Choosing the right cryptocurrency exchange is crucial for your trading success. Two popular platforms that often come up in comparison are Bitpanda and Binance. These exchanges offer different features, fee structures, and user experiences that may impact your decision.

Binance generally scores higher overall with an 8.1 rating compared to Bitpanda, offering lower fees and more trading options. However, Bitpanda may have advantages in terms of regulation within the European Union, as it’s an EU-based platform. This makes it potentially more compliant with European laws.

When deciding between these two exchanges, you should consider what matters most to you. Binance excels in advanced trading tools and features, while Bitpanda offers simplicity and better fiat currency access. Your trading needs, location, and experience level will all play important roles in determining which platform is the better fit for your cryptocurrency journey.

Bitpanda Vs Binance: At A Glance Comparison

When choosing between Bitpanda and Binance, understanding their key differences will help you make the right choice for your crypto needs.

Binance currently holds a higher overall score of 8.1 compared to Bitpanda based on recent evaluations. This reflects its broader market position and feature set.

Trading Fees:

- Binance: Lower trading fees overall

- Bitpanda: Generally higher fees but offers a more simplified fee structure

Available Cryptocurrencies:

| Exchange | Crypto Selection |

|---|---|

| Binance | Extensive (500+) |

| Bitpanda | More limited selection |

User Experience:

Bitpanda offers a more beginner-friendly interface that’s easy to navigate. Binance provides a comprehensive platform with advanced trading tools, which may be overwhelming for new users.

Security Features:

Both exchanges implement strong security measures. Binance has faced some regulatory challenges in certain countries, while Bitpanda is fully regulated in the EU.

Additional Services:

Binance excels with its wide range of features including staking, lending, and futures trading. Bitpanda offers a more streamlined approach with some unique products like Bitpanda Stocks.

You’ll find Binance better suited for experienced traders looking for low fees and extensive features. Bitpanda works well if you value a simpler interface and stronger European regulatory compliance.

Bitpanda Vs Binance: Trading Markets, Products & Leverage Offered

When comparing Binance and Bitpanda’s trading options, Binance clearly offers a more extensive range of markets and products. Binance supports more cryptocurrencies and trading pairs than Bitpanda.

Both platforms allow you to trade popular assets like Bitcoin and Ethereum. However, Binance provides access to hundreds of altcoins and unique tokens that you won’t find on Bitpanda.

Trading Products Comparison:

| Feature | Binance | Bitpanda |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | Limited |

| Options | ✓ | ✗ |

| Margin Trading | ✓ | ✗ |

| Token Variety | Extensive | Moderate |

Binance offers more advanced trading products including futures, options, and margin trading with leverage options. This gives you more flexibility if you’re an experienced trader looking to use advanced strategies.

Bitpanda has a more simplified approach focused on easy cryptocurrency purchases and investments. It’s better suited for beginners or those looking for straightforward trading without complex features.

For leverage trading, Binance is the clear winner. You can access up to 125x leverage on certain futures contracts, while Bitpanda offers limited leverage options.

If you need a wide variety of trading pairs and advanced trading products, Binance provides more comprehensive offerings. Bitpanda may be sufficient if you only need access to major cryptocurrencies with simpler trading options.

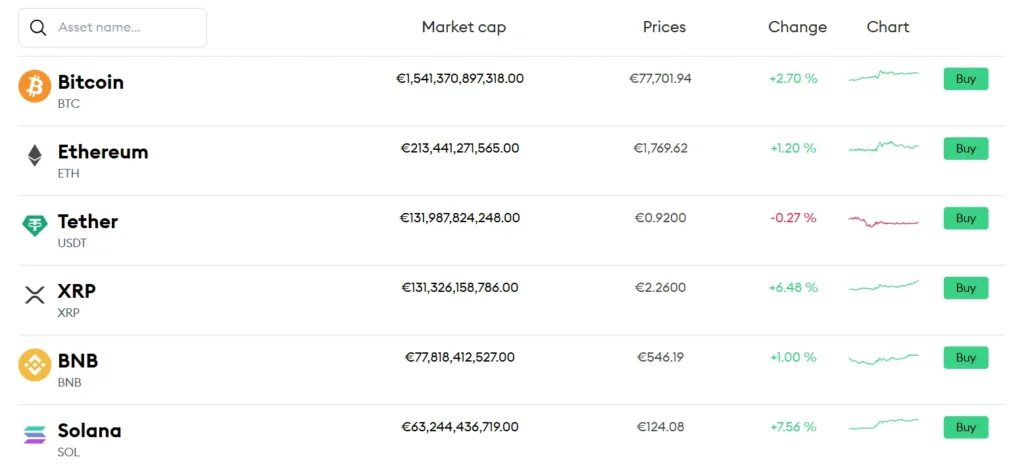

Bitpanda Vs Binance: Supported Cryptocurrencies

When choosing a crypto exchange, the variety of available cryptocurrencies is a key factor to consider. Binance US and Bitpanda offer different selections that might influence your decision.

Binance US clearly leads in cryptocurrency variety. The platform supports a significantly higher number of cryptocurrencies compared to Bitpanda. This makes Binance an excellent choice if you’re looking to diversify your crypto portfolio beyond the mainstream options.

Bitpanda offers a more limited selection but covers all major cryptocurrencies that most traders typically need. Their curated approach focuses on established coins rather than newer, more speculative assets.

Cryptocurrency Support Comparison:

| Feature | Binance US | Bitpanda |

|---|---|---|

| Number of cryptocurrencies | Higher | Lower |

| Major coins (Bitcoin, Ethereum, etc.) | ✓ | ✓ |

| Altcoin variety | Extensive | Limited |

| New/emerging cryptocurrencies | More available | Fewer options |

If you want access to niche altcoins and newer tokens, Binance will likely meet your needs better. Their expansive selection gives you more trading opportunities and exposure to emerging projects.

For investors focused mainly on established cryptocurrencies, Bitpanda’s more selective approach might be sufficient. You’ll find all the major coins without being overwhelmed by too many choices.

Bitpanda Vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitpanda and Binance, fees play a crucial role in your decision. Let’s look at how these platforms compare in terms of costs.

Trading Fees

Bitpanda has higher trading fees compared to Binance. On Bitpanda Pro, fees start at 0.1% for makers and 0.15% for takers in their tiered structure. The standard Bitpanda platform charges up to 1.49% per trade.

Binance typically offers lower trading fees, making it more cost-effective for frequent traders.

Withdrawal Fees

Binance usually charges lower cryptocurrency withdrawal fees than Bitpanda. However, Bitpanda stands out by offering free fiat withdrawals, which can save you money when converting back to traditional currency.

Deposit Fees

Both platforms have competitive deposit fees, but specific rates vary by payment method and currency.

Here’s a quick comparison:

| Fee Type | Bitpanda | Binance |

|---|---|---|

| Trading | Higher (Up to 1.49%) | Lower |

| Crypto Withdrawal | Higher | Lower |

| Fiat Withdrawal | Free | Varies |

Your trading volume and preferred currency for deposits/withdrawals will determine which platform offers better value for your needs.

Remember that fee structures may change over time, so checking the latest information on both platforms before making your decision is worthwhile.

Bitpanda Vs Binance: Order Types

When trading cryptocurrencies, the types of orders available can greatly impact your strategy. Binance and Bitpanda offer different options to meet various trading needs.

Binance Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

- Trailing stop orders

- Post-only orders

Binance provides a comprehensive range of advanced order types. This makes it suitable for both beginners and experienced traders who want more control over their trades.

Bitpanda Order Types:

- Market orders

- Limit orders

- Stop-limit orders

Bitpanda offers fewer order types compared to Binance. However, the platform includes the most essential order types that will satisfy most basic to intermediate trading strategies.

If you’re interested in complex trading strategies, Binance’s variety of order types gives you more flexibility. The OCO and trailing stop features are particularly useful for managing risk in volatile markets.

For beginner traders, Bitpanda’s simpler selection might actually be beneficial. You won’t feel overwhelmed by too many options while learning the basics of cryptocurrency trading.

Both platforms allow you to set price limits and stop losses, which are crucial tools for managing risk. Your choice should depend on how complex your trading strategy is and your experience level.

Bitpanda Vs Binance: KYC Requirements & KYC Limits

Both Bitpanda and Binance require users to complete Know Your Customer (KYC) verification to prevent fraud and money laundering. These verification procedures differ in their complexity and limits.

Bitpanda KYC Process:

- Requires identity verification for all users

- Typically needs government ID, proof of address, and selfie

- Verification must be completed before trading

Bitpanda enforces strict KYC compliance in line with European regulations. You cannot access full platform features without completing verification.

Binance KYC Process:

- Uses a tiered verification system

- Level 1: Basic info (name, email, phone number)

- Level 2: Government ID and facial verification

- Level 3: Advanced verification for higher limits

With Binance, your withdrawal limits increase as you complete higher KYC levels. Unverified accounts have very restrictive limits.

Trading Limits Comparison:

| Platform | Unverified | Basic Verification | Full Verification |

|---|---|---|---|

| Bitpanda | Not allowed | Limited trading | Up to €2,500,000/month |

| Binance | Up to 2 BTC/day | Up to 100 BTC/day | Higher limits available |

Verification processing time varies between platforms. Bitpanda typically completes verification within 24 hours, while Binance may take 1-3 business days during high demand periods.

Remember that KYC requirements may change based on your country of residence and current regulations.

Bitpanda Vs Binance: Deposits & Withdrawal Options

Both Bitpanda and Binance offer multiple ways to fund your account and withdraw your funds. Understanding these options can help you choose the platform that best fits your needs.

Deposit Methods

Bitpanda provides several deposit options for European users. You can use SEPA bank transfers, credit cards, and various payment services like Sofort and Giropay.

Binance offers more global payment options. These include bank transfers, credit/debit cards, and P2P trading. Binance also supports deposits through numerous third-party payment providers.

Withdrawal Methods

| Platform | Crypto Withdrawals | Fiat Withdrawals | Special Features |

|---|---|---|---|

| Bitpanda | Multiple cryptocurrencies | Free SEPA transfers | Instant withdrawals |

| Binance | Wide range of tokens | Bank transfers, cards | Lower crypto fees |

Bitpanda stands out with its free fiat withdrawals through SEPA transfers. This can save you money if you frequently move funds back to your bank account.

Binance typically has lower cryptocurrency withdrawal fees. This makes it more cost-effective if you mainly withdraw crypto to external wallets.

Processing Times

On Bitpanda, SEPA transfers usually take 1-3 business days. Crypto withdrawals are processed quickly, often within minutes.

Binance processing times vary by method. Crypto withdrawals are typically fast, while fiat withdrawals can take 1-5 business days depending on your region and bank.

Both platforms require identity verification before you can access all deposit and withdrawal features.

Bitpanda Vs Binance: Trading & Platform Experience Comparison

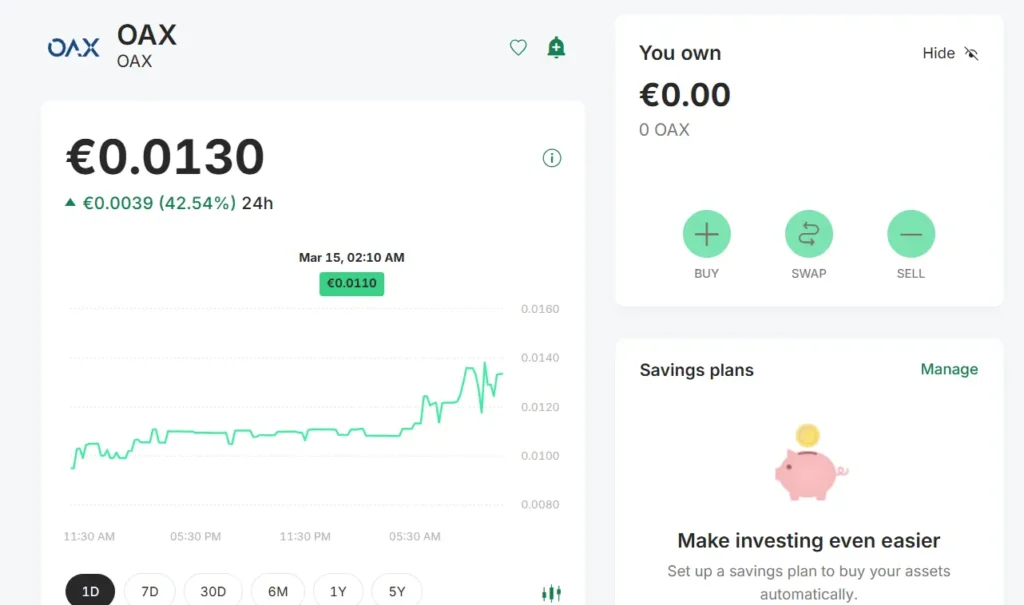

When choosing between Bitpanda and Binance, the trading experience differs significantly. Both platforms offer user-friendly interfaces, but they cater to different types of traders.

Binance provides a more comprehensive trading experience with advanced charting tools and numerous order types. You can access features like futures trading, margin trading, and staking on one platform. The interface might feel overwhelming for beginners, but it offers everything experienced traders need.

Bitpanda focuses on simplicity and ease of use. Its clean interface makes buying and selling cryptocurrencies straightforward, which is perfect if you’re new to crypto trading. The platform also offers a unique feature called Bitpanda Swap that lets you exchange one asset for another directly.

| Feature | Binance | Bitpanda |

|---|---|---|

| Trading interface | Complex, feature-rich | Simple, beginner-friendly |

| Mobile app | Highly rated, full-featured | Clean design, basic functions |

| Available assets | 350+ cryptocurrencies | 200+ cryptocurrencies, plus stocks and metals |

| Order types | Numerous advanced options | Basic buy/sell options |

Binance offers lower trading fees starting at 0.1% for makers, while Bitpanda charges around 1.49% for buying and selling cryptocurrencies.

You’ll find Binance more suitable if you’re looking for advanced trading features and lower fees. However, if you prefer a simpler platform with a focus on user experience, Bitpanda might be the better choice for you.

Bitpanda Vs Binance: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for your risk management. Both Bitpanda and Binance have systems in place to protect themselves when markets move against leveraged positions.

Binance uses a tiered liquidation process that starts with warnings when your margin ratio approaches dangerous levels. The platform begins partial liquidation at specific thresholds rather than closing your entire position at once.

Bitpanda’s liquidation mechanism is generally more straightforward. It typically closes positions when they reach predetermined margin thresholds, offering less granularity than Binance’s tiered approach.

On Binance, you’ll find a real-time liquidation calculator that helps you anticipate potential liquidation prices based on your position size and leverage. This tool is invaluable for planning your risk tolerance.

Binance also implements an “Insurance Fund” to handle liquidations during extreme volatility. This fund acts as a buffer to prevent socialized losses across user accounts.

Bitpanda doesn’t offer the same comprehensive liquidation tools or insurance mechanisms as Binance. Your positions might be liquidated with less warning on Bitpanda compared to Binance.

For high-leverage trading, Binance provides more sophisticated liquidation protection features. You can set stop-losses and take-profits to automatically exit positions before liquidation occurs.

Remember to regularly monitor your margin levels on either platform to avoid unexpected liquidations during volatile market conditions.

Bitpanda Vs Binance: Insurance

When comparing Binance and Bitpanda, understanding their insurance policies is crucial for your funds’ protection. Both platforms have different approaches to safeguarding user assets.

Binance offers the Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund. This fund holds 10% of all trading fees and can be used to cover losses in case of security breaches or hacks.

Bitpanda, on the other hand, doesn’t have a dedicated insurance fund like SAFU. However, they do keep client funds in cold storage and separate from company operational funds for added security.

Insurance Coverage Comparison:

| Platform | Dedicated Insurance Fund | Cold Storage | Fund Segregation |

|---|---|---|---|

| Binance | Yes (SAFU) | Yes | Yes |

| Bitpanda | No | Yes | Yes |

It’s worth noting that neither platform offers full insurance coverage like traditional banks. Your crypto assets are not protected by government-backed insurance such as FDIC in the US or similar programs in other countries.

For maximum protection, you should consider:

- Enabling all security features on your chosen platform

- Using hardware wallets for large holdings

- Diversifying where you store your assets

- Regularly monitoring your accounts for suspicious activity

The insurance aspect should be one factor in your decision between these exchanges, alongside fees, available cryptocurrencies, and user experience.

Bitpanda Vs Binance: Customer Support

When choosing between Bitpanda and Binance, customer support is a key factor to consider. Both platforms offer several ways to get help, but they differ in response times and support options.

Binance provides 24/7 customer support through live chat, email, and a ticket system. You can usually get a response within hours, though complex issues might take longer. Their help center is extensive with detailed guides and FAQs.

Bitpanda offers support through email and a ticket system, but lacks the 24/7 live chat option. Response times generally range from a few hours to 1-2 days. Their help center is well-organized but less comprehensive than Binance’s.

Support Options Comparison:

| Feature | Binance | Bitpanda |

|---|---|---|

| Live Chat | ✅ (24/7) | ❌ |

| Email Support | ✅ | ✅ |

| Ticket System | ✅ | ✅ |

| Help Center | Extensive | Good |

| Response Time | Hours | Hours to days |

Binance has a larger user base, which can sometimes lead to delays during high-volume periods. However, their multilingual support team handles a wider range of languages than Bitpanda.

Bitpanda’s support team has received positive feedback for being more personalized and thorough in their responses. They excel particularly in helping European users with regional compliance questions.

Consider your specific needs when choosing. If immediate assistance is important, Binance’s live chat might be better for you. If you prefer quality over speed, Bitpanda’s more personalized approach could be a good fit.

Bitpanda Vs Binance: Security Features

Both Bitpanda and Binance place a strong emphasis on security, but they implement different features to protect user assets.

Bitpanda offers two-factor authentication (2FA) to add an extra layer of security to your account. They also use cold storage for the majority of user funds, keeping them offline and safe from potential hackers.

Binance strengthens its security with the Secure Asset Fund for Users (SAFU). This emergency fund helps protect users in case of security breaches. Binance holds 10% of all trading fees in this fund as insurance.

Both platforms require identity verification to comply with regulations. This KYC (Know Your Customer) process helps prevent fraud and money laundering.

Bitpanda is regulated in Europe and follows strict European financial regulations. This gives European users an added layer of regulatory protection.

Binance has a more global presence but has faced regulatory challenges in some countries. They’ve worked to improve compliance in recent years.

Binance offers additional security features like:

- Anti-phishing codes

- Device management

- Address whitelisting

- Withdrawal address management

Bitpanda’s security strengths include:

- EU regulation compliance

- PSD2-compliant login

- Biometric authentication options

- Regular security audits

You should always enable all available security features on whichever platform you choose. This includes using a strong password and activating 2FA immediately after creating your account.

Is Bitpanda A Safe & Legal To Use?

Bitpanda operates as a regulated cryptocurrency platform in Europe, giving you peace of mind when trading. Unlike some crypto exchanges that operate without clear legal frameworks, Bitpanda provides a secure environment for users.

The platform is compliant with European regulations, which adds an extra layer of security for your investments. This compliance means Bitpanda follows strict protocols for handling your funds and personal information.

Safety Features:

- Regulated operation

- Secure framework for transactions

- Compliance with European financial laws

- User protection measures

Bitpanda’s regulatory status makes it a safer choice compared to unregulated exchanges. When you use Bitpanda, you’re trading on a platform that meets established financial standards.

For Austrian bank account holders specifically, Bitpanda offers a compatible and secure trading environment. The platform’s legal status in Europe makes it appropriate for users concerned about regulatory compliance.

While Bitpanda has strong safety credentials, it’s always wise to use standard security practices. Enable two-factor authentication and be cautious with your login details regardless of the platform’s security measures.

Is Binance A Safe & Legal To Use?

Binance is generally considered a safe cryptocurrency exchange. It stores most user funds in “cold wallets” that aren’t connected to the internet, which provides strong protection against hacking.

Safety features on Binance include two-factor authentication (2FA), advanced encryption, and anti-phishing measures. These help protect your account from unauthorized access.

However, like any exchange, Binance isn’t without risks. The platform has faced regulatory challenges in several countries. Always check if Binance is legally permitted to operate in your location before using it.

For US residents, Binance.US is available as a separate platform. It offers fewer cryptocurrencies and different fee structures than the global Binance.com site, but it follows US regulations.

Security tips when using Binance:

- Enable all security features (2FA, withdrawal whitelist)

- Use a unique, strong password

- Be cautious of phishing attempts

- Consider moving large holdings to a personal wallet

Many crypto experts advise against leaving large amounts on any exchange for extended periods. If you plan to hold $5,000 or more for a long time, consider transferring to a hardware wallet.

Binance requires identity verification (KYC) for most of its services, which helps prevent fraud but also means sharing personal information with the company.

Frequently Asked Questions

Choosing between cryptocurrency exchanges requires understanding key differences in costs, features, and security. These questions address the most common concerns when comparing Bitpanda and Binance.

What are the main differences in the fee structures between Bitpanda and Binance?

Binance offers lower trading fees than Bitpanda. Binance typically charges between 0.1% and 0.5% per trade, while Bitpanda’s fees range from 0.5% to 1.49%.

You can reduce Binance fees further by using their native BNB token. Bitpanda’s fee structure is simpler but generally more expensive.

Deposit and withdrawal costs also differ. Binance provides more free deposit options while Bitpanda charges for certain deposit methods.

How do the trading platform features of Bitpanda compare to those of Binance?

Binance offers a more comprehensive trading platform with advanced charting tools, futures trading, and multiple order types. This suits experienced traders who need detailed analysis features.

Bitpanda provides a cleaner, more user-friendly interface that beginners find easier to navigate. Their simple buy/sell process makes it accessible for newcomers.

Binance’s mobile app includes nearly all desktop features, while Bitpanda’s app focuses on core functions with a streamlined experience.

Which exchange offers better security, Bitpanda or Binance?

Both exchanges implement strong security measures including two-factor authentication and cold storage for funds. Bitpanda operates under EU regulations, providing clear compliance with European financial laws.

Binance has faced regulatory challenges in some countries but maintains a strong security record. They offer additional security features like anti-phishing codes and withdrawal address management.

Bitpanda may appeal more to security-conscious European users due to its regulatory clarity and EU-based operations.

Can users expect higher liquidity on Binance or Bitpanda?

Binance provides significantly higher liquidity than Bitpanda. With daily trading volumes often exceeding billions of dollars, Binance offers tighter spreads and less price slippage.

This makes Binance better for large trades and active traders who need immediate execution at stable prices. Bitpanda’s lower trading volume means you might face wider spreads on some cryptocurrency pairs.

For popular coins like Bitcoin and Ethereum, both exchanges offer reasonable liquidity, but Binance’s advantage becomes more apparent with less common cryptocurrencies.

What are the customer support experiences like on Bitpanda versus Binance?

Bitpanda generally receives better reviews for customer support with faster response times and more personalized assistance. Their EU-based support team offers help in multiple European languages.

Binance handles a much larger user base, which can lead to longer wait times for support responses. They rely heavily on automated support systems and knowledge bases.

During high-volume trading periods, both platforms may experience delays in support response, but Bitpanda typically maintains more consistent service levels.

How do the cryptocurrency asset offerings differ between Bitpanda and Binance?

Binance lists significantly more cryptocurrencies than Bitpanda. You can trade hundreds of different tokens on Binance compared to about 100+ on Bitpanda.

Bitpanda focuses on established cryptocurrencies and adds new listings more cautiously. This approach may reduce risk for newer investors but limits access to emerging projects.

Binance regularly adds new tokens shortly after they launch, giving you earlier access to potential opportunities. They also offer more trading pairs, allowing direct exchanges between various cryptocurrencies.

Binance Vs Bitpanda Conclusion: Why Not Use Both?

When choosing between Binance and Bitpanda, you don’t necessarily have to pick just one. Both platforms have strengths that can complement each other in your crypto journey.

Binance offers lower fees and a wider variety of cryptocurrencies. It also provides more advanced trading tools for experienced users. Many users find its interface smooth and user-friendly.

Bitpanda, on the other hand, excels in simplicity and regulatory compliance within the EU. It’s a great option if you value ease of use and strong legal standing in European markets.

Here’s a quick comparison of key features:

| Feature | Binance | Bitpanda |

|---|---|---|

| Fees | Lower | Higher |

| Crypto Options | More extensive | More limited |

| User Experience | Smooth but complex | Simple, beginner-friendly |

| Regulation | Varies by region | Strong EU compliance |

You might consider using Binance for its lower fees when trading larger amounts or accessing unique cryptocurrencies. Meanwhile, Bitpanda could be your go-to for simpler trades or when regulatory compliance is your priority.

Your trading habits and goals should guide your choice. If you’re new to crypto, you might start with Bitpanda and gradually explore Binance as you gain confidence.

Remember that the crypto market changes quickly. What works best for you today might change as both platforms update their features and as regulations evolve.