Choosing between BitMart and Poloniex can be challenging when you’re looking for a crypto exchange. Both platforms offer different features, fees, and trading options that might work better for your specific needs.

BitMart has a higher overall score of 7.2 compared to Poloniex according to recent comparisons. This difference comes from various factors including user experience, available cryptocurrencies, and platform reliability. BitMart also offers a 1.5% interest rate on Bitcoin and includes compounding benefits.

When selecting between these exchanges, you should consider what matters most to you – whether that’s lower fees, more crypto options, or better user interfaces. The right choice depends on your trading goals, experience level, and the specific cryptocurrencies you want to trade.

Bitmart vs Poloniex: At A Glance Comparison

BitMart and Poloniex are popular cryptocurrency exchanges with different strengths. Based on recent comparisons, BitMart has an overall score of 7.2, which is higher than Poloniex.

Both platforms offer cryptocurrency trading services but differ in several key aspects:

| Feature | BitMart | Poloniex |

|---|---|---|

| Overall Score | 7.2 | Lower than BitMart |

| Interest Rate (BTC) | 1.5% | Not specified |

| Compounding | Yes | Not specified |

| Platform Type | Centralized | Centralized |

BitMart appears to have an edge in terms of user ratings and overall performance. The platform offers interest-earning options with compounding benefits.

When choosing between these exchanges, you should consider your specific trading needs. Each platform supports different cryptocurrencies and offers varying fee structures.

Trading volumes and liquidity are important factors to consider. CoinMarketCap ranks exchanges based on these metrics, along with traffic and legitimacy of reported volumes.

Both exchanges have been operating in the cryptocurrency space for several years. They continue to compete for market share in 2025.

The right choice depends on which features matter most to you—whether that’s lower fees, more supported cryptocurrencies, or better trading tools.

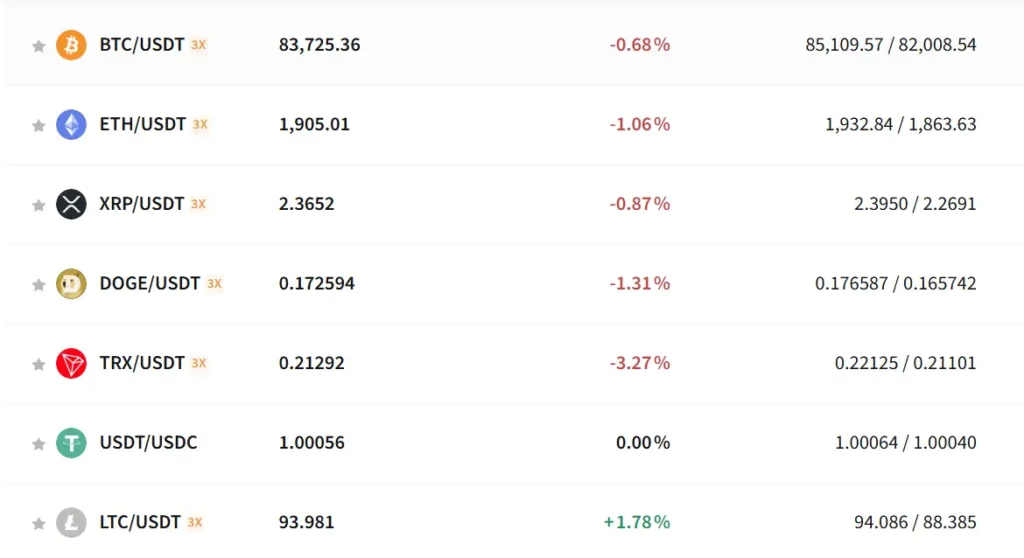

Bitmart vs Poloniex: Trading Markets, Products & Leverage Offered

BitMart and Poloniex both offer a variety of trading options for crypto enthusiasts. When comparing their markets and products, there are some notable differences to consider.

Available Cryptocurrencies:

- BitMart: Supports a wide range of cryptocurrencies for trading

- Poloniex: Offers 350+ currencies including Bitcoin

Trading Types:

| Feature | BitMart | Poloniex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ | Limited |

| Margin Trading | Available | Available |

BitMart’s platform enables both spot and futures trading on many cryptocurrencies. You can also access leveraged trading options if you’re looking to amplify your potential returns.

Poloniex focuses more on spot trading but does offer some margin trading capabilities. Their platform is known for supporting a diverse range of altcoins beyond just the major cryptocurrencies.

Leverage Options:

BitMart provides more extensive leverage options for traders looking to maximize their position sizes. You’ll find various leverage ratios depending on the trading pair and market conditions.

Both exchanges offer compounding features, which can be beneficial for your long-term investment strategy. This allows your earnings to generate additional returns over time.

When choosing between these platforms, consider which specific cryptocurrencies you want to trade and what type of trading (spot, futures, margin) best fits your investment strategy.

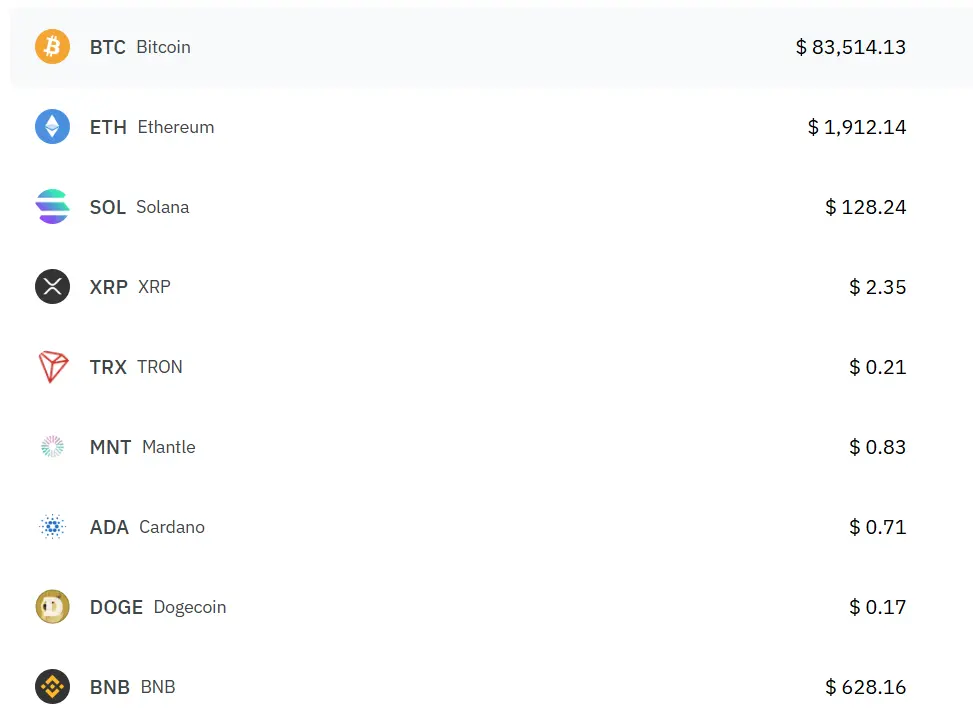

Bitmart vs Poloniex: Supported Cryptocurrencies

When choosing between BitMart and Poloniex, the variety of available cryptocurrencies is a key factor to consider.

BitMart offers a more extensive selection of cryptocurrencies compared to Poloniex. This gives you more trading options and opportunities to diversify your portfolio.

According to recent data, BitMart supports a significantly higher number of tokens and coins. This makes it potentially more appealing if you’re looking to trade lesser-known altcoins or newer projects.

Key Differences:

| Feature | BitMart | Poloniex |

|---|---|---|

| Total Cryptocurrencies | Higher number | Lower number |

| Altcoin Variety | More extensive | More limited |

| Trading Pairs | More options | Fewer options |

Both exchanges support major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). However, if you’re interested in trading a wide range of altcoins, BitMart might be the better choice for your needs.

Poloniex still offers a solid selection of established cryptocurrencies. Its more curated approach might appeal to you if you prefer focusing on more established tokens rather than newer, potentially riskier assets.

The gap in cryptocurrency offerings could affect your trading strategy, especially if you’re looking for specific tokens that may only be available on one platform but not the other.

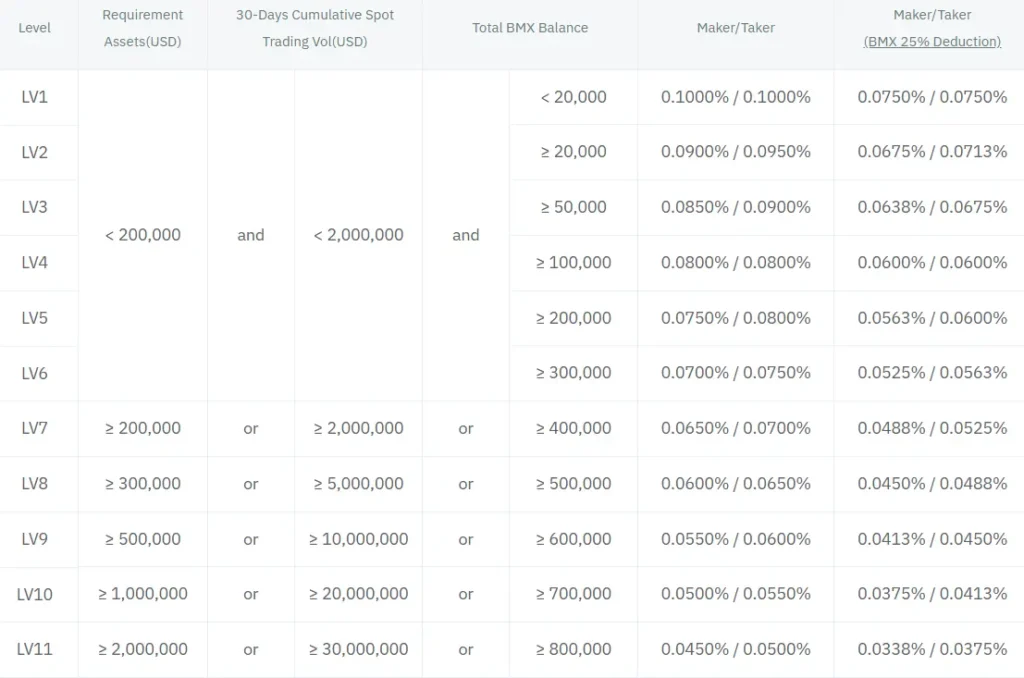

Bitmart vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BitMart and Poloniex, understanding their fee structures is crucial for your trading strategy. Let’s compare their fees to help you make an informed decision.

Trading Fees:

BitMart offers more competitive trading fees with rates up to 0.6%, making it the more affordable option between the two exchanges. Poloniex’s trading fees are slightly higher than BitMart’s.

| Exchange | Trading Fees |

|---|---|

| BitMart | Up to 0.6% |

| Poloniex | Higher than BitMart |

Both platforms likely offer fee discounts based on trading volume or if you hold their native tokens. This tiered structure rewards active traders with lower costs over time.

Deposit Fees:

Most cryptocurrency exchanges, including BitMart and Poloniex, don’t charge for crypto deposits. However, if you’re depositing fiat currency, fees may apply depending on your payment method.

Withdrawal Fees:

Withdrawal fees vary by cryptocurrency on both platforms. These fees are used to cover the blockchain network costs for processing transactions.

Each exchange sets specific withdrawal minimums and fees for different coins. These can change based on network conditions and cryptocurrency values.

Before making large transactions, you should check the current fee schedule on both platforms. Fees can significantly impact your overall trading profits, especially if you make frequent withdrawals.

Bitmart vs Poloniex: Order Types

When trading on cryptocurrency exchanges, the available order types can greatly impact your trading strategy. Both BitMart and Poloniex offer several order types to help you execute trades effectively.

BitMart Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

- Trailing stop orders

BitMart provides a good range of order types for both beginners and advanced traders. The platform’s trailing stop feature is particularly useful for maximizing profits in volatile markets.

Poloniex Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Post-only orders

- Fill-or-kill orders

Poloniex offers specialized order types like post-only orders that ensure you’re always the maker rather than the taker in transactions. This can help you save on fees.

Both exchanges support the essential market and limit orders that most traders commonly use. Market orders execute immediately at the best available price, while limit orders let you set specific price points.

For risk management, both platforms provide stop-limit orders. These allow you to set triggers that automatically create limit orders when prices reach certain levels.

If you’re an advanced trader who uses multiple order strategies, Poloniex’s fill-or-kill option might be appealing. This order type must be filled immediately and completely, or it won’t execute at all.

Bitmart vs Poloniex: KYC Requirements & KYC Limits

BitMart has a somewhat flexible approach to KYC (Know Your Customer) verification. You can make deposits without completing KYC first, which gives you initial access to the platform.

However, to unlock full trading capabilities and higher withdrawal limits on BitMart, you’ll eventually need to complete their verification process. This typically involves submitting identification documents.

Poloniex also implements KYC requirements, but with a notable difference. Without completing KYC verification on Poloniex, you can still withdraw up to 20 BTC per day, which is quite generous compared to many exchanges.

Both exchanges follow standard verification procedures where you’ll need to provide:

- Government-issued photo ID

- Proof of address

- A selfie with your ID in some cases

Here’s a simple comparison of their KYC approaches:

| Exchange | KYC Required for Deposits | Withdrawal Limits Without KYC |

|---|---|---|

| BitMart | No | Very limited |

| Poloniex | No | Up to 20 BTC daily |

Setting up two-factor authentication (2FA) is recommended for both platforms to enhance your account security beyond the basic KYC requirements.

Remember that KYC requirements may change as regulations evolve, so checking the exchanges’ current policies before signing up is always a good idea.

Bitmart vs Poloniex: Deposits & Withdrawal Options

When choosing between BitMart and Poloniex, understanding your deposit and withdrawal options is crucial. Both exchanges offer multiple methods, but there are some key differences.

BitMart provides several deposit options for users. You can fund your account using bank transfers, credit/debit cards, and cryptocurrency deposits. This flexibility makes it accessible for both beginners and experienced traders.

BitMart also supports multiple withdrawal methods. However, some users have noted that improvements could be made to streamline the withdrawal process.

Poloniex similarly offers various deposit methods. You can use bank transfers and direct cryptocurrency deposits to fund your account. Their system is designed to accommodate different user preferences.

For withdrawals, Poloniex maintains straightforward options focused primarily on cryptocurrency transfers to external wallets.

| Feature | BitMart | Poloniex |

|---|---|---|

| Bank Transfers | Yes | Yes |

| Credit/Debit Cards | Yes | Limited |

| Crypto Deposits | Yes | Yes |

| Withdrawal Options | Multiple | Primarily crypto |

Processing times and fees can vary between these platforms. BitMart sometimes charges higher fees for certain withdrawal methods compared to Poloniex.

Remember to verify the available options in your region, as both exchanges may have geographical restrictions on specific deposit and withdrawal methods.

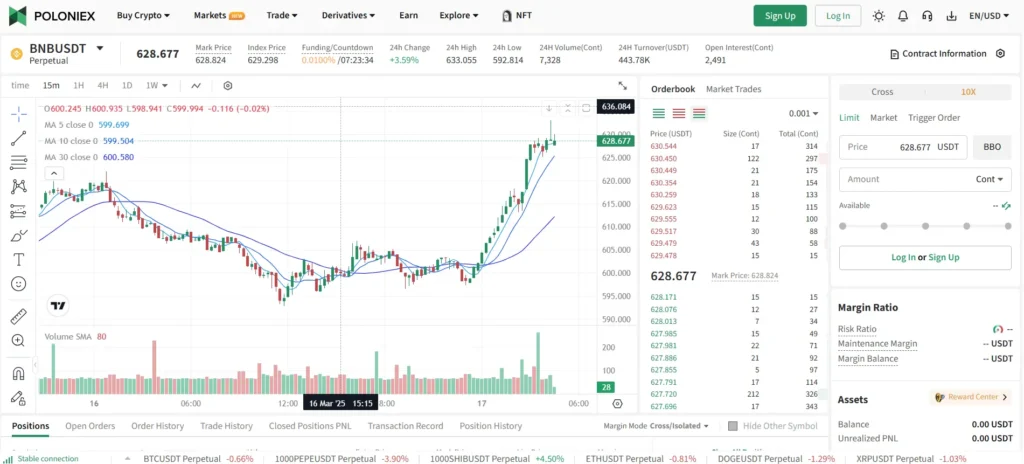

Bitmart vs Poloniex: Trading & Platform Experience Comparison

Both BitMart and Poloniex offer unique trading experiences that cater to different types of crypto traders. Your experience will vary based on what features matter most to you.

BitMart’s platform supports spot and futures trading with dozens of cryptocurrencies and trading pairs. The interface is designed to be accessible while still offering advanced tools for experienced traders.

Poloniex has a longer history in the crypto space and offers a platform that many seasoned traders find familiar. Their trading interface tends to include more detailed market data and analysis tools.

User Experience Comparison:

| Feature | BitMart | Poloniex |

|---|---|---|

| Overall Score | 7.2 | Lower than BitMart |

| Platform Type | Web + Mobile | Web + Mobile |

| Beginner Friendly | Yes | Moderate |

| Advanced Features | Futures trading | Margin trading |

| Compound Interest | Yes | Varies by asset |

BitMart offers a 1.5% rate on BTC holdings, which might appeal to you if you’re looking to earn passive income on your crypto.

The trading experience on BitMart is generally considered more straightforward for newcomers. Poloniex, while still accessible, tends to appeal more to traders who value having extensive market data at their fingertips.

Both platforms support a wide range of cryptocurrencies, but the specific selection differs. Check both exchanges for your preferred coins before deciding.

Mobile trading is available on both platforms, making it convenient to manage your portfolio on the go.

Bitmart vs Poloniex: Liquidation Mechanism

When trading on crypto exchanges, understanding the liquidation mechanism is essential for your risk management. Both BitMart and Poloniex have systems in place to handle liquidations, but they differ in important ways.

BitMart uses a tiered liquidation system that gradually closes positions as they approach margin limits. This gives you some buffer time to add funds or adjust your position before complete liquidation occurs.

Poloniex employs a more immediate liquidation approach when positions fall below maintenance margin requirements. Their system is designed to protect the platform from negative balances during high volatility.

Key Differences in Liquidation Processes:

| Feature | BitMart | Poloniex |

|---|---|---|

| Warning notifications | Multiple alerts | Limited warnings |

| Partial liquidation | Available | Limited availability |

| Liquidation fees | 0.5-2% depending on asset | Flat 1% fee on most assets |

| Appeal process | Available for some accounts | Not available |

Both platforms calculate liquidation prices based on your position size, leverage used, and maintenance margin requirements. However, BitMart typically provides more detailed information about potential liquidation points in their interface.

One search result mentioned that Poloniex may impose restrictions on withdrawing funds during certain market conditions. This could impact your ability to manage positions facing liquidation.

BitMart offers liquidation insurance for VIP traders, which can protect a portion of your assets during extreme market volatility. Poloniex does not currently offer similar protection.

Bitmart vs Poloniex: Insurance

When choosing a crypto exchange, insurance is a key factor to consider. Both BitMart and Poloniex offer some form of protection, but they differ in their approaches.

BitMart maintains insurance funds to protect users against potential losses from security breaches. However, it’s important to note that this coverage may not extend to all assets or circumstances.

Poloniex also provides insurance protection through their security protocols. They allocate funds specifically to cover certain types of losses that might occur during trading or from platform issues.

Neither exchange offers full insurance coverage like traditional financial institutions. Most crypto exchanges, including these two, typically insure only a portion of their holdings.

You should be aware that in most cases, personal errors (like sending crypto to wrong addresses) are not covered by exchange insurance policies.

Here’s how their insurance features compare:

| Feature | BitMart | Poloniex |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Full Asset Coverage | No | No |

| Cold Storage Protection | Yes | Yes |

| User Error Coverage | No | No |

For maximum security, you should consider using hardware wallets for long-term storage regardless of which exchange you choose.

Remember to review the most current insurance policies on both platforms before making your decision, as coverage terms may change over time.

BitMart vs Poloniex: Customer Support

When choosing a crypto exchange, good customer support is essential. Both BitMart and Poloniex offer support options, but they differ in quality and response times.

Poloniex provides 24/7 customer support through multiple channels. You can reach them via email, live chat, and their help center. Users report relatively quick response times, which can be crucial when dealing with urgent issues.

BitMart also offers customer support through similar channels. However, user experiences suggest that response times may be slower compared to Poloniex. During peak trading periods, you might experience longer wait times.

Both platforms provide FAQ sections and knowledge bases where you can find answers to common questions. This self-service option can save you time for basic inquiries.

Support Channel Comparison:

| Feature | BitMart | Poloniex |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Email Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Help Center/FAQ | Yes | Yes |

| Response Time | Moderate | Quick |

Language support is another factor to consider. Poloniex offers support in several languages, making it accessible to a wider international audience.

When facing technical issues or account problems, Poloniex tends to resolve matters more efficiently. This can be particularly important when dealing with trading or withdrawal issues that need immediate attention.

Bitmart vs Poloniex: Security Features

When choosing a crypto exchange, security should be your top priority. Both BitMart and Poloniex offer important security features to protect your funds.

BitMart Security Features:

- Two-factor authentication (2FA)

- Comprehensive security measures for asset protection

- No major security incidents reported in recent data

Poloniex Security Features:

- Two-factor authentication (2FA)

- Cold storage for majority of user funds

- Advanced security protocols

It’s worth noting that Poloniex experienced a security breach in the past. This history might concern some users who prioritize exchanges with clean security records.

BitMart appears to have a better security track record with no major hacks reported in recent years. This could give you more confidence when storing your assets on their platform.

Both exchanges regularly update their security measures to combat emerging threats. They employ industry-standard encryption to protect user data and transactions.

Remember to always enable all available security features on whichever platform you choose. This includes using strong passwords, enabling 2FA, and being cautious about phishing attempts.

The security of your crypto ultimately depends on both the exchange’s measures and your own security practices. Never share your login details or private keys with anyone.

Is Bitmart A Safe & Legal To Use?

BitMart is a legitimate cryptocurrency exchange operating in over 180 countries with approximately nine million users. Based on search results, it’s a legal platform for buying, selling, and trading cryptocurrencies.

The exchange implements comprehensive security measures to protect user assets and data. This focus on security helps safeguard your investments while using the platform.

BitMart has established a solid reputation in the cryptocurrency market. However, some users have reported challenges with customer support responsiveness, which is something to consider before opening an account.

When comparing BitMart to other exchanges like Poloniex, BitMart offers a wider selection of cryptocurrencies. This gives you more trading options and flexibility with your investments.

Key safety features include:

- Comprehensive security protocols

- Legitimate operating status

- Wide global availability

- Established presence in the crypto market

If you’re considering using BitMart, it’s worth noting that while some users have faced support issues, the platform itself is not a scam. It functions as a genuine cryptocurrency exchange with advanced features for both individual and institutional users.

Is Poloniex A Safe & Legal To Use?

Poloniex has been operating since 2014, giving it almost a decade of experience in the cryptocurrency exchange market. This long-standing presence suggests a certain level of stability in the industry.

When it comes to security, Poloniex implements several protective measures including:

- Cold storage for user funds

- Two-factor authentication (2FA)

- Encryption protocols

However, it’s worth noting that Poloniex has experienced security breaches in the past. Despite these incidents, the exchange has worked to improve its security systems and now ranks alongside major exchanges like Binance in terms of protection.

Some users have reported issues with customer service and withdrawal processes. On platforms like Reddit, you can find complaints about delayed responses and difficulties accessing funds.

Regarding legality, Poloniex operates as a legitimate cryptocurrency exchange in many regions. Before using the platform, you should verify that it’s authorized to operate in your country, as cryptocurrency regulations vary worldwide.

For your protection when using Poloniex, consider these safety practices:

- Enable all available security features

- Use unique, strong passwords

- Never share your authentication details

- Withdraw large amounts to a personal wallet

- Keep transaction records

Always research current user experiences before depositing significant funds on any exchange, including Poloniex.

Frequently Asked Questions

Investors comparing BitMart and Poloniex need answers to key questions before choosing a platform. These exchanges differ in trading fees, security protocols, cryptocurrency offerings, support quality, user interface design, and trading volume.

What are the trading fee differences between BitMart and Poloniex?

BitMart charges standard trading fees of approximately 0.25% per transaction for makers and takers. They also offer fee discounts based on trading volume and for holders of their native BMX token.

Poloniex typically charges slightly lower fees starting at 0.2% and decreases rates for high-volume traders. Both platforms implement withdrawal fees that vary by cryptocurrency.

BitMart’s compounding feature may provide additional value for certain investors looking to maximize returns.

How do security measures compare between BitMart and Poloniex?

BitMart employs standard security protocols including two-factor authentication, cold storage for most funds, and regular security audits. They’ve improved measures following a 2021 security breach.

Poloniex uses similar security features but adds IP address monitoring and advanced encryption. Both exchanges require KYC verification for higher withdrawal limits.

Neither platform offers insurance on digital assets, so you should consider using personal wallets for long-term storage.

Can you outline the variety of cryptocurrencies available on BitMart versus Poloniex?

BitMart supports over 1,000 cryptocurrencies and typically lists new tokens faster than competitors. They feature many smaller altcoins and emerging projects not found on larger exchanges.

Poloniex offers approximately 300+ cryptocurrencies with a focus on established coins and tokens. Their selection tends to be more curated with fewer high-risk assets.

Both platforms support major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins, but BitMart provides access to more niche market options.

Which exchange offers better customer support, BitMart or Poloniex?

BitMart provides customer support through email, tickets, and limited live chat. Response times vary widely from hours to days depending on issue complexity and platform traffic.

Poloniex offers similar support channels but has generally received better user reviews for response times. Their knowledge base is more comprehensive and well-organized.

Neither exchange currently offers telephone support, which remains a limitation compared to larger platforms.

How do the user interfaces of BitMart and Poloniex differ for newcomers to crypto trading?

BitMart features a relatively straightforward interface with basic trading views, though some users report navigation can feel cluttered. Their mobile app receives mixed reviews for functionality.

Poloniex offers a cleaner interface with better organized menus and trading pairs. Their advanced trading views provide more technical analysis tools for experienced traders.

New users often find Poloniex’s learning curve slightly gentler, while BitMart’s interface requires more time to master despite recent improvements.

What are the liquidity and volume contrasts between BitMart and Poloniex?

BitMart reports higher daily trading volumes overall, particularly for newer altcoins and token offerings. This can mean better liquidity for traders of emerging assets.

Poloniex typically maintains stronger liquidity in established cryptocurrency pairs. Their market depth for major coins often shows tighter spreads between buy and sell orders.

During market volatility, both exchanges may experience slippage, but Poloniex generally demonstrates more stable order book depth for major cryptocurrency pairs.

Poloniex vs Bitmart Conclusion: Why Not Use Both?

After comparing Poloniex and BitMart, you might wonder which exchange is better. The answer depends on your specific needs.

BitMart has a higher overall score of 7.2 compared to Poloniex. It might be the preferred choice if you value a platform with strong overall performance.

Poloniex has backing from Goldman Sachs, making it attractive for both individual traders and firms involved in crypto trading.

Both exchanges offer built-in wallets for different tokens. This means you don’t need to set up separate wallets for each cryptocurrency you trade.

Consider using both platforms to enjoy their unique benefits. This strategy allows you to:

- Spread risk across multiple exchanges

- Access more trading pairs that might be exclusive to one platform

- Take advantage of different fee structures when profitable

- Maintain backup access to crypto markets if one exchange has downtime

You can start with smaller amounts on each platform to test their features. This hands-on experience will help you decide which exchange works better for different types of transactions.

Remember that diversifying your exchange usage can be a smart approach in the volatile crypto market.