Choosing the right cryptocurrency exchange is important for your trading success. When comparing Bitfinex vs KuCoin, you’ll find distinct differences that could impact your experience.

Bitfinex has a higher user rating (3.8) compared to KuCoin (2.8), suggesting many traders prefer Bitfinex’s overall experience. However, KuCoin offers a more intuitive user interface, faster deposit and withdrawal times, and potentially higher liquidity for certain trading pairs.

Your decision between these platforms should be based on your specific needs. Consider factors like the user interface you prefer, the cryptocurrencies you want to trade, fee structures, and security features. Both exchanges have established themselves in the crypto market, but their strengths appeal to different types of traders.

Bitfinex vs KuCoin: At A Glance Comparison

When choosing between Bitfinex and KuCoin, several key differences can help you make your decision.

User Experience

- Bitfinex: Higher user rating (3.8/5)

- KuCoin: Lower user rating (2.8/5)

Bitfinex offers a more favorable overall user experience according to ratings, which might make it easier for you to navigate and trade.

Fee Structure

KuCoin provides lower trading fees for VIP users, making it more cost-effective if you’re a high-volume trader.

Trading Options

Both exchanges offer a variety of cryptocurrency trading options and features to help you diversify your portfolio.

| Feature | Bitfinex | KuCoin |

|---|---|---|

| User Rating | 3.8/5 | 2.8/5 |

| VIP Trading Fees | Higher | Lower |

| Variety of Coins | Wide selection | Wide selection |

You’ll find both platforms provide legitimate trading volumes and liquidity, which are important factors for efficient trading.

The best choice depends on your specific needs. If user experience is your priority, Bitfinex might be preferable. If you trade in high volumes and want to save on fees, KuCoin could be the better option.

Both exchanges rank among popular cryptocurrency platforms and continue to serve traders with different preferences and requirements.

Bitfinex vs KuCoin: Trading Markets, Products & Leverage Offered

Bitfinex and KuCoin both offer a variety of trading options, but they differ in important ways. Let’s look at what each platform provides.

Bitfinex supports trading for numerous cryptocurrencies and offers advanced trading products. One standout feature is its margin trading with up to 10x leverage, allowing you to multiply potential profits significantly.

KuCoin has a higher overall score (7.8) compared to Bitfinex according to recent comparisons. The platform is known for its wide selection of altcoins, making it appealing if you’re looking to trade less common cryptocurrencies.

Both exchanges offer:

- Spot trading

- Margin trading

- Futures contracts

- Staking options

When it comes to leverage, your options vary:

| Exchange | Maximum Leverage |

|---|---|

| Bitfinex | Up to 10x |

| KuCoin | Up to 100x (on some products) |

KuCoin typically lists new tokens faster than Bitfinex, giving you early access to emerging projects. However, Bitfinex is often preferred by institutional traders for its deep liquidity in major trading pairs.

You might find Bitfinex’s trading interface more sophisticated, while KuCoin offers a more accessible experience for newer traders.

Trading fees also differ between platforms, with competitive rates that vary based on your trading volume and whether you use their native tokens.

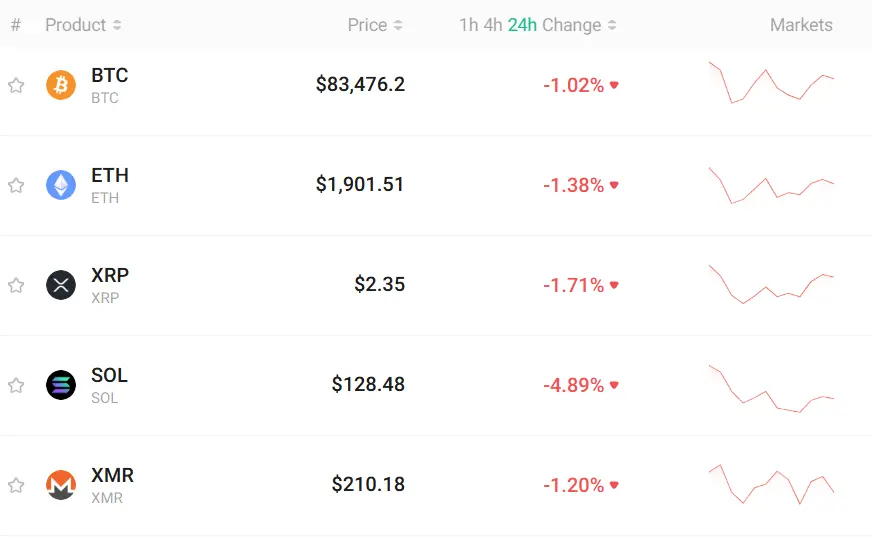

Bitfinex vs KuCoin: Supported Cryptocurrencies

When choosing between Bitfinex and KuCoin, the variety of available cryptocurrencies can be a deciding factor for your trading strategy.

Bitfinex offers around 170+ cryptocurrencies for trading. Their selection includes major coins like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as a range of altcoins and tokens.

KuCoin stands out with its impressive offering of 700+ cryptocurrencies. This makes KuCoin an excellent choice if you’re looking to trade newer or less common altcoins.

Coin Selection Comparison:

| Exchange | Number of Cryptocurrencies | Notable Unique Offerings |

|---|---|---|

| Bitfinex | 170+ | LEO Token (native token) |

| KuCoin | 700+ | KCS Token (native token), many small-cap altcoins |

KuCoin is known for listing new projects earlier than many other exchanges. This gives you access to emerging cryptocurrencies before they hit larger platforms.

Bitfinex focuses more on established cryptocurrencies with higher market caps and trading volumes. Their selection is curated for stability rather than quantity.

If you’re interested in trading rare altcoins or getting in early on new projects, KuCoin’s extensive selection gives you more options. For traders focused on mainstream cryptocurrencies with deeper liquidity, Bitfinex’s offering is sufficient.

Both platforms regularly add new cryptocurrencies as the market evolves, but KuCoin typically moves faster with new listings.

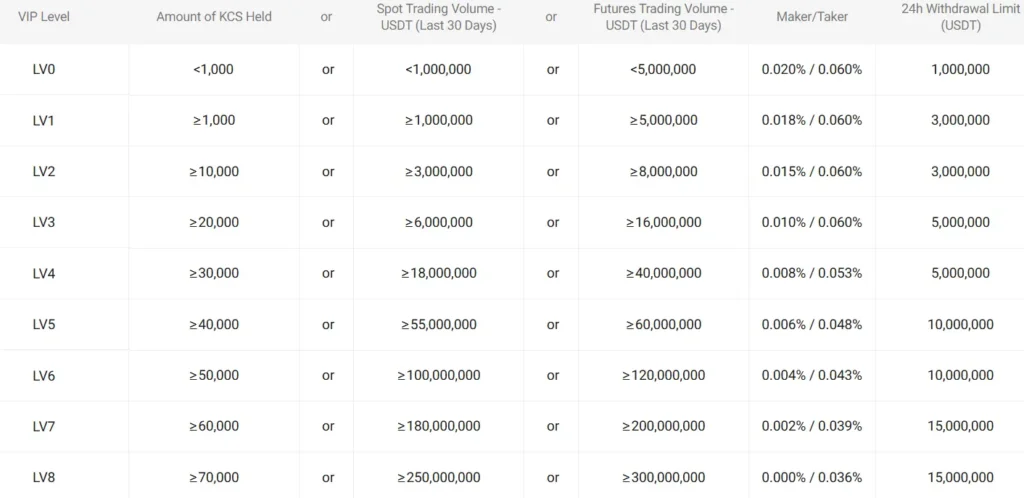

Bitfinex vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Bitfinex and KuCoin, fees play a crucial role in your decision. Both platforms offer different fee structures that can impact your trading profits.

Trading Fees

| Exchange | Maximum Trading Fee | VIP/High Volume Discounts |

|---|---|---|

| Bitfinex | Up to 0.2% | Volume-based reductions |

| KuCoin | Up to 0.4% | Lower fees for VIP users |

Bitfinex offers more competitive standard trading fees at a maximum of 0.2% compared to KuCoin’s 0.4%. However, KuCoin provides significant discounts for VIP users, making it potentially more cost-effective for high-volume traders.

Withdrawal Fees

| Exchange | Withdrawal Fee Range |

|---|---|

| Bitfinex | Up to 1.0% |

| KuCoin | Up to $60 |

KuCoin’s withdrawal fees can reach up to $60 depending on the cryptocurrency. Bitfinex charges up to 1.0% for withdrawals, which can be more expensive for large transactions.

Deposit Fees

Both exchanges have varying deposit fees depending on the payment method and cryptocurrency. Bitfinex provides a detailed fee schedule on their website for different deposit methods.

Your trading volume will significantly impact which platform offers better value. If you’re a high-volume trader, KuCoin’s VIP discounts might save you money despite the higher standard rates.

Remember that fees can change, so always check the exchanges’ official websites for the most current information before making your decision.

Bitfinex vs KuCoin: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both Bitfinex and KuCoin offer a variety of order types to help you execute trades effectively.

Bitfinex Order Types:

- Market orders

- Limit orders

- Stop orders

- Stop-limit orders

- Fill or Kill (FOK)

- Immediate or Cancel (IOC)

- Post-Only orders

- Trailing stop orders

Bitfinex stands out with its advanced order types that cater to experienced traders. The platform’s trailing stop orders are particularly useful for maximizing profits in volatile markets.

KuCoin Order Types:

- Market orders

- Limit orders

- Stop orders

- Stop-limit orders

- Post-Only orders

- Iceberg orders

KuCoin offers a solid range of order types that meet most trading needs. Their iceberg orders allow you to place large orders without revealing the full size to the market.

Both exchanges provide the essential order types you need for basic trading strategies. However, Bitfinex offers more specialized options that might benefit advanced traders looking for precise control.

When choosing between these platforms, consider which order types align with your trading style. If you use complex strategies, Bitfinex might give you more flexibility with its additional order options.

Bitfinex vs KuCoin: KYC Requirements & KYC Limits

Both Bitfinex and KuCoin have different approaches to Know Your Customer (KYC) requirements. These differences might impact which exchange you choose based on your privacy preferences.

Bitfinex KYC Policy:

- Requires KYC verification for certain activities

- Offers a “Privacy Mode” for users seeking additional privacy

- Full verification needed for higher trading volumes and some features

KuCoin KYC Policy:

- More relaxed KYC requirements for basic trading

- No mandatory verification until you exceed the 2 BTC daily trading limit

- Verification becomes necessary if suspicious activity is detected

KuCoin is often considered more accessible for users who prefer minimal verification. You can start trading immediately after creating an account, with reasonable limits even without completing KYC.

Bitfinex takes a more structured approach to verification but compensates with its Privacy Mode feature. This option might appeal if you value both security and some level of privacy.

Be cautious when using exchanges without completing KYC. Some users report that exchanges like KuCoin may freeze withdrawals and demand verification if they detect unusual activity, such as changing IP addresses.

When choosing between these platforms, consider your trading volume needs and privacy requirements. KuCoin serves about 30 million active users compared to Bitfinex’s 2 million, suggesting more traders find KuCoin’s KYC policy acceptable for their needs.

Bitfinex vs KuCoin: Deposits & Withdrawal Options

When choosing between Bitfinex and KuCoin, understanding their deposit and withdrawal options is crucial for your trading experience.

Deposit Methods

Both exchanges support cryptocurrency deposits, but they differ in fiat options. Bitfinex accepts bank transfers and select credit cards. KuCoin offers P2P trading for fiat transactions but has fewer direct fiat deposit options.

Withdrawal Fees

KuCoin typically charges lower withdrawal fees for most cryptocurrencies compared to Bitfinex. While Bitfinex fees can go up to $60 for some currencies, KuCoin keeps withdrawal costs more competitive.

Processing Times

KuCoin generally offers faster deposit and withdrawal processing times. This can be important if you need quick access to your funds during volatile market conditions.

| Feature | Bitfinex | KuCoin |

|---|---|---|

| Withdrawal Fees | Up to $60 (0.1%-1.0%) | Lower fees for most coins |

| Fiat Deposits | Bank transfers, select cards | Limited direct options, P2P available |

| Processing Speed | Standard | Faster processing |

| Minimum Withdrawal | Higher thresholds | Lower minimums for most coins |

Both platforms have minimum withdrawal requirements that vary by cryptocurrency. You should check their respective fee schedules before making transactions, as these can change.

KuCoin supports a wider variety of altcoins for deposits and withdrawals, which might be important if you trade less common cryptocurrencies.

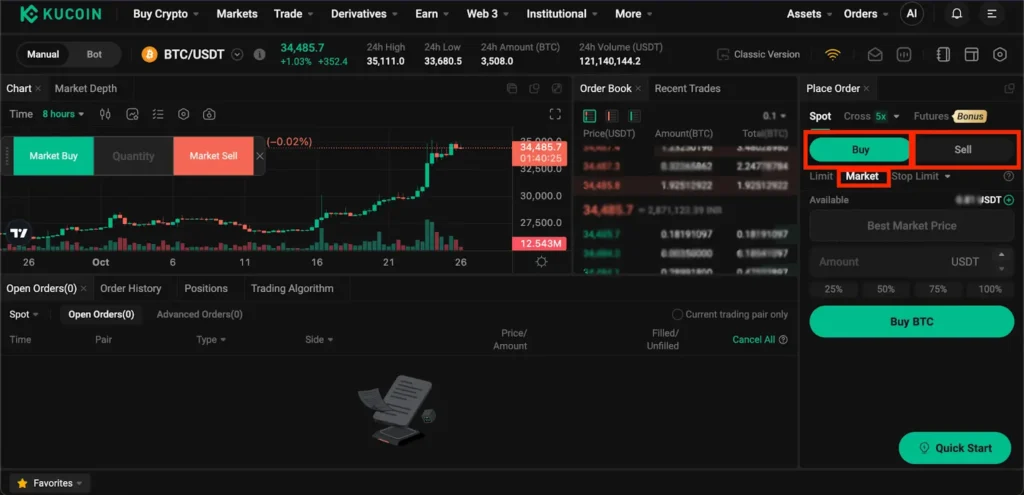

Bitfinex vs KuCoin: Trading & Platform Experience Comparison

When choosing between Bitfinex and KuCoin, the trading platform experience matters significantly. Based on recent ratings, Bitfinex has a higher user satisfaction score of 3.8 compared to KuCoin’s 2.8.

Bitfinex offers a more professional trading interface that appeals to experienced traders. You’ll find advanced charting tools and a clean layout that helps with technical analysis.

KuCoin, meanwhile, provides a more user-friendly experience that beginners might appreciate. The platform includes helpful guides and a more intuitive design.

Trading Fees Comparison:

| Exchange | Maker Fee | Taker Fee | VIP Advantages |

|---|---|---|---|

| Bitfinex | 0.1% | 0.2% | Volume-based discounts |

| KuCoin | 0.1% | 0.1% | Lower fees for VIP users |

KuCoin appears more cost-effective for high-volume traders thanks to its VIP structure. You’ll save on fees if you trade frequently.

Both platforms offer mobile apps, but you might find Bitfinex’s app more robust for serious trading on the go. KuCoin’s app focuses on accessibility and ease of use.

The trading pair selection differs between the two. KuCoin typically lists more altcoins and emerging projects, giving you access to a wider variety of trading opportunities.

Bitfinex provides more advanced order types and margin trading options. If you use complex trading strategies, this might be the deciding factor for you.

Bitfinex vs KuCoin: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. This process occurs when your position can’t meet margin requirements.

Bitfinex Liquidation Process:

- Uses a tiered liquidation system that first issues margin calls

- Gives traders time to add funds before forced liquidation

- Employs an auto-deleveraging system that gradually reduces position size

- Maintains a dedicated insurance fund to protect against negative balances

Bitfinex offers partial liquidations, allowing you to keep part of your position rather than losing it entirely. This can help you maintain some market exposure during volatile periods.

KuCoin Liquidation Process:

- Features an immediate liquidation when margin ratio reaches threshold (typically 80%)

- Uses a “mark price” mechanism to prevent flash crash liquidations

- Offers a smaller insurance fund compared to Bitfinex

- Provides liquidation warnings through email and app notifications

KuCoin’s system tends to be more aggressive with liquidations but provides clear warnings before positions reach critical levels.

Key Differences:

| Feature | Bitfinex | KuCoin |

|---|---|---|

| Warning System | Margin calls | Notifications only |

| Liquidation Speed | Gradual | Immediate |

| Partial Liquidation | Yes | Limited |

| Insurance Fund | Larger | Smaller |

You should consider these liquidation differences when choosing between platforms, especially if you plan to use higher leverage in your trading strategy.

Bitfinex vs KuCoin: Insurance

When choosing a crypto exchange, insurance protection is a key factor to consider. This protection can help safeguard your funds in case of security breaches or platform failures.

Bitfinex Insurance: Bitfinex allocates approximately 5% of its trading fees to a dedicated recovery fund. This fund aims to protect users against potential losses from security incidents. However, Bitfinex doesn’t offer a comprehensive insurance policy that covers all user assets.

KuCoin Insurance: KuCoin maintains a “Safeguard Fund” designed to protect user assets. After experiencing a hack in 2020, KuCoin demonstrated its commitment to security by fully reimbursing affected users. The exchange has since strengthened its insurance measures.

Neither exchange provides complete insurance coverage like some larger platforms such as Coinbase or Gemini. This is an important consideration for your risk assessment.

Here’s a quick comparison of their insurance features:

| Feature | Bitfinex | KuCoin |

|---|---|---|

| Insurance Fund | Recovery fund from trading fees | Safeguard Fund |

| Coverage Scope | Limited | Limited |

| Past Incident Response | Mixed record | Strong record (2020 hack recovery) |

| Transparent Insurance Details | Minimal information | Basic information available |

You should consider these insurance limitations when deciding how much to deposit on either platform. Many experienced traders recommend keeping significant holdings in personal wallets for additional security.

Bitfinex vs KuCoin: Customer Support

When choosing a crypto exchange, customer support quality can make or break your experience. Both Bitfinex and KuCoin offer several support channels, but there are some key differences.

According to user feedback, Bitfinex receives a support rating of 5.2 compared to KuCoin’s 5.6. This suggests KuCoin users may be slightly more satisfied with the support they receive.

KuCoin offers 24/7 live chat support, which is valuable when you need immediate assistance with trading issues. You can also reach their team through email and support tickets.

Bitfinex provides email support and a comprehensive knowledge base. Their support team is known for thorough responses, though response times can be longer during high-volume periods.

Response Time Comparison:

| Exchange | Average Response Time |

|---|---|

| KuCoin | 1-24 hours |

| Bitfinex | 24-48 hours |

KuCoin’s larger user base (approximately 30 million users compared to Bitfinex’s 2 million) means their support team handles a higher volume of requests. This can sometimes affect response quality during peak times.

Both exchanges offer self-help resources including FAQs, tutorials, and community forums where you can find answers to common questions.

Language support is another consideration. KuCoin offers multilingual support, which is helpful if English isn’t your first language. Bitfinex primarily provides English-language support.

Bitfinex vs KuCoin: Security Features

When trading cryptocurrency, security should be your top priority. Both Bitfinex and KuCoin offer strong security measures, but they differ in several ways.

Two-Factor Authentication (2FA) is available on both platforms. This adds an extra layer of protection to your account. You’ll need to enter a code from your phone when logging in.

Bitfinex uses cold storage for most user funds, keeping them offline and away from potential hackers. They also employ a multi-signature wallet system that requires multiple approvals for withdrawals.

KuCoin provides insurance protection against potential security breaches. If a hack occurs, you have a better chance of recovering your funds on KuCoin than on Bitfinex.

Device management features let you track which devices have accessed your account. Both exchanges allow you to block unknown devices and get alerts about new login attempts.

API security options are more advanced on Bitfinex, giving you better control when using trading bots or third-party services.

KuCoin offers trading password protection as an additional security feature. This means you need a separate password to make trades, even if someone gets into your account.

Both platforms regularly undergo security audits, but Bitfinex has had a major hack in its history (2016). KuCoin also experienced a security breach in 2020 but managed to recover most affected funds.

Is Bitfinex Safe & Legal To Use?

Bitfinex maintains a moderate level of security for protecting your crypto assets. The exchange implements several security features including two-factor authentication (2FA), biometric authentication, and email encryption to keep your account secure.

For additional protection, Bitfinex operates a bug bounty program that offers rewards exceeding $10,000 to individuals who identify potential security vulnerabilities. This proactive approach helps strengthen their security system continuously.

Most of Bitfinex’s crypto assets are stored in cold wallets, which means they’re kept offline and away from potential online threats. This is a standard security practice among reputable exchanges.

Regarding legality, Bitfinex is registered in the British Virgin Islands and operates legally in many countries. However, availability varies by region due to different regulatory requirements.

Important security features of Bitfinex:

- Two-factor authentication (2FA)

- Biometric authentication options

- Email encryption

- Cold storage for most assets

- Bug bounty program

You should verify if Bitfinex is available in your country before creating an account. Some regions have restrictions on cryptocurrency exchanges, and Bitfinex may not serve customers in certain jurisdictions.

Always enable all available security features when using any crypto exchange, including Bitfinex. This includes using a strong, unique password and activating 2FA for your account.

Is KuCoin Safe & Legal To Use?

KuCoin has generally established itself as a legitimate cryptocurrency exchange, though its safety record isn’t perfect. In 2020, the platform experienced a significant hack where approximately $280 million in crypto assets were stolen. However, KuCoin managed to recover most of the funds and has since improved its security measures.

For your protection, KuCoin now implements several security features:

- Two-factor authentication (2FA)

- Trading password requirements

- Cold storage for the majority of user assets

- Advanced encryption protocols

The legality of using KuCoin depends on your location. The platform operates globally but lacks clear regulatory approval in some countries. This regulatory uncertainty represents a risk you should consider.

Some users express concern about KuCoin’s transparency regarding its operating location and licensing. The company is based in Seychelles but has offices in several Asian countries.

If you decide to use KuCoin, follow these safety practices:

- Enable all security features

- Use a strong, unique password

- Consider keeping only trading funds on the exchange

- Transfer larger holdings to private wallets

The current market uncertainty around crypto exchanges suggests caution. Some users recommend temporarily withdrawing funds from KuCoin until the market stabilizes.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges like Bitfinex and KuCoin. These platforms differ in important ways that impact trading experience, costs, and security.

What are the main differences between Bitfinex and KuCoin in terms of trade execution efficiency?

Bitfinex typically offers faster trade execution speeds due to its more robust infrastructure and higher liquidity. This makes it preferred by professional traders who need quick order filling.

KuCoin may experience slight delays during peak trading periods. However, its platform has improved significantly in recent years.

The difference in execution speed is most noticeable during volatile market conditions when Bitfinex tends to maintain better performance.

Which exchange between Bitfinex and KuCoin offers a wider range of cryptocurrencies for trading?

KuCoin offers a substantially larger selection of cryptocurrencies, with support for hundreds of altcoins and newer tokens. This makes it a go-to platform for traders seeking exposure to emerging projects.

Bitfinex focuses on a more curated selection of established cryptocurrencies. While its listing count is smaller, it emphasizes quality over quantity.

KuCoin is known as “The People’s Exchange” partly because of its willingness to list promising smaller-cap cryptocurrencies earlier than other exchanges.

How do Bitfinex and KuCoin compare in terms of user security and fund safety?

Bitfinex has implemented robust security measures following past security incidents, including cold storage for most funds and a comprehensive verification system. It now maintains a strong security record.

KuCoin experienced a major hack in 2020 but handled it well by fully reimbursing affected users. The exchange has since upgraded its security protocols significantly.

Both exchanges now offer two-factor authentication, anti-phishing codes, and withdrawal confirmation steps. Bitfinex generally has a slight edge in security reputation among institutional traders.

What are the key distinctions in the fee structures between Bitfinex and KuCoin?

KuCoin offers more competitive fees for regular traders, with standard trading fees starting at 0.1%. Its fee structure benefits smaller traders and those who hold KCS tokens get additional discounts.

Bitfinex targets higher-volume traders with fees that decrease significantly as your 30-day trading volume increases. Starting fees are slightly higher than KuCoin’s.

Both exchanges offer maker-taker models, but KuCoin’s VIP program provides greater fee reductions for loyal users and KCS token holders.

Can users expect better customer support from Bitfinex or KuCoin?

Bitfinex provides more specialized customer support with faster response times for verified users. Their support team is known for technical expertise but serves a more exclusive user base.

KuCoin offers support through more channels including live chat, email, and social media. However, response times can be longer during busy periods.

Neither exchange offers comprehensive phone support, which remains a limitation compared to traditional financial institutions.

How do the liquidity and volume on Bitfinex compare to those on KuCoin?

Bitfinex typically maintains higher liquidity for major cryptocurrency pairs like BTC/USD and ETH/USD. This results in tighter spreads and less price slippage for large orders.

KuCoin offers decent liquidity for major pairs but truly shines in providing liquidity for a wide range of altcoins that aren’t available on many other exchanges.

Trading volume on both platforms fluctuates, but Bitfinex generally handles more volume for institutional-sized trades while KuCoin sees more diverse trading across many smaller-cap assets.

Bitfinex vs KuCoin Conclusion: Why Not Use Both?

After looking at both platforms, you might wonder if you need to choose just one. The truth is, using both Bitfinex and KuCoin can give you more trading options.

Bitfinex offers a better overall user experience according to ratings, with a 3.8 compared to KuCoin’s 2.8. It also provides ways to withdraw money directly to your bank account, which KuCoin lacks.

However, KuCoin has its own strengths. It offers lower trading fees for VIP users, making it a good choice if you trade large amounts. This can save you money over time.

Each platform supports different cryptocurrencies too. By using both, you can access a wider range of coins and trading pairs than you would with just one exchange.

Benefits of using both platforms:

- More cryptocurrency options

- Different fee structures to choose from

- Risk spreading across platforms

- Access to unique features on each

Keep in mind that both exchanges have had security issues in the past. KuCoin experienced a major hack, and Bitfinex has had its own troubles. This is why spreading your assets across platforms can be a smart safety measure.

For beginners, you might want to start with one platform and get comfortable before adding another. For experienced traders, using both can give you more flexibility and trading options.