Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Today we’re comparing two popular platforms: Bitunix and WhiteBIT. Both exchanges offer different features that might suit your specific needs.

Bitunix is a centralized cryptocurrency exchange supporting over 270 cryptocurrencies with both spot and derivatives trading options, while WhiteBIT offers competitive interest rates and different trading features. These exchanges are ranked based on factors like trading volume, security features, and user trust scores.

You’ll want to consider aspects like proof of reserves (which Bitunix offers), available cryptocurrencies, trading fees, and interest rates when making your choice. Some users find Bitunix compares favorably to even top-tier exchanges, but your priorities as a trader or investor will determine which platform works best for you.

Bitunix Vs WhiteBIT: At A Glance Comparison

Bitunix and WhiteBIT are both centralized cryptocurrency exchanges that offer various trading options to users. While they share similarities, they differ in several key aspects.

Bitunix focuses on both spot and derivatives trading with support for over 270 cryptocurrencies. It appeals to traders looking for a wide variety of coins and trading pairs.

WhiteBIT also offers comprehensive trading options but with its own unique features and fee structure.

Trading Options Comparison:

| Feature | Bitunix | WhiteBIT |

|---|---|---|

| Exchange Type | Centralized | Centralized |

| Spot Trading | Yes | Yes |

| Derivatives | Yes | Yes |

| Supported Coins | 270+ | 400+ |

Fee Structure:

Both exchanges implement tiered fee structures that typically decrease as your trading volume increases. WhiteBIT may offer slightly different rates compared to Bitunix.

You should consider several factors when choosing between these platforms:

- Trading fees (maker/taker fees)

- Withdrawal costs

- Available trading pairs

- Security features

- User interface

The platform that works best for you depends on your specific needs. If you trade less common cryptocurrencies, check which exchange lists your preferred coins.

Both exchanges provide interest-earning opportunities on crypto assets, though rates and terms vary between platforms.

Bitunix Vs WhiteBIT: Trading Markets, Products & Leverage Offered

Bitunix and WhiteBIT both offer diverse cryptocurrency trading options, but they differ in several key aspects.

Bitunix supports over 270 cryptocurrencies for trading. It focuses on both spot trading and derivatives markets, giving you multiple ways to engage with crypto assets.

WhiteBIT provides access to more than 330 cryptocurrencies with over 550 trading pairs available. For futures traders, WhiteBIT offers approximately 180 futures trading pairs, which is quite extensive.

Trading Products Comparison:

| Feature | Bitunix | WhiteBIT |

|---|---|---|

| Cryptocurrencies | 270+ | 330+ |

| Trading Pairs | Not specified | 550+ |

| Futures Pairs | Not specified | 180+ |

| Focus | Spot and derivatives | Comprehensive trading |

Both exchanges offer leverage trading, allowing you to amplify your position sizes. This can increase potential profits but also magnifies risk, so use caution.

WhiteBIT’s larger selection of trading pairs gives you more flexibility when creating trading strategies. This can be particularly valuable if you trade less common altcoins.

For derivatives traders, both platforms provide options, but WhiteBIT’s 180+ futures pairs might offer more specialized trading opportunities.

When choosing between these exchanges, consider which specific cryptocurrencies and trading pairs matter most to your strategy. Also evaluate the user interface, as trading comfort differs between platforms.

Bitunix Vs WhiteBIT: Supported Cryptocurrencies

When choosing between Bitunix and WhiteBIT exchanges, the number of available cryptocurrencies is an important factor to consider.

Bitunix offers access to over 270 cryptocurrencies for trading. This includes popular coins and tokens that most traders look for when selecting an exchange.

WhiteBIT provides a multicurrency wallet system upon signup. While the exact number isn’t specified in the search results, WhiteBIT is known for supporting major cryptocurrencies.

Comparison at a glance:

| Exchange | Number of Cryptocurrencies | Notable Features |

|---|---|---|

| Bitunix | 270+ | Focus on both spot and derivatives trading |

| WhiteBIT | Multiple (exact number not specified) | Multicurrency wallet available immediately on signup |

You can easily top up your WhiteBIT wallet using credit cards and other payment options, making it convenient for beginners.

Both exchanges support the major cryptocurrencies that most traders are interested in, such as Bitcoin and Ethereum.

The wider selection of cryptocurrencies on Bitunix might appeal to you if you’re interested in trading less common altcoins or want more variety in your trading options.

Consider which specific cryptocurrencies you plan to trade when making your decision between these two exchanges.

Bitunix Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitunix and WhiteBIT, understanding their fee structures is crucial for your trading decisions.

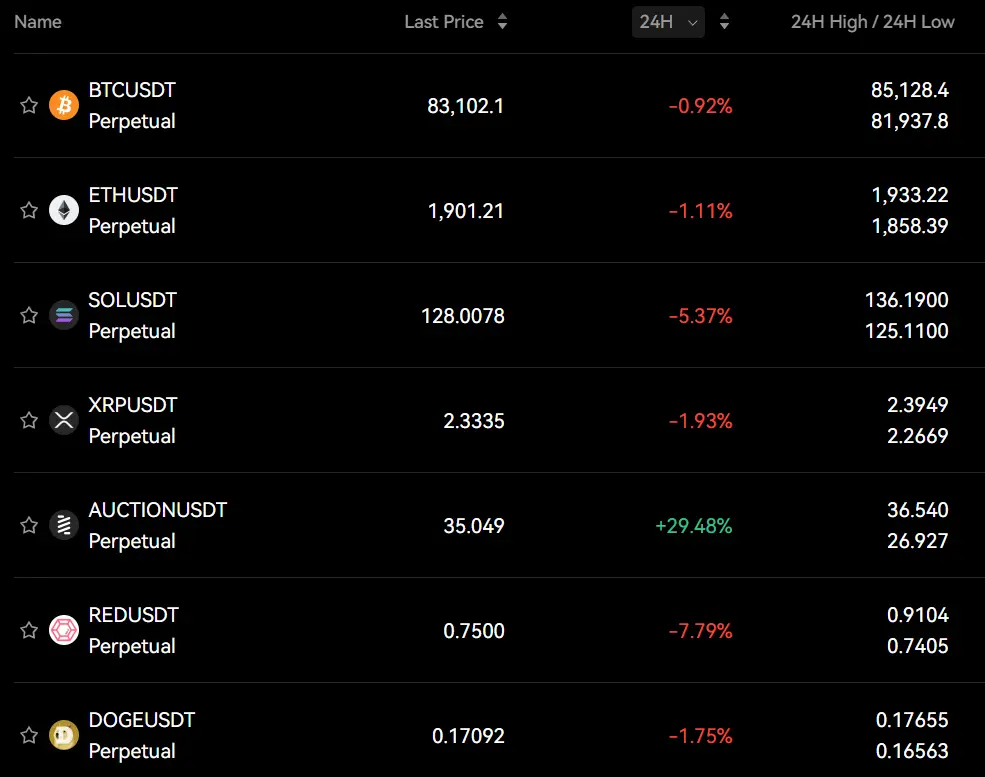

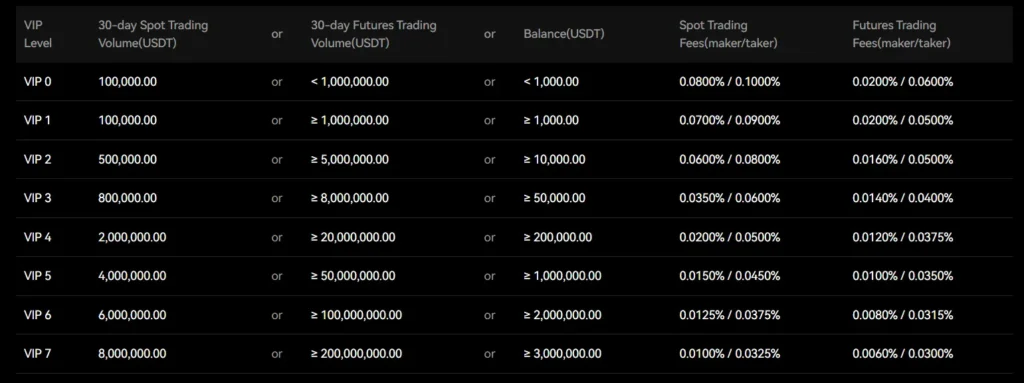

Bitunix operates on a tiered fee structure based on your 30-day trading volume. Their standard trading fee is approximately 0.01%, making it one of the more competitive options in the market.

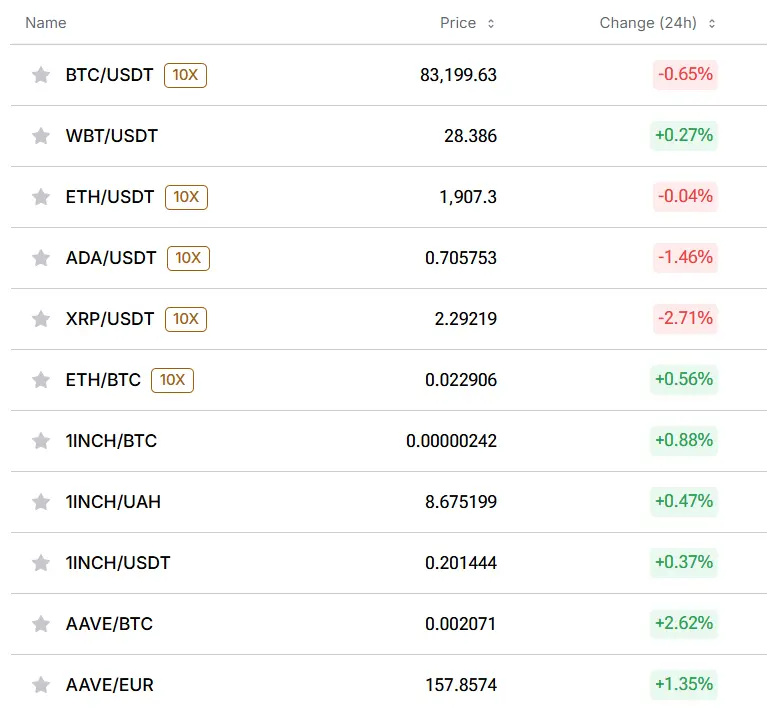

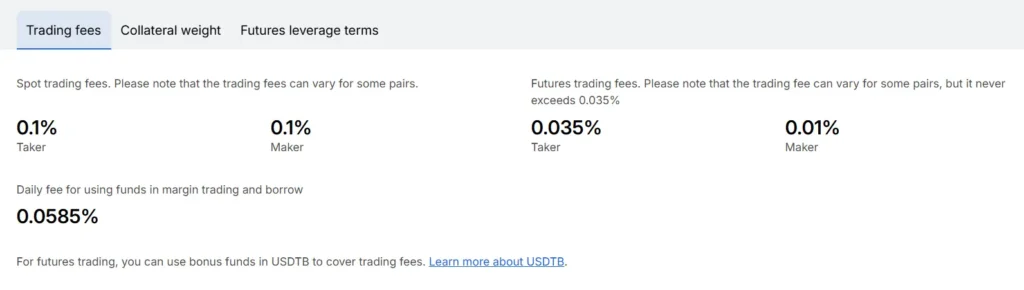

WhiteBIT, in comparison, typically charges around 0.02% for trading fees, slightly higher than Bitunix.

Both exchanges offer fee reductions based on trading volume and token holdings. The more you trade, the lower your fees become over time.

Trading Fee Comparison:

| Exchange | Standard Trading Fee |

|---|---|

| Bitunix | 0.01% |

| WhiteBIT | 0.02% |

For deposit fees, both platforms generally offer free cryptocurrency deposits, though network fees may still apply depending on the blockchain used.

Withdrawal fees vary by cryptocurrency on both exchanges. These fees change frequently based on network conditions and token values.

Bitunix focuses on both spot and derivatives trading, giving you flexibility in your trading options while maintaining competitive fees.

When selecting between these exchanges, consider your trading volume and preferred cryptocurrencies. If you’re a high-volume trader, Bitunix’s lower fee structure might save you more in the long run.

Remember that fees can change, so it’s worth checking both platforms’ official fee schedules before making your final decision.

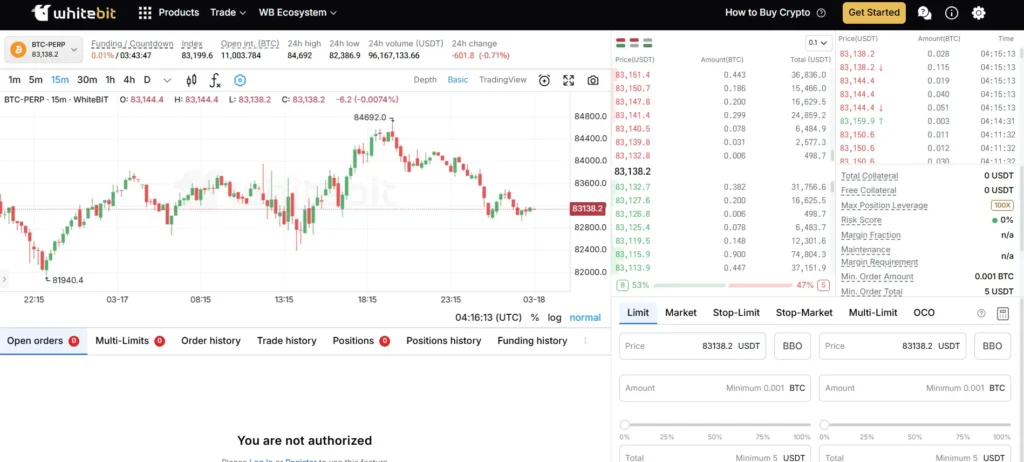

Bitunix Vs WhiteBIT: Order Types

When trading crypto on exchanges like Bitunix and WhiteBIT, understanding the different order types can help you make better trading decisions.

Bitunix is a centralized exchange that supports over 270 cryptocurrencies for spot and derivatives trading. They offer several basic order types to help you execute trades according to your strategy.

WhiteBIT provides a wider variety of order types. According to the search results, they currently offer Market, Limit, Stop-limit, Stop-market, and OCO (One Cancels Other) orders. They also feature Trailing Stop orders, which can automatically adjust your stop price as the market moves.

Common Order Types on Both Platforms:

| Order Type | Description |

|---|---|

| Market | Executes immediately at current market price |

| Limit | Sets a specific price for your order |

| Stop-limit | Combines stop price trigger with limit order |

WhiteBIT’s additional Trailing Stop feature is particularly useful for maximizing profits. It adjusts your stop price automatically when the market moves in your favor.

Both platforms provide these tools to help you manage risk and execute your trading strategy effectively. The right order type depends on your trading goals, market conditions, and risk tolerance.

You should practice using different order types on both platforms to understand how they work before trading with significant amounts.

Bitunix Vs WhiteBIT: KYC Requirements & KYC Limits

Bitunix and WhiteBIT both implement Know Your Customer (KYC) procedures, but they differ in their requirements and associated benefits.

Bitunix KYC Process:

- Uses KYC to identify customers and analyze risk profiles

- Requires government-issued ID and proof of address

- KYC verification unlocks higher withdrawal limits

- Offers access to exclusive events after verification

- Enhances platform security for verified users

Bitunix structures its KYC in tiers, with each level granting increased withdrawal capabilities. As a new user, you’ll start with basic limits, but after completing verification, your account privileges expand significantly.

WhiteBIT KYC Process:

- Features a three-tier verification system

- Basic tier requires email and phone verification only

- Advanced tiers need ID documents and facial verification

- Higher tiers allow larger withdrawal amounts (up to 100 BTC daily at top tier)

- Trading remains available even without full KYC in some regions

WhiteBIT allows limited functionality without complete verification, but you’ll need to complete higher KYC levels to access the platform’s full features.

Both exchanges use KYC to prevent money laundering and ensure regulatory compliance. Your choice may depend on which platform offers the verification tier that best matches your trading needs.

The verification process typically takes 1-3 business days on both platforms, though Bitunix may process simpler verifications faster in some cases.

Bitunix Vs WhiteBIT: Deposits & Withdrawal Options

When choosing between Bitunix and WhiteBIT, understanding their deposit and withdrawal options can help you decide which platform better meets your needs.

Bitunix supports over 270 cryptocurrencies for trading. This wide range gives you flexibility when moving your digital assets on and off the platform.

WhiteBIT offers various transaction methods including traditional options like Mastercard and modern solutions like ApplePay. This diversity makes it convenient for users who prefer different payment methods.

Both exchanges implement a fee structure for withdrawals. These fees vary based on the cryptocurrency you’re withdrawing and the network you choose.

WhiteBIT provides detailed information about their deposit fees and withdrawal costs. This transparency helps you plan your transactions and avoid unexpected charges.

Deposit Options Comparison:

| Exchange | Crypto Deposits | Fiat Methods |

|---|---|---|

| Bitunix | 270+ coins | Limited |

| WhiteBIT | Multiple coins | Mastercard, ApplePay, others |

When withdrawing funds, both platforms use a tiered fee structure. Your fees may decrease as your trading volume increases over a 30-day period.

Before making any transfers, check current fee schedules on both platforms. Fees can change based on market conditions and platform policies.

Your choice between these exchanges may depend on which cryptocurrencies you trade and your preferred deposit methods.

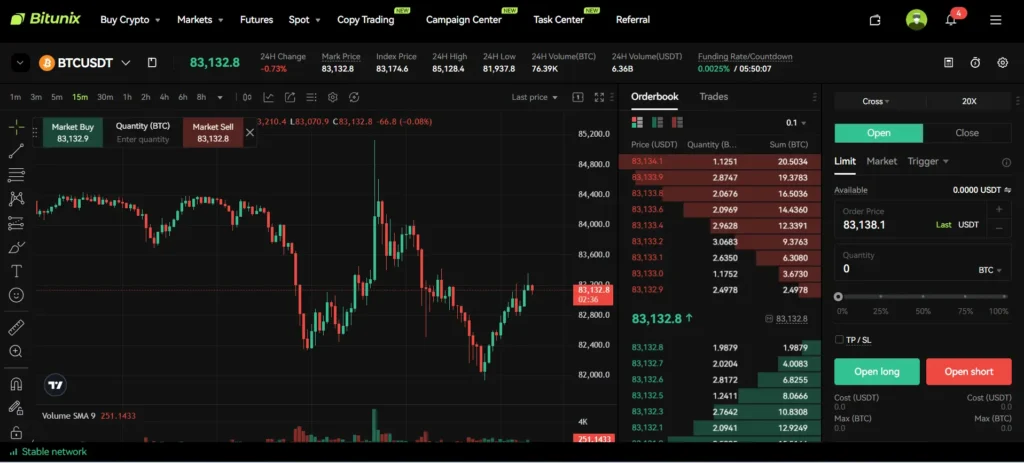

Bitunix Vs WhiteBIT: Trading & Platform Experience Comparison

Bitunix and WhiteBIT offer different trading experiences that may suit various types of crypto traders.

Bitunix is a centralized exchange that provides both spot and derivatives trading options. It supports over 270 cryptocurrencies, giving you plenty of trading pairs to choose from.

WhiteBIT is also well-established in the crypto space, known for its security features and reliability. The platform offers a feature-rich trading environment that caters to both beginners and experienced traders.

User Interface Comparison:

- Bitunix: Clean interface with straightforward navigation

- WhiteBIT: Professional layout with detailed market information

Trading Features:

| Feature | Bitunix | WhiteBIT |

|---|---|---|

| Supported Coins | 270+ | 400+ |

| Trading Types | Spot & Derivatives | Spot, Margin, Futures |

| Mobile App | Yes | Yes |

| Trading Fees | Competitive | Average |

Bitunix has gained popularity for its proof of reserves system, which adds an extra layer of security for your funds. Some users on Reddit even suggest it compares favorably to top-tier exchanges.

WhiteBIT stands out with its additional features like margin trading options and a wider selection of cryptocurrencies. Its established reputation in the market gives you confidence when trading larger amounts.

Both platforms offer mobile apps so you can trade on the go, monitor your positions, and receive alerts about market movements.

Bitunix Vs WhiteBIT: Liquidation Mechanism

Both Bitunix and WhiteBIT use liquidation mechanisms to protect their platforms when traders’ positions become too risky. Understanding how these work can help you avoid unexpected losses.

Bitunix shows an Estimated Liquidation Price that indicates when your position will be closed automatically due to insufficient margin. This transparent approach helps you monitor risk levels.

WhiteBIT, like Bitunix, will forcibly close positions when margin requirements aren’t met. This happens when market movements go against your trade and your collateral can no longer support the position.

Key differences to consider:

| Feature | Bitunix | WhiteBIT |

|---|---|---|

| Transparency | Shows estimated liquidation price | Standard liquidation notifications |

| User Feedback | Users report favorable comparison to top exchanges | Less specific user feedback available |

| Security | Offers proof of reserves for added security | Standard exchange security features |

Both platforms face similar liquidation risks – once your position is liquidated, it remains closed even if prices move favorably afterward.

To avoid liquidation on either platform, monitor your positions closely. Add more funds when approaching margin limits or reduce position sizes during high volatility.

Remember that market conditions can affect how quickly you can withdraw funds, potentially complicating your ability to respond to margin calls on either platform.

Bitunix Vs WhiteBIT: Insurance

When trading on crypto exchanges, insurance protection matters for your assets. Both Bitunix and WhiteBIT offer security measures, but their insurance approaches differ.

Bitunix implements a proof of reserves system that adds an extra layer of security. This system verifies that the exchange actually holds the assets they claim, which indirectly protects your funds.

WhiteBIT focuses on secure storage solutions and regulatory compliance. The exchange follows KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, creating a more secure trading environment.

Neither exchange advertises a specific insurance fund amount that directly compensates users in case of hacks or breaches. This differs from some major exchanges that maintain clear insurance funds.

Both platforms emphasize security through:

- Cold storage for majority of assets

- Two-factor authentication

- Regular security audits

When choosing between these exchanges, consider how their security measures align with your risk tolerance. While insurance isn’t explicitly highlighted by either platform, their overall security approaches serve as protective measures.

Remember to keep only small amounts of crypto on any exchange for trading. For long-term holding, consider moving your assets to a personal wallet where you control the private keys.

Bitunix Vs WhiteBIT: Customer Support

When choosing between Bitunix and WhiteBIT, customer support can be a deciding factor for your trading experience.

WhiteBIT offers a comprehensive support system that many users find helpful. However, one notable limitation is the lack of live chat support, which might slow down problem resolution when you need immediate assistance.

Bitunix provides standard customer support options for users. As a centralized exchange focusing on both spot and derivatives trading, they maintain typical support channels for their user base.

CoinMetro, while not one of our main comparison exchanges, is worth mentioning for its exceptional track record in customer service and protection, setting a high standard in the industry.

WhiteBIT’s support system is integrated with its user-friendly interface and intuitive design. This makes finding help resources easier when you encounter issues or have questions about the platform.

Support Options Comparison:

| Feature | WhiteBIT | Bitunix |

|---|---|---|

| Live Chat | No | Limited |

| Email Support | Yes | Yes |

| Help Center | Basic | Basic |

| Learning Resources | Limited | Standard |

WhiteBIT lacks learning portals and guides, which might be problematic if you’re new to cryptocurrency trading and need educational resources.

When seeking help on either platform, you should prepare your account details and specific questions to streamline the support process and get more efficient assistance.

Bitunix Vs WhiteBIT: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitunix and WhiteBIT offer strong security features, but they differ in some aspects.

Bitunix provides proof of reserves, which adds an extra layer of security for users. This feature allows you to verify that the exchange actually holds the assets it claims to have.

WhiteBIT focuses on user protection through multiple security systems. These include two-factor authentication (2FA), anti-phishing tools, and advanced encryption systems.

Both exchanges are centralized platforms, which means they maintain control over security infrastructure rather than relying on users to secure their own accounts.

Key Security Features Comparison:

| Feature | Bitunix | WhiteBIT |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Proof of Reserves | ✓ | Not specified |

| Anti-phishing Tools | Not specified | ✓ |

| Advanced Encryption | ✓ | ✓ |

WhiteBIT emphasizes compliance with regulations, which can provide additional security through oversight. This compliance helps protect you from potential legal issues when trading.

For maximum protection on either platform, you should always enable all available security features for your account. This includes using strong, unique passwords and activating 2FA.

Remember that while exchanges offer security features, you still need to practice good security habits when accessing your accounts.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to be a legitimate cryptocurrency exchange that prioritizes security. According to search results, users have found it to be safe for trading cryptocurrencies.

The exchange implements various security measures to protect user data and assets. This commitment to security helps establish Bitunix as a stable platform with a growing reputation in the cryptocurrency market.

Bitunix supports over 270 cryptocurrencies and offers both spot and derivatives trading. This wide range of options gives you flexibility when trading on the platform.

Users have expressed positive experiences with Bitunix, particularly noting its safety features. One aspect that stands out is the exchange’s offering of more cryptocurrency options compared to some alternatives.

While the search results don’t specifically address legality in all jurisdictions, it’s worth noting that availability may vary by country. The information indicates Bitunix might not be available in the United States.

Before using any cryptocurrency exchange, you should:

- Verify it’s legal in your country

- Enable all available security features

- Use strong, unique passwords

- Consider using two-factor authentication

For most users seeking a secure trading environment with a good selection of cryptocurrencies, Bitunix seems to be a reasonable option with positive user feedback regarding safety.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT is considered a safe cryptocurrency exchange with strong security features. According to search results, it has earned an AAA security rating and ranks in the Top 3 safest trading platforms.

The exchange has undergone security audits and received certifications from CER.live in 2022, confirming it meets high security requirements. This makes WhiteBIT one of the more reliable exchanges in the crypto space.

WhiteBIT operates as a legal entity in the jurisdictions where it’s available. It has established itself as one of Europe’s leading crypto exchanges, serving over 5 million users worldwide.

The platform offers a secure trading environment with various protective measures for user funds and personal information. This includes advanced encryption and likely two-factor authentication options common to reputable exchanges.

When considering safety, WhiteBIT appears to prioritize security protocols that protect users from potential threats. Their well-established reputation suggests they maintain compliance with regulatory requirements.

Key Safety Features:

- AAA security rating

- Certified by third-party auditors

- Part of the Top 3 safest trading platforms

- Serves 5+ million users globally

- Well-established reputation

Before using WhiteBIT, you should verify it’s legal in your country as cryptocurrency regulations vary globally.

Frequently Asked Questions

Many traders want to know specific details about Bitunix and WhiteBIT before choosing an exchange. These questions address key differences in fees, security, coin availability, and user experience.

What are the main differences between Bitunix and WhiteBIT in terms of trading fees?

Bitunix generally offers competitive trading fees compared to major exchanges. Their fee structure is straightforward and appeals to regular traders.

WhiteBIT’s fee structure varies more frequently. They implement a tiered system where higher trading volumes result in lower fees.

WhiteBIT requires minimum lockup periods for many coins – typically 10 days, with some requiring 30 days. This affects liquidity for traders who need quick access to their funds.

How do the security features of Bitunix compare with those of WhiteBIT?

Bitunix emphasizes security with proof of reserves, allowing users to verify that their assets are fully backed. This transparency builds trust among users concerned about exchange solvency.

WhiteBIT is considered a well-established exchange with reliable security protocols. They maintain a secure trading platform with standard security features like two-factor authentication.

Both exchanges implement cold storage solutions for the majority of user funds, protecting assets from online threats.

Which exchange offers a wider variety of cryptocurrencies, Bitunix or WhiteBIT?

WhiteBIT offers a broader selection of cryptocurrencies, including many altcoins and newer tokens. Their multicurrency wallet supports numerous digital assets.

Bitunix has a more focused selection of established cryptocurrencies. This approach prioritizes quality over quantity in their listings.

For traders seeking niche or emerging cryptocurrencies, WhiteBIT typically provides more options.

Can traders from the United States access and use WhiteBIT for cryptocurrency trading?

WhiteBIT has geographical restrictions that affect US-based traders. The platform is not currently available to users from the United States due to regulatory concerns.

Bitunix has different geographical restrictions. You should check their current terms of service to confirm availability in your region.

Always verify the latest regulatory status before creating an account, as exchange policies regarding geographical access can change.

What kind of customer support can users expect from Bitunix and WhiteBIT?

Bitunix offers standard customer support options including email and ticket systems. Their response times are generally competitive for the industry.

WhiteBIT provides multiple support channels including live chat, email support, and an extensive knowledge base. They cater to an international audience with multilingual support.

Both exchanges maintain active community forums where users can find answers to common questions and share experiences.

How do the user interface and trading experience of Bitunix differ from that of WhiteBIT?

Bitunix features a straightforward interface that appeals to both beginners and experienced traders. Navigation is intuitive with essential tools readily accessible.

WhiteBIT offers a feature-rich platform with advanced trading tools. Their interface includes detailed charts, order books, and trading history views.

WhiteBIT’s platform includes additional features like staking options and earning opportunities. These extras come with a steeper learning curve but provide more functionality for advanced users.

Bitunix vs WhiteBIT Conclusion: Why Not Use Both?

When comparing trading platforms, you don’t always need to choose just one. Both Bitunix and WhiteBIT offer unique advantages that could benefit your trading strategy.

Bitunix excels with its user-friendly interface and lower fees on certain transactions. It provides excellent customer support and educational resources for newer traders.

WhiteBIT, meanwhile, offers more advanced trading tools and supports a wider range of cryptocurrencies. Its security features are notably robust, and experienced traders appreciate its detailed analytics.

Consider your specific needs:

- Trading volume: Bitunix works better for smaller trades, while WhiteBIT might offer better rates for larger transactions

- Security priorities: Both platforms use two-factor authentication, but WhiteBIT adds additional security layers

- Trading frequency: Daily traders might prefer WhiteBIT’s advanced tools, while occasional investors might find Bitunix more straightforward

Many experienced traders maintain accounts on both platforms. This approach lets you leverage Bitunix’s lower fees for certain transactions while using WhiteBIT’s advanced features when needed.

The choice isn’t always binary. You can start with the platform that matches your current needs and expand to using both as your trading strategies evolve.