Looking for the best crypto exchange? You might be deciding between BitMart and BYDFi, two popular trading platforms. Both exchanges offer various cryptocurrencies and trading options, but they differ in important ways.

BYDFi scores higher overall with a 9.0 rating compared to BitMart’s lower score. This difference matters when you’re choosing where to put your money and trade digital assets. Each platform has unique features, fee structures, and security measures that affect your trading experience.

When comparing these exchanges, you’ll want to look at trading fees, available cryptocurrencies, user interface, and security features. Both platforms offer transaction history tracking, but their approach to fees and available trading pairs may vary significantly. Understanding these differences will help you choose the exchange that best fits your trading needs.

Bitmart vs BYDFi: At A Glance Comparison

When choosing between cryptocurrency exchanges, it’s helpful to see key differences side by side. Based on recent 2025 comparisons, BYDFi and BitMart offer different strengths for crypto traders.

BYDFi has earned a higher overall score of 9.0 compared to BitMart in recent evaluations. This difference suggests BYDFi may provide a better overall user experience.

Exchange Ratings Comparison:

| Feature | BYDFi | BitMart |

|---|---|---|

| Overall Score | 9.0 | Lower than BYDFi |

| User Interface | Modern | Standard |

| Trading Options | Comprehensive | Varied |

Both platforms offer cryptocurrency trading services, but they differ in several important ways. BYDFi tends to focus on providing a more streamlined experience for traders.

BitMart has some limitations regarding deposit and withdrawal options compared to other exchanges. You might find fewer payment methods available on BitMart than on some competitors.

When comparing trading features, both exchanges provide standard trading tools, but BYDFi appears to offer more comprehensive options for serious traders.

Security measures are essential for any crypto exchange. Both platforms implement standard security protocols, though specific features may vary between them.

Fee structures differ between these exchanges, so you should check current rates before deciding which platform better suits your trading needs.

Bitmart vs BYDFi: Trading Markets, Products & Leverage Offered

BYDFi and BitMart offer different trading options for crypto investors. Understanding these differences can help you choose the platform that best fits your trading style.

BYDFi stands out with its high leverage options, offering up to 100x leverage for certain cryptocurrency pairs. This makes it particularly appealing if you’re interested in day trading or scalping.

BitMart, while offering leverage trading, typically provides lower leverage limits compared to BYDFi. However, BitMart compensates with a wider selection of cryptocurrencies available for trading.

Available Products:

- BYDFi: Spot trading, futures trading, perpetual contracts, copy trading

- BitMart: Spot trading, futures, staking, launchpad for new tokens

BYDFi is designed with professional traders in mind. Its platform includes advanced charting tools and order types that help you execute complex trading strategies.

BitMart offers a more diverse ecosystem beyond just trading. You can participate in token sales and staking directly on the platform.

Trading Markets Comparison:

| Feature | BYDFi | BitMart |

|---|---|---|

| Leverage | Up to 100x | Lower than BYDFi |

| Crypto Selection | Good | Excellent (wider variety) |

| Trading Tools | Advanced | Intermediate |

| Target User | Day traders/Professionals | Both beginners and advanced |

Both exchanges support popular trading pairs with Bitcoin, Ethereum, and major altcoins. Your choice should depend on whether you prioritize high leverage or a wider selection of cryptocurrencies.

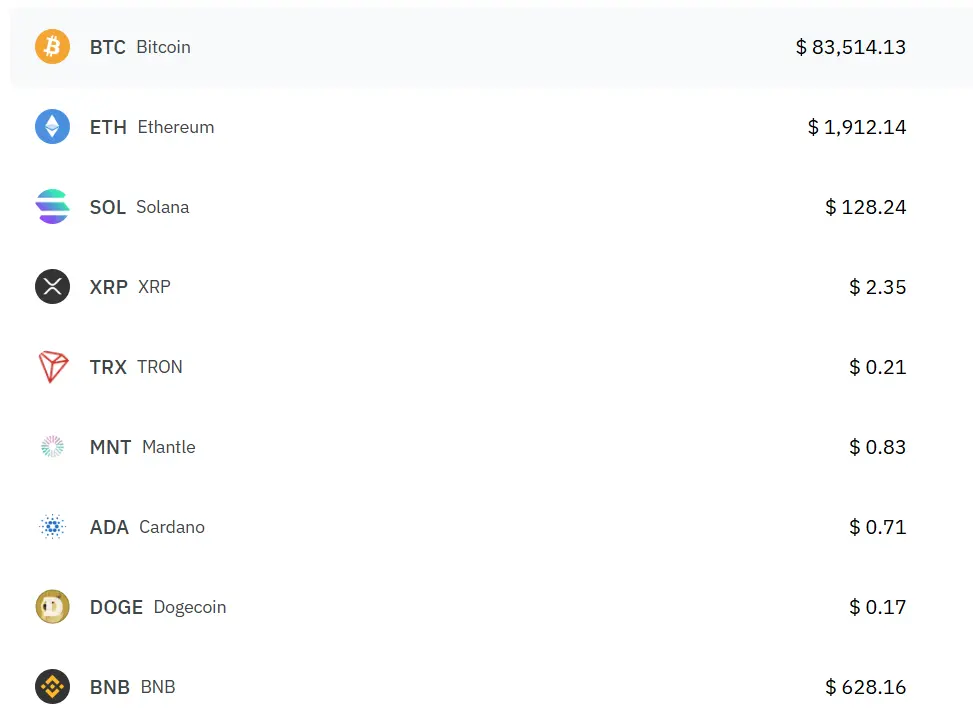

Bitmart vs BYDFi: Supported Cryptocurrencies

When choosing a crypto exchange, the variety of available cryptocurrencies is an important factor to consider. Both BitMart and BYDFi offer a range of digital assets, but there are notable differences.

BYDFi supports more cryptocurrencies than BitMart. This gives you more options when looking to diversify your crypto portfolio. With BYDFi, you’ll have access to a wider selection of altcoins and tokens.

BitMart is still known for its impressive variety of altcoins. This makes it a popular choice for traders looking beyond the major cryptocurrencies like Bitcoin and Ethereum.

BitMart Cryptocurrency Support:

- Major cryptocurrencies (Bitcoin, Ethereum)

- Wide range of altcoins

- Some newer tokens and projects

BYDFi Cryptocurrency Support:

- Major cryptocurrencies

- More extensive altcoin selection

- Greater number of acceptable cryptocurrencies overall

If you’re focused on trading less common or newer cryptocurrencies, BYDFi might be the better option due to its larger selection. However, BitMart still offers enough variety for most traders.

Both exchanges regularly add new cryptocurrencies to their platforms. This helps you stay current with emerging projects and investment opportunities in the crypto space.

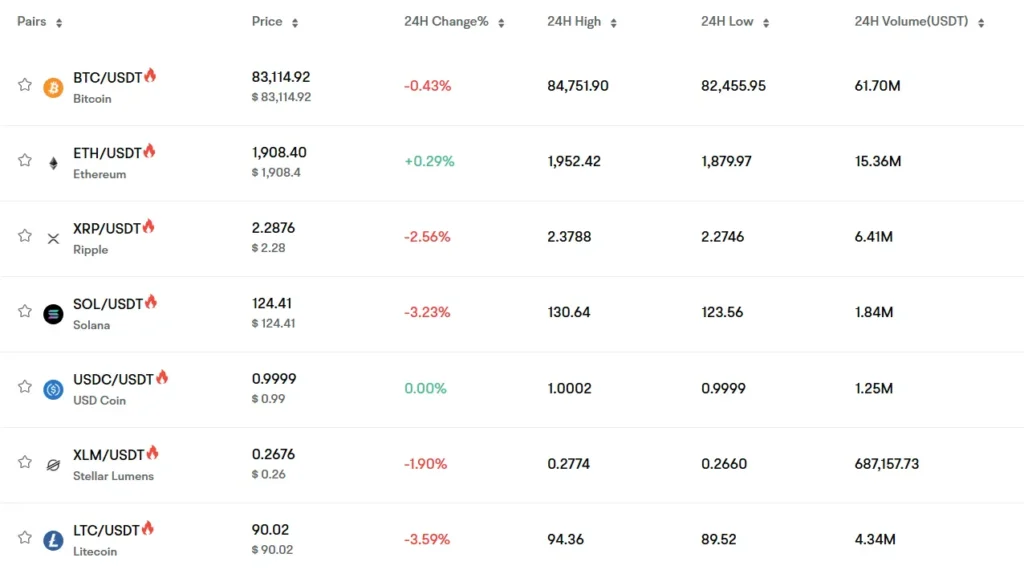

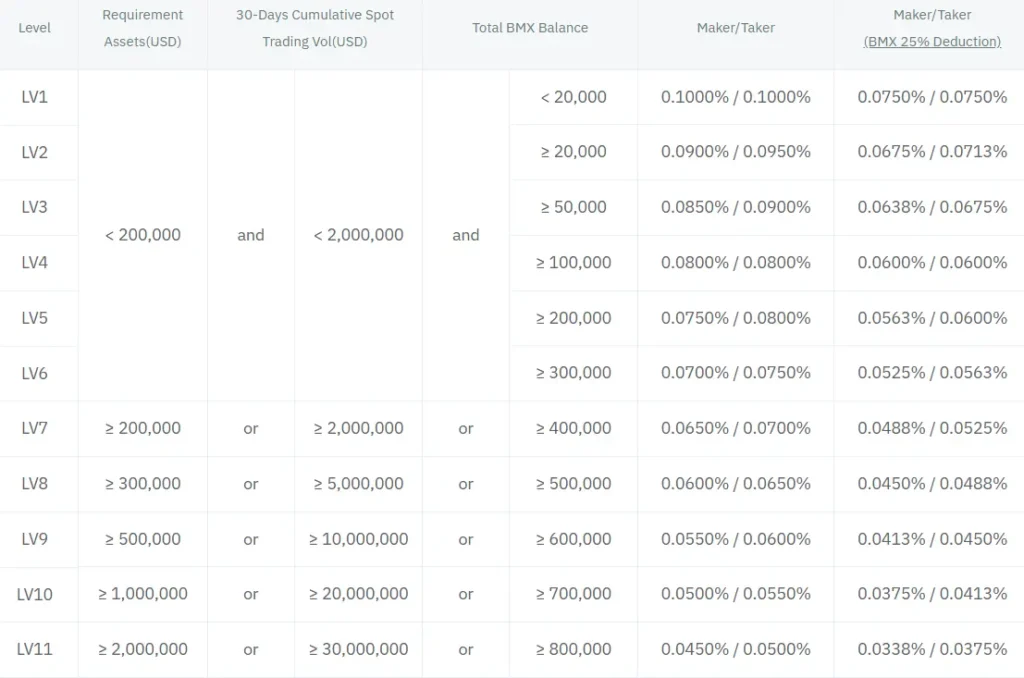

Bitmart vs BYDFi: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BitMart and BYDFi, understanding their fee structures can help you make a better decision for your trading needs.

BitMart offers the lower trading fee percentage at up to 0.6%, giving you a slight edge when executing trades. BYDFi’s trading fees are higher, though they remain competitive in the overall market.

Trading Fees Comparison:

| Exchange | Trading Fee |

|---|---|

| BitMart | Up to 0.6% |

| BYDFi | Higher rate than BitMart |

Both platforms charge fees for depositing and withdrawing cryptocurrencies. These costs vary based on the specific cryptocurrency you’re handling.

The exact withdrawal fees depend on the network congestion and the particular crypto asset you’re transferring. Always check current rates before making transactions, as these can change frequently.

Some cryptocurrencies may have lower withdrawal fees than others on both platforms. This is important to consider if you plan to move funds regularly.

Both exchanges may offer fee discounts for high-volume traders or those holding native exchange tokens. This can significantly reduce your trading costs over time.

Remember to factor in these fees when calculating your potential profits from trading. Even small percentage differences can add up with larger trading volumes.

Bitmart vs BYDFi: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both BitMart and BYDFi offer various order types to help you execute trades effectively.

BitMart Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One Cancels the Other)

- Trailing stop orders

BitMart provides these standard order types that cater to both beginners and experienced traders. The platform’s interface makes it relatively straightforward to place these orders.

BYDFi Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Take profit orders

- Trailing stop orders

- Conditional orders

BYDFi edges ahead with a slightly wider range of order types. Their conditional orders give you more flexibility for setting up complex trading strategies.

Both platforms support the essential market and limit orders that most traders use regularly. However, BYDFi offers more advanced options for technical traders who need precise control over their positions.

You’ll find that both exchanges allow for position adjustments after order placement, though the process varies slightly between platforms. BYDFi’s interface tends to be more intuitive for managing multiple order types.

For beginner traders, the basic order types on either platform will likely be sufficient. As you advance in your trading skills, you might appreciate BYDFi’s additional order flexibility and conditional triggers.

Bitmart vs BYDFi: KYC Requirements & KYC Limits

When choosing between Bitmart and BYDFi, understanding their KYC (Know Your Customer) requirements is crucial for your trading experience.

BYDFi KYC Requirements:

- You can access most features without KYC verification

- Trading, cryptocurrency pairs, and fiat support available without identity verification

- Higher trading limits may require some verification

BYDFi is preferred by traders seeking privacy and convenience. You can start trading immediately without submitting personal documents.

Bitmart KYC Requirements:

- KYC verification is required for full platform access

- You can explore the platform before verification

- Cannot use actual trading features without completing KYC

While Bitmart allows you to browse their interface, you’ll need to complete identity verification before making any trades.

Comparison Table:

| Feature | BYDFi | Bitmart |

|---|---|---|

| No-KYC Access | Most features available | Limited exploration only |

| Trading Without KYC | Yes | No |

| Fiat Support Without KYC | Yes | No |

Your location may affect these requirements, as both exchanges might have different policies based on regional regulations.

For traders prioritizing privacy and immediate access, BYDFi offers a more flexible approach to KYC requirements.

Bitmart vs BYDFi: Deposits & Withdrawal Options

When choosing between BitMart and BYDFi exchanges, understanding their deposit and withdrawal options is crucial for your trading experience.

BitMart supports multiple deposit methods including cryptocurrency transfers and some fiat options. You can deposit using bank transfers, credit/debit cards, and third-party payment processors in certain regions.

BYDFi also offers cryptocurrency deposits but may have fewer fiat options compared to BitMart. The platform focuses primarily on crypto-to-crypto transactions.

For withdrawals, both platforms allow you to transfer your cryptocurrencies to external wallets. However, they differ in processing times and fees.

| Feature | BitMart | BYDFi |

|---|---|---|

| Crypto deposits | Wide range | Wide range |

| Fiat deposits | Yes (varies by region) | Limited |

| Withdrawal fees | Varies by cryptocurrency | Competitive rates |

| Processing time | 1-24 hours typically | Generally fast |

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication. This helps protect your funds from unauthorized access.

Withdrawal limits vary between the platforms and depend on your verification level. Higher verification tiers usually grant higher daily and monthly withdrawal limits.

Remember to check the current fee structure before making transactions, as cryptocurrency exchange fees can change frequently.

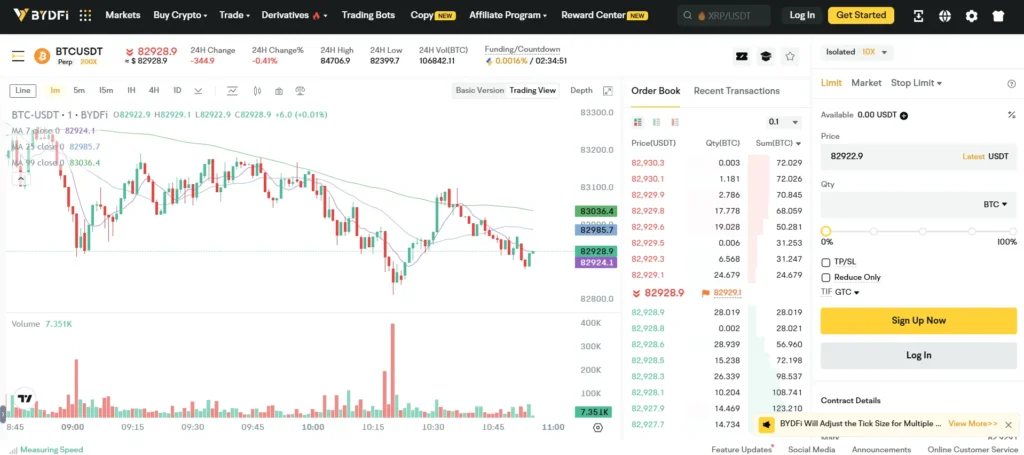

Bitmart vs BYDFi: Trading & Platform Experience Comparison

When choosing between BitMart and BYDFi for your crypto trading, the platform experience can make a big difference in your success.

BYDFi offers a higher overall score of 9.0 compared to BitMart, according to recent comparisons. This suggests a better overall user experience for traders.

Trading Features:

- BitMart: Offers up to 100x leverage options

- BYDFi: Known for high-leverage trading with no KYC requirements

BYDFi stands out as the preferred choice for traders seeking high-leverage options without identity verification processes. This makes it more accessible for users who value privacy.

The interface design differs between both platforms. BYDFi tends to have a more intuitive layout that beginners can navigate easily. BitMart’s platform might take more time to master.

Trading Tools:

| Feature | BitMart | BYDFi |

|---|---|---|

| Charts | Advanced | Advanced |

| Order Types | Standard | Expanded |

| Mobile App | Yes | Yes |

| Demo Account | Limited | Available |

Both exchanges provide mobile apps for trading on the go, but users often report BYDFi’s app as more responsive and reliable during high market activity.

BitMart does have strengths in its variety of altcoins and trading pairs. However, BYDFi typically offers a smoother experience with fewer reported technical issues during peak trading hours.

Bitmart vs BYDFi: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation process is crucial. Both BitMart and BYDFi have different approaches to handling liquidations.

BitMart employs a partially forced liquidation mechanism. This system automatically tries to reduce maintenance margin requirements to help you avoid complete liquidation of your positions. This offers some protection when markets become volatile.

In contrast, BYDFi’s liquidation process is designed to be quick and seamless. When a crypto asset is liquidated on BYDFi, the funds are automatically transferred to your account. This efficiency helps you access your remaining funds without delay.

Both platforms initiate liquidation when your positions can no longer be maintained due to market movements against your trades. However, their execution methods differ.

Key Liquidation Differences:

| Feature | BitMart | BYDFi |

|---|---|---|

| Liquidation Type | Partially forced | Automatic |

| Process | Attempts to reduce margin requirements | Quick transfer to user account |

| User Experience | Potential to save positions | Seamless and fast process |

You should consider these liquidation approaches when choosing between the two exchanges. BitMart might give you more chance to recover during market volatility, while BYDFi prioritizes speed and efficiency.

Remember that liquidations can happen quickly in volatile markets. Setting appropriate stop-losses and managing your leverage wisely can help you avoid liquidations altogether.

Bitmart vs BYDFi: Insurance

When trading cryptocurrency, insurance is an important factor to consider. It protects your assets if the exchange faces security breaches or other issues.

BitMart offers some insurance protection for user funds. After a major hack in 2021, they committed to strengthening their security measures and established a fund to reimburse affected users.

BYDFi also prioritizes security but has a different approach to insurance. They focus on preventative security rather than extensive insurance coverage.

Neither exchange offers the comprehensive insurance coverage found on platforms like Coinbase or Gemini. This is something to keep in mind when deciding where to trade.

Insurance Comparison:

| Feature | BitMart | BYDFi |

|---|---|---|

| Insurance Fund | Yes (Limited) | Limited |

| User Fund Protection | Partial coverage | Focus on security measures |

| Historical Response to Breaches | Has reimbursed users | No major reported breaches |

You should consider how important insurance is to your trading strategy. If you plan to keep large amounts on an exchange, you might want more robust insurance coverage than either platform offers.

Both exchanges recommend using their security features like two-factor authentication and withdrawal address whitelisting to enhance your account protection.

Remember to check each platform’s current insurance policies before making your decision, as these terms can change over time.

Bitmart vs BYDFi: Customer Support

When choosing a crypto exchange, good customer support can make a big difference in your trading experience. Both BitMart and BYDFi offer support services, but they differ in availability and responsiveness.

BitMart provides 24/7 customer support, according to the search results. Their team is described as receptive and always available to help with your trading issues or questions. This round-the-clock service can be valuable if you encounter problems outside regular business hours.

BYDFi’s customer support details aren’t specifically mentioned in the search results. However, as a smaller exchange with around 500,000 active users compared to BitMart’s 9 million, their support resources might be more limited.

Both platforms likely offer multiple support channels such as:

- Email support

- Live chat

- Help center documentation

- FAQ sections

Response times may vary between the two platforms. BitMart might have an advantage with its larger team supporting its bigger user base.

When you need assistance with account issues, deposit problems, or trading questions, knowing how to reach support quickly is important. You should check each platform’s current support options before making your final decision.

Bitmart vs BYDFi: Security Features

When choosing a crypto exchange, security should be your top priority. Both BitMart and BYDFi offer various security features to protect your assets.

BYDFi implements offline cold storage for most user funds, keeping them away from potential online threats. They also use multi-signature technology which requires multiple approvals for transactions.

BitMart, after experiencing a security breach in 2021, has strengthened its security protocols. They now offer two-factor authentication (2FA) and advanced encryption to protect user accounts.

BYDFi operates as a regulated Money Services Business (MSB) in the USA and Canada, adding a layer of credibility and oversight. This regulation means they must follow certain security standards.

Both platforms offer account security features such as:

| Feature | BitMart | BYDFi |

|---|---|---|

| Two-factor authentication | ✓ | ✓ |

| Email verification | ✓ | ✓ |

| Anti-phishing codes | ✓ | ✓ |

| Withdrawal address whitelisting | ✓ | ✓ |

BYDFi seems to place more emphasis on cold storage security, while BitMart has improved its security systems following past incidents.

You should enable all available security features regardless of which platform you choose. Using strong passwords and enabling 2FA are essential steps to protect your crypto investments on either exchange.

Is Bitmart a Safe & Legal To Use?

Bitmart is generally considered a safe cryptocurrency exchange. It operates legally in many countries, including the United States where it maintains a user-friendly approach for American traders.

Despite experiencing a security incident in December 2021, Bitmart has taken steps to improve its security measures. After this breach, the exchange strengthened its protections to safeguard user assets.

For your legal protection, Bitmart implements standard KYC (Know Your Customer) procedures. These verification steps help ensure compliance with financial regulations in different regions.

The platform uses two-factor authentication (2FA) to add an extra layer of security to your account. This makes unauthorized access much more difficult.

Key Security Features:

- Two-factor authentication

- Cold storage for majority of assets

- Regular security audits

- Insurance fund for emergency situations

When transferring cryptocurrencies from Bitmart to other wallets like Trust Wallet, the process is generally safe. Just make sure to double-check addresses before confirming transactions.

Bitmart has earned a decent reputation in the crypto community. While no exchange is 100% immune to risks, Bitmart has shown commitment to maintaining security standards and legal compliance.

Always use strong, unique passwords and enable all available security features to maximize your protection when using Bitmart or any cryptocurrency exchange.

Is BYDFi a Safe & Legal To Use?

BYDFi operates as a legitimate cryptocurrency exchange that is legal for users in the United States. According to recent information, it is registered as a Money Services Business (MSB) in both the USA and Canada, which adds to its credibility.

Security is a priority for BYDFi, with multiple protective measures in place. They implement offline cold storage and multi-signature technology to keep your funds safe from potential threats.

For US citizens specifically, BYDFi is fully compliant with US regulations. This compliance means you can trade on the platform without concerns about legal issues.

Key security features of BYDFi include:

- Offline cold storage for crypto assets

- Multi-signature technology for transactions

- Regulatory compliance in major markets

- Standard security protocols common to reputable exchanges

BYDFi serves traders of all experience levels, from beginners to advanced users. The platform balances accessibility with security features that protect your investments.

When comparing exchanges like BYDFi and BitMart, BYDFi appears to have scored higher in overall ratings (9.0) based on the search results. This suggests users generally have positive experiences with the platform’s security and service.

You should always use two-factor authentication and strong passwords when setting up any cryptocurrency exchange account, including BYDFi, to add an extra layer of protection to your funds.

Frequently Asked Questions

Traders often need specific information about cryptocurrency exchanges before committing their assets. These common questions address key comparison points between BitMart and BYDFi platforms.

What are the primary differences in features between BitMart and BYDFi?

BYDFi has a higher overall score of 9.0 compared to BitMart. This rating reflects BYDFi’s more user-friendly interface and advanced trading tools.

BitMart offers a wider range of trading products including spot trading, futures, and margin trading. BYDFi stands out with its copy trading feature that allows beginners to mirror successful traders’ strategies.

BitMart provides staking options for passive income, while BYDFi offers more competitive yield farming opportunities.

Which exchange offers better security measures, BitMart or BYDFi?

BYDFi implements stronger two-factor authentication protocols and regular security audits to protect user funds. Their cold storage solution keeps over 95% of assets offline.

BitMart experienced a significant security breach in December 2021, which affected user trust. Since then, they’ve upgraded their security infrastructure with increased insurance coverage.

Both platforms now use anti-phishing codes and advanced KYC procedures, but BYDFi’s security track record remains stronger overall.

How do the transaction fees compare between BitMart and BYDFi?

BitMart charges trading fees starting at 0.25% for makers and takers on their standard tier. These fees decrease as your trading volume increases.

BYDFi offers more competitive rates starting at 0.2% for regular users. Their VIP program provides greater fee reductions based on trading volume and token holdings.

Both exchanges charge withdrawal fees, but BitMart’s rates are typically higher for most cryptocurrencies. Deposit fees are minimal to zero on both platforms.

What range of cryptocurrencies is available on BitMart versus BYDFi?

BitMart supports over 1,000 cryptocurrencies and 1,500+ trading pairs, making it more diverse for altcoin traders. They frequently list new tokens soon after launch.

BYDFi offers approximately 400+ cryptocurrencies but focuses on more established tokens with higher liquidity. This approach provides better trading conditions for major assets.

Both exchanges support the most popular cryptocurrencies like Bitcoin, Ethereum, and Shiba Inu, but BitMart gives you access to more obscure altcoins.

Can users from the United States trade on both BitMart and BYDFi?

BitMart allows US users to trade with some limitations on certain tokens and features. US traders can access most spot trading markets but not futures or derivatives.

BYDFi currently does not fully support US users due to regulatory constraints. They restrict US IP addresses from accessing certain platform features.

Trading regulations change frequently, so you should check the current status directly with both exchanges if you’re a US-based trader.

What are the customer support experiences like for BitMart and BYDFi users?

BYDFi offers faster response times through their 24/7 live chat support system. Users typically receive assistance within minutes for basic issues.

BitMart’s support system relies more heavily on ticket submission, which can take 24-48 hours for responses. However, they provide more extensive help articles and tutorials.

Both platforms have active community forums where users can find solutions to common problems, but BYDFi’s Expert Q&A Hub provides more direct access to cryptocurrency specialists.

BYDFi vs Bitmart Conclusion: Why Not Use Both?

After comparing BYDFi and BitMart, it’s clear that each platform has its own strengths. BYDFi scores higher overall with a 9.0 rating compared to BitMart, according to our research.

BYDFi stands out for day traders and scalpers with its high leverage options and low fees. The platform also prioritizes security with mandatory KYC verification, making it both technically and legally safe.

BitMart, while scoring lower overall, may offer features that appeal to different types of traders. The exchange has its own unique benefits that might complement your trading strategy.

Why choose just one? Many crypto traders use multiple exchanges to take advantage of:

- Different fee structures

- Varied coin selections

- Unique trading features

- Price differences between platforms

- Spreading risk across exchanges

You can use BYDFi for day trading and scalping where its professional tools shine. Meanwhile, BitMart might serve as your secondary platform for specific coins or features not available on BYDFi.

The key is understanding your trading needs. If you’re serious about crypto trading, maintaining accounts on both platforms gives you flexibility and options.

Remember to complete proper verification on each platform and keep track of your assets across exchanges. This dual-platform approach can maximize your trading opportunities while minimizing limitations.