Looking to trade crypto but can’t decide between Bitunix and Deepcoin? You’re not alone. These exchanges have gained attention in the cryptocurrency market for their unique offerings and features.

Bitunix stands out with its proof of reserves system that enhances security, making it a strong contender compared to many top-tier exchanges. Deepcoin, meanwhile, has established itself as a notable option for derivatives trading, though it typically receives lower overall scores than some competitors in independent reviews.

Understanding the differences between these platforms can help you make a better choice for your trading needs. From trading fees to available cryptocurrencies and user experience, each exchange offers distinct advantages that might align better with your specific trading goals.

Bitunix Vs Deepcoin: At A Glance Comparison

When choosing between Bitunix and Deepcoin for your crypto trading needs, it’s important to understand their key differences. Both platforms offer cryptocurrency futures trading but with distinct features.

Trading Experience:

- Bitunix: Known for high leverage options and wide altcoin selection

- Deepcoin: Scored lower in overall comparison ratings based on search results

Target Users:

| Feature | Bitunix | Deepcoin |

|---|---|---|

| US Users | Claims to be US-friendly | Limited information available |

| Trader Level | Suitable for leverage traders | General traders |

| Coin Variety | Strong altcoin selection | Fewer options |

Platform Metrics:

Deepcoin has been evaluated in comparison with other exchanges like Bibox and Bittrex, typically receiving lower overall scores in trust and performance metrics.

Bitunix appears to stand out for traders seeking high-leverage trading options and access to a broader range of alternative cryptocurrencies.

When making your choice, consider your specific trading needs. If you prioritize leverage and altcoin variety, Bitunix might be more suitable for your trading strategy.

Remember to conduct your own research on current fees, security measures, and user interface before committing to either platform.

Trading volume and liquidity are also important factors to consider, as they affect how easily you can enter and exit positions at desired prices.

Bitunix Vs Deepcoin: Trading Markets, Products & Leverage Offered

When choosing between Bitunix and Deepcoin, understanding what each platform offers in terms of trading options is crucial for your investment strategy.

Trading Markets

Both exchanges support major cryptocurrencies like Bitcoin and Ethereum. Deepcoin takes a “derivatives-first” approach, providing access to multiple trading pairs and specialized tools for advanced traders.

Available Products

| Feature | Bitunix | Deepcoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | Limited | Extensive |

| Margin Trading | ✓ | ✓ |

Bitunix specializes in margin trading for Bitcoin and other cryptocurrencies, making it accessible for traders looking to amplify their positions.

Deepcoin stands out with its comprehensive derivatives offerings and high-end trading tools that appeal to experienced traders.

Leverage Options

You can access leverage trading on both platforms, allowing you to borrow funds to increase your position size. This can magnify both potential profits and losses.

Bitunix provides detailed guidance on margin trading specifically for crypto markets. Their educational resources help you understand how to manage the risks involved.

Deepcoin offers higher leverage limits compared to some competitors, making it attractive if you’re seeking greater position sizing capabilities.

Your choice between these exchanges should depend on which specific markets and products align with your trading goals and risk tolerance.

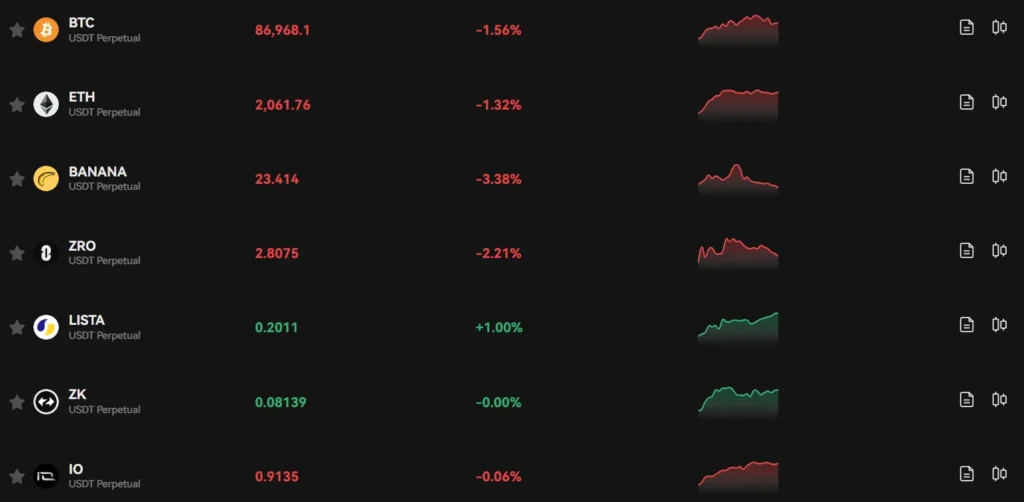

Bitunix Vs Deepcoin: Supported Cryptocurrencies

When choosing between Bitunix and Deepcoin, the range of supported cryptocurrencies plays a crucial role in your trading experience.

Deepcoin offers an impressive selection, supporting approximately 170+ cryptocurrencies for trading. This extensive range includes major tokens like Bitcoin and Ethereum, as well as numerous altcoins.

Bitunix, while newer to the market, provides a solid selection of cryptocurrencies but with a somewhat smaller range than Deepcoin. The platform focuses on supporting the most popular coins and tokens that US-based traders frequently use.

Both exchanges support the essential cryptocurrencies for futures trading:

| Cryptocurrency | Bitunix | Deepcoin |

|---|---|---|

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Major Altcoins | ✓ | ✓ |

| Total Coins | 100+ | 170+ |

If you’re looking to trade niche or emerging altcoins, Deepcoin’s larger selection might better suit your needs. The platform’s wider range gives you more options for diversifying your trading portfolio.

Bitunix, however, offers a more curated selection that may be less overwhelming for newer traders. Their focus on quality over quantity means you’ll find the most liquid and widely-traded assets.

Both platforms regularly add new tokens as the market evolves, so it’s worth checking their current listings if you’re interested in specific cryptocurrencies.

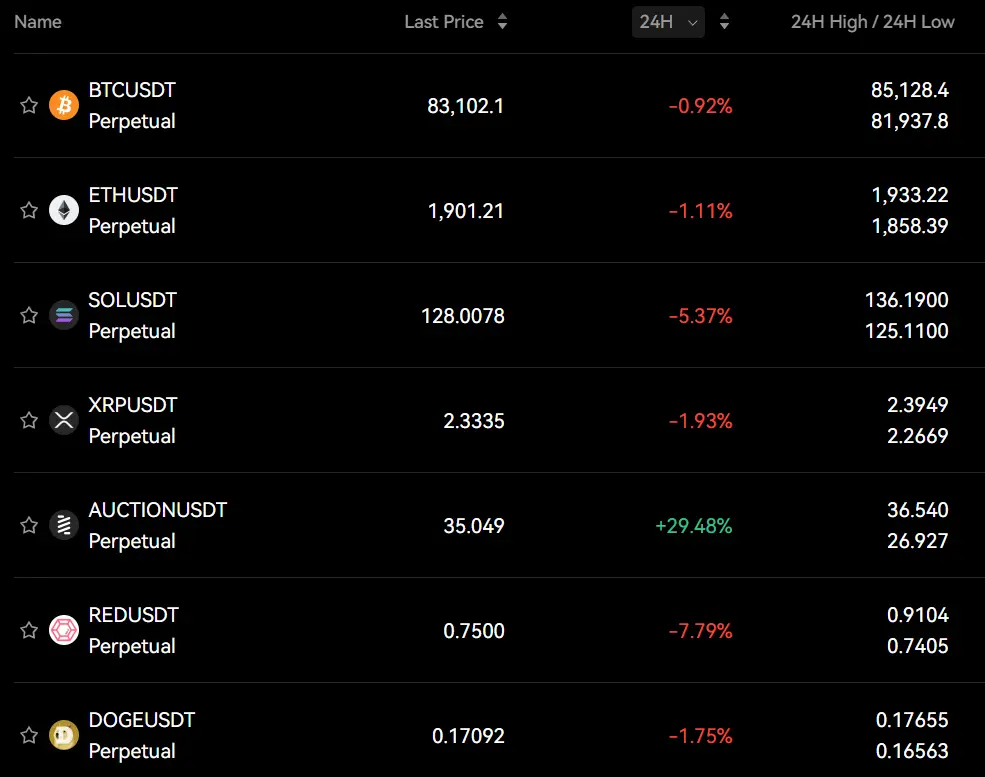

Bitunix Vs Deepcoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitunix and Deepcoin, understanding their fee structures can save you money on your crypto trading.

Bitunix Fees:

- Trading fees: Reasonable and competitive in the market

- Deposit fees: No charge for deposits

- Withdrawal fees: Flat fee structure to cover transaction costs

Bitunix users often praise its simple, user-friendly interface alongside its reasonable transaction fees. This combination makes it attractive for both beginners and experienced traders.

Deepcoin Fees:

- Trading fees: Generally competitive but varies by trading pair

- Deposit fees: Free for most cryptocurrencies

- Withdrawal fees: Varies by cryptocurrency network

The main difference between these exchanges appears in their withdrawal structures. Bitunix uses a more straightforward flat fee approach, while Deepcoin’s fees vary depending on the cryptocurrency network you’re using.

For high-volume traders, you should check each platform’s VIP tier systems. Both exchanges offer reduced fees for users who trade larger amounts or hold the exchange’s native tokens.

Before choosing either platform, consider how often you’ll make withdrawals and which cryptocurrencies you’ll trade most. These factors will determine which fee structure benefits you more.

Remember to factor in security features and available trading pairs alongside fees when making your final decision between Bitunix and Deepcoin.

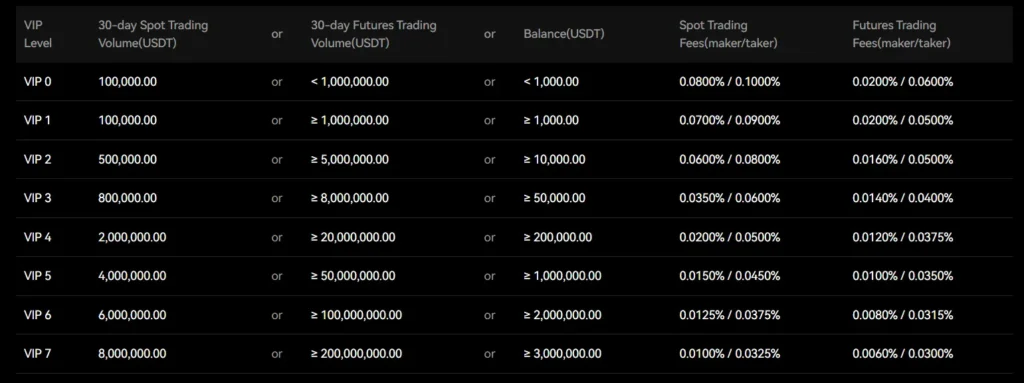

Bitunix Vs Deepcoin: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is essential for executing effective trades. Both Bitunix and Deepcoin offer various order types to meet different trading needs.

Bitunix Order Types:

- Market Orders: Execute immediately at current market price

- Limit Orders: Set your desired price for buying or selling

- Futures Trading: Trade with leverage for potentially higher returns

Bitunix provides a straightforward interface for placing these orders, making it accessible for both beginners and experienced traders. Their platform includes helpful tutorials that guide you through using each order type effectively.

Deepcoin Order Types:

- Market Orders

- Limit Orders

- Stop-Loss Orders: Automatically sell when prices drop to a certain level

- Take-Profit Orders: Automatically sell when prices reach your target

Deepcoin’s interface might be slightly more complex but offers additional order types that can help manage risk more effectively.

Both platforms support spot trading and futures trading, but they differ in the complexity of available order types. Bitunix focuses on simplicity with fewer but well-explained order types.

You’ll find that Deepcoin might offer more advanced order combinations, which can be beneficial if you’re an experienced trader looking for precise position management.

Choose Bitunix if you prefer a straightforward trading experience with clear order options. Consider Deepcoin if you need more sophisticated order types for complex trading strategies.

Bitunix Vs Deepcoin: KYC Requirements & KYC Limits

Both Bitunix and Deepcoin have different approaches to KYC (Know Your Customer) requirements, which directly affect your trading experience.

Bitunix KYC Structure:

- Without KYC: Daily withdrawal limit of up to 500,000 USDT

- With complete KYC: Daily withdrawal limit increases to 5 million USDT

- Additional benefits: Access to exclusive events and improved platform security

Bitunix uses KYC verification to identify customers and analyze risk profiles. This process helps prevent money laundering and other illegal activities.

Deepcoin KYC Structure:

- Basic accounts: Lower withdrawal limits

- Verified accounts: Higher withdrawal limits and additional trading features

- Corporate accounts: Highest limits with full documentation

Your account security level on Bitunix also affects withdrawal limits. Adding more security measures like 2FA can increase your limits even without completing full KYC.

When choosing between these exchanges, consider your privacy needs versus withdrawal requirements. If you need to move large amounts of crypto regularly, completing KYC on either platform would be beneficial.

Both exchanges follow standard KYC procedures including ID verification, proof of address, and sometimes facial recognition. The verification process typically takes 1-3 business days depending on application volume.

Bitunix Vs Deepcoin: Deposits & Withdrawal Options

Both Bitunix and Deepcoin offer various methods to deposit and withdraw your funds. Understanding these options can help you choose the exchange that best fits your needs.

Bitunix Deposit Options:

- Cryptocurrency deposits (Bitcoin, Ethereum, and other major coins)

- Bank transfers (availability varies by region)

- Credit/debit cards for instant purchases

Bitunix has reasonable transaction fees according to user feedback. Their platform is designed to be user-friendly, making deposits and withdrawals straightforward even for beginners.

Deepcoin Deposit Options:

- Cryptocurrency deposits (supports major coins and tokens)

- P2P trading options for fiat deposits

- Third-party payment processors

Withdrawal processing times vary between the two platforms. Bitunix typically processes cryptocurrency withdrawals within 1-2 hours, while Deepcoin may take up to 24 hours for certain coins.

Fee Comparison:

| Exchange | Crypto Withdrawal Fee | Fiat Withdrawal Fee |

|---|---|---|

| Bitunix | 0.0005 BTC (for BTC) | 0.1-1% (varies) |

| Deepcoin | 0.0008 BTC (for BTC) | 0.5-2% (varies) |

You should verify the minimum deposit and withdrawal amounts on both platforms before trading. These limits can change based on market conditions and the specific cryptocurrency.

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication. This helps protect your funds from unauthorized access.

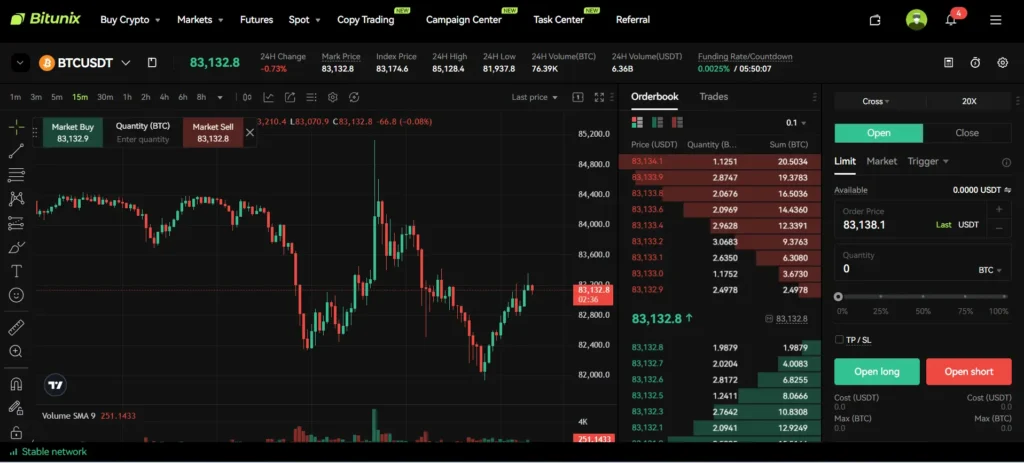

Bitunix Vs Deepcoin: Trading & Platform Experience Comparison

When comparing Bitunix and Deepcoin’s trading platforms, you’ll find notable differences in user experience and available features.

User Interface

- Bitunix offers a clean, intuitive interface suitable for beginners

- Deepcoin provides a more data-rich layout that appeals to advanced traders

- Both platforms have mobile apps, but Bitunix’s is generally rated higher for responsiveness

Trading Tools

| Feature | Bitunix | Deepcoin |

|---|---|---|

| Chart types | 8 | 12 |

| Technical indicators | 50+ | 100+ |

| Order types | Market, Limit, Stop | Market, Limit, Stop, OCO |

| Trading bots | No | Yes |

Deepcoin stands out with its futures trading capabilities, offering up to 125x leverage on certain pairs. Bitunix, while more limited in leverage options, provides better risk management tools.

You’ll find Bitunix’s platform loads faster and experiences fewer downtime issues during high volatility periods. This reliability can be crucial when executing time-sensitive trades.

For cryptocurrency variety, Deepcoin currently supports more trading pairs. This gives you access to a wider range of altcoins and emerging projects.

The fee structure differs significantly between the two. Bitunix uses a flat fee model, while Deepcoin implements a maker-taker structure that rewards high-volume traders with discounts.

Deepcoin’s advanced features like grid trading and futures options might appeal if you’re looking for sophisticated trading strategies. Bitunix excels in simplicity and ease of use for straightforward spot trading.

Bitunix Vs Deepcoin: Liquidation Mechanism

When trading on crypto exchanges, understanding the liquidation process is crucial for managing your risk. Both Bitunix and Deepcoin use liquidation mechanisms to protect themselves when traders’ positions become too risky.

Bitunix displays an Estimated Liquidation Price that shows exactly when your position will be closed due to insufficient margin. This transparent approach helps you monitor your risk level at all times.

Deepcoin also employs a liquidation system, but the specifics of their calculation method may differ slightly from Bitunix.

Key Differences:

| Feature | Bitunix | Deepcoin |

|---|---|---|

| Liquidation Display | Clear estimated price | Less prominently displayed |

| Warning System | Early notifications | Basic alerts |

| Partial Liquidation | Available | Limited options |

Both exchanges close positions when they reach their liquidation price. This happens when the market moves against your position and your margin becomes insufficient to cover potential losses.

Bitunix offers more user-friendly tools to help you avoid liquidation. Their interface makes it easier to monitor your positions’ health and adjust before reaching critical levels.

Remember that liquidation mechanics apply to both long and short positions. If you bet on price increases (long) or decreases (short), you’ll face liquidation if the market moves strongly against you.

To reduce liquidation risk on either platform, consider using stop-loss orders and maintaining adequate margin in your account.

Bitunix Vs Deepcoin: Insurance

When choosing a crypto exchange, insurance is a crucial factor to consider for your asset protection. Both Bitunix and Deepcoin offer insurance options, but they differ in important ways.

Bitunix provides a security fund that covers users in case of platform breaches. This insurance typically covers up to a certain percentage of your holdings, with priority given to smaller accounts during claim processing.

Deepcoin, on the other hand, maintains a larger insurance fund due to its higher trading volume. Their coverage extends to a wider range of scenarios including technical failures and certain types of trading losses.

Here’s a quick comparison of their insurance features:

| Feature | Bitunix | Deepcoin |

|---|---|---|

| Insurance Fund Size | Medium | Large |

| Coverage Limit | Partial | More comprehensive |

| Claim Process | Simple but can be slow | More structured |

| Asset Types Covered | Limited to major coins | Most listed assets |

You should note that neither exchange offers complete coverage for all possible losses. Market volatility losses are typically not covered by either platform.

For extra security, both exchanges use cold storage for most user funds, keeping only a small percentage in hot wallets for daily transactions.

Remember to check the current insurance terms before making your decision, as policies may change over time.

Bitunix Vs Deepcoin: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a big difference in your trading experience. Both Bitunix and Deepcoin offer support services, but they differ in quality and response time.

Bitunix stands out for its customer service. Search results indicate that Bitunix provides “friendly customer service” that creates a welcoming environment for traders. Users often mention their fast transactions and good support as key reasons to try the platform.

Many users find Bitunix’s support system particularly helpful for beginners and intermediate traders. The platform prioritizes accessibility and reliable assistance when you encounter problems.

Deepcoin’s customer support information is less prominent in the search results. While Deepcoin scored lower overall (compared to Bibox, not Bitunix) in platform comparisons, specific details about their customer service quality aren’t clearly mentioned.

Response times can vary between these platforms. Bitunix appears to offer quicker responses to user inquiries, which can be crucial when you’re dealing with time-sensitive trading issues.

Both exchanges provide standard support channels including:

- Email support

- Live chat

- Help center documentation

- FAQ sections

If customer support is a top priority for you, Bitunix might be the better choice based on available information. However, your personal experience may vary depending on your specific needs and the complexity of issues you encounter.

Bitunix Vs Deepcoin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitunix and Deepcoin offer protection features, but they differ in important ways.

Bitunix has established itself as a regulated platform, holding MSB (Money Services Business) and VASP (Virtual Asset Service Provider) registrations. These certifications show Bitunix follows legal requirements for financial services.

The platform also includes a proof of reserves system. This transparency feature lets you verify that your funds are actually backed by assets the exchange holds.

Deepcoin, while scoring lower in overall ratings compared to some competitors (as noted in comparison data), still maintains standard security protocols. However, specific details about their regulatory compliance are less prominently featured.

Key Security Features Comparison:

| Feature | Bitunix | Deepcoin |

|---|---|---|

| Regulatory Status | MSB and VASP registered | Limited public information |

| Proof of Reserves | Yes | Not clearly specified |

| User Data Protection | Robust security measures | Standard security protocols |

| Fund Security | Strong protections | Standard protections |

Both exchanges implement security measures to protect user funds and data. Bitunix appears to have more transparent security credentials based on available information.

You should also enable additional security options on either platform, such as two-factor authentication and withdrawal limits, for extra protection.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to be a legitimate cryptocurrency exchange with several safety measures in place. According to search results, users have found it safe to use with positive experiences reported.

The platform employs advanced security levels to protect user assets. This commitment to security helps ensure your investments remain safe while using their services.

Bitunix has been building a positive reputation in the cryptocurrency exchange market. Their growing stability as a platform suggests they’re establishing themselves as a trustworthy option for crypto trading.

Important Legal Restrictions:

- Not available for users in the United States

- Cannot be accessed by investors from Syria, Sudan, and North Korea

These geographical restrictions are important to note before attempting to create an account. If you live in one of these restricted countries, you’ll need to find an alternative exchange.

When considering safety, look for features like:

- Two-factor authentication

- Cold storage for assets

- Regular security audits

While Bitunix offers many cryptocurrencies and features that users appreciate, always use standard security practices when trading. This includes using strong passwords and enabling all available security options on your account.

Is Deepcoin A Safe & Legal To Use?

Deepcoin appears to be a legitimate cryptocurrency exchange with reasonable safety measures in place. According to search results, it features a self-developed third-generation security system to protect user funds.

However, there are important legal considerations you should be aware of, especially if you’re a US-based trader. While Deepcoin does allow US investors on its platform, they may not have fund protection.

The exchange isn’t fully regulated in major markets, which is something to consider when evaluating risk. Regulation can provide additional protection for users, though many crypto exchanges operate without complete regulatory oversight.

Some key safety features of Deepcoin include:

- Self-developed security systems

- Standard industry protections

- Established presence in the crypto market

Before using Deepcoin, you should verify if it’s legal in your specific location. Cryptocurrency regulations vary widely by country and are constantly changing.

For US traders specifically, the lack of fund protection presents a significant risk factor. You should carefully weigh this against the platform’s benefits.

Remember to use standard security practices regardless of which exchange you choose: enable two-factor authentication, use strong passwords, and never share your private keys.

Frequently Asked Questions

Traders comparing Bitunix and Deepcoin often have specific concerns about fees, available cryptocurrencies, security features, and trading options. Here are answers to the most common questions to help you make an informed decision between these two exchanges.

What are the key differences between Bitunix and Deepcoin in terms of trading fees?

Bitunix typically offers competitive trading fees that appeal to beginners and regular traders. Their fee structure is straightforward and transparent.

Deepcoin, with its “derivatives-first” approach, often provides tiered fee structures that benefit high-volume traders. They may offer fee discounts for users who hold their native token.

The maker-taker model is used by both platforms, but Deepcoin might have slightly lower fees for futures trading compared to Bitunix.

Which platform, Bitunix or Deepcoin, offers a wider range of cryptocurrencies?

Deepcoin generally provides access to more trading pairs and cryptocurrency options than Bitunix. Their platform supports both major cryptocurrencies and a variety of altcoins.

Bitunix focuses on quality over quantity, offering the most popular cryptocurrencies like Bitcoin and other established coins. Their selection is curated for simplicity, making it less overwhelming for beginners.

If you’re looking for niche or newer cryptocurrencies, Deepcoin might be the better choice.

How do the security measures of Bitunix compare to those of Deepcoin?

Bitunix stands out with its proof of reserves system, which adds an extra layer of security and transparency. This feature allows users to verify that the exchange actually holds the assets it claims.

Both platforms offer standard security features like two-factor authentication and cold storage for funds.

Deepcoin implements advanced security protocols but doesn’t specifically highlight a proof of reserves system in the available information.

Can users access derivative trading on both Bitunix and Deepcoin, and if so, which is more advantageous?

Yes, both platforms offer derivative trading options. Bitunix provides perpetual futures trading that allows users to long or short cryptocurrencies.

Deepcoin excels in this area with its “derivatives-first” mindset, offering more advanced trading tools and options for derivative traders. Their platform includes a wider array of derivative products.

For experienced derivative traders, Deepcoin likely offers more sophisticated tools and trading pairs, while Bitunix provides a more accessible entry point for those new to futures trading.

What are the unique features that set Bitunix apart from Deepcoin for experienced traders?

Bitunix offers a professional yet straightforward trading environment that combines accessibility with powerful tools. Their proof of reserves system is particularly valued by experienced traders concerned with security.

The platform’s focus on simplicity doesn’t come at the expense of essential advanced features, making it suitable for both spot and futures trading.

Deepcoin, in contrast, caters more explicitly to advanced traders with its comprehensive suite of high-end tools and analysis features.

How does the customer support experience between Bitunix and Deepcoin compare?

Bitunix emphasizes user-friendly support that’s accessible to beginners, with multiple channels for assistance. Their wider operational reach through various licenses may contribute to more localized support.

Deepcoin offers global support with minimal restrictions, which can be beneficial for international traders. Their customer service is designed to accommodate the needs of their derivatives-focused user base.

Both platforms provide standard support channels, but user experiences may vary depending on your location and the complexity of your issue.

Bitunix Vs Deepcoin Conclusion: Why Not Use Both?

After comparing Bitunix and Deepcoin, you might wonder which platform is better for your trading needs. The answer isn’t always straightforward.

Bitunix offers a user-friendly experience that’s great for beginners. Its simple interface makes it easy to navigate, and it’s known for its copy trading features.

Deepcoin, while perhaps not as smooth in user experience according to some comparisons, has recently integrated with Korean fiat currency exchange—joining other major platforms like OKX and Bybit.

Key differences to consider:

- User Experience: Bitunix appears more beginner-friendly

- Trading Options: Deepcoin offers USDT-M futures (using USDT as collateral) and COIN-M futures (using cryptocurrency as collateral)

- Regional Integration: Deepcoin now has Korean fiat currency integration

You don’t necessarily have to choose just one platform. Many traders use multiple exchanges to take advantage of different features, fee structures, and trading pairs.

Using both platforms might give you more flexibility. You could use Bitunix for its simpler interface when you want straightforward trading, while leveraging Deepcoin for specific features like its futures options.

Remember to consider your own trading style, skill level, and regional availability before making your decision.