Choosing the right cryptocurrency exchange can make a big difference in your trading experience. When comparing Bitmart and WhiteBIT, two popular exchanges in 2025, several factors stand out that could impact your decision.

WhiteBIT offers lower fees than BitMart, making it potentially more cost-effective for frequent traders. Both platforms provide full exchange services and support a wide variety of cryptocurrencies, giving you multiple options for your trading activities.

Each exchange has its own strengths. WhiteBIT is known for excellent interest rates when you lock up coins for longer periods (up to 360 days), while BitMart has built a reputation for its user-friendly interface. Understanding these differences can help you select the platform that best aligns with your trading needs and preferences.

Bitmart vs WhiteBIT: At A Glance Comparison

When choosing between Bitmart and WhiteBIT, understanding their key differences helps you make an informed decision about which crypto exchange better fits your needs.

Fee Structure

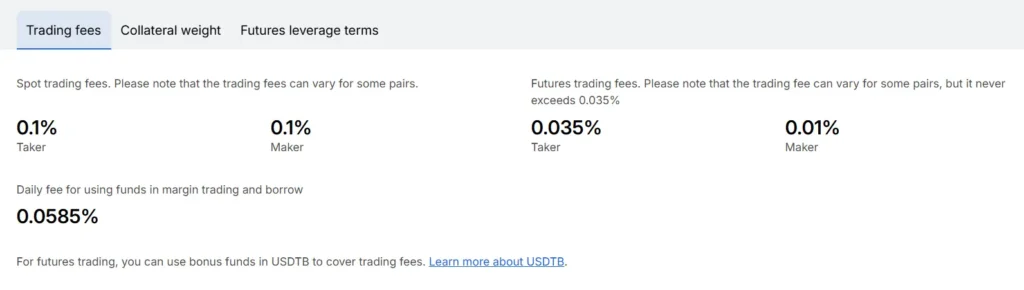

WhiteBIT offers a lower fee structure compared to BitMart. This can make a significant difference if you trade frequently.

Supported Cryptocurrencies

Both exchanges support a variety of coins, but WhiteBIT is noted for its wide selection of supported cryptocurrencies.

Exchange Features Comparison:

| Feature | BitMart | WhiteBIT |

|---|---|---|

| Fee Structure | Higher | Lower |

| Interest Rates | Standard | Great rates for most coins with 360-day lockup |

| Trading Types | Basic options | Full exchange services |

BitMart Pros:

- Easy to use platform

- Established presence in the market

BitMart Cons:

- Higher fees than some competitors

- Limited interest rate options

WhiteBIT Pros:

- Lower fees

- Excellent interest rates with lockup periods

- Full exchange services

- Wide variety of supported coins

WhiteBIT Cons:

- May require more technical knowledge

You’ll find WhiteBIT particularly advantageous if you’re planning to hold coins for longer periods, as they offer competitive rates for 360-day lockups.

BitMart might work better for you if you prefer a more straightforward interface and don’t mind the higher fee structure.

Bitmart vs WhiteBIT: Trading Markets, Products & Leverage Offered

Both BitMart and WhiteBIT offer a variety of trading options and markets, but they differ in several key aspects.

Available Markets

- BitMart supports over 1,000 trading pairs across spot and futures markets

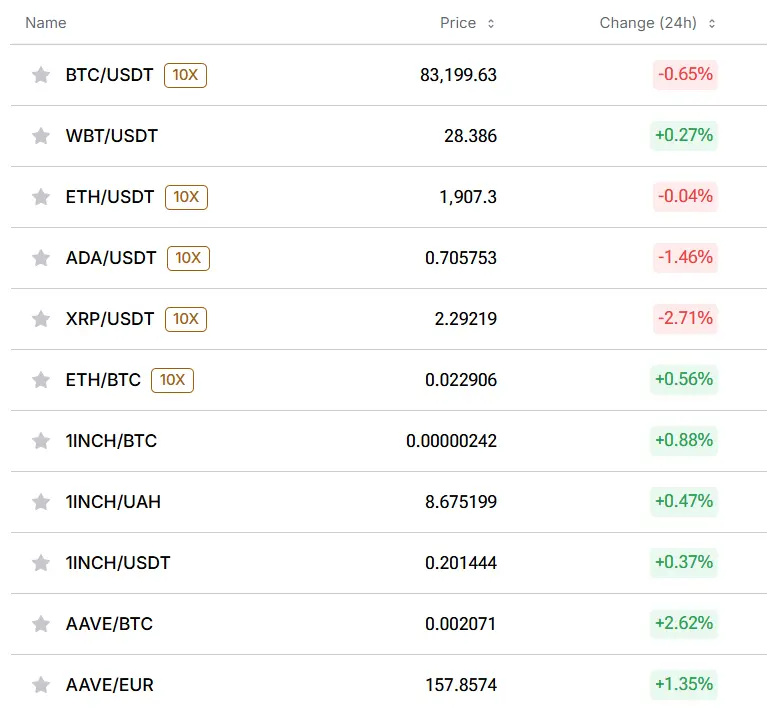

- WhiteBIT offers spot trading with several hundred trading pairs

- Both exchanges list major cryptocurrencies like Bitcoin and Ethereum

Trading Products

| Feature | BitMart | WhiteBIT |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures Trading | Yes | Yes |

| Margin Trading | Yes | Yes |

| Options | Limited | No |

| Copy Trading | No | Yes |

Leverage Options

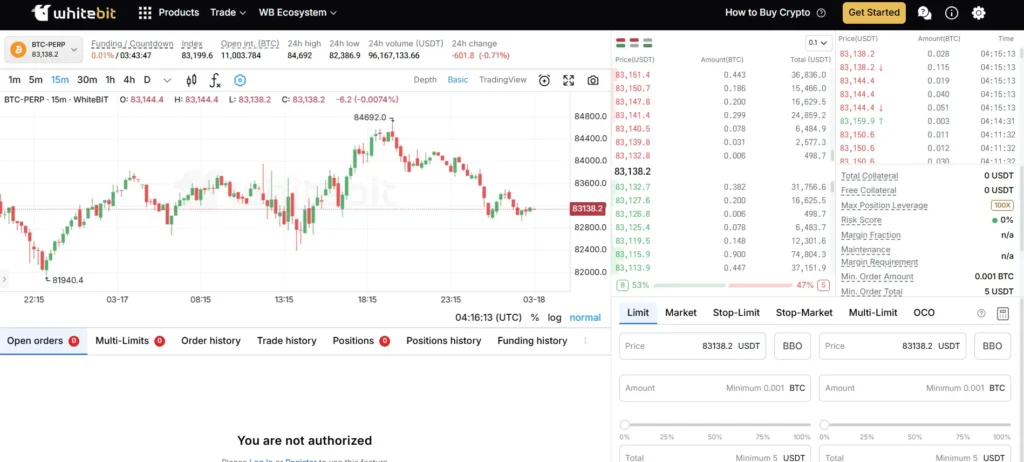

BitMart provides leverage of up to 100x on select futures markets. This gives you more trading power but comes with higher risk.

WhiteBIT offers leverage trading up to 20x on certain pairs. While lower than BitMart, this still provides significant trading potential with slightly reduced risk.

Additional Features

BitMart includes an “Earn” section where you can stake cryptocurrencies for passive income. They also offer launchpad opportunities for new token sales.

WhiteBIT provides staking options and a P2P marketplace. Their trading interface is considered more user-friendly by many traders.

When choosing between these exchanges, consider which trading pairs are most important to you. BitMart generally offers more pairs but WhiteBIT may provide better liquidity for specific cryptocurrencies you want to trade.

Bitmart vs WhiteBIT: Supported Cryptocurrencies

When choosing between Bitmart and WhiteBIT, the range of supported cryptocurrencies is an important factor to consider.

BitMart offers an impressive selection with support for over 1,400 cryptocurrencies. This extensive range gives you access to both established coins and emerging tokens.

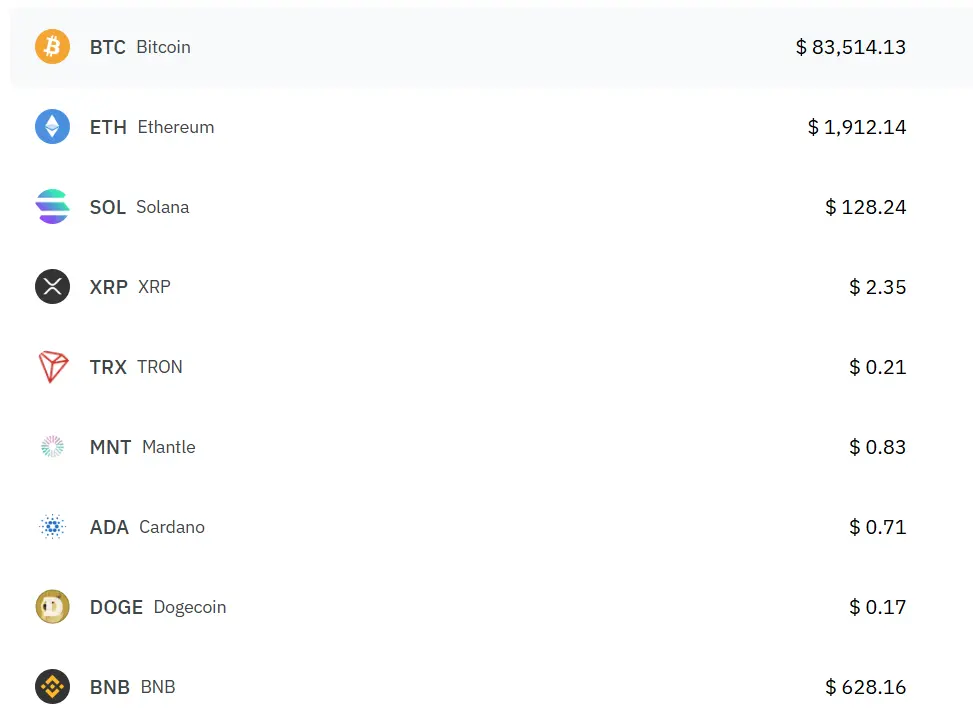

WhiteBIT focuses on supporting all major cryptocurrencies including Bitcoin, Ethereum, Chainlink, Ripple, DAI, DOGE, Monero, and Polkadot. While its selection may not be as vast as BitMart’s, it covers the most important digital assets.

Here’s a quick comparison of their cryptocurrency support:

| Exchange | Number of Cryptocurrencies | Notable Supported Coins |

|---|---|---|

| BitMart | 1,400+ | Bitcoin, Ethereum, and many altcoins |

| WhiteBIT | Major cryptocurrencies | Bitcoin, Ethereum, Chainlink, Ripple, DOGE, Monero, Polkadot |

Both exchanges give you access to the most popular cryptocurrencies, but BitMart might be better if you’re looking to trade lesser-known altcoins or newer tokens.

Your choice between these platforms may depend on whether you prefer more variety (BitMart) or if you mainly trade established cryptocurrencies (WhiteBIT).

Before creating an account, you might want to check if your preferred coins are available on either platform, especially if you plan to trade specific altcoins.

Bitmart vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitmart and WhiteBIT, understanding their fee structures is crucial for your trading strategy. Both exchanges have different approaches to trading, deposit, and withdrawal fees.

WhiteBIT generally offers a lower overall fee structure compared to BitMart. This can make a significant difference if you’re an active trader or planning to move funds frequently.

For trading fees, WhiteBIT’s rates are more competitive than BitMart’s. This means you’ll keep more of your profits when executing trades on WhiteBIT.

Withdrawal Fees:

- WhiteBIT charges 1.5% for withdrawing EUR and USD via Advcash

- WhiteBIT charges 4.5% for UAH withdrawals through Advcash

- BitMart’s withdrawal fees vary by cryptocurrency but are typically higher

Both platforms offer various deposit methods, but they differ in supported options and associated fees. You should check the specific cryptocurrencies you plan to trade, as support varies between the two exchanges.

When comparing fiat currency options, WhiteBIT provides more detailed information about their fee structure. This transparency can help you better plan your trading activities.

Your trading volume and preferred currencies will ultimately determine which platform offers the better value. Higher volume traders might benefit more from WhiteBIT’s lower fee structure, while occasional traders might find other factors more important.

Bitmart vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, the types of orders available can significantly impact your trading strategy. Both BitMart and WhiteBIT offer a variety of order types, but there are some notable differences.

WhiteBIT provides 6 main order types:

- Market orders

- Limit orders

- Multi-Limit orders

- Stop-Limit orders

- Stop-Market orders

- OCO (One Cancels Other) orders

WhiteBIT also offers Trailing Stop orders, which automatically adjust your stop price as the market moves in your favor. This feature helps maximize profits without constant monitoring.

BitMart supports:

- Market orders

- Limit orders

- Stop-Limit orders

- OCO orders

The Multi-Limit feature on WhiteBIT is particularly useful as it allows you to place multiple limit orders simultaneously. This saves time when implementing complex trading strategies.

Both platforms support the essential order types most traders need. However, WhiteBIT offers more advanced options that might appeal to experienced traders.

When choosing between these exchanges, consider which order types are most important for your trading style. If you’re a beginner, the basic order types on BitMart may be sufficient.

For active traders who use technical analysis, WhiteBIT’s more comprehensive selection of order types provides greater flexibility and potential for profit optimization.

Bitmart vs WhiteBIT: KYC Requirements & KYC Limits

Both BitMart and WhiteBIT implement KYC (Know Your Customer) procedures, but they differ in their approach and withdrawal limits.

WhiteBIT KYC Requirements:

- Mandatory KYC for users who signed up after September 21, 2022

- Optional verification for accounts created before this date

- Complies with both KYC and AML (Anti-Money Laundering) regulations

WhiteBIT prioritizes security through their verification process. This helps protect users and ensures the platform meets regulatory standards.

BitMart KYC Requirements:

- KYC verification is optional but recommended

- Verified accounts receive higher withdrawal limits

- Basic accounts can still use the platform with restrictions

Withdrawal Limits Comparison:

| Exchange | Unverified Limits | Verified Limits |

|---|---|---|

| WhiteBIT | Lower limits | Up to 20 BTC daily for verified users |

| BitMart | Basic withdrawal | Significantly higher limits after verification |

When you complete KYC on either platform, you’ll need to provide identification documents. This typically includes government-issued ID and proof of address.

The verification process helps both exchanges prevent fraud and comply with international regulations. If you plan to trade significant amounts, completing KYC on either platform is advisable.

Your choice between these exchanges might depend on how comfortable you are with providing personal information versus your desired withdrawal amounts.

Bitmart vs WhiteBIT: Deposits & Withdrawal Options

When choosing between Bitmart and WhiteBIT, understanding their deposit and withdrawal options is crucial for your trading experience.

BitMart supports multiple deposit methods including cryptocurrency transfers and some fiat options. You can deposit via bank transfers and credit/debit cards on BitMart, though availability varies by region.

WhiteBIT offers similar cryptocurrency deposit options but has expanded its fiat deposit methods in 2025. Their platform now supports bank transfers, credit/debit cards, and some regional payment systems.

For withdrawal options, both exchanges allow crypto withdrawals to external wallets. BitMart users can withdraw to bank accounts in supported regions, while WhiteBIT offers wider fiat withdrawal coverage.

Fee comparison:

| Exchange | Crypto Withdrawal Fees | Fiat Withdrawal Fees |

|---|---|---|

| BitMart | Varies by coin | 1-3% + fixed fee |

| WhiteBIT | Generally lower | 0.5-2% depending on method |

Processing times differ between the platforms. WhiteBIT typically processes withdrawals faster, with most crypto withdrawals completed within an hour. BitMart can take 1-24 hours depending on network congestion.

Security measures for deposits and withdrawals are robust on both platforms. Each uses two-factor authentication and withdrawal address whitelisting to protect your funds.

Remember to verify the current deposit and withdrawal methods available in your region, as these can change based on regulatory requirements.

Bitmart vs WhiteBIT: Trading & Platform Experience Comparison

When comparing BitMart and WhiteBIT’s trading platforms, you’ll notice several key differences that might influence your choice.

BitMart offers a straightforward interface that beginners can navigate easily. The platform supports spot trading, futures, and has a mobile app for trading on the go.

WhiteBIT provides a more feature-rich environment with advanced trading tools. Their platform includes detailed charting capabilities and a variety of order types that experienced traders might prefer.

Trading Fees Comparison:

| Exchange | Maker Fee | Taker Fee | Trading Pairs |

|---|---|---|---|

| BitMart | 0.25% | 0.25% | 1000+ |

| WhiteBIT | 0.1% | 0.1% | 400+ |

WhiteBIT generally offers lower trading fees, which can be significant for active traders. However, BitMart provides access to more trading pairs.

Both platforms offer mobile apps, but users often report that WhiteBIT’s app is more stable and feature-complete.

For security, WhiteBIT implements stronger measures with 96% of assets stored in cold wallets. BitMart has improved its security following past incidents, but some users still express concerns.

The user interface on WhiteBIT tends to be cleaner and more intuitive. You’ll find it easier to locate trading pairs and execute orders without confusion.

BitMart’s strength lies in its wide variety of lesser-known altcoins, making it attractive if you’re looking to trade emerging cryptocurrencies.

Bitmart vs WhiteBIT: Liquidation Mechanism

When trading on cryptocurrency exchanges like BitMart and WhiteBIT, understanding their liquidation mechanisms is crucial for your financial safety.

Both platforms have systems in place to manage risk when market conditions become volatile. These mechanisms help protect both the exchange and other users from excessive losses.

WhiteBIT’s Liquidation Process

WhiteBIT uses an automated system that monitors your positions continuously. If your collateral falls below required maintenance margins, the system begins liquidation.

You’ll receive notifications before liquidation occurs, giving you a chance to add funds or close positions voluntarily.

BitMart’s Approach

BitMart employs similar liquidation principles but with slightly different parameters. Their system monitors account health and initiates liquidation when certain thresholds are crossed.

Key Differences

| Feature | WhiteBIT | BitMart |

|---|---|---|

| Warning notifications | Yes | Limited |

| Partial liquidation | Available | Limited availability |

| Liquidation fees | Lower | Varies by asset |

Withdrawal Considerations

Based on search results, some users report that WhiteBIT may impose restrictions on withdrawing funds during volatile market conditions. BitMart has similar policies, which can affect how quickly you can move your assets.

Risk Management Tips

- Set stop-loss orders to prevent forced liquidations

- Keep extra funds in your account as a buffer

- Monitor your positions regularly, especially during market volatility

Understanding these mechanisms helps you make informed decisions about which platform better suits your trading style and risk tolerance.

Bitmart vs WhiteBIT: Insurance

When choosing a cryptocurrency exchange, insurance protection is a critical factor to consider. This protection helps shield your assets if the exchange faces security breaches or operational failures.

WhiteBIT offers a dedicated Insurance Fund designed to protect user assets. This fund serves as a safety net in case of extreme market volatility or system issues. The exchange maintains this fund separately from operational accounts.

BitMart has strengthened its insurance measures following a security incident in 2021. They implemented an insurance mechanism to help compensate users in case of future security breaches.

Neither exchange offers the comprehensive insurance coverage you might find with some larger platforms. However, both have taken steps to improve user protection.

WhiteBIT’s insurance system appears more transparent, with clearer information about how the fund operates and what it covers. They publish regular updates about the insurance fund’s status.

BitMart’s insurance details are less prominently featured on their platform. You may need to search through their documentation to find specific information about coverage limits and conditions.

Both exchanges use cold storage solutions as an additional security measure to protect most user funds. This practice keeps the majority of assets offline and away from potential online threats.

When deciding between these exchanges, you should evaluate their insurance offerings alongside other security measures to determine which provides better protection for your specific needs.

Bitmart vs WhiteBIT: Customer Support

When choosing between Bitmart and WhiteBIT, customer support can be a deciding factor. Both exchanges offer support options, but they differ in quality and availability.

Bitmart provides customer service through email tickets and live chat. Many users report slow response times, sometimes waiting days for resolution. Their support team operates 24/7, but language barriers can sometimes cause communication issues.

WhiteBIT offers more comprehensive support options including email, live chat, and an extensive knowledge base. Based on user feedback, WhiteBIT typically responds faster, often within hours rather than days.

Response Time Comparison:

| Exchange | Average Response Time | 24/7 Support |

|---|---|---|

| Bitmart | 24-48 hours | Yes |

| WhiteBIT | 4-12 hours | Yes |

WhiteBIT has earned a stronger reputation for customer service. The search results mention that Coinmetro (not WhiteBIT) has “a really good track record when it comes to customer service,” but user reviews consistently rank WhiteBIT’s support above Bitmart’s.

You’ll find WhiteBIT’s support team more communicative during issues like account lockouts or deposit problems. Their staff appears better trained to handle complex situations.

Both platforms offer multilingual support, though WhiteBIT supports more languages effectively. This can be important if English isn’t your primary language.

Bitmart vs WhiteBIT: Security Features

When choosing a crypto exchange, security should be your top priority. Both BitMart and WhiteBIT offer strong security features, but they differ in several ways.

BitMart protects your assets with two-factor authentication (2FA) and multi-signature wallets. They store most user funds in cold wallets, keeping them offline and safe from hackers. BitMart experienced a major hack in 2021, which led them to strengthen their security measures.

WhiteBIT places a strong emphasis on security compliance. They store 96% of user assets in cold wallets, which is slightly higher than industry average. WhiteBIT has maintained a clean security record with no major breaches reported.

Key Security Features Comparison:

| Feature | BitMart | WhiteBIT |

|---|---|---|

| Cold Storage | Yes (majority of funds) | Yes (96% of funds) |

| Two-Factor Authentication | Yes | Yes |

| Security History | Experienced hack in 2021 | No major breaches |

| Regulatory Compliance | Moderate | Strong |

| Insurance Fund | Limited | Yes |

WhiteBIT uses advanced security protocols including regular security audits and anti-phishing protection. Their platform also includes withdrawal confirmation emails and anti-fraud systems to protect your account.

You should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious of phishing attempts.

Is Bitmart A Safe & Legal To Use?

BitMart operates as a regulated cryptocurrency exchange available in over 180 countries. According to search results, it’s designed with security features for both individual and institutional users.

Some users have reported issues with the platform. On Reddit, there are complaints about difficulties withdrawing funds, with claims that BitMart uses its User Agreement to retain user money without proper accountability.

BitMart is generally considered legal in jurisdictions where cryptocurrency trading is permitted. However, you should always verify its legal status in your specific country before trading.

The platform does implement standard security measures like two-factor authentication. But like all crypto exchanges, it carries platform risks including potential vulnerability to hacking, fraud, or mismanagement.

When comparing BitMart to other platforms like WhiteBIT, both exchanges have their own fee structures and security protocols. Some users find BitMart reliable with reasonable trading fees.

Key safety considerations:

- Enable all security features (2FA, email verification)

- Use strong, unique passwords

- Store large amounts of crypto in personal wallets, not on the exchange

- Start with small transactions to test withdrawal processes

Remember that cryptocurrency investments come with inherent risks regardless of the platform you choose. You should only invest what you can afford to lose.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT is generally considered a safe cryptocurrency exchange with strong security measures in place. According to search results, it has earned an AAA rating and ranks among the top 3 most secure crypto exchanges according to cer.live.

The platform complies with both Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, which helps ensure legal operation in many jurisdictions. This compliance is important for you as a user since it means the exchange follows regulatory standards.

WhiteBIT offers secure storage for your cryptocurrencies, which is a crucial factor when choosing an exchange. The platform appears to operate with a conservative business approach similar to Kraken, prioritizing safety.

Key Security Features:

- AAA security rating

- KYC and AML compliance

- Secure cryptocurrency storage

- Conservative business approach

However, like all cryptocurrency platforms, there are inherent risks you should be aware of. When using any third-party platform including WhiteBIT, your funds could potentially be at risk due to:

- Hacking attempts

- Fraud

- Platform mismanagement

- Potential insolvency issues

Before using WhiteBIT, you should verify it’s legal in your specific location, as cryptocurrency regulations vary widely by country. Always research current regulations in your jurisdiction.

Frequently Asked Questions

When comparing BitMart and WhiteBIT, traders often have specific concerns about security, fees, cryptocurrency selection, support quality, interface usability, and withdrawal processes. These key factors can significantly influence which platform might better suit your trading needs.

What security measures do BitMart and WhiteBIT implement to protect users’ funds?

BitMart employs multi-signature wallets and two-factor authentication (2FA) to secure user accounts. They also maintain an emergency insurance fund to protect against potential breaches.

WhiteBIT offers enhanced security through cold storage solutions, keeping most user funds offline and safe from online attacks. They implement compliance with international security standards and regular security audits.

Both exchanges use anti-phishing codes in emails and advanced encryption technologies, though WhiteBIT has gained a slightly stronger reputation for security protocols among users in recent evaluations.

How do BitMart’s trading fees compare to those of WhiteBIT?

BitMart charges maker/taker fees starting at 0.25% for regular users, which can decrease based on trading volume and BMX token holdings.

WhiteBIT offers a competitive fee structure with base trading fees of 0.10% for makers and 0.15% for takers. These fees can be reduced further when using their native WBT token.

For deposit fees, WhiteBIT generally provides more free deposit options across different networks compared to BitMart, making it potentially more cost-effective for frequent depositors.

What variety of cryptocurrencies do BitMart and WhiteBIT support for trading?

BitMart supports over 1,000 trading pairs and provides access to many smaller altcoins and newer token projects. This makes it popular for traders seeking exposure to emerging cryptocurrencies.

WhiteBIT offers around 450+ trading pairs with stronger focus on established cryptocurrencies and carefully vetted newer tokens. Their selection process tends to be more stringent regarding which assets they list.

Both exchanges regularly add new tokens, but BitMart typically lists new projects more quickly, while WhiteBIT takes a more cautious approach to new listings.

Which exchange offers better customer support, BitMart or WhiteBIT?

BitMart provides 24/7 customer support through ticket systems, email, and limited live chat options. Response times can vary significantly during high-volume periods.

WhiteBIT features a more comprehensive FAQ section addressing common user questions. Their support team is available via live chat, email, and through an extensive knowledge base.

User feedback generally indicates faster response times from WhiteBIT’s support team, with more consistent resolution rates for common trading and account issues.

How do the user interfaces of BitMart and WhiteBIT differ?

BitMart’s interface offers a straightforward design that newer traders find accessible, though advanced features may require some exploration to locate.

WhiteBIT provides a more modern interface with cleaner organization of trading tools and analytics. Their mobile app receives particularly strong reviews for functionality and ease of use.

Both platforms offer dark mode options and customizable trading views, but WhiteBIT’s interface typically earns higher marks for intuitiveness and overall user experience.

What are the withdrawal processes and limits for BitMart and WhiteBIT?

BitMart implements tiered withdrawal limits based on verification levels. Unverified users face strict daily limits, while fully verified accounts can withdraw significantly larger amounts.

WhiteBIT requires completion of KYC verification before allowing withdrawals above minimal amounts. Their withdrawal processing tends to be faster, typically completing within 30 minutes during normal operations.

Both exchanges charge network fees for withdrawals that vary by cryptocurrency. WhiteBIT generally offers more transparent fee structures and processing time estimates before finalizing withdrawals.

WhiteBIT vs Bitmart Conclusion: Why Not Use Both?

After comparing WhiteBIT and BitMart, you might wonder which platform to choose. The truth is, you don’t always need to pick just one.

Both exchanges offer strong features for beginners and advanced traders alike. WhiteBIT stands out with excellent interest rates when you lock up coins for 360 days, while BitMart offers more comprehensive features overall.

Benefits of using both platforms:

- Diversify your trading options: Access different coins and trading pairs

- Take advantage of varying fees: Use the platform with lower fees for specific transactions

- Manage risk: Spread your assets across multiple exchanges for security

For leverage trading, BitMart allows you to use leverage in both spot and futures trading, giving you more flexibility in your trading strategy.

WhiteBIT’s competitive rates make it attractive for long-term holdings, especially if you’re willing to commit to the 360-day lockup period.

Remember that cryptocurrency prices are highly volatile regardless of which platform you use. Price fluctuations can affect the value of your assets on both exchanges.

By using both platforms strategically, you can maximize benefits while minimizing the limitations of each. Choose WhiteBIT when its interest rates are more favorable, and switch to BitMart when you need access to its broader feature set.

The best approach is to evaluate your specific trading needs and use each platform for what it does best.