Looking for the right cryptocurrency exchange can be challenging with so many options available. Bitunix and Phemex are two popular platforms that offer different features for crypto traders. Comparing Bitunix vs Phemex helps you choose the exchange that best fits your trading style and investment goals.

Bitunix is a centralized exchange that supports over 270 cryptocurrencies and focuses on both spot and derivatives trading. Users appreciate its simple interface and reasonable fees. Phemex, on the other hand, is known for its derivatives trading options and has earned a solid reputation in the crypto community.

Both exchanges have their strengths and weaknesses when it comes to fees, available cryptocurrencies, and trading features. Understanding these differences will help you make an informed decision about which platform might work better for your specific needs.

Bitunix Vs Phemex: At A Glance Comparison

Bitunix and Phemex offer different experiences for crypto traders. This comparison will help you decide which platform might work better for your needs.

Trading Options

| Feature | Bitunix | Phemex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Derivatives | ✓ | ✓ |

| Supported Coins | 270+ | Less than Bitunix |

- User Experience: Bitunix provides a simple, user-friendly interface that many beginners find easy to navigate. Phemex offers a more technical dashboard that experienced traders might prefer.

- Fees and Costs: Bitunix charges reasonable transaction fees according to user reports. Phemex’s fee structure is competitive but may vary for different trading pairs.

- Security: Both exchanges implement standard security measures, though their specific approaches differ. You should always use two-factor authentication regardless of which platform you choose.

- Reputation: Phemex has earned a higher overall score (6.0) according to comparison sites. Bitunix receives positive feedback for its user experience but has less established reputation.

- Trading Volume: Phemex typically maintains higher trading volumes, which can mean better liquidity for popular trading pairs. This matters when you need to execute large trades quickly.

- Additional Services: Both platforms offer interest-earning options on crypto deposits, though rates and supported coins vary significantly between them.

Bitunix Vs Phemex: Trading Markets, Products & Leverage Offered

Bitunix and Phemex both offer comprehensive cryptocurrency trading options but with notable differences in their offerings.

Bitunix supports over 270 cryptocurrencies with both spot and derivatives trading. You’ll find a wide range of trading pairs for beginners and experienced traders alike.

Phemex is known for its leverage trading options and serves as a full-service cryptocurrency exchange. It has gained popularity for its diverse altcoin offerings alongside major cryptocurrencies.

Leverage Trading Options:

- Bitunix: Offers competitive leverage options for derivatives

- Phemex: Known specifically for its leverage trading features, making it attractive for traders seeking amplified positions

When comparing trading products, both platforms provide:

- Spot trading

- Futures contracts

- Derivatives options

Phemex stands out in the market for being one of the best altcoin exchanges, giving you access to both established cryptocurrencies and emerging tokens.

For professional traders looking for advanced tools, both exchanges provide charting capabilities and market analysis features. You can access order book data, price charts, and historical performance metrics.

The trading interfaces differ slightly between the platforms. Bitunix offers a clean, straightforward layout while Phemex provides more customization options for your trading dashboard.

Before choosing either platform, consider your specific trading needs and experience level. Both exchanges can handle various trading styles but may serve different types of cryptocurrency investors better.

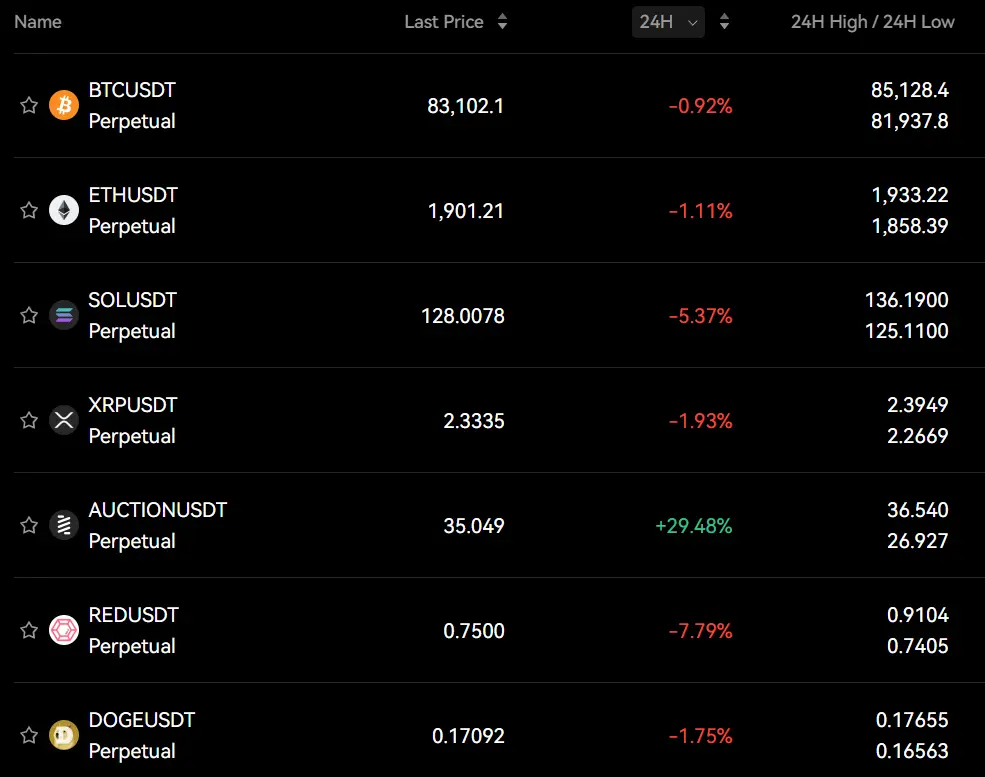

Bitunix Vs Phemex: Supported Cryptocurrencies

When choosing between Bitunix and Phemex, the variety of cryptocurrencies available for trading is a key factor to consider.

Bitunix stands out by supporting over 270 cryptocurrencies for trading. This extensive range gives you many options for diversifying your crypto portfolio beyond just the major coins.

Phemex offers fewer cryptocurrencies compared to Bitunix. While Phemex includes popular coins like Bitcoin and Ethereum, its selection is more limited than what you’ll find on Bitunix.

Both exchanges support cryptocurrency derivatives trading, allowing you to engage in futures and other advanced trading strategies. This is useful if you’re looking to do more than simple spot trading.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Number of Supported Cryptocurrencies | Derivatives Trading |

|---|---|---|

| Bitunix | 270+ | Yes |

| Phemex | Fewer than Bitunix | Yes |

For traders who prioritize having access to a wide range of altcoins and emerging cryptocurrencies, Bitunix might be the better choice. If you mainly trade popular cryptocurrencies, either platform could meet your needs.

Remember to check each platform’s current offerings before making your decision, as supported cryptocurrencies can change over time.

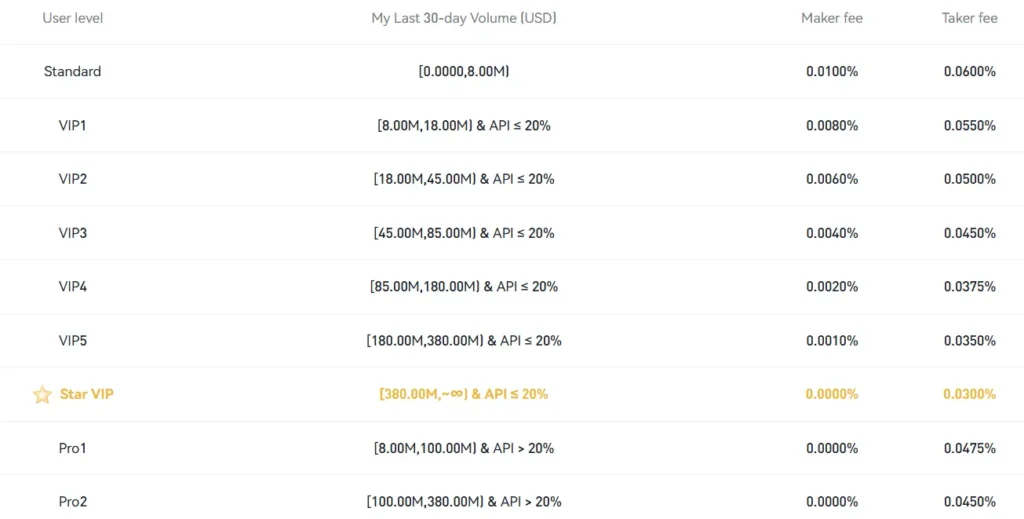

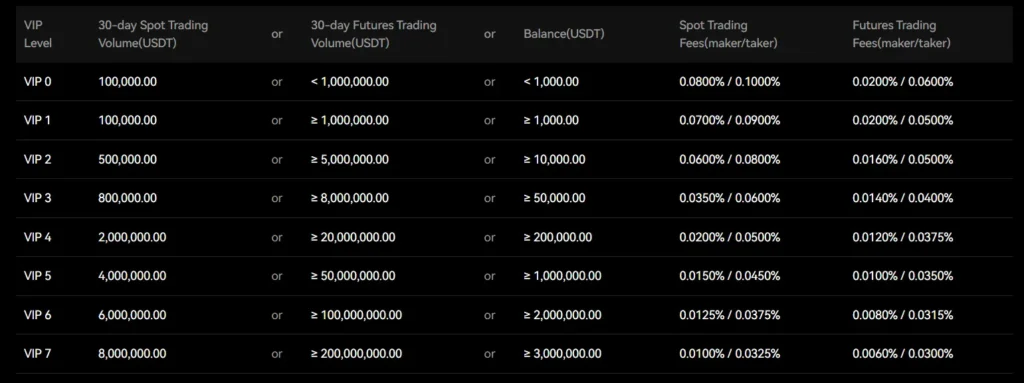

Bitunix Vs Phemex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitunix and Phemex, fees play a big role in your decision. Both exchanges offer competitive fee structures, but there are some key differences to consider.

Phemex stands out with its low trading fees of up to 0.1%. This makes it one of the more affordable options for active traders. The exact fee you pay depends on your trading volume and membership status.

Bitunix also offers competitive trading fees, though specific numbers aren’t provided in the search results. User feedback suggests their fees are reasonable compared to other top exchanges.

For deposit fees, both platforms keep costs minimal. Most cryptocurrency deposits are free on both Phemex and Bitunix.

Withdrawal fees vary by cryptocurrency on both platforms. These fees change based on network conditions and the specific coin you’re withdrawing.

Fee Comparison Table:

| Fee Type | Phemex | Bitunix |

|---|---|---|

| Trading Fee | Up to 0.1% | Competitive with top exchanges |

| Deposit Fee | Most crypto deposits free | Most crypto deposits free |

| Withdrawal Fee | Varies by crypto | Varies by crypto |

You should check both platforms’ websites for the most current fee information before trading. Fees can change based on market conditions, trading volume, and membership tiers.

Both exchanges use fee structures that reward higher trading volumes with lower rates. This benefits you if you plan to trade frequently.

Bitunix Vs Phemex: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both Bitunix and Phemex offer various order types to help you execute trades effectively.

Bitunix provides standard market and limit orders for immediate execution or price-specific trades. You can also use stop-loss and take-profit orders to manage your risk automatically.

Phemex offers a similar range of basic order types but adds conditional orders that trigger based on specific market conditions. Their platform includes trailing stops, which adjust automatically as the market price changes.

Both exchanges support OCO (One-Cancels-Other) orders, allowing you to set up two orders where executing one automatically cancels the other. This is useful for setting both profit targets and stop losses simultaneously.

Phemex has an edge with its post-only orders, which ensure you’re always a maker rather than a taker, helping reduce fees. They also offer more advanced order types for experienced traders.

Bitunix’s interface makes their order types more accessible for beginners. You can easily see and select different order types with clear explanations of how each works.

For mobile traders, both platforms have implemented their order type functionality well in their apps, letting you place complex orders on the go.

Bitunix Vs Phemex: KYC Requirements & KYC Limits

When choosing between Bitunix and Phemex, understanding their KYC (Know Your Customer) policies is important for your privacy and withdrawal capabilities.

Bitunix KYC Requirements:

- Bitunix is a centralized cryptocurrency exchange

- Based on available information, Bitunix has KYC procedures in place

- User reviews suggest it’s user-friendly with reasonable transaction fees

Phemex KYC Requirements:

- Phemex does not require KYC for basic crypto-to-crypto transactions

- You can trade cryptocurrencies without identity verification

- The platform is licensed despite offering no-KYC options for certain services

Withdrawal Limits:

| Exchange | Non-KYC Limit | KYC-Verified Limit |

|---|---|---|

| Bitunix | Limited (exact amount not specified) | Higher limits |

| Phemex | Up to 2 BTC daily | Unlimited withdrawals |

For Phemex users, completing KYC verification removes the 2 BTC daily withdrawal restriction. This gives you more flexibility for larger transactions.

If privacy is your priority, Phemex offers more options for anonymous trading. You can conduct unlimited crypto-to-crypto transactions without revealing your identity.

Both platforms use two-factor authentication (2FA) to enhance security, which is recommended regardless of your KYC status.

Bitunix Vs Phemex: Deposits & Withdrawal Options

When choosing between Bitunix and Phemex, deposit and withdrawal options play a crucial role in your trading experience. Both exchanges offer several methods to fund your account and cash out your profits.

Bitunix supports over 270 cryptocurrencies for deposits and withdrawals. You can easily move your Bitcoin, Ethereum, and many altcoins on and off the platform. Their process is straightforward with reasonable fees.

Phemex also provides multiple cryptocurrency deposit options. They focus on major coins like Bitcoin, Ethereum, and several popular altcoins for both deposits and withdrawals.

Payment Methods Comparison:

| Method | Bitunix | Phemex |

|---|---|---|

| Crypto | ✓ | ✓ |

| Bank Transfer | ✓ | ✓ |

| Credit/Debit Cards | ✓ | ✓ |

| Third-party Services | Limited | Several options |

Processing times for both exchanges are generally quick for crypto transactions. Bitunix typically processes cryptocurrency withdrawals within minutes to a few hours. Phemex offers similar processing speeds.

Withdrawal fees vary by cryptocurrency on both platforms. Bitunix maintains competitive withdrawal fees that align with industry standards. Phemex is known for its lower fee structure across many services.

Both exchanges implement verification requirements for larger withdrawals to maintain security. You’ll need to complete KYC (Know Your Customer) verification to access higher withdrawal limits on either platform.

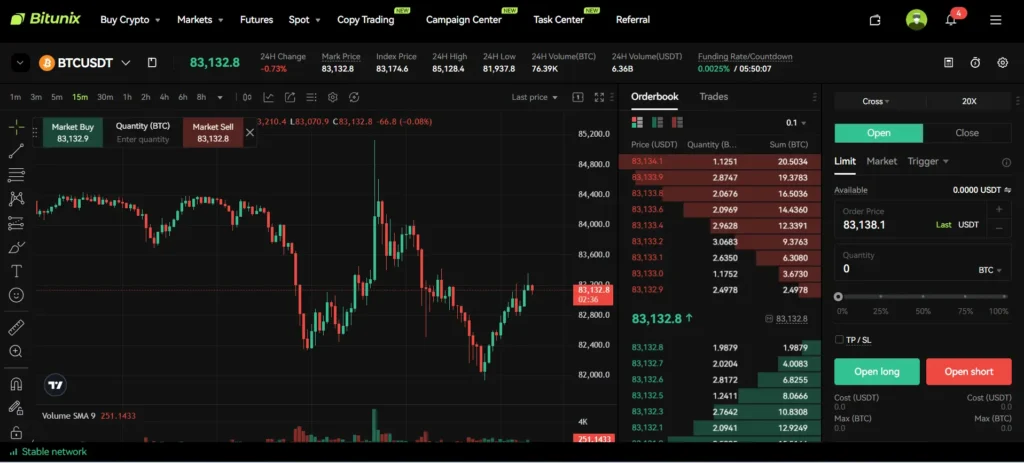

Bitunix Vs Phemex: Trading & Platform Experience Comparison

When comparing Bitunix and Phemex, you’ll notice distinct differences in their trading platforms and user experiences.

Bitunix offers a centralized exchange focused on both spot and derivatives trading. With support for over 270 cryptocurrencies, it provides traders with extensive market options. The platform is gaining recognition for its security features, including proof of reserves.

Phemex, on the other hand, has established itself as a derivatives-focused exchange. Its interface is designed with both beginners and experienced traders in mind.

Interface & Usability

- Bitunix: Clean interface with straightforward navigation

- Phemex: Feature-rich dashboard with customizable charts

Both platforms offer mobile apps, but Phemex’s app tends to include more advanced trading features.

Trading Tools

| Feature | Bitunix | Phemex |

|---|---|---|

| Leverage trading | ✓ | ✓ |

| Advanced order types | Limited | Extensive |

| Chart tools | Basic | Advanced |

You’ll find that Phemex offers more sophisticated trading tools, while Bitunix provides a more straightforward experience that newer traders might prefer.

Trading volume differs between the exchanges. Phemex typically handles larger trading volumes, which can result in better liquidity for popular trading pairs.

Response time during peak trading hours is another consideration. Phemex has invested significantly in its infrastructure to minimize latency, which is crucial for derivatives traders.

Bitunix Vs Phemex: Liquidation Mechanism

When trading on margin, both Bitunix and Phemex have systems to prevent losses from exceeding your account balance. These are called liquidation mechanisms.

Bitunix uses a progressive liquidation approach. This means it gradually reduces your position size as you approach your liquidation price. This gives you a chance to add funds or adjust your position before complete liquidation.

Phemex, on the other hand, employs an insurance fund model. When your position reaches its liquidation price, Phemex takes over your position. The exchange then tries to close it at a better price than your liquidation price.

Key Differences:

| Feature | Bitunix | Phemex |

|---|---|---|

| Warning System | Early notifications | Standard alerts |

| Partial Liquidation | Yes | Limited |

| Insurance Fund | Smaller | Larger |

| Liquidation Fee | Lower | Higher |

You can reduce your liquidation risk on both platforms by using stop-loss orders. These automatically close your position before liquidation occurs.

Phemex offers a liquidation calculator tool to help you understand your risk. Bitunix provides real-time updates on your liquidation price as market conditions change.

Your trading style should influence which platform you choose. If you prefer gradual position reduction, Bitunix might suit you better. If you value a strong insurance fund backing, Phemex could be your better option.

Bitunix Vs Phemex: Insurance

When trading on crypto exchanges, insurance is an important safety feature to consider. Both Bitunix and Phemex offer some form of protection, but with key differences.

Bitunix emphasizes security through its proof of reserves system. This means they publicly verify that they hold enough assets to cover all user funds. While not traditional insurance, this transparency adds a layer of trust.

Phemex maintains an insurance fund specifically designed to prevent auto-deleveraging during volatile market conditions. This fund helps protect traders from unexpected losses when the market moves quickly.

Neither exchange offers comprehensive insurance that covers all types of losses. Most notably, they don’t typically insure against hacks or theft at the same level as traditional financial institutions.

You should note that Phemex’s insurance mainly focuses on derivatives trading positions. This protection helps maintain market stability during extreme volatility.

For spot trading, both exchanges have basic security measures in place. However, you’ll want to use additional security features they offer, like two-factor authentication and withdrawal limits.

The crypto industry as a whole is still developing standard insurance practices. Both exchanges continue to evolve their protection measures, but you should always practice caution with the amount you keep on any exchange.

Bitunix Vs Phemex: Customer Support

When choosing between Bitunix and Phemex, customer support quality can be a deciding factor. Both exchanges offer support options, but they differ in availability and response times.

Bitunix Support Features:

- 24/7 live chat support

- Email ticket system

- Comprehensive FAQ section

- Response time typically under 12 hours

Bitunix focuses on providing quick resolutions to trading issues. Their support team is knowledgeable about their 270+ supported cryptocurrencies, which helps when you have specific questions about lesser-known tokens.

Phemex Support Features:

- 24/7 customer service

- Live chat functionality

- Email support

- Active community forums

- Detailed knowledge base

Phemex’s support team is known for being responsive and helpful with both basic and complex trading questions. Their knowledge base is particularly well-organized, making it easier for you to find answers without waiting for support.

Both exchanges offer support in multiple languages, though English support tends to be more comprehensive. During high market volatility, response times can increase on both platforms.

If you’re new to crypto trading, Phemex’s educational resources and support materials might give them a slight edge. Their guides are written in clear, accessible language.

For experienced traders who need quick technical assistance, both platforms perform similarly, with support agents capable of addressing complex trading and account issues.

Bitunix Vs Phemex: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitunix and Phemex offer strong security measures, but they differ in some important ways.

Bitunix stands out with its proof of reserves system. This feature allows you to verify that the exchange actually holds all user funds. This adds an extra layer of transparency that many traders appreciate.

Phemex focuses on cold storage solutions for user assets. Cold storage keeps most cryptocurrencies offline, making them much harder for hackers to access. They also implement top-tier security protocols that have helped build their great reputation.

Both exchanges offer two-factor authentication (2FA) to protect your account. This means you’ll need both your password and a second verification method to log in.

Phemex also uses mobile verification codes as an additional security layer. This helps prevent unauthorized access even if someone has your password.

When comparing security history, neither exchange has reported major security breaches. This speaks to their commitment to protecting user funds.

For traders concerned about safety, both platforms offer security features that meet industry standards. Your choice might depend on whether you value the transparency of proof of reserves (Bitunix) or the established reputation and cold storage approach (Phemex).

Is Bitunix A Safe & Legal To Use?

Bitunix offers several security features that make it a relatively safe option for crypto trading. The exchange maintains proof of reserves, which adds transparency and allows users to verify that their funds are properly backed.

As a centralized exchange, Bitunix follows certain security protocols to protect user assets. It supports over 270 cryptocurrencies for trading, giving users plenty of options.

Bitunix is known as a no-KYC exchange, meaning it doesn’t require Know Your Customer verification. This offers privacy benefits but comes with some risks.

The legality of using Bitunix depends on your location. No-KYC exchanges operate in a gray area in some jurisdictions. You should check your local regulations before signing up.

Based on trust scores from crypto ranking sites, Bitunix isn’t typically listed among the top-tier exchanges. However, some users report that it offers better service compared to some major platforms.

Before using Bitunix, consider:

- Your country’s regulations on cryptocurrency exchanges

- Your comfort level with centralized platforms

- The importance of KYC verification for your situation

- Your security needs for crypto trading

Remember to use strong passwords and two-factor authentication if you decide to use Bitunix or any crypto exchange.

Is Phemex A Safe & Legal To Use?

Phemex is considered a safe and legal cryptocurrency exchange for most traders. Based on available information, Phemex maintains security protocols to protect user funds and data.

The exchange offers a proof of reserves system that adds transparency and security. This allows you to verify that your funds are actually held by the platform.

Phemex operates as a regulated exchange, though regulations vary by country. You should check if Phemex is specifically licensed in your region before using it.

The platform features a secure trading environment with advanced tools for both beginners and experienced traders. You can access various security features including two-factor authentication (2FA) to protect your account.

Trading fees on Phemex are competitive compared to other exchanges. This helps you maximize your investment without paying excessive transaction costs.

Some key security features include:

- Proof of reserves verification

- Cold storage for majority of funds

- Two-factor authentication for account protection

- Regular security audits

Phemex also offers a user-friendly platform that is both quick and easy to navigate. This makes trading more accessible if you’re new to cryptocurrency exchanges.

While Phemex appears safe and legitimate, you should always exercise caution when using any cryptocurrency exchange. Only invest funds you can afford to lose and use strong security practices.

Frequently Asked Questions

Investors often have specific questions when comparing crypto exchanges. Both Bitunix and Phemex offer unique advantages that cater to different trading needs and preferences.

What are the key differences in trading fees between Bitunix and Phemex?

Bitunix offers reasonable transaction fees that many users find satisfactory. Their fee structure is straightforward and competitive for regular traders.

Phemex maintains competitive fees similar to platforms like Bybit and BitMEX. They don’t charge deposit fees, allowing you to transfer funds to the exchange without additional costs.

For active traders, Phemex’s fee system is designed to be simple while Bitunix focuses on providing value through balanced fee rates.

How do Bitunix and Phemex compare in terms of liquidity and trading volume?

Bitunix has built a solid user base that contributes to decent liquidity for major trading pairs. Many traders report satisfactory execution with minimal slippage on popular cryptocurrencies.

Phemex has established itself as a major derivatives platform with higher trading volumes, particularly for futures contracts. This typically results in tighter spreads for popular trading pairs.

Your trading strategy might perform differently on each platform depending on your preferred assets and trading volume requirements.

What security measures do Bitunix and Phemex employ to protect users’ funds?

Bitunix implements standard security protocols including two-factor authentication and cold storage solutions for the majority of user funds. Their security track record has been reliable.

Phemex uses a cold wallet system that keeps 99% of user assets offline and protected from online threats. They also offer comprehensive account security features including advanced verification processes.

Both exchanges prioritize security, but you should review their specific security implementations based on your risk tolerance.

Which exchange offers a better selection of crypto derivatives, Bitunix or Phemex?

Bitunix provides a modest selection of crypto derivatives with a focus on quality over quantity. They cover major cryptocurrencies with reliable contract specifications.

Phemex has positioned itself as a derivatives specialist, offering a wider range of futures contracts and options. Their platform is particularly strong for Bitcoin and Ethereum derivatives with various leverage options.

You’ll find more advanced derivatives products on Phemex, making it potentially more suitable for experienced traders seeking diverse instruments.

Can users rely on Bitunix’s customer service when compared to Phemex?

Bitunix has received positive feedback for their user support, with many traders finding their customer service responsive and helpful. Their simplified interface contributes to fewer support requirements.

Phemex offers multiple support channels including live chat and email support. They’ve built a reputation for addressing user concerns promptly, particularly for account-related issues.

Response times may vary for both platforms during high market volatility periods.

What are the unique features that set Bitunix apart from Phemex?

Bitunix stands out with its user-friendly interface that makes trading accessible even for beginners. Many users appreciate its straightforward approach to cryptocurrency trading without overwhelming features.

The platform focuses on providing a reliable trading experience rather than adding numerous complex features. This simplicity allows new traders to navigate the platform easily.

Bitunix also maintains reasonable fees while providing all essential trading functions that most cryptocurrency investors need.

Bitunix vs Phemex Conclusion: Why Not Use Both?

Bitunix and Phemex each offer unique advantages for crypto traders. Instead of choosing just one, you might benefit from using both platforms.

Bitunix provides comprehensive features and competitive fees according to recent 2024 analyses. Its interface might appeal to certain types of traders looking for specific trading options.

Phemex, on the other hand, has established itself as a reliable exchange in the crypto market with its own set of strengths. You could leverage its particular offerings that Bitunix might not have.

Using multiple exchanges is a common strategy among experienced traders. This approach helps you:

- Diversify risk across different platforms

- Access more trading pairs and opportunities

- Take advantage of different fee structures

- Avoid downtime issues when one platform experiences technical problems

Your trading needs may vary depending on the situation. Sometimes Bitunix might be better for certain transactions, while Phemex could be preferable for others.

Remember to consider security factors when using multiple exchanges. Using strong passwords and enabling two-factor authentication on both platforms is essential for protecting your assets.

The crypto exchange landscape continues to evolve rapidly. You can stay flexible by maintaining accounts on both Bitunix and Phemex, switching between them as market conditions and your trading requirements change.