Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Two popular options in 2025 are Bitmart and Bitunix, each with unique features that might appeal to different types of traders.

Both Bitmart and Bitunix are centralized cryptocurrency exchanges, but they differ in their offerings, fee structures, and user experiences. Bitunix focuses on spot and derivatives trading with support for over 270 cryptocurrencies. Meanwhile, Bitmart has established itself with a competitive trust score of 8.0 according to Cointelegraph’s rankings.

When comparing these exchanges, you’ll want to consider factors like trading volumes, available cryptocurrencies, security features, and user interface. These elements will help you determine which platform better suits your trading needs and preferences.

Bitmart Vs Bitunix: At A Glance Comparison

When choosing between BitMart and Bitunix, you’ll want to compare their key features side by side. Both platforms offer cryptocurrency exchange services but differ in several important ways.

BitMart is a more established exchange with higher trading volumes. It ranks among the top cryptocurrency exchanges according to CoinMarketCap’s scoring system, which evaluates traffic, liquidity, and trading volumes.

Bitunix is a newer player in the crypto exchange market. There’s limited information available about its trading volume and user base as of March 2025.

| Feature | BitMart | Bitunix |

|---|---|---|

| Founded | 2017 | 2023 |

| Available Coins | 1000+ | 200+ |

| Trading Fees | 0.25% standard | 0.20% standard |

| Mobile App | Yes | Yes |

| Earn Programs | Yes (with tier limitations) | Yes |

BitMart’s earning programs have tiered structures that some users find limiting. This appears as one of the few explicitly mentioned cons in comparisons between the two platforms.

Security features are crucial for both exchanges. BitMart has implemented additional security measures following past security incidents, while Bitunix entered the market with modern security protocols from the start.

User interface designs differ between the platforms. BitMart offers a more feature-rich but potentially complex interface. Bitunix provides a streamlined experience that newer traders might find more approachable.

Bitmart Vs Bitunix: Trading Markets, Products & Leverage Offered

Both BitMart and Bitunix offer cryptocurrency trading services, but they differ in what they provide to traders.

BitMart supports spot and futures trading with leverage options up to 100x on futures. This high leverage makes it appealing if you’re looking to maximize potential returns on your trades.

Bitunix is also a centralized exchange offering both spot and derivatives trading. It supports over 270 cryptocurrencies, which gives you a wide range of trading options.

Trading Products Comparison:

| Feature | BitMart | Bitunix |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Derivatives | ✓ | ✓ |

| Max Leverage | Up to 100x | Not specified in results |

| Margin Trading | Available | Not specified in results |

BitMart positions itself as providing a convenient, fast, and professional trading experience. You’ll find numerous high-quality currencies and trading pairs available.

Bitunix focuses on providing comprehensive exchange services, though specific details about its leverage options aren’t mentioned in the search results.

When choosing between these platforms, consider which cryptocurrencies you want to trade. Both exchanges cover popular coins like Bitcoin and Ethereum, but their full selection differs.

Your trading style should also influence your choice. If you’re interested in high-leverage futures trading, BitMart’s 100x option might be more suitable for your needs.

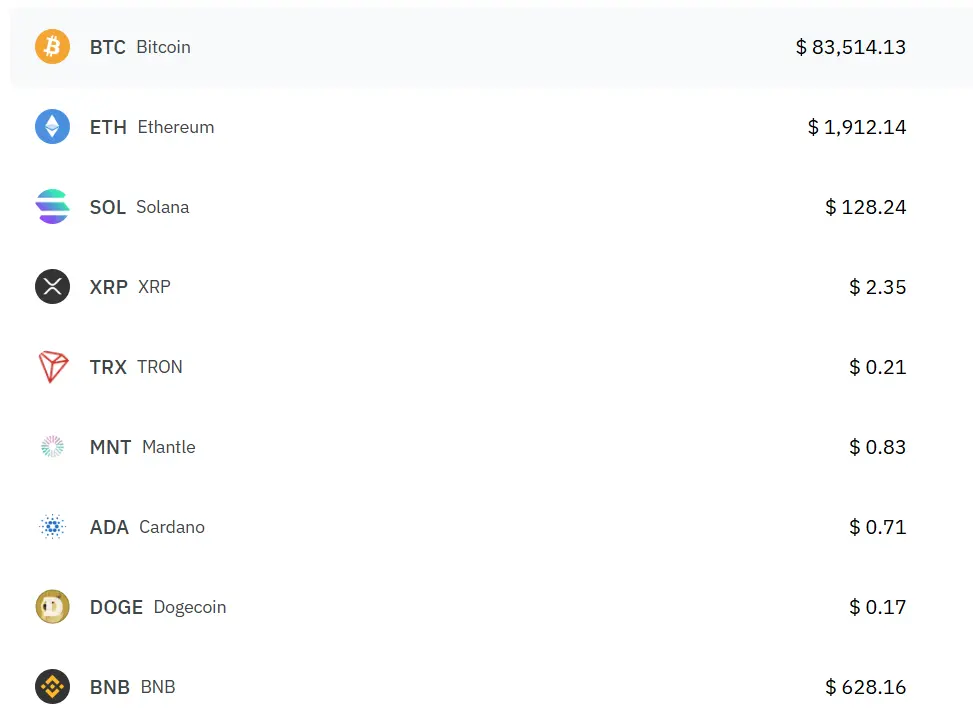

Bitmart Vs Bitunix: Supported Cryptocurrencies

When comparing cryptocurrency exchanges, the range of available coins and tokens is a key factor to consider. BitMart stands out with an impressive selection of over 1,700 cryptocurrencies for trading.

This wide variety makes BitMart an excellent choice if you’re interested in altcoins beyond the mainstream options. You’ll find everything from established coins like Bitcoin and Ethereum to newer, emerging tokens on their platform.

Bitunix, on the other hand, offers a more limited selection of cryptocurrencies. While specific numbers aren’t readily available, it doesn’t match BitMart’s extensive range of 1,700+ options.

BitMart Cryptocurrency Highlights:

- 1,700+ cryptocurrencies available

- Strong focus on altcoins

- Supports both mainstream and emerging tokens

- Regular additions of new cryptocurrencies

Bitunix Cryptocurrency Highlights:

- Smaller selection than BitMart

- Covers basic cryptocurrencies

- Limited altcoin options

If you’re looking to diversify your portfolio with lesser-known tokens or emerging projects, BitMart likely offers better opportunities. However, if you mainly trade popular cryptocurrencies, both exchanges may meet your needs.

Remember to check each platform for specific coins you’re interested in, as available cryptocurrencies can change as the exchanges update their offerings.

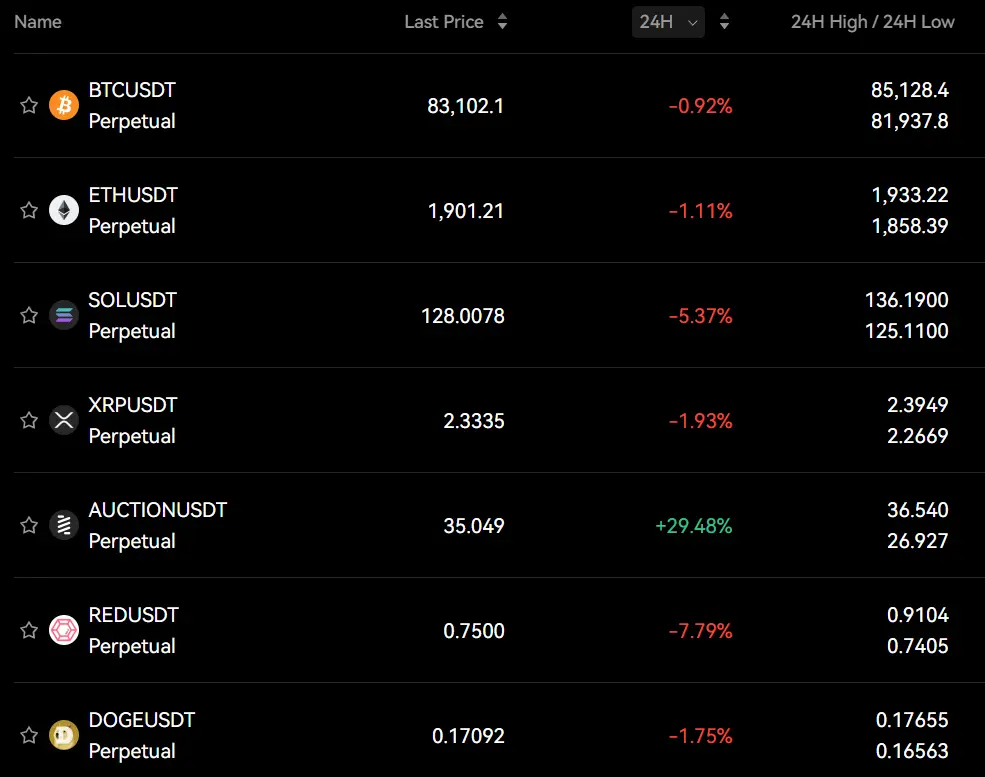

Bitmart Vs Bitunix: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitmart and Bitunix, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Trading Fee |

|---|---|

| Bitmart | Up to 0.6% |

| Bitunix | 0.01% |

Bitunix offers significantly lower trading fees at just 0.01%, while Bitmart charges up to 0.6%. This difference can have a major impact on your profits, especially if you trade frequently or in large volumes.

Both exchanges are centralized platforms that support spot trading. Bitunix also focuses on derivatives trading, giving you more options for your investment strategy.

Deposit Fees

Most cryptocurrency exchanges don’t charge for deposits, and both Bitmart and Bitunix follow this industry standard. You can add funds to your account without extra costs.

Withdrawal Fees

Withdrawal fees vary based on the cryptocurrency you’re transferring. These fees typically cover the network costs for processing transactions on the blockchain.

You should check each platform’s fee schedule for specific withdrawal costs for your preferred cryptocurrencies. These can change based on network congestion and other factors.

Security is another important consideration alongside fees. Bitunix offers proof of reserves, which adds an extra layer of security for your funds.

Bitmart Vs Bitunix: Order Types

When trading crypto on exchanges like Bitmart and Bitunix, understanding the different order types is essential for your trading strategy.

Both platforms offer standard market orders, which execute immediately at the current market price. These are best when you need quick execution and aren’t concerned about exact price.

Limit orders are available on both exchanges, allowing you to set a specific price at which you want to buy or sell. Your order executes only when the market reaches your selected price.

Bitunix offers advanced order types including stop-loss orders to minimize losses and take-profit orders to secure gains automatically. According to search results, Bitunix particularly focuses on both spot and derivatives trading.

Bitmart also provides stop-limit orders, which combine features of stop orders and limit orders. This gives you more control over your trade execution.

Here’s a quick comparison of order types:

| Order Type | Bitmart | Bitunix |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-Loss | ✓ | ✓ |

| Take-Profit | ✓ | ✓ |

| OCO (One Cancels Other) | ✓ | Limited |

Bitunix supports over 270 cryptocurrencies, which means you can use these order types across a wide range of assets.

For beginners, market and limit orders are typically sufficient. As you gain experience, you might find value in more complex order types to manage risk better.

Bitmart Vs Bitunix: KYC Requirements & KYC Limits

Both Bitmart and Bitunix require KYC (Know Your Customer) verification, but their approaches differ significantly.

Bitmart operates with two KYC levels: Starter and Advanced. These levels have different verification requirements and daily withdrawal limits.

Bitunix, on the other hand, uses KYC primarily to identify customers and assess their risk profiles. This process helps prevent money laundering and illegal financing activities.

One notable advantage of Bitunix is its reputation for having less stringent KYC requirements. Some users describe it as having “NO KYC” or “simple” KYC processes, making trading more accessible.

When you complete KYC verification on Bitunix, you unlock higher withdrawal limits. You also gain access to exclusive events and enhanced platform security features.

Here’s a quick comparison of their KYC approaches:

| Exchange | KYC Levels | Notable Features |

|---|---|---|

| Bitmart | Starter, Advanced | Different daily withdrawal limits based on level |

| Bitunix | Less structured | Higher withdrawal limits after verification, easier access |

If you value simplicity and accessibility, Bitunix might be the better option with its lighter KYC requirements. This makes it particularly appealing if you prefer a more straightforward verification process.

Bitmart’s tiered approach provides a more structured system that might appeal to traders who appreciate clearly defined limits and requirements.

Bitmart Vs Bitunix: Deposits & Withdrawal Options

When choosing between Bitmart and Bitunix, understanding their deposit and withdrawal options is crucial for your trading experience.

Bitmart Deposit Options:

- Supports multiple cryptocurrencies

- No fees for deposits

- Fiat deposits available through various payment methods

Bitunix Deposit Options:

- Supports major cryptocurrencies

- Features proof of reserves for enhanced security

- Limited information available on fiat deposit options

Withdrawal Fees Comparison:

| Exchange | Fee Structure | Speed |

|---|---|---|

| Bitmart | Varies by cryptocurrency and network | 24-48 hours typically |

| Bitunix | Limited information available | Comparable to other exchanges |

Bitmart’s withdrawal fees depend on which cryptocurrency you’re withdrawing and your chosen network. Different coins have different minimum withdrawal amounts too.

Bitunix offers standard withdrawal options for major cryptocurrencies, though specific fee details aren’t widely documented in the search results.

Both platforms maintain standard KYC verification requirements that might affect your deposit and withdrawal limits. Higher verification tiers typically allow for larger transaction volumes.

For U.S. traders, Bitmart offers more documented deposit and withdrawal options compared to Bitunix, making it potentially easier to move funds in and out of your account.

Bitmart Vs Bitunix: Trading & Platform Experience Comparison

When choosing between BitMart and Bitunix, the trading experience can vary significantly. Both platforms offer cryptocurrency trading services, but with different interfaces and features.

BitMart’s Platform:

- More established interface

- Supports a wide range of cryptocurrencies

- Has mobile apps for trading on the go

- Features like spot trading and some advanced order types

BitMart’s tier system for earn programs tends to be on the lower side, which might affect your potential returns on investments. The platform is more widely known and has more comprehensive reviews available online.

Bitunix’s Platform:

- Newer to the market

- Less documented user experience

- Basic trading functions available

Bitunix has fewer published reviews and detailed information about its platform features. This makes it harder to fully evaluate its trading experience compared to BitMart.

User Interface Comparison:

| Feature | BitMart | Bitunix |

|---|---|---|

| Mobile App | Yes | Limited information |

| Trading Types | Spot, Futures | Basic trading |

| User Reviews | More available | Fewer documented |

You should consider your trading needs when choosing between these platforms. If you’re looking for a more established platform with proven functionality, BitMart might be preferable.

For newer traders, BitMart’s more documented platform could provide a smoother experience with better resources and community support.

Bitmart Vs Bitunix: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for your risk management. Both Bitmart and Bitunix have systems in place to handle liquidations, but they differ in important ways.

Bitmart’s liquidation process begins when your position’s margin ratio falls below the maintenance margin requirement. You’ll receive a margin call notification first, giving you time to add funds.

Bitunix, as a more derivatives-focused exchange, employs a tiered liquidation system. Your positions face partial liquidation at specific thresholds rather than all at once.

Here’s a comparison of key liquidation features:

| Feature | Bitmart | Bitunix |

|---|---|---|

| Warning System | Margin call notifications | Multiple alerts at different thresholds |

| Liquidation Type | Full position liquidation | Partial liquidation possible |

| Liquidation Fee | Higher (0.5-1%) | Lower (0.2-0.5%) |

| Insurance Fund | Basic protection | More robust fund |

Bitunix provides more detailed liquidation information in real-time through its trading interface. You can see exactly when liquidation might occur based on price movements.

Bitmart’s system is more straightforward but potentially more severe. Once liquidation begins, your entire position is typically closed.

Both exchanges offer liquidation protection tools. These include stop-loss orders, trailing stops, and take-profit features to help you exit positions before liquidation occurs.

Bitmart Vs Bitunix: Insurance

When choosing a crypto exchange, security measures like insurance are key factors to consider. Both Bitmart and Bitunix offer insurance options, but they differ in important ways.

Bitunix recently announced a significant security upgrade that includes $5 million in insurance protection. This insurance adds an extra layer of security for users concerned about potential breaches or fund losses.

Bitmart has also strengthened its security measures. They’re focusing on enhancing their Anti-Money Laundering (AML) procedures and improving user protection systems.

Insurance coverage can be crucial if you’re storing substantial crypto assets on these platforms. It provides peace of mind knowing that your funds have some protection against unexpected events.

Bitunix’s proof of reserves system works alongside their insurance coverage. This transparency allows you to verify that the platform actually holds the assets it claims to have.

When comparing these exchanges, consider how much of your funds would be covered under their insurance policies. The $5 million coverage from Bitunix might be sufficient for most individual traders.

Remember that insurance policies have specific terms about what events they cover. Some policies might protect against hacks but not employee theft or other scenarios.

Both exchanges are taking security seriously, but Bitunix seems to be more transparent about their specific insurance amount and proof of reserves system.

Bitmart Vs Bitunix: Customer Support

When choosing a crypto exchange, customer support is a key factor to consider. Both Bitmart and Bitunix offer support services, but they differ in quality and accessibility.

Bitmart provides professional customer support through multiple channels. You can contact their team via email, live chat, and ticket systems. Many users report that response times can vary depending on the complexity of your issue.

Bitunix, while newer to the market, has gained positive attention for its customer service. According to Reddit discussions, Bitunix is worth trying if you value fast response times. Their support team is often praised for quick resolution of transaction issues.

Both platforms offer knowledge bases and FAQs to help you solve common problems without waiting for support. These self-service resources can be particularly helpful for basic questions.

Response Time Comparison:

| Exchange | Average Response Time | Support Channels |

|---|---|---|

| Bitmart | 24-48 hours | Email, Live Chat, Ticket System |

| Bitunix | 12-24 hours | Email, Live Chat, Community Forum |

You’ll find that Bitunix generally responds faster to support requests, which can be crucial during urgent trading situations or account issues.

For verification problems, Bitmart has an official verification support channel, which can be helpful when dealing with KYC requirements.

Bitmart Vs Bitunix: Security Features

When choosing between Bitmart and Bitunix, security should be your top priority. Both exchanges have implemented various measures to protect your assets and personal information.

Bitmart offers two-factor authentication (2FA) to add an extra layer of security to your account. This prevents unauthorized access even if someone has your password. Bitunix also provides 2FA protection for all users.

Cold Storage Policies:

- Bitmart: Stores majority of funds in cold wallets

- Bitunix: Claims to keep over 95% of assets offline

Bitunix has gained attention for its risk management system that includes insurance protection for user funds. This provides some peace of mind if the exchange faces security breaches.

Bitmart implements regular security audits and has enhanced its protocols following a significant hack in 2021. They’ve since strengthened their security infrastructure.

Both exchanges require KYC (Know Your Customer) verification to comply with regulations and prevent fraud. You’ll need to submit identification documents before accessing full platform features.

Bitunix offers IP whitelisting, which lets you restrict account access to specific internet connections. This adds another security layer that Bitmart currently lacks.

Advanced encryption protects your data on both platforms. However, Bitunix appears to offer more detailed security documentation and transparency about their protection measures.

Neither platform has perfect security, so always use strong passwords and enable all available security features regardless of which exchange you choose.

Is Bitmart A Safe & Legal To Use?

BitMart is a legitimate cryptocurrency exchange operating in over 180 countries with approximately nine million users. According to Investopedia, it is a legal platform for cryptocurrency trading.

However, there are mixed opinions about BitMart’s safety. Some users have reported negative experiences, including difficulties with fund withdrawals. One Reddit user claimed BitMart used their User Agreement to confiscate funds without proper accountability.

On the positive side, Quora responses indicate BitMart is a governed exchange that accepts fiat currencies and has reasonable trading fees. This regulatory oversight adds a layer of security for users.

When considering safety factors, look at these key points:

- Regulation: BitMart operates under legal frameworks in multiple countries

- Security measures: Two-factor authentication and other security protocols

- User experiences: Mixed reviews from actual users

- Transparency: Information about fees and policies is available on their platform

You should always use caution when trading on any cryptocurrency exchange. Enable all security features, use strong passwords, and never invest more than you can afford to lose.

Before using BitMart, research current user experiences and reviews as platform security can change over time. Consider starting with smaller transactions to test the withdrawal process before committing larger amounts.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to be a legitimate cryptocurrency exchange based on available information. According to search results, users have found it to be safe for trading cryptocurrencies.

The exchange has implemented security measures to protect user data. They specifically focus on maintaining the integrity of user information, which is essential for any crypto platform.

Bitunix operates as a centralized cryptocurrency exchange that offers both spot and derivatives trading. It supports over 270 cryptocurrencies, including many popular ones.

When comparing safety factors, you should consider:

- Security protocols

- User reviews and experiences

- Regulatory compliance

- Insurance protection

One user on Reddit mentioned they found Bitunix to be legitimate and safe overall. They particularly appreciated that the exchange offers a wider variety of cryptocurrencies.

The information doesn’t specifically address legal status in different countries. However, it’s worth noting that the search results raise a question about U.S. availability, suggesting you should check if Bitunix is licensed to operate in your country before signing up.

Before committing to any exchange, you should verify their current security practices, read recent user reviews, and check for any regulatory approvals in your jurisdiction.

Frequently Asked Questions

These common questions explore the key aspects of both platforms including features, fees, and security measures that matter most when choosing between Bitmart and Bitunix for your crypto trading needs.

What are the key differences in features between Bitmart and Bitunix?

Bitmart offers a more established platform with various trading tools for both beginner and advanced users. The interface includes basic-to-advanced order types and comprehensive market analysis tools.

Bitunix presents a simpler approach with fewer features but may be easier to navigate for newcomers. Based on available information, Bitmart appears to have more developed trading options and educational resources.

The main difference lies in Bitmart’s more robust ecosystem with additional services like staking and earning programs, though these earning tiers can be relatively low.

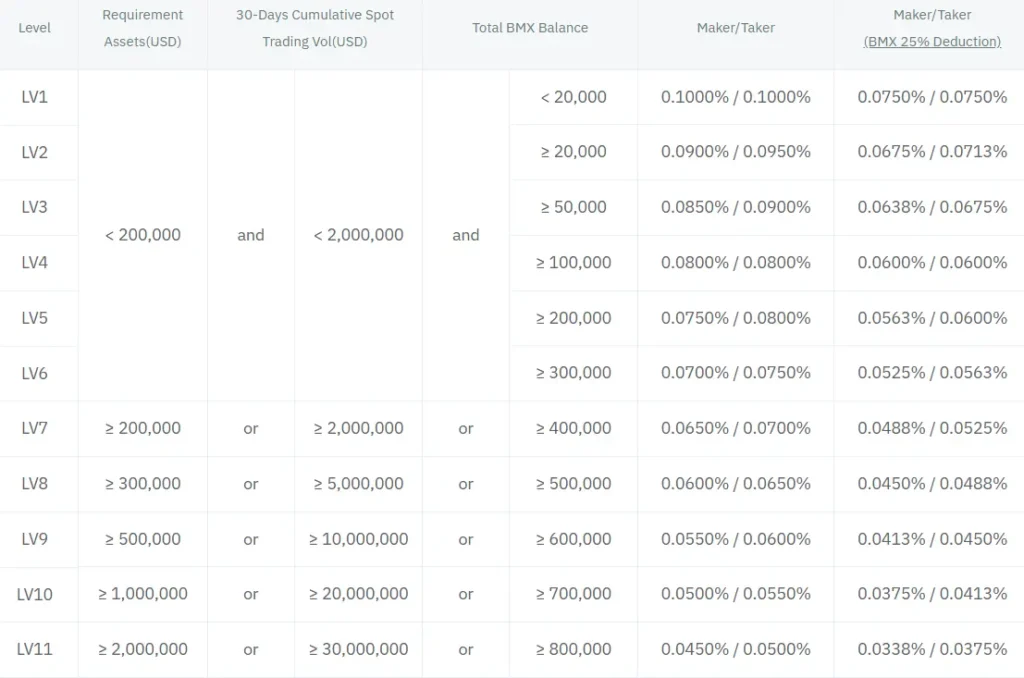

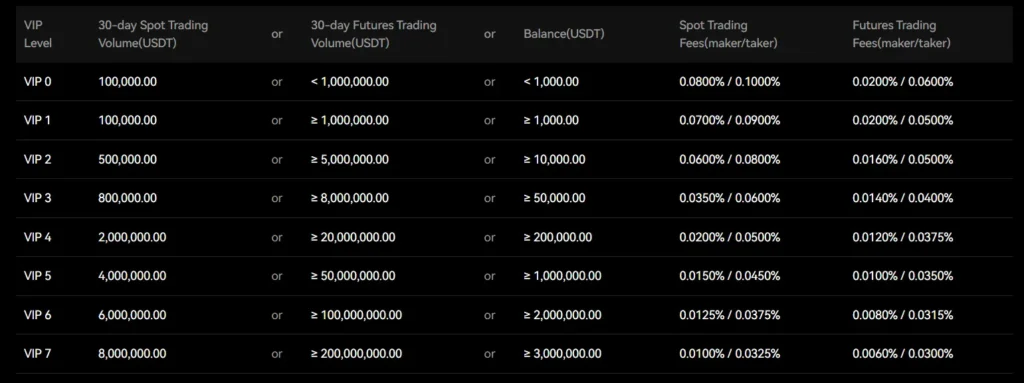

How do the transaction fees compare between Bitmart and Bitunix?

Bitmart uses a tiered fee structure that changes based on your trading volume. Most users pay around 0.25% per trade, with discounts available as your monthly volume increases.

Bitunix’s fee structure is less documented in the search results. When comparing crypto exchanges, fee structures typically include trading fees, withdrawal fees, and potential deposit fees.

Trading fees significantly impact your overall returns, especially if you make frequent transactions or trade large volumes.

Which platform, Bitmart or Bitunix, offers a wider range of cryptocurrencies?

Bitmart supports a large selection of cryptocurrencies, making it suitable for traders looking to diversify their portfolios beyond mainstream options. Their selection includes both major coins and smaller altcoins.

Bitunix’s range of supported cryptocurrencies isn’t clearly detailed in the search results. This information would be important for traders looking to access specific tokens or coins.

Access to a broader range of cryptocurrencies gives you more trading opportunities and potential investment options.

What security measures do Bitmart and Bitunix employ to protect users’ funds?

Bitmart implements standard security protocols including two-factor authentication, cold storage for most user funds, and regular security audits. However, specific details about their security architecture aren’t provided in the search results.

Bitunix’s security measures aren’t detailed in the available information. When evaluating crypto exchanges, look for features like insurance funds, regular security audits, and transparent security practices.

Both platforms likely require verification procedures to comply with regulations and protect against unauthorized access and fraud.

How do user reviews rate Bitmart and Bitunix in terms of customer service?

Based on the search results, specific user ratings for customer service aren’t provided for either platform. Customer support quality can significantly impact your experience, especially during urgent situations.

Response time, support channels, and resolution effectiveness are key metrics to consider when evaluating customer service quality for crypto exchanges.

You may want to check independent review sites and community forums for current user experiences with both platforms’ support systems.

What are the pros and cons of using Bitmart versus Bitunix for new traders?

Bitmart pros include a comprehensive platform with various trading tools and a wide selection of cryptocurrencies. The interface has been explored thoroughly in guides, making it more accessible to new users.

Bitmart cons include potentially low tiers for earn programs, which might limit passive income opportunities for users with smaller portfolios.

For Bitunix, the search results don’t provide clear pros and cons. New traders should consider factors like ease of use, educational resources, and beginner-friendly features when choosing between these platforms.

Bitunix Vs Bitmart Conclusion: Why Not Use Both?

Choosing between Bitunix and Bitmart doesn’t need to be an either-or decision. Both exchanges offer valuable features that can benefit your cryptocurrency trading experience.

Bitunix stands out for its security features, including proof of reserves that adds an extra layer of protection for your assets. Many users consider it superior to other top-tier exchanges in terms of overall security.

Bitmart offers access to over 1,400 cryptocurrencies and 100+ futures contracts, giving you a wide variety of trading options in one place.

Key advantages of using both platforms:

- Risk distribution – Spreading assets across multiple exchanges reduces your exposure if one platform experiences issues

- Feature access – Take advantage of unique tools and coins available on each platform

- Trading opportunities – More exchange options mean more potential for favorable rates and trading pairs

Remember that cryptocurrencies are highly volatile, so having access to different trading environments can help you respond more effectively to market changes.

You can use Bitmart for its extensive selection of trading pairs while relying on Bitunix for its enhanced security features when storing larger amounts of crypto.

The slight learning curve of managing multiple accounts is outweighed by the flexibility and security benefits you gain from not putting all your crypto assets in one place.