Choosing the right cryptocurrency exchange can make a big difference in your trading experience. BitMart and KuCoin are two popular platforms that offer various trading options, but they have key differences worth exploring.

When comparing BitMart vs KuCoin in 2025, KuCoin stands out with its wider range of earning products including savings, staking, and lending programs, while BitMart offers its own unique set of features and trading options. Both exchanges have their strengths, which is why many crypto traders use multiple platforms to take advantage of different opportunities.

Understanding what makes each exchange unique can help you decide which one better suits your needs. From trading fees to available cryptocurrencies and security measures, there are several factors to consider before committing to either BitMart or KuCoin.

Bitmart Vs KuCoin: At A Glance Comparison

BitMart and KuCoin are popular cryptocurrency exchanges that offer various features for traders. Here’s a quick comparison to help you decide which platform might work better for your needs.

Trading Volume & Ranking

KuCoin typically ranks higher than BitMart in global exchange rankings. This is based on trading volume, user traffic, and trust scores according to CoinMarketCap and CoinGecko.

Available Cryptocurrencies

- KuCoin: 700+ cryptocurrencies

- BitMart: 400+ cryptocurrencies

Fees Structure

| Fee Type | BitMart | KuCoin |

|---|---|---|

| Spot Trading | 0.25% | 0.1% |

| Withdrawal | Varies by coin | Varies by coin |

Security Features

Both exchanges offer two-factor authentication and other security measures. KuCoin experienced a hack in 2020 but managed to recover most assets, while BitMart suffered a security breach in 2021.

User Experience

KuCoin offers a more advanced interface with additional trading tools and features. BitMart provides a simpler interface that might be easier for beginners to navigate.

Special Features

KuCoin provides unique offerings like Trading Bot, Lending, and KuCoin Shares (KCS) that give holders trading fee discounts. BitMart offers its BMX token with similar benefits but has fewer advanced trading features.

Regulatory Compliance

Both exchanges have faced regulatory challenges in various countries. You should check if either exchange is fully compliant in your region before signing up.

Bitmart Vs KuCoin: Trading Markets, Products & Leverage Offered

Both BitMart and KuCoin offer diverse cryptocurrency trading options but differ in several key areas. Let’s examine what each platform provides for traders.

KuCoin stands out with a wider range of cryptocurrencies available for trading. You’ll find over 700 different tokens on KuCoin, while BitMart offers around 400+ coins.

Available Products:

| Feature | BitMart | KuCoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Staking | ✓ | ✓ |

| Lending | Limited | Extensive |

| NFT Marketplace | No | Yes |

When it comes to leverage trading, KuCoin offers up to 100x leverage on futures contracts. BitMart provides more conservative options with maximum leverage of 50x on select trading pairs.

KuCoin’s advanced trading features include grid trading, futures bot trading, and lending programs. These tools make it more suitable for experienced traders who want to use advanced strategies.

BitMart offers simpler trading interfaces that might be easier to navigate for beginners. You’ll find basic spot trading and staking options clearly presented.

Both exchanges support fiat on-ramps, allowing you to purchase crypto with traditional currencies. KuCoin supports more payment methods for these transactions.

Trading fees are competitive on both platforms, with discounts available when using their native tokens for transaction fees.

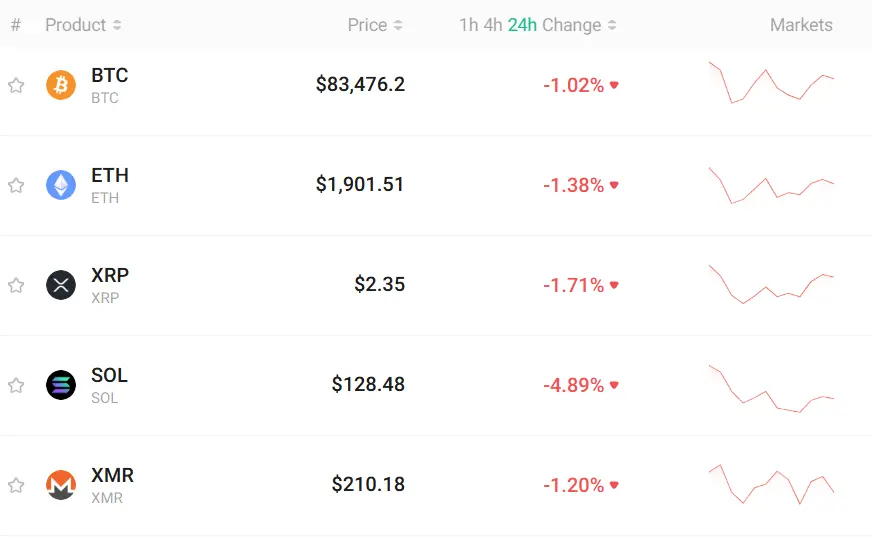

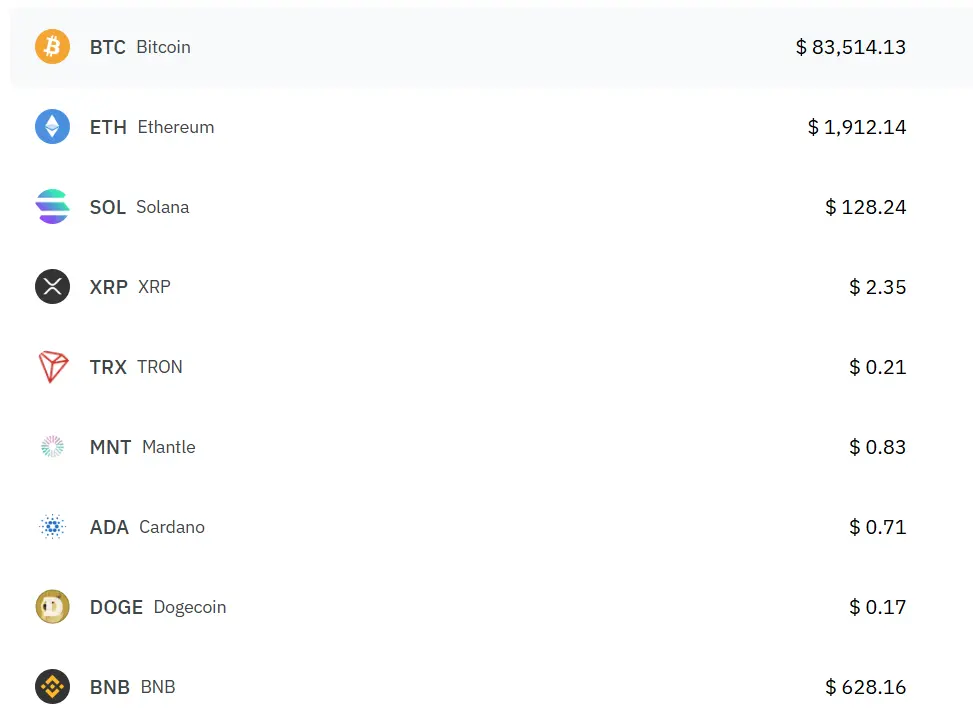

Bitmart Vs KuCoin: Supported Cryptocurrencies

When choosing between BitMart and KuCoin, the variety of available cryptocurrencies is an important factor to consider. Based on current information, KuCoin offers a larger selection of cryptocurrencies compared to BitMart.

KuCoin supports hundreds of different cryptocurrencies and trading pairs, making it a more versatile option if you’re looking to trade lesser-known tokens or altcoins. This wider selection gives you more opportunities to diversify your crypto portfolio.

BitMart still offers a decent range of cryptocurrencies, but its selection is more limited than KuCoin’s. However, both exchanges cover all the major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins.

If you’re interested in trading specific tokens, it’s worth checking both platforms to ensure they support your preferred cryptocurrencies. The availability of certain coins can change as exchanges regularly add new tokens.

Both exchanges also offer their own native tokens:

- KuCoin Token (KCS) – Current value: ~$11.99

- BitMart Token (BMX) – Current value: ~$0.31

KCS has a significantly larger market cap at approximately $1.47 billion compared to BMX’s market cap of around $99.5 million.

For traders focused on variety and access to a wide range of crypto assets, KuCoin generally provides more options. However, if the specific coins you want to trade are available on both platforms, you might want to consider other factors in your decision.

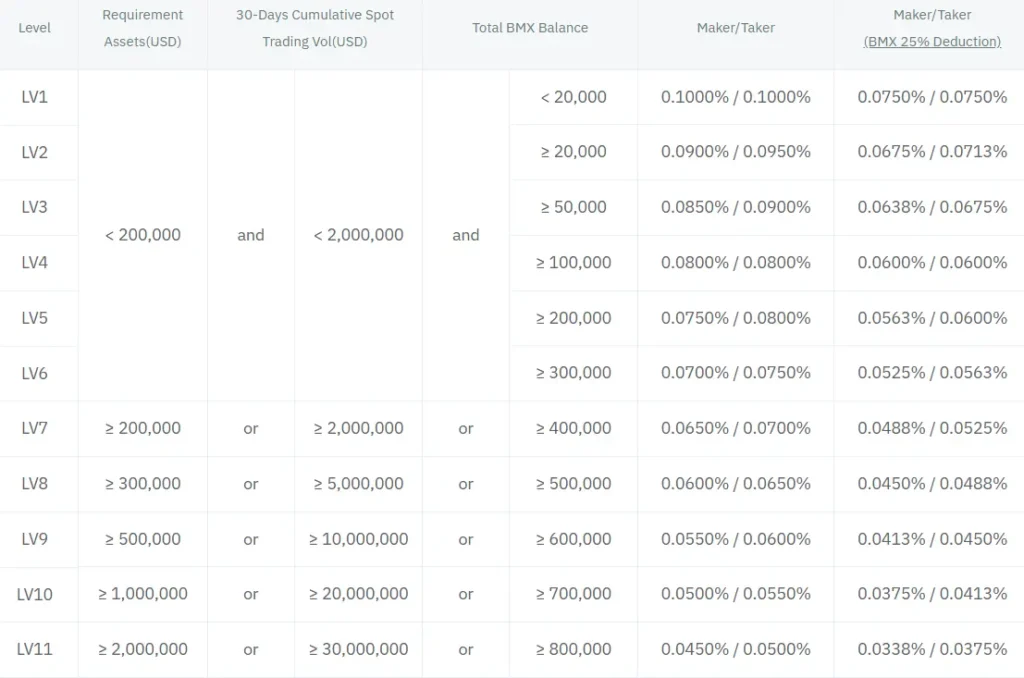

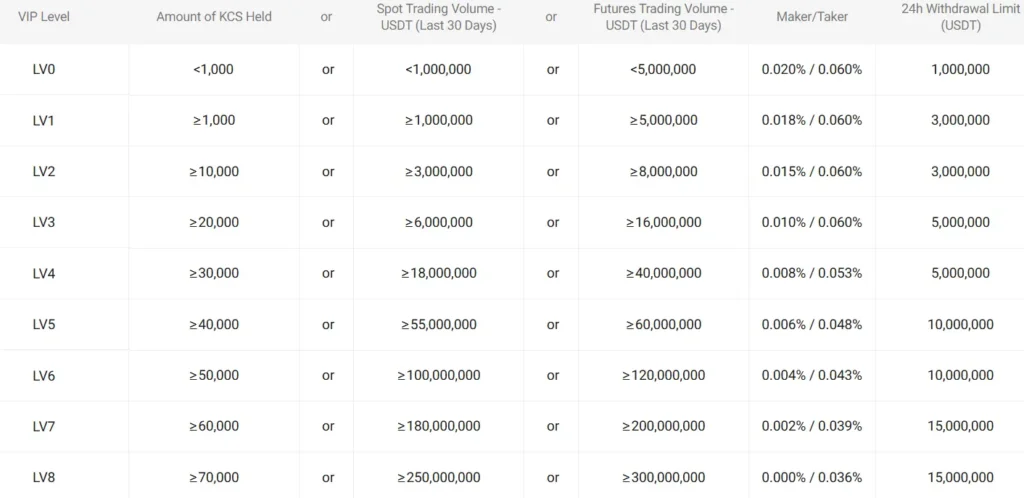

BitMart Vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BitMart and KuCoin, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

- KuCoin: Up to 0.40% per trade

- BitMart: Up to 0.60% per trade

KuCoin offers slightly lower trading fees compared to BitMart. This difference can add up if you’re an active trader making multiple transactions.

Withdrawal Fees

- KuCoin: Up to $60 or 0.1% (can be as high as 0.001 BTC for some cryptocurrencies)

- BitMart: Up to 0.001 BTC for certain assets

Both platforms use variable withdrawal fees depending on the cryptocurrency you’re withdrawing. KuCoin’s fee structure is more complex with percentage-based options.

Deposit Fees

Neither exchange charges fees for depositing crypto. This is standard across most cryptocurrency exchanges and gives you flexibility to fund your account.

You can reduce your trading costs on KuCoin by holding their native KCS token, which provides fee discounts similar to how other exchanges operate.

BitMart’s fee structure is more straightforward but tends to be higher overall. The platform compensates with other features that might be valuable depending on your trading style.

Remember that fees can change based on market conditions and platform updates. It’s always best to check the current fee schedules on both exchanges before making your decision.

Bitmart Vs KuCoin: Order Types

When trading on cryptocurrency exchanges, the variety of order types available can significantly impact your trading strategy. Both BitMart and KuCoin offer several order types to help you execute trades effectively.

KuCoin provides a more comprehensive range of order types. You can access standard market and limit orders, plus more advanced options like stop-limit orders, post-only orders, and iceberg orders.

BitMart offers the basic market and limit orders that most traders need. However, it lacks some of the more sophisticated order types found on KuCoin.

KuCoin Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Post-only orders

- Iceberg orders

- OCO (One-Cancels-the-Other)

BitMart Order Types:

- Market orders

- Limit orders

- Stop orders

KuCoin’s trading interface is designed for both beginners and advanced traders. You can easily switch between basic and advanced views depending on your experience level.

BitMart’s simpler selection of order types might be sufficient if you’re new to crypto trading. You won’t feel overwhelmed by too many options.

For margin trading, KuCoin again offers more flexibility with cross and isolated margin options. BitMart’s margin trading features are more limited in comparison.

If you use technical analysis or algorithmic trading strategies, KuCoin’s advanced order types will give you more control over your trades and help you implement complex strategies.

Bitmart Vs KuCoin: KYC Requirements & KYC Limits

Both BitMart and KuCoin have different approaches to KYC (Know Your Customer) requirements, which impacts how much you can withdraw and what features you can access.

BitMart KYC Levels:

- Starter: Basic verification

- Advanced: More thorough verification

- Daily withdrawal limits vary based on your verification level

BitMart requires users to complete KYC verification to use their platform fully. Without verification, your access to certain features will be limited.

KuCoin KYC Approach:

- More flexible for small traders

- You can trade without KYC for smaller transactions

- Non-KYC daily withdrawal limit: 20,000 USDT

- Higher limits require ID verification and proof of address

KuCoin is often preferred by users seeking privacy as it allows basic trading without mandatory KYC. However, to access earn products and higher withdrawal limits, you’ll need to complete verification.

Which is better for privacy? KuCoin offers more flexibility if you want to trade smaller amounts without providing personal information.

Which has higher limits? Both exchanges increase your withdrawal limits after you complete verification, but KuCoin’s initial non-KYC limit of 20,000 USDT is relatively generous.

Your choice depends on your privacy preferences and trading volume. If you plan to trade large amounts, you’ll eventually need to complete KYC on either platform.

Bitmart Vs KuCoin: Deposits & Withdrawal Options

When choosing between BitMart and KuCoin, understanding their deposit and withdrawal options is essential for your trading experience.

KuCoin offers more deposit methods than BitMart. You can fund your KuCoin account using cryptocurrencies, credit/debit cards, and third-party payment processors.

BitMart primarily focuses on cryptocurrency deposits, with fewer fiat options available. This might limit your choices if you prefer direct bank transfers.

Withdrawal options comparison:

| Feature | KuCoin | BitMart |

|---|---|---|

| Crypto withdrawals | Extensive selection | Good selection |

| Fiat withdrawals | Limited options | Very limited |

| Withdrawal fees | Competitive | Generally higher |

| Processing time | Usually faster | Can be slower |

Both exchanges require KYC verification for larger withdrawals. KuCoin typically processes withdrawals faster, which is important when you need quick access to your funds.

The minimum withdrawal amounts vary by cryptocurrency on both platforms. KuCoin tends to have lower minimum withdrawal requirements for most popular coins.

Remember that withdrawal fees can significantly impact your profits, especially for frequent traders. KuCoin generally offers more competitive withdrawal fees compared to BitMart.

For security purposes, both exchanges implement withdrawal address whitelisting. This adds an extra layer of protection for your funds.

Bitmart Vs KuCoin: Trading & Platform Experience Comparison

BitMart and KuCoin offer different trading experiences that might affect your choice between them.

User Interface

- BitMart provides a straightforward interface that’s easier for beginners

- KuCoin offers a more feature-rich platform with advanced charting tools

- Both have mobile apps, but KuCoin’s app receives higher ratings for stability

Trading Features

| Feature | BitMart | KuCoin |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures Trading | Limited | Extensive |

| Trading Bots | No | Yes |

| Trading Fees | 0.25% (standard) | 0.1% (standard) |

KuCoin stands out with its Trading Bot feature that lets you automate strategies. This gives you an edge if you want to trade without constant monitoring.

Available Assets

BitMart lists approximately 1,000+ cryptocurrencies while KuCoin offers 700+. However, KuCoin typically adds new promising projects faster.

Trading Volume

KuCoin consistently maintains higher daily trading volumes, which results in better liquidity and tighter spreads for popular trading pairs.

Platform Reliability

KuCoin has fewer reported outages during high market volatility. This reliability is crucial when you need to execute trades during market movements.

Learning Resources

KuCoin provides more comprehensive educational materials including guides, videos, and trading tutorials. BitMart’s resources are more basic but still helpful for newcomers.

Bitmart Vs KuCoin: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for your risk management. Both BitMart and KuCoin implement liquidation processes to protect themselves when markets move against leveraged positions.

KuCoin uses a tiered liquidation system that gradually reduces your position size as your margin ratio approaches the liquidation threshold. This system gives you a chance to add funds before complete liquidation occurs.

BitMart, in comparison, typically uses a more straightforward liquidation process. Your position gets closed when your maintenance margin level is reached, with less graduated warnings.

KuCoin Liquidation Process:

- Initial margin call warning at approximately 80% margin ratio

- Partial liquidation begins at lower thresholds

- Insurance fund used to cover losses when necessary

- Liquidation fees: 0.5% to 2% depending on the asset

BitMart Liquidation Process:

- Single liquidation threshold with fewer intermediate steps

- Full position closure when maintenance margin is reached

- Similar insurance fund structure

- Liquidation fees: Generally 1% to 2.5%

Both exchanges calculate liquidation prices based on your position size, leverage used, and maintenance margin requirements. However, KuCoin’s more gradual approach may give traders additional time to react during volatile market conditions.

The liquidation mechanisms on both platforms aim to protect the exchange while maintaining market stability. Your choice between them might depend on whether you prefer KuCoin’s more nuanced approach or BitMart’s straightforward system.

Bitmart Vs KuCoin: Insurance

When choosing a cryptocurrency exchange, insurance coverage is crucial for protecting your assets. Both BitMart and KuCoin offer different approaches to security and insurance.

KuCoin maintains a dedicated insurance fund called the “Safeguard Program.” This fund allocates 10% of all trading fees to protect users against potential security breaches or hacks. As of March 2025, this fund has grown significantly, providing users with an added layer of protection.

BitMart, following a major security breach in December 2021, strengthened its security measures. However, BitMart’s insurance coverage is less transparent compared to KuCoin. They don’t clearly advertise a dedicated insurance fund like KuCoin does.

Insurance Comparison Table:

| Feature | KuCoin | BitMart |

|---|---|---|

| Dedicated Insurance Fund | Yes (Safeguard Program) | Not clearly specified |

| Coverage Transparency | High | Low |

| Fund Source | 10% of trading fees | Not disclosed |

| Past Security Incidents | Minor incidents, quickly addressed | Major breach in 2021 |

Both exchanges implement standard security features like cold storage for most assets and two-factor authentication. However, KuCoin’s more transparent approach to insurance gives you clearer information about how your funds might be protected in worst-case scenarios.

You should consider insurance as just one factor in your decision between these exchanges. Review their security history, user protection policies, and recovery plans for a complete picture.

Bitmart Vs KuCoin: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a big difference in your trading experience. Both BitMart and KuCoin offer support options, but they differ in quality and accessibility.

KuCoin provides 24/7 customer support through multiple channels. You can reach their team via live chat, support tickets, and email. Many users report relatively fast response times compared to other exchanges.

BitMart also offers customer support through similar channels. However, based on user feedback, response times can be slower than KuCoin, especially during busy trading periods.

Both platforms provide knowledge bases and FAQs to help you solve common issues without contacting support. KuCoin’s help center is generally considered more comprehensive and easier to navigate.

Support Options Comparison:

| Feature | KuCoin | BitMart |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Support Tickets | Yes | Yes |

| Response Time | Faster | Slower |

| Help Center | More comprehensive | Basic |

One advantage of KuCoin is its active community forums where you can get help from other users while waiting for official support.

Language support is available in multiple languages on both platforms, making them accessible to global users. KuCoin offers support in more languages than BitMart.

Bitmart Vs KuCoin: Security Features

When choosing between Bitmart and KuCoin, security should be at the top of your priority list. Both exchanges offer essential security measures but differ in their implementation.

KuCoin provides a robust security framework with two-factor authentication (2FA) and multi-layer encryption. Their platform employs hot and cold wallet systems, with the majority of assets stored in cold wallets away from potential online threats.

Bitmart also utilizes 2FA and encryption protocols to protect user accounts. After experiencing a security breach in 2021, Bitmart strengthened their security infrastructure significantly.

Here’s a quick comparison of key security features:

| Security Feature | KuCoin | Bitmart |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | 90% of assets | Majority of assets |

| Insurance Fund | Available | Limited |

| Security History | No major breaches | Had a breach in 2021 |

| KYC Requirements | Basic and advanced tiers | Required for withdrawals |

KuCoin offers additional security through trading password protection and anti-phishing codes in emails. This gives you an extra layer of protection against potential scams.

Bitmart has implemented regular security audits and enhanced their monitoring systems. You’ll find their withdrawal process includes verification steps to prevent unauthorized access.

Both exchanges provide security notifications for account activities, but KuCoin’s notification system is more comprehensive, alerting you to any unusual login attempts or changes to your account.

Is Bitmart A Safe & Legal To Use?

Bitmart is a legitimate cryptocurrency exchange that operates legally in many countries. According to search results, despite some negative feedback, it’s not a scam but a genuine platform for trading digital assets.

The exchange did experience a security incident in December 2021, which might raise concerns. However, search results indicate that Bitmart is still considered a safe option for cryptocurrency trading.

User reviews suggest that customer support responsiveness can be challenging at times. Some users have reported difficulties getting timely responses when issues arise.

In terms of cryptocurrency options, Bitmart offers a decent selection, though KuCoin appears to have a larger variety of supported cryptocurrencies based on the search results.

Bitmart implements standard security measures to protect user funds and data. Like most reputable exchanges, they use features such as:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- KYC verification procedures

- Regular security audits

When using Bitmart, you should still follow basic cryptocurrency security practices:

- Use strong, unique passwords

- Enable all available security features

- Consider using a hardware wallet for long-term storage

- Only invest what you can afford to lose

Is KuCoin A Safe & Legal To Use?

KuCoin has been operating since 2017 and is considered a legitimate cryptocurrency exchange. The platform implements several security features to protect user assets.

However, it’s important to note that KuCoin experienced a major hack in 2020. After this incident, they strengthened their security measures to better protect users.

KuCoin operates in what some consider a “gray area” regarding regulation. The exchange does not hold licenses from major financial regulatory bodies like the FCA.

Security features include:

- Multi-signature offline crypto wallets

- Two-factor authentication (2FA)

- Anti-phishing safety phrases

These measures help reduce the risk of cyber attacks and provide users with additional peace of mind.

When using KuCoin, it’s advisable to follow these safety practices:

- Enable all security features

- Use strong, unique passwords

- Consider not storing large amounts long-term on the exchange

If you’re concerned about safety, you might want to use the platform only for trading and move your assets to a personal wallet for storage.

While KuCoin is generally considered safe to use, the lack of strong regulatory oversight means you should exercise caution when using their services.

Frequently Asked Questions

Both BitMart and KuCoin offer distinct features that cater to different types of crypto traders. These exchanges have notable differences in security measures, fee structures, available cryptocurrencies, and user experience.

What are the key differences in security features between BitMart and KuCoin?

KuCoin implements more robust security measures with its multi-layer protection system. They utilize industry-standard encryption, two-factor authentication, and regular security audits.

BitMart offers basic security features but has experienced a significant hack in December 2021. Since then, they’ve strengthened their security protocols and implemented insurance funds.

KuCoin also provides an advanced risk control system that monitors unusual account activities. Their cold storage policy keeps the majority of user assets offline for added protection.

How do the trading fees compare between BitMart and KuCoin?

KuCoin typically offers lower trading fees, starting at 0.1% for makers and takers. These fees can be reduced further by holding their native KCS token or increasing trading volume.

BitMart’s fee structure is slightly higher, with standard trading fees around 0.25%. They also offer fee discounts based on trading volume and BMX token holdings.

KuCoin provides more fee reduction options overall. Their tiered VIP system rewards high-volume traders with significantly lower costs.

Can you highlight the variety of cryptocurrencies available on BitMart versus KuCoin?

KuCoin supports over 700 cryptocurrencies and offers more than 1,100 trading pairs. This extensive selection includes major coins, altcoins, and many emerging tokens.

BitMart lists approximately 350-400 cryptocurrencies with around 900 trading pairs. While less than KuCoin, they still provide a diverse range of options.

KuCoin is often quicker to list new and promising projects. This makes it particularly attractive if you’re interested in discovering early-stage cryptocurrencies with growth potential.

What are the customer service experiences like on BitMart compared to KuCoin?

KuCoin provides 24/7 customer support through multiple channels including live chat, email, and an extensive knowledge base. Response times are generally within 24 hours.

BitMart’s customer service has received mixed reviews. Some users report slower response times, particularly during high-volume trading periods.

KuCoin’s support is available in more languages, making it more accessible to a global user base. They also offer dedicated VIP support for high-volume traders.

How do BitMart and KuCoin differ in terms of user interface and ease of use?

KuCoin offers a more sophisticated interface with advanced trading tools. This includes detailed charting options, trading bots, and customizable layouts for experienced traders.

BitMart provides a simpler, more straightforward interface that beginners find easier to navigate. Their mobile app is also designed with simplicity in mind.

If you’re new to crypto trading, BitMart’s learning curve is less steep. However, as you grow more experienced, KuCoin provides more powerful tools to enhance your trading strategies.

What are the unique selling points of BitMart and KuCoin compared to other exchanges?

KuCoin stands out with its Trading Bot feature, allowing automated trading strategies. Their Spotlight token launch platform and KuCoin Earn program also provide unique opportunities.

BitMart distinguishes itself with the BitMart Shooting Star program for new token listings. They also offer competitive staking options and regular promotional activities.

KuCoin’s native token (KCS) provides significant benefits through KCS bonuses, where holders receive daily dividends from trading fees. BitMart’s BMX token offers similar but less extensive benefits.

BitMart Vs KuCoin Conclusion: Why Not Use Both?

When comparing BitMart and KuCoin, both exchanges offer unique advantages that might appeal to different trading needs.

KuCoin stands out with a smoother user experience and interface according to many users. The platform is known for being more intuitive, which can be particularly helpful if you’re newer to crypto trading.

BitMart offers its own set of benefits, including different fee structures and coin offerings that might not be available on KuCoin.

Why consider using both platforms:

- Diversified access: Each exchange lists different cryptocurrencies

- Risk management: Spreading assets across platforms reduces single-point failure risk

- Fee optimization: Take advantage of lower fees for specific transactions on each platform

- Trading opportunities: Access unique features like trading competitions or staking options specific to each exchange

You can use KuCoin for its user-friendly experience when performing everyday trades. Meanwhile, BitMart might serve as your platform for accessing specific tokens not available elsewhere.

The crypto landscape changes rapidly, and having accounts on multiple exchanges gives you flexibility. You’ll be prepared to move quickly when opportunities arise.

Remember to maintain proper security practices with both platforms by using strong passwords, enabling two-factor authentication, and keeping only trading amounts on the exchanges.