Choosing the right cryptocurrency exchange can be a game-changer for your trading experience. Bitstamp and Binance are two popular platforms that offer different advantages depending on what you’re looking for. According to recent comparisons, Bitstamp scores higher overall with an 8.4 rating, while Binance offers lower deposit fees and caters to a broader audience with its user-friendly interface.

These exchanges differ in key areas that might matter to you. Bitstamp provides a more professional trading environment that experienced traders might prefer. Binance, on the other hand, has become known for its lower fees, especially for credit card deposits, where Bitstamp’s 5% fee might be a dealbreaker for some users.

As you consider which platform fits your needs, think about what matters most to you – lower fees, interface simplicity, or trading environment. The right choice depends on your experience level and trading goals as of 2025.

Bitstamp vs Binance: At A Glance Comparison

When choosing between Bitstamp and Binance, understanding their key differences helps you make a better decision for your crypto trading needs.

Bitstamp has an overall score of 8.4 compared to Binance’s slightly lower score, according to comparison data. This rating considers multiple factors like usability, fees, and available features.

Fee Structures:

- Bitstamp charges higher credit card deposit fees (5%)

- Binance typically offers lower deposit fees overall

Platform Comparison:

| Feature | Bitstamp | Binance |

|---|---|---|

| Founded | 2011 | 2017 |

| Cryptocurrencies | Fewer options | Extensive selection |

| User Interface | Beginner-friendly | Feature-rich but complex |

| Security | Strong | Strong |

Bitstamp is one of the oldest exchanges in the crypto space, which gives it credibility for stability. It offers a more straightforward experience for new traders.

Binance provides more trading options and cryptocurrencies. You’ll find advanced trading features that experienced traders often prefer.

Your trading volume and preferred payment methods will significantly impact which platform works better for you. If you frequently use credit cards, Binance’s lower fees might save you money.

Both platforms offer mobile apps, but they differ in complexity and available features. Consider how you plan to access and use the exchange when making your choice.

Bitstamp vs Binance: Trading Markets, Products & Leverage Offered

Binance offers a vast selection of cryptocurrencies with over 350 tokens available for trading. You can access numerous trading pairs, including popular and emerging altcoins.

Bitstamp provides a more focused selection with approximately 70 cryptocurrencies. This smaller range focuses on established tokens rather than newer offerings.

Trading Products Comparison:

| Feature | Binance | Bitstamp |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ | ✗ |

| Options | ✓ | ✗ |

| Margin Trading | ✓ | ✗ |

| Staking | ✓ | Limited |

| NFT Marketplace | ✓ | ✗ |

Binance offers substantial leverage options, allowing you to trade with up to 125x leverage on certain futures contracts. This provides greater potential returns but comes with significantly higher risk.

Bitstamp does not offer leverage trading. The platform focuses on spot trading only, which may be preferable if you want a simpler, less risky trading experience.

You’ll find more advanced trading features on Binance, including futures, options, and margin trading. These products let you diversify your crypto strategy beyond basic buying and selling.

Bitstamp’s straightforward approach makes it suitable if you prefer focusing on direct cryptocurrency purchases without complex derivatives or leveraged positions.

Bitstamp vs Binance: Supported Cryptocurrencies

When choosing between Bitstamp and Binance, the variety of available cryptocurrencies is an important factor to consider. Based on current information, Bitstamp offers more cryptocurrencies than Binance.

Bitstamp focuses on quality over quantity, providing access to established cryptocurrencies with proven track records. You’ll find major coins like Bitcoin, Ethereum, Ripple, and Litecoin on their platform.

Binance, while having fewer cryptocurrencies than Bitstamp according to recent comparisons, still offers a substantial selection. Their platform includes popular coins and some altcoins that appeal to different types of traders.

Here’s a simple comparison of their cryptocurrency offerings:

| Feature | Bitstamp | Binance |

|---|---|---|

| Total cryptocurrencies | Higher number | Lower number |

| Focus | Established coins | Mix of established and some altcoins |

| Major coins | Bitcoin, Ethereum, etc. | Bitcoin, Ethereum, etc. |

Your trading needs should guide your choice between these platforms. If you want access to more cryptocurrency options, Bitstamp might be the better choice.

Both exchanges regularly update their offerings, so it’s worth checking their current listings before making your decision. The cryptocurrency market changes rapidly, and exchanges adjust their supported coins accordingly.

Bitstamp vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitstamp and Binance, understanding their fee structures is crucial for your trading strategy.

Trading Fees

Bitstamp charges higher trading fees than Binance, with rates up to 0.40% per transaction. Binance offers more competitive rates, typically ranging from 0.38% to 0.57% on most transactions for US users.

Deposit Fees

Both exchanges charge varying deposit fees depending on your payment method. Bank transfers like SEPA (for European users) are available on both platforms with different fee structures.

Here’s a quick comparison of key fees:

| Fee Type | Bitstamp | Binance |

|---|---|---|

| Trading Fees | Up to 0.40% | Up to 0.57% (US version) |

| Withdrawal Fees | Up to $60 | Varies by network |

| Deposit Methods | SEPA, bank transfer, card | SEPA, bank transfer, card |

Withdrawal Fees

Bitstamp withdrawal fees can reach up to $60 depending on the method. Binance’s withdrawal fees vary based on the cryptocurrency network you’re using, which can be more cost-effective for certain tokens.

Both platforms also charge network transaction fees that vary based on blockchain congestion and the specific cryptocurrency you’re trading.

For frequent traders, Binance generally offers more competitive fee structures, while Bitstamp’s higher fees come with different platform benefits like enhanced security features.

Bitstamp vs Binance: Order Types

When trading cryptocurrencies, the types of orders available can significantly impact your trading strategy. Both Bitstamp and Binance offer various order types, but there are notable differences between them.

Bitstamp Order Types:

- Market orders

- Limit orders

- Stop orders

- Instant orders

Bitstamp keeps things relatively simple with these basic order types. This makes it easier for beginners to understand and use the platform without feeling overwhelmed.

Binance Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

- Post-only orders

- Trailing stop orders

- Take profit orders

Binance clearly offers more advanced order types. This gives you greater flexibility to implement complex trading strategies and manage risk more effectively.

If you’re new to crypto trading, Bitstamp’s straightforward approach might be more appealing. You can place basic trades without navigating through numerous options.

For experienced traders, Binance provides tools like trailing stops that automatically adjust your exit price as the market moves. The OCO feature lets you set both a take-profit and stop-loss simultaneously.

Both exchanges allow you to view your order history and active orders easily. However, Binance’s advanced features like time-in-force options give you more control over how long your orders remain active.

Your choice ultimately depends on your trading experience and needs. Bitstamp works well for straightforward trading, while Binance excels for those requiring more sophisticated order execution.

Bitstamp vs Binance: KYC Requirements & KYC Limits

Both Bitstamp and Binance require users to complete Know Your Customer (KYC) procedures, but they differ in their approaches and limitations.

Bitstamp has stricter KYC requirements that some users find quite detailed. Based on search results, users have described Bitstamp’s KYC as “seriously NOSY” with extensive information requests.

Binance’s KYC process is generally considered more streamlined while still meeting regulatory standards. This contributes to its higher popularity among traders who want quicker verification.

Bitstamp KYC Levels:

- Basic verification: Requires personal information, ID document, and proof of residence

- Higher limits require more extensive documentation

- Full verification needed for all trading features

Binance KYC Levels:

- Basic verification: Allows limited trading with simple ID verification

- Intermediate: Requires photo ID and facial verification

- Advanced: Requires additional documents for higher limits

Bitstamp’s withdrawal limits are typically lower until full verification is complete. This can be frustrating if you need to move larger amounts quickly.

Binance offers more flexibility with its tiered verification system, allowing you to start trading with basic verification while gradually increasing your limits.

For US users, both exchanges have adapted their KYC procedures to comply with stricter regulations, but Binance.US has separate requirements from the international platform.

Remember that KYC requirements may change as regulations evolve, so check the latest information directly from each exchange before signing up.

Bitstamp vs Binance: Deposits & Withdrawal Options

Both Bitstamp and Binance offer various options for depositing and withdrawing your funds. Understanding these options can help you choose the exchange that better suits your needs.

Deposit Methods:

Bitstamp supports bank transfers (SEPA, international wire), credit/debit cards, and cryptocurrency deposits. Binance offers more options including bank transfers, credit/debit cards, P2P trading, and numerous cryptocurrency deposits.

Withdrawal Methods:

| Feature | Bitstamp | Binance |

|---|---|---|

| Crypto Withdrawals | Yes | Yes |

| Bank Transfers | Yes | Yes |

| Withdrawal Fees | Up to $60 | Varies by network |

| Processing Time | 1-3 business days | Often faster |

Bitstamp’s withdrawal fees can be higher, with charges up to $60 depending on the method. Binance typically offers lower withdrawal fees that vary based on the cryptocurrency network you’re using.

Binance generally processes withdrawals faster than Bitstamp, which can take 1-3 business days for fiat currency withdrawals.

You’ll find that Binance supports more cryptocurrencies for deposits and withdrawals (200+) compared to Bitstamp’s more limited selection (around 70).

For USD transactions, both exchanges provide support for deposits and withdrawals, making them accessible for US-based traders.

Binance wins on variety and cost-effectiveness for deposits and withdrawals, while Bitstamp offers a more straightforward approach with fewer but well-established options.

Bitstamp vs Binance: Trading & Platform Experience Comparison

Bitstamp offers a more beginner-friendly trading experience with a cleaner interface and simpler navigation. You’ll find it easier to make basic trades without feeling overwhelmed by options.

Binance, on the other hand, caters to experienced traders with advanced trading tools and charts. Its platform includes more complex order types and technical analysis features that power users appreciate.

User Interface Comparison:

- Bitstamp: Clean, straightforward design with fewer distractions

- Binance: Feature-rich but potentially overwhelming for beginners

When it comes to mobile trading, both exchanges offer apps for iOS and Android. Bitstamp’s mobile app mirrors its desktop simplicity, while Binance’s app maintains most of the advanced features found on its web platform.

Trading speed matters for active traders. Binance generally processes transactions faster and handles higher volumes without slowdowns, giving it an edge for day traders.

Bitstamp supports over 80 cryptocurrencies, which is decent but limited compared to Binance’s impressive selection of 600+ crypto assets. This difference significantly impacts your trading options.

The pro trading view on Bitstamp provides enough tools for intermediate traders. However, Binance’s advanced trading interface offers more depth with multiple chart types, indicators, and customization options.

For new crypto investors, Bitstamp’s learning curve is gentler. You can get started making trades quickly without needing to understand complex features.

Bitstamp vs Binance: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial. This process triggers when your position can’t meet the required margin levels.

Binance’s Liquidation Approach:

- Uses a tiered liquidation system to protect traders

- Implements partial liquidations when possible

- Offers an “Auto-Deleveraging” (ADL) system for extreme market conditions

- Maintains an Insurance Fund to cover negative balances

Binance provides early warnings through a margin ratio indicator. You’ll receive notifications as your position approaches liquidation levels.

Bitstamp’s Liquidation Approach:

- Employs a more traditional liquidation model

- Offers fewer advanced liquidation features than Binance

- Provides clear margin call warnings

- Generally has more conservative leverage options

Comparison Table:

| Feature | Binance | Bitstamp |

|---|---|---|

| Partial Liquidation | Yes | Limited |

| Insurance Fund | Yes | Yes (smaller) |

| Max Leverage | Higher (up to 125x on some pairs) | Lower (more conservative) |

| Warning System | Comprehensive | Basic |

Binance tends to offer more sophisticated liquidation mechanics with greater flexibility. This can help you manage risk more effectively during volatile market conditions.

Bitstamp’s simpler approach might be more suitable for beginners or those preferring lower leverage trading with less liquidation complexity.

Bitstamp vs Binance: Insurance

When choosing a cryptocurrency exchange, security should be a top priority. Insurance protection is one way exchanges safeguard your assets.

Binance offers the Secure Asset Fund for Users (SAFU), which was established in 2018. This emergency insurance fund holds 10% of all trading fees. It acts as a safety net in case of security breaches or hacks.

Bitstamp provides insurance coverage through BitGo, a digital asset trust company. This insurance covers digital assets held in their hot wallets against theft and cybersecurity breaches.

Both exchanges implement cold storage solutions for most user funds. Binance stores approximately 90% of user assets in cold wallets, while Bitstamp maintains a similar approach.

Insurance Coverage Comparison:

| Exchange | Insurance Type | Coverage |

|---|---|---|

| Binance | SAFU | Emergency fund from trading fees |

| Bitstamp | BitGo Insurance | Coverage for hot wallet assets |

Neither exchange guarantees complete protection against all possible losses. You should still practice good security habits like using two-factor authentication and strong passwords.

Remember that insurance policies may change over time. It’s wise to check the exchanges’ current insurance details before making your decision.

Both platforms regularly undergo security audits to maintain high safety standards, but their insurance approaches differ in implementation and coverage scope.

Bitstamp vs Binance: Customer Support

When choosing between Bitstamp and Binance, customer support can be a deciding factor for your trading experience. Both exchanges offer support options, but they differ in availability and response times.

Bitstamp provides 24/7 customer support through email tickets and live chat. Their team is known for relatively quick response times, usually within 24-48 hours for email inquiries. Many users report positive experiences with their support staff’s helpfulness.

Binance also offers 24/7 support through multiple channels including email, tickets, and live chat. They’ve expanded their support team significantly since 2021. However, due to their larger user base, response times can sometimes be longer than Bitstamp.

Support Channels Comparison:

| Feature | Bitstamp | Binance |

|---|---|---|

| Email Support | ✓ | ✓ |

| Live Chat | ✓ | ✓ |

| Phone Support | Limited | No |

| Help Center | Comprehensive | Extensive |

| Community Forum | Limited | Active |

Bitstamp has an advantage for newer crypto users, as their support team often provides more personalized guidance. Their representatives are typically fluent in multiple languages.

Binance compensates for potentially longer wait times with an extensive knowledge base and FAQ section. You can often find answers to common questions without contacting support directly.

For urgent account issues, Bitstamp might be more responsive. However, Binance’s community forums can provide peer assistance when official support is delayed.

Bitstamp vs Binance: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitstamp and Binance offer strong security measures, but they approach protection in different ways.

Bitstamp has built its reputation on regulatory compliance and a long operating history since 2011. This established track record gives many users peace of mind. Bitstamp stores most customer funds in cold storage, keeping them offline and away from potential hackers.

Binance invests heavily in security technology. They use a combination of cold wallet storage and their Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund. Binance also employs advanced security protocols including two-factor authentication (2FA).

Key Security Features Comparison:

| Security Feature | Bitstamp | Binance |

|---|---|---|

| Cold Storage | Yes | Yes |

| Two-Factor Authentication | Yes | Yes |

| Insurance Fund | Limited | SAFU Fund |

| Regulatory Compliance | Strong focus | Varies by region |

| Security History | Few incidents | Has experienced hacks |

Bitstamp requires identity verification for all accounts, which adds an extra layer of protection. Their focus on regulatory compliance means they follow strict security standards across all operations.

Binance offers additional security tools like anti-phishing codes and withdrawal address management. You can also set up withdrawal whitelists to ensure your funds only go to approved addresses.

Both platforms encourage you to use security features like strong passwords and 2FA. Your personal security practices play a crucial role in keeping your crypto assets safe regardless of which exchange you choose.

Is Bitstamp A Safe & Legal To Use?

Bitstamp is generally considered a safe and legal cryptocurrency exchange to use. It operates with strong regulatory compliance and holds licenses in multiple regions, including the UK (FCA), Luxembourg (CSSF), Malta (MFSA), and Belgium (FSMA).

The exchange has built a reputation for security and compliance over its years of operation. This focus on following regulations helps protect your funds and personal information when trading.

However, according to the search results, Bitstamp scored lower than competitors like Binance and Coinbase in some security aspects. It lacks verifiable proof of reserves and hasn’t conducted penetration tests.

Despite these limitations, Bitstamp has maintained its fiat on/off ramps (ways to convert between cryptocurrency and traditional currency). This suggests the exchange meets the necessary legal requirements to offer these services.

Key Safety Features:

- Multi-regional licensing

- Strict security protocols

- Long-standing operation in the crypto space

Legal Considerations:

- Regulated in multiple European countries

- Complies with financial regulations

- May require identity verification for compliance

You should always use strong passwords and two-factor authentication when using Bitstamp. As with any crypto exchange, it’s best to only keep trading funds on the platform and store long-term holdings in a personal wallet.

Is Binance A Safe & Legal To Use?

Binance is generally considered a safe platform for cryptocurrency trading. It ranks among the largest crypto exchanges globally and employs several security measures to protect users’ assets.

The exchange offers two-factor authentication (2FA) for account protection. They also store most user funds in secure offline storage, which helps prevent hacking attempts.

Binance uses real-time monitoring systems to detect suspicious activities. This adds an extra layer of protection for your investments.

Regarding legality, Binance is regulated in multiple European countries including France, Italy, and Lithuania. This regulatory compliance helps ensure the platform follows proper financial guidelines.

In the United States, Binance operates as Binance US, which is a separate entity designed to comply with U.S. regulations. This distinction is important if you’re a U.S. resident looking to use their services.

Despite its security measures, you should always practice caution when using any crypto exchange. This includes using strong passwords and enabling all available security features.

For beginners, Binance might feel overwhelming due to its extensive features. However, these same features make it attractive to experienced traders.

Remember to verify Binance’s current regulatory status in your country before trading, as cryptocurrency regulations change frequently.

Frequently Asked Questions

Trading on crypto exchanges brings up many questions about fees, security, and available cryptocurrencies. These crucial factors can help you decide which platform best fits your trading needs.

What are the differences in trading fees between Bitstamp and Binance?

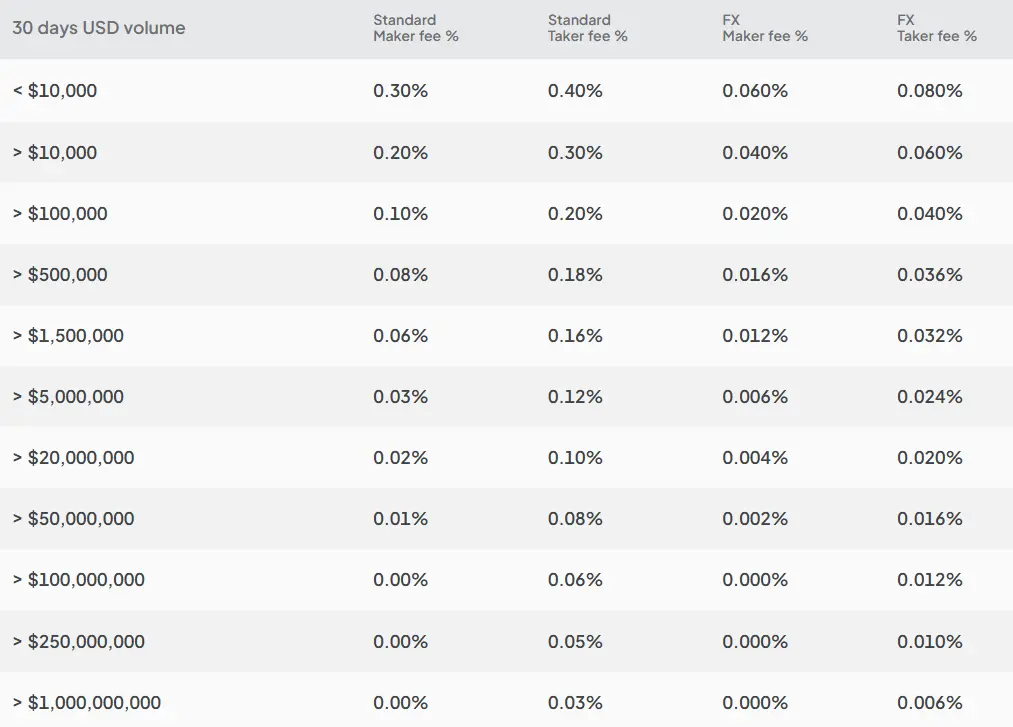

Binance offers a tiered fee structure that benefits high-volume traders. As your trading volume increases, your fees decrease.

Bitstamp has a more straightforward fee schedule that doesn’t change as much with volume. Their base fees are typically higher than Binance’s.

For regular traders, Binance generally provides lower trading fees. However, beginners might find Bitstamp’s simple fee structure easier to understand.

Which platform offers better security features, Bitstamp or Binance?

Both exchanges prioritize security but implement different measures. Bitstamp has been operating since 2011 with a strong security record and stores most funds in cold storage.

Binance uses SAFU (Secure Asset Fund for Users) to protect user funds. They also offer advanced security options like hardware key authentication.

You should enable two-factor authentication on either platform for added protection. Both exchanges require identity verification to comply with regulations.

How do the withdrawal and deposit fees compare on Bitstamp and Binance?

Deposit fees vary by payment method on both platforms. Bank transfers are often cheaper than credit card deposits.

Binance typically offers lower cryptocurrency withdrawal fees for most coins. They adjust these fees periodically based on network conditions.

Bitstamp’s withdrawal fees tend to be slightly higher but are more consistent. Their fee structure is less complex, which some users prefer.

Can users expect a significant variation in cryptocurrency prices between Bitstamp and Binance?

Price differences between the exchanges usually remain small but can exist due to liquidity differences. Binance typically has higher trading volume, which can lead to tighter spreads.

During volatile market periods, price gaps between exchanges may widen temporarily. This creates arbitrage opportunities for experienced traders.

You might notice slightly higher prices on Bitstamp due to its lower trading volume compared to Binance.

What are the main advantages and drawbacks of using Bitstamp for cryptocurrency trading?

Bitstamp offers a clean, user-friendly interface that works well for beginners. Their customer support has a good reputation for responsiveness.

The main drawback is their limited cryptocurrency selection compared to Binance. Bitstamp supports fewer trading pairs and offers fewer features.

Bitstamp provides strong regulatory compliance and operates with licenses in multiple jurisdictions. This can give you more confidence in their legitimacy.

Which exchange provides a wider range of cryptocurrencies, Bitstamp or Binance?

Binance clearly wins in cryptocurrency selection with hundreds of available coins and tokens. They regularly add new cryptocurrencies to their platform.

Bitstamp focuses on a smaller selection of established cryptocurrencies. They offer around 50+ cryptocurrencies compared to Binance’s 350+.

If you want to trade newer or less popular cryptocurrencies, Binance will provide more options. Bitstamp primarily lists major cryptocurrencies with proven track records.

Binance vs Bitstamp Conclusion: Why Not Use Both?

After comparing these two popular crypto exchanges, you might wonder which one to choose. The answer might surprise you – why not use both?

Binance offers a wider range of cryptocurrencies and typically lower fees. It’s great for advanced traders who want access to many trading options and features.

Bitstamp provides a smoother user experience that’s easier to navigate. Its long history and strong regulatory compliance give it an edge in terms of trust and security.

Each platform has unique strengths that might suit different aspects of your crypto journey. For example, you could use:

- Bitstamp for your core Bitcoin and major cryptocurrency investments

- Binance for trading altcoins and accessing more advanced features

Using both platforms allows you to enjoy the benefits of each while minimizing their drawbacks. You can take advantage of Bitstamp’s user-friendly interface and Binance’s extensive cryptocurrency options.

Remember that both exchanges require verification, so you’ll need to complete KYC procedures for each. This might take some additional time initially but gives you more flexibility long-term.

Your specific needs should guide your decision. If simplicity is your priority, Bitstamp might be enough. If you want the widest range of trading options, Binance could be your go-to choice.

Consider starting with the platform that best matches your immediate needs, then expanding to the other as you grow more comfortable with cryptocurrency trading.