Looking for the right cryptocurrency exchange can be tough with so many options available. BitMart and OKX are two popular platforms that many traders consider in 2025. When comparing BitMart vs OKX, you’ll find differences in their fee structures, available cryptocurrencies, trading features, and user experiences that could impact your trading success.

These exchanges offer different advantages depending on what you need. BitMart and OKX have unique approaches to compounding, interest rates, and platform features. For example, OKX offers a 1% BTC rate and includes compounding options, which might appeal to long-term investors.

Understanding how these exchanges differ can help you choose the platform that best fits your trading style and goals. Both platforms have received various user reviews and ratings that provide insights into their reliability and performance. The right choice depends on your specific requirements for fees, deposit methods, and the types of cryptocurrencies you want to trade.

Bitmart Vs OKX: At A Glance Comparison

When choosing between BitMart and OKX in 2025, understanding their key differences can help you make the right decision for your trading needs.

Trading Volume & Ranking

OKX typically ranks higher on cryptocurrency exchange listings based on trading volume and trust scores. This suggests OKX has greater liquidity, which can mean better prices and faster transactions for you.

Fee Comparison

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| BitMart | Moderate | Varies by coin |

| OKX | Lower overall | Competitive |

Available Features

BitMart offers:

- User-friendly interface

- Decent selection of cryptocurrencies

- Basic trading tools

OKX provides:

- More advanced trading options

- Wider range of cryptocurrencies

- Additional financial products

Security & Trust

OKX generally scores higher in trust ratings. This reflects better security practices and more transparent operations.

Best For

BitMart is better suited for beginners looking for a simple platform. OKX works well for more experienced traders who need advanced features and higher liquidity.

The differences between these exchanges matter most depending on what you want to do. Trading volume, available coins, and security should be top considerations when making your choice.

Bitmart Vs OKX: Trading Markets, Products & Leverage Offered

BitMart and OKX offer different trading options for crypto enthusiasts. Understanding these differences can help you choose the platform that fits your needs.

BitMart serves over 9 million users across more than 180 countries. The exchange provides spot trading for numerous cryptocurrencies and has been expanding its features.

OKX (formerly OKEx) generally scores higher in overall ratings with a 7.5 score compared to BitMart’s lower rating. OKX offers a more comprehensive suite of trading products.

Trading Products Comparison:

| Feature | BitMart | OKX |

|---|---|---|

| Spot Trading | ✅ | ✅ |

| Futures | ✅ | ✅ |

| Options | ❌ | ✅ |

| Margin Trading | ✅ | ✅ |

| Copy Trading | Limited | Extensive |

| Staking | Recently added | Well-established |

For leverage trading, both platforms offer options but with different maximums. BitMart has been adding leverage features along with new staking options.

OKX provides more advanced trading tools and higher leverage options for experienced traders. Their derivatives market is more developed with options trading not available on BitMart.

If you’re looking for variety in trading pairs, OKX typically offers more options. However, BitMart continues to expand its offerings and may be easier for beginners to navigate.

Both platforms support multiple fiat deposit methods, making it convenient to fund your account and begin trading.

Bitmart Vs OKX: Supported Cryptocurrencies

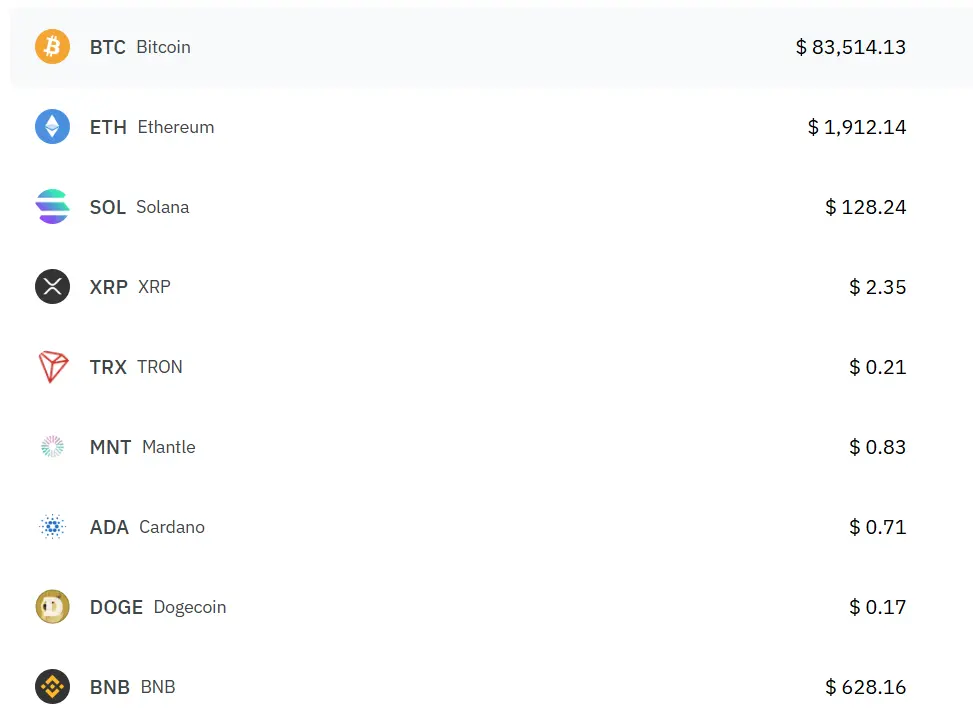

When choosing between BitMart and OKX (formerly OKEx), the range of available cryptocurrencies is an important factor to consider. According to recent information, OKX supports a higher number of cryptocurrencies than BitMart.

OKX offers traders access to a comprehensive selection of cryptocurrencies, including major coins like Bitcoin and Ethereum, as well as numerous altcoins and tokens. This wider variety gives you more trading options and portfolio diversification opportunities.

BitMart, while offering fewer cryptocurrencies than OKX, still provides access to many popular digital assets. The exchange includes both established coins and some emerging tokens that might not be available on larger platforms.

Cryptocurrency Support Comparison:

| Feature | OKX | BitMart |

|---|---|---|

| Total cryptocurrencies | Higher number | Lower number |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Altcoin variety | Extensive | Moderate |

| New/emerging tokens | Some | Some |

The difference in cryptocurrency selection might impact your trading strategy. If you’re looking to trade a wide range of assets, OKX’s larger selection could be more beneficial for your needs.

It’s worth noting that both exchanges regularly update their listings, adding new cryptocurrencies as they gain popularity and market traction. Always check their current offerings before making your decision.

Bitmart Vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

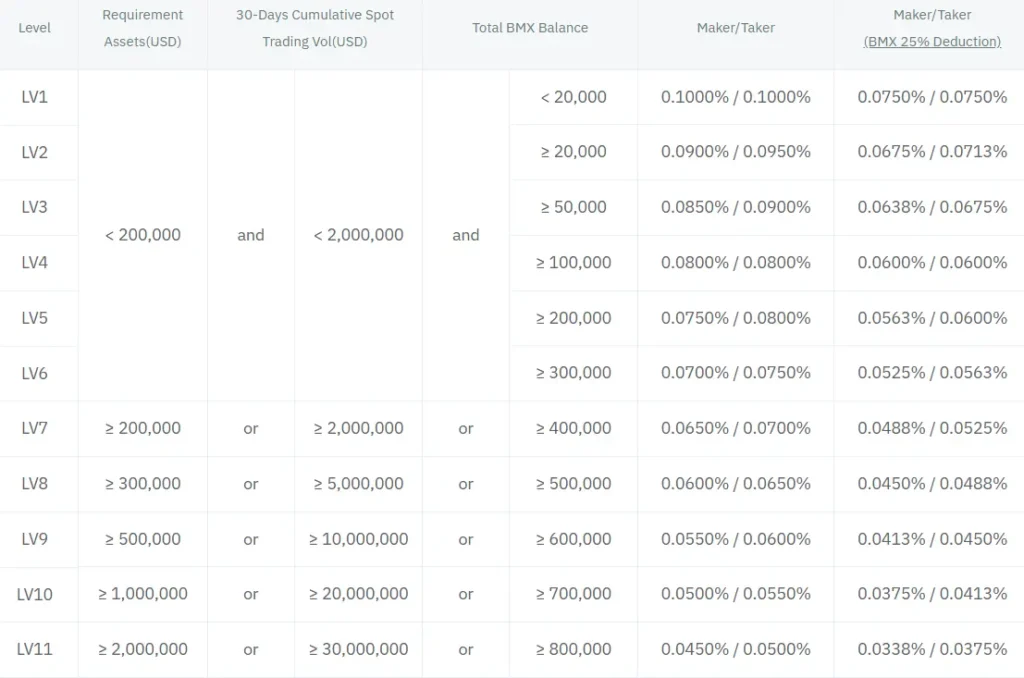

When choosing between BitMart and OKX, understanding their fee structures is crucial for your trading strategy.

Trading Fees

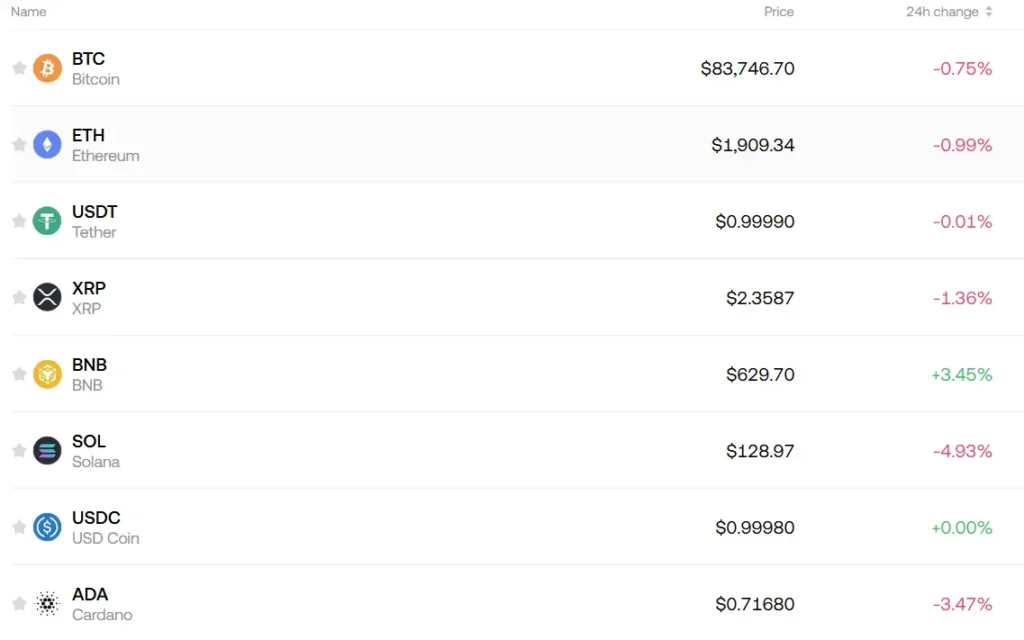

BitMart charges standard trading fees of around 0.25% for makers and takers. OKX offers slightly lower fees, starting at 0.10% for makers and 0.15% for takers.

Both exchanges offer fee discounts for high-volume traders and for using their native tokens. OKX’s tiered fee structure rewards frequent traders more aggressively than BitMart.

Deposit Fees

Good news! Both platforms offer free deposits for most cryptocurrencies. However, fiat deposits may incur fees depending on your payment method.

Withdrawal Fees

| Exchange | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| BitMart | 0.0005 BTC | 0.005 ETH |

| OKX | 0.0005 BTC | 0.001 ETH |

OKX generally has more competitive withdrawal fees, especially for Ethereum and ERC-20 tokens. BitMart’s withdrawal fees are slightly higher across most cryptocurrencies.

You should check the exact fees for your preferred cryptocurrencies, as they vary by asset and can change based on network conditions.

Both platforms offer multiple deposit and withdrawal methods. OKX provides more options for fiat transactions, which can be helpful if you frequently move between crypto and traditional currency.

Remember that withdrawal limits exist on both platforms and may require completion of higher verification levels to increase these limits.

Bitmart Vs OKX: Order Types

When trading on cryptocurrency exchanges, understanding order types is essential. Both Bitmart and OKX offer several order options, but they differ in some important ways.

Bitmart Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One Cancels Other)

Bitmart keeps things relatively simple with these standard options. You can execute immediate trades at market price or set specific price points with limit orders.

OKX Order Types:

- Market orders

- Limit orders

- Stop orders

- Trailing stop orders

- Iceberg orders

- TWAP (Time-Weighted Average Price)

- Algo orders

OKX clearly offers more advanced trading options. With iceberg orders, you can hide the true size of large orders to prevent market impact. The trailing stop feature helps you maximize profits in volatile markets.

For beginners, Bitmart’s simpler interface might be less overwhelming. You’ll find the basic order types sufficient for most trading strategies.

Advanced traders will appreciate OKX’s sophisticated order options. The platform allows for more precise trade execution and risk management through its expanded toolset.

Both exchanges support conditional orders, but OKX provides more flexibility for complex trading strategies. This makes it particularly valuable if you engage in frequent trading or manage significant positions.

Bitmart Vs OKX: KYC Requirements & KYC Limits

Both BitMart and OKX require KYC (Know Your Customer) verification to access higher withdrawal limits and complete trading functionality. These requirements help exchanges comply with regulations while protecting users from fraud.

BitMart KYC Levels:

BitMart offers a tiered KYC system:

- Level 1 KYC: Requires basic information and unlocks daily withdrawal limits of 0.5 BTC

- To complete KYC on BitMart, log into your account, go to account settings, find the KYC section, and select “Verify Now”

OKEx (OKX) KYC Requirements:

OKX also implements verification tiers to manage user access:

- Without KYC verification, users can still access limited functions

- For higher withdrawal limits and full features, identity verification is needed

Withdrawal Limits Comparison:

| Exchange | Without KYC | With Basic KYC | Full Verification |

|---|---|---|---|

| BitMart | Very limited | 0.5 BTC daily | Higher limits |

| OKX | Limited | Increased | Up to 20 BTC daily |

If privacy is your priority, OKX offers more generous withdrawal limits without full KYC. However, both exchanges will require some form of verification for regular traders.

Remember that KYC requirements may change as regulations evolve. Always check the latest requirements directly on the exchange websites.

Bitmart Vs OKX: Deposits & Withdrawal Options

Both BitMart and OKX offer multiple ways to deposit and withdraw your funds. These options are important to consider when choosing which exchange to use.

OKX Deposit Methods:

- Cryptocurrency transfers

- Bank transfers

- Credit/debit cards

- Third-party payment processors

OKX provides reasonable fees for deposits, though these vary by method. Some cryptocurrency deposits are free, while fiat deposits may include processing fees.

BitMart Deposit Methods:

- Cryptocurrency transfers

- Credit/debit cards

- Some bank transfer options

- Select third-party payment providers

BitMart’s deposit options are slightly more limited than OKX, especially for international users. However, they still cover the most common methods.

Withdrawal Comparison:

| Feature | OKX | BitMart |

|---|---|---|

| Crypto withdrawals | Yes | Yes |

| Fiat withdrawals | Yes (multiple currencies) | Limited |

| Withdrawal fees | Competitive | Generally higher |

| Processing time | Fast (varies by method) | Can be slower |

OKX generally offers more withdrawal options and often features lower fees. This makes it more convenient if you frequently move funds in and out of your account.

BitMart’s withdrawal process can sometimes take longer, and their fees tend to be slightly higher for both crypto and fiat options.

Both platforms enforce security measures like withdrawal confirmations and limits to protect your funds.

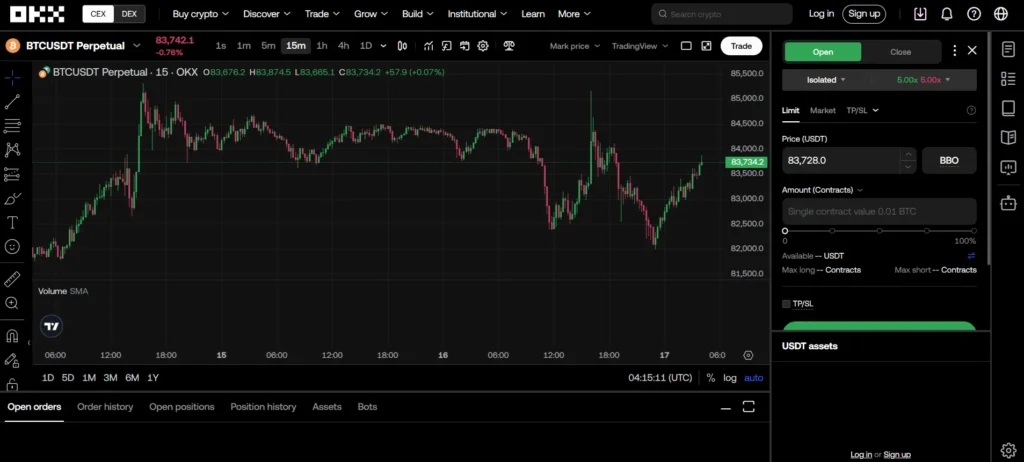

Bitmart Vs OKX: Trading & Platform Experience Comparison

BitMart and OKX offer different trading experiences that might affect your choice between them. Both exchanges support spot and derivatives trading, but there are key differences to consider.

OKX provides a more advanced trading platform with a wider range of trading types. The interface offers professional-grade charts and tools that experienced traders often prefer.

BitMart has a simpler, more user-friendly interface that beginners might find easier to navigate. However, it doesn’t offer as many advanced features as OKX.

Trading Features Comparison:

| Feature | BitMart | OKX |

|---|---|---|

| User Interface | Beginner-friendly | Professional, advanced |

| Mobile App | Yes, decent ratings | Yes, higher-rated app |

| Trading Types | Spot, futures | Spot, futures, options, margin |

| Chart Tools | Basic | Advanced |

OKX generally offers better liquidity, which means you’ll likely experience less price slippage when executing larger trades.

Both platforms provide mobile apps, but OKX’s app is typically rated higher for reliability and feature completeness.

The trading fees structure differs between the two exchanges. OKX usually offers more competitive rates for high-volume traders, while BitMart’s fee structure is simpler but potentially more expensive.

You’ll find that OKX supports more order types, including limit, market, stop-limit, and trailing stop orders, giving you more flexibility in your trading strategy.

Bitmart Vs OKX: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. Both BitMart and OKX have systems in place to protect traders and the platforms from excessive losses.

BitMart employs a liquidation mechanism that triggers when your margin balance falls below the maintenance margin requirement. This helps protect both you and the platform from significant losses during volatile market conditions.

OKX’s liquidation process is particularly notable due to recent events. In early 2025, OKX’s native token (OKB) experienced a dramatic 50% price drop within minutes due to a wave of liquidations. This event highlighted the importance of understanding liquidation risks.

Key Differences:

| Feature | BitMart | OKX |

|---|---|---|

| Liquidation Warning | Provides alerts when approaching margin limits | Offers tiered warning system |

| Liquidation Process | Full position liquidation | Partial liquidation possible |

| Recovery Mechanisms | Limited recovery options | Currently focusing on user loss recovery |

Both platforms carry liquidity risks that may affect your ability to withdraw funds quickly during market stress. OKX appears to have more sophisticated liquidation mechanisms but experienced a major liquidation event recently.

You should always maintain adequate margin in your trading accounts on either platform. Setting stop-loss orders can help you avoid liquidation scenarios altogether.

Trading with leverage requires understanding these mechanisms fully before committing significant capital to either platform.

Bitmart Vs OKX: Insurance

When trading on crypto exchanges, insurance is a key factor to consider for your asset protection. Both BitMart and OKX offer some form of insurance coverage, but they differ in their approaches.

OKX maintains a dedicated user protection fund worth over $300 million as of early 2025. This fund acts as insurance against unexpected trading losses and potential security breaches.

BitMart also offers insurance protection, but with a smaller reserve fund compared to OKX. After experiencing a significant hack in December 2021, BitMart strengthened its security measures and insurance policies.

Here’s a quick comparison of their insurance features:

| Feature | BitMart | OKX |

|---|---|---|

| Protection Fund | Yes (smaller) | Yes ($300M+) |

| SAFU-type Fund | Limited | Comprehensive |

| Third-party Insurance | Available | Available |

| Cold Wallet Coverage | Partial | Nearly Complete |

Both exchanges keep most user assets in cold storage to minimize risks. OKX stores approximately 95% of assets offline, while BitMart maintains a slightly lower percentage.

Neither exchange offers FDIC insurance since they operate outside traditional banking systems. This is standard across the crypto industry.

You should note that insurance policies may not cover all potential losses. Market volatility, personal errors, and some types of technical failures might not be eligible for compensation under either exchange’s policies.

BitMart Vs OKX: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your experience. Let’s look at how BitMart and OKX compare in this area.

OKX offers a comprehensive support system. You can reach their team through email, live chat, and phone support. Their agents are available 24/7, which is great if you need help at odd hours.

The support team at OKX is known for being responsive. This means you won’t have to wait long to get your issues resolved.

BitMart also provides customer support options, though specific details about their response times are less widely reported in our search results.

Both platforms offer knowledge bases and FAQ sections. These resources can help you solve common problems without needing to contact support directly.

Response times may vary depending on the complexity of your issue and current demand. During high-volume trading periods, you might experience longer wait times on both platforms.

When choosing between these exchanges, consider what type of support matters most to you. If phone support is important, OKX seems to have an edge based on the available information.

Remember to check the most recent user reviews for up-to-date experiences with each platform’s customer service. Support quality can change over time as companies adjust their resources.

Bitmart Vs OKX: Security Features

When choosing between Bitmart and OKX, security should be one of your top concerns. Both exchanges have implemented various measures to protect user funds and data.

Bitmart experienced a security breach in 2021, which prompted them to strengthen their security systems. They now offer two-factor authentication (2FA), anti-phishing codes, and regular security audits.

OKX (formerly OKEx) has a more robust security track record. They use multi-signature wallets and store the majority of user funds in cold storage to prevent hacking attempts.

Key Security Features Comparison:

| Feature | Bitmart | OKX |

|---|---|---|

| Two-factor authentication | ✓ | ✓ |

| Cold storage | Partial | 95%+ of funds |

| Anti-phishing protection | ✓ | ✓ |

| Withdrawal whitelist | ✓ | ✓ |

| Insurance fund | Limited | Comprehensive |

Both platforms require identity verification to comply with KYC (Know Your Customer) regulations. This helps prevent fraud and money laundering activities on their platforms.

OKX offers more advanced security features like withdrawal locks and security questions. You can also set up SMS alerts for account activities to stay informed about any suspicious actions.

For added protection, both exchanges let you create whitelisted withdrawal addresses. This means your funds can only be sent to pre-approved wallet addresses that you’ve verified.

Is Bitmart A Safe & Legal To Use?

BitMart’s safety is a mixed picture. The exchange experienced a significant security breach in December 2021, which raises some concerns about its overall security measures.

BitMart operates as a regulated cryptocurrency exchange that accepts both crypto and fiat currencies. This regulatory oversight adds a layer of legitimacy to its operations.

The exchange has a reasonable fee structure for its trading services, making it accessible to many users. However, it lacks Proof of Reserves to back customer assets, which is a security feature many top exchanges now offer.

According to recent information, BitMart may be facing government and legal challenges. These issues could potentially impact the platform’s stability and reliability in 2025.

When comparing BitMart to OKEx (now OKX), evaluation scores suggest that OKX offers better features and security. This is an important consideration when choosing between these exchanges.

Safety Tips When Using BitMart:

- Enable two-factor authentication

- Use strong, unique passwords

- Withdraw large amounts to personal wallets

- Keep up with security updates from the platform

BitMart is legal to use in most jurisdictions, but you should verify its status in your specific location as cryptocurrency regulations vary widely around the world.

Remember that no exchange is completely risk-free. Even with safety measures in place, you should exercise caution when storing significant assets on any platform.

Is OKX A Safe & Legal To Use?

OKX is considered a safe and legal cryptocurrency exchange for users in 2025. The platform has not experienced any hacking breaches so far, which is a positive sign for security-conscious traders.

Security at OKX includes several important features. They implement two-factor authentication (2FA), encryption, and cold storage for funds. These measures help protect your assets from unauthorized access.

OKX has received an “AA” rating from CertiK, a respected security auditor. It ranks #3 among the safest crypto exchanges according to search results.

The exchange operates under regulation from multiple financial authorities. This regulatory oversight provides an additional layer of protection for investors using the platform.

For beginners and experienced traders alike, OKX offers a secure environment to buy and sell cryptocurrency. The platform’s security measures make it a relatively safe choice in the crypto exchange landscape.

When comparing safety between different exchanges, OKX stands as one of the more secure options. However, as with any crypto platform, you should still practice good security habits like using strong passwords and enabling all available security features.

Frequently Asked Questions

Traders evaluating BitMart and OKX often have specific concerns about fees, security, and platform features. These exchanges differ significantly in several key areas that can impact your trading experience and costs.

What are the major differences in trading fees between BitMart and OKX?

OKX generally offers lower trading fees than BitMart. OKX’s fee structure starts at 0.1% for makers and 0.15% for takers, with potential reductions based on trading volume and OKB token holdings.

BitMart charges slightly higher fees, typically 0.25% for both makers and takers. However, BitMart provides fee discounts for users who hold their native BMX token.

Both exchanges offer fee reductions for high-volume traders, but OKX’s tiered discount structure tends to be more favorable for professional traders.

How do the security features of BitMart compare to those of OKX?

OKX employs more robust security measures, including multi-signature wallets, regular security audits, and up to 95% of assets stored in cold wallets. They maintain a significant insurance fund to protect user assets.

BitMart experienced a major security breach in December 2021, which affected user confidence. Since then, they’ve improved their security protocols with two-factor authentication and SSL encryption.

Both exchanges offer standard security features like anti-phishing codes and withdrawal confirmations, but OKX’s security track record has been stronger overall.

Which exchange, BitMart or OKX, offers a wider range of cryptocurrencies?

OKX supports over 350 cryptocurrencies and more than 600 trading pairs, making it one of the more comprehensive exchanges in terms of asset variety.

BitMart offers around 250 cryptocurrencies and approximately 500 trading pairs. While still extensive, its selection is somewhat more limited than OKX.

OKX also tends to list new, promising projects more quickly, which can be important if you’re interested in emerging cryptocurrencies.

Can users from the United States trade on both BitMart and OKX?

BitMart is available to US users in most states, though with some limitations depending on state regulations. They have obtained licenses to operate in many US jurisdictions.

OKX has traditionally restricted access to US traders. While they’ve recently begun exploring US market entry, their services remain limited for American users.

If you’re a US-based trader, BitMart currently offers more accessibility, though you should check the specific regulations for your state.

What are the customer support experiences like on BitMart vs. OKX?

OKX generally receives higher ratings for customer support, offering 24/7 live chat, email support, and an extensive help center. Response times average under 24 hours for most inquiries.

BitMart’s customer support has received mixed reviews, with some users reporting slower response times and difficulty resolving complex issues. They do offer multiple support channels including ticket systems and email.

Both exchanges provide support in multiple languages, but OKX covers more languages and typically provides more comprehensive assistance.

How do the mobile trading apps of BitMart and OKX differ in functionality and user experience?

OKX’s mobile app is more feature-rich, offering advanced trading tools, futures trading, staking options, and DeFi services all in one application. The interface is intuitive despite the complexity of features.

BitMart’s mobile app focuses on simplicity and is more beginner-friendly. It offers basic trading functionality but lacks some of the advanced features found in the OKX app.

Both apps provide real-time price alerts and portfolio tracking, but OKX’s app has better ratings on both iOS and Android platforms, suggesting higher user satisfaction.

OKX Vs Bitmart Conclusion: Why Not Use Both?

When comparing OKX and BitMart, both exchanges offer unique advantages that might benefit your trading strategy. OKX scores higher overall with a 7.5 rating compared to BitMart’s slightly lower score.

OKX provides a more robust platform with advanced features that experienced traders appreciate. Its interface is polished, and security measures are generally well-regarded in the crypto community.

BitMart, despite facing a security breach in 2021, has strengthened its security protocols. The exchange offers access to some tokens you might not find on other platforms.

The fees structure differs between these exchanges. Before committing to either one, compare their transaction costs based on your typical trading volume and frequency.

Why choose just one? Many crypto traders maintain accounts on multiple exchanges to:

- Take advantage of different coin offerings

- Capitalize on price discrepancies

- Reduce risk through platform diversification

- Access special features unique to each exchange

Volatility is a significant concern with both platforms. Cryptocurrency prices can change rapidly, affecting the value of your holdings regardless of which exchange you use.

Your trading needs might be best served by creating accounts on both OKX and BitMart. This approach gives you flexibility and more trading options without committing exclusively to either platform.

Remember to practice good security habits if you choose to use both exchanges, including strong passwords and two-factor authentication for all accounts.