Looking for the right crypto exchange? BitMart and Bybit are two popular choices, but they have key differences that matter for your trading experience.

Bybit outperforms BitMart in several areas, particularly by offering fiat currency support for trading while BitMart has limited deposit and withdrawal options. This makes Bybit more accessible if you’re new to crypto or prefer using traditional currency.

When comparing these exchanges, you’ll find differences in their fee structures, supported cryptocurrencies, and trading features. Bybit also offers compounding on cryptocurrency earnings, which can help grow your investment over time. Understanding these differences will help you choose the platform that best fits your trading needs and goals.

Bitmart Vs Bybit: At A Glance Comparison

When choosing between Bitmart and Bybit for your cryptocurrency trading needs, understanding their key differences is essential.

Bybit has a clear advantage when it comes to payment options. You can use fiat currency (regular money like USD or EUR) to trade on Bybit, while Bitmart offers more limited deposit and withdrawal methods.

Both exchanges provide a range of cryptocurrency trading options, but they differ in their user experience and fee structures.

Platform Features:

| Feature | BitMart | Bybit |

|---|---|---|

| Fiat Currency Support | Limited | Yes |

| User Interface | Moderate complexity | More intuitive |

| Trading Volume | Lower | Higher |

| Security Features | Standard | Advanced |

Bybit tends to have higher trading volumes, which can mean better liquidity for your trades. This makes it easier to buy or sell quickly without affecting the price.

The exchanges also differ in their target users. Bybit caters more to experienced traders with advanced trading tools, while BitMart might be more accessible to newer crypto traders.

Both platforms support mobile trading through dedicated apps, allowing you to manage your crypto investments on the go.

Fee structures vary between the two platforms, so you’ll want to compare the specific trading and withdrawal fees based on your expected trading volume and cryptocurrency preferences.

Bitmart Vs Bybit: Trading Markets, Products & Leverage Offered

BitMart offers a wider range of trading markets and products compared to Bybit. You’ll find dozens of cryptocurrencies and trading pairs available on BitMart’s platform for both spot and futures trading.

Bybit, while offering fewer assets, provides competitive leverage options that appeal to advanced traders. You can access significant leverage when trading futures on Bybit, making it attractive for those looking to maximize potential returns.

Available Products Comparison:

| Feature | BitMart | Bybit |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ | ✓ |

| Margin Trading | Limited | Extensive |

| Number of Trading Pairs | More | Fewer |

| Leverage Options | Standard | Competitive |

BitMart supports fiat deposits through third-party providers like Simplex and MoonPay. This gives you more options to enter the crypto market directly with traditional currency.

Both platforms offer robust trading features, but your choice might depend on what you prioritize. If you want access to more coins and trading pairs, BitMart might be the better option.

If leverage trading is your priority, Bybit’s competitive leverage offerings could better suit your needs. Their platform is often preferred by experienced traders focusing on futures contracts.

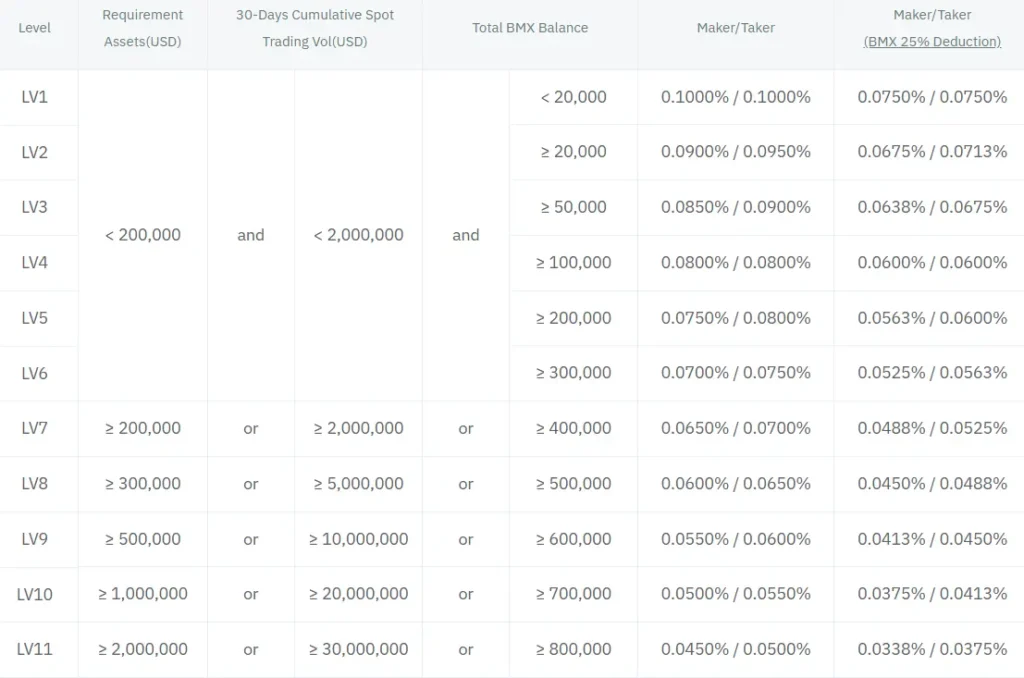

Bitmart Vs Bybit: Supported Cryptocurrencies

When choosing between BitMart and Bybit, the variety of available cryptocurrencies can be a deciding factor for your trading needs.

Based on current information, Bybit offers more cryptocurrencies than BitMart. This gives you more trading options and flexibility on Bybit’s platform.

BitMart still provides access to many popular cryptocurrencies, but its selection is more limited compared to Bybit.

While BitMart focuses on a mix of established and smaller altcoins, Bybit puts more emphasis on derivatives trading with popular coins that have higher market capitalization and trading volume.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | BitMart | Bybit |

|---|---|---|

| Total Cryptocurrencies | Fewer | More |

| Focus | Mix of established and smaller altcoins | Popular coins for derivatives trading |

| Token Variety | Moderate | High |

If you’re looking to trade a wide range of cryptocurrencies, especially for derivatives trading, Bybit might better suit your needs.

For traders interested in specific altcoins, it’s worth checking both platforms directly to see if they support your preferred tokens, as available cryptocurrencies can change as exchanges regularly update their offerings.

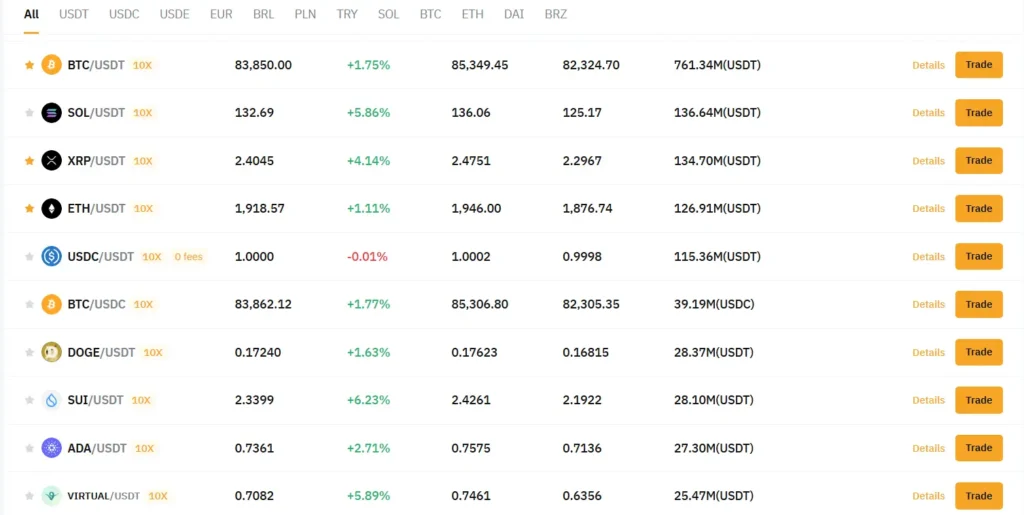

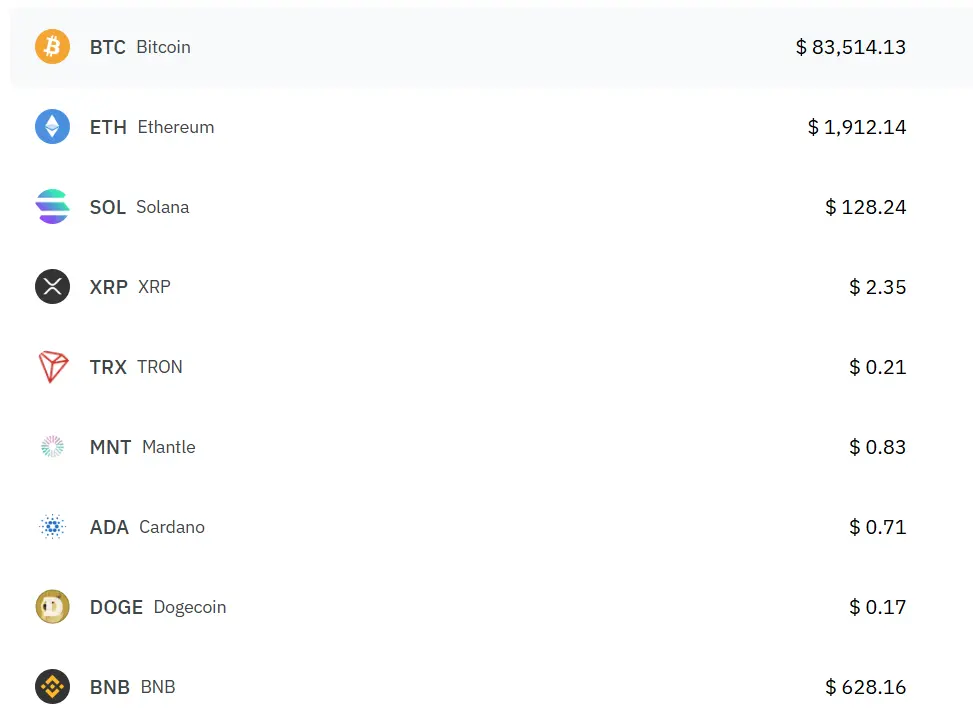

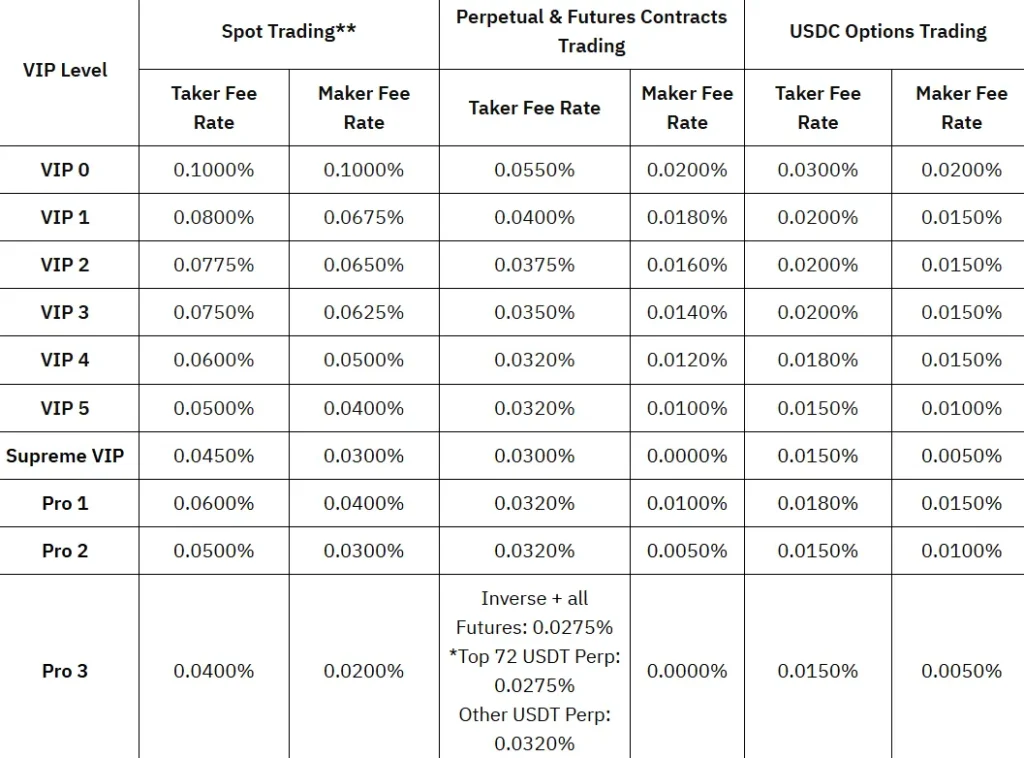

Bitmart Vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BitMart and Bybit, understanding their fee structures is crucial for your trading strategy. Each platform has different costs that can impact your overall returns.

BitMart offers lower trading fees compared to Bybit. This advantage can be significant if you trade frequently or in large volumes.

Bybit, however, stands out with its more competitive withdrawal fees. For example, when withdrawing LTC, BitMart charges 0.008 LTC (approximately $0.54), which is eight times higher than Bybit’s fee of 0.001 LTC (about $0.07).

Trading Fee Comparison:

| Exchange | Trading Fees |

|---|---|

| BitMart | Lower |

| Bybit | Higher |

Withdrawal Fee Comparison:

| Exchange | Withdrawal Fees |

|---|---|

| BitMart | Higher |

| Bybit | Lower |

Your deposit options may also influence your choice. Both exchanges support various deposit methods, though specific options may vary based on your location.

If you trade frequently but withdraw less often, BitMart’s lower trading fees might save you more money. Conversely, if you make regular withdrawals, Bybit’s lower withdrawal fees could be more beneficial.

Consider your typical trading patterns when deciding. A high-volume trader might benefit more from BitMart, while someone who frequently moves crypto between wallets might prefer Bybit.

Bitmart Vs Bybit: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both BitMart and Bybit offer several order types, but there are some differences worth noting.

BitMart Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

BitMart provides these essential order types that cover most trading scenarios. These options are suitable for both beginners and intermediate traders.

Bybit Order Types:

- Market orders

- Limit orders

- Conditional orders

- Take Profit/Stop Loss

- Trailing Stop

- Advanced order types for futures trading

Bybit offers a more comprehensive selection of order types. This makes it particularly strong for advanced traders who need precise control over their positions.

The conditional orders on Bybit allow you to set specific price triggers before your orders are executed. This gives you more flexibility when implementing complex trading strategies.

According to search results, Bybit is considered the winner in this category. The platform offers more order types, which can be especially valuable if you’re engaged in futures trading or other complex trading activities.

Your trading style and needs will determine which platform’s order types serve you better. Beginners might find BitMart’s selection adequate, while experienced traders will likely appreciate Bybit’s expanded options.

Bitmart Vs Bybit: KYC Requirements & KYC Limits

Both BitMart and Bybit use Know Your Customer (KYC) verification to confirm user identities and comply with regulations.

BitMart KYC Levels:

- Level 1 KYC: Unlocks most features with a daily withdrawal limit of 0.5 BTC

- Requires basic personal information

- KYC-verified accounts enjoy higher withdrawal limits

Bybit KYC:

- Uses verification to identify customers and analyze risk profiles

- Helps prevent money laundering and financing of illicit activities

- May require KYC to approve withdrawal requests at any point

When you use Bybit, completing KYC verification gives you access to more platform features and higher transaction limits.

BitMart offers KYC verification as an option for users who want better account privileges. Without verification, your access to certain features and withdrawal amounts will be restricted.

Due to regulatory requirements, especially in the US, both exchanges have different KYC policies. Bybit faces particularly strict regulations in the United States.

When choosing between these exchanges, consider how much personal information you’re comfortable sharing and what withdrawal limits you need. KYC requirements can change as regulations evolve.

Remember that completing KYC verification generally improves your experience on both platforms by increasing your withdrawal limits and access to features.

Bitmart Vs Bybit: Deposits & Withdrawal Options

When choosing between BitMart and Bybit, deposit and withdrawal options are key factors to consider. These options affect how easily you can move your money in and out of the exchanges.

Bybit offers more flexibility with deposits, allowing you to use fiat currency (regular money like USD or EUR) to fund your account. This makes it easier for beginners to start trading without already owning cryptocurrency.

BitMart has more limited deposit options, focusing primarily on cryptocurrency deposits. This means you might need to purchase crypto elsewhere before transferring it to BitMart.

Bybit Deposit Methods:

- Fiat currency options

- Cryptocurrency transfers

- Credit/debit card purchases

- Bank transfers (in some regions)

BitMart Deposit Methods:

- Cryptocurrency transfers

- Limited fiat options

For withdrawals, both platforms allow you to take out your cryptocurrencies to external wallets. However, Bybit generally offers more comprehensive withdrawal options.

Fees for deposits and withdrawals vary between the platforms. You should check the current fee structure on both exchanges before making your decision, as these can change over time.

Processing times also differ between the platforms, with some methods being faster than others. Cryptocurrency transactions typically process faster than fiat withdrawals on both exchanges.

Security for your deposits is important on both platforms, with each offering various protection measures for your funds during the deposit and withdrawal process.

Bitmart Vs Bybit: Trading & Platform Experience Comparison

When choosing between Bitmart and Bybit, the trading and platform experience can be a deciding factor for your crypto journey.

Bitmart offers a wider range of trading markets and products according to recent comparisons. You’ll find more cryptocurrency options available, which is helpful if you’re looking to diversify your portfolio beyond major coins.

Bybit, on the other hand, shines in derivatives trading. It’s considered the best overall exchange for this purpose, with competitive fees and leverage options that active traders will appreciate.

User Experience Comparison:

| Feature | Bitmart | Bybit |

|---|---|---|

| Interface | User-friendly | More technical |

| Trading options | Wide variety | Focused on derivatives |

| Mobile experience | Good functionality | Excellent performance |

| Trading tools | Basic | Advanced |

Bybit focuses on providing a smooth trading experience with advanced tools for serious traders. You’ll find their platform particularly suited for futures and margin trading.

Bitmart’s interface is designed to be accessible to beginners while still offering enough features for experienced traders. The platform is intuitive, making it easier to navigate for newcomers to crypto trading.

Both platforms offer mobile apps, allowing you to trade on the go. However, some users report that Bybit’s mobile experience is more robust for complex trading strategies.

The choice between these two will depend on your specific needs. If you want more cryptocurrency options, Bitmart might be better. For derivatives trading with competitive fees, Bybit could be your go-to platform.

Bitmart Vs Bybit: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for managing your risk. Bitmart and Bybit handle this process differently.

Bitmart uses a partial forced liquidation mechanism. This system automatically tries to reduce your maintenance margin requirements to help avoid a complete liquidation of your position. It gives you a chance to recover before losing all your funds.

Bybit, on the other hand, employs a more sophisticated approach. It uses a tiered liquidation system with early warnings. You’ll receive notifications when your position approaches dangerous territory, giving you time to add more margin or reduce your position size.

Risk management features comparison:

| Feature | Bitmart | Bybit |

|---|---|---|

| Liquidation warnings | Basic | Advanced multi-tier alerts |

| Partial liquidation | Yes | Yes, with more control |

| Stop-loss integration | Limited | Comprehensive |

| Insurance fund protection | Available | Larger fund size |

Bybit’s liquidation process is generally considered more trader-friendly. You get more tools to manage potential liquidations and a clearer interface showing your liquidation price.

Remember that both platforms will liquidate your position if your margin falls below the maintenance requirement. The key difference is how much warning and control you have during this process.

Trading with lower leverage (2x-5x) can significantly reduce your liquidation risk on both platforms compared to using maximum leverage options.

Bitmart Vs Bybit: Insurance

When trading cryptocurrency, security measures like insurance can protect your assets. Both BitMart and Bybit offer some form of insurance protection, but there are important differences.

Bybit maintains a more robust insurance fund to protect users against negative balance and auto-deleveraging. As of 2025, Bybit’s insurance fund holds significantly more assets compared to BitMart’s fund.

BitMart’s insurance coverage is more limited in scope. After experiencing a security breach in 2021, they’ve improved their security measures but still lag behind Bybit in comprehensive coverage.

Bybit Insurance Features:

- Protection against negative balance

- Auto-deleveraging prevention

- Regular public reporting of fund status

- Coverage for spot and derivatives trading

BitMart Insurance Features:

- Basic coverage for platform issues

- Limited protection against hacks

- Smaller overall fund size

- Less transparent reporting structure

You should verify current insurance details directly on each platform before trading. Insurance policies can change quickly in crypto markets.

Neither platform offers FDIC-style insurance that you might find with traditional banks. Your crypto assets remain at some risk regardless of the exchange you choose.

Bybit’s larger user base (61.72M vs BitMart’s 9M users) allows them to maintain a more substantial insurance fund, creating a potential security advantage for traders concerned about protection.

Bitmart Vs Bybit: Customer Support

When choosing between BitMart and Bybit, customer support can be a deciding factor for your trading experience. Both exchanges offer support systems, but they differ in quality and accessibility.

Bybit emphasizes strong customer service as part of their platform. They provide 24/7 customer support, which is crucial for crypto traders who operate across different time zones. Their support system includes live chat and ticket-based assistance.

BitMart also offers customer support channels, but based on available information, they don’t prominently advertise 24/7 availability like Bybit does.

Bybit integrates a comprehensive security approach with their customer support. They implement an insurance fund that protects traders from negative balances, giving you added peace of mind while trading.

Support Comparison:

| Feature | Bybit | BitMart |

|---|---|---|

| 24/7 Support | Yes | Limited information |

| Support Channels | Live chat, ticket system | Ticket system |

| Security Integration | Insurance fund | Standard protection |

User feedback suggests Bybit generally receives better ratings for their customer service responsiveness. This could be important if you’re new to crypto trading or frequently need assistance.

Remember that good customer support becomes especially valuable during market volatility or when you encounter technical issues with deposits or withdrawals.

Bitmart Vs Bybit: Security Features

When choosing between BitMart and Bybit, security should be one of your top priorities. Both exchanges have implemented various security measures, but they differ in important ways.

BitMart experienced a significant security breach in 2021, which led them to strengthen their security features. After this incident, they improved their desktop security protocols substantially.

However, BitMart’s mobile app security remains somewhat weaker compared to its desktop version. This is something to consider if you prefer trading on mobile devices.

Bybit has maintained a stronger security record without any major reported breaches. They use multi-signature wallets and cold storage solutions to protect user funds.

Both exchanges offer two-factor authentication (2FA) to add an extra layer of security to your account. This feature helps prevent unauthorized access even if your password is compromised.

Key Security Features Comparison:

| Feature | BitMart | Bybit |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | Partial | Majority of funds |

| Security Breach History | Major breach in 2021 | No major breaches |

| Account Verification | Required | Required |

| Insurance Fund | Limited | Comprehensive |

Bybit also offers an insurance fund to protect users against losses during extreme market conditions. This provides an additional safety net that BitMart doesn’t match in scope.

Remember to always use strong passwords and enable all available security features regardless of which platform you choose.

Is Bitmart A Safe & Legal To Use?

Bitmart has shown it is generally safe and legal for cryptocurrency trading. After a security breach in December 2021, the exchange took steps to improve its security measures.

The platform is registered in the Cayman Islands and operates in compliance with regulations in various countries. This helps ensure its legitimacy as a cryptocurrency exchange.

Security Features:

- Two-factor authentication (2FA)

- Cold storage for most user funds

- Regular security audits

However, some users have expressed concerns about Bitmart’s transparency. According to search results, some people advise caution when using the platform.

You should be aware that cryptocurrency exchanges always carry some risk. It’s wise to use strong passwords and enable all security features when trading on Bitmart.

The exchange does offer insurance for user funds, which provides some protection against potential security breaches.

Important Safety Tips:

- Only keep trading amounts on the exchange

- Enable all security features

- Withdraw large holdings to personal wallets

When comparing with Bybit, both exchanges offer similar security features. Your choice might depend more on specific trading needs rather than significant security differences between them.

Is Bybit A Safe & Legal To Use?

Bybit is considered a safe and legitimate cryptocurrency exchange in 2025. The platform implements multiple security measures to protect user funds and information.

Security Features:

- Two-factor authentication (2FA)

- Anti-phishing code

- Regular security audits

Bybit has a strong focus on compliance with regulations, which adds to its legitimacy in the cryptocurrency market. This commitment to following rules helps maintain its legal status in many countries.

The exchange has built a significant user base of approximately 61.72 million active users. This large user community suggests a level of trust in the platform’s security and services.

When comparing to BitMart, Bybit appears to have a stronger reputation for security practices. The platform prioritizes creating a safe trading environment for its users.

It’s important to check if Bybit is available in your country before signing up. Regulations vary by location, and some features might be restricted depending on where you live.

You should still practice good security habits when using Bybit. This includes using strong passwords, enabling all security features, and being cautious about phishing attempts.

Frequently Asked Questions

Here are the most common questions traders have when comparing BitMart and Bybit exchanges. These answers will help you make an informed decision based on fees, security features, availability, asset selection, and trading experience.

What are the key differences in trading fees between BitMart and Bybit?

BitMart offers lower spot trading fees compared to Bybit. Their base fee structure starts at slightly lower rates for makers and takers.

Bybit compensates with more competitive withdrawal fees, which could save you money if you frequently move assets off the exchange.

Both platforms offer fee discounts based on trading volume and token holdings, but their tier structures differ significantly.

How do the security features of Bybit compare to those offered by BitMart?

Bybit implements robust security protocols including two-factor authentication, cold storage for most user funds, and regular security audits.

BitMart enhanced their security after a 2021 hack, but Bybit generally receives higher marks from users for their comprehensive security approach.

Both exchanges offer insurance funds to protect traders, though Bybit’s fund is typically larger and better funded.

Can traders from the United States access BitMart and what restrictions, if any, apply?

BitMart is available to US traders in most states, though with some restrictions on certain features and trading pairs.

Bybit, however, does not officially serve US customers due to regulatory constraints. US traders attempting to use Bybit may face account restrictions.

Always check the current regulatory status as crypto exchange policies regarding US users frequently change.

What varieties of cryptocurrency assets are available on BitMart versus Bybit?

BitMart supports a wider range of cryptocurrencies, with over 1,000 trading pairs including many smaller altcoins and new token listings.

Bybit focuses on approximately 300+ high-quality assets with an emphasis on major cryptocurrencies and established projects.

Your choice might depend on whether you prefer access to emerging tokens (BitMart) or a more curated selection (Bybit).

What leverage options do BitMart and Bybit provide to their traders?

Bybit is known for its derivatives platform, offering leverage up to 100x on futures contracts for experienced traders.

BitMart provides more conservative leverage options, generally capping at lower levels depending on the trading pair.

Both platforms implement risk controls, but Bybit’s advanced trading features make it more popular among leverage traders.

How do the user interfaces and trading experiences differ between BitMart and Bybit?

Bybit’s interface is often praised for its clean design and responsiveness, making it accessible to both beginners and experienced traders.

BitMart’s platform contains more features packed into the interface, which some find comprehensive while others consider cluttered.

Mobile app experiences differ significantly too, with Bybit typically receiving higher ratings for app stability and user experience.

Bybit Vs Bitmart Conclusion: Why Not Use Both?

After comparing Bybit and Bitmart, you might wonder which platform to choose. The answer might surprise you – using both exchanges could be beneficial for different trading needs.

Bybit excels with a smoother user experience and intuitive interface. It offers competitive trading fees and strong leverage options that many traders appreciate. The platform is known for its reliability during high market volatility.

Bitmart provides a wider range of trading markets and cryptocurrency options. If you’re looking for altcoins and newer tokens, Bitmart typically lists more varieties than Bybit.

Key differences at a glance:

| Feature | Bybit | Bitmart |

|---|---|---|

| User Experience | Smoother, more intuitive | More complex but feature-rich |

| Trading Markets | Fewer options but well-curated | Wider variety of tokens |

| Fees | Competitive fee structure | Variable fees depending on trading pairs |

| Security | Strong security features | Improved security after 2021 breach |

Using both platforms lets you leverage their unique strengths. You might use Bybit for its user-friendly interface when making quick trades, while turning to Bitmart when you need access to a specific altcoin not available elsewhere.

Many experienced traders maintain accounts on multiple exchanges to take advantage of different fee structures, token availability, and trading features. This strategy provides more flexibility in your trading approach.