Choosing the right cryptocurrency exchange can make a big difference in your trading experience. BitMart and BitMEX are two popular platforms that many traders consider, each with their own strengths and weaknesses. BitMart scores higher overall with a 7.5 rating compared to BitMEX, according to recent comparisons.

These exchanges differ in several key areas including fees, available cryptocurrencies, and trading features. BitMart may appeal to you if you’re looking for a wider selection of cryptocurrencies, while BitMEX might be your choice if you’re interested in specific trading products. As of March 2025, understanding these differences can help you decide which platform better suits your trading needs.

When selecting between these exchanges, you should consider factors like security measures, user interface, and customer support. Both platforms have established themselves in the crypto market, but your specific trading goals will determine which one provides the most value for your situation.

BitMart Vs BitMEX: At A Glance Comparison

When choosing between BitMart and BitMEX, understanding their key differences can help you make an informed decision. Based on recent 2025 data, BitMart scores higher overall with a 7.5 rating compared to BitMEX.

Exchange Focus:

- BitMart: General cryptocurrency exchange with a wide range of tokens

- BitMEX: Specialized in crypto derivatives and futures trading

User Experience:

- BitMart: More beginner-friendly interface

- BitMEX: Advanced trading tools favored by experienced traders

Here’s how they compare on essential features:

| Feature | BitMart | BitMEX |

|---|---|---|

| Trading Volume | High | High |

| Available Cryptocurrencies | 1000+ | Limited selection |

| Trading Fees | Competitive | Lower for high-volume traders |

| Leverage Options | Moderate | Up to 100x on some products |

| Security Features | Two-factor authentication, cold storage | Multi-signature wallets, insurance fund |

BitMart offers you a broader selection of cryptocurrencies to trade. If you’re looking for variety in tokens, this gives BitMart an advantage.

BitMEX excels in derivatives trading with powerful futures contracts and higher leverage options. You’ll find its platform more suitable if you’re an advanced trader focusing on these products.

Both exchanges provide mobile apps, but their availability varies by region. You should check if either exchange is accessible in your location before creating an account.

Bitmart Vs BitMEX: Trading Markets, Products & Leverage Offered

When comparing BitMart and BitMEX, the trading products and leverage options differ significantly.

BitMEX focuses primarily on derivatives trading. They specialize in Bitcoin futures and swaps, offering up to 100x leverage on some contracts. This high leverage is one of BitMEX’s standout features for experienced traders.

BitMEX’s product lineup includes perpetual contracts and futures contracts for Bitcoin and other major cryptocurrencies. Their platform is designed for traders who want advanced derivatives tools.

BitMart offers a broader range of products. You’ll find spot trading for hundreds of cryptocurrencies alongside some derivatives options. BitMart typically offers lower leverage than BitMEX, usually up to 10-20x depending on the product.

The exchanges also differ in market selection:

| Feature | BitMEX | BitMart |

|---|---|---|

| Main Focus | Derivatives | Spot Trading |

| Cryptocurrencies | Limited selection | Hundreds available |

| Max Leverage | Up to 100x | Up to 10-20x |

| Target Users | Advanced traders | Both beginners and experienced |

BitMEX has built its reputation on high-performance trading engines and advanced charting tools. Their platform caters to professional traders who need sophisticated derivatives instruments.

BitMart provides a more accessible entry point if you’re looking to trade a wider variety of cryptocurrencies directly. Their platform balances accessibility with some advanced features.

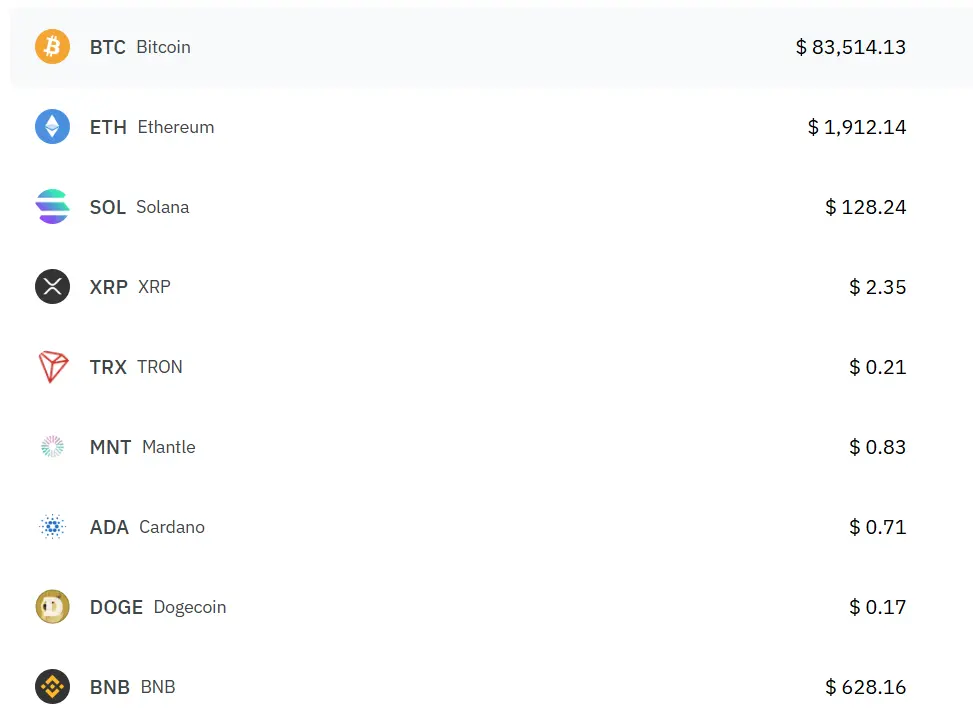

Bitmart Vs BitMEX: Supported Cryptocurrencies

When choosing between BitMart and BitMEX, the range of supported cryptocurrencies is a key factor to consider for your trading needs.

BitMart offers a significantly larger selection of cryptocurrencies than BitMEX. This platform supports hundreds of different coins and tokens, giving you access to both established cryptocurrencies and emerging altcoins.

BitMEX takes a more focused approach. It primarily supports major cryptocurrencies with an emphasis on Bitcoin and other top market cap coins. The platform specializes in cryptocurrency derivatives and futures rather than offering a wide variety of assets.

BitMart Supported Cryptocurrencies:

- Hundreds of cryptocurrencies

- Both major coins and smaller altcoins

- Regular additions of new tokens

- Support for many emerging projects

BitMEX Supported Cryptocurrencies:

- Limited selection focused on major cryptocurrencies

- Strong emphasis on Bitcoin trading pairs

- Fewer altcoins available

- Focus on quality over quantity

If you’re looking to trade a diverse range of cryptocurrencies, including smaller cap coins, BitMart provides more options. However, if you’re primarily interested in trading derivatives of major cryptocurrencies, BitMEX’s focused selection might be sufficient for your needs.

The difference in available cryptocurrencies reflects each exchange’s business model and target audience. BitMart aims to be comprehensive, while BitMEX specializes in derivatives trading with established cryptocurrencies.

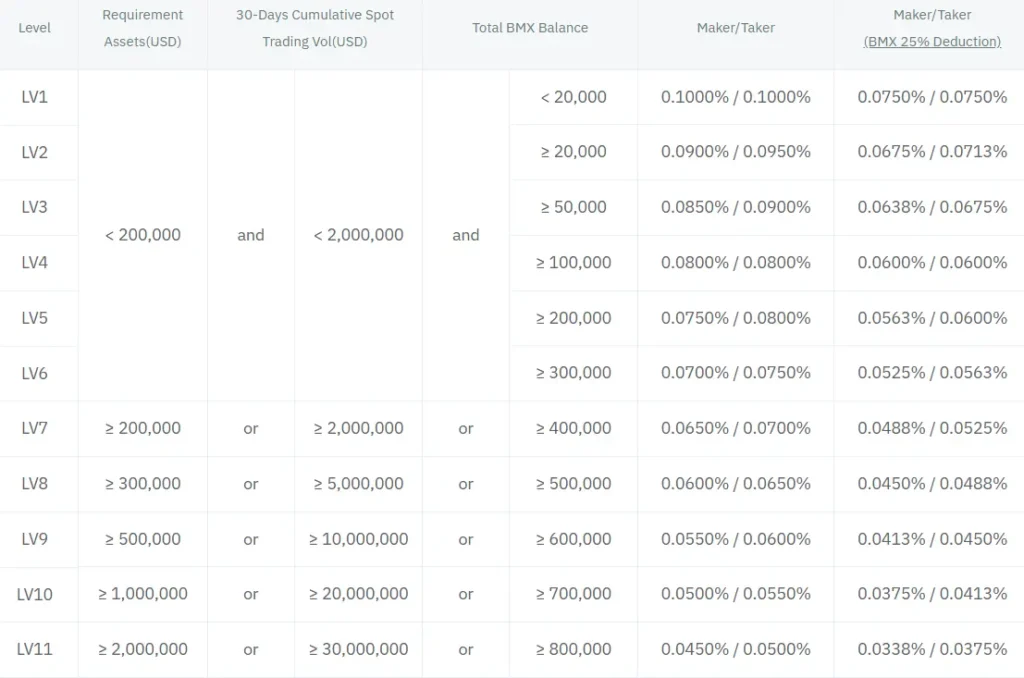

Bitmart Vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BitMart and BitMEX, understanding their fee structures is crucial for maximizing your profits.

Trading Fees

BitMart charges up to 0.40% in trading fees, while BitMEX fees can go up to 0.6%. This difference might seem small, but it adds up with frequent trading or larger transactions.

Withdrawal Fees

BitMart’s withdrawal fees can reach up to $60 for some cryptocurrencies. BitMEX typically charges up to 0.001 BTC for withdrawals, which is a fixed amount regardless of the size of your withdrawal.

Both exchanges use a fixed fee model for withdrawals, but the exact amounts vary by cryptocurrency. BitMart adjusts withdrawal fees regularly based on blockchain conditions.

Deposit Fees

Neither exchange typically charges for deposits, which is standard across most cryptocurrency platforms.

Fee Comparison Table

| Fee Type | BitMart | BitMEX |

|---|---|---|

| Trading Fees | Up to 0.40% | Up to 0.6% |

| Withdrawal Fees | Up to $60 | Up to 0.001 BTC |

| Deposit Fees | Usually free | Usually free |

You should check the current fee structures on both platforms before trading. Fees can change based on market conditions and company policies.

For active traders, BitMart’s lower trading fees might be more appealing. However, if you make fewer but larger withdrawals, BitMEX’s fixed withdrawal fee could be more cost-effective.

BitMart Vs BitMEX: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both BitMart and BitMEX offer various order options, but they differ in some important ways.

BitMEX provides a more extensive range of order types for advanced traders. They offer standard Limit orders that let you set a specific price for buying or selling.

BitMEX also features Take Profit orders in two variations: Take Profit Market Order and Take Profit Limit Order. These execute when the market reaches your trigger price.

For risk management, BitMEX includes Stop Loss orders that help protect your investments from significant downturns.

BitMart offers a more simplified set of order types. They focus on basic Limit and Market orders that are accessible to beginners.

BitMEX Order Types:

- Limit Orders

- Market Orders

- Stop Orders

- Take Profit Orders

- Trailing Stop Orders

- Post-Only Orders

BitMart Order Types:

- Limit Orders

- Market Orders

- Stop Limit Orders

If you need advanced trading options, BitMEX gives you more tools to execute complex strategies. Their order types are designed for experienced traders who need precise control.

BitMart’s simpler approach works well if you prefer straightforward trading without complicated options. This makes it more approachable for newcomers to cryptocurrency trading.

Bitmart Vs BitMEX: KYC Requirements & KYC Limits

Both BitMart and BitMEX require KYC verification from users, but they differ in their processes and levels.

BitMart operates a two-tier KYC system: Starter and Advanced. Each level grants different trading privileges and withdrawal limits. The Starter level requires basic personal information, while the Advanced level needs more documentation.

BitMEX has a standard KYC process that all users must complete to use the platform fully. Their compliance team verifies your identity documents before allowing full platform access.

For ID verification, both platforms require clear images of government-issued identification. Make sure your photos are well-lit and all text is readable to avoid delays in verification.

Here’s a quick comparison of their KYC approaches:

| Feature | BitMart | BitMEX |

|---|---|---|

| KYC Required | Yes | Yes |

| Verification Levels | Two (Starter & Advanced) | One standard level |

| User Base | Approximately 9M users | Approximately 100K users |

| Document Requirements | Government ID, selfie | Government ID, proof of address |

The larger user base of BitMart (9 million compared to BitMEX’s 100,000) might suggest their KYC process is more streamlined.

You should complete KYC verification as soon as possible on either platform to access all features and higher withdrawal limits.

Bitmart Vs BitMEX: Deposits & Withdrawal Options

When choosing between BitMart and BitMEX, deposit and withdrawal options play a crucial role in your trading experience.

BitMart offers more flexibility with multiple deposit and withdrawal methods. You can use both cryptocurrency and fiat currency options on this platform.

BitMEX focuses primarily on cryptocurrency deposits and withdrawals. The platform doesn’t support fiat currency transactions, which might limit options for some traders.

Withdrawal Fees Comparison:

| Exchange | Withdrawal Fees |

|---|---|

| BitMart | Up to $60 |

| BitMEX | Up to 0.001 BTC |

BitMart’s withdrawal fees can be higher, reaching up to $60 depending on the currency and amount. This is something to consider if you plan frequent withdrawals.

BitMEX charges up to 0.001 BTC for withdrawals, which is more transparent but still variable based on network conditions.

An advantage of BitMEX is that some reports suggest it charges competitive mining withdrawal fees compared to industry averages.

Your choice between these platforms may depend on whether you need fiat currency support. If you only trade in cryptocurrencies, BitMEX’s focused approach might work well for you.

Consider how often you’ll make withdrawals and in what amounts when deciding between these exchanges.

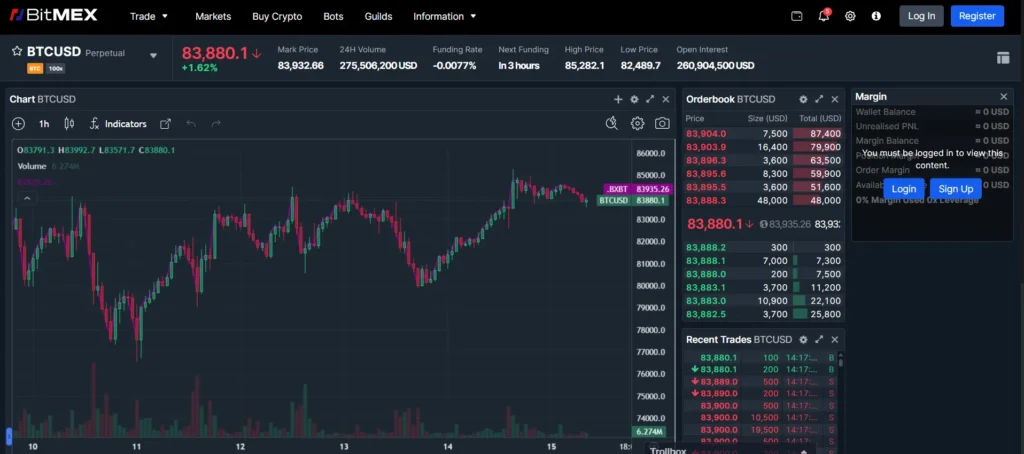

Bitmart Vs BitMEX: Trading & Platform Experience Comparison

BitMart and BitMEX offer different trading experiences that cater to various types of crypto traders. Both platforms have established themselves in the market with distinct features and interfaces.

BitMart provides a more straightforward trading experience suitable for beginners and intermediate users. Its interface is clean and relatively easy to navigate compared to some competitors.

BitMEX, on the other hand, targets more experienced traders with its advanced trading tools and focus on derivatives trading. The platform is known for its robust architecture but comes with a steeper learning curve.

User Interface Comparison:

- BitMart: More user-friendly, simplified navigation

- BitMEX: Complex but powerful, designed for experienced traders

When it comes to trading features, BitMEX excels in derivatives trading with high leverage options. BitMart offers a wider variety of spot trading pairs but with more limited leverage capabilities.

Trading Tools:

| Feature | BitMart | BitMEX |

|---|---|---|

| Spot Trading | Extensive | Limited |

| Derivatives | Basic options | Advanced options |

| Charting Tools | Moderate | Comprehensive |

| Mobile Experience | Smooth, full-featured | Functional but complex |

BitMart’s platform has reliable architecture and robust security mechanisms that provide a dependable trading experience. This makes it particularly suitable for mid-sized businesses and regular traders.

BitMEX boasts one of the highest trading volumes in the crypto industry, which can mean better liquidity for your trades. However, this can also lead to platform congestion during peak trading periods.

Bitmart Vs BitMEX: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation process is crucial. Both Bitmart and BitMEX have mechanisms in place to manage risk, but they operate differently.

BitMEX employs a partial liquidation process that stands out in the industry. This system automatically reduces maintenance margins in an attempt to avoid completely liquidating your position. The goal is to give traders a chance to recover before total liquidation occurs.

BitMEX also uses a sophisticated Liquidation Process that tries to prevent complete liquidation by increasing your maintenance margin when necessary. This can be beneficial if you’re in a volatile trading situation.

BitMart’s liquidation mechanism is less documented in the search results, but the exchange generally follows standard industry practices for liquidation procedures.

One notable issue with BitMEX’s system is that some traders have reported situations where profitable positions were liquidated. This can happen if one of BitMEX’s two price indexes experiences issues, potentially triggering liquidations despite positions being in profit.

When choosing between these platforms, consider your trading style and risk tolerance. If you frequently use high leverage, BitMEX’s partial liquidation process might offer more protection against complete position losses.

Remember to always use stop-loss orders and proper risk management regardless of which platform you choose.

Bitmart Vs BitMEX: Insurance

When trading cryptocurrencies, insurance protection is a key factor to consider. BitMEX offers a robust Insurance Fund that helps protect traders from auto-deleveraging in their positions.

BitMEX’s Insurance Fund is designed to manage unfilled liquidation orders. When a trader’s position gets liquidated but the market doesn’t allow for complete liquidation at the bankruptcy price, the Insurance Fund steps in to cover the difference.

As of 2025, BitMEX’s Insurance Fund has grown substantially, providing users with an added layer of security for their trading activities.

BitMart’s insurance protection differs in its approach. While BitMEX focuses on preventing auto-deleveraging, BitMart emphasizes general platform security measures.

You should note that BitMart serves a larger user base of around 9 million active users compared to BitMEX’s approximately 100,000 users. This difference in scale may impact how each platform structures their insurance protection.

When you’re choosing between these exchanges, consider your trading style. If you engage in margin trading or futures, BitMEX’s Insurance Fund may provide you with valuable protection against market volatility.

For standard spot trading with fewer leveraged positions, BitMart’s security measures might be sufficient for your needs.

Remember to review each platform’s current insurance terms, as policies may have updated since this comparison was made.

Bitmart Vs BitMEX: Customer Support

When choosing between crypto exchanges, customer support can be a deciding factor. Both BitMart and BitMEX offer support options, but they differ in quality and availability.

BitMEX provides dedicated customer service to help users with questions and problems. Their support team is known for being responsive, which can be crucial when dealing with urgent trading issues.

BitMart serves around 9 million users compared to BitMEX’s 100,000 active users. This larger user base might affect response times during high-volume periods.

Support Channels Comparison:

| Platform | Email Support | Live Chat | Help Center | Response Time |

|---|---|---|---|---|

| BitMart | ✓ | ✓ | ✓ | Variable |

| BitMEX | ✓ | ✓ | ✓ | Generally fast |

Both exchanges offer knowledge bases with FAQs and guides. These resources can help you solve common problems without waiting for support.

If you’re a US resident, BitMart might be more suitable as it allows US customers after completing KYC verification. The verification process typically takes only a few hours.

Language support is another consideration. BitMEX focuses primarily on English support, while BitMart offers assistance in more languages to serve its broader international user base.

Remember to check recent user reviews about support quality before making your decision, as service levels can change over time.

BitMart Vs BitMEX: Security Features

When choosing between BitMart and BitMEX, security should be a top priority for your crypto investments. Both exchanges offer important security measures but differ in their approaches.

BitMart provides robust security through two-factor authentication (2FA), SSL encryption, and cold storage for most user funds. These features help protect your assets from unauthorized access and potential breaches.

BitMEX also employs strong security protocols including 2FA, multi-signature wallets, and encryption. Their security team continuously monitors the platform for suspicious activities. BitMEX stores the majority of user funds in cold wallets that are disconnected from the internet.

One notable difference is regulatory compliance. BitMEX has worked to improve its regulatory standing in recent years. BitMart, however, lacks regulation from major financial authorities, which might be a concern for security-conscious traders.

Key Security Features Comparison:

| Feature | BitMart | BitMEX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| SSL Encryption | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Multi-signature Wallets | Limited | ✓ |

| Major Regulatory Compliance | Limited | Improved recently |

Both exchanges have experienced security incidents in the past. BitMart suffered a significant hack in December 2021, while BitMEX has faced regulatory challenges that indirectly affect security.

For additional protection, you should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious about phishing attempts.

Is Bitmart A Safe & Legal To Use?

Bitmart is a legitimate cryptocurrency exchange that serves over 9 million users in more than 180 countries. The platform operates legally in many jurisdictions, though regulations for crypto exchanges vary by country.

Users have mixed opinions about Bitmart’s safety. Some reports suggest the exchange has faced legal challenges and government scrutiny. These issues might affect how you view the platform’s reliability.

When considering safety, remember that all cryptocurrency exchanges carry certain risks. Bitmart has faced some security incidents in the past, like many exchanges in the crypto space.

Key safety considerations:

- Two-factor authentication (2FA) is available

- Funds are stored in both hot and cold wallets

- KYC (Know Your Customer) verification is required for higher withdrawal limits

Bitmart claims to use industry-standard security measures to protect user funds and data. However, it’s always wise to use caution when storing large amounts of cryptocurrency on any exchange.

Before using Bitmart, check if it’s licensed to operate in your country. Regulations change frequently in the crypto world, so what’s legal today might change tomorrow.

For maximum safety, consider using hardware wallets for long-term storage and only keep trading amounts on the exchange.

Is BitMEX A Safe & Legal To Use?

BitMEX has strong security measures to protect your funds. They use multi-factor authentication and manual checks for withdrawals to keep your crypto safe.

BitMEX is a legitimate cryptocurrency exchange that has been operating since 2014. However, there’s an important restriction you should know about – BitMEX is not available to customers in the United States.

This restriction exists because BitMEX is not regulated in the U.S. If you’re a U.S. resident, you won’t be able to create an account or trade on BitMEX legally.

For users outside the U.S., BitMEX operates legally in many countries. But you should always check your local regulations before signing up.

When using BitMEX, it’s best to follow safe trading practices:

- Only keep the funds you need for trading on the exchange

- Don’t use it as a long-term storage solution

- Enable all available security features

- Use strong, unique passwords

BitMEX has about 100,000 active users, which is smaller than BitMart’s 9 million users. While smaller, this established user base suggests many traders trust the platform.

Remember that all cryptocurrency exchanges carry some risk. You should only trade amounts you can afford to lose and be aware of the volatile nature of crypto markets.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges. These answers address key differences between BitMart and BitMEX that matter most to users making a choice between the platforms.

What are the main differences between the trading fees on BitMart and BitMEX?

BitMart and BitMEX employ different fee structures. BitMart uses a tiered fee system based on trading volume, with maker fees typically ranging from 0.05% to 0.2% and taker fees from 0.05% to 0.25%.

BitMEX has a different approach with a maker-taker model that actually pays makers a rebate (negative fee) while charging takers a premium. This can result in makers earning 0.01% to 0.05% while takers pay between 0.05% to 0.075%.

The fee differences make BitMEX potentially more attractive for high-volume traders who primarily provide liquidity as makers.

How do BitMart and BitMEX compare in terms of user security and platform safety measures?

BitMart implements standard security practices including two-factor authentication, cold storage for most funds, and regular security audits. Following a security breach in 2021, they’ve enhanced their security protocols significantly.

BitMEX places heavy emphasis on security with multi-signature wallet technology, thorough KYC procedures, and insurance funds to protect against auto-deleveraging. Their security team has a strong reputation in the industry.

Both exchanges require identity verification, but BitMEX has stricter compliance measures and more robust security infrastructure overall.

Which platform offers a broader range of cryptocurrencies and trading pairs, BitMart or BitMEX?

BitMart clearly leads in cryptocurrency diversity with support for hundreds of different coins and tokens. You can access many altcoins and newer projects on BitMart that aren’t available elsewhere.

BitMEX focuses primarily on Bitcoin and a select number of major cryptocurrencies. Their emphasis is on offering sophisticated derivatives products rather than supporting a wide variety of tokens.

The difference in available assets makes BitMart more suitable for traders seeking exposure to emerging cryptocurrencies.

Which exchange has a more user-friendly interface for beginners, BitMart or BitMEX?

BitMart offers a relatively straightforward interface that new users can navigate without extensive trading knowledge. The platform provides basic charts, simple order placement, and clear account information.

BitMEX presents a more complex interface designed for professional traders. The platform includes advanced charting tools, complex order types, and detailed position information that can overwhelm beginners.

New traders typically find BitMart easier to use, while experienced traders often prefer BitMEX’s comprehensive tools.

Can you provide a comparison of the customer support services between BitMart and BitMEX?

BitMart provides customer support through email, tickets, and social media channels. Response times vary but typically range from a few hours to days depending on inquiry complexity.

BitMEX offers more comprehensive support with 24/7 customer service, detailed knowledge base articles, and faster response times. Their support team is known for technical expertise, particularly regarding derivatives trading issues.

Both platforms offer multilingual support, but BitMEX generally receives higher ratings for the quality and speed of their customer service interactions.

How do the leverage and margin trading options differ between BitMart and BitMEX?

BitMart offers leverage trading up to 100x on select trading pairs. Their futures market includes perpetual contracts similar to those found on other major exchanges.

BitMEX made its name with high-leverage trading, offering up to 100x leverage on Bitcoin contracts. They specialize in perpetual swaps and futures contracts with sophisticated risk management tools.

BitMEX provides more advanced liquidation mechanisms and a well-established insurance fund to protect traders during volatile market conditions.

BitMEX Vs Bitmart Conclusion: Why Not Use Both?

BitMEX and BitMart offer different strengths that might appeal to various types of crypto traders. BitMEX has a solid reputation as the first exchange to launch perpetual contracts, giving it an edge for derivatives trading.

BitMart boasts a significantly larger user base with approximately 9 million active users compared to BitMEX’s 100,000. This popularity may suggest better liquidity and trading options on BitMart.

When it comes to security, both platforms prioritize user safety. BitMart implements 2FA, SSL encryption, and cold storage solutions. However, it lacks regulation from major financial authorities, which might concern some users.

Why consider using both platforms?

- Different trading pairs and opportunities

- Risk diversification across exchanges

- Ability to leverage specific features unique to each platform

You might prefer BitMEX for its specialized derivatives trading while using BitMart for its wider selection of cryptocurrencies and larger community. This dual approach could maximize your trading potential.

The best strategy depends on your trading needs. If you’re a casual trader, one platform might suffice. For more advanced traders, utilizing both exchanges could provide greater flexibility and access to more trading options.

Remember to consider fees, security measures, and user experience when deciding which platform(s) work best for your cryptocurrency trading journey.