When choosing between BitMart and PrimeXBT in 2025, understanding their key differences is crucial for your crypto trading success. These popular platforms offer unique features that cater to different types of traders and investors.

BitMart currently has a higher overall score of 7.6 compared to PrimeXBT, making it potentially more suitable for beginners and those seeking a wider range of cryptocurrencies. BitMart also offers interest rates of around 1.5% for BTC with compounding benefits, which might appeal to you if you’re looking to grow your holdings passively.

PrimeXBT, on the other hand, focuses more on advanced trading features and derivatives. The platforms differ in their fee structures, supported deposit methods, and available trading options. Your choice will ultimately depend on whether you prioritize variety of assets, user-friendly interfaces, or sophisticated trading tools.

Bitmart Vs PrimeXBT: At A Glance Comparison

When choosing between BitMart and PrimeXBT, it’s important to understand their key differences. Here’s a quick comparison to help you decide which platform might better suit your trading needs.

BitMart has an overall higher score of 7.6 compared to PrimeXBT according to recent evaluations. This rating reflects their general performance across various features.

Platform Features:

| Feature | BitMart | PrimeXBT |

|---|---|---|

| Overall Score | 7.6 | Lower than BitMart |

| Interest Rates | BTC: 1.5% | Not specified |

| Compounding | Yes | Not specified |

| Leverage | Standard | Up to 200x for crypto, 1000x for forex |

PrimeXBT stands out with its impressive leverage options. You can access up to 200x leverage for cryptocurrency pairs and up to 1000x for forex pairs. This makes it attractive if you’re interested in high-leverage trading.

BitMart offers compounding interest on your crypto holdings, which can be beneficial if you’re looking to grow your assets over time.

Both exchanges support various cryptocurrencies, but they differ in trading types and fee structures. BitMart may be more suitable for beginners due to its user-friendly interface.

Your choice should depend on your specific trading goals. If you’re seeking high leverage trading opportunities, PrimeXBT might be your preferred option. For a more balanced platform with better overall ratings, BitMart could be the better choice.

Bitmart Vs PrimeXBT: Trading Markets, Products & Leverage Offered

BitMart and PrimeXBT offer different trading options for cryptocurrency investors. Understanding what each platform provides can help you choose the right one for your needs.

BitMart Trading Options:

- Wide selection of cryptocurrencies

- Spot trading available

- Limited leverage options

- Focus primarily on crypto assets

BitMart scores higher overall with a 7.6 rating compared to PrimeXBT. It caters more to traders looking for variety in cryptocurrency selection rather than high leverage trading.

PrimeXBT Trading Options:

- Up to 200x leverage for cryptocurrency pairs

- Up to 1,000x leverage for forex pairs

- 30+ crypto futures including Bitcoin

- Multi-asset trading capabilities

- Recently integrated MetaTrader 5 platform

PrimeXBT bridges traditional and crypto markets, making it attractive if you want to trade beyond just cryptocurrencies. The platform offers advanced tools for experienced traders who understand the risks of high leverage.

Key Differences:

| Feature | BitMart | PrimeXBT |

|---|---|---|

| Max Crypto Leverage | Lower | Up to 200x |

| Market Variety | Mostly crypto | Crypto, forex, commodities |

| Platform Tools | Basic | Advanced with MT5 integration |

| Primary Focus | Cryptocurrency selection | High leverage trading |

Your trading style should determine which platform is better for you. If you prefer many crypto options with less leverage, BitMart might work better. For high leverage trading across different asset classes, PrimeXBT offers more flexibility.

Bitmart Vs PrimeXBT: Supported Cryptocurrencies

When choosing between BitMart and PrimeXBT, the range of supported cryptocurrencies is an important factor to consider.

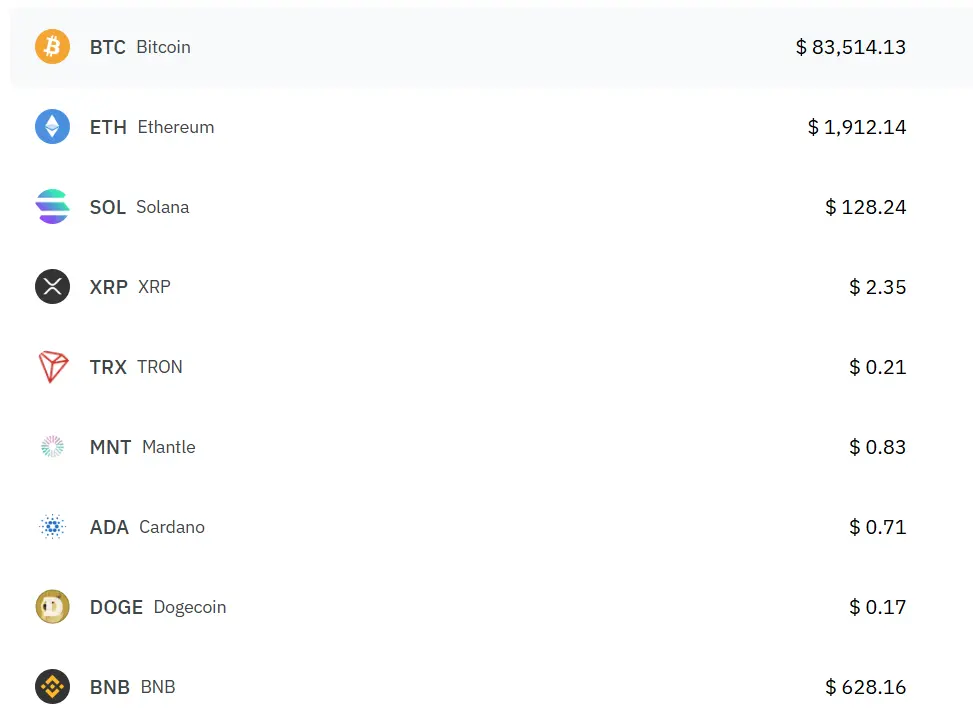

BitMart offers a wider selection of cryptocurrencies for trading. The platform supports hundreds of digital assets, including major coins like Bitcoin (BTC) and Ethereum (ETH), as well as numerous altcoins and tokens.

BitMart is known for listing newer, emerging cryptocurrencies earlier than many competitors. This gives you access to potential early investment opportunities in up-and-coming projects.

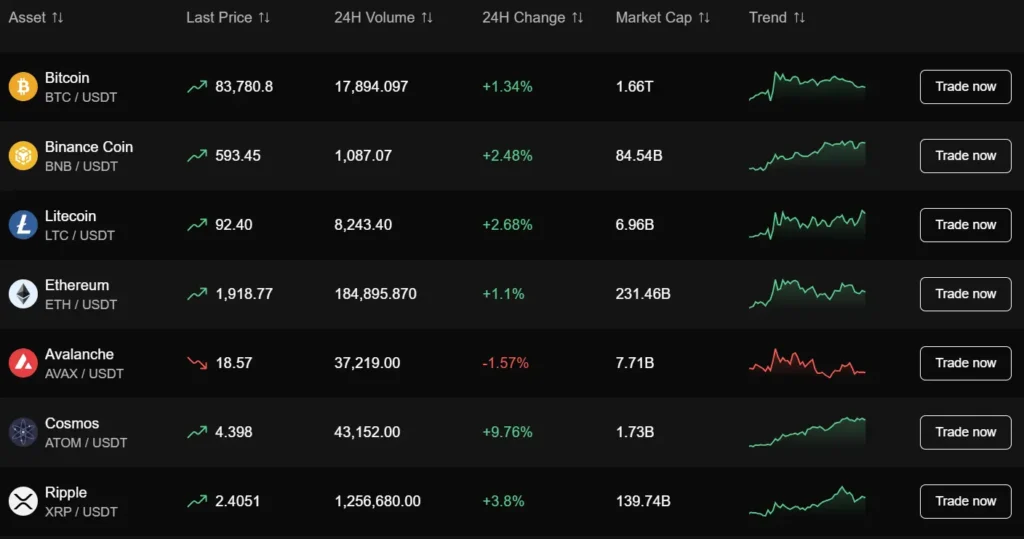

PrimeXBT takes a different approach with a more focused selection. The platform supports major cryptocurrencies like Bitcoin, Ethereum, Litecoin, and other established digital assets.

While PrimeXBT offers fewer cryptocurrencies than BitMart, it compensates with higher leverage options. You can trade with up to 200x leverage on cryptocurrency pairs, which appeals to experienced traders looking for amplified positions.

Here’s a quick comparison:

| Feature | BitMart | PrimeXBT |

|---|---|---|

| Number of cryptocurrencies | Hundreds | Dozens |

| Support for new tokens | Extensive | Limited |

| Major coins (BTC, ETH) | ✓ | ✓ |

| Trading pairs | Many | Fewer |

| Leverage trading | Yes (lower) | Yes (up to 200x) |

Your choice should depend on your specific trading needs. If you want access to a wide variety of cryptocurrencies, BitMart might be better suited for you. If you prefer trading established coins with high leverage, PrimeXBT could be the better option.

Bitmart Vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

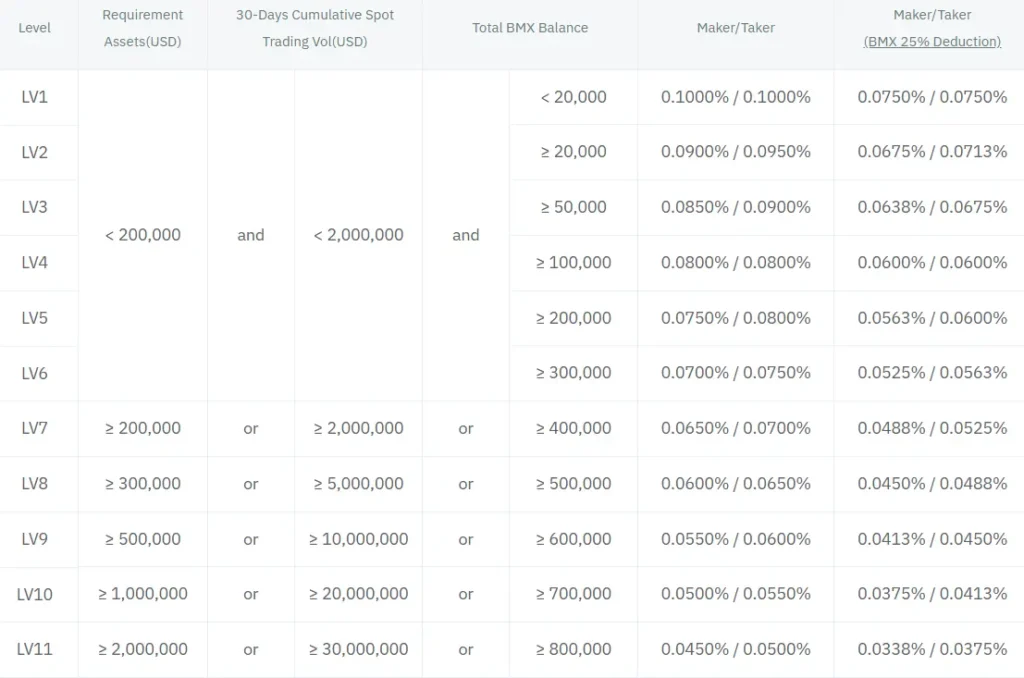

When choosing between BitMart and PrimeXBT, understanding their fee structures is crucial for your trading strategy. Let’s compare how these platforms stack up in terms of costs.

Trading Fees:

- BitMart: Up to 0.40% per trade

- PrimeXBT: Up to 0.6% per trade

BitMart offers slightly lower trading fees, which can make a difference if you’re an active trader. Every fraction of a percent matters when you’re making multiple transactions.

Withdrawal Fees:

| Platform | Withdrawal Fee |

|---|---|

| BitMart | Up to $60 |

| PrimeXBT | Up to 0.001 BTC |

Withdrawal costs vary based on the cryptocurrency you’re transferring. BitMart’s fees can reach up to $60, while PrimeXBT caps at around 0.001 BTC.

Deposit Fees:

BitMart doesn’t charge for deposits, making it easier to fund your account. PrimeXBT also offers deposit options, though specific fees may vary by payment method.

Payment Methods:

Both exchanges support various payment methods for deposits and withdrawals. Your choice might depend on which platform supports your preferred payment option.

The fee structure should align with your trading habits. If you trade frequently in small amounts, lower trading fees might be more important. For occasional large trades, withdrawal fees might be your priority.

Remember that fees can change, so always check the platforms’ current rates before making your decision.

Bitmart Vs PrimeXBT: Order Types

When trading on cryptocurrency exchanges, the available order types can greatly impact your trading strategy. Both BitMart and PrimeXBT offer various order options to help you execute trades effectively.

BitMart provides a comprehensive set of order types for traders. You can use limit orders to buy or sell at a specific price, market orders for immediate execution at current prices, stop loss orders to minimize losses, and take profit orders to secure gains.

PrimeXBT, as a platform that bridges cryptocurrency and traditional markets, also offers standard order types. Their recent integration with MetaTrader 5 has expanded their capabilities, giving you access to more sophisticated trading tools.

Order Types Comparison:

| Order Type | BitMart | PrimeXBT |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop Loss | ✓ | ✓ |

| Take Profit | ✓ | ✓ |

| OCO Orders | ✓ | ✓ |

| Trailing Stop | Limited | ✓ |

BitMart’s interface makes these order types accessible even to beginners. You can easily set parameters for each order type through their user-friendly platform.

PrimeXBT’s MT5 integration gives you additional technical analysis tools that work seamlessly with their order system. This makes it particularly suitable if you’re looking to implement more complex trading strategies.

Both platforms allow you to set multiple orders simultaneously, helping you manage your trading positions without constant monitoring.

Bitmart Vs PrimeXBT: KYC Requirements & KYC Limits

BitMart and PrimeXBT have different approaches to KYC (Know Your Customer) requirements, which may influence your trading experience.

BitMart KYC Policy:

- Requires KYC verification for all users

- Uses standard email or mobile number registration process

- Has withdrawal limits tied to verification level

PrimeXBT KYC Policy:

- Offers no-KYC trading, allowing anonymous sign-up

- Rare feature in the crypto exchange market

- Enables privacy-focused trading without identity verification

For BitMart users who haven’t completed KYC, there are significant limitations. Your daily withdrawal limit would be capped at 20,000 USDT, and you won’t have access to certain earning products.

PrimeXBT’s no-KYC policy is one of its major advantages. You can create an account and begin trading without submitting personal identification documents.

Your choice between these platforms may depend on your privacy preferences. If remaining anonymous while trading is important to you, PrimeXBT offers that benefit.

Remember that regulatory requirements can change, and exchanges may update their KYC policies accordingly. Always check the most current requirements before opening an account.

Bitmart Vs PrimeXBT: Deposits & Withdrawal Options

When choosing between BitMart and PrimeXBT, their deposit and withdrawal options are important factors to consider.

BitMart offers various payment methods for deposits, though specific options aren’t detailed in the search results. The platform charges no fees for deposits, which is a plus for traders looking to save on transaction costs.

PrimeXBT also provides deposit options, but the exact payment methods aren’t specified in the given information.

Withdrawal Fees:

| Platform | Fee Structure |

|---|---|

| BitMart | Up to $60 |

| PrimeXBT | Up to 0.001 BTC |

BitMart’s withdrawal fees vary depending on the cryptocurrency you’re withdrawing. The maximum fee can reach $60, which is relatively high compared to some competitors.

PrimeXBT charges withdrawal fees of up to 0.001 BTC. Depending on Bitcoin’s current value, this could be more or less expensive than BitMart’s fees.

Before choosing either platform, you should check if they support your preferred deposit method. Consider how frequently you plan to withdraw funds, as these fees can add up over time.

Remember that cryptocurrency networks sometimes experience congestion, which might affect withdrawal processing times on both platforms.

Bitmart Vs PrimeXBT: Trading & Platform Experience Comparison

BitMart and PrimeXBT offer different trading experiences that cater to various types of traders. Understanding these differences can help you choose the platform that better suits your needs.

BitMart provides a more traditional cryptocurrency exchange interface with spot trading as its main focus. The platform scores higher overall with a 7.6 rating compared to PrimeXBT, according to comparison data.

PrimeXBT, on the other hand, specializes in multi-asset trading with advanced tools for more experienced investors. It offers leverage trading options that BitMart doesn’t provide.

User Interface Comparison:

- BitMart: More beginner-friendly with straightforward navigation

- PrimeXBT: More complex interface with advanced charting tools

Trading Features:

| Feature | BitMart | PrimeXBT |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Margin Trading | Limited | Extensive |

| Leverage | Lower | Higher |

| Advanced Charting | Basic | Comprehensive |

When using BitMart, you’ll find a wider selection of cryptocurrencies available for trading. This makes it better for those looking to diversify into altcoins.

PrimeXBT shines with its multi-asset trading capabilities. You can trade cryptocurrencies alongside traditional markets like forex, commodities, and indices all from one platform.

Mobile trading experiences differ between the platforms too. BitMart offers a more streamlined mobile app, while PrimeXBT’s mobile experience maintains most of its advanced features but with a steeper learning curve.

Bitmart Vs PrimeXBT: Liquidation Mechanism

When trading on leverage platforms like Bitmart and PrimeXBT, understanding liquidation mechanisms is crucial. Liquidation happens when your position can’t meet the minimum margin requirements.

BitMart’s Liquidation Process

BitMart uses a graduated liquidation system that gives traders warnings as their positions approach liquidation levels. You’ll receive notifications when your margin ratio falls below certain thresholds.

BitMart offers a more user-friendly approach with clearer indicators of when liquidation might occur. This helps you make timely decisions about adding funds or closing positions.

PrimeXBT’s Liquidation Approach

PrimeXBT employs an automatic liquidation system that triggers when your margin falls below maintenance requirements. The platform liquidates positions quickly to prevent further losses.

PrimeXBT’s system is designed for experienced traders who understand risk management, with less hand-holding through the process.

Key Differences

| Feature | BitMart | PrimeXBT |

|---|---|---|

| Warning System | Multiple notifications | Limited warnings |

| Liquidation Speed | Gradual | Quick |

| User Interface | More indicators | Less visual guidance |

| Risk Management Tools | More beginner-friendly | Advanced tools |

Both platforms may impose restrictions on withdrawing funds during volatile market conditions. This can make it challenging to liquidate your assets quickly when needed.

Understanding these liquidation mechanisms will help you better manage risk when trading on either platform.

Bitmart Vs PrimeXBT: Insurance

When comparing Bitmart and PrimeXBT, understanding their insurance policies is crucial for your security as a trader.

Bitmart offers a protection fund called the “Bitmart Security Reserve” that covers potential losses from security breaches. After experiencing a hack in 2021, they strengthened their insurance measures to rebuild user trust.

PrimeXBT maintains insurance coverage through partnerships with third-party insurance providers. They focus on protecting user funds from potential cybersecurity threats and operational risks.

Insurance Coverage Comparison:

| Platform | Insurance Type | Coverage Focus | User Fund Protection |

|---|---|---|---|

| Bitmart | Security Reserve | Hack/Breach Protection | Partial coverage |

| PrimeXBT | Third-party insurance | Cybersecurity & operational risks | Asset-dependent coverage |

Neither platform guarantees 100% protection of all assets. Your funds’ security depends on specific asset types and the circumstances of any potential loss.

Both platforms implement cold storage solutions to keep most user funds offline as an additional security measure beyond insurance.

You should verify current insurance policies directly on each platform before trading, as coverage terms may change periodically without notice.

Remember that insurance policies typically don’t cover losses from market volatility or your personal trading decisions.

Bitmart Vs PrimeXBT: Customer Support

When comparing cryptocurrency exchanges, customer support can make or break your trading experience. Both BitMart and PrimeXBT offer support options, but they differ in some key ways.

BitMart provides customer support through email, tickets, and live chat. You can typically expect responses within 24 hours for most inquiries. Their help center also includes extensive FAQs and guides to help you solve common problems.

PrimeXBT offers similar support channels with email and ticket systems. They also maintain an active presence on social media platforms where you can reach out for assistance. Their knowledge base is comprehensive and covers most trading-related questions.

Response times can vary for both platforms. During high-volume trading periods, you might experience longer wait times when seeking help from either exchange.

BitMart’s support team has received mixed reviews from users. Some praise their helpfulness, while others note delays in complex issue resolution.

PrimeXBT’s support team is generally regarded as responsive, especially for verification and account-related issues. Their multilingual support is beneficial if English isn’t your primary language.

Support Comparison:

| Feature | BitMart | PrimeXBT |

|---|---|---|

| Email Support | ✓ | ✓ |

| Live Chat | ✓ | Limited |

| Help Center | Comprehensive | Comprehensive |

| Social Media Support | Limited | Active |

| Response Time | Usually 24 hours | Usually 24 hours |

For beginners, BitMart’s user-friendly interface extends to their support system. PrimeXBT’s support is more tailored to traders familiar with leverage trading concepts.

Bitmart Vs PrimeXBT: Security Features

When choosing between BitMart and PrimeXBT, security should be a top priority for your crypto trading needs. BitMart has established itself as a secure platform with highly rated security features.

BitMart implements multi-factor authentication (MFA) to protect your account from unauthorized access. This adds an extra layer of security beyond just your password.

PrimeXBT also offers strong security measures including cold storage for most user funds. This means your assets are kept offline, making them less vulnerable to hacking attempts.

Both platforms use encryption technology to protect your personal information and transaction data. However, there are some key differences to consider.

BitMart Security Features:

- Multi-factor authentication

- SSL encryption

- Regular security audits

- Fund insurance (for certain assets)

PrimeXBT Security Features:

- Cold storage for funds

- IP address monitoring

- Anti-phishing protection

- Advanced encryption protocols

One notable difference is regulatory status. BitMart operates with more regulatory oversight in various jurisdictions, which can provide additional security through compliance requirements.

You should enable all available security features on whichever platform you choose. This includes using strong, unique passwords and keeping your recovery phrases in secure, offline locations.

Remember that no platform is 100% immune to security risks, so it’s wise to only keep trading funds on these exchanges and store long-term holdings in private wallets.

Is Bitmart A Safe & Legal To Use?

Bitmart is generally considered a safe cryptocurrency exchange operating in over 180 countries. The platform implements security measures to protect user funds and data.

In December 2021, Bitmart experienced a security incident. Despite this breach, the exchange has taken steps to improve its security protocols and continues to operate as a legitimate platform.

Users should know that Bitmart has proper licensing in most regions where it operates. However, regulations around cryptocurrency exchanges vary by country, so you should verify its legal status in your location.

According to search results, Bitmart offers a smooth user experience compared to competitors like PrimeXBT. This ease of use can be important for both beginners and experienced traders.

Some concerns have been raised about Bitmart’s financial stability and regulatory challenges. A few users have reported issues with the platform’s operations and customer service.

When using Bitmart, consider these safety practices:

- Enable two-factor authentication (2FA)

- Use strong, unique passwords

- Withdraw large amounts to private wallets

- Keep updated on any security announcements

The platform serves both individual and institutional users with various trading options. Before choosing Bitmart, research recent reviews and verify its current standing with regulatory bodies in your area.

Is PrimeXBT A Safe & Legal To Use?

PrimeXBT provides robust security measures to protect user assets. The platform employs cold storage for most funds, two-factor authentication, and encrypted communications to ensure trading safety.

According to search results, some users consider trading on PrimeXBT “completely safe and fast.” This confidence suggests a positive user experience regarding security concerns.

The legality of PrimeXBT varies by location. Before using the platform, you should check if it’s permitted in your country or region. Some jurisdictions have restrictions on high-leverage trading platforms.

PrimeXBT offers significant leverage – up to 200x for cryptocurrency pairs and up to 1000x for forex pairs. While this creates trading opportunities, it also increases risk exposure.

The platform features a user-friendly interface that makes trading accessible. This ease of use helps you navigate security features and trading tools effectively.

Key Security Features:

- Cold storage for majority of funds

- Two-factor authentication

- Encrypted communications

- IP address monitoring

Remember that no trading platform is completely risk-free. You should always use strong passwords, enable all security features, and never invest more than you can afford to lose.

For US traders specifically, regulations are strict regarding cryptocurrency platforms. Verify PrimeXBT’s current legal status in your area before creating an account.

Frequently Asked Questions

Investors need clear answers when choosing between BitMart and PrimeXBT. These platforms differ significantly in their features, fees, and trading options that impact your cryptocurrency experience.

What are the main differences in trading features between BitMart and PrimeXBT?

BitMart offers spot trading as its primary service, allowing you to buy and sell cryptocurrencies directly. The platform supports standard order types like market, limit, and stop-limit orders.

PrimeXBT focuses exclusively on margin trading with leverage. You won’t find spot trading here, but instead can trade with leverage up to 100x on certain assets. This makes PrimeXBT more specialized for traders seeking amplified positions.

BitMart provides a more traditional cryptocurrency experience, while PrimeXBT caters to traders looking for advanced trading tools and derivatives.

Which exchange offers more comprehensive asset types, BitMart or PrimeXBT?

BitMart supports a wider variety of cryptocurrencies for direct ownership. You can access hundreds of different tokens and coins, including many smaller altcoins not available on other exchanges.

PrimeXBT offers fewer total assets but provides exposure to multiple markets. Beyond cryptocurrencies, you can trade forex pairs, commodities, and stock indices—all using cryptocurrency as collateral.

The choice depends on whether you want access to many cryptocurrencies (BitMart) or fewer assets across diverse market categories (PrimeXBT).

How do BitMart’s security measures compare to those implemented by PrimeXBT?

BitMart implements standard security protocols including two-factor authentication and cold storage for majority of funds. The platform experienced a security breach in 2021 but has since strengthened its security infrastructure.

PrimeXBT also employs two-factor authentication and cold storage solutions. The platform adds additional security through address whitelisting and has maintained a relatively clean security record.

Both exchanges invest in security measures, but neither provides insurance on user deposits like some larger exchanges do.

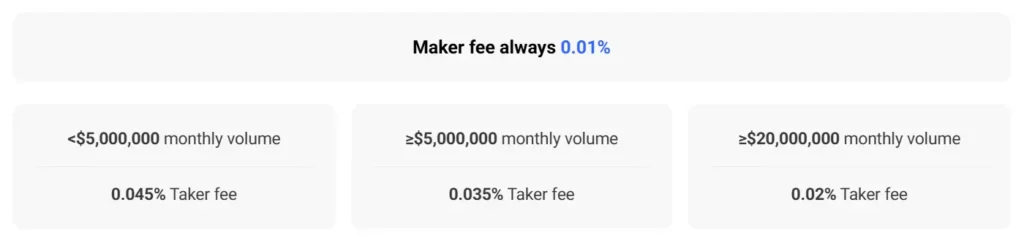

Can users expect lower trading fees on BitMart or PrimeXBT?

BitMart charges trading fees starting at 0.25% for makers and takers, with potential reductions based on trading volume and BM token holdings. Withdrawal fees vary by cryptocurrency.

PrimeXBT generally offers lower trading fees, starting at 0.05% for most cryptocurrency pairs. However, overnight financing fees apply to leveraged positions held for extended periods.

For spot traders with moderate volume, BitMart’s fee structure may result in higher costs compared to PrimeXBT’s base rates.

What are the advantages of using PrimeXBT over BitMart for leveraged trading?

PrimeXBT specializes in leverage trading with multipliers up to 100x on cryptocurrencies. You can access advanced charting tools, copy trading features, and multi-asset exposure.

The platform offers a more refined interface for margin positions with intuitive stop-loss and take-profit settings. PrimeXBT also provides better liquidity for large leveraged positions.

BitMart offers limited margin trading features with lower maximum leverage, making PrimeXBT clearly superior for traders focused on leveraged positions.

Which platform, BitMart or PrimeXBT, offers better user support and educational resources?

BitMart provides 24/7 customer support through ticket systems and live chat. Educational resources include basic articles and guides but lack comprehensive trading tutorials.

PrimeXBT offers similar customer service channels but stands out with its Covesting module and blog containing detailed market analysis. The platform provides more advanced educational content for traders looking to develop their skills.

Both platforms could improve their educational offerings, but PrimeXBT currently provides slightly more robust resources for traders seeking to learn advanced strategies.

Bitmart Vs PrimeXBT Conclusion: Why Not Use Both?

BitMart and PrimeXBT each offer unique strengths for crypto traders. BitMart scores higher overall with a 7.6 rating compared to PrimeXBT, according to recent comparisons.

BitMart excels in security features with two-factor authentication, cold storage for 99% of user funds, and bank-grade encryption. It’s available in over 180 countries, making it accessible for most traders worldwide.

PrimeXBT, while scoring slightly lower overall, may offer different trading tools and features that could complement your trading strategy.

Why choose just one platform? Using both exchanges can give you access to:

- Different coin selections

- Varied fee structures

- Alternate trading features

- Risk diversification across platforms

Many experienced traders maintain accounts on multiple exchanges to take advantage of:

| Benefit | Description |

|---|---|

| Price variations | Arbitrage opportunities between exchanges |

| Feature access | Use the best tools from each platform |

| Backup options | Continue trading if one platform experiences issues |

| Portfolio diversity | Access to more tokens and trading pairs |

You can use BitMart for its strong security and wide availability while leveraging PrimeXBT for its unique offerings. This dual-platform approach gives you more flexibility and trading options.

Remember to consider your personal trading needs and security requirements when deciding how to distribute your assets across these platforms.