When choosing between Bitget and Bybit in 2025, you’re looking at two popular crypto exchanges with distinct advantages. Bitget offers a more beginner-friendly experience with strong regulatory compliance and excellent copy trading features. Meanwhile, Bybit boasts higher liquidity and lower trading fees, typically ranking among the top three exchanges globally.

Bitget has better copy trading platforms and trading bots, while Bybit provides superior liquidity and passive earning options. This key difference might influence your decision depending on your trading style and experience level.

Both exchanges offer significant bonuses to new users and have built solid reputations in the crypto space. Your choice ultimately depends on whether you prioritize user-friendliness and copy trading (Bitget) or lower fees and liquidity (Bybit) for your cryptocurrency trading journey.

Bitget Vs Bybit: At A Glance Comparison

When choosing between Bitget and Bybit, understanding their key differences helps you make a better decision for your crypto trading needs.

Regulation & Security:

- Bybit: Licensed in Dubai and regulated by Cyprus authorities

- Bitget: Features a growing customer protection fund and healthy proof of reserve

Trading Fees:

- Bybit: Generally offers lower trading fees

- Bitget: Known for low-fee trading structure

Platform Features:

| Feature | Bitget | Bybit |

|---|---|---|

| Copy Trading | Yes (standout feature) | Limited |

| Leverage Trading | Available | Higher leverage options |

| Passive Earning | Basic options | Better passive earn options |

Bitget stands out for its copy trading feature, which lets you follow successful traders’ strategies automatically. This makes it ideal if you’re newer to trading.

Bybit appeals more to experienced traders with its higher leverage options and more comprehensive passive earning opportunities.

Both exchanges offer similar cryptocurrency selections and trading pairs, though their user interfaces differ slightly in layout and complexity.

When it comes to customer support, both platforms provide standard options like live chat and email assistance, but response times may vary depending on your region.

Bitget Vs Bybit: Trading Markets, Products & Leverage Offered

When choosing between Bitget and Bybit, understanding what markets and products each platform offers is crucial for your trading strategy.

Trading Markets

Both exchanges offer spot trading with a wide range of cryptocurrencies. Bybit and Bitget support major coins like Bitcoin, Ethereum, and various altcoins.

Contract Types

- Bybit: Offers USDT perpetuals, inverse perpetuals, and options

- Bitget: Provides USDT perpetuals, inverse perpetuals, and copy trading features

Leverage Options

| Exchange | Maximum Leverage |

|---|---|

| Bitget | Up to 125x |

| Bybit | Up to 100x |

Bitget stands out with its copy trading function where you can follow expert traders automatically. This feature is particularly helpful if you’re newer to trading.

Bybit offers a more comprehensive derivatives suite with options trading, which Bitget currently lacks. This gives experienced traders more tools for hedging positions.

Both platforms provide demo accounts so you can practice trading without risking real money. This is valuable for testing strategies before committing funds.

For passive income seekers, Bybit has more developed earn products with staking options. Bitget is catching up in this area but currently offers fewer yield-generating products.

Bitget Vs Bybit: Supported Cryptocurrencies

Both Bitget and Bybit offer a wide range of cryptocurrencies for trading, but there are some differences worth noting.

Bybit supports over 400 cryptocurrencies as of March 2025. This includes major coins like Bitcoin, Ethereum, and Solana, as well as numerous altcoins and tokens from emerging blockchain projects.

Bitget offers access to approximately 350+ cryptocurrencies. While slightly fewer than Bybit, Bitget regularly adds new tokens, especially those gaining popularity in the market.

Popular cryptocurrencies supported by both exchanges:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Polkadot (DOT)

- Ripple (XRP)

When comparing trading pairs, Bybit typically offers more variety with both USDT and USD pairs for most major cryptocurrencies. Bitget focuses more on USDT pairs but has been expanding its options.

If you’re interested in trading newer, less established tokens, you might find Bybit adds them to their platform slightly faster than Bitget. However, both exchanges have improved their listing process in the past year.

For DeFi tokens, both platforms provide good coverage, though Bybit tends to list a broader selection of DeFi projects from various blockchains.

You’ll find that both exchanges allow spot trading for all supported cryptocurrencies, but futures and options trading is limited to a smaller selection of the more established tokens.

Bitget Vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitget and Bybit, understanding their fee structures can save you money on your crypto trading journey.

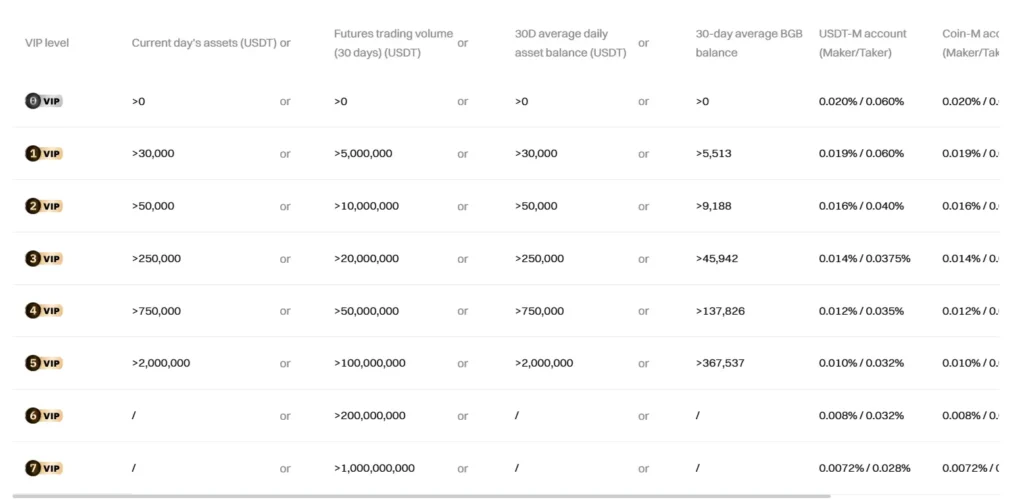

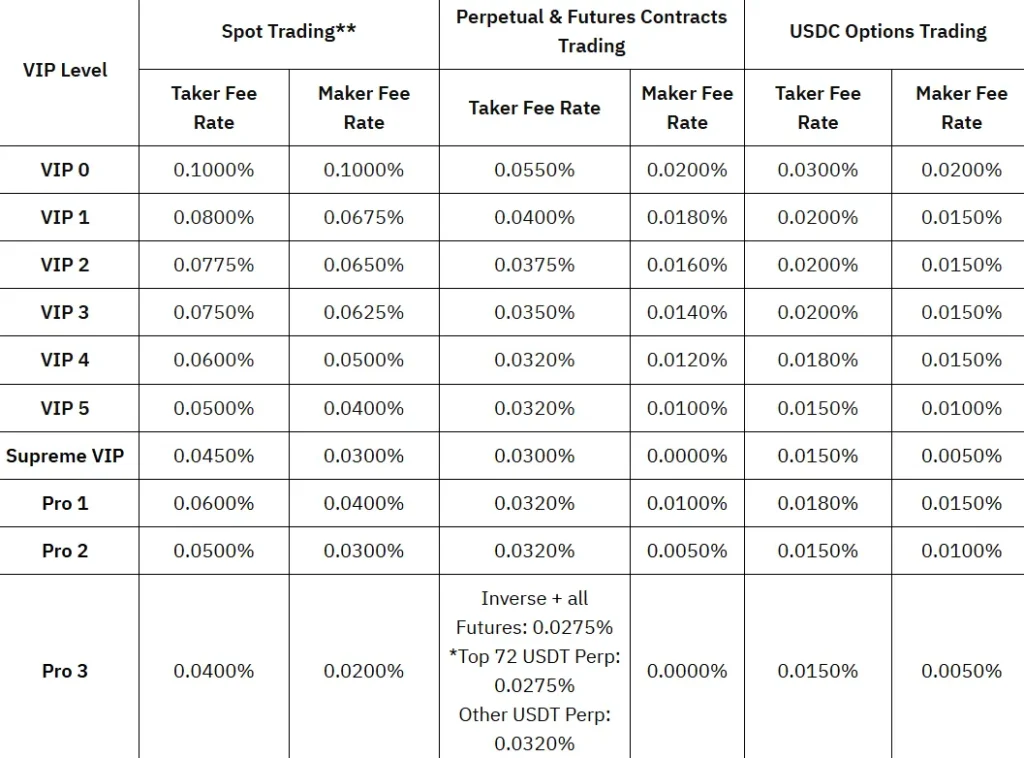

Both exchanges offer competitive trading fees that are among the lowest in the market. Bybit has a slight edge with lower trading fees compared to Bitget.

For spot trading, both platforms use a maker-taker fee model. Makers create liquidity by placing orders that don’t execute immediately, while takers remove liquidity by matching existing orders.

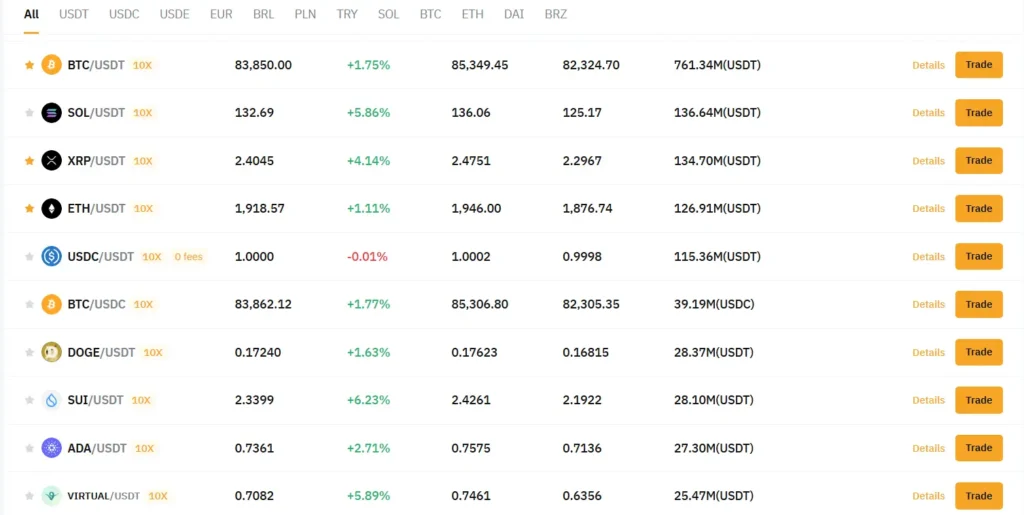

Basic Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bitget | 0.1% | 0.1% |

| Bybit | 0.1% | 0.1% |

For futures trading, Bybit charges less:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bitget | 0.02% | 0.06% |

| Bybit | 0.01% | 0.06% |

Both platforms offer fee discounts for users with higher trading volumes or those holding platform tokens.

Withdrawal Fees:

Both exchanges charge a 0.0005 BTC withdrawal fee for Bitcoin. Other crypto withdrawal fees vary by asset but remain competitive across both platforms.

Deposit fees are generally free on both Bitget and Bybit, making it easy to fund your account without extra costs.

You can reduce your fees on both platforms by increasing your trading volume or participating in their loyalty programs.

Bitget Vs Bybit: Order Types

When trading on cryptocurrency exchanges, the types of orders available can significantly impact your trading strategy. Both Bitget and Bybit offer a variety of order types to help you execute trades effectively.

Limit Orders are available on both platforms. These let you set a specific price at which you want to buy or sell. Your order will only execute when the market reaches your set price.

Market Orders allow for immediate execution at the current market price. Both exchanges offer this basic order type for when speed is more important than price precision.

Stop Loss and Take Profit Orders help manage risk. Bybit and Bitget both support these essential risk management tools that automatically close positions when certain price levels are reached.

Bybit offers Conditional Orders which are helpful for setting up trades that only trigger when specific market conditions occur. This is especially useful for more complex trading strategies.

Bitget features TWAP Orders (Time-Weighted Average Price), which break large orders into smaller pieces executed over a specified time period. This helps minimize market impact when placing large trades.

Post-Only Orders are available on both platforms. These ensure your order only executes as a maker, not a taker, helping you save on fees.

Both exchanges also support Trailing Stop Orders that adjust automatically as the market moves in your favor. This helps you lock in profits during volatile market conditions.

Bitget Vs Bybit: KYC Requirements & KYC Limits

KYC (Know Your Customer) requirements differ significantly between Bitget and Bybit, which might affect your trading experience.

Bitget enforces strict KYC requirements. You’ll need to complete verification to access many features on the platform. Bitget offers full fiat currency support, which often comes with these stricter verification requirements.

Bybit takes a more flexible approach. The platform maintains optional KYC procedures, meaning you can trade without sharing personal information at basic levels.

Bybit offers different KYC tiers:

- Non-KYC: Basic access

- Individual KYC Level 1: Increased features

- Individual KYC Level 2: Full access

For beginners learning to trade, Bybit’s tiered approach might be more appealing as you can start with minimal verification.

Bitget consistently works with regulatory agencies, which explains their stricter KYC stance. This compliance focus might provide extra security for your funds.

When choosing between these exchanges, consider how important privacy is to you versus access to fiat currencies and certain features.

Remember that KYC requirements can change based on your location and evolving regulations. What’s optional today might become mandatory tomorrow.

Bitget Vs Bybit: Deposits & Withdrawal Options

Both Bitget and Bybit offer multiple options for depositing and withdrawing your funds. Understanding these options can help you choose the exchange that best fits your needs.

Deposit Methods

- Both platforms support cryptocurrency deposits with no fees

- Fiat deposits are available through bank transfers and credit/debit cards

- Bybit offers more payment providers for fiat deposits in certain regions

Withdrawal Methods

- Cryptocurrency withdrawals are supported on both exchanges

- Fiat withdrawals are available but may have limitations based on your location

- Bybit generally processes withdrawals faster, with most completed within 24 hours

Fees

| Exchange | Crypto Withdrawal Fees | Fiat Withdrawal Fees |

|---|---|---|

| Bitget | Varies by asset | 1-3% depending on method |

| Bybit | Slightly lower on average | 0.5-2.5% depending on method |

You’ll find that minimum deposit and withdrawal amounts exist on both platforms. These minimums vary based on the specific cryptocurrency or fiat currency you’re using.

Processing times can differ between the exchanges. Bybit typically completes transactions more quickly than Bitget, especially during high network congestion periods.

Both platforms implement security measures for withdrawals, including email verification, 2FA, and withdrawal address whitelisting to protect your funds.

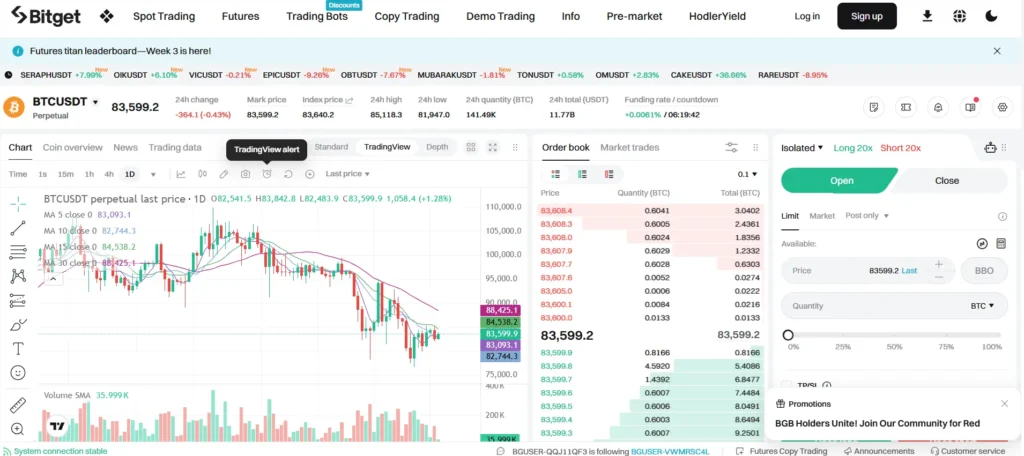

Bitget Vs Bybit: Trading & Platform Experience Comparison

When trading on cryptocurrency exchanges, the platform experience can make or break your trading journey. Both Bitget and Bybit offer robust trading platforms, but they differ in several key aspects.

Bybit provides a more modern interface that many users find intuitive and easy to navigate. The platform’s clean design helps you execute trades quickly without confusion.

Bitget’s interface, while functional, feels less intuitive according to user feedback. However, it compensates with some unique features that might appeal to certain traders.

Trading Features Comparison:

| Feature | Bitget | Bybit |

|---|---|---|

| Copy Trading | Strong platform | Basic options |

| Trading Bots | Advanced options | Limited selection |

| User Interface | Functional but less intuitive | Modern and intuitive |

| Liquidity | Good | Excellent (Top 3 ranked) |

Bybit excels in liquidity, typically ranking among the top three cryptocurrency exchanges. This means your orders are filled faster and with less slippage—an important factor for active traders.

Bitget stands out with its copy trading platform, allowing you to automatically mirror successful traders’ strategies. Their trading bots also offer more options for automated trading compared to Bybit.

For beginners, Bybit’s cleaner interface might be easier to learn. The modern feel and straightforward navigation can help you get started quickly without feeling overwhelmed.

Advanced traders might appreciate Bitget’s specialized tools despite the slightly steeper learning curve.

Bitget Vs Bybit: Liquidation Mechanism

Liquidation is a crucial part of leveraged trading on both Bitget and Bybit. It happens when your position can’t be maintained due to insufficient margin to cover potential losses.

Bybit offers a more trader-friendly liquidation process compared to Bitget. The platform uses a tiered liquidation mechanism that gradually reduces your position size instead of closing it all at once.

Bitget’s liquidation process tends to be more straightforward but potentially more abrupt. When your margin ratio falls below the maintenance requirement, the system will liquidate your position fully.

Liquidation Features Comparison:

| Feature | Bitget | Bybit |

|---|---|---|

| Partial Liquidation | Limited | Yes |

| Liquidation Warning | Yes | Yes |

| Liquidation Price Calculator | Available | Available |

| Insurance Fund | Yes | Yes (larger) |

Both exchanges use insurance funds to protect traders from negative balances during extreme market conditions. Bybit’s insurance fund is generally larger, providing better protection against cascading liquidations.

You can reduce your liquidation risk on both platforms by:

- Using lower leverage

- Setting stop-loss orders

- Adding more margin to your positions

- Monitoring your positions regularly

Bybit provides more detailed information about approaching liquidation, giving you more time to add funds or adjust your position.

Bitget Vs Bybit: Insurance

When trading crypto, your funds’ safety is a top priority. Both Bitget and Bybit offer protection through insurance funds, but they differ in significant ways.

Bitget maintains a Protection Fund that has been growing consistently. As of March 2025, Bitget’s fund exceeds $400 million in assets. This fund serves as a safety net for users if the exchange faces financial difficulties.

Bybit also offers an insurance mechanism but with a different approach. Their fund is typically smaller than Bitget’s but still provides reasonable protection for traders. Bybit focuses on using their insurance primarily for covering losses in their derivatives trading system.

Protection Fund Comparison:

| Exchange | Fund Size | Transparency | Regular Updates |

|---|---|---|---|

| Bitget | $400M+ | High | Monthly |

| Bybit | Smaller | Moderate | Quarterly |

Both exchanges publish proof of reserves to show they have the assets they claim. This transparency helps you verify that your funds are backed by real assets.

You should note that Bitget appears to place more emphasis on their protection fund as a selling point. They regularly highlight its growth in their marketing materials.

Neither insurance fund guarantees complete protection against all possible risks. Market risks, personal account security, and extreme scenarios may still expose you to potential losses.

Bitget Vs Bybit: Customer Support

When choosing between Bitget and Bybit, customer support plays a crucial role in your trading experience. Both exchanges offer support options, but they differ in some important ways.

Bitget provides customer assistance through live chat and email. You need to fill out a form in their help center before accessing these support channels. Their customer service team operates 24/7, ensuring you can get help whenever you need it.

Bybit also offers 24-hour customer support with multiple contact options. They have live chat functionality directly on their platform and email support for more complex issues.

Response times vary between the platforms. Bitget typically responds within a few hours for email inquiries, while their live chat aims to connect you with an agent within minutes.

Both exchanges provide comprehensive help centers with FAQs, guides, and tutorials to help solve common problems without contacting support directly.

Language Support Comparison:

| Exchange | Number of Languages | Key Languages |

|---|---|---|

| Bitget | 10+ | English, Chinese, Korean, Vietnamese |

| Bybit | 13+ | English, Japanese, Russian, Spanish |

Users often report that Bitget’s Copy Trading support is particularly helpful for newcomers to this feature. However, Bybit receives praise for their technical support team’s knowledge about complex trading tools.

You should consider which support channel matters most to you – whether it’s quick live chat responses or detailed email assistance for more complex issues.

Bitget Vs Bybit: Security Features

When choosing between Bitget and Bybit, security should be a top priority for your crypto assets. Both exchanges have implemented various measures to protect users.

Bitget has made a significant security commitment with its $200 million protection fund. This fund specifically aims to safeguard users’ assets in case of security breaches or other issues.

Bybit takes a different approach with an insurance model to protect user funds. However, based on available information, this appears less comprehensive than Bitget’s dedicated protection fund.

Both exchanges employ standard security features including:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Regular security audits

- Withdrawal confirmations

Bitget Security Highlights:

- $200 million protection fund

- Multi-signature wallets

- Advanced encryption protocols

- Real-time monitoring systems

Bybit Security Highlights:

- Insurance-based protection

- Anti-phishing measures

- Risk management system

- Address whitelisting options

You should enable all available security features on whichever platform you choose. This includes setting up strong passwords, enabling 2FA, and being cautious with withdrawal addresses.

The security infrastructure of both platforms continues to evolve as cryptocurrency threats advance. Bitget’s larger protection fund may offer additional peace of mind for traders concerned about asset safety.

Is Bitget A Safe & Legal To Use?

Bitget has established itself as a legitimate cryptocurrency exchange in the market. According to recent information, Bitget has not experienced any major security breaches or loss of user funds, which is a positive indicator of its security measures.

Some users have reported issues with Bitget, including temporary freezing of assets. One search result mentioned that some users experienced their assets being frozen for up to two weeks without explanation.

The platform employs security protocols to protect user funds and information. This includes standard security features that most reputable exchanges implement.

Regarding legality, Bitget operates in multiple countries but has restrictions in some regions. You should verify if Bitget is allowed to operate in your country before creating an account.

Unlike Bybit, which is explicitly mentioned as not available for US users due to regulatory restrictions, Bitget’s availability in the US isn’t clearly stated in the search results.

Safety considerations for Bitget:

- No major reported attacks

- Generally secure for trading

- Some user complaints about account freezes

- Implements standard security measures

Before using Bitget, you should research the most current regulatory status in your region. Cryptocurrency regulations change frequently, and what’s legal today might not be tomorrow.

Is Bybit A Safe & Legal To Use?

Bybit operates as a legitimate cryptocurrency exchange with licenses in Dubai and regulatory supervision from Cyprus authorities. This oversight adds a layer of trustworthiness and suggests responsible management practices.

However, Bybit is not available for users in the United States due to regulatory restrictions. If you’re based in the US, you’ll need to find alternative exchanges that comply with local regulations.

For users outside restricted regions, Bybit has maintained a relatively secure platform. The exchange hasn’t experienced significant security breaches or recorded major losses of user funds, which speaks to its security measures.

When considering safety, you should look at factors like:

- Regulatory compliance in your region

- Security features (2FA, withdrawal limits)

- Insurance funds to protect users

- Transparency about operations

The legality of using Bybit depends entirely on your location. While it’s accessible in many countries, some jurisdictions have strict regulations around cryptocurrency exchanges.

Before creating an account, you should verify whether Bybit operates legally in your country. Using an exchange that isn’t authorized in your region could expose you to legal risks and potential account restrictions.

Frequently Asked Questions

Traders considering Bitget and Bybit need answers to key questions about fees, security, and user experience. These points often determine which platform best suits individual trading needs and preferences.

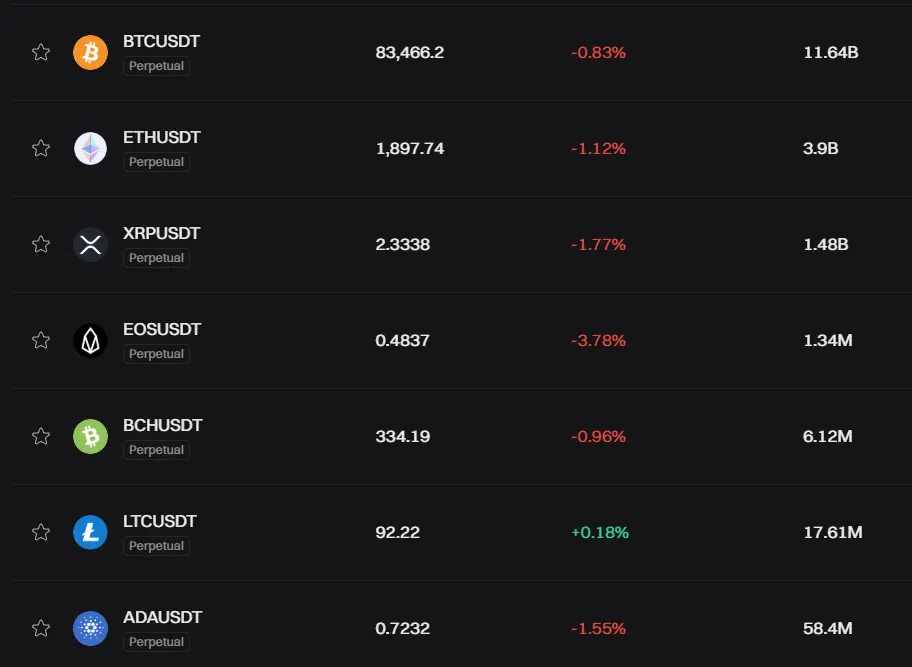

What are the main differences in trading fees between Bitget and Bybit?

Bybit typically offers lower trading fees compared to Bitget, especially for high-volume traders. Users can reduce fees on Bybit by increasing their 30-day trading volume.

Bybit’s fee structure provides better long-term savings for active traders who reach higher tier levels. This advantage becomes more significant as your trading activity increases.

For occasional traders, the fee difference may be less noticeable, but serious traders should consider Bybit’s potential fee savings.

Which platform offers better security features, Bitget or Bybit?

Bitget appears to have a stronger regulatory position and security focus. The platform maintains a healthy Proof of Reserve system and consistently grows its customer protection funds.

Both exchanges use two-factor authentication and cold wallet storage for the majority of user funds. However, Bitget’s emphasis on regulatory compliance may provide additional security assurances.

You should always enable all available security features regardless of which platform you choose.

How do Bitget’s user interface and user experience compare to those of Bybit?

Both platforms offer modern, functional interfaces designed for traders of various experience levels. Bitget features Copy Trading, which allows you to automatically mirror successful traders’ positions.

Bybit’s interface is known for being intuitive with advanced charting tools that appeal to experienced traders. The mobile apps for both platforms provide similar functionality to their desktop versions.

New users might find Bitget’s copy trading feature helpful for learning, while more experienced traders might prefer Bybit’s advanced charting capabilities.

Which of the two platforms, Bitget or Bybit, offers a wider range of cryptocurrencies and trading pairs?

Both exchanges offer a substantial selection of cryptocurrencies and trading pairs. The exact counts change regularly as new coins are added.

Bybit typically maintains a slight edge in the variety of trading pairs available, particularly for newer or less mainstream cryptocurrencies. Both platforms support major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins.

You should check both platforms for specific coins you want to trade, as availability can change.

How do withdrawal processes and limits on Bitget compare to Bybit?

Both platforms impose withdrawal limits based on account verification levels. Higher verification tiers grant higher withdrawal limits on both exchanges.

Processing times are comparable, with most withdrawals completed within 24 hours. Fees vary by cryptocurrency, with Bybit sometimes offering slightly lower withdrawal fees for certain tokens.

Both exchanges implement a security waiting period for withdrawals after changing security settings to protect your funds.

What are the customer support options available on Bitget and Bybit, and which is more reliable?

Both exchanges offer 24/7 customer support through multiple channels including live chat, email, and help centers with FAQs.

Bybit has developed a reputation for more responsive customer service, especially during high-volume trading periods. Response times can vary based on inquiry complexity and platform traffic.

You can find educational resources on both platforms, but Bybit often provides more comprehensive trading guides and tutorials for new users.

Bybit Vs Bitget Conclusion: Why Not Use Both?

After comparing Bybit and Bitget, you might wonder if you need to choose just one platform. The truth is, many crypto traders use multiple exchanges to take advantage of different benefits.

Bybit offers better liquidity and lower long-term fees, especially at higher tier levels. If you trade large volumes, this could save you money over time.

Bitget stands out with its copy trading platform and trading bots. These features can be valuable if you’re looking to automate some of your trading or learn from experienced traders.

Benefits of using both platforms:

- Diversify risk across exchanges

- Take advantage of different fee structures

- Access unique features only available on one platform

- Compare trading experiences firsthand

You might use Bybit for its liquidity and competitive fees while using Bitget for its copy trading features. This combination could give you the best of both worlds.

Remember to consider your own trading needs, volume, and preferences. What works for one trader may not work for another.

Both platforms offer bonuses for new users, so you could try both with minimal risk to see which interface and feature set you prefer.