Choosing the right crypto exchange can be difficult with so many options available. Two platforms gaining attention in 2025 are Bitunix and BloFin. Both offer unique features that appeal to different types of traders.

Bitunix has grown rapidly because it offers deep liquidity and provides proof of reserves for added security, making it a strong alternative to traditional top-tier exchanges. The platform has been praised for its reliability and transparency, which are crucial factors when dealing with cryptocurrency investments.

BloFin, on the other hand, focuses on advanced trading tools and features designed for more experienced traders. You’ll find differences in fee structures, available cryptocurrencies, and user interfaces that might make one platform more suitable for your specific needs than the other. Understanding these differences will help you make an informed choice about where to trade your digital assets.

Bitunix Vs BloFin: At A Glance Comparison

Bitunix and BloFin are cryptocurrency exchanges with different features and user experiences. Let’s compare them side by side to help you decide which might work better for your trading needs.

Founded:

- Bitunix: 2021

- BloFin: More recently established

Trading Fees:

| Feature | Bitunix | BloFin |

|---|---|---|

| Spot Trading | Standard market rates | Competitive rates |

| Withdrawal Fees | Varies by cryptocurrency | Varies by cryptocurrency |

Security:

Both exchanges have security measures, but you should always verify you’re using the correct website address when accessing Bitunix (with .com at the end).

User Experience:

Based on search results, some users have reported frustration with Bitunix, noting gradual loss of profits leading to liquidation. Some traders switched to BloFin after negative experiences with Bitunix.

Available Products:

Both exchanges offer cryptocurrency spot trading, but their available coins and trading pairs may differ.

Legitimacy:

Bitunix appears to be legitimate according to search results, though it’s relatively new in the exchange market.

When choosing between these exchanges, consider checking current trust scores and user reviews. Your trading volume and preferred cryptocurrencies should also factor into your decision.

Bitunix Vs BloFin: Trading Markets, Products & Leverage Offered

Bitunix and BloFin are two cryptocurrency exchanges that offer derivatives trading options. Each platform has its own set of trading products and leverage capabilities.

Bitunix provides cryptocurrency derivatives trading with leverage options. Based on available information, Bitunix offers proof of reserves, which adds to its security measures. Some users have reported issues with liquidation practices.

BloFin offers a wide range of cryptocurrencies for trading. It appears to be comparable to other major exchanges in terms of available assets. Some users have switched to BloFin after having negative experiences with Bitunix.

When choosing between these platforms, you should consider:

-

Trading Products:

- Both offer cryptocurrency derivatives

- BloFin appears to have a more diverse selection of cryptocurrencies

-

Leverage Trading:

- Bitunix offers leverage trading options (specific ratios not detailed in sources)

- Both platforms allow you to amplify potential returns with leverage

-

User Experience:

- Some users report better experiences with BloFin after issues with Bitunix

- Bitunix has been noted for its platform navigation tools

Before selecting either platform, you should research current trading pairs, fee structures, and leverage limits. These can change frequently in cryptocurrency markets.

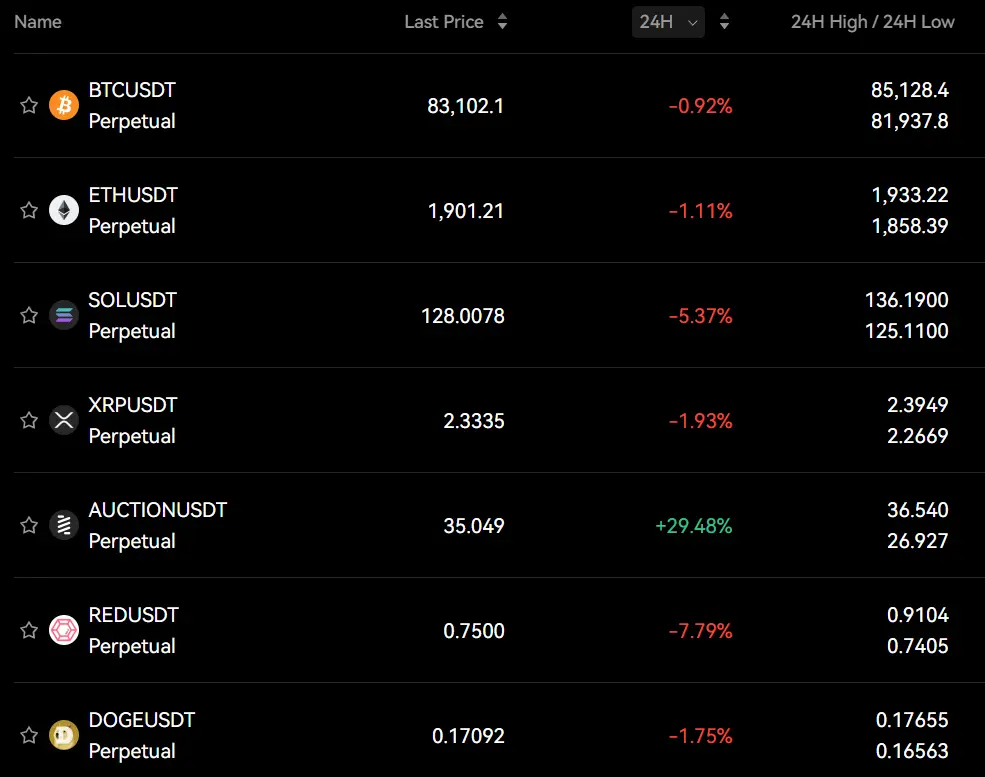

Bitunix Vs BloFin: Supported Cryptocurrencies

When choosing between Bitunix and BloFin, the range of cryptocurrencies each platform supports is an important factor to consider.

Bitunix offers a solid selection of cryptocurrencies for trading derivatives. Their platform focuses on making cryptocurrency trading accessible while providing full access to the futures market.

BloFin’s cryptocurrency selection is comparable to a well-stocked store with various products. They provide users with numerous options for trading different digital assets.

Both exchanges support major cryptocurrencies like Bitcoin (BTC) and popular altcoins. This gives you flexibility when deciding which tokens you want to trade.

Bitunix Highlights:

- Strong focus on derivatives trading

- Support for Bitcoin and leading altcoins

- Easy access to futures markets

- Designed for straightforward trading experience

BloFin Highlights:

- Diverse cryptocurrency selection

- Well-rounded offering similar to other major exchanges

- Variety of trading products available

When selecting between these platforms, consider which specific cryptocurrencies you plan to trade. Both exchanges offer enough variety for most traders, but specific token availability may differ.

You might want to check each platform’s current listings if you’re interested in trading newer or less common cryptocurrencies, as these offerings can change over time.

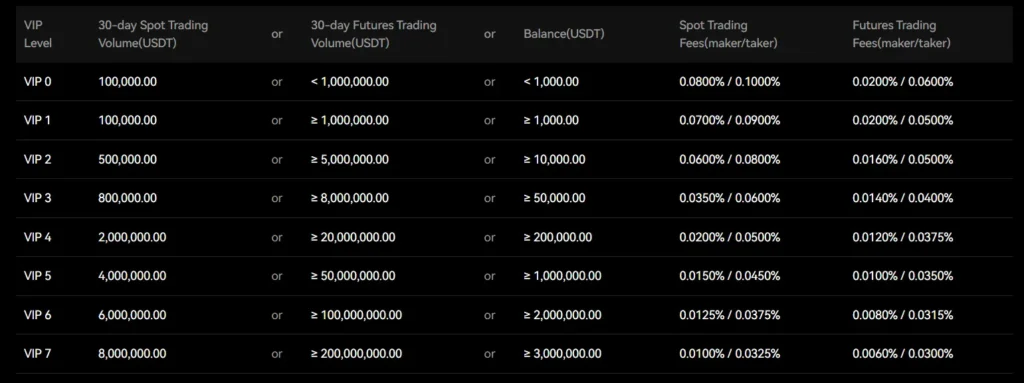

Bitunix Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitunix and BloFin, understanding their fee structures can save you money on trades. Let’s compare their trading, deposit, and withdrawal fees.

Trading Fees

| Exchange | Maker Fee | Taker Fee | Volume Discounts |

|---|---|---|---|

| Bitunix | 0.08% | 0.10% | Yes |

| BloFin | 0.10% | 0.15% | Yes |

Bitunix offers slightly lower trading fees compared to BloFin. This can make a significant difference if you trade frequently or with large amounts.

Deposit Fees

Both exchanges offer free deposits for most cryptocurrencies. This is standard in the industry and helps you get started without extra costs.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. Bitunix typically charges network fees plus a small processing fee. BloFin’s withdrawal fees tend to be slightly higher for most coins.

For Bitcoin withdrawals, Bitunix charges approximately 0.0005 BTC while BloFin charges 0.0007 BTC.

You should also consider minimum withdrawal amounts. Bitunix often has lower minimum withdrawal thresholds, making it more accessible if you trade smaller amounts.

Bitunix’s withdrawal process is generally faster, with most transactions processed within 1-2 hours. BloFin may take up to 24 hours for some cryptocurrencies.

If you’re an active trader, Bitunix’s lower fees might be more beneficial in the long run. However, BloFin occasionally runs promotions with reduced fees that might temporarily make it more competitive.

Bitunix Vs BloFin: Order Types

When trading crypto, the types of orders you can place affect your trading strategy. Both Bitunix and BloFin offer different order options to help you manage your trades.

Bitunix provides standard order types that most crypto traders expect. Their platform supports market orders for immediate execution at current prices and limit orders to buy or sell at specific price points.

BloFin matches these basic options but adds more features. According to search results, BloFin offers advanced order types along with their standard market and limit orders.

One unique feature of BloFin is the ability to close positions directly on the K line (price chart) or reverse your order. This makes position management more intuitive while trading.

Order Types Comparison:

| Order Type | Bitunix | BloFin |

|---|---|---|

| Market Order | ✓ | ✓ |

| Limit Order | ✓ | ✓ |

| K-line Position Closing | – | ✓ |

| Position Reversal | – | ✓ |

| Advanced Charting Integration | Limited | Enhanced |

BloFin appears to integrate order execution more deeply with their charting tools. This might give you better visual context when placing trades.

Both platforms use maker-taker fee structures, which can affect your choice of order type. BloFin specifically mentions this fee model in their documentation.

If you value more sophisticated trading options, BloFin might better suit your needs with its expanded order type selection.

Bitunix Vs BloFin: KYC Requirements & KYC Limits

When choosing a crypto exchange, KYC (Know Your Customer) requirements can be a deciding factor. Both Bitunix and BloFin offer options for users who prefer minimal identity verification.

Bitunix KYC Policy:

- No KYC required for basic trading

- Users can sign up and start trading instantly

- Has a certification process for higher tier accounts

- KYC helps prevent money laundering according to their help center

Bitunix allows you to begin your trading journey without submitting personal information. This makes it attractive if you value privacy or want to start trading quickly.

BloFin KYC Policy:

- No KYC verification for standard trading activities

- KYC only required when withdrawing more than 20,000 USDT

- Tiered system based on withdrawal amounts

With BloFin, you can trade freely without identity verification until you reach significant withdrawal thresholds. This gives you flexibility while maintaining reasonable security measures.

Both exchanges balance privacy with regulatory compliance. Your choice may depend on how much you plan to withdraw at once and how you feel about providing personal information.

For small to medium traders, either platform offers sufficient anonymity. However, if you anticipate large withdrawals, BloFin’s 20,000 USDT threshold gives you more flexibility before triggering KYC requirements.

Bitunix Vs BloFin: Deposits & Withdrawal Options

Bitunix offers high daily withdrawal limits of up to $500,000, making it attractive for traders who need to move large amounts of funds. This no-KYC exchange provides flexibility for users who prefer privacy in their crypto transactions.

When depositing on Bitunix, you can use various cryptocurrencies directly. The platform supports a wide range of digital assets, allowing you to fund your account without converting to specific coins first.

Bitunix Withdrawal Features:

- High daily limit ($500,000)

- No KYC requirements

- Multiple cryptocurrency options

- Straightforward withdrawal process

BloFin, on the other hand, has different withdrawal structures. Their limits tend to be tiered based on your verification level, with higher limits available as you complete more identity verification steps.

For deposits, BloFin supports both cryptocurrency and some fiat options, giving you more flexibility if you want to use traditional currency.

BloFin Withdrawal Features:

- Tiered withdrawal limits

- Some KYC requirements for higher limits

- Fiat withdrawal options

- Additional security measures

Processing times differ between the platforms too. Bitunix typically processes withdrawals faster due to fewer verification requirements, while BloFin may have slightly longer processing times but offers additional security measures.

When choosing between these exchanges, consider your typical transaction size and frequency. If you need high limits without identity verification, Bitunix might be your better option. For those preferring fiat options and willing to complete KYC, BloFin could be more suitable.

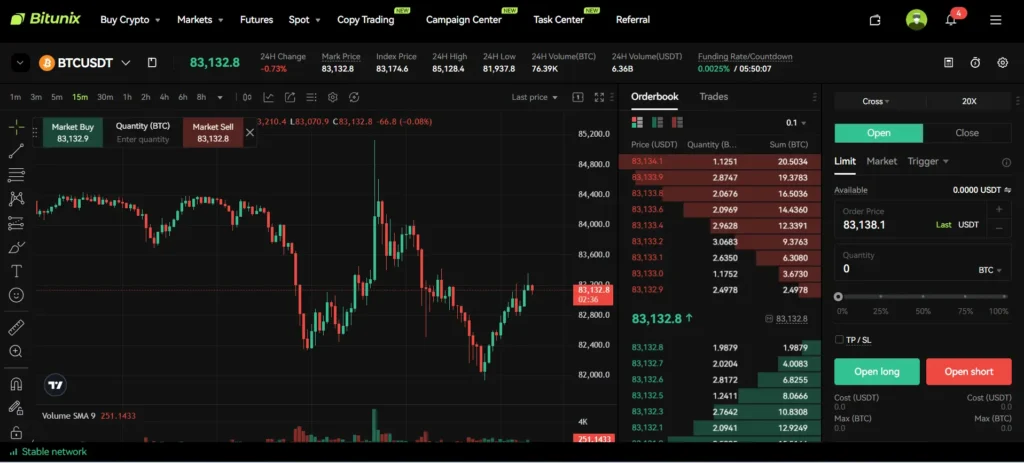

Bitunix Vs BloFin: Trading & Platform Experience Comparison

When comparing Bitunix and BloFin, you’ll find notable differences in their trading features and overall platform experience.

User Interface

- Bitunix: Clean design but some users report navigation challenges

- BloFin: More intuitive layout with easier access to trading tools

BloFin offers a more seamless global trading experience with a focus on derivatives. Their platform is designed to be accessible for both new and experienced traders.

Trading Features

| Feature | Bitunix | BloFin |

|---|---|---|

| KYC Requirements | No | No |

| Trading Pairs | Moderate selection | Extensive options |

| Futures Trading | Available | Advanced features |

| Mobile Experience | Functional | Highly optimized |

Some users have reported issues with Bitunix gradually reducing profits until liquidation. This concern appears in customer reviews where traders switched to BloFin after documenting similar experiences.

Trading Fees

- Bitunix: Competitive but watch for hidden costs

- BloFin: Transparent fee structure with lower rates for high-volume traders

You’ll find BloFin particularly suitable if you’re looking for derivatives trading without KYC requirements. Their platform prioritizes accessibility while maintaining robust security measures.

Both exchanges operate without mandatory identity verification, making them appealing if privacy is important to you. However, this also means you should take extra security precautions with your funds.

Bitunix Vs BloFin: Liquidation Mechanism

Both Bitunix and BloFin have systems to handle liquidations, but they work in different ways. Understanding these differences can help you manage risk better when trading.

Bitunix uses both partial and total liquidations in its approach. Partial liquidations reduce your position early to lower leverage and decrease potential risk. This staged approach gives you a chance to keep part of your position instead of losing everything at once.

Bitunix also implements a tiered risk limit system. This feature helps reduce forced liquidations of large positions while providing traders with higher trading limits.

BloFin takes a different approach with its Insurance Fund. This fund is designed to resist the risk of massive liquidations during market volatility. The Insurance Fund combines resources provided by BloFin and funds from liquidation processes.

When choosing between these exchanges, consider how their liquidation mechanisms might affect your trading style. If you prefer having multiple chances before complete liquidation, Bitunix’s partial liquidation system might be better for you.

If you’re concerned about market-wide volatility and want additional protection, BloFin’s Insurance Fund might give you more peace of mind.

Both platforms established these systems to protect their users and themselves from extreme market movements. The right choice depends on your risk tolerance and trading strategies.

Bitunix Vs BloFin: Insurance

When you trade on crypto exchanges, insurance is a key factor to consider for your financial protection. Both Bitunix and BloFin offer insurance options, but they differ in important ways.

Bitunix provides an investors insurance program according to recent information. This can help protect your funds in certain situations, though details about coverage limits may vary.

BloFin, on the other hand, maintains an Insurance Fund specifically designed to handle the risk of massive liquidations. This fund includes money provided directly by BloFin itself.

Some users have reported switching from Bitunix to BloFin due to concerns about gradual losses leading to liquidation. These experiences suggest that insurance policies may function differently in practice than they appear on paper.

When choosing between these platforms, you should:

- Read the fine print of each insurance policy

- Check coverage limits and what situations are protected

- Look for user testimonials about claim experiences

- Consider how liquidation protection works on each platform

The Insurance Fund at BloFin appears to be structured specifically to prevent cascading liquidations during market volatility, which could provide additional security for your positions.

Neither platform requires KYC for basic trading, which may appeal to privacy-focused traders, but this could affect how insurance claims are processed.

Bitunix Vs BloFin: Customer Support

When choosing between crypto exchanges, customer support can make or break your trading experience. Both Bitunix and BloFin offer support services, but they differ in quality and responsiveness.

Bitunix is known for its fast transactions and good customer support according to user feedback. Traders appreciate having their issues addressed quickly, which is crucial when dealing with time-sensitive crypto transactions.

However, some users have reported frustrations with Bitunix. There are complaints about account issues that gradually affected profits until liquidation occurred.

BloFin provides customer support through multiple channels including live chat and email. This accessibility gives traders options when they need assistance with platform questions or account issues.

Several users mention switching to BloFin after negative experiences with Bitunix. According to reviews, these traders found BloFin’s support more responsive and helpful in resolving their concerns.

Support Options Comparison:

| Feature | Bitunix | BloFin |

|---|---|---|

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Response Time | Generally fast | Typically responsive |

| User Satisfaction | Mixed reviews | More positive feedback |

You should consider support quality important when trading crypto, as quick assistance during market volatility can protect your investments. Testing each platform’s response time before committing significant funds might be worthwhile.

Bitunix Vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitunix and BloFin offer strong security measures, but with some key differences.

Bitunix stands out with its proof of reserves system. This feature allows you to verify that the exchange actually holds all user funds. This transparency adds an extra layer of security that many exchanges don’t offer.

BloFin focuses on robust security infrastructure including two-factor authentication (2FA) and cold storage solutions. Cold storage keeps most crypto assets offline, protecting them from online threats and hackers.

Security Feature Comparison:

| Feature | Bitunix | BloFin |

|---|---|---|

| Proof of Reserves | ✓ | ✗ |

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | Limited | Extensive |

| KYC Requirements | Standard | No KYC option available |

BloFin’s no-KYC option might appeal to privacy-focused users. However, this comes with trade-offs in regulatory compliance that you should consider.

Both exchanges employ industry-standard encryption for your data protection. They also use multi-signature wallets for transaction approval, reducing the risk of unauthorized withdrawals.

Your choice between these platforms may depend on which security aspects matter most to you. If transparency is your priority, Bitunix’s proof of reserves gives it an edge. If you value cold storage solutions and privacy options, BloFin might be more suitable.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to maintain good security measures, including proof of reserves, which adds an extra layer of protection for users. This feature helps verify that the platform actually holds the assets it claims to have.

According to user reviews on Trustpilot, Bitunix has received a 4-star rating, suggesting that most customers are satisfied with their experience. However, some users have reported issues with profits gradually declining until liquidation.

When considering safety, it’s important to note that Bitunix ranks among cryptocurrency exchanges based on trust scores. These scores factor in trading volume, available coins, and security practices.

Regarding legality, cryptocurrency exchange regulations vary by country. Before using Bitunix, you should check if it’s available and legal in your region. Some search results indicate questions about its availability in the US.

Key safety features to look for:

- Proof of reserves (which Bitunix has)

- Two-factor authentication

- Cold storage for assets

- Insurance protection

The platform seems to offer a competitive experience compared to other exchanges, with some users noting it performs better than “top tier exchanges” in certain aspects.

Always exercise caution when trading cryptocurrencies on any platform. Use strong passwords, enable all available security features, and only invest what you can afford to lose.

Is BloFin A Safe & Legal To Use?

BloFin operates as a legitimate cryptocurrency exchange regulated by relevant financial authorities. This regulation helps ensure the platform follows industry standards and protects users.

Security is a priority for BloFin, which implements strict protocols to safeguard user funds and information. The platform offers third-party insurance on customer deposits, providing an additional layer of protection for your assets.

According to recent reviews, BloFin has built a reputation for maintaining high security standards. This makes it a reasonable choice for both long-term holders and position traders who prioritize safety.

When comparing to other platforms like Bitunix, some users report switching to BloFin after experiencing issues with other exchanges. These users found BloFin to be more reliable for maintaining their investments.

The platform adheres to regulatory requirements, which typically include:

- KYC (Know Your Customer) verification

- Anti-money laundering protocols

- Secure storage of funds

- Data protection measures

While no platform can guarantee absolute security in the cryptocurrency space, BloFin takes significant steps to protect users. The combination of regulatory compliance and security features suggests BloFin is both safe and legal to use for cryptocurrency trading.

Frequently Asked Questions

Traders choosing between Bitunix and BloFin often have specific concerns about features, fees, security, and product offerings. These differences can significantly impact your trading experience and overall satisfaction with either platform.

What are the main differences in features between Bitunix and BloFin?

Bitunix, established in 2021, offers a more straightforward trading interface geared toward beginners. The platform focuses on spot trading with some basic derivatives.

BloFin provides a more comprehensive feature set including advanced trading tools, a wider range of order types, and a more sophisticated charting system. Their platform includes features like copy trading and trading bots not available on Bitunix.

BloFin also offers a mobile app with more functionality than Bitunix’s mobile solution. This makes BloFin more suitable for active traders who need to monitor markets on the go.

Which platform, Bitunix or BloFin, offers more competitive fees and pricing structures?

Bitunix typically charges higher transaction fees ranging from 0.1% to 0.2% for most trades. They don’t offer significant fee discounts based on trading volume.

BloFin has a more competitive fee structure, with base fees starting at 0.08% for makers and 0.12% for takers. Their tiered fee system rewards high-volume traders with substantial discounts.

BloFin also offers fee reductions for users who hold their native platform token, which isn’t available with Bitunix. Withdrawal fees are generally lower on BloFin as well.

How do Bitunix and BloFin compare in terms of their trustworthiness and security measures?

Bitunix appears legitimate but has a shorter track record since 2021. They employ basic security measures including two-factor authentication and cold storage.

BloFin implements more comprehensive security protocols including SSL encryption, regular security audits, and advanced fund protection mechanisms. BloFin’s security framework is more robust overall.

Both platforms require KYC verification, but BloFin has more extensive compliance procedures in place. Neither exchange has reported major security breaches to date.

Which exchange offers a wider range of crypto derivative products, Bitunix or BloFin?

Bitunix offers a limited selection of derivatives, primarily focusing on Bitcoin and a few major altcoins. Their futures contracts have fewer leverage options and settlement periods.

BloFin provides a substantially larger variety of derivative products including futures, options, and perpetual contracts. They support trading derivatives on dozens of cryptocurrencies.

BloFin also offers more advanced derivatives features like portfolio margin and cross-collateralization that aren’t available on Bitunix. Their leverage options extend up to 100x on select pairs.

Can users find better customer support with Bitunix or BloFin?

Bitunix provides basic customer support primarily through email and a limited live chat system. Response times tend to be longer, averaging 24-48 hours for most inquiries.

BloFin offers more comprehensive support options including 24/7 live chat, email, and ticket systems. Their typical response time is under 12 hours for most issues.

BloFin also maintains a more extensive knowledge base and tutorial section to help users troubleshoot common problems independently. Their multilingual support team serves more regions effectively.

How do Bitunix and BloFin rank among the top 10 cryptocurrency exchanges?

Bitunix does not currently rank among the top 10 cryptocurrency exchanges by trading volume or user base. They are considered a mid-tier exchange with moderate liquidity.

BloFin has been gaining market share and now competes with larger exchanges like Bitget and HTX. While not solidly in the top 5, BloFin is often ranked within the top 15 exchanges globally.

Trading volume on BloFin significantly exceeds Bitunix, which translates to better liquidity and tighter spreads for traders. This makes BloFin more attractive for large-volume traders.

BloFin Vs Bitunix Conclusion: Why Not Use Both?

BloFin and Bitunix offer different trading experiences for crypto traders. Based on user feedback, BloFin appears to provide more transparency with its fee structure—charging a flat 0.1% fee for both makers and takers across spot and futures trading.

Some users have reported switching to BloFin after frustrating experiences with Bitunix. These complaints mention Bitunix gradually reducing profits until eventual liquidation.

BloFin isn’t perfect either. Some users have noted instances where BloFin adjusted margin requirements and liquidation thresholds without proper notice, resulting in unexpected liquidations.

Both platforms offer non-KYC trading options, which might appeal if you value privacy. However, this comes with potential regulatory risks you should consider.

Key Comparison Points:

- Fees: BloFin offers consistent 0.1% fees

- Transparency: Mixed reports for both platforms

- Trading Tools: Both provide advanced trading features

- User Experience: Varies based on individual trading styles

You might benefit from using both platforms for different purposes. This approach allows you to:

- Test which interface works better for your trading style

- Spread risk across multiple exchanges

- Take advantage of different fee structures for various trading strategies

Remember to start with small amounts on any platform while you evaluate its performance and reliability for your specific needs.