Choosing the right cryptocurrency exchange can make a big difference in your trading experience. BingX and BloFin are two popular platforms that offer crypto derivatives trading with their own unique features and benefits. Comparing these exchanges side by side will help you determine which one better suits your trading style, security preferences, and fee expectations.

Both exchanges have built solid reputations in the crypto space, though they differ in several key areas. BingX has established itself with competitive trading fees and a wide range of supported cryptocurrencies. BloFin, on the other hand, has gained attention for its user-friendly approach, with many users praising its liquidity pools that result in smaller spreads between buy and sell prices.

As you consider which platform to use, you’ll want to look at factors beyond just fees. This includes KYC (Know Your Customer) requirements, available trading competitions, bonus structures, and the overall user experience. Each platform offers distinct advantages that might align better with your specific trading needs.

BingX vs BloFin: At A Glance Comparison

When choosing between BingX and BloFin, it’s helpful to understand their key differences at a glance. Both platforms serve as cryptocurrency exchanges but have distinct features that may influence your decision.

BingX operates in more countries than BloFin, which serves over 150 countries and regions. This geographic reach might impact your ability to access either platform depending on your location.

KYC Requirements:

- BingX: Requires KYC for full features

- BloFin: No-KYC platform, allowing trading without identity verification

BloFin stands out with its great liquidity pools, resulting in minimal spread when trading. This can lead to better pricing for your trades.

Platform Features Comparison:

| Feature | BingX | BloFin |

|---|---|---|

| Geographic Availability | More countries | 150+ countries |

| KYC Requirements | Required | None |

| Liquidity | Good | Excellent |

| Extra Benefits | — | Trading competitions, bonuses, automated grid |

BloFin offers several additional benefits like trading competitions and automated grid systems that may enhance your trading experience.

The user experience on BloFin is notable for its hassle-free approach, with no KYC process slowing down your ability to begin trading immediately.

When comparing costs, both platforms offer competitive pricing, but you should review the specific fee structures that may affect your trading strategy.

BingX vs BloFin: Trading Markets, Products & Leverage Offered

BingX and BloFin both offer cryptocurrency derivatives trading, but with notable differences in their available markets and products.

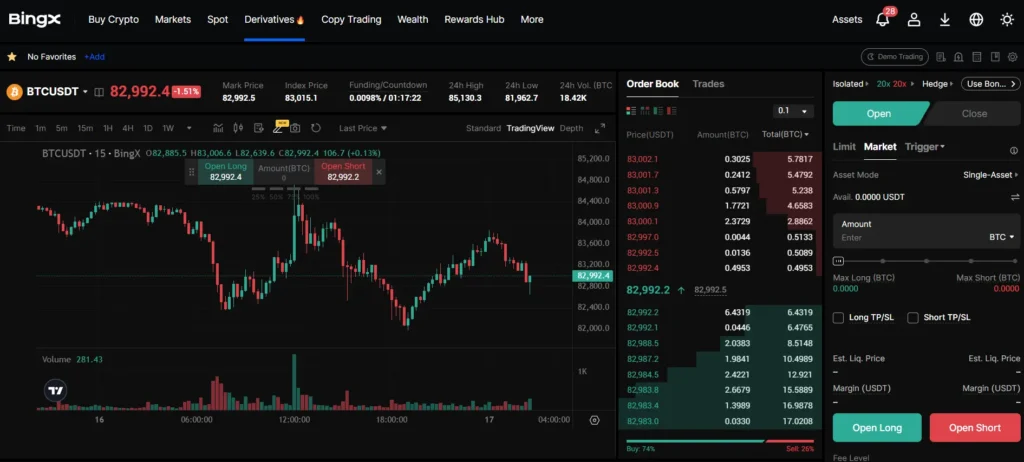

BingX provides spot trading, futures contracts, copy trading, and grid trading options. Their leverage goes up to 100x on most futures contracts, giving traders significant position amplification potential.

BloFin focuses primarily on derivatives trading with futures contracts being their main product. Based on the search results, BloFin is known for having excellent liquidity pools, which means smaller price spreads when executing trades.

Both platforms support a wide range of cryptocurrencies, though the exact number varies. Here’s how they compare:

| Feature | BingX | BloFin |

|---|---|---|

| Spot Trading | Yes | Limited |

| Futures | Yes | Yes |

| Copy Trading | Yes | No |

| Grid Trading | Yes | No |

| Max Leverage | Up to 100x | Up to 125x |

| Liquidity | Good | Excellent |

BloFin appears to be a no-KYC platform, meaning you can trade without completing identity verification processes. This offers more privacy but might limit certain features.

When choosing between these platforms, consider which trading products are most important to you. If you want variety, BingX offers more product types. If you prioritize pure derivatives trading with high liquidity, BloFin might be the better choice.

Remember that higher leverage increases both potential profits and risks. Only use high leverage if you understand the significant risks involved.

BingX vs BloFin: Supported Cryptocurrencies

When choosing between BingX and BloFin, the range of supported cryptocurrencies is a key factor to consider. Both exchanges offer a variety of digital assets, but there are some differences worth noting.

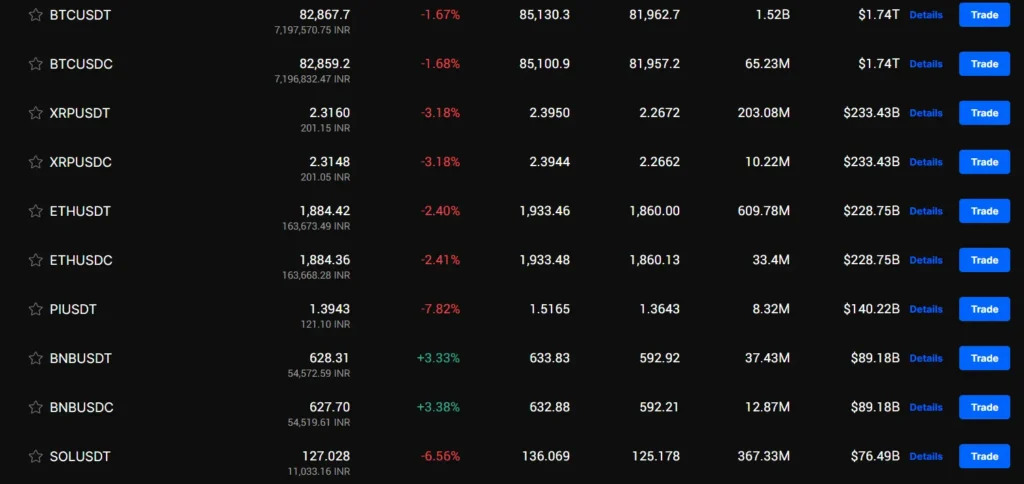

BingX supports a wide selection of cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). You’ll also find numerous altcoins and emerging tokens on their platform.

BloFin also offers the major cryptocurrencies but has gained recognition for its extensive altcoin selection. Users appreciate that BloFin provides access to some newer tokens that aren’t yet available on other platforms.

Key Differences in Cryptocurrency Support:

| Feature | BingX | BloFin |

|---|---|---|

| Major Coins (BTC, ETH) | ✓ | ✓ |

| Altcoin Variety | Good | Excellent |

| New Token Listings | Regular | Frequent |

| Stablecoins | Multiple options | Multiple options |

BingX tends to be more selective with new listings, focusing on established cryptocurrencies with proven track records. This approach may appeal to you if security and stability are priorities.

BloFin appears to list new tokens more aggressively, giving you early access to emerging projects. This could provide more opportunities for finding high-growth assets, though with potentially higher risk.

Both exchanges regularly update their cryptocurrency offerings, so it’s worth checking their current listings before making your final decision.

BingX vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing crypto exchanges, fees often influence your final decision. Both BingX and BloFin have competitive fee structures, but they differ in important ways.

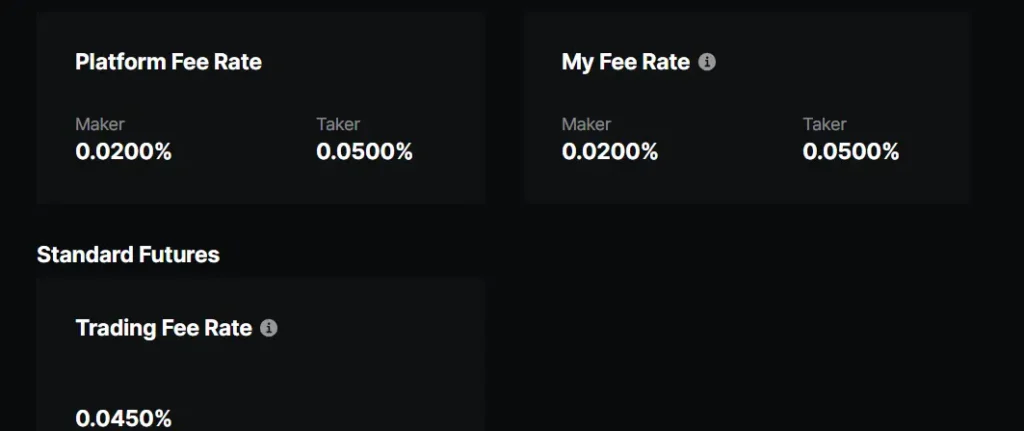

BingX charges 0.1% for both maker and taker fees on spot trading. For futures trading, they offer lower rates at 0.02% for makers and 0.05% for takers. These rates make BingX attractive for frequent traders, especially those doing futures trading.

BloFin, while not explicitly stated in the search results, is known for its great liquidity pools with minimal spread. This suggests competitive pricing, though exact percentages aren’t specified in our data.

Fee Comparison Table:

| Fee Type | BingX | BloFin |

|---|---|---|

| Spot Trading (Maker) | 0.1% | Not specified |

| Spot Trading (Taker) | 0.1% | Not specified |

| Futures (Maker) | 0.02% | Not specified |

| Futures (Taker) | 0.05% | Not specified |

For withdrawals and deposits, neither platform’s specific fees are detailed in our search results. However, you should know that BloFin operates without KYC requirements, which can make deposits and withdrawals more straightforward for some users.

BingX also offers peer-to-peer trading options which might affect how you deposit or withdraw funds. This feature could potentially help you find better rates when moving money in or out of the platform.

You should check each platform’s current fee schedule before trading, as crypto exchange fees often change with market conditions and platform updates.

BingX vs BloFin: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both BingX and BloFin offer various order options to meet different trading needs.

BingX provides the standard market and limit orders that most traders are familiar with. You can also access stop-loss and take-profit orders to manage risk automatically.

BloFin offers a more comprehensive selection of order types. The platform includes not only basic market and limit orders but also advanced options like OCO (One-Cancels-the-Other) and trailing stop orders.

One notable difference is BloFin’s automated grid trading feature. This tool allows you to set multiple buy and sell orders at different price levels automatically. It’s particularly useful in volatile markets.

BingX counters with its copy trading functionality, where order execution can follow experienced traders’ moves.

| Order Type | BingX | BloFin |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-Loss | ✓ | ✓ |

| Take-Profit | ✓ | ✓ |

| OCO Orders | ✗ | ✓ |

| Trailing Stop | ✗ | ✓ |

| Grid Trading | ✗ | ✓ |

For new traders, BloFin’s variety might seem overwhelming, while BingX offers a more streamlined experience. However, experienced traders may appreciate the additional control that BloFin’s order types provide.

BingX vs BloFin: KYC Requirements & KYC Limits

Both BingX and BloFin offer options for traders who prefer minimal identity verification when trading cryptocurrency.

BingX KYC Policy:

- No KYC required for smaller account balances

- Allows anonymous trading within certain limits

- Higher withdrawal and trading limits require completing verification

BloFin KYC Policy:

- No mandatory KYC to set up an account and begin trading

- Daily withdrawal limit of 20,000 USDT without verification

- KYC level 1 must be completed for withdrawals exceeding 20,000 USDT

BingX might be preferable if you’re trading with smaller amounts and want to maintain anonymity. The platform specifically designs its verification requirements around account balance size.

BloFin takes a slightly different approach. You can trade freely without verification, but your daily withdrawal limit is capped at 20,000 USDT. This gives you significant flexibility for most trading activities.

When choosing between these exchanges, consider your typical trading volume and withdrawal needs. If you rarely withdraw large amounts, either platform could meet your low-KYC preferences.

Remember that while these platforms offer no-KYC options, completing verification typically provides access to higher limits and additional features.

BingX vs BloFin: Deposits & Withdrawal Options

When choosing between BingX and BloFin, understanding their deposit and withdrawal options is crucial for a smooth trading experience.

BingX supports multiple deposit methods including bank transfers, credit/debit cards, and cryptocurrency deposits. You can fund your account with popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

BloFin offers a more streamlined approach with cryptocurrency deposits being the primary option. This platform doesn’t require KYC verification for basic accounts, making the deposit process faster for users prioritizing privacy.

Withdrawal Options Comparison:

| Feature | BingX | BloFin |

|---|---|---|

| Crypto withdrawals | Yes | Yes |

| Fiat withdrawals | Yes (limited regions) | Limited |

| Withdrawal fees | Variable by asset | Competitive rates |

| Processing time | 1-24 hours | Generally faster |

BingX charges variable withdrawal fees depending on the cryptocurrency, network congestion, and withdrawal amount. Processing times typically range from 1-24 hours.

BloFin is known for efficient withdrawals with competitive fee structures. The platform has gained popularity for its liquidity pools which help reduce spreads when converting between assets.

Security measures for both platforms include withdrawal confirmations and address whitelisting to protect your funds. BloFin typically processes withdrawals faster, which can be advantageous during volatile market conditions.

Remember to verify the current withdrawal limits and fees on both platforms before making your decision, as these can change based on market conditions and regulatory requirements.

BingX vs BloFin: Trading & Platform Experience Comparison

BingX and BloFin offer distinct trading experiences tailored to different types of crypto traders.

BingX provides a social-driven copy trading platform where you can follow and automatically copy successful traders. This feature is especially helpful if you’re new to crypto trading or don’t have time to research extensively.

BloFin stands out for its no-KYC approach, allowing you to trade without identity verification. This creates a faster onboarding process and greater privacy when trading digital assets.

When comparing trading tools, both platforms offer automated grid trading. BingX includes technical analysis tools that help you make informed decisions, while BloFin provides excellent liquidity pools resulting in smaller price spreads.

Fee Comparison:

| Platform | Trading Fees | Withdrawal Fees |

|---|---|---|

| BingX | Low to moderate | Varies by asset |

| BloFin | Competitive | Varies by asset |

BloFin offers regular trading competitions and bonuses that can enhance your trading experience. Users on Reddit have praised BloFin’s liquidity pools for reducing spreads when executing trades.

BingX excels with its diverse asset options and seamless copy trading interface. You can easily track the performance of top traders and mirror their strategies with a few clicks.

The user interface on both platforms is designed for different preferences. BingX focuses on social features and copy trading accessibility, while BloFin emphasizes privacy and trading efficiency.

BingX vs BloFin: Liquidation Mechanism

When trading on margin platforms, understanding the liquidation mechanism is crucial. This aspect can make or break your trading experience.

BingX employs a dual price mechanism with mark price and last price to determine liquidations. This system helps protect you from flash crashes and temporary market volatility.

In contrast, BloFin has faced criticism for its liquidation practices. According to Reddit discussions, some users report that BloFin has adjusted margin requirements and liquidation thresholds without proper notice.

These unexpected changes reportedly led to trader liquidations that might have been avoided with better communication. Transparency in liquidation policies is essential for responsible trading.

Key Differences:

| Feature | BingX | BloFin |

|---|---|---|

| Price Mechanism | Dual price (mark price + last price) | Standard price |

| Notifications | Advanced warnings | Limited communication reported |

| Threshold Adjustments | Transparent process | Some users report arbitrary changes |

BingX’s system is designed to reduce premature liquidations during short-term price spikes. This can be especially helpful during volatile trading periods.

You should carefully review the liquidation terms before choosing either platform. Pay attention to margin requirements, maintenance margins, and how each platform handles market volatility.

Consider testing both platforms with smaller positions before committing significant capital to better understand how their liquidation mechanisms work in practice.

BingX vs BloFin: Insurance

When trading cryptocurrencies, protecting your assets is crucial. Both BingX and BloFin offer insurance options, but they differ in coverage and implementation.

BingX provides a standard insurance fund to protect users against losses during extreme market volatility. This fund helps prevent auto-liquidations and maintains platform stability during high-volume trading periods.

BloFin also offers an insurance fund, but based on available information, it appears to provide more comprehensive coverage. Their insurance system is designed to safeguard user assets against potential security breaches and market manipulation.

Here’s a comparison of their insurance features:

| Feature | BingX | BloFin |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Coverage Type | Market volatility protection | Security + market protection |

| Transparency | Monthly reports | Regular updates |

| User Control | Limited | Some customization options |

You should check both platforms’ websites for the most current insurance fund sizes. These funds typically grow over time as the exchanges collect fees.

Neither exchange guarantees 100% protection against all risks. It’s always wise to use additional security measures like two-factor authentication and hardware wallets for long-term storage.

Remember that insurance policies may change based on market conditions and regulatory requirements. Always review the current terms before making your trading decisions.

BingX vs BloFin: Customer Support

When trading cryptocurrencies, reliable customer support can make a significant difference in your experience. Both BingX and BloFin offer support systems, but they differ in several ways.

BingX provides customer service through multiple channels including live chat, email, and a ticket system. Their support team is available 24/7, which is helpful for traders in different time zones. You can also find answers in their extensive knowledge base.

BloFin similarly offers 24/7 support through live chat and email options. Their response times are generally quick, with most inquiries addressed within a few hours. The exchange has built a reputation for responsive customer service.

Response Time Comparison:

| Exchange | Average Chat Response | Email Response | Support Hours |

|---|---|---|---|

| BingX | 5-10 minutes | 6-12 hours | 24/7 |

| BloFin | 3-8 minutes | 4-10 hours | 24/7 |

Both platforms offer support in multiple languages, though English is the primary language. BingX currently supports more languages than BloFin, which may be important if you prefer service in your native language.

Neither exchange offers phone support, which might be a drawback if you prefer speaking with a representative directly.

The quality of troubleshooting differs slightly between the platforms. BloFin’s support team is noted for their technical knowledge and ability to solve complex issues. BingX representatives excel at guiding new users through platform features.

BingX vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both BingX and BloFin offer various security measures to protect your assets.

BloFin emphasizes security with its cold wallet storage system, which keeps most user funds offline and safe from online threats. The platform also provides anti-phishing codes to help you verify genuine communications.

For account protection, BloFin implements two-factor authentication (2FA) and biometric authentication options. These features significantly reduce the risk of unauthorized access to your account.

BingX also utilizes cold wallet storage for most user assets. Their security protocols include 2FA and regular security audits to identify and address potential vulnerabilities.

BingX offers IP address monitoring, which alerts you of login attempts from unfamiliar locations. This adds an extra layer of protection against unauthorized access attempts.

Security Feature Comparison:

| Feature | BingX | BloFin |

|---|---|---|

| Cold Wallet Storage | ✓ | ✓ |

| Two-Factor Authentication | ✓ | ✓ |

| Anti-Phishing Protection | Limited | Advanced codes |

| Biometric Authentication | Limited | ✓ |

| IP Monitoring | ✓ | Basic |

Both platforms employ industry-standard encryption to protect your data during transmission. However, BloFin’s real-time crypto monitoring provides additional security by tracking unusual activity patterns.

Remember to always enable all available security features regardless of which platform you choose. This helps ensure your crypto assets remain protected from potential threats.

Is BingX Safe & Legal To Use?

BingX appears to be a legitimate cryptocurrency exchange based on available information. According to recent search results, users who have investigated the platform concluded that “BingX is legit.” This suggests a level of trust from the cryptocurrency community.

The platform is also mentioned alongside other “safest crypto exchanges” in 2025 listings, which indicates it meets certain security standards. In fact, one search result places BingX at the top of a list of safe crypto exchanges.

When comparing safety features with competitors like BloFin, BingX likely implements standard security measures for cryptocurrency exchanges. These typically include:

- Two-factor authentication (2FA)

- Cold wallet storage for most funds

- Regular security audits

- Insurance funds for user protection

You should be aware that cryptocurrency exchanges operate in a rapidly changing regulatory environment. Different countries have different laws regarding cryptocurrency trading. Before using BingX, verify it’s permitted in your jurisdiction.

For your protection when using BingX or any crypto exchange, consider these safety practices:

- Enable all available security features

- Use strong, unique passwords

- Withdraw large amounts to private wallets

- Keep your account details confidential

- Be cautious of phishing attempts

Remember to conduct your own due diligence before depositing significant funds on any exchange platform.

Is BloFin Safe & Legal To Use?

BloFin operates as a crypto exchange with a focus on security features. Based on recent information, the platform has partnered with Fireblocks for cold wallet security and Chainalysis for transaction monitoring.

Your funds on BloFin benefit from third-party insurance on deposits, which adds an extra layer of protection. This makes it a reasonable choice for hodlers and position traders looking for secure storage options.

However, it’s important to note that BloFin lacks major regulatory licenses compared to some competitors in the market. While Binance has secured approvals in regions like the EU, Japan, and Australia, BloFin doesn’t currently hold the same level of regulatory credentials.

BloFin operates as a no-KYC crypto exchange platform. This means you can trade without completing identity verification procedures that are common on many other exchanges.

Security Features:

- Cold wallet security through Fireblocks

- Real-time transaction monitoring via Chainalysis

- Third-party insurance on customer deposits

The exchange appears legitimate based on available information, but you should always exercise caution when using platforms with limited regulatory oversight. Consider your own risk tolerance when deciding if BloFin meets your security requirements.

Frequently Asked Questions

When comparing BingX and BloFin, users often have specific questions about trading fees, security measures, and unique platform features. Here are answers to common questions that can help you decide which exchange better fits your trading needs.

What are the main differences in trading fees between BingX and BloFin?

BloFin offers particularly competitive futures trading fees, especially for high-volume traders. Maker fees can be significantly reduced as your trading volume increases.

BingX structures its fees differently, with varying rates depending on trading pairs and account tiers. Their fee structure is competitive within the broader cryptocurrency exchange landscape.

Both platforms offer fee discounts through loyalty programs or native tokens, but the specific benefits differ based on your trading habits and volume.

How do BloFin and BingX compare in terms of platform security and trust scores?

Both exchanges implement standard security measures including two-factor authentication and cold wallet storage for majority of assets.

BingX has established a longer track record in the market, which has helped build trust among users. Their security protocols have been tested over time.

BloFin, while newer, has focused significantly on security infrastructure. However, trust scores generally favor platforms with longer operational histories and proven security during market volatility.

What are the unique advantages of using BingX for cryptocurrency trading?

BingX offers social and copy trading features that allow you to follow and automatically copy successful traders’ strategies. This is especially valuable for beginners.

The platform provides a wide range of trading types and supported cryptocurrencies, giving you more options than many competing exchanges.

BingX also offers a more intuitive interface that caters to both beginners and experienced traders, with educational resources integrated into the platform.

Can users expect quick and reliable withdrawal processes with BloFin?

BloFin’s withdrawal processing is generally efficient for verified accounts. Processing times vary by cryptocurrency network and congestion levels.

The platform has established withdrawal limits that differ based on verification level and account standing. Higher-tier accounts typically enjoy higher withdrawal limits.

Most user reviews indicate satisfactory withdrawal experiences, though like any exchange, network fees and verification requirements can impact the process.

How does the user experience compare between BingX and similar platforms like Bybit?

BingX offers a cleaner, more streamlined interface compared to many competitors. The platform prioritizes accessibility for newer traders while maintaining advanced tools.

Trading tools on BingX are comprehensive but presented in a less cluttered manner than some alternatives like Bybit.

Mobile functionality is a strength for BingX, with their app receiving positive feedback for reliability and feature parity with the desktop version.

What has been the general user sentiment in recent reviews of BloFin?

Recent BloFin reviews highlight the platform’s competitive fee structure as a major positive. Users frequently mention this as a deciding factor for choosing the exchange.

The trading interface receives mixed feedback. Experienced traders appreciate the advanced features, while beginners sometimes find it overwhelming.

Customer support responsiveness has improved according to 2025 reviews, with faster ticket resolution times being noted by users across multiple review platforms.

BloFin vs BingX Conclusion: Why Not Use Both?

After examining both platforms, it’s clear that BingX and BloFin each have unique strengths. BingX is available in more countries than BloFin, which serves over 150 regions but fewer than some competitors.

BloFin offers deep liquidity and advanced trading features that appeal to more experienced traders. Their platform focuses on sophisticated tools for those who want detailed analysis and trading options.

BingX, on the other hand, has established itself as a legitimate exchange with solid reputation among users. Its copy trading features are particularly notable, making it accessible for beginners.

You might consider using both platforms for different purposes. Here’s how you could split your activity:

BloFin for:

- Advanced trading features

- Deep liquidity pools

- Sophisticated analysis tools

BingX for:

- Copy trading functionality

- Wider geographic availability

- Beginner-friendly features

Using multiple exchanges can help diversify your trading strategy and reduce risk. You can leverage the strengths of each platform depending on your trading goals at different times.

Remember to consider the fee structures of both platforms when making your decision. Compare costs for the specific trading activities you perform most frequently.

The crypto exchange landscape continues to evolve rapidly, so staying flexible with multiple platform options gives you more trading opportunities as markets change.