Choosing between Bitget and Binance can be challenging for crypto traders. Both exchanges have established themselves as major players in the cryptocurrency market, offering various trading options and features to meet different needs.

Binance leads in trading volume and offers more coins, while Bitget stands out with special features like copy trading and its growing customer protection funds. When selecting between these platforms, you’ll want to consider factors like security measures, available cryptocurrencies, fee structures, and user interface that best match your trading style.

As cryptocurrency adoption continues to grow in 2025, understanding the key differences between these exchanges helps you make an informed decision. Whether you’re a beginner looking for user-friendly platforms or an experienced trader seeking advanced tools, comparing Bitget and Binance side-by-side will highlight which exchange might better serve your crypto journey.

Bitget Vs Binance: At A Glance Comparison

Binance and Bitget are popular crypto exchanges with distinct features that cater to different types of traders. Here’s a quick look at how they compare in key areas.

Trading Options

- Binance: Offers spot trading, futures, and margin trading

- Bitget: Provides futures, options, and spot trading

Experience Level

- Binance: Suitable for both beginners and experienced traders

- Bitget: Excellent for beginners and derivatives traders

Both platforms offer comprehensive trading tools, but their strengths differ. Binance has more extensive experience in the market, making it a trusted choice for many traders.

Fee Structure

| Feature | Binance | Bitget |

|---|---|---|

| Trading Fees | Competitive | Competitive |

| Discount Options | 20% fee discount with referral | Bonus offers up to $8000 |

You can find various trading pairs on both platforms. Binance typically has more cryptocurrency options due to its larger size and longer presence in the market.

The user interface differs between the two. Bitget is often praised for its user-friendly design, making it appealing if you’re new to crypto trading.

Security features are robust on both exchanges, but you should always use two-factor authentication regardless of which platform you choose.

Your choice between these exchanges should depend on your specific trading needs, experience level, and the types of cryptocurrencies you want to trade.

Bitget Vs Binance: Trading Markets, Products & Leverage Offered

Binance and Bitget offer different trading options that might suit your specific needs. Both platforms provide spot trading and futures markets, but there are some key differences.

Binance has a wider range of cryptocurrencies available for trading. It supports over 350 coins and thousands of trading pairs. This makes it ideal if you’re looking for variety and rare altcoins.

Bitget offers fewer coins but is known for its copy trading feature. This allows you to automatically mirror successful traders’ strategies, which is great if you’re new to crypto trading.

Leverage Comparison:

- Binance: Up to 125x leverage on futures

- Bitget: Up to 100x leverage on certain pairs

When it comes to products, both exchanges offer:

- Spot trading

- Futures contracts

- Options trading

- Staking opportunities

- Launchpad for new tokens

Binance has more advanced trading features like margin trading, liquid swap, and a wider variety of derivative products. Its trading volume is significantly higher, which can mean better liquidity for your trades.

Bitget stands out with its user-friendly interface and social trading features. Many users find it easier to navigate, especially if you’re just starting your crypto journey.

Trading fees are comparable between the platforms. Binance charges around 0.1% per trade, while Bitget has similar fee structures. Both offer fee discounts for high-volume traders.

Bitget Vs Binance: Supported Cryptocurrencies

Binance leads the crypto exchange market with support for over 350 cryptocurrencies. This extensive selection includes major coins like Bitcoin and Ethereum, plus a wide range of altcoins and tokens.

Bitget offers a more modest selection, supporting approximately 200+ cryptocurrencies. While this covers all major coins, you’ll find fewer obscure altcoins compared to Binance.

Both platforms support the following popular cryptocurrencies:

| Cryptocurrency | Binance | Bitget |

|---|---|---|

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Solana (SOL) | ✓ | ✓ |

| XRP | ✓ | ✓ |

| Cardano (ADA) | ✓ | ✓ |

Binance excels with its variety of trading pairs. You’ll find more options for direct exchanges between specific cryptocurrencies without needing to convert to a base currency first.

Bitget focuses more on popular trading pairs, which can actually make navigation simpler for beginners. Their platform emphasizes commonly traded coins rather than overwhelming you with choices.

Both exchanges regularly add new cryptocurrencies as the market evolves. Binance typically adds new tokens faster due to its larger infrastructure and market position.

When choosing between the two, consider if you need access to niche altcoins (choose Binance) or if trading major cryptocurrencies meets your needs (either exchange works well).

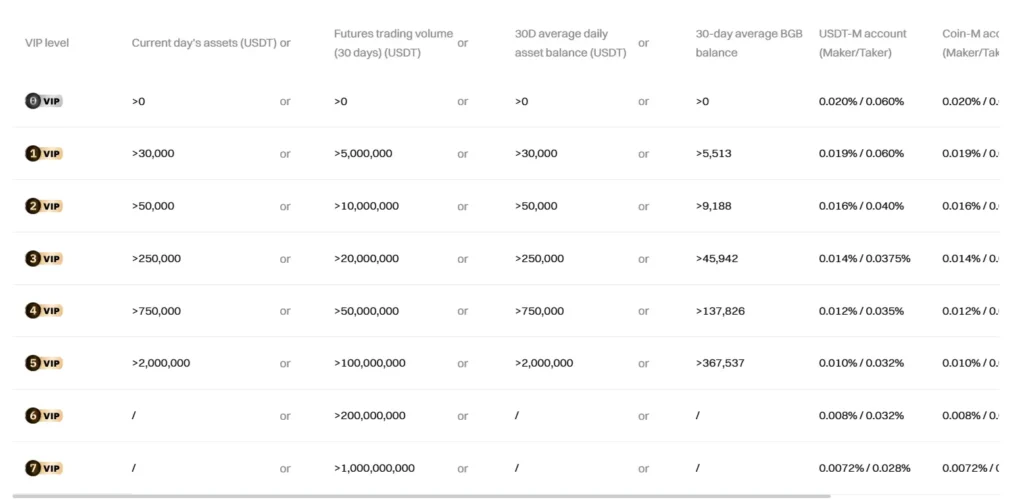

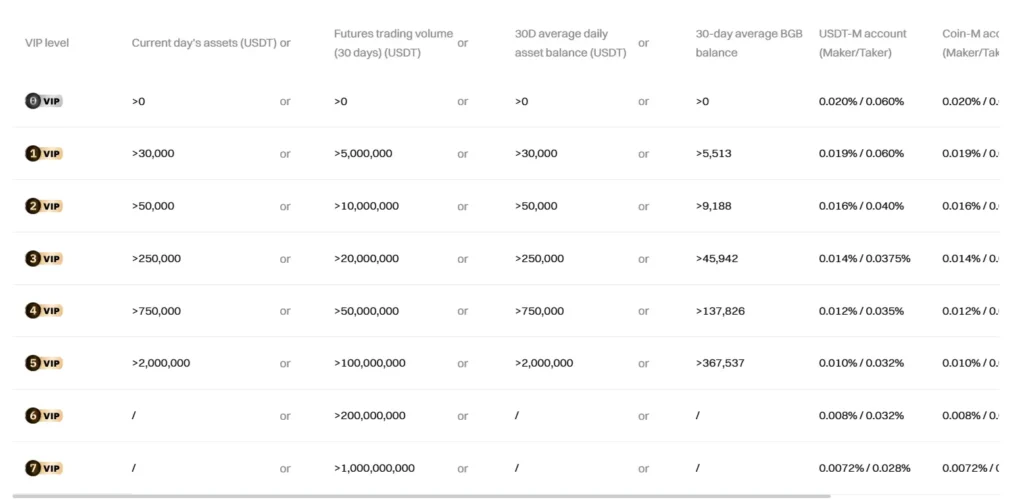

Bitget Vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitget and Binance, understanding their fee structures is crucial for your trading decisions.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bitget | 0.02% | 0.06% |

| Binance | 0.1% | 0.1% |

Bitget offers lower trading fees compared to Binance for spot trading. You’ll pay just 0.02% as a maker and 0.06% as a taker on Bitget, while Binance charges a flat 0.1% for both.

Bitget allows you to pay commissions with bonus funds, which can further reduce your costs.

Deposit Fees

Both platforms typically offer free cryptocurrency deposits. However, fiat deposit methods may have varying fees depending on your payment method and location.

Withdrawal Fees

Withdrawal fees differ based on the cryptocurrency you’re withdrawing. Binance often has competitive withdrawal fees for popular coins, but the exact amounts vary by network and token.

You should check the current fee schedule on both platforms before making large withdrawals, as these rates change frequently.

Fee Reduction Options

Both exchanges offer ways to reduce your trading fees:

- Using their native tokens (BGB for Bitget, BNB for Binance)

- Increasing your trading volume

- Participating in VIP programs

Remember to factor in these fees when calculating your potential profits from trading activities.

Bitget Vs Binance: Order Types

Both Binance and Bitget offer a variety of order types to help you execute trades according to your strategy.

Binance Order Types:

- Market orders (instant execution at market price)

- Limit orders (set your desired price)

- Stop-limit orders (triggers a limit order when price reaches stop price)

- OCO (One-Cancels-the-Other)

- Trailing stop orders

- Post-only orders

Binance also provides advanced options like iceberg orders, which help you place large orders without revealing the full size to the market.

Bitget Order Types:

- Market orders

- Limit orders

- Stop orders

- Conditional orders

- TWAP (Time-Weighted Average Price)

Bitget’s platform includes a feature called “Copy Trading” that lets you automatically copy experienced traders’ positions with customizable order types.

When trading futures, both exchanges expand their offerings. Binance futures include TP/SL (Take Profit/Stop Loss) orders that can be set during position opening.

Bitget offers similar futures functionality but adds unique order types like “Spot-Futures Arbitrage,” allowing you to profit from price differences between spot and futures markets.

Both platforms provide mobile apps where you can access these order types on the go, though some advanced features might be more accessible on desktop versions.

Your trading style will determine which platform’s order types better suit your needs. More active traders might appreciate Binance’s broader selection, while Bitget’s specialized features could benefit certain strategies.

Bitget Vs Binance: KYC Requirements & KYC Limits

Both Bitget and Binance require KYC (Know Your Customer) verification for users to access full platform features. This process helps these exchanges comply with regulatory requirements while protecting users from fraud.

Binance KYC Levels:

- Without KYC: Limited to 20,000 USDT daily withdrawal

- With Basic KYC: Higher withdrawal limits

- With Advanced KYC: Full access to all features including earn products

Binance has faced more regulatory scrutiny in recent years, which has led to stricter KYC enforcement across their platform.

Bitget KYC Requirements:

- Tier 1 (Basic): Email verification only

- Tier 2 (Intermediate): ID verification

- Tier 3 (Advanced): Additional documentation

Your withdrawal limits increase as you complete higher verification levels on both platforms. This tiered approach allows you to choose your comfort level with identity verification.

Both exchanges request similar documentation for verification:

- Government-issued ID

- Proof of address

- Facial verification

The KYC process on both platforms typically takes 1-3 business days to complete, though Binance might take longer during high-volume periods.

If you value privacy, note that neither platform offers true anonymity. However, basic functions with limited withdrawal amounts are available without full verification on both exchanges.

Bitget Vs Binance: Deposits & Withdrawal Options

Both Bitget and Binance offer multiple options for depositing and withdrawing funds, but they differ in several key areas.

Deposit Methods:

- Both exchanges offer free deposits

- Both support cryptocurrency deposits

- Both support fiat currency deposits via bank transfers

- Binance offers more payment methods overall including credit/debit cards and third-party payment processors

Withdrawal Fees:

| Exchange | Crypto Withdrawal | Fiat Withdrawal |

|---|---|---|

| Binance | Variable (0-3.5%) | Depends on method |

| Bitget | Variable | Depends on method |

Withdrawal processing times also vary between the platforms. Binance typically processes crypto withdrawals faster due to its larger infrastructure.

You should consider withdrawal limits when choosing between these exchanges. Binance offers higher withdrawal limits for verified accounts compared to Bitget.

Each platform has different verification tiers that affect your withdrawal limits. The more verification you complete, the higher your withdrawal limits become on both exchanges.

Security for deposits and withdrawals is strong on both platforms. Binance and Bitget use cold storage for most funds and require 2FA for withdrawals.

Bitget has been growing its customer protection fund, which can provide additional security for your deposits in case of emergencies.

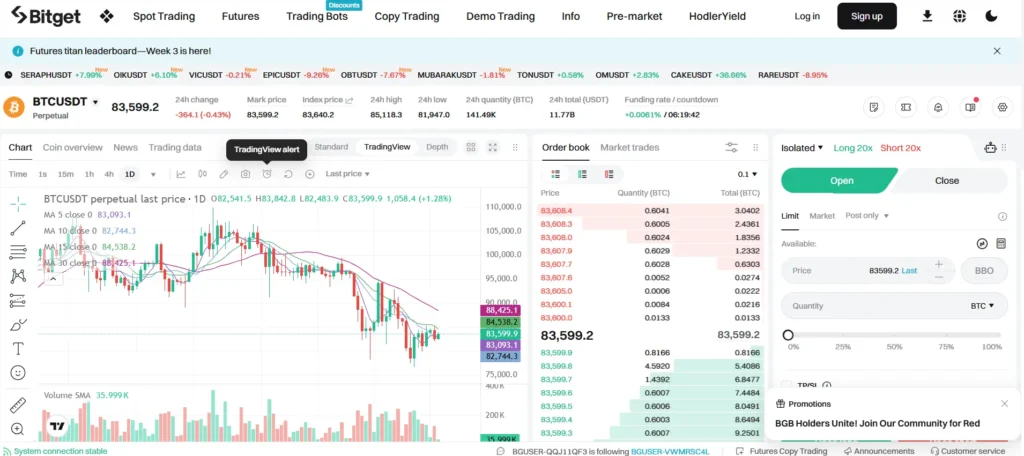

Bitget Vs Binance: Trading & Platform Experience Comparison

When choosing between Bitget and Binance, trading experience plays a crucial role in your decision.

Binance offers a more extensive selection of cryptocurrencies for trading. This gives you more options to diversify your portfolio. The platform is known for its high liquidity, which helps execute trades quickly at stable prices.

Bitget stands out with its copy trading feature, allowing you to automatically copy experienced traders’ strategies. This is especially helpful if you’re new to crypto trading.

Fee Structure:

| Platform | Maker Fee | Taker Fee |

|---|---|---|

| Bitget | 0.02% | 0.06% |

| Binance | Higher than Bitget | Higher than Bitget |

Bitget generally offers lower trading fees compared to Binance, which can save you money on frequent trades.

Binance’s interface can feel overwhelming for beginners due to its extensive features and options. However, it provides more advanced trading tools for experienced traders.

Both platforms offer mobile apps, but Binance’s app has more features and better stability. This makes managing your trades on the go easier.

Bitget has been gaining popularity for its growing customer protection funds and healthy proof of reserve. These features provide added security for your investments.

The trading experience on both platforms includes spot trading, futures, and margin options. Binance offers more trading pairs and market depth.

Your choice ultimately depends on what you value most: Binance for variety and advanced features, or Bitget for lower fees and simpler copy trading options.

Bitget Vs Binance: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for managing risk. Both Bitget and Binance have systems in place to protect themselves when your position approaches a point where you might not be able to cover potential losses.

Binance uses a tiered liquidation system that gradually reduces your position size as it approaches the liquidation price. This progressive liquidation helps you avoid complete position closure in many cases.

Bitget, on the other hand, employs a full liquidation model that closes your entire position when it reaches the liquidation threshold. While this might seem harsher, it can be more predictable for planning purposes.

Liquidation Thresholds Comparison:

| Exchange | Initial Margin | Maintenance Margin | Warning Level |

|---|---|---|---|

| Binance | 1-8% (varies) | 0.5-5% (varies) | Yes (email/app) |

| Bitget | 1-10% (varies) | 0.5-8% (varies) | Yes (in-platform) |

Both platforms offer liquidation prevention tools:

- Price alerts

- Stop-loss orders

- Auto-deleveraging options

Binance provides a wider range of risk management tools including GSRM (Global Settings Risk Management) for advanced traders.

Bitget offers a simpler interface with clearer warnings when your positions approach liquidation levels, which can be helpful for newer traders.

You should test both platforms’ demo accounts to experience how each liquidation system works before trading with real funds. This hands-on experience will help you determine which approach better suits your trading style.

Bitget Vs Binance: Insurance

When comparing crypto exchanges, insurance is a crucial factor to consider for your safety. Both Bitget and Binance offer protection funds to safeguard your assets.

Binance has a larger insurance fund called SAFU (Secure Asset Fund for Users). This fund holds about $1 billion to protect users against potential hacks or security breaches.

Bitget also maintains a protection fund, though smaller than Binance’s. Based on recent information, Bitget has been consistently growing its customer protection funds to enhance user security.

Both exchanges keep most user funds in cold storage to minimize security risks. This practice helps protect your assets from online threats.

Binance has faced more regulatory challenges and lawsuits in recent years compared to Bitget. These issues don’t directly affect the insurance aspect but might influence your trust in the platform.

For maximum protection, you should enable all security features regardless of which exchange you choose. This includes two-factor authentication and withdrawal address whitelisting.

Remember that no insurance plan offers 100% protection. You should always practice good security habits when trading cryptocurrency on any platform.

Bitget Vs Binance: Customer Support

When choosing between Bitget and Binance, customer support can be a deciding factor for your trading experience. Both platforms offer multiple ways to get help when you need it.

Binance provides support through several channels including a help center, live chat, and email. You can also reach them via social media platforms. Their FAQ section is particularly extensive, covering most common issues traders face.

Bitget also offers customer support through similar channels. They have a help center with guides and FAQs to help you solve problems quickly. Live chat and email support are available when you need more personalized assistance.

Response times can vary for both platforms depending on the issue and current demand. During high-volume trading periods or major market events, you might experience longer wait times.

Both exchanges offer support in multiple languages, making them accessible to global users. This is helpful if English isn’t your first language.

For new users, Binance’s extensive knowledge base might be more helpful due to its comprehensive nature. However, Bitget has been working to improve their support resources.

When comparing the two, consider which support channel matters most to you. If you prefer self-service through detailed FAQs, Binance might have an edge. If quick live chat support is your priority, test both platforms to see which responds faster.

Bitget Vs Binance: Security Features

When comparing Bitget and Binance for security, both exchanges offer strong protection for your funds. The search results indicate that security between these platforms is considered a tie.

Both exchanges provide two-factor authentication (2FA) to protect your account from unauthorized access. This extra layer of security helps keep your crypto assets safe.

Cold storage is a key security feature used by both platforms. This means the majority of user funds are kept in offline wallets, making them less vulnerable to online attacks.

Binance has faced more regulatory challenges and legal issues in recent years compared to Bitget. This doesn’t necessarily mean Binance is less secure, but it’s something to be aware of when choosing an exchange.

KYC (Know Your Customer) verification is required on both platforms to help prevent fraud and comply with regulations. You’ll need to verify your identity before accessing all features.

Both exchanges have anti-phishing measures to protect you from fake websites and emails trying to steal your information.

Binance does have an edge with its SAFU fund (Secure Asset Fund for Users), which is designed to protect users in extreme cases. This insurance-like protection gives some users extra peace of mind.

For day-to-day security concerns, both platforms offer similar protection levels and features to keep your crypto investments safe.

Is Bitget A Safe & Legal To Use?

Bitget is generally considered safe for crypto trading. According to search results, the platform hasn’t experienced significant security breaches or loss of user funds. This is a positive sign for traders concerned about security.

However, there are some mixed user experiences. Some reports mention issues with accounts being frozen for extended periods without clear explanations, which may be concerning.

Regarding legality, Bitget operates in many countries worldwide but has notable exceptions. The exchange is not available in:

- United States

- United Kingdom

- Canada

- Sanctioned countries

This limited availability affects its legality depending on your location. Always verify if Bitget is permitted in your country before opening an account.

In terms of regulation, Bitget appears to have less regulatory coverage compared to some competitors. While some exchanges hold licenses in multiple jurisdictions, Bitget’s regulatory status is more limited.

When comparing safety features with Binance, they offer similar security measures. Both platforms use:

- Two-factor authentication (2FA)

- Cold storage for majority of funds

- Regular security audits

Before choosing Bitget, you should research its current regulatory status in your region and consider setting up all available security features to protect your assets.

Is Binance A Safe & Legal To Use?

Binance is generally considered a safe cryptocurrency exchange. As one of the largest and most popular platforms in the crypto space, it has maintained a strong security track record overall.

Binance implements several security measures to protect user funds. These include offline cold storage for most cryptocurrencies and a Secure Asset Fund for Users (SAFU) that works as an emergency insurance fund.

However, Binance has faced significant regulatory challenges in recent years. The exchange has been subject to more scrutiny and lawsuits than some competitors like Bitget.

Regulation status by country:

- US: Not fully regulated

- UK (FCA): Not regulated

- Germany: Not regulated

- France (AMF): Regulated

You should be aware that Binance’s legal status varies by location. In some countries, the platform operates with restrictions or isn’t available at all.

Despite these challenges, Binance continues to work toward compliance in various jurisdictions. The company has increased its KYC (Know Your Customer) requirements to meet regulatory standards.

For maximum security on Binance, you should enable two-factor authentication, use a strong unique password, and consider keeping large holdings in private wallets rather than on the exchange.

Always verify you’re using the official Binance website or app to avoid phishing attempts targeting Binance users.

Binance Vs Bitget Conclusion: Why Not Use Both?

Both Binance and Bitget offer valuable features for crypto traders in 2025. Neither platform is universally better – each has unique strengths that might suit different parts of your trading strategy.

Binance stands out with its massive selection of over 600 cryptocurrencies and extensive market options. Its larger trading volume provides better liquidity for major trades and more advanced features for experienced traders.

Bitget shines with its copy trading feature, which lets you automatically mimic successful traders’ moves. It also maintains a strong proof of reserve and growing customer protection funds, which might give you additional peace of mind.

Your choice ultimately depends on your specific needs. If you’re looking for the widest variety of coins and maximum liquidity, Binance is your best bet. If you’re newer to trading or value copy trading features, Bitget could be more suitable.

Why choose just one? Many traders maintain accounts on both platforms to leverage specific advantages:

| Platform | Best For |

|---|---|

| Binance | Wide coin selection, high liquidity, advanced features |

| Bitget | Copy trading, strong security measures, newer traders |

You can use Binance for its extensive coin options while utilizing Bitget’s copy trading to learn from experienced traders. This dual approach might maximize your trading potential.

The fee structures are similar between both exchanges, so cost shouldn’t be the deciding factor in your choice.

Frequently Asked Questions

Trading fees, security, cryptocurrency variety, user reviews, customer support, and P2P transactions are key areas where Bitget and Binance differ. Understanding these differences can help you choose the right platform for your trading needs.

What are the differences in trading fees between Bitget and Binance?

Binance charges a standard trading fee of 0.1% per transaction. This fee structure is straightforward and competitive in the cryptocurrency exchange market.

Bitget also offers competitive fees that are comparable to Binance. Both exchanges provide fee discounts for high-volume traders and those who hold the platform’s native tokens.

You can reduce your fees on both platforms by using their respective tokens (BNB for Binance and BGB for Bitget) or by increasing your trading volume to reach higher VIP levels.

How does the security of Bitget compare to that of Binance?

Both exchanges implement strong security measures including two-factor authentication (2FA), cold storage for most funds, and regular security audits.

Binance has a more established track record in security and operates the Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund to protect user assets in extreme cases.

Bitget has also invested heavily in security infrastructure but hasn’t been in the market as long as Binance. Both platforms regularly update their security protocols to address emerging threats.

What are the user reviews saying about Bitget versus Binance?

Users typically praise Binance for its comprehensive features, extensive trading options, and overall reliability. Many experienced traders prefer its advanced charting tools and wide range of trading pairs.

Bitget receives positive reviews for its user-friendly interface and copy trading features, which are particularly appealing to newer crypto traders.

Some users report that Binance can be overwhelming for beginners due to its extensive features, while Bitget is often described as more approachable for newcomers to cryptocurrency trading.

Which exchange offers better customer support, Bitget or Binance?

Binance offers 24/7 customer support through multiple channels including live chat, email, and an extensive help center. However, response times can vary during high-volume periods.

Bitget also provides round-the-clock customer service, with users generally reporting satisfactory response times and resolution rates.

Both platforms offer support in multiple languages, though Binance tends to have more language options reflecting its larger global presence.

Are there any significant differences in the variety of cryptocurrencies offered by Bitget and Binance?

Binance clearly leads in terms of cryptocurrency variety, offering hundreds of coins and thousands of trading pairs. This makes it an excellent choice if you’re looking to trade lesser-known altcoins.

Bitget offers a more limited but still substantial selection of cryptocurrencies. The platform focuses on providing the most popular and established coins rather than offering every available token.

You’ll find all major cryptocurrencies on both platforms, but for more obscure tokens or newly launched projects, Binance typically adds them sooner and has a more extensive selection.

What are the advantages and disadvantages of using Bitget as opposed to Binance for P2P transactions?

Binance has a more established and liquid P2P marketplace with more payment methods and currencies supported. This means you’ll likely find more trading partners and options for local currency transactions.

Bitget’s P2P platform is growing but currently offers fewer payment methods and currency options compared to Binance. However, some users report lower fees on certain P2P transactions.

You might find that Binance’s P2P platform has better market depth, while Bitget may offer a simpler interface for those new to peer-to-peer cryptocurrency trading.