Choosing the right cryptocurrency exchange can save you money and make trading easier. Both Bitpanda and Coinbase are popular platforms in 2025, but they have key differences that might matter to you.

Bitpanda offers lower trading fees at 1.49% compared to Coinbase’s fees that can go up to 3.99%. This price difference adds up, especially if you trade often. Bitpanda also provides around 2185 different stocks for trading, giving you more options beyond just cryptocurrencies.

When picking between these platforms, you should also consider their user-friendliness and the number of active users. Coinbase is known for its simple interface that beginners find easy to use. However, if saving on fees is your top priority, Bitpanda might be the better choice for your trading needs.

Bitpanda vs Coinbase: At A Glance Comparison

When choosing between Bitpanda and Coinbase, several key differences stand out. Here’s what you need to know before making your decision.

Coinbase has a higher overall score of 9.6 compared to Bitpanda based on recent comparisons. This reflects its broader market position and feature set.

Trading Options:

- Coinbase offers both basic and advanced trading platforms

- Bitpanda mainly focuses on a simpler trading experience

- Coinbase Advanced provides access to over 350 market pairs

Cryptocurrency Support:

- Coinbase supports more cryptocurrencies than Bitpanda

- Both platforms offer the major coins like Bitcoin and Ethereum

Payment Methods:

- Coinbase accepts PayPal payments

- Bitpanda does not support PayPal

Fee Structure:

Coinbase typically charges higher fees than Bitpanda, which may impact your trading costs over time.

Earning Potential:

Coinbase offers up to 7% APY on eligible assets, giving you passive income options.

The platform you choose should align with your trading experience and needs. If you’re looking for more advanced trading features and wider cryptocurrency selection, Coinbase might be your better option.

For beginners or those seeking lower fees, Bitpanda could be more suitable. Your trading volume and preferred payment methods should also factor into your decision.

Bitpanda vs Coinbase: Trading Markets, Products & Leverage Offered

Coinbase offers access to over 230 cryptocurrencies, significantly more than Bitpanda’s 120+ options. This wider selection gives you more trading opportunities and portfolio diversification possibilities.

Both platforms provide spot trading of major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. You can buy, sell, and store these assets directly on either platform.

Bitpanda stands out by offering trading in precious metals (gold, silver, platinum) and fractional stocks. This feature allows you to diversify beyond just cryptocurrencies.

Trading Products Comparison:

| Feature | Bitpanda | Coinbase |

|---|---|---|

| Cryptocurrencies | 120+ | 230+ |

| Precious Metals | Yes (Gold, Silver, etc.) | No |

| Fractional Stocks | Yes | No |

| Crypto-to-Crypto Trading | Yes | Yes |

Leverage trading is limited on both platforms. Bitpanda Pro offers some margin trading features, while Coinbase focuses primarily on spot trading for retail customers.

Coinbase provides staking services for proof-of-stake cryptocurrencies, allowing you to earn passive income on certain holdings. Bitpanda also offers staking but with fewer supported assets.

Both platforms feature user-friendly mobile apps that let you trade on the go. You can set price alerts, view market data, and execute trades from your smartphone.

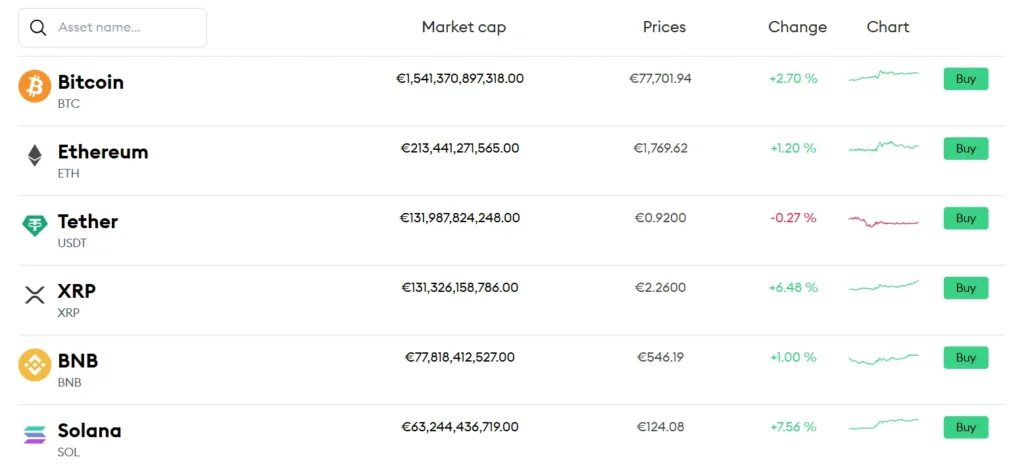

Bitpanda vs Coinbase: Supported Cryptocurrencies

When choosing between Bitpanda and Coinbase, the range of available cryptocurrencies is an important factor to consider.

Coinbase offers a wider selection of cryptocurrencies compared to Bitpanda. With Coinbase, you can access over 350 different cryptocurrencies, including popular options like Bitcoin, Ethereum, and Litecoin.

Bitpanda provides fewer cryptocurrency options, though it still covers the major coins most investors look for. The platform focuses on quality over quantity, ensuring the cryptocurrencies they offer meet certain standards.

Both platforms regularly add new cryptocurrencies as the market evolves. Here’s a quick comparison:

| Feature | Coinbase | Bitpanda |

|---|---|---|

| Number of cryptocurrencies | 350+ | Fewer options |

| Popular coins (BTC, ETH) | ✓ | ✓ |

| Regular additions | ✓ | ✓ |

If you’re looking to invest in less common or newer cryptocurrencies, Coinbase might be the better choice due to its extensive selection. However, if you’re primarily interested in mainstream cryptocurrencies, both platforms will likely meet your needs.

Coinbase Advanced provides access to over 350 market pairs, giving you more trading possibilities. This can be beneficial if you’re interested in trading between different cryptocurrency pairs.

Remember that availability of certain cryptocurrencies may vary based on your location due to regional regulations.

Bitpanda vs Coinbase: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Bitpanda and Coinbase, fees play a crucial role in your decision-making process. Both platforms have different fee structures that impact your overall trading experience.

Trading Fees:

- Bitpanda: Up to 1.49% per trade

- Coinbase: Up to 3.99% per trade (standard), or up to 0.60% (Coinbase Pro)

Bitpanda generally offers more competitive trading fees than Coinbase’s standard service. This difference can significantly impact your profits, especially if you trade frequently.

Withdrawal Fees:

| Platform | Withdrawal Fee |

|---|---|

| Bitpanda | Up to 0.00003900 BTC |

| Coinbase | Up to $60 or 3% |

Coinbase’s withdrawal fees tend to be higher, which might reduce your overall returns when moving funds off the platform.

For deposits, both platforms offer free options depending on your payment method. However, credit card deposits typically incur higher fees on both services.

The fee structure may change based on your location, payment method, and transaction size. It’s worth noting that Coinbase offers more cryptocurrencies (405+) compared to Bitpanda (120+), which might justify its higher fees for some users.

If low fees are your priority, Bitpanda appears to be the more economical choice for most regular traders. However, you should consider other factors like available cryptocurrencies, security features, and user experience before making your final decision.

Bitpanda vs Coinbase: Order Types

When trading cryptocurrency, the types of orders you can place matter a lot. Coinbase and Bitpanda offer different options that might impact your trading strategy.

Coinbase Order Types:

- Market orders (buy/sell at current price)

- Limit orders (set your desired price)

- Stop orders (execute when price reaches trigger)

- Advanced conditional orders (on Coinbase Advanced)

Coinbase Advanced provides over 350 market pairs and more sophisticated trading options. This platform is designed for experienced traders who need precise control over their trades.

Bitpanda Order Types:

- Market orders

- Limit orders

- Stop-limit orders (on Bitpanda Pro)

Bitpanda Pro is the platform’s advanced trading interface. It offers more technical tools compared to the standard Bitpanda experience, though with fewer order variations than Coinbase Advanced.

The difference becomes important if you use specific trading strategies. Coinbase gives you more flexibility with its range of order types.

Both platforms have simple interfaces for beginners. You can place basic buy and sell orders without understanding complex trading terms.

Your trading style should determine which platform suits you better. If you need advanced order capabilities, Coinbase offers more options. For simpler trading needs, both platforms provide adequate basic order functions.

Bitpanda vs Coinbase: KYC Requirements & KYC Limits

Both Bitpanda and Coinbase require you to verify your identity before trading. This process, known as Know Your Customer (KYC), helps prevent fraud and money laundering.

When you sign up for either platform, you’ll need to provide a government-issued ID. This typically involves scanning your ID and sometimes taking a selfie for verification.

Bitpanda’s verification is mandatory from the start. You cannot use their services without completing their KYC procedures, which include personal information and ID verification.

Coinbase follows a similar approach, requiring identity verification to unlock full trading capabilities. Without verification, your account will have significant limitations.

KYC Levels Comparison:

| Feature | Bitpanda | Coinbase |

|---|---|---|

| Basic Verification | Personal info + ID scan | Personal info + ID scan |

| Advanced Verification | ID + facial recognition | ID + facial recognition |

| Verification Time | Usually within 24 hours | Usually within 48 hours |

Verification on both platforms affects your trading limits. Unverified accounts have strict restrictions, while fully verified accounts can access higher deposit and withdrawal limits.

The verification process is straightforward on both platforms. You can complete it using your smartphone by taking photos of your ID and a selfie for face matching.

Remember that these KYC requirements are not optional—they’re regulatory requirements that all legitimate crypto exchanges must follow to operate legally.

Bitpanda vs Coinbase: Deposits & Withdrawal Options

When choosing between Bitpanda and Coinbase, understanding their deposit and withdrawal options is crucial for managing your crypto assets effectively.

Deposit Methods

Both platforms support bank transfers for funding your account. Coinbase accepts credit/debit cards and PayPal in many regions, while Bitpanda offers SEPA transfers for European users.

Withdrawal Options

Coinbase allows free deposits but charges withdrawal fees that can reach up to $60 depending on the cryptocurrency and network congestion. Bitpanda’s withdrawal fees are generally lower, with Bitcoin withdrawals costing approximately 0.00003900 BTC.

Fee Structures

| Platform | Deposit Fees | Withdrawal Fees |

|---|---|---|

| Coinbase | Free for most methods | Up to $60 |

| Bitpanda | Varies by method | Lower than Coinbase |

Coinbase offers instant deposits with certain payment methods, which can be convenient when you want to buy crypto quickly during market movements.

Bitpanda provides more European-friendly options, making it easier for EU residents to move money in and out of the platform.

Processing times vary between the platforms. Bank transfers typically take 1-3 business days on both exchanges, while card payments are usually processed instantly.

Your location matters when choosing between these platforms, as available payment methods differ by country. Always check the specific options for your region before deciding.

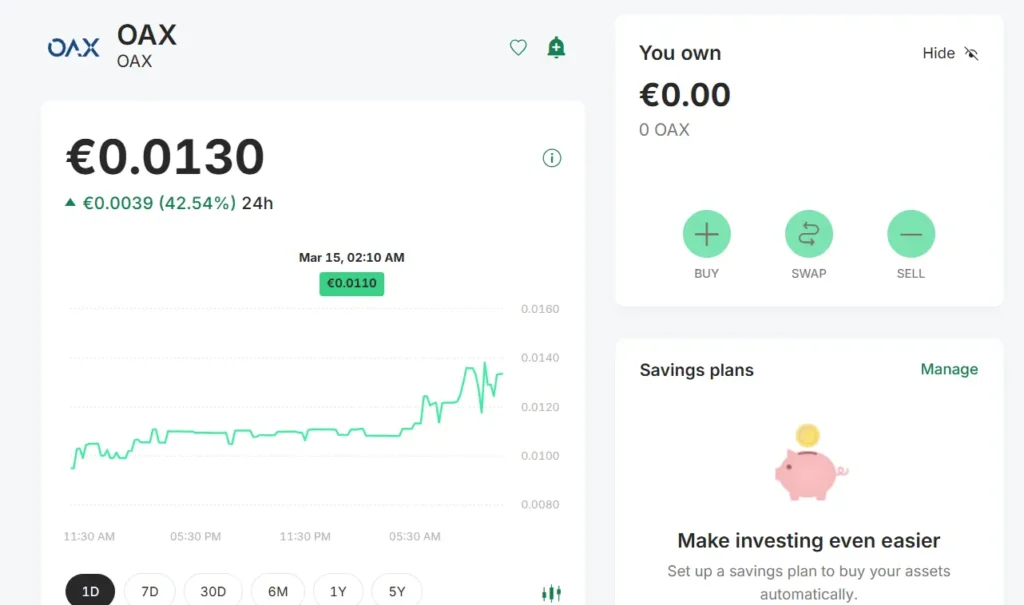

Bitpanda vs Coinbase: Trading & Platform Experience Comparison

When choosing between Bitpanda and Coinbase, the trading experience and platform usability play crucial roles in your decision.

Coinbase offers a clean, user-friendly interface designed for beginners. The platform features a straightforward dashboard where you can quickly buy, sell, and manage your assets.

Bitpanda also prioritizes ease of use but adds more advanced features for intermediate traders. Both platforms offer mobile apps that mirror their web functionality.

Trading Features Comparison:

| Feature | Coinbase | Bitpanda |

|---|---|---|

| Available Cryptocurrencies | ~230 | Fewer options |

| User Interface | Beginner-friendly | User-friendly with more tools |

| Mobile App | Yes | Yes |

| Advanced Trading Tools | Limited on basic platform | More integrated options |

Coinbase Pro provides advanced trading features for experienced users, including detailed charts and more order types. Bitpanda integrates these advanced features more directly into its main platform.

Trading fees differ significantly between the two platforms. Coinbase charges around 0.90% per transaction on average, while Bitpanda’s fees are typically higher at approximately 1.49%.

Both platforms offer instant purchases using credit/debit cards, but Coinbase has wider payment method support in most regions. Bitpanda, however, may offer more competitive rates for European users.

The verification process is streamlined on both platforms, but some users report faster approval times with Coinbase.

Bitpanda vs Coinbase: Liquidation Mechanism

When you trade on margin or use leveraged products, understanding the liquidation mechanism is crucial. Both Bitpanda and Coinbase have systems in place to manage risk when your positions fall below required margins.

Coinbase uses a tiered liquidation process. If your position falls below maintenance margin requirements, you’ll receive a margin call notification first. You then have time to add funds before automatic liquidation begins.

Bitpanda’s liquidation process is generally more straightforward. They monitor positions continuously and may liquidate when your margin falls below the required threshold, often with less warning time than Coinbase.

Key differences in liquidation approaches:

| Feature | Coinbase | Bitpanda |

|---|---|---|

| Warning period | Longer warning period | Shorter warning period |

| Liquidation steps | Multi-tiered approach | More direct liquidation |

| Partial liquidation | Available on some assets | Limited availability |

| Liquidation fees | 1-3% depending on asset | Typically 1.5% flat fee |

Both platforms aim to protect themselves from market volatility, but their approaches differ slightly. Coinbase tends to give you more time to react before full liquidation occurs.

You should regularly monitor your positions on either platform to avoid unexpected liquidations. Setting up alerts can help you stay informed about margin levels and potential liquidation risks.

Bitpanda vs Coinbase: Insurance

When choosing a cryptocurrency exchange, security is a top priority. Insurance protection adds an extra layer of safety for your digital assets.

Coinbase offers insurance coverage for digital assets held in their online storage. They maintain a commercial crime policy that protects a portion of digital assets from theft and cybersecurity breaches. For US customers, USD balances are FDIC-insured up to $250,000.

Bitpanda provides insurance coverage as well, but with different terms. They secure digital assets through partnerships with custodial services and maintain insurance against theft and security breaches.

Both platforms store the majority of customer funds in cold storage (offline) to minimize risk of hacking. This practice is considered industry standard for protecting digital assets.

It’s worth noting that insurance policies typically cover incidents like hacking and theft, but may not cover losses due to:

- Personal account compromises

- Phishing attacks

- Unauthorized access through stolen credentials

- Market volatility

When comparing insurance protection, Coinbase may have an advantage for US customers due to the FDIC insurance on fiat deposits. However, both platforms maintain similar security measures for cryptocurrency holdings.

Before choosing either platform, you should review their current insurance policies as coverage terms may change over time.

Bitpanda vs Coinbase: Customer Support

When choosing a cryptocurrency exchange, customer support can make or break your experience. Both Bitpanda and Coinbase offer several support options, but there are key differences worth noting.

Coinbase provides support through email, a help center, and a chatbot. Premium users get access to 24/7 phone support. Response times typically range from a few hours to several days, depending on your account level and query complexity.

Bitpanda offers support via email and a comprehensive help center. They also have a chatbot for quick questions. Unlike Coinbase, Bitpanda doesn’t offer phone support for most users.

Response Times Comparison:

| Platform | Email Response | Live Chat | Phone Support |

|---|---|---|---|

| Coinbase | 1-3 days | Available | Available for premium users |

| Bitpanda | 1-2 days | Available | Not widely available |

Both platforms prioritize tickets based on urgency and account level. If you’re a high-volume trader, you’ll typically receive faster responses.

User feedback suggests that Coinbase’s support quality can be inconsistent during high-volume periods. Bitpanda generally maintains more consistent response times, though their support options are more limited.

For beginners, both platforms offer extensive FAQs and guides to help you navigate common issues. These self-help resources can resolve many questions without needing to contact support directly.

Bitpanda vs Coinbase: Security Features

When choosing a crypto exchange, security should be your top priority. Both Bitpanda and Coinbase offer strong security features to protect your assets.

Coinbase stores most cryptocurrency balances in cold storage, keeping them offline and safe from online threats. They also provide FDIC insurance for USD holdings up to $250,000, giving you extra protection.

Bitpanda also implements cold storage solutions for the majority of user funds. They maintain an offline backup system to ensure your assets remain secure even in worst-case scenarios.

Two-Factor Authentication (2FA) is available on both platforms. This adds an extra layer of security when you log in or make transactions.

Coinbase offers additional security features like:

- Biometric login options

- Device verification

- Address whitelisting for withdrawals

Bitpanda provides:

- API key management

- Session timeout controls

- Regular security audits

Both platforms comply with strict regulatory requirements and implement KYC (Know Your Customer) procedures. This helps prevent fraud and illegal activities.

Coinbase has a longer track record with no major security breaches affecting user funds. Their security team actively monitors for suspicious activities on your account.

Bitpanda’s security systems are regularly updated to address new threats. They use encryption for all sensitive data and transactions.

Remember to always use strong, unique passwords and enable all available security features no matter which platform you choose.

Is Bitpanda Safe & Legal To Use?

Bitpanda is considered safe and legal to use. It operates under regulation from the German Federal Financial Supervisory Authority (BaFin), which adds a layer of trustworthiness to the platform.

The exchange has never experienced a hack, according to search results. This clean security record is important when considering a crypto platform.

Security features include:

- SOC 2 Type 1 certification

- Multi-factor authentication

- Secure password protocols

For users in Austria and Europe, Bitpanda provides a compliant framework that follows regional regulations. This makes it particularly suitable if you have an Austrian bank account.

User reviews generally speak positively about Bitpanda’s security measures. Many consider it one of the better cryptocurrency brokers available, especially for European users.

When comparing safety with Coinbase, both platforms maintain strong security standards. Bitpanda’s European regulatory compliance might make it more appealing if you’re based in Europe.

The platform’s clear legal framework helps protect your investments and personal information. Unlike some crypto exchanges that operate in regulatory gray areas, Bitpanda has established itself as a properly regulated service.

For beginners concerned about safety, Bitpanda’s security features and regulatory compliance make it a solid choice for your first crypto trading experience.

Is Coinbase Safe & Legal To Use?

Coinbase is a legal and regulated cryptocurrency exchange in many countries. It follows financial regulations and has proper licenses to operate. In the United States, Coinbase is registered with FinCEN and complies with state regulations.

The platform prioritizes security with several protective measures. Most user funds (about 98%) are stored in cold storage, away from internet access. This significantly reduces the risk of hacking.

Coinbase offers two-factor authentication (2FA) to secure your account. You can use an authenticator app or SMS verification for an extra layer of protection.

For U.S. customers, Coinbase provides FDIC insurance coverage. This means USD balances are insured up to $250,000 per customer in case of company failure.

The exchange also uses encryption for sensitive data and regularly performs security audits. Their staff undergoes background checks, and they have a bug bounty program to identify vulnerabilities.

Coinbase has a strong track record for security. While no exchange is completely immune to risks, they have avoided major security breaches that affected other platforms.

When using Coinbase, you should still practice good security habits:

- Use a strong, unique password

- Enable all security features

- Consider using a hardware wallet for large amounts

- Be cautious of phishing attempts

Coinbase vs Bitpanda Conclusion: Why Not Use Both?

Both Coinbase and Bitpanda offer valuable services for crypto investors, but they shine in different areas. Using both platforms might give you the best overall experience.

Coinbase offers a larger selection with over 405 cryptocurrencies compared to Bitpanda’s 120+. If you want access to more niche coins, Coinbase has the advantage here.

However, Bitpanda charges lower trading fees (up to 1.49%) than Coinbase. This can save you money on frequent trades. Bitpanda also provides more investment options beyond crypto, including stocks and precious metals.

When it comes to user experience, Coinbase appears to have a smoother interface according to most comparisons. This makes it better for beginners just starting their crypto journey.

Benefits of using both platforms:

- Access more cryptocurrencies through Coinbase

- Enjoy lower fees on Bitpanda for regular trading

- Diversify investments with Bitpanda’s stocks and metals options

- Use Coinbase’s simpler interface for learning

You might consider starting with Coinbase if you’re new to crypto, then adding Bitpanda as you gain experience and want to diversify. Alternatively, you could use Bitpanda for regular trading and Coinbase for accessing specific coins not available elsewhere.

Your specific needs will determine which platform works better for you—or if using both makes the most sense.

Frequently Asked Questions

Customers have specific concerns when choosing between Bitpanda and Coinbase for their cryptocurrency needs. These exchanges differ in important ways that affect trading costs, available assets, security protocols, and user experience.

What are the differences in security measures between Bitpanda and Coinbase?

Both platforms prioritize security but implement different measures. Coinbase stores 98% of customer funds in offline cold storage and offers two-factor authentication for account access.

Bitpanda utilizes multi-signature technology and also implements cold storage solutions. They provide biometric authentication options in their mobile app for added security.

Coinbase has the advantage of being a publicly-traded company, which means additional regulatory oversight. Bitpanda, while regulated in Europe, doesn’t have the same level of public scrutiny.

Which platform offers more diverse cryptocurrency investment options, Bitpanda or Coinbase?

Coinbase supports over 200 cryptocurrencies for trading, including major coins like Bitcoin, Ethereum, and many altcoins. They regularly add new assets after careful review.

Bitpanda offers more than 1,000 digital assets, including cryptocurrencies, stocks, ETFs, and even precious metals like gold. This makes it more of an all-in-one investment platform rather than just a crypto exchange.

For European users interested in diversification beyond crypto, Bitpanda provides more variety in a single platform.

How do the customer support experiences compare between Bitpanda and Coinbase users?

Coinbase offers email support, a help center, and phone support for urgent issues. However, during high volume periods, response times can be slow, which has led to some customer frustration.

Bitpanda provides support through email, chat, and their help center. They focus primarily on European customers, which can mean more personalized support for users in that region.

User reviews suggest Bitpanda often has faster response times, though Coinbase has made improvements to their support system in recent years.

What is the fee structure for trading on Bitpanda versus Coinbase?

Bitpanda typically charges lower trading fees at around 1.49% per transaction. They also offer a Pro version with even lower fees for more active traders.

Coinbase has higher fees that can reach up to 3.99% for certain transactions. Their base platform is known for being more expensive than Coinbase Pro (now Advanced Trade).

Both platforms charge additional fees for deposits and withdrawals, with the exact amounts varying based on payment method and location.

Which exchange provides a more user-friendly interface for beginners, Bitpanda or Coinbase?

Coinbase is widely recognized for its intuitive, clean interface designed specifically with beginners in mind. The platform includes educational resources and a simple buying process.

Bitpanda also offers a user-friendly experience but includes more investment options which might feel overwhelming to complete newcomers. Their app is well-designed and straightforward to navigate.

Both platforms offer mobile apps, but Coinbase’s app is often praised for its simplicity and ease of use for first-time crypto buyers.

How do withdrawal times and methods differ when using Bitpanda compared to Coinbase?

Coinbase withdrawals to bank accounts typically take 1-5 business days in the US and Europe. They support ACH transfers, wire transfers, and PayPal in selected regions.

Bitpanda processes SEPA transfers within 1-3 business days for European users. They offer a wider range of withdrawal options for European banking systems compared to Coinbase.

Cryptocurrency withdrawals are processed at different speeds on both platforms depending on network congestion, with Bitcoin transfers typically taking 10-60 minutes on both exchanges.