When comparing cryptocurrency exchanges, Bitunix and BitMEX often come up in conversations. Bitunix has gained attention for its security features, including proof of reserves which adds an extra layer of protection for your assets. Bitunix is considered by many users to be superior to some top-tier exchanges, offering a more favorable trading experience for both beginners and experienced traders.

BitMEX, on the other hand, has established itself as one of the largest crypto derivatives exchanges with high liquidity. It offers a fully customizable trading terminal with various widgets that can be tailored to your preferences. However, its interface may be complex for new traders, potentially creating a steeper learning curve compared to more user-friendly alternatives like Bitunix.

Bitunix Vs BitMEX: At A Glance Comparison

Bitunix and BitMEX are two cryptocurrency exchanges with different features and strengths. Let’s look at how they compare in key areas.

Security

Bitunix offers proof of reserves, adding an extra layer of security for your assets. BitMEX also emphasizes security but takes a different approach with their risk management systems.

Overall Rating

BitMEX has an overall score of 6.0 according to comparison sites. Bitunix doesn’t have as many published ratings, but some users consider it better than top-tier exchanges.

Trading Features

| Feature | Bitunix | BitMEX |

|---|---|---|

| Contract Types | Standard crypto trading | Bitcoin derivatives, futures contracts |

| Leverage Options | Limited | Advanced with high leverage options |

| User Interface | Newer, streamlined | Established, complex but comprehensive |

Trading Volume

BitMEX has historically maintained higher trading volumes, which can mean better liquidity for your trades. Bitunix is newer to the market with growing but smaller volume.

Fees

Both exchanges offer competitive fee structures, but they calculate them differently. You’ll want to check current rates as they frequently update pricing.

Target Users

BitMEX caters more to experienced traders looking for advanced derivatives trading. Bitunix appears to be positioning itself as more accessible while still offering solid security features.

When choosing between these exchanges, consider your trading experience level and what specific features matter most to your investment strategy.

Bitunix Vs BitMEX: Trading Markets, Products & Leverage Offered

BitMEX and Bitunix offer various cryptocurrency trading options, but with some key differences in their offerings.

BitMEX is known for its high leverage trading, allowing users to trade Bitcoin and other cryptocurrencies with up to 100x leverage. This means you can control $100 worth of Bitcoin with just $1 of capital.

BitMEX primarily focuses on futures and swaps, with their Bitcoin perpetual swap being particularly popular among traders seeking exposure to price movements without owning the asset.

Bitunix also provides margin trading but offers a different range of products. While not as widely known as BitMEX, Bitunix has been gaining popularity as an alternative exchange.

Both platforms support major cryptocurrencies, but their available trading pairs may differ. You’ll find Bitcoin trading options on both, though the selection of altcoins may vary.

When comparing leverage options:

- BitMEX: Up to 100x leverage on Bitcoin

- Bitunix: Offers margin trading, though specific leverage limits may vary

For advanced traders, both platforms provide trading terminals with customization options. BitMEX advertises a fully customizable interface with expandable widgets to tailor your trading experience.

Trading fees structure differs between the platforms, which might influence your choice depending on your trading volume and strategy.

Before choosing either platform, you should consider your risk tolerance, as high-leverage trading significantly increases both potential profits and losses.

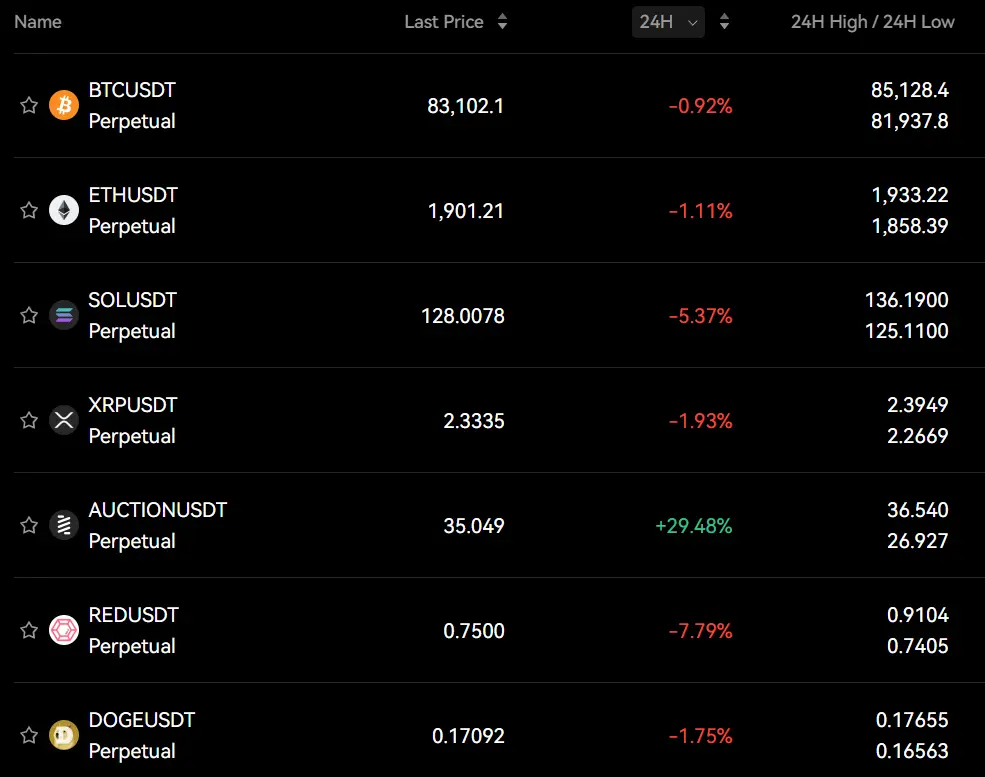

Bitunix Vs BitMEX: Supported Cryptocurrencies

When choosing a crypto exchange, knowing which cryptocurrencies you can trade is important. Both Bitunix and BitMEX offer different options for traders.

BitMEX focuses mainly on Bitcoin derivatives trading. While it has expanded its offerings over time, it remains best known for its Bitcoin perpetual contracts and futures. The exchange also supports trading in some major altcoins like Ethereum.

Bitunix appears to offer a wider range of cryptocurrencies based on user feedback. This could be beneficial if you’re looking to diversify your trading portfolio beyond the major coins.

Here’s a simple comparison of supported cryptocurrencies:

| Exchange | Bitcoin | Ethereum | Altcoins Support |

|---|---|---|---|

| BitMEX | ✅ | ✅ | Limited |

| Bitunix | ✅ | ✅ | More extensive |

If you primarily trade Bitcoin and a few major cryptocurrencies, either platform might meet your needs. However, if you want access to a broader range of altcoins, Bitunix might be the better choice.

Remember that cryptocurrency availability can change as exchanges update their offerings. It’s always a good idea to check the current listings on both platforms before making your decision.

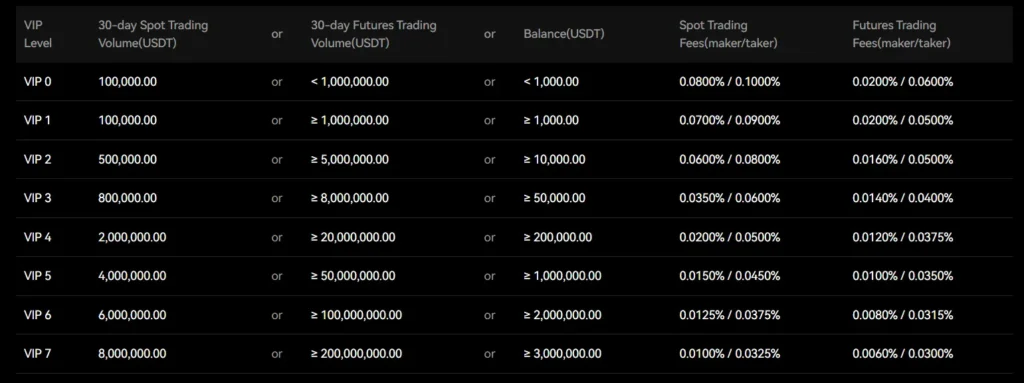

Bitunix Vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitunix and BitMEX, understanding the fee structure is crucial for your trading success.

BitMEX Trading Fees:

- Taker fee: 0.075% (among the lowest in the market)

- Maker fee: Likely offers rebates or lower fees to encourage liquidity

- Leverage trading: Supports up to 100x leverage on Bitcoin and other cryptocurrencies

Bitunix Trading Fees:

- Complete fee details aren’t specified in the search results

- Users report that Bitunix offers competitive fees compared to top-tier exchanges

Deposit & Withdrawal Fees:

BitMEX:

- No Bitcoin deposit or withdrawal fees mentioned

- Minimum deposit: 1000 EUR/GBP/PLN/USD

BitMEX also offers immediate Bitcoin withdrawals up to 2 XBT from their Advance Withdrawal fund, providing you with faster access to your funds.

Bitunix hasn’t shared specific deposit and withdrawal fee information in the search results. However, users note that Bitunix includes proof of reserves for added security, which might justify any potential fee differences.

When comparing these exchanges, consider how the fee structure aligns with your trading style. If you’re a high-volume trader, even small fee differences can significantly impact your profits.

Remember to verify the current fee structures on both platforms before making your decision, as exchanges periodically update their pricing.

Bitunix Vs BitMEX: Order Types

When trading on cryptocurrency exchanges, understanding the different order types is crucial for effective trading. Both Bitunix and BitMEX offer various order types to help you execute your trading strategies.

BitMEX provides several order types including Market Orders, Limit Orders, and Stop Orders. They also offer specialized orders like Take Profit Market Orders, which automatically place a market order when the price reaches your target.

Bitunix similarly offers standard order types but focuses on making them accessible to traders of all experience levels. Their platform explains when and how to use each order type in clear terms.

Both platforms support margin trading, allowing you to trade with leverage. This means you can open positions larger than your actual balance by borrowing funds.

Common Order Types on Both Platforms:

- Market Orders (execute immediately at current price)

- Limit Orders (execute only at specified price or better)

- Stop Orders (trigger when market reaches certain price)

- Take Profit Orders (secure profits at predetermined levels)

BitMEX’s order interface might be more complex but offers greater customization for advanced strategies. Bitunix’s approach tends to be more straightforward, with educational resources that explain each order type.

Your trading style should determine which platform’s order system works better for you. If you need advanced order types for complex strategies, BitMEX might be preferable. For newer traders seeking clarity, Bitunix’s approach may be more suitable.

Bitunix Vs BitMEX: KYC Requirements & KYC Limits

Both Bitunix and BitMEX require KYC (Know Your Customer) verification, but they have some important differences in their requirements and limits.

Bitunix KYC Details:

- Allows KYC verification for US users

- Verification unlocks higher withdrawal limits

- Provides access to exclusive events

- Enhances platform security

- Required to withdraw funds from the platform

BitMEX KYC Details:

- Faced a $100 million fine for previously not implementing proper KYC

- Now has strict compliance requirements

- Required by law to verify user identities

- Helps prevent money laundering

- Monitors for financing of illegal activities

When you verify your identity on Bitunix, you gain access to more features and higher limits. This makes it easier to trade larger amounts and withdraw your funds when needed.

BitMEX had legal troubles in the past for not following proper verification procedures, especially with US customers. They now have a comprehensive KYC program to comply with regulations.

Both exchanges require standard identification documents. Make sure your ID photos are clear and readable when submitting them for verification.

Your withdrawal capabilities on both platforms depend on your verification level. Higher tiers of verification typically allow for larger withdrawals and additional platform benefits.

Bitunix Vs BitMEX: Deposits & Withdrawal Options

When choosing between Bitunix and BitMEX, understanding their deposit and withdrawal systems is crucial for your trading experience.

Bitunix offers a streamlined deposit process with minimal delays. The platform supports cryptocurrency deposits with competitive processing times, helping you get started quickly.

For withdrawals, Bitunix maintains a security-focused approach without excessive delays. Their proof of reserves system, mentioned in user feedback, adds an extra layer of security for your funds.

BitMEX provides comprehensive deposit and withdrawal options through their dedicated system. They have separate sections for deposits and withdrawals in their help center, making information easy to find.

BitMEX’s withdrawal process includes standard mining fees. These fees are something to consider when comparing platforms.

Fee Comparison:

| Exchange | Withdrawal Fees | Processing Time |

|---|---|---|

| Bitunix | Standard mining fees | 1-24 hours (typical) |

| BitMEX | Standard mining fees | 1-24 hours (typical) |

Looking at alternatives like Bybit can provide perspective. According to search results, Bybit charges no withdrawal fees and has mining withdrawal fees 41% lower than industry average, including BitMEX.

Both platforms support major cryptocurrencies for deposits and withdrawals, but specific coin availability may vary. You should check their current supported assets before making your decision.

Processing times on both platforms typically range from minutes to hours depending on network congestion.

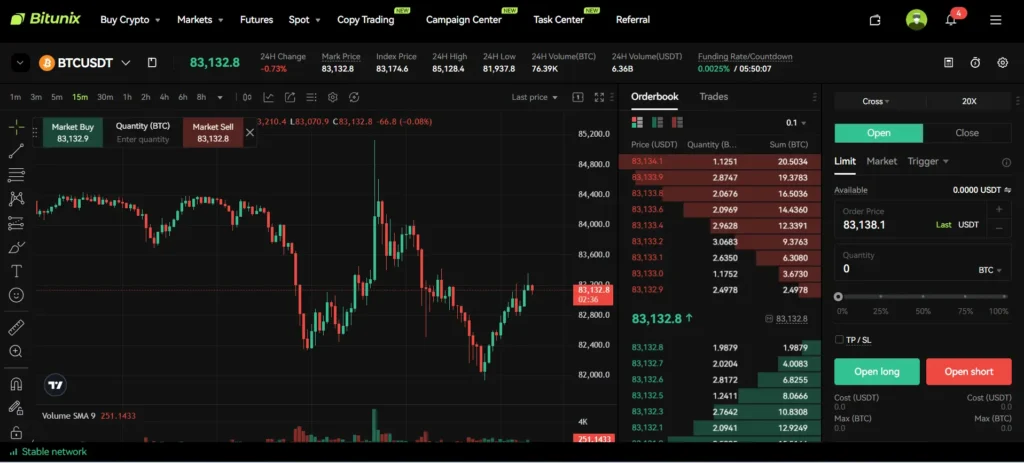

Bitunix Vs BitMEX: Trading & Platform Experience Comparison

When choosing between Bitunix and BitMEX, your trading experience will differ significantly in several key areas. Both platforms offer crypto margin trading but with distinct approaches.

User Interface

- Bitunix: Clean, modern interface with comprehensive tools for margin trading

- BitMEX: Fully customizable trading terminal with expandable widgets for personalized setup

Trading Features

| Feature | Bitunix | BitMEX |

|---|---|---|

| Margin Trading | Yes | Yes |

| Customization | Standard | Extensive |

| Security | Proof of reserves | Industry standard |

BitMEX provides a more tailor-made trading experience, allowing you to arrange your trading screen exactly as you prefer. This can be particularly helpful if you have specific monitoring preferences.

Bitunix, while newer to the scene, has gained recognition for its comprehensive margin trading features and security measures. Their proof of reserves adds an extra layer of transparency that many traders value.

Platform Reliability

BitMEX has been in the market longer, which gives it some advantage in terms of established infrastructure. However, some users report that Bitunix offers a smoother trading experience.

Your trading style will determine which platform suits you better. If you prioritize customization and established reputation, BitMEX might be your choice. If security transparency and a fresh approach appeal to you, Bitunix could be the better option.

Both platforms continue to evolve their offerings to compete in the fast-paced crypto exchange marketplace.

Bitunix Vs BitMEX: Liquidation Mechanism

When trading on cryptocurrency exchanges, understanding the liquidation process is crucial for your risk management. BitMEX and Bitunix have different approaches to handling liquidations.

BitMEX uses a sophisticated liquidation process that tries to avoid closing positions automatically by increasing users’ maintenance margin. This system has been described as aggressive compared to other platforms.

When your position on BitMEX reaches the liquidation price, the exchange fully liquidates your position rather than doing it incrementally. This approach can sometimes lead to dramatic price movements in the market.

BitMEX also uses two price indexes for reference. If one of these indexes experiences technical issues or sudden movements, your profitable position could potentially be liquidated even if the market hasn’t actually moved against you.

Bitunix, on the other hand, employs a more gradual liquidation mechanism. Instead of closing your entire position at once, it reduces your position size in stages.

This approach by Bitunix helps minimize market impact and gives you more opportunity to add funds before losing your entire position.

Key Differences:

| Feature | BitMEX | Bitunix |

|---|---|---|

| Liquidation Style | Full position liquidation | Gradual position reduction |

| Price Reference | Dual index system | Single stable index |

| Market Impact | Potentially higher | Typically lower |

Your choice between these platforms should consider how their liquidation mechanisms align with your trading style and risk tolerance.

Bitunix Vs BitMEX: Insurance

Both Bitunix and BitMEX offer insurance features to protect traders, but they work in different ways.

BitMEX uses an Insurance Fund to avoid Auto-Deleveraging in traders’ positions. When a trader’s position is liquidated, this fund covers any shortfall that might occur if the liquidation order can’t be filled at the bankruptcy price.

This system gives winning traders confidence that they’ll receive their expected profits, even if the other party to their trade goes bankrupt.

Bitunix also offers insurance protection for its users, though specific details about its insurance mechanism aren’t as widely documented as BitMEX’s.

What you should know is that Bitunix has implemented proof of reserves, which adds an extra layer of security for your funds. This means they prove they hold the assets that back user deposits.

BitMEX’s Insurance Fund is quite transparent, with the exchange publishing its size and usage regularly. This openness helps traders understand the level of protection available.

When choosing between these platforms, consider how important insurance protection is for your trading strategy. If you frequently use leverage or engage in high-risk trades, robust insurance mechanisms become more valuable.

Remember that no insurance system offers complete protection against extreme market events, so always trade within your risk tolerance.

Bitunix Vs BitMEX: Customer Support

When choosing a crypto exchange, customer support is a key factor to consider. Both Bitunix and BitMEX offer support services, but they differ in several ways.

Bitunix provides 24/7 customer support through multiple channels including live chat, email, and a comprehensive help center. Users often report fast response times, typically within a few hours for email inquiries.

BitMEX also offers 24/7 support primarily through email and a knowledge base. Their response times can vary, with some users reporting longer wait times during high-volume trading periods.

Support Channels Comparison:

| Feature | Bitunix | BitMEX |

|---|---|---|

| Live Chat | Yes | Limited |

| Email Support | Yes | Yes |

| Phone Support | No | No |

| Help Center | Comprehensive | Extensive |

| Response Time | Generally fast | Variable |

Bitunix has received positive feedback for its user-friendly approach to solving problems. Their support team is known for explaining complex issues in simple terms, which is helpful for new traders.

BitMEX’s support team consists of experienced professionals who can handle complex trading questions. However, some users find their responses too technical.

For beginners, Bitunix’s support system might be more approachable. If you’re an advanced trader with specific technical questions, BitMEX’s detailed responses could be more valuable.

Both platforms offer multilingual support, though English remains the primary language for fastest responses.

Bitunix Vs BitMEX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitunix and BitMEX offer security features to protect your investments, but they differ in some important ways.

Bitunix emphasizes its Proof of Reserves system, which allows you to verify that the platform actually holds the crypto assets it claims. This transparent approach helps build trust and ensures your funds are backed by real assets.

BitMEX uses a combination of cold and hot wallet storage systems to secure user funds. Cold wallets keep most assets offline and safe from online threats, while hot wallets contain only what’s needed for daily operations.

BitMEX Security Features:

- Industry-strength cryptography key management

- Rigorous operational security measures

- Combined cold and hot wallet storage

- Established security track record since 2014

Bitunix Security Features:

- Proof of Reserves verification system

- Modern security infrastructure

- Newer but potentially more transparent approach

BitMEX has been operating since 2014, giving it more time to build and test its security systems. However, this doesn’t automatically make it more secure than Bitunix.

You should consider complementing exchange security with your own practices. Use two-factor authentication, create strong passwords, and consider hardware wallets for large holdings regardless of which platform you choose.

Remember that no exchange is 100% immune to security issues, so never store more crypto on an exchange than you can afford to lose.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to be a legitimate cryptocurrency exchange with security measures in place to protect user assets. According to search results, many users consider it safe and appreciate its offering of multiple cryptocurrencies.

The exchange employs advanced security levels to protect investments, which helps build user confidence. Bitunix is working to establish itself as a stable platform with a strengthening reputation.

However, there are important legal restrictions to be aware of. Bitunix is not available for users in the United States. This is a critical consideration if you’re a US-based investor.

Additionally, residents of several other countries cannot access Bitunix:

- Syria

- Sudan

- North Korea

Before signing up, you should verify that Bitunix is legal in your country of residence. Cryptocurrency regulations vary widely across different jurisdictions.

When choosing any exchange, it’s wise to start with smaller amounts and gradually increase your investment as you build trust with the platform. Many users report positive experiences with Bitunix, particularly praising its range of available cryptocurrencies.

Always enable all available security features like two-factor authentication if you decide to use Bitunix. This adds an extra layer of protection for your funds and personal information.

Is BitMEX A Safe & Legal To Use?

BitMEX has taken significant steps to improve its security and compliance features. The platform employs strong wallet protection and trading security measures to safeguard user funds.

However, it’s important to note that BitMEX is not available to customers in the United States. The exchange is not regulated in the U.S., making it illegal for American residents to use.

For users outside the U.S., BitMEX operates as a legitimate cryptocurrency exchange. The platform has worked hard to rebuild its reputation following past legal troubles by enhancing its compliance procedures.

When using BitMEX, you should practice caution as with any crypto exchange. Experts recommend:

- Only keeping trading funds on the exchange

- Not using it as a long-term storage solution

- Being aware of the risks associated with margin trading

BitMEX appears to take user safety and privacy seriously. Their security framework covers multiple aspects of the trading experience.

Remember that margin trading on BitMEX comes with significant risks. You should never invest more money than you can afford to lose, especially when using leverage.

While BitMEX has improved its security features, you should still exercise proper risk management and only use the platform for your immediate trading needs rather than storing large amounts of cryptocurrency.

Frequently Asked Questions

Traders often have specific questions when choosing between cryptocurrency exchanges. Here are answers to common inquiries about Bitunix and BitMEX that can help you make an informed decision.

What are the main differences in features between Bitunix and BitMEX?

BitMEX offers more extensive derivative products including Perpetual Swaps, Futures, Pre-Launch futures, and Prediction Markets contracts. The platform specializes in high-leverage trading with options up to 100x.

Bitunix has a smaller product range but focuses on user-friendly interfaces for newer traders. Their platform emphasizes simplified trading tools and educational resources.

BitMEX targets professional traders with advanced charting tools and order types. They provide more complex trading instruments and technical indicators compared to Bitunix.

How do Bitunix and BitMEX compare in terms of trading fees and pricing?

BitMEX uses a maker-taker fee model where makers typically receive rebates while takers pay fees ranging from 0.05% to 0.25% depending on trading volume and contract type.

Bitunix generally charges slightly higher fees for basic users but offers competitive discounts for high-volume traders. Their fee structure is more straightforward but potentially more expensive for casual traders.

Both platforms offer fee discounts based on trading volume, but BitMEX’s discount tiers typically kick in at lower volumes, benefiting medium-sized traders more quickly.

Can users from the United States legally use Bitunix or BitMEX for trading?

Neither Bitunix nor BitMEX allows users from the United States to trade on their platforms. This restriction is clearly stated in both platforms’ terms of service.

BitMEX has faced legal troubles with US regulators, resulting in a $100 million fine for violating the Bank Secrecy Act by failing to maintain adequate anti-money laundering procedures.

Both exchanges employ IP blocking and verification procedures to prevent US-based traders from accessing their services. Attempting to bypass these restrictions could result in account termination.

Which platform, Bitunix or BitMEX, is considered more reliable by the cryptocurrency community?

BitMEX has been operating since 2014, giving it a longer track record in the cryptocurrency industry. This longevity has helped establish its reputation despite past regulatory issues.

Bitunix is newer to the market and has less community feedback about its reliability. Many traders prefer BitMEX’s proven history of handling high trading volumes during market volatility.

BitMEX’s trading engine is known for better performance during extreme market conditions. However, both platforms experience occasional downtime during peak trading periods.

Regarding platform security, how do Bitunix and BitMEX ensure the safety of their users’ funds?

BitMEX uses multi-signature wallets for crypto assets and keeps most user funds in cold storage. They also implement two-factor authentication and address whitelisting for withdrawals.

Bitunix employs similar security measures with cold storage solutions and mandatory security protocols. Both platforms use SSL encryption for data protection.

BitMEX has experienced security challenges in the past but has since improved its security infrastructure. Neither platform has reported major hacks resulting in significant customer fund losses.

What are the unique selling points of Bitunix compared to BitMEX in the competitive crypto derivatives exchange market?

Bitunix offers a more streamlined trading experience with less complex features, making it potentially more accessible to beginners. Their interface prioritizes simplicity over advanced functionality.

While BitMEX caters to professional traders, Bitunix positions itself as more welcoming to retail investors. They provide more visual tutorials and simplified explanations of trading concepts.

Bitunix also focuses on faster customer support response times as a key differentiator. However, they offer fewer contract types and lower maximum leverage compared to BitMEX’s extensive options.

BitMEX Vs Bitunix Conclusion: Why Not Use Both?

Both BitMEX and Bitunix offer valuable features for cryptocurrency traders. BitMEX provides high liquidity and uses index prices for margin calculations rather than last traded prices, which can protect you from unnecessary liquidations during price spikes.

Bitunix, on the other hand, offers spot and perpetual swap trading with sophisticated tools that might appeal to different trading styles. The platforms seem to target slightly different user bases.

You don’t have to limit yourself to just one platform. Many experienced traders maintain accounts on multiple exchanges to:

- Take advantage of different fee structures

- Access various trading pairs and products

- Spread risk across platforms

- Capitalize on price differences between exchanges

When using both, be mindful of your total leverage across platforms. Overextending yourself on multiple exchanges can amplify risk.

Consider your trading volume carefully. If you’re an active trader, concentrating your activity might earn you VIP status and reduced fees on one platform.

For beginners, starting with one platform to learn its features thoroughly before expanding to another is often wise. BitMEX may be more complex for new traders, while Bitunix might offer a more accessible interface.

Remember to prioritize security by using strong passwords and two-factor authentication on all exchanges you choose to trade with.