Looking for the right crypto exchange? BitMart and Coinbase are two popular choices with different strengths. As of March 2025, these platforms serve millions of users worldwide with distinct features and capabilities.

Coinbase is known for its user-friendly interface and security, while BitMart stands out for its extensive selection of altcoins not available on other exchanges. Launched in 2017, BitMart now serves over 9 million users across more than 180 countries, offering a comprehensive trading platform for cryptocurrency enthusiasts.

When choosing between these exchanges, you’ll want to consider factors like fees, available cryptocurrencies, and trading options. Coinbase typically appeals to beginners and those prioritizing security, whereas BitMart attracts traders looking for rare digital assets and more diverse trading opportunities.

Bitmart Vs Coinbase: At A Glance Comparison

When choosing between BitMart and Coinbase, understanding their key differences helps you make the right decision for your crypto needs. Both platforms offer cryptocurrency trading but have distinct features that set them apart.

Platform Basics:

| Feature | BitMart | Coinbase |

|---|---|---|

| User Interface | Moderate complexity | Beginner-friendly |

| Cryptocurrencies | Wider selection | More limited but carefully vetted |

| Security | Standard security | Industry-leading security measures |

| Target Users | Intermediate traders | Beginners and institutional investors |

BitMart offers a 1.5% interest rate on Bitcoin and includes compounding features. This might appeal to you if you’re looking to grow your crypto holdings passively.

Coinbase is known for its ease of use and strong reputation in the market. The platform has powerful trading tools and various order types to match different trading styles.

Fee Comparison:

- BitMart typically has lower trading fees

- Coinbase charges premium fees but provides enhanced security and service

- Both platforms have varying withdrawal fees depending on the cryptocurrency

You’ll find BitMart offers more cryptocurrencies, making it suitable if you’re interested in trading newer or less established tokens.

Coinbase focuses on quality over quantity, listing fewer cryptocurrencies but with stronger verification processes. This approach provides you with added security when trading on their platform.

Bitmart Vs Coinbase: Trading Markets, Products & Leverage Offered

BitMart and Coinbase offer different trading options that might affect your choice between platforms. Understanding what each exchange provides can help you make a better decision.

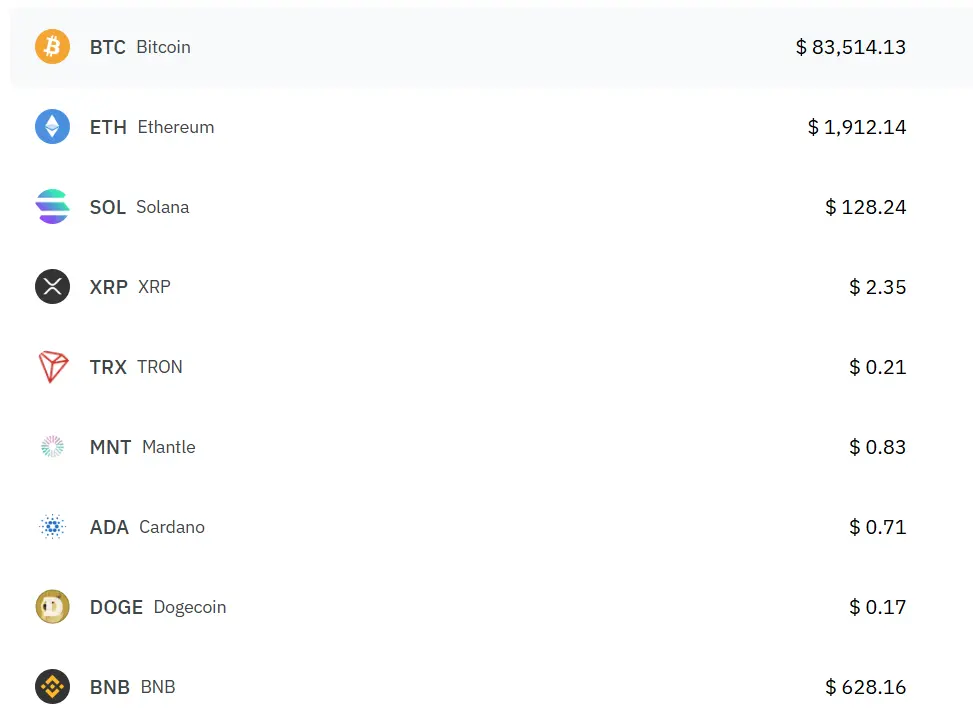

Available Cryptocurrencies:

- BitMart: Offers access to over 1,700 cryptocurrencies

- Coinbase: Provides fewer options but focuses on well-established coins

BitMart stands out for altcoin traders who want access to a wider variety of tokens. If you’re looking for newer or less common cryptocurrencies, BitMart likely has more options.

Trading Products:

| Feature | BitMart | Coinbase |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | Limited |

| P2P Trading | ✓ | ✗ |

| Staking | ✓ | ✓ |

BitMart offers peer-to-peer trading options that Coinbase doesn’t provide. This gives you more flexibility when buying or selling directly with other users.

Leverage Trading:

BitMart provides leverage trading options for users who want to amplify their trading potential. Coinbase has more limited leverage offerings through their advanced platform.

Market Tools:

Both platforms offer trading charts and analysis tools, but their interfaces differ significantly. Coinbase provides a more beginner-friendly experience with simpler tools.

Your trading style and cryptocurrency preferences should guide your choice. BitMart might be better if you want more variety and advanced trading options, while Coinbase offers a more streamlined experience with established cryptocurrencies.

Bitmart Vs Coinbase: Supported Cryptocurrencies

When choosing between Bitmart and Coinbase, the range of cryptocurrencies each platform supports is an important factor to consider.

Coinbase offers a larger selection of cryptocurrencies compared to Bitmart. This gives you more options when diversifying your crypto portfolio.

Bitmart, however, shines in the altcoin department. If you’re looking for lesser-known or emerging cryptocurrencies not available on mainstream exchanges, Bitmart might be your better option.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | Coinbase | Bitmart |

|---|---|---|

| Major cryptocurrencies (BTC, ETH, etc.) | ✅ | ✅ |

| Number of cryptocurrencies | Higher | Lower |

| Rare altcoins | Limited | Extensive |

| New token listings | Selective | Frequent |

Coinbase focuses on established cryptocurrencies with proven track records. Their strict listing requirements mean you’ll find fewer but potentially more stable options.

Bitmart takes a different approach by offering many altcoins that aren’t available on larger exchanges. This makes it attractive if you’re hunting for the next big crypto opportunity.

Your choice between these platforms may depend on your investment strategy. If you prefer sticking with well-known cryptocurrencies, Coinbase provides a solid selection. For those seeking variety and access to emerging tokens, Bitmart offers more possibilities.

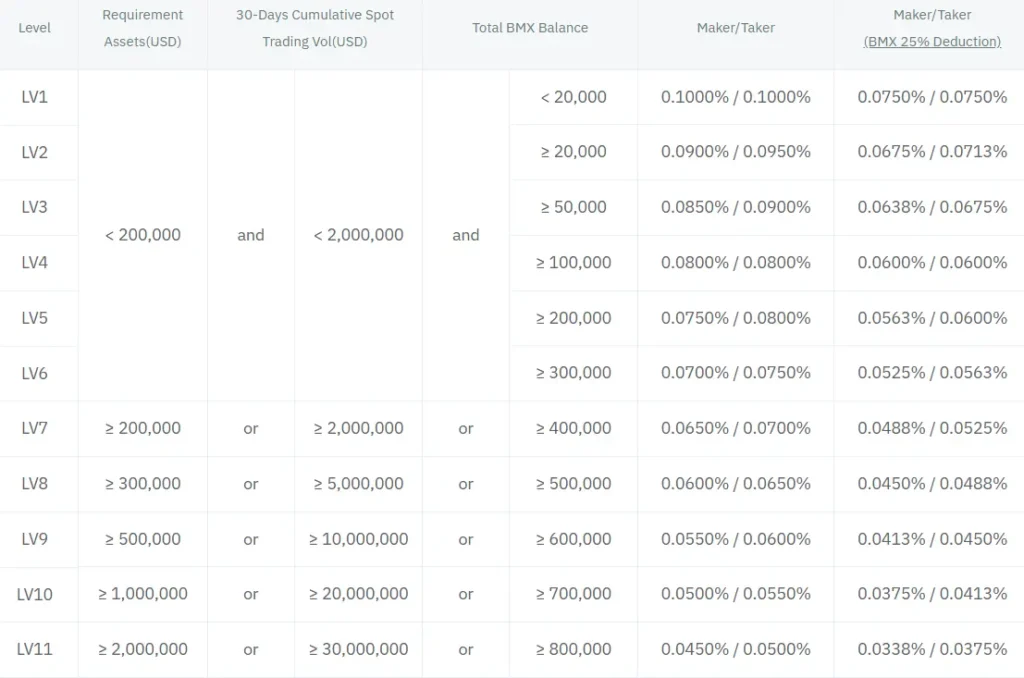

Bitmart Vs Coinbase: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Bitmart and Coinbase, fees are an important factor to consider. Based on recent data, Coinbase offers lower trading fees with percentages up to 0.60%, while Bitmart’s fees are generally higher.

Coinbase’s fee structure is more straightforward, but you should know that their convenience comes with a price. They charge higher fees for small transactions, which can add up if you trade frequently with small amounts.

Bitmart offers trading in more countries (180 compared to Coinbase’s 100), but you should review their fee chart carefully before opening an account. Their fee structure can be more complex and varies depending on your trading volume.

Trading Fee Comparison:

| Exchange | Trading Fee |

|---|---|

| Coinbase | Up to 0.60% |

| Bitmart | Higher (varies) |

For deposits, Coinbase supports more traditional payment methods like bank transfers and credit cards. Bitmart focuses more on crypto-to-crypto exchanges.

Withdrawal fees differ between platforms too. Coinbase tends to have competitive withdrawal fees for major cryptocurrencies, while Bitmart’s fees vary by cryptocurrency.

You should check both platforms’ current fee structures before deciding, as they update their pricing models regularly. The right choice depends on your trading volume, location, and which cryptocurrencies you plan to trade.

Bitmart Vs Coinbase: Order Types

When trading cryptocurrency, the types of orders available can significantly impact your trading strategy. Coinbase and BitMart offer different options in this area.

Coinbase provides a more comprehensive selection of order types. You can use market orders, limit orders, and stop orders on Coinbase. This variety gives you more control over your trading approach.

BitMart offers a more limited selection. According to recent information, BitMart only supports two order types: market orders and limit orders.

Market orders execute immediately at the current market price. They’re perfect when you need to buy or sell quickly.

Limit orders allow you to set a specific price at which you want to buy or sell. Your order will only execute if the market reaches your specified price.

Coinbase’s additional stop orders let you set automatic buy or sell triggers when prices reach certain levels. This feature helps protect your investments from significant market drops.

The difference in available order types might influence your choice between these platforms. If you use advanced trading strategies that rely on stop orders, Coinbase would be the better option for you.

For basic trading needs using just market and limit orders, either platform will work well for your requirements.

Bitmart Vs Coinbase: KYC Requirements & KYC Limits

Both BitMart and Coinbase require Know Your Customer (KYC) verification, but they differ in their approaches and limits.

BitMart KYC Levels:

- Starter Level: Basic verification

- Advanced Level: More comprehensive verification

- Each level has different verification requirements and daily limits

Without completing KYC on BitMart, your trading capabilities and withdrawal options will be severely limited.

Coinbase KYC Process:

- Mandatory for all users

- Requires personal information, ID verification, and sometimes additional documentation

- Full verification needed to access all platform features

Coinbase is known for its strict compliance with regulations, which means its KYC process tends to be more rigorous than some competitors.

Withdrawal Limits Comparison:

| Exchange | Without KYC | With Basic KYC | With Full KYC |

|---|---|---|---|

| BitMart | Very limited | Increased limits | Highest limits |

| Coinbase | Not available | Limited access | Full platform access |

If privacy is your priority, it’s worth noting that BitMart appears to offer some functionality with lower KYC requirements compared to Coinbase.

For high-volume traders, completing the full KYC process on either platform is recommended to access higher withdrawal limits and all available features.

Bitmart Vs Coinbase: Deposits & Withdrawal Options

When choosing between BitMart and Coinbase, understanding how you can add or remove funds is crucial. Both platforms offer different options that might affect your decision.

Coinbase Deposit Methods:

- Bank transfers (ACH)

- Wire transfers

- Credit/debit cards

- PayPal (in some regions)

- Cryptocurrency transfers

BitMart Deposit Methods:

- Cryptocurrency transfers

- Credit/debit cards

- Limited bank transfer options

Coinbase provides more traditional banking options for deposits, making it easier for beginners to start trading. BitMart tends to focus more on crypto-to-crypto transactions.

Withdrawal Options Comparison:

| Feature | Coinbase | BitMart |

|---|---|---|

| Bank withdrawals | Yes | Limited |

| Crypto withdrawals | Yes | Yes |

| PayPal support | Yes (select regions) | No |

| Processing time | 1-5 business days (fiat) | 1-3 business days (fiat) |

| Crypto transfer time | 30-45 minutes | 30-45 minutes |

Coinbase charges varying withdrawal fees depending on the method used. Their network fees for crypto transfers can be higher than some competitors.

BitMart also charges withdrawal fees that vary by cryptocurrency. They typically have daily withdrawal limits based on your verification level.

You should consider processing times when planning your trading strategy. Crypto transfers between exchanges like Coinbase to BitMart typically take 30-45 minutes, depending on network congestion.

Bitmart Vs Coinbase: Trading & Platform Experience Comparison

When choosing between BitMart and Coinbase, the trading experience and platform features play a crucial role in your decision.

User Interface

- Coinbase offers a clean, beginner-friendly interface that’s easy to navigate

- BitMart provides a more complex interface with advanced trading tools

- Both platforms have mobile apps, but Coinbase’s app is typically rated higher for ease of use

Trading Features

- BitMart supports more cryptocurrencies than Coinbase

- Coinbase offers simpler buying/selling options perfect for beginners

- BitMart provides more advanced trading options including futures trading

Fees Structure

| Platform | Trading Fees | Withdrawal Fees |

|---|---|---|

| Coinbase | Higher (0.5-3.99%) | Varies by crypto |

| BitMart | Lower (0.25%) | Varies by crypto |

BitMart tends to appeal more to experienced traders looking for diverse trading pairs and lower fees. You’ll find more advanced charting tools and order types here.

Coinbase shines for newcomers with its educational resources and straightforward buying process. The platform emphasizes security and compliance, which gives many users peace of mind.

Both platforms offer staking options, but Coinbase generally provides a more streamlined experience for earning rewards on your crypto holdings.

Your choice ultimately depends on your experience level and trading needs. Beginners might prefer Coinbase’s simplicity, while active traders could benefit from BitMart’s lower fees and advanced features.

Bitmart Vs Coinbase: Liquidation Mechanism

When trading on crypto exchanges, understanding the liquidation mechanism is crucial for managing risk. Both Bitmart and Coinbase have systems in place to handle liquidations, but they work differently.

Coinbase Liquidation Process:

- More gradual approach to liquidation

- Sends multiple warnings before initiating liquidation

- Often gives users time to add funds or reduce positions

- Generally considered more user-friendly for beginners

Coinbase typically notifies you via email and app alerts when your account approaches liquidation levels. This gives you a chance to deposit additional funds or close positions voluntarily.

Bitmart Liquidation Process:

- Typically faster to trigger liquidation events

- May provide fewer warnings before liquidation

- Often has stricter liquidation thresholds

- Better suited for experienced traders

According to search results, Bitmart may impose more restrictions on withdrawing funds during volatile market conditions. This can make it challenging to quickly access your assets when markets are unstable.

Liquidation Risk Factors:

| Factor | Coinbase | Bitmart |

|---|---|---|

| Warning System | Multiple alerts | Fewer notifications |

| Time to Respond | Longer window | Shorter window |

| Minimum Requirements | Generally higher | Can be lower |

You should consider these differences when choosing between the platforms, especially if you plan to engage in margin trading or use leverage.

Bitmart Vs Coinbase: Insurance

When choosing a crypto exchange, insurance protection is a crucial factor to consider. This protection can safeguard your assets in case of hacks, theft, or platform failures.

Coinbase offers robust insurance coverage for its users. Your USD balances are protected up to $250,000 through FDIC insurance (for U.S. customers). This means if Coinbase were to fail, your dollar deposits would be safe up to this amount.

For crypto assets, Coinbase maintains a commercial crime insurance policy that covers a portion of digital assets held in their hot wallets. This policy protects against theft and cybersecurity breaches.

BitMart’s insurance approach is less comprehensive. The exchange doesn’t clearly advertise FDIC insurance for fiat deposits. After experiencing a significant hack in December 2021, BitMart established a security fund to strengthen its protection measures.

However, BitMart doesn’t provide the same level of transparent insurance information that Coinbase does.

Here’s a quick comparison:

| Feature | Coinbase | BitMart |

|---|---|---|

| FDIC Insurance | Yes (up to $250,000 for USD) | Not clearly specified |

| Crypto Insurance | Commercial crime policy for hot wallets | Security fund after 2021 hack |

| Transparency | High | Limited |

You should consider these insurance differences when deciding between these platforms, especially if security is your top priority.

Bitmart Vs Coinbase: Customer Support

When choosing between BitMart and Coinbase, customer support is an important factor to consider. Both exchanges offer support options, but they differ in quality and accessibility.

Coinbase provides more robust customer service options. They offer 24/7 support through their help center, email system, and chat features. For urgent matters, you can request a call from their support team.

BitMart’s customer support is generally considered less comprehensive. While they do offer support channels, response times can be longer compared to Coinbase.

Here’s a quick comparison of their support features:

| Feature | Coinbase | BitMart |

|---|---|---|

| 24/7 Support | Yes | Limited |

| Live Chat | Yes | Yes |

| Phone Support | Available on request | No |

| Email Support | Yes | Yes |

| Response Time | Generally faster | Can be delayed |

If you’re new to crypto trading, Coinbase’s more accessible customer service might give you greater peace of mind. Their guaranteed recovery model and MPC security also show their commitment to user support.

For experienced traders who rarely need assistance, BitMart’s support limitations might be less of a concern. However, during high-volume trading periods or when facing account issues, responsive customer service becomes invaluable.

Remember that support quality can make a significant difference when you encounter problems with deposits, withdrawals, or account access.

Bitmart Vs Coinbase: Security Features

When choosing a crypto exchange, security should be your top priority. Both BitMart and Coinbase offer various security features to protect your digital assets, but they differ in important ways.

Coinbase is widely recognized for its strong security practices. The platform stores 98% of customer funds in offline cold storage, protecting them from online threats. They also offer two-factor authentication (2FA) and biometric login options.

BitMart provides similar basic security features like 2FA and SSL encryption. However, BitMart experienced a major security breach in December 2021, losing about $196 million in customer assets.

Coinbase Security Features:

- Cold storage for majority of funds

- FDIC insurance on USD deposits (up to $250,000)

- Biometric authentication

- Address whitelisting

- 2FA via SMS or authenticator apps

BitMart Security Features:

- Two-factor authentication

- SSL encryption

- Regular security audits

- Anti-phishing code system

Coinbase has never experienced a major hack affecting customer funds. The exchange also maintains insurance policies to cover digital assets in case of a security breach.

Your account security also depends on how you use these platforms. Always enable all available security features and use strong, unique passwords regardless of which exchange you choose.

Both platforms offer email alerts for suspicious activities, but Coinbase’s security infrastructure is generally considered more robust based on its security history and comprehensive protection measures.

Is Bitmart A Safe & Legal To Use?

BitMart is a legitimate cryptocurrency exchange that operates legally in the United States. According to search results, it provides secure and reliable services to its users.

U.S. residents can use BitMart, though some restrictions apply. The Earn and Lending products are not available to U.S.-based users due to regulatory requirements.

Security is a primary concern when choosing a crypto exchange. BitMart implements safety precautions to protect user funds and information, similar to other established exchanges.

Some users have reported challenges with customer support. There are mentions of delayed responses when issues arise, which is something to keep in mind before opening an account.

When comparing BitMart to Coinbase, both are legitimate platforms, but they offer different features and security measures. Coinbase is often considered more established in the U.S. market.

Before using BitMart, you should:

- Verify it’s allowed in your specific state

- Understand the fee structure

- Set up proper security measures for your account

- Be aware of potential support response delays

While BitMart accepts fiat currencies and offers numerous trading options, some users choose other exchanges for certain transactions due to these support concerns.

Is Coinbase A Safe & Legal To Use?

Coinbase is widely recognized as one of the safest cryptocurrency exchanges available today. The platform implements industry-best security practices to protect your digital assets and personal information.

As a U.S.-based company, Coinbase operates legally and is fully compliant with relevant regulations. This gives you an added layer of protection compared to exchanges based in less regulated countries.

Security Features:

- Two-factor authentication (2FA)

- Biometric login options

- Cold storage for 98% of customer funds

- $250,000 FDIC insurance on USD balances

- AES-256 encryption for digital information

Coinbase also maintains a solid insurance policy that covers losses due to security breaches or hacks of their systems. However, this doesn’t cover losses from unauthorized access to your individual account.

The platform’s user-friendly interface makes it particularly suitable for beginners. You can easily navigate the platform while benefiting from robust security infrastructure.

It’s worth noting that while Coinbase is considered safe, you should still follow best practices for crypto security. This includes using strong passwords and enabling all available security features.

For added protection, consider moving large amounts of cryptocurrency to a personal wallet after purchase rather than storing everything on the exchange.

Frequently Asked Questions

Investors comparing BitMart and Coinbase often have specific concerns about fees, security, and available cryptocurrencies. These exchanges differ significantly in their target users, verification requirements, and overall trading experience.

What are the key differences in fees between BitMart and Coinbase?

Coinbase charges higher fees than BitMart for most transactions. Standard Coinbase trades incur fees between 0.5% to 4.5%, plus additional fixed fees based on transaction size.

BitMart offers more competitive trading fees, typically around 0.25% per transaction. Their fee structure rewards higher trading volumes with discounts.

For withdrawals, Coinbase fees vary by cryptocurrency but are generally higher than BitMart’s withdrawal fees.

How do both platforms compare in terms of security measures?

Coinbase has established itself as an industry leader in security. They store 98% of customer funds in offline cold storage and offer two-factor authentication, biometric login options, and FDIC insurance on USD balances up to $250,000.

BitMart implements standard security features like two-factor authentication and cold wallet storage. However, BitMart experienced a significant security breach in December 2021, raising some concerns.

Coinbase has never experienced a major hack of its main platform, giving it an edge in security reputation.

Which exchange offers a wider variety of cryptocurrencies, BitMart or Coinbase?

BitMart offers a significantly larger selection of cryptocurrencies, supporting over 1,000 different tokens and trading pairs. This includes many smaller, emerging altcoins.

Coinbase supports fewer cryptocurrencies, focusing on established coins with larger market caps. Their selection includes approximately 200+ cryptocurrencies as of March 2025.

If you’re looking to trade newer or more obscure tokens, BitMart typically lists them earlier than Coinbase.

Can users from the USA easily use both BitMart and Coinbase for trading?

Coinbase is fully licensed and regulated in the United States, making it easily accessible for US users. Registration requires standard KYC verification but is straightforward.

BitMart’s accessibility for US users is more limited. Some states have restrictions, and the platform operates with fewer US regulatory approvals than Coinbase.

US users may face more verification hurdles and potential limitations when using BitMart compared to the more US-friendly Coinbase platform.

How do BitMart and Coinbase customer support experiences compare?

Coinbase offers multiple support channels including email, chat support, and phone assistance for certain issues. Response times have improved in recent years, though can still be slow during high-volume periods.

BitMart’s customer support is primarily available through email tickets and online chat. Many users report longer wait times and less satisfactory resolution compared to Coinbase.

Both platforms struggle with customer service during extreme market volatility, but Coinbase generally provides a more reliable support experience.

What are the pros and cons of using BitMart over Coinbase for beginner traders?

BitMart’s advantages include lower trading fees and access to a wider variety of cryptocurrencies. You can start trading with smaller amounts of money and explore more token options.

The main disadvantages of BitMart for beginners include a more complex interface, less educational content, and fewer beginner-friendly features than Coinbase offers.

Coinbase provides a simplified user interface, extensive educational resources, and a more intuitive mobile app. However, you’ll pay higher fees for this more beginner-friendly experience.

Coinbase Vs Bitmart Conclusion: Why Not Use Both?

When comparing Coinbase and Bitmart, each platform has distinct advantages. Coinbase offers a better user experience with a smoother interface, making it ideal for beginners in the crypto world.

Bitmart, however, has a wider global reach, serving users in 180 countries compared to Coinbase’s 100. This makes Bitmart more accessible if you live outside Coinbase’s service area.

You might find different pricing between these exchanges. This isn’t unusual – each platform sets its own prices based on their available coin supply and market conditions.

Key Differences:

- User Experience: Coinbase ✓ | Bitmart ✗

- Geographic Reach: Coinbase (100 countries) | Bitmart (180 countries)

- Pricing: Varies between platforms

Using both platforms could be a smart strategy. This approach lets you take advantage of Coinbase’s user-friendly interface while accessing Bitmart’s wider selection of trading pairs or different pricing opportunities.

You might use Coinbase for your basic crypto needs and regular investing. Then turn to Bitmart when you need access to coins not available on Coinbase or when you notice price differences that could work in your favor.

The crypto world is diverse, and limiting yourself to just one exchange might mean missing opportunities. By using both platforms strategically, you can maximize your crypto trading potential.