Choosing the right cryptocurrency trading platform can make a big difference in your trading success. BitMEX and Bitget are two popular options that traders often compare when looking for a reliable exchange.

Both platforms offer cryptocurrency trading with leverage, but they differ in user experience, fees, and available features. BitMEX is known for high liquidity and has been around longer, while Bitget has gained popularity for its more user-friendly interface.

When deciding between these platforms, you’ll want to consider factors like trading fees, supported cryptocurrencies, security measures, and available tools. This comparison will help you understand which platform might better suit your trading needs and experience level.

Bitget vs BitMEX: At A Glance Comparison

When choosing between Bitget and BitMEX for your cryptocurrency trading, understanding their key differences is essential. Both platforms offer crypto derivatives trading but have distinct features that might make one better suited for your needs.

Trading Experience

| Feature | Bitget | BitMEX |

|---|---|---|

| User Interface | More beginner-friendly | Complex, suited for advanced traders |

| Available Products | Spot, futures, copy trading | Primarily derivatives, futures |

| Mobile Experience | Well-developed app | Less intuitive mobile platform |

Trading Costs

Bitget typically offers competitive fees for both makers and takers. BitMEX is known for its high liquidity but can have more complex fee structures.

Security Features

Both exchanges implement strong security measures. BitMEX has been around longer and has weathered various market challenges, while Bitget is newer but growing rapidly in popularity.

Market Selection

BitMEX focuses heavily on Bitcoin derivatives and perpetual contracts. Bitget offers a wider variety of cryptocurrencies and trading pairs for you to choose from.

Key Strengths

Bitget stands out with its copy trading feature, allowing you to mirror successful traders’ strategies. BitMEX is recognized for its trading engine and high liquidity, especially for experienced traders.

Your choice between these platforms should depend on your trading experience level, preferred cryptocurrencies, and whether you value simplicity or advanced trading features.

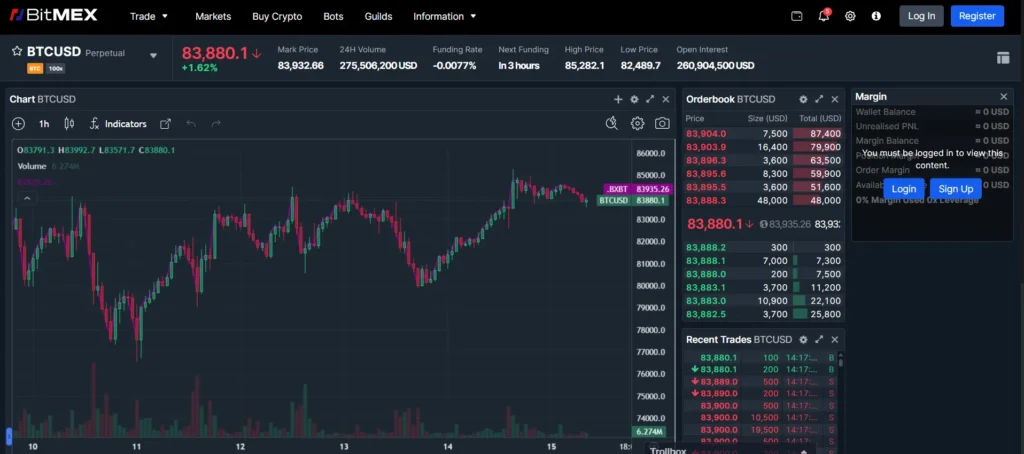

Bitget vs BitMEX: Trading Markets, Products & Leverage Offered

BitMEX and Bitget both offer cryptocurrency trading with leverage, but they differ in what they provide to traders.

BitMEX focuses primarily on Bitcoin futures and swaps. It’s known for offering up to 100x leverage on its trading products. This platform has built its reputation on Bitcoin derivatives.

Bitget provides a wider variety of cryptocurrencies and altcoins. It appeals to traders looking for more diversity in their trading options beyond just Bitcoin.

When comparing trading products, BitMEX specializes in:

- Bitcoin futures contracts

- Perpetual swaps

- Up to 100x leverage

- Fast execution speeds

Bitget offers:

- Spot trading

- Futures trading

- Copy trading features

- A larger selection of altcoins

- Competitive leverage options

The leverage options are important to consider. While BitMEX is known for its 100x leverage, Bitget also offers high leverage trading. Both platforms let you amplify your potential returns, but remember this also increases your risk.

If you’re mainly interested in Bitcoin trading with high leverage, BitMEX might be your preference. If you want more variety in cryptocurrencies and trading features, Bitget could be more suitable for your needs.

Trading fees differ between the platforms too. You should compare their fee structures based on your expected trading volume before making your choice.

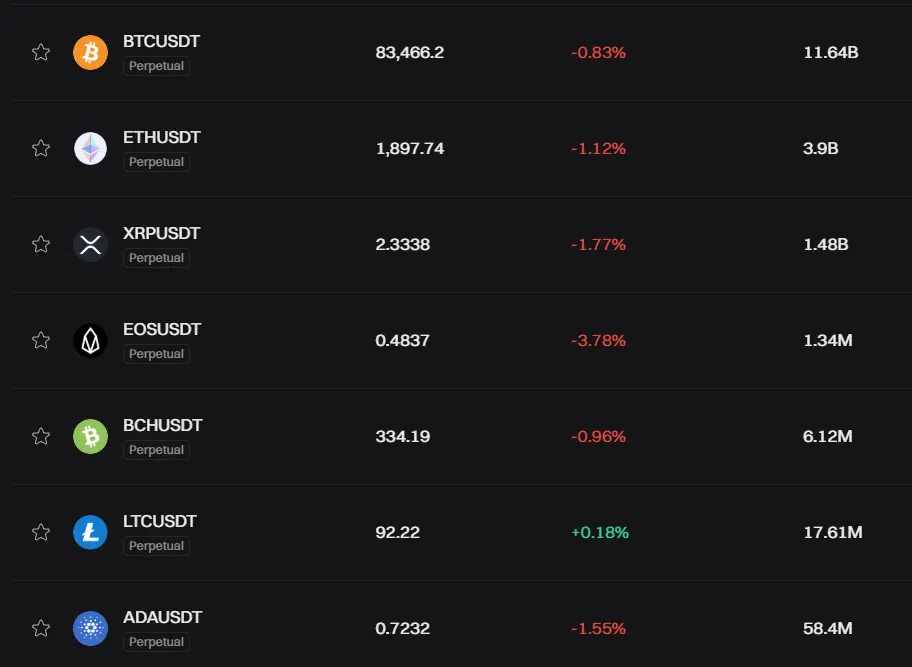

Bitget vs BitMEX: Supported Cryptocurrencies

When choosing between Bitget and BitMEX, the range of supported cryptocurrencies is an important factor to consider. Both platforms offer different options for trading digital assets.

BitMEX focuses primarily on Bitcoin derivatives trading. Its flagship product is the Bitcoin perpetual swap contract. While the platform is Bitcoin-centric, it does support a limited selection of other cryptocurrencies.

Bitget offers a more diverse range of cryptocurrency options. You can trade a wider variety of digital assets on Bitget compared to BitMEX, making it potentially more suitable if you’re looking to diversify your trading portfolio.

Here’s a comparison of supported cryptocurrencies on both platforms:

| Platform | Primary Focus | Number of Cryptocurrencies |

|---|---|---|

| BitMEX | Bitcoin | Limited selection |

| Bitget | Various | Wider selection |

BitMEX’s limited selection includes:

- Bitcoin (BTC)

- Ethereum (ETH)

- A few other major altcoins

Bitget supports many more cryptocurrencies including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Various altcoins

- Emerging cryptocurrencies

If you’re primarily interested in Bitcoin trading, both platforms will meet your needs. However, if you want to trade a broader range of cryptocurrencies, Bitget may be the better option for you.

The available trading pairs also differ between the platforms, with Bitget typically offering more combinations for traders to utilize.

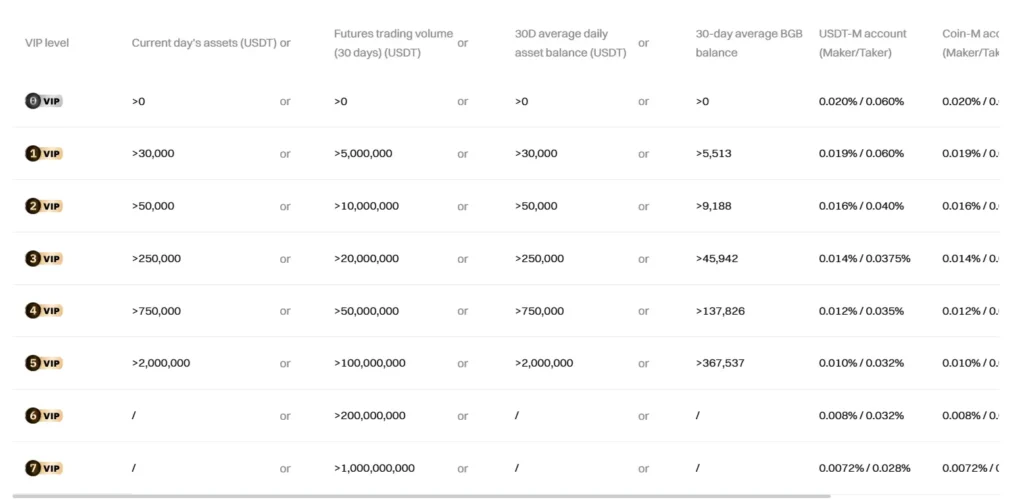

Bitget vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitget and BitMEX, understanding their fee structures can save you money. Let’s look at how these platforms compare.

Trading Fees

| Platform | Standard Trading Fee | Potential Discounts |

|---|---|---|

| Bitget | 0.1% for spot trading | Lower fees when using BGB token |

| BitMEX | Generally higher than Bitget | Varies by contract type |

Bitget offers competitive trading fees at just 0.1% for spot transactions. You can reduce these fees further by paying with their native BGB token.

Deposit Fees

Both platforms offer free cryptocurrency deposits. Bitget provides free USDT and BTC deposits specifically. However, Bitget charges 4%-8% for third-party fiat purchases, which is something to consider if you’re funding your account with traditional currency.

Withdrawal Fees

The platforms differ in their withdrawal fee structures. BitMEX tends to have fixed withdrawal fees depending on the cryptocurrency.

Bitget may offer more favorable terms for certain cryptocurrencies. The exact withdrawal fees can vary based on network congestion and the specific cryptocurrency being withdrawn.

Fee structures can impact your trading profitability, especially if you make frequent trades or withdrawals. Consider your trading volume and frequency when deciding which platform might be more cost-effective for your needs.

Bitget vs BitMEX: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both Bitget and BitMEX offer various order types to help you execute trades effectively.

BitMEX Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Take Profit Orders

- Hidden Orders

- Post-Only Orders

- Reduce-Only Orders

- Trailing Stop Orders

BitMEX is known for its advanced trading features. Their platform specializes in futures and perpetual contracts with high leverage options up to 100x.

Bitget Order Types:

- Market Orders

- Limit Orders

- Stop Limit Orders

- Take Profit Orders

- OCO (One Cancels Other)

- TWAP (Time-Weighted Average Price)

- Iceberg Orders

- Trailing Stop Orders

Bitget offers a more user-friendly interface that might appeal to less experienced traders. However, don’t let this fool you – their order types are still quite sophisticated.

Both platforms allow you to set conditional orders that execute based on price movements. This helps you manage risk without constantly watching the market.

The main difference lies in how these orders are presented. BitMEX has a more technical interface that experienced traders might prefer. Bitget organizes their order types in a more accessible way.

You should consider which order types match your trading style before choosing a platform. Complex strategies may require specialized order types that only one platform offers.

Bitget vs BitMEX: KYC Requirements & KYC Limits

Bitget has recently implemented mandatory KYC requirements for all users. This change aims to improve security and compliance for traders on the platform. When you use Bitget, you’ll need to complete their KYC process to access full trading features.

The KYC process on Bitget is designed to be simple and efficient. Their compliance team uses this information to properly identify customers, creating a more secure trading environment for everyone.

In contrast, BitMEX appears to have more relaxed KYC policies. Based on recent information, BitMEX does not require KYC verification for withdrawals. This can be appealing if you prefer more privacy when trading.

However, it’s important to note that KYC requirements can change as regulations evolve. The crypto landscape of 2025 has seen increased regulation worldwide.

Bitget KYC Features:

- Mandatory verification for all users

- Simple KYC process

- Enhanced security compliance

BitMEX KYC Features:

- Less strict KYC requirements

- No KYC needed for withdrawals (as of recent information)

- More privacy-focused approach

Your choice between these platforms may depend on how much you value privacy versus security. Some traders prefer stricter KYC measures for added protection, while others prioritize privacy and convenience.

Remember that withdrawal and trading limits are often tied to verification levels on most exchanges, including these two platforms.

Bitget vs BitMEX: Deposits & Withdrawal Options

When choosing between Bitget and BitMEX, deposit and withdrawal options play a crucial role in your trading experience.

Bitget offers more flexibility with deposits. You can deposit using cryptocurrencies or fiat methods. According to search results, Bitget provides free USDT or BTC deposits, which can save you money on transaction fees.

BitMEX takes a more limited approach. The platform primarily supports cryptocurrency deposits, with Bitcoin being the main option. This might be a limitation if you prefer using fiat currency or various altcoins.

For withdrawal speeds, both exchanges process cryptocurrency withdrawals within similar timeframes. However, Bitget may offer more withdrawal options since it supports a broader range of deposit methods.

Fee structures differ between the platforms. Bitget provides free Bitcoin withdrawals in some cases, which is a significant advantage if you frequently move funds off the exchange.

Comparison Table:

| Feature | Bitget | BitMEX |

|---|---|---|

| Crypto deposits | Free USDT/BTC deposits | Primarily BTC |

| Fiat support | Yes | Limited |

| Withdrawal options | More diverse | Mainly crypto |

| Free withdrawals | Available for some coins | Less common |

You should consider these deposit and withdrawal options carefully based on your preferred trading style and the currencies you most frequently use.

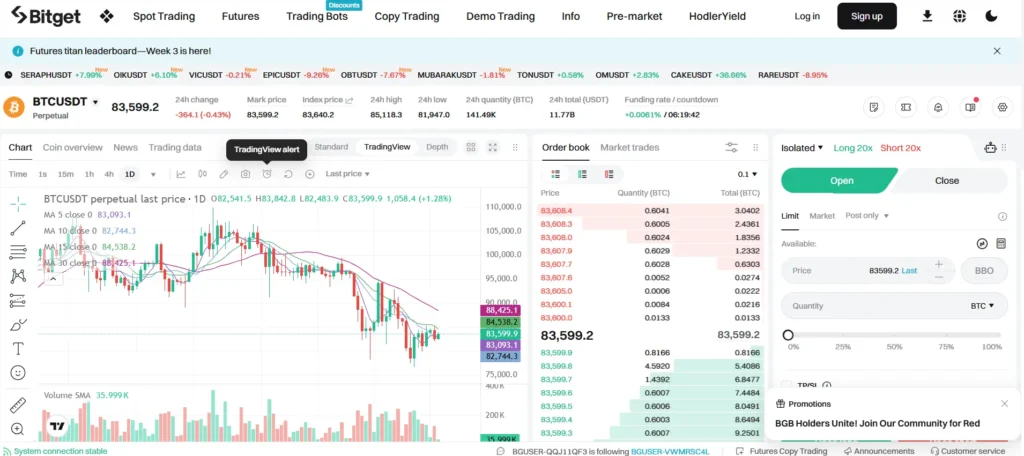

Bitget vs BitMEX: Trading & Platform Experience Comparison

Both Bitget and BitMEX offer unique trading experiences that cater to different types of crypto traders.

User Interface

- BitMEX offers a more technical interface designed for advanced traders

- Bitget provides a cleaner, more intuitive design that’s easier for beginners to navigate

- Both platforms display real-time market data, but Bitget’s presentation is generally more user-friendly

Trading Tools

| Feature | BitMEX | Bitget |

|---|---|---|

| Leverage | Up to 100x | Up to 100x |

| Order Types | Market, Limit, Stop | Market, Limit, Stop, OCO |

| Charts | Advanced | Advanced with more indicators |

BitMEX has built its reputation on powerful derivative trading with strong security measures. It’s known for its reliability during high market volatility.

Bitget has gained popularity for offering a more seamless trading experience. The platform provides additional features like copy trading that aren’t available on BitMEX.

You’ll find mobile trading more convenient with Bitget, as its app receives better user reviews for functionality and reliability.

When it comes to execution speed, both platforms perform well, but BitMEX sometimes experiences overload during extreme market conditions.

For new traders, Bitget’s platform is easier to learn. BitMEX’s interface has a steeper learning curve but offers more detailed information for technical analysis.

Bitget vs BitMEX: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial. This system protects exchanges from losses when markets move against traders’ positions.

BitMEX employs a sophisticated liquidation process designed to help users avoid complete liquidation. When your position approaches the liquidation price, BitMEX attempts to increase your maintenance margin before fully liquidating.

During market volatility, BitMEX’s system has faced criticism. Some users have accused the platform of manipulation during liquidation events, especially in high-leverage trading scenarios where liquidations can happen quickly.

Bitget also implements a liquidation mechanism, but with some differences in execution. The exchange aims to provide transparency in how positions are closed when margin requirements aren’t met.

Key differences in liquidation approaches:

- BitMEX uses a multi-step liquidation process that attempts partial liquidations when possible

- Bitget focuses on clear liquidation rules and position management

- Both platforms calculate liquidation prices based on your leverage and position size

You should closely monitor your positions on either platform. Setting appropriate stop-loss orders can help you avoid liquidation scenarios altogether.

Remember that higher leverage means your liquidation price will be closer to your entry price, increasing your risk of being liquidated during normal market fluctuations.

Bitget vs BitMEX: Insurance

When trading cryptocurrencies, insurance funds provide crucial protection against losses. Both Bitget and BitMEX offer insurance mechanisms, but with different approaches and coverage amounts.

BitMEX maintains an insurance fund that has grown significantly over the years. This fund helps prevent auto-deleveraging when traders face liquidations. As of 2024, their insurance fund holds substantial reserves to protect the trading ecosystem.

Bitget’s insurance fund is more recent but has been growing steadily. They commit to user protection through their “Protection Fund,” which provides coverage against platform risks.

Insurance Fund Comparison:

| Feature | BitMEX | Bitget |

|---|---|---|

| Fund Size | Larger, more established | Growing, newer |

| Transparency | Regular public reports | Dashboard with real-time updates |

| Coverage Focus | Preventing auto-deleveraging | User asset protection |

BitMEX publishes daily insurance fund updates on their website, allowing you to track fund performance. This transparency helps you assess platform stability before trading.

Bitget takes a different approach with their Protection Fund. They offer a more comprehensive protection system that covers various platform risks beyond just liquidation issues.

When choosing between these platforms, consider your risk tolerance and the importance of insurance protection for your trading strategy. Larger funds typically indicate better ability to handle market volatility.

Remember that insurance funds don’t guarantee complete protection against all losses. They primarily serve to maintain platform stability during extreme market conditions.

Bitget vs BitMEX: Customer Support

When trading cryptocurrency, good customer support is crucial. Both Bitget and BitMEX offer support services, but they differ in quality and availability.

BitMEX provides customer support on a 24/5 schedule. This means they’re available during weekdays but not on weekends. Their team works to ensure smooth implementation and offers onboarding training for new users.

Bitget also offers customer support, but reviews suggest it may not be ideal for beginners. Many new users report that the support team isn’t always helpful with basic questions.

If you’re new to crypto trading, this is an important factor to consider. Bitget seems to be designed more for experienced traders who need less guidance.

Both platforms provide support through standard channels like email and ticket systems. Response times can vary depending on your issue and when you contact them.

BitMEX might be more suitable if you value structured support with training options. Their 24/5 availability means you can get help during most business hours.

Bitget may work better for you if you’re already comfortable with crypto exchanges and don’t need extensive support. The platform focuses more on features than hand-holding.

Remember to check the most recent reviews about support quality before making your decision, as service levels can change over time.

Bitget vs BitMEX: Security Features

When choosing a crypto trading platform, security should be your top priority. Both Bitget and BitMEX offer several features to protect your investments.

Bitget emphasizes security with robust two-factor authentication (2FA) protection for all accounts. The platform also sends email alerts whenever there’s a login attempt or withdrawal request, helping you monitor account activity.

One standout feature of Bitget is its anti-phishing code system. This extra layer of security helps you verify that emails are actually from Bitget and not from scammers.

BitMEX also provides industry-standard security features including two-factor authentication. The platform stores the majority of cryptocurrency funds in cold wallets, which keeps assets offline and safe from online threats.

Both platforms have security systems to protect against unauthorized access. They use encryption technology to safeguard your personal information and trading activities.

Key Security Features Comparison:

| Feature | Bitget | BitMEX |

|---|---|---|

| Two-factor authentication | ✓ | ✓ |

| Email alerts | ✓ | ✓ |

| Cold wallet storage | Limited info | ✓ |

| Anti-phishing code | ✓ | Limited info |

You should enable all available security features when using either platform. This includes using strong passwords and activating 2FA through an authenticator app rather than SMS when possible.

Regular security audits are conducted by both platforms to identify and address potential vulnerabilities before they can be exploited.

Is Bitget A Safe & Legal To Use?

Bitget is generally considered safe and legal for crypto trading. It has not faced major attacks or lost user funds, which helps establish its safety record.

The platform offers several security features to protect your assets. These include:

- Two-factor authentication (2FA)

- Email alerts for logins and withdrawals

- Anti-phishing code features

Bitget has also set up a 300 Million USDT Protection Fund to safeguard user assets, showing their commitment to security.

While some users have reported concerns, Bitget maintains a reputation as a legitimate global crypto exchange. It operates in most countries worldwide.

It’s important to note that Bitget is not available in several major regions:

- United States

- United Kingdom

- Canada

- Countries under sanctions

Before using Bitget, verify that it’s allowed in your location. Even though the platform has security measures in place, always use caution when trading cryptocurrencies.

Remember to enable all available security features on your account and follow good security practices like using unique passwords and keeping your authentication methods secure.

Is BitMEX A Safe & Legal To Use?

BitMEX operates with legitimate licenses and regulatory compliance in many jurisdictions. The platform has been operating since 2014 and has built a reputation in the cryptocurrency trading space.

For safety, BitMEX uses multi-signature wallets and cold storage solutions to protect user funds. They also implement two-factor authentication (2FA) to add an extra layer of security to your account.

However, BitMEX has faced some regulatory challenges in the past. In 2020, the platform was charged by the U.S. Commodity Futures Trading Commission (CFTC) for operating an unregistered trading platform.

Legal Status by Region:

- United States: Not available to U.S. residents

- Europe: Generally legal with some country-specific restrictions

- Asia: Varies by country with some restrictions

BitMEX now has stronger KYC (Know Your Customer) procedures to verify user identities. This helps prevent fraud and meets regulatory requirements in many countries.

The platform’s insurance fund is designed to prevent auto-deleveraging, which adds some protection for traders. Your trading experience may be safer when you use proper risk management strategies.

Before using BitMEX, you should check if it’s legal in your specific location. Regulations change frequently in the crypto space, so staying updated on your local laws is important.

Frequently Asked Questions

Here are answers to common questions about Bitget and BitMEX trading platforms. These responses cover platform differences, security features, accessibility, leadership, and trading considerations to help you make informed decisions.

What are the key differences between Bitget and BitMEX trading platforms?

Bitget offers a more user-friendly interface compared to BitMEX, making it better suited for beginners. BitMEX has traditionally focused on derivatives trading with high liquidity but presents a steeper learning curve.

Bitget supports a wider range of cryptocurrencies, while BitMEX primarily concentrates on Bitcoin and select altcoins.

Customer support also differs between the platforms. Bitget provides 24/7 live chat support, while BitMEX relies more on a contact form and detailed FAQ documentation.

How reliable are the security measures implemented by Bitget?

Bitget employs industry-standard security protocols including two-factor authentication (2FA) and cold storage for most user funds. The platform has not experienced any major security breaches.

Bitget also implements risk management tools like stop-loss orders and position limits to protect traders. Their security setup includes regular security audits and real-time monitoring systems.

User feedback generally indicates confidence in Bitget’s security measures, though as with any exchange, using personal security best practices remains important.

Is BitMEX accessible to users in the United States?

No, BitMEX is not available to users in the United States. The platform blocks US IP addresses due to regulatory restrictions.

This limitation was implemented following regulatory challenges with US authorities. BitMEX requires KYC verification that specifically excludes US residents from creating accounts.

US traders should consider alternative platforms that comply with US regulations if they need similar trading services.

Who is the current CEO or founder of Bitget?

Gracy Chen serves as the Managing Director of Bitget, effectively functioning as the CEO in public-facing roles. She joined the company in 2022 to help expand its global presence.

Bitget was founded in 2018 in Singapore. The company has maintained some privacy regarding its founding team, which is not uncommon in the cryptocurrency industry.

The platform has grown significantly under its current leadership, expanding to serve millions of users across more than 100 countries.

What aspects should I consider when choosing the best platform for trading Bitcoin?

Trading fees should be a primary consideration, as they directly impact your profitability. Both platforms have different fee structures for makers and takers.

Security is crucial—evaluate each platform’s history of breaches, insurance policies, and security features like 2FA and cold storage implementation.

Platform liquidity affects your ability to execute trades quickly at expected prices. BitMEX traditionally offers high liquidity for Bitcoin futures trading.

User interface complexity matters based on your experience level. BitMEX tends to cater to experienced traders, while Bitget offers a more accessible experience.

How does the leverage offered by Bitget compare to that of BitMEX?

BitMEX offers up to 100x leverage on certain contracts, which has been one of its distinctive features since its early days. This high leverage attracts experienced traders seeking amplified positions.

Bitget also provides up to 100x leverage on some trading pairs, matching BitMEX’s offering. However, Bitget may have more restrictions and liquidation protections in place.

Both platforms implement risk management systems to prevent excessive losses, but the high leverage options should be approached with caution, especially by newer traders.

BitMEX vs Bitget Conclusion: Why Not Use Both?

After comparing BitMEX and Bitget, it’s clear both platforms offer unique advantages for cryptocurrency traders. Using both could maximize your trading potential rather than limiting yourself to just one.

BitMEX stands out with its advanced derivative trading options and robust security measures. Its margin calculation using index prices instead of last traded prices can offer more stability during volatile market conditions.

Bitget, on the other hand, provides a more seamless trading experience according to many users. Its interface is often considered more user-friendly, making it accessible for traders at different experience levels.

Key benefits of using both platforms:

- Risk diversification – Spreading your assets across multiple exchanges reduces exposure to platform-specific risks

- Feature optimization – Use BitMEX for its derivatives expertise and Bitget for its user experience

- Market opportunities – Different exchanges may offer varying prices during high volatility

You might consider allocating your trading activities based on your specific needs. Complex derivative trades could go to BitMEX while more straightforward transactions might be better suited for Bitget.

Remember that both platforms continue to evolve. What matters most is choosing the tools that align with your trading strategy, risk tolerance, and experience level.

The best approach may be testing both platforms with small amounts before deciding which works better for your specific trading style—or continuing to use both for different purposes.