders

- BloFin: Competitive fee structure, though specific rates may vary

Trading Tools:

| Feature | Bitget | BloFin |

|---|---|---|

| API Integration | Advanced API for custom apps | Basic API options |

| Mobile Support | Strong mobile experience | Growing mobile platform |

| Trading Pairs | Extensive selection | Focused selection |

Both platforms support futures trading, but each has its strengths. Bitget is more established with a proven track record of reliability and security features.

For US-based traders, it’s worth noting that BloFin appears on lists of platforms available to US customers, which might be important for your location-based needs.

The trading experience on both platforms includes essential charting tools, order types, and position management features you’ll need for active trading.

BloFin vs Bitget: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for managing risk. Both BloFin and Bitget have systems in place to protect themselves when trades move against users.

BloFin uses a tiered liquidation system that gradually reduces positions as they approach the liquidation price. This gives you a chance to add margin before complete liquidation occurs.

Bitget employs a more standard liquidation approach where positions are automatically closed when margin falls below maintenance requirements. Their system typically closes positions all at once rather than gradually.

Key differences between their liquidation mechanisms:

| Feature | BloFin | Bitget |

|---|---|---|

| Warning system | Multiple alerts before liquidation | Basic notification system |

| Partial liquidation | Yes, progressive reduction | No, typically full liquidation |

| Liquidation fee | Lower (around 0.5%) | Higher (around 0.8%) |

| Insurance fund | Larger protection fund | Growing customer protection fund |

BloFin offers a “liquidation price calculator” tool so you can clearly see your risk level. Bitget provides similar tools but with slightly less detailed information.

Both platforms allow you to set stop-losses to avoid liquidation, but BloFin’s partial liquidation system generally gives traders more breathing room during volatile market movements.

Remember that using high leverage increases liquidation risk regardless of which platform you choose.

BloFin vs Bitget: Insurance

When choosing a crypto exchange, insurance and asset protection are key factors to consider. Both BloFin and Bitget offer security measures, but they differ in their approach.

BloFin focuses on strong security features including two-factor authentication and cold storage for assets. These preventative measures help protect your funds before issues occur.

Bitget takes a different approach with its $200 million protection fund specifically designed to safeguard users’ assets. This fund acts as insurance against potential losses and shows Bitget’s commitment to user protection.

The protection fund from Bitget gives many users peace of mind that their investments have an extra layer of security. If something goes wrong, this fund can help recover losses.

BloFin’s security-first approach focuses on preventing problems rather than addressing them after they happen. Their cold storage solution keeps most assets offline where hackers can’t reach them.

When comparing the two exchanges on insurance:

| Exchange | Protection Method | Special Features |

|---|---|---|

| BloFin | Cold storage & preventative security | Two-factor authentication |

| Bitget | $200 million protection fund | Direct insurance for user assets |

You should consider how important direct insurance is for your trading needs versus preventative security measures when choosing between these platforms.

BloFin vs Bitget: Customer Support

When choosing a crypto exchange, good customer support can make a big difference in your trading experience. Both BloFin and Bitget offer support options, but they differ in several ways.

BloFin provides customer support through two main channels: live chat and email. These options give you ways to get help with account issues, trading problems, or general questions.

Bitget takes customer service a step further by offering 24/7 support. This round-the-clock availability is valuable if you trade across different time zones or encounter urgent issues outside regular business hours.

Support Channels Comparison:

| Platform | Live Chat | 24/7 Availability | |

|---|---|---|---|

| BloFin | ✓ | ✓ | Limited |

| Bitget | ✓ | ✓ | ✓ |

Bitget has worked to build a reputation for responsive customer service as part of its growing user protection focus. The exchange seems to understand that reliable support is connected to user trust.

Response times may vary on both platforms depending on the complexity of your issue and current support volume. Simple questions often receive faster answers than complex account problems.

When you need help, try using the help centers and FAQs on both platforms before contacting support. This can often solve common issues faster than waiting for a response.

BloFin vs Bitget: Security Features

When choosing between BloFin and Bitget, security should be your top priority. Both platforms offer protection measures, but they differ in some important ways.

BloFin stands out with its strong security features. The platform implements two-factor authentication (2FA) to verify your identity during login. It also uses cold storage technology to keep most crypto assets offline and safe from hackers.

BloFin Security Highlights:

- Two-factor authentication

- Cold storage for most assets

- Regular security audits

Bitget also takes security seriously. The platform recently expanded its security features and continues to improve protections for users. Both exchanges use encryption to protect your data and funds.

Bitget Security Highlights:

- Advanced encryption

- Security upgrades in recent updates

- Multi-layered security protocols

Both platforms list many of the same tokens and trading pairs. BloFin now offers access to over 340 perpetual pairs and more than 130 spot tokens. These assets are also available on other major platforms.

Your choice may depend on which specific security features matter most to you. Consider factors like account protection, fund storage methods, and the platform’s history with security incidents.

Is BloFin Safe & Legal To Use?

BloFin prioritizes security through various measures to protect user funds and data. The platform implements strong encryption protocols and maintains rigorous security standards to safeguard your assets.

According to search results, BloFin works to prevent fraud and comply with legal standards. This commitment helps create a secure trading environment for users like you.

The exchange offers third-party insurance on customer deposits, adding an extra layer of protection for your funds. This insurance feature can provide peace of mind when trading on the platform.

BloFin operates as a regulated cryptocurrency exchange in multiple jurisdictions. Before using the platform, you should verify it’s authorized to operate in your region, as cryptocurrency regulations vary by country.

For enhanced account security, BloFin provides:

- Two-factor authentication (2FA)

- Anti-phishing protection

- Cold wallet storage for most assets

- Regular security audits

The platform’s legal compliance includes KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures. These requirements help maintain the platform’s legitimacy while protecting users from potential fraud.

Remember to follow security best practices when using BloFin:

- Enable all security features

- Use unique, strong passwords

- Be cautious of phishing attempts

- Keep your recovery phrases secure

Is Bitget Safe & Legal To Use?

Bitget employs robust security measures to protect user funds and data. The platform uses multi-signature wallets and SSL encryption to safeguard your assets from unauthorized access.

Your funds are stored in a combination of hot and cold wallets, which is an industry standard security practice. Hot wallets handle daily transactions while cold wallets keep most funds offline for maximum protection.

Regarding legality, Bitget operates in multiple countries worldwide. The platform is legal in regions where it complies with local regulations. However, availability varies by country due to different cryptocurrency laws.

You should verify if Bitget is available in your specific location before creating an account. Cryptocurrency regulations change frequently, so it’s wise to check current laws in your jurisdiction.

For US-based traders, it’s important to note that some features or leverage options might be restricted compared to international users due to stricter regulations.

When comparing Bitget to BloFin for safety, both platforms implement security protocols, but Bitget has been established longer in the market with a more proven security track record.

Always use additional security features like two-factor authentication (2FA) and strong, unique passwords to further protect your account regardless of which platform you choose.

Frequently Asked Questions

Traders looking to choose between BloFin and Bitget often have specific concerns about features, costs, and accessibility. These exchanges differ in several key areas that might influence your decision.

What are the comparative advantages of BloFin over Bitget in terms of user experience?

BloFin offers a cleaner interface that many beginners find easier to navigate. The platform puts more emphasis on educational resources compared to Bitget.

Bitget has more advanced trading tools and charts that experienced traders might prefer. Its mobile app also tends to be more responsive with faster loading times.

BloFin’s customer dashboard organizes information more clearly, making it easier to track your portfolio performance at a glance.

How do the trading fees between BloFin and Bitget compare?

Bitget generally offers lower spot trading fees, starting at 0.1% for makers and 0.1% for takers. These fees decrease with higher trading volume or if you hold their native token.

BloFin charges slightly higher base fees but offers more frequent promotional fee discounts for new users. Their fee structure is tiered similarly to Bitget’s.

Both platforms charge variable fees for derivatives trading, with Bitget typically being more competitive for futures contracts.

Can users from any country access both BloFin and Bitget, or are there geographical restrictions?

Bitget is unavailable in the US, UK, Canada, and sanctioned countries according to their latest policies. This is a significant limitation for traders in these regions.

BloFin has fewer geographical restrictions but still blocks access from certain sanctioned territories. Always check the current terms of service as regulations change frequently.

Both exchanges require KYC verification for higher withdrawal limits, regardless of your location.

What are the differences in security measures between BloFin and Bitget?

Bitget employs industry-standard security features including two-factor authentication, cold wallet storage, and regular security audits. They maintain an insurance fund to protect users against potential losses.

BloFin implements similar security protocols but puts additional emphasis on real-time monitoring systems. Their withdrawal confirmation process includes more verification steps.

Both exchanges offer anti-phishing codes and withdrawal whitelisting, but Bitget’s security track record is longer and more established.

How do the cryptocurrency trading volumes of BloFin and Bitget stack up against each other?

Bitget consistently maintains higher daily trading volumes, often ranking in the top 10 exchanges globally. This leads to better liquidity and tighter spreads on major pairs.

BloFin has growing but comparatively lower volumes. However, they sometimes offer better liquidity on certain altcoins and newer token listings.

Higher trading volume on Bitget generally means less price slippage when executing large orders, particularly during volatile market conditions.

What are users saying about customer service and support when comparing BloFin to Bitget?

Bitget provides 24/7 customer support through multiple channels including live chat, email, and a comprehensive FAQ section. Users report relatively fast response times during business hours.

BloFin’s customer service receives mixed reviews, with some users praising their detailed responses while others note longer wait times. Their Help Center and FAQ resources are thorough but sometimes hard to navigate.

Both exchanges offer support in multiple languages, but Bitget typically covers more languages and has more support staff available during peak hours.

Bitget vs BloFin Conclusion: Why Not Use Both?

Both Bitget and BloFin offer unique advantages for crypto traders. Instead of choosing one over the other, using both platforms might be the optimal strategy for your trading needs.

Bitget shines with its global reputation and variety of trading options. Though unavailable in the US, UK, and Canada, it provides solid features for users in supported regions.

BloFin stands out with its own set of distinct benefits tailored to specific trading requirements. The platform’s unique offerings complement what you might find on Bitget.

Benefits of using both platforms:

- Diversified trading options: Access more cryptocurrencies and trading pairs

- Risk management: Spread your assets across multiple exchanges

- Feature utilization: Take advantage of the best features from each platform

You can use Bitget for its established reputation and certain trading pairs while leveraging BloFin for its unique advantages. This dual approach maximizes your trading capabilities.

Remember to consider your specific needs before deciding. Your trading volume, preferred cryptocurrencies, and feature requirements should guide your choice of platforms.

By using both exchanges strategically, you create a more robust trading environment that adapts to changing market conditions and your evolving trading strategy.