Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Two popular platforms, Bitstamp and Kraken, offer different features that might suit your specific needs.

Kraken edges out Bitstamp with lower trading fees, starting at 0.40% and dropping to as low as 0.10% for high-volume traders, while Bitstamp charges a flat 0.25% fee for trades under $20,000. This fee difference can add up quickly, especially if you make many trades.

Kraken also supports more cryptocurrencies than Bitstamp, giving you access to a wider range of investment options. Both exchanges are well-established in the crypto market, but these key differences in fees and available assets may help you decide which platform better matches your trading style and goals.

Bitstamp Vs Kraken: At A Glance Comparison

When choosing between Bitstamp and Kraken, several key differences can help you decide which exchange better suits your needs.

Kraken clearly leads in cryptocurrency selection, offering over 300 coins compared to Bitstamp’s 131 options. This gives you significantly more trading opportunities with Kraken.

Kraken supports seven fiat currencies including USD, while Bitstamp offers fewer fiat options. This makes Kraken more flexible for users from different countries.

| Feature | Kraken | Bitstamp |

|---|---|---|

| Cryptocurrencies | 300+ | 131 |

| Fiat Currencies | 7 | Fewer |

| Trading Fees | 0.40% to 0.10% | 0.40% and higher |

| Trading Pairs | More options | Limited selection |

Fee structures differ between the platforms. Kraken Pro’s fees start at 0.40% and can go as low as 0.10% for high-volume traders. Bitstamp’s fees also start at 0.40% but don’t drop as low as Kraken’s for most trading volumes.

Both platforms offer security features to protect your investments, but they differ in user interface and additional services.

If you value variety in cryptocurrencies and trading pairs, Kraken provides more options. Bitstamp might appeal to you if you prefer a more straightforward platform with fewer but well-established cryptocurrencies.

Bitstamp Vs Kraken: Trading Markets, Products & Leverage Offered

Kraken provides a much wider selection of cryptocurrencies compared to Bitstamp. You can access 356 different digital assets on Kraken, while Bitstamp offers only 103 cryptocurrencies.

This difference in variety gives Kraken an advantage if you’re looking to trade beyond the most popular coins. Bitstamp focuses on a more curated selection of established cryptocurrencies.

Trading Pair Comparison:

| Feature | Kraken | Bitstamp |

|---|---|---|

| Number of cryptocurrencies | 356 | 103 |

| Fiat currencies supported | Multiple | Multiple |

| Trading pairs | Extensive | Limited |

Kraken also offers more advanced trading products. You can access futures trading, margin trading with leverage, and staking services on Kraken, giving you more ways to potentially grow your portfolio.

Bitstamp has a simpler product lineup focused primarily on spot trading. This makes it easier to navigate for beginners but may feel limiting for advanced traders.

Leverage options are another area where Kraken pulls ahead. You can trade with up to 5x leverage on Kraken for certain pairs, while Bitstamp doesn’t offer leverage trading.

Both exchanges support major fiat currencies for deposits and withdrawals, letting you easily move between crypto and traditional money. However, Kraken’s wider selection of trading pairs gives you more flexibility.

For traders seeking variety and advanced trading options, Kraken’s broader marketplace offers clear advantages over Bitstamp’s more limited but focused selection.

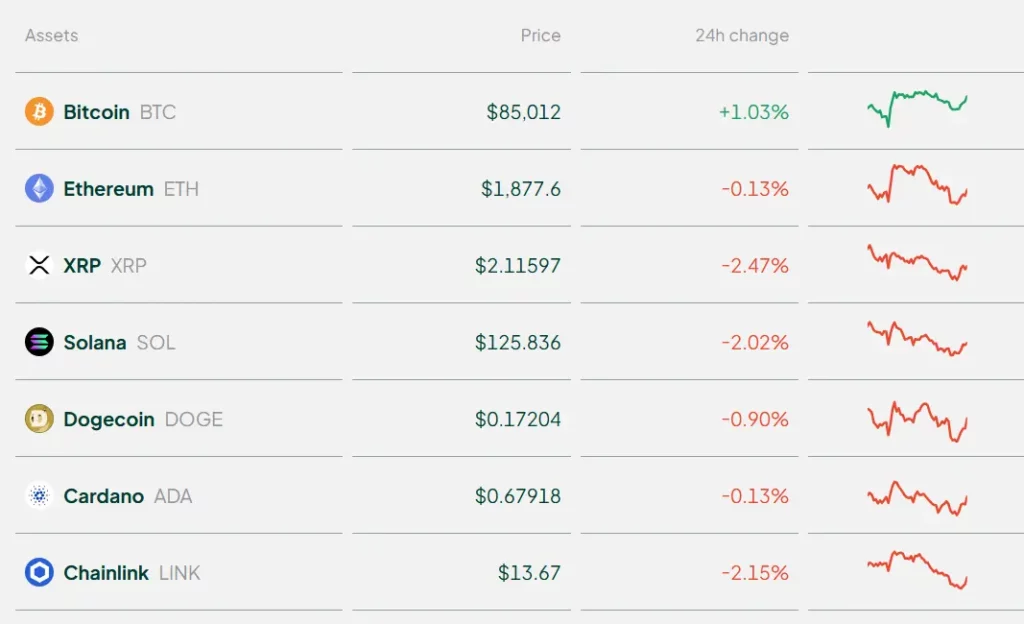

Bitstamp Vs Kraken: Supported Cryptocurrencies

When comparing cryptocurrency exchanges, the variety of supported coins can be a decisive factor for your trading strategy. Kraken clearly takes the lead in this category with over 300 cryptocurrencies available for trading.

Bitstamp offers a more limited selection with approximately 131 coins. While this covers most major cryptocurrencies, it might not satisfy you if you’re looking to diversify into altcoins.

Here’s a quick comparison of their offerings:

| Exchange | Number of Cryptocurrencies | Notable Features |

|---|---|---|

| Kraken | 300+ | Wide variety of altcoins, regular additions |

| Bitstamp | 131 | Focus on established cryptocurrencies |

Kraken also supports more fiat currencies, giving you more options for deposits and withdrawals. You can use USD, EUR, CAD, AUD, GBP, CHF, and JPY on Kraken.

Bitstamp’s more curated approach means they focus on quality over quantity. However, if you want to explore emerging cryptocurrencies or need specific altcoins, Kraken provides you with more options.

Both platforms support the major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Your choice might depend on whether you prefer a wide selection (Kraken) or a more focused approach with established coins (Bitstamp).

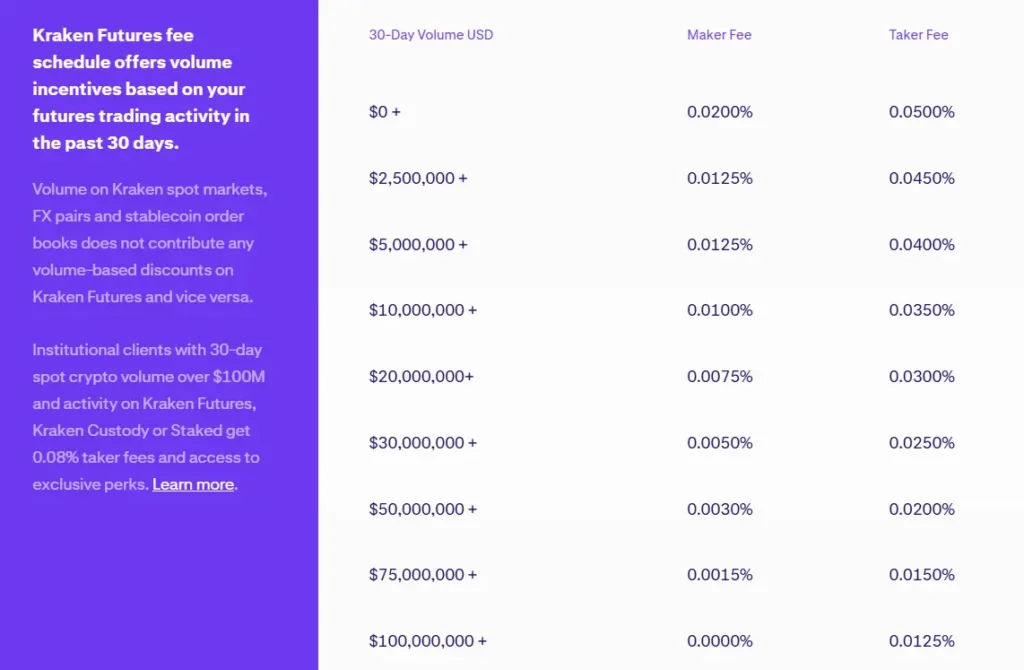

Bitstamp Vs Kraken: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitstamp and Kraken, fees play a crucial role in your decision. Let’s compare their fee structures to help you determine which platform might be more cost-effective for your trading needs.

Kraken offers lower trading fees compared to Bitstamp. Kraken’s trading fees go up to 0.40%, while Bitstamp charges 0.25% for trades under $20,000.

For active traders, Kraken’s fee structure becomes more attractive as your trading volume increases.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Kraken | Lower by 0.05% | Varies by volume |

| Bitstamp | 0.25% (under $20K) | 0.25% (under $20K) |

Deposit and withdrawal fees also differ between the platforms. Bitstamp typically charges more for certain fiat currency deposits and withdrawals compared to Kraken.

The method you choose for deposits and withdrawals will affect the fees you pay. Credit card transactions generally cost more than bank transfers on both platforms.

Before selecting either exchange, consider your trading volume and preferred payment methods. Higher volume traders may benefit more from Kraken’s tiered fee structure.

Remember that fee structures can change, so it’s wise to check the current rates on both platforms before making your final decision.

Bitstamp Vs Kraken: Order Types

When choosing between Bitstamp and Kraken, understanding the different order types available on each platform can help you make more strategic trades.

Kraken offers a more comprehensive selection of order types compared to Bitstamp. This gives you greater flexibility when executing your trading strategy.

On Kraken, you can access:

- Market orders

- Limit orders

- Stop-loss orders

- Take-profit orders

- Stop-limit orders

- Conditional close orders

- Settle position orders

Bitstamp provides a more streamlined selection of order types:

- Market orders

- Limit orders

- Stop orders

- Instant orders

For beginners, Bitstamp’s simpler approach might be easier to understand. You won’t feel overwhelmed by too many choices.

However, if you’re an advanced trader looking to implement complex strategies, Kraken’s variety of order types will give you more control over your trades.

Both exchanges allow you to set buy and sell orders at specific price points. This helps you automate your trading strategy without watching the market constantly.

Kraken stands out for its conditional orders that let you link multiple actions together. For example, you can set up a limit order that automatically triggers a stop-loss if executed.

This difference in order type availability might be a deciding factor depending on your trading style and experience level.

Bitstamp Vs Kraken: KYC Requirements & KYC Limits

Both Bitstamp and Kraken require KYC (Know Your Customer) verification to comply with regulations. These checks help prevent fraud and money laundering while protecting legitimate users.

Bitstamp KYC Requirements:

- Photo ID verification required

- Personal information collection

- Proof of residence document

- More thorough verification process

- Known for having stricter KYC policies

Bitstamp’s verification process can take 1-2 business days to complete. Some users find Bitstamp’s requirements particularly detailed and extensive.

Kraken KYC Requirements:

- Tiered verification system

- Basic tier requires personal information

- Higher tiers require ID verification and proof of residence

- More flexible verification options

Kraken’s verification can be completed in a few hours to a few days depending on verification tier and system load.

Trading Limits:

| Platform | Unverified | Basic Verification | Full Verification |

|---|---|---|---|

| Bitstamp | No trading | Limited deposits/withdrawals | Unlimited |

| Kraken | Minimal | Higher limits | Highest limits |

Your verification level directly impacts your trading experience on both platforms. Higher verification levels unlock larger deposit and withdrawal limits.

For US users, both exchanges require full verification before allowing significant trading activity.

If privacy is your primary concern, Kraken’s tiered approach might offer more flexibility for your specific needs.

Bitstamp Vs Kraken: Deposits & Withdrawal Options

When trading crypto, how you move your money matters. Both Bitstamp and Kraken offer several ways to deposit and withdraw funds, but they differ in important ways.

Deposit Methods:

- Bank transfers (SEPA, wire transfer)

- Credit/debit cards

- Cryptocurrency deposits

Kraken doesn’t charge for SEPA deposits, similar to Bitstamp. However, Bitstamp typically charges more for some fiat deposits and withdrawals.

For credit card deposits, Bitstamp charges around 5%, while Kraken’s fees aren’t as clearly listed on their main fee pages.

Withdrawal Options:

- Bank transfers

- Cryptocurrency withdrawals

| Method | Bitstamp | Kraken |

|---|---|---|

| SEPA Deposit | Free | Free |

| Wire Transfer | $0-$5 | 0-0.05% |

| Credit Card Deposit | ~5% | Not clearly listed |

| Crypto Withdrawal | Varies by asset | Varies by asset |

Both exchanges process withdrawals fairly quickly, but Kraken often gets better reviews for processing speed.

You’ll find that Kraken supports more cryptocurrencies for deposits and withdrawals than Bitstamp, giving you more options for moving your assets.

For international users, Kraken generally offers more regional payment methods and currency pairs than Bitstamp.

Remember that deposit and withdrawal limits may vary based on your verification level with either exchange.

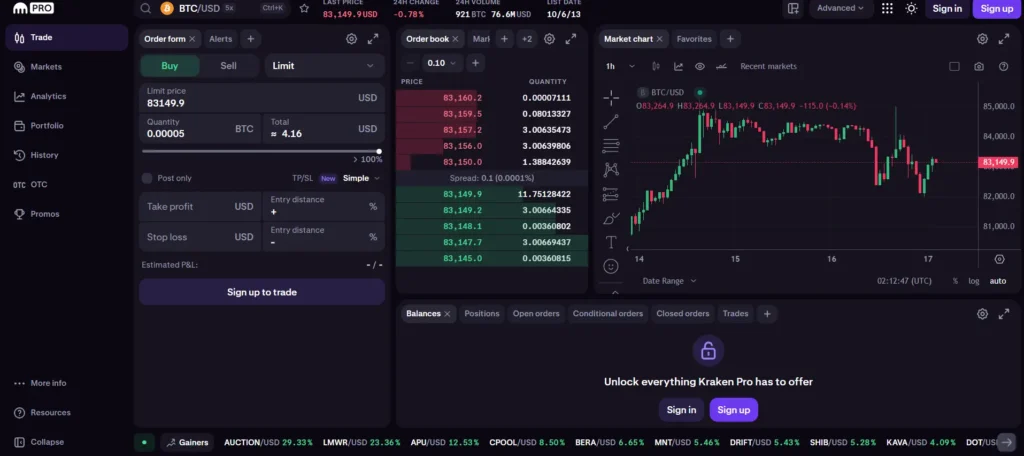

Bitstamp Vs Kraken: Trading & Platform Experience Comparison

When choosing between Bitstamp and Kraken, the trading experience can make a big difference for your crypto journey.

Kraken offers a more diverse trading experience with significantly more cryptocurrencies and trading pairs than Bitstamp. This gives you more options to diversify your portfolio.

User Interface

- Bitstamp: Clean, simple interface that’s easy for beginners

- Kraken: More feature-rich but might feel complex for new users

Kraken’s platform includes advanced charting tools and order types that serious traders will appreciate. Bitstamp keeps things straightforward but still professional.

Trading Features Comparison:

| Feature | Bitstamp | Kraken |

|---|---|---|

| Cryptocurrencies | Fewer options | Much larger selection |

| Trading pairs | Limited | Extensive |

| Order types | Basic | Advanced |

| Mobile app | User-friendly | Feature-complete |

Both exchanges offer mobile apps so you can trade on the go. Kraken’s app includes most features from the desktop version, while Bitstamp’s focuses on simplicity.

Kraken stands out with its Pro version that offers deeper liquidity and more advanced trading tools. This makes it better suited for experienced traders who need more sophisticated options.

For beginners who value simplicity, Bitstamp’s straightforward approach might be less overwhelming. The platform is designed to be accessible without sacrificing essential trading features.

Bitstamp Vs Kraken: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for your risk management.

Kraken employs an automated liquidation system that kicks in when your position’s margin ratio falls below the maintenance margin requirement. This typically happens when the market moves against your position significantly.

Bitstamp, on the other hand, has a more conservative approach to liquidation. Since Bitstamp offers less leverage than Kraken, its liquidation process is generally less aggressive.

Kraken’s Liquidation Process:

- Sends warnings as your position approaches liquidation levels

- Uses a tiered liquidation system based on position size

- Offers partial liquidation for some large positions

- Maintenance margin typically around 80% of initial margin

Bitstamp’s Liquidation Process:

- More straightforward liquidation mechanism

- Less frequent liquidations due to lower leverage options

- Fewer warning levels before liquidation occurs

- Generally higher maintenance margin requirements

Kraken provides more detailed liquidation information in its trading interface, helping you track your position’s health. This transparency gives traders more control in volatile markets.

Both platforms add liquidation fees when closing positions automatically. However, Kraken’s fees are typically lower, ranging from 0.1% to 0.3% compared to Bitstamp’s slightly higher rates.

Your trading style should inform which liquidation mechanism suits you better. Frequent traders may prefer Kraken’s more sophisticated system, while casual investors might appreciate Bitstamp’s simpler approach.

Bitstamp Vs Kraken: Insurance

When comparing Bitstamp and Kraken, insurance is an important factor to consider for your crypto investments. Both exchanges have taken steps to protect user funds, but their approaches differ.

Kraken provides insurance coverage through a global crime insurance policy. This policy covers digital assets held in their custodial wallets against theft and other criminal activities. They keep most funds in cold storage (offline) for added security.

Bitstamp also maintains insurance for digital assets. They partnered with BitGo to provide custody services with insurance protection. This coverage helps protect against security breaches, theft, and other potential losses.

Neither exchange offers complete coverage for all potential losses. Market volatility, personal account breaches due to poor security practices, and some other scenarios may not be covered.

Here’s a quick comparison of their insurance features:

| Feature | Kraken | Bitstamp |

|---|---|---|

| Insurance Provider | Global crime insurance | BitGo partnership |

| Cold Storage | 95%+ of assets | Majority of assets |

| Coverage Type | Theft and criminal activity | Security breaches and theft |

| FDIC Insurance | Not available for crypto | Not available for crypto |

You should note that both exchanges store most assets offline in cold storage. This practice greatly reduces the risk of large-scale hacks compared to keeping funds in hot wallets.

Bitstamp Vs Kraken: Customer Support

When choosing between Bitstamp and Kraken, customer support can be a deciding factor. Both platforms offer various support channels to assist you with your crypto trading needs.

Kraken provides 24/7 customer service, which is a significant advantage. You can reach their team through live chat, email, or their help center at any time of day.

Bitstamp also offers strong customer support but may not be available around the clock. Their support channels include email tickets, phone support, and a comprehensive FAQ section.

Response times vary between the exchanges. Kraken typically responds quickly through their live chat feature. Bitstamp is known for prioritizing safety and acting fast when issues arise.

Both platforms provide:

- Help center articles

- Email support

- FAQs

- Account verification assistance

Kraken offers a more robust support system for advanced traders with dedicated account managers for high-volume customers. This personalized service can be valuable if you trade frequently.

Bitstamp’s strength lies in its thorough approach to resolving security concerns. You’ll find their team particularly responsive when dealing with account security matters.

For beginners, both platforms offer adequate guidance, but Kraken’s 24/7 availability might give you more peace of mind when starting your crypto journey.

Bitstamp Vs Kraken: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitstamp and Kraken have strong security measures in place to protect your investments.

Bitstamp stores most user funds in cold storage, keeping them offline and safe from hackers. They also offer two-factor authentication (2FA) to add an extra layer of protection to your account.

Kraken is known for its transparency regarding security practices. They also use cold storage for the majority of user funds and provide 2FA options. Kraken has never experienced a major security breach, which speaks to their robust security infrastructure.

Key Security Features Comparison:

| Feature | Bitstamp | Kraken |

|---|---|---|

| Cold Storage | Yes | Yes |

| Two-Factor Authentication | Yes | Yes |

| Insurance | Limited | Yes |

| Security History | Had a breach in 2015 | No major breaches |

| Account Verification | Multiple tiers | Multiple tiers |

Bitstamp is quick to respond when security issues arise, putting customer fund safety first. Their platform uses encryption to protect your personal information and trading activities.

Kraken offers additional security features like global settings lock and email confirmation for withdrawals. They also have a dedicated security team that monitors the platform 24/7.

Both exchanges require identity verification to comply with regulations, which adds another layer of security to protect users from fraud.

Is Bitstamp Safe & Legal To Use?

Bitstamp is generally considered a safe and legal cryptocurrency exchange. It was founded in 2011, making it one of the oldest exchanges still operating today.

Bitstamp is registered as a payment institution in Luxembourg and complies with EU regulations. For US users, Bitstamp is registered with FinCEN as a Money Services Business.

The exchange has faced security challenges in the past. In 2015, Bitstamp experienced a hack that resulted in the loss of approximately 19,000 Bitcoin. Since then, they’ve significantly improved their security measures.

Key Security Features:

- Cold storage for 98% of cryptocurrency assets

- Two-factor authentication (2FA)

- Encryption for sensitive data

- Insurance for digital assets held in hot wallets

Bitstamp uses a multi-signature system that requires multiple approvals for withdrawals. This adds an extra layer of protection for your funds.

The platform conducts regular security audits and implements advanced monitoring systems to detect suspicious activities.

When you use Bitstamp, you must complete identity verification to comply with KYC (Know Your Customer) regulations. This helps prevent fraud and money laundering.

Legal Status by Region:

- EU: Fully regulated

- UK: Registered with FCA

- US: Available in most states (except NY and WA)

- Canada: Legal to use

- Australia: Compliant with local regulations

Remember to always use strong passwords and enable all available security features when using any crypto exchange, including Bitstamp.

Is Kraken Safe & Legal To Use?

Kraken is generally considered a secure cryptocurrency exchange. It has maintained a strong security record with no major hacks reported, unlike some competitors in the industry.

Kraken implements several safety features to protect user funds and information. These include:

- Cold storage for the majority of assets

- Two-factor authentication (2FA)

- Strong encryption protocols

- Regular security audits

From a legal standpoint, Kraken operates as a regulated exchange in many jurisdictions. It complies with relevant financial regulations and has obtained necessary licenses in countries where it offers services.

You should know that Kraken is particularly transparent about its security measures. This transparency helps build trust with users who want to ensure their investments are protected.

For advanced traders, Kraken provides additional security features that can be customized to your specific needs. These include API key management and withdrawal address whitelisting.

When comparing security between Kraken and Bitstamp, both exchanges prioritize user safety. However, Kraken is often noted for its more advanced trading tools alongside robust security protocols.

Remember to always use strong passwords and enable all available security features when setting up your Kraken account. This adds an extra layer of protection beyond what the exchange provides.

Frequently Asked Questions

Here are answers to common questions about Bitstamp and Kraken exchanges. These details will help you decide which platform better suits your trading needs based on fees, available cryptocurrencies, and user experience.

What are the differences in fee structures between Bitstamp and Kraken?

Bitstamp and Kraken have different fee structures. Bitstamp typically charges between 0.5% and 0.25% per trade, depending on your 30-day trading volume.

Kraken offers a more tiered approach with fees ranging from 0.26% for makers to 0.16% for takers at the basic level. As your trading volume increases, these fees decrease.

Both exchanges charge fees for deposits and withdrawals, but these vary based on payment method and currency type.

How do withdrawal and deposit methods compare between Bitstamp and Kraken?

Bitstamp supports bank transfers, credit card payments, and cryptocurrency deposits. Their fiat deposit options include SEPA transfers for European users and ACH transfers for US customers.

Kraken offers similar options but with more variety in fiat currencies. They support USD, EUR, CAD, GBP, JPY, CHF, and AUD.

Both platforms charge fees for fiat deposits and withdrawals, with cryptocurrency withdrawals incurring network fees.

Which exchange offers a wider variety of cryptocurrencies, Bitstamp or Kraken?

Kraken clearly leads in cryptocurrency selection with over 300 different cryptocurrencies available for trading. This gives you more options for diversifying your portfolio.

Bitstamp offers a more limited selection with approximately 131 cryptocurrencies. They focus on established coins rather than newer altcoins.

If you’re looking for obscure or newer cryptocurrencies, Kraken will likely have more options for you.

In terms of security measures, how do Bitstamp and Kraken differ?

Both exchanges prioritize security but implement different measures. Bitstamp stores 98% of user assets in cold storage and offers two-factor authentication.

Kraken is known for its strong security record with 95% of deposits in cold storage. They also provide global settings lock and configurable account timeout features.

Both platforms comply with regulatory requirements and have implemented KYC (Know Your Customer) procedures to verify user identities.

Can US residents trade on both Bitstamp and Kraken, and are there any restrictions?

US residents can trade on both Bitstamp and Kraken, but with some restrictions. Bitstamp is available in most US states and offers services to American customers.

Kraken also serves US customers but doesn’t operate in New York due to the BitLicense requirement. Some advanced features like margin trading may be restricted for US users on both platforms.

Always check the most current state-by-state availability as regulations change frequently.

How do user experiences with customer support compare between Bitstamp and Kraken?

User experiences with customer support vary between the two exchanges. Bitstamp offers email support and a help center with detailed guides.

Kraken provides 24/7 live chat support, which many users find more responsive than Bitstamp’s email system. They also maintain an extensive knowledge base.

Response times can vary for both platforms during high market volatility or increased demand periods.

Bitstamp Vs Kraken Conclusion: Why Not Use Both?

Both Bitstamp and Kraken offer strong features for crypto trading, but they serve different needs. Kraken stands out with its wider selection of cryptocurrencies and deep liquidity for large trades.

Bitstamp provides a more streamlined experience with ACH transfer support that some users find more convenient than Kraken’s setup process.

For security, both exchanges implement cold storage, two-factor authentication, and encryption. Kraken edges ahead with more transparency about its security practices.

Why consider using both platforms:

- Diversify risk – Splitting assets between exchanges reduces exposure if one platform faces issues

- Access more coins – Use Kraken for its extensive coin selection while enjoying Bitstamp’s simplicity for major cryptocurrencies

- Compare fees – Take advantage of fee differences for different transaction types

You might prefer Bitstamp for basic trading of major coins with simple deposits. Then use Kraken when you need access to more obscure cryptocurrencies or want to place larger orders with minimal slippage.

Many experienced traders maintain accounts on multiple exchanges to capitalize on price differences and feature advantages.

Your trading volume, preferred coins, and need for specific features should guide your decision. There’s no rule saying you must choose just one platform.