Cryptocurrency traders often look for the best platform to maximize their trading potential. When comparing BingX and BitMEX in 2025, you’ll find distinct differences that might impact your trading experience. Both platforms offer cryptocurrency derivatives trading, but they differ significantly in their features, fee structures, and available trading options.

BingX stands out with its diverse trading features including copy trading, bot trading, grid trading, and margin trading. These tools help you implement complex strategies even if you’re not constantly monitoring the markets. BitMEX, on the other hand, has established itself as one of the pioneering derivatives exchanges with its own set of advantages.

Understanding the specific strengths of each platform can help you choose the one that best fits your trading style and goals. Whether you prioritize lower fees, more supported cryptocurrencies, or advanced trading features, a direct comparison between BingX and BitMEX will guide your decision in the evolving crypto landscape of 2025.

BingX Vs BitMEX: At A Glance Comparison

Both BingX and BitMEX are popular cryptocurrency exchanges in 2025, but they differ in several key areas. Let’s compare their main features side by side.

Trading Options

| Feature | BingX | BitMEX |

|---|---|---|

| Margin Trading | Yes | Yes |

| Copy Trading | Yes | No |

| Bot Trading | Yes | Limited |

| Grid Trading | Yes | No |

BingX stands out with its comprehensive suite of trading tools. The platform offers copy trading, which lets you automatically mimic successful traders’ strategies.

Fees and Costs

BingX typically offers competitive trading fees compared to BitMEX. Both platforms use a maker-taker fee structure, but the exact percentages vary based on trading volume and user level.

Supported Cryptocurrencies

Both exchanges support major cryptocurrencies, but their selection differs. You’ll need to check their current listings to see if they support the specific coins you want to trade.

User Experience

BingX aims for a more user-friendly interface with tools designed for both beginners and advanced traders. BitMEX tends to cater more to experienced traders with its advanced trading features.

Security Features

Both exchanges implement security measures like two-factor authentication and cold storage for funds. Your choice might depend on which platform’s security approach you feel more comfortable with.

Mobile Access

Both exchanges offer mobile apps, allowing you to trade on the go and monitor your positions from anywhere.

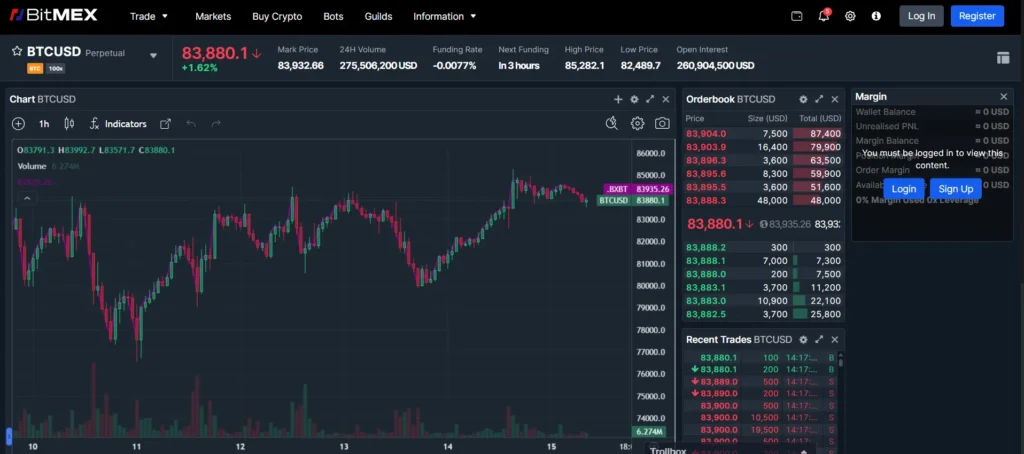

BingX Vs BitMEX: Trading Markets, Products & Leverage Offered

BingX and BitMEX offer different trading products and leverage options for cryptocurrency traders. Both platforms support derivative trading but with notable differences.

BitMEX is known for its Bitcoin futures and swaps. It allows users to trade with up to 100x leverage, making it popular among experienced traders looking for high-risk, high-reward opportunities.

BingX provides a more diverse set of trading options. Its features include margin trading, bot trading, copy trading, and grid trading. These tools help traders execute complex strategies with more flexibility.

In terms of cryptocurrency support, both platforms differ significantly. BitMEX focuses more on Bitcoin and a select few altcoins. BingX supports a wider range of cryptocurrencies for trading.

Here’s a quick comparison of their offerings:

| Feature | BingX | BitMEX |

|---|---|---|

| Max Leverage | Varies by asset | Up to 100x |

| Trading Types | Spot, Futures, Copy Trading, Grid Trading | Futures, Swaps |

| Bot Trading | Yes | No |

| Copy Trading | Yes | No |

You might find BingX more suitable if you want diverse trading options and automated features. BitMEX might be better if you’re focused on Bitcoin trading with high leverage.

Trading fees also differ between the platforms, which can impact your overall trading costs and strategy selection.

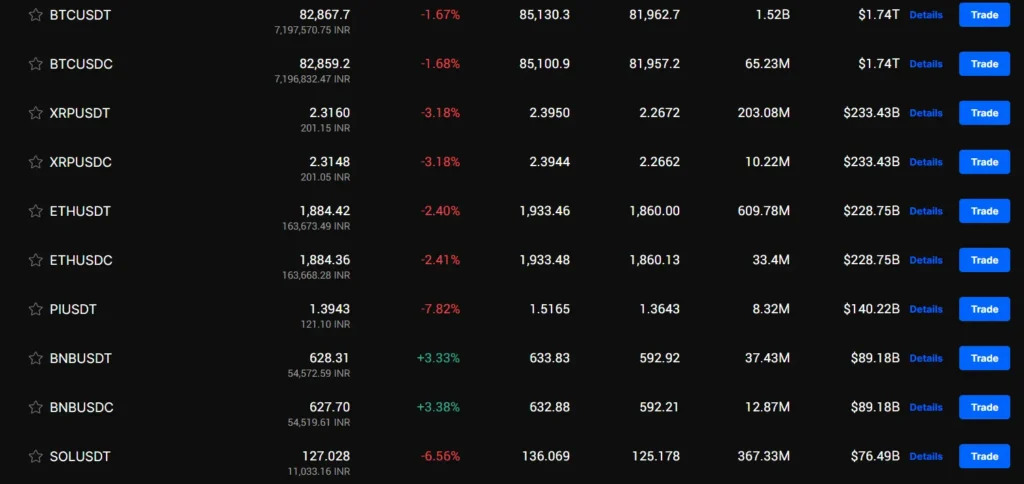

BingX Vs BitMEX: Supported Cryptocurrencies

When choosing between BingX and BitMEX, the variety of cryptocurrencies available for trading is an important factor to consider.

BitMEX primarily focuses on Bitcoin trading pairs. While they have expanded their offerings over time, their selection remains more limited compared to many competitors in 2025.

BingX offers a significantly wider range of cryptocurrencies. You can trade major coins like Bitcoin and Ethereum, but also access many altcoins not available on BitMEX.

Here’s a comparison of supported cryptocurrencies:

| Platform | Bitcoin | Ethereum | Stablecoins | Altcoins |

|---|---|---|---|---|

| BingX | ✓ | ✓ | Multiple | Extensive selection |

| BitMEX | ✓ | ✓ | Limited | Few options |

BingX’s broader selection makes it better suited for traders who want to diversify their portfolio beyond major cryptocurrencies.

If you’re interested in trading newer or less established altcoins, BingX will likely meet your needs better than BitMEX.

Both platforms offer futures trading on their supported cryptocurrencies, but BingX gives you more options to explore different market opportunities.

For Bitcoin-focused traders who don’t need access to numerous altcoins, BitMEX might be sufficient despite its more limited selection.

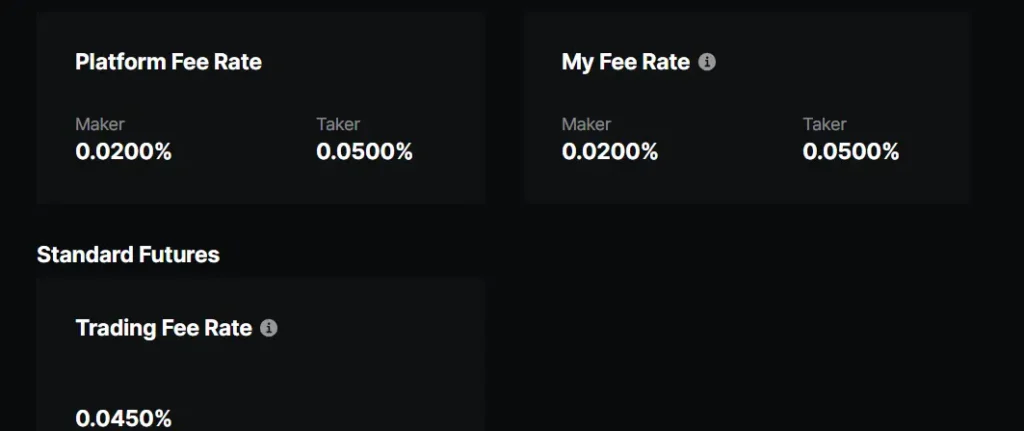

BingX Vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between BingX and BitMEX, understanding their fee structures can significantly impact your trading profitability.

BingX charges a flat 0.1% fee for spot trading. For futures trading, BingX offers a more competitive rate with 0.02% maker fees and 0.04% taker fees.

BitMEX, on the other hand, has a different fee structure. While the search results don’t specify BitMEX’s exact rates, they indicate that there are notable differences between the two platforms’ fee schedules.

Trading Fee Comparison:

| Platform | Spot Trading | Futures Trading (Maker) | Futures Trading (Taker) |

|---|---|---|---|

| BingX | 0.1% | 0.02% | 0.04% |

| BitMEX | Varies | Varies | Varies |

For deposits, most crypto exchanges including BingX and BitMEX typically don’t charge fees for cryptocurrency deposits.

Withdrawal fees vary based on the cryptocurrency you’re withdrawing. BingX does charge withdrawal fees, though the specific rates aren’t detailed in the search results.

Both platforms support multiple cryptocurrencies, which affects your deposit and withdrawal options. The flexibility of payment methods could be an important factor in your decision.

You should consider your trading volume and preferred cryptocurrencies when comparing these platforms. Higher volume traders might benefit more from one fee structure over the other.

BingX Vs BitMEX: Order Types

Both BingX and BitMEX offer various order types to help you execute your trading strategies effectively.

BitMEX provides two main types of Take Profit Orders: Take Profit Market Orders that place a market order when the trigger price is reached, and Take Profit Limit Orders.

BingX offers more advanced trading features including margin trading, bot trading, copy trading, and grid trading. These tools help you implement complex strategies without needing to monitor the market constantly.

BitMEX Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Take Profit Orders

- Trailing Stop Orders

BingX Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Grid Trading Orders

- Copy Trading Orders

- Bot-assisted Orders

The grid trading feature on BingX is particularly useful if you want to automate buying and selling at preset price intervals. This can help capture profits during market volatility without constant monitoring.

BitMEX’s order system is more traditional but very reliable for professional traders who need precise execution. Their trailing stop orders are especially helpful for protecting profits during volatile market conditions.

Your trading style should determine which platform’s order types better suit your needs. If you prefer automation and newer trading methods, BingX might be more appropriate. If you value established order execution systems, BitMEX could be the better choice.

BingX Vs BitMEX: KYC Requirements & KYC Limits

BingX and BitMEX have different approaches to Know Your Customer (KYC) verification, which affects how quickly you can start trading and what limits you’ll face.

BingX offers flexible KYC options. You can trade with minimal or no KYC verification for certain transactions, making it easier to begin trading quickly. This privacy-focused approach attracts users who prefer anonymity.

However, BingX does implement different rules for verified and unverified users. Completing verification provides access to higher trading limits and additional features.

BitMEX, in contrast, has stricter KYC requirements. All users must complete verification before trading, with no options to trade anonymously. This comprehensive approach aims to ensure regulatory compliance.

KYC Limit Comparison:

| Exchange | Unverified Users | Basic Verification | Full Verification |

|---|---|---|---|

| BingX | Limited trading allowed | Higher withdrawal limits | Full platform access |

| BitMEX | No trading without KYC | Basic trading limits | Higher withdrawal limits |

The KYC process on BingX is straightforward and quick for those who choose to verify. You’ll need to provide basic identification documents.

BitMEX’s verification generally takes more time and requires more extensive documentation, but provides a fully compliant trading environment.

Your choice between these exchanges may depend on how quickly you want to start trading and your comfort level with providing personal information.

BingX Vs BitMEX: Deposits & Withdrawal Options

When choosing between BingX and BitMEX, understanding their deposit and withdrawal options is crucial for managing your crypto assets effectively.

BingX supports multiple deposit methods including bank transfers, credit/debit cards, and cryptocurrency deposits. This variety gives you flexibility in funding your account based on your preferences.

BitMEX takes a different approach by only accepting cryptocurrency deposits. This means you’ll need to already own crypto to begin trading on their platform.

For withdrawal options, both platforms support cryptocurrency withdrawals. However, BingX offers more comprehensive options, allowing you to withdraw to bank accounts in some regions.

Processing Times and Fees:

| Platform | Deposit Processing | Withdrawal Processing | Fee Structure |

|---|---|---|---|

| BingX | Generally faster for fiat methods | 24-48 hours | Variable fees based on method |

| BitMEX | Depends on network congestion | Typically processed once daily | Network fees apply |

Both platforms implement security measures for withdrawals, including verification steps to protect your funds.

The minimum deposit amounts differ between the platforms. BingX typically has lower entry barriers, making it more accessible for beginners or those wanting to start with smaller amounts.

If you value having multiple funding options, especially using fiat currencies, BingX offers more versatility. If you’re already comfortable with crypto-only transactions, BitMEX’s streamlined approach might work for your needs.

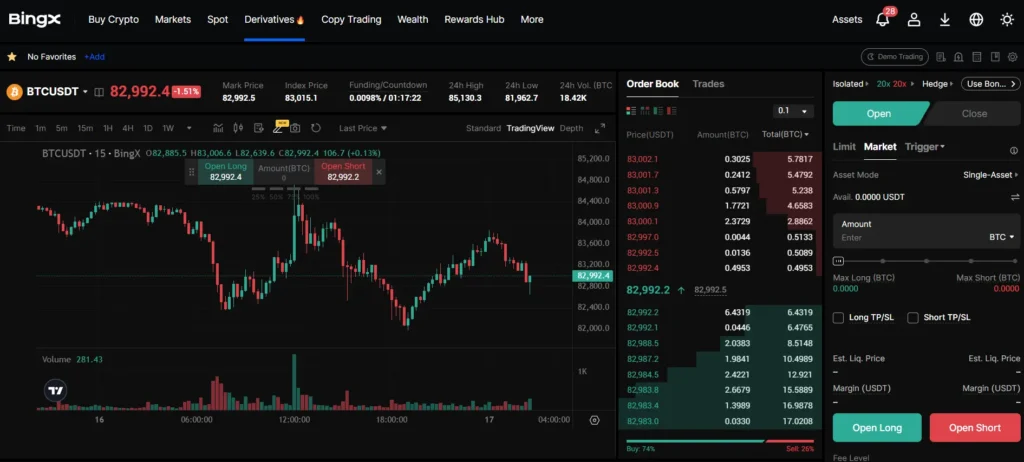

BingX Vs BitMEX: Trading & Platform Experience Comparison

When choosing between BingX and BitMEX, the trading experience differs significantly in several key areas.

BingX offers a more diverse range of trading options. You can access margin trading, bot trading, copy trading, and grid trading on their platform. These features help you execute complex strategies without extensive market knowledge.

BitMEX, on the other hand, is known for its robust perpetual contracts and derivatives trading. The platform has been around longer and appeals to more experienced traders.

User Interface Comparison:

- BingX: More modern interface, beginner-friendly

- BitMEX: Technical interface, steeper learning curve

In terms of liquidity, BitMEX traditionally has higher trading volumes. However, BingX maintains good liquidity across its trading pairs, making it suitable for most traders.

Trading Features:

| Feature | BingX | BitMEX |

|---|---|---|

| Copy Trading | Yes | No |

| Bot Trading | Yes | Limited |

| Perpetual Contracts | Yes | Yes |

| Grid Trading | Yes | No |

The mobile experience also varies between platforms. BingX has invested heavily in their app functionality, while BitMEX focuses more on desktop trading.

You’ll find BingX better suited if you’re interested in social or automated trading. BitMEX might be your preference if you prioritize high-volume perpetual contract trading with advanced order types.

BingX Vs BitMEX: Liquidation Mechanism

When trading on crypto exchanges, understanding liquidation mechanisms is crucial. Liquidation happens when your position’s losses reach a certain threshold, and the exchange closes your trade to prevent further losses.

BitMEX has a unique approach to liquidation. It only liquidates positions based on the index price movements, not market price. This offers protection against market manipulation, where traders might try to push prices temporarily to trigger liquidations.

BingX, on the other hand, offers high leverage trading which can lead to faster liquidations. When using high leverage on BingX, your positions can be liquidated rapidly if the market moves against you.

Both platforms use liquidation to manage risk, but they implement it differently. BitMEX’s index-based liquidation provides more stability, while BingX’s approach with high leverage options creates both opportunity and risk.

The best choice depends on your trading style. If you prefer protection against market manipulation, BitMEX might be more suitable. If you want access to higher leverage with the understanding that liquidation risk increases, BingX could be your choice.

Remember that regardless of platform, using stop-loss orders and proper risk management can help you avoid liquidations. Never risk more than you can afford to lose, especially when trading with leverage.

BingX Vs BitMEX: Insurance

When trading on cryptocurrency exchanges, insurance coverage is a crucial safety feature that protects your funds. Both BingX and BitMEX have implemented insurance funds, but they differ in their approach.

BitMEX has a substantial insurance fund that has grown over time. As of 2025, BitMEX maintains one of the largest insurance funds in the crypto industry. This fund helps cover losses when liquidated positions can’t be closed at the bankruptcy price.

BingX also offers an insurance fund, though it’s typically smaller than BitMEX’s. BingX’s insurance system aims to protect traders from abnormal losses during volatile market conditions.

Insurance Fund Comparison:

| Feature | BingX | BitMEX |

|---|---|---|

| Insurance Fund Size | Moderate | Large |

| Transparency | Regular reports | Daily public updates |

| Coverage Focus | Market volatility protection | Bankruptcy price protection |

| History | Newer fund | Well-established fund |

Neither exchange guarantees complete protection of your funds. Insurance only covers specific scenarios related to trading losses and liquidations.

You should note that neither exchange offers FDIC-like insurance that protects against exchange insolvency or hacks. Your funds remain at risk if the exchange itself faces security breaches.

For maximum security, consider keeping only trading capital on these platforms and storing long-term holdings in personal wallets.

BingX Vs BitMEX: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a big difference in your trading experience. Both BingX and BitMEX offer support options, but they differ in several ways.

BingX provides 24/7 customer support through multiple channels. You can reach their team via live chat, email, and social media platforms. Many users appreciate the quick response times, especially through the live chat feature.

BitMEX offers customer support primarily through email and a ticket system. Their support team operates during business hours but may not be available round-the-clock like BingX’s team.

Response Time Comparison:

| Exchange | Average Response Time | 24/7 Support |

|---|---|---|

| BingX | 1-3 hours | Yes |

| BitMEX | 6-24 hours | No |

BingX also provides more resources for new users. Their help center includes tutorials, FAQs, and guides to help you navigate the platform. These materials are often updated and available in multiple languages.

BitMEX tends to focus their support on more technical issues. Their knowledge base is comprehensive but may be challenging for beginners to understand.

Both platforms offer community forums where you can connect with other traders. These forums can be helpful for troubleshooting common problems or sharing trading strategies.

Your trading volume may affect the level of support you receive. VIP users on both platforms typically get access to dedicated account managers and faster response times.

BingX Vs BitMEX: Security Features

When choosing a crypto exchange, security should be your top priority. Both BingX and BitMEX offer strong security measures, but they differ in their approaches.

BitMEX emphasizes advanced multi-factor security technology. They make safety their main concern, implementing both internal and external security protocols to protect user funds and data.

BingX also maintains robust security features while providing a user-friendly experience. Their platform includes standard security measures like two-factor authentication (2FA) to help secure your account.

Key Security Features Comparison:

| Feature | BingX | BitMEX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Multi-factor Security | ✓ | ✓ |

| Cold Storage | Partial | Majority |

| Insurance Fund | Available | Comprehensive |

BitMEX stores most user funds in cold wallets, keeping them offline and away from potential hackers. This approach is considered safer than hot wallets that remain connected to the internet.

BingX utilizes a mix of hot and cold wallet storage to balance security and transaction speed. This helps you access your funds quickly while maintaining reasonable security.

Both platforms employ encryption technology to protect your personal information and transaction data. They also regularly update their security systems to address new threats.

Remember to enable all available security features when using either platform. This includes setting up 2FA, using strong passwords, and being cautious about phishing attempts.

Is BingX Safe & Legal To Use?

BingX operates as a legally registered financial services provider in multiple jurisdictions. If you’re considering using this platform, safety and legitimacy are important factors to evaluate.

The platform implements strict compliance protocols and advanced security measures to protect user assets. BingX also maintains transparent practices that help users understand how their funds are being managed.

However, opinions about BingX’s safety vary. While some users report positive experiences describing it as legitimate and reliable, others raise concerns.

One important note: BingX is not regulated by financial authorities with strict standards like those that oversee traditional brokers. This lack of rigorous regulation is a potential red flag you should consider.

When comparing BingX to more established exchanges like Binance or Kraken, it offers competitive fees and robust safety features, but with more limited global accessibility.

Key safety features include:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Regular security audits

- KYC verification requirements

Legal status:

- Registered in various jurisdictions

- Complies with local regulatory requirements

- Available in many countries, but with some restrictions

Before creating an account, you should verify BingX’s current legal status in your specific country, as cryptocurrency regulations change frequently.

Is BitMEX Safe & Legal To Use?

BitMEX has faced legal challenges in the past but has worked to rebuild its reputation. In 2020, the platform encountered issues with US regulators, resulting in restrictions for American traders.

Since then, BitMEX has strengthened its compliance and security features. The exchange now employs stricter verification processes and enhanced security protocols to protect users’ funds and information.

BitMEX is legally available in many countries worldwide, but not in the United States and some other restricted regions. Before using the platform, you should verify whether it’s permitted in your location.

When considering safety, remember this advice from user feedback: “Trust it as far as you need for your trades but don’t accumulate on it more than what you need.” This suggests keeping only necessary trading funds on the exchange rather than using it as a long-term storage solution.

The platform offers:

- Strict security measures

- Two-factor authentication (2FA)

- Cold storage for most funds

- Insurance fund for liquidations

BitMEX requires KYC (Know Your Customer) verification for all users, unlike some other platforms that offer no-KYC options. This increased regulation helps make the platform more legitimate but reduces privacy.

If you’re looking for alternatives, platforms like Bitget have been recommended by some users as secure and reputable options with similar trading features.

Frequently Asked Questions

New cryptocurrency traders often have important questions when comparing exchanges like BingX and BitMEX. These platforms differ in several key areas including fees, product offerings, and security features that directly impact trading experience.

What are the differences in trading fees between BingX and BitMEX?

BingX typically charges maker fees ranging from 0.02% to 0.04% and taker fees between 0.06% and 0.08% depending on your trading volume and VIP level. These fees are competitive for the industry.

BitMEX has a different fee structure with maker fees often at -0.01% (a rebate) and taker fees around 0.075%. This negative maker fee means you actually earn a small rebate when adding liquidity to the market.

Both exchanges offer reduced fees for high-volume traders, though their VIP tier requirements differ significantly.

How do BingX and BitMEX compare in terms of liquidity and trading volume?

BitMEX has historically maintained higher liquidity, especially for Bitcoin perpetual contracts where it was once an industry leader. Daily trading volumes on BitMEX often reach billions of dollars across its various contracts.

BingX has been growing rapidly and improving its liquidity pools, particularly since 2023. It offers competitive spreads on major trading pairs but may have less depth in some altcoin markets compared to BitMEX.

Slippage during large trades tends to be lower on BitMEX for BTC contracts, while BingX may offer better liquidity for certain altcoin pairs.

What variety of derivatives products are offered by BingX versus BitMEX?

BitMEX specializes in perpetual contracts and futures contracts with a strong focus on Bitcoin. It offers quarterly futures, perpetual swaps, and leverage up to 100x on select contracts.

BingX provides a broader range of products including spot trading, copy trading features, and derivatives. Its perpetual contracts cover more altcoins than BitMEX does.

BingX also offers social and copy trading options that let you follow successful traders, which BitMEX doesn’t currently provide.

Which exchange, BingX or BitMEX, provides better platform security and user protection?

BitMEX has implemented multi-signature wallets and keeps most user funds in cold storage. It has faced regulatory challenges in the past but has since improved its compliance measures.

BingX maintains a comprehensive security system with two-factor authentication, anti-phishing codes, and regular security audits. It also has an insurance fund to protect users against excessive losses.

Both platforms offer risk management tools like stop-loss orders and liquidation protections, though their implementation details differ.

Can traders from all countries use both BingX and BitMEX, or are there regional restrictions?

BitMEX is unavailable to residents of the United States, Quebec (Canada), Cuba, Crimea, Sevastopol, Iran, Syria, North Korea, and Sudan due to regulatory constraints.

BingX also restricts users from several jurisdictions including the United States, Singapore, Canada, and countries subject to UN sanctions. Their restrictions may change as regulations evolve.

Always check the current terms of service before signing up, as both exchanges periodically update their restricted regions list.

What customer support options are available for BingX and BitMEX?

BingX offers 24/7 customer support through live chat, email tickets, and social media channels. They typically respond within 24 hours and provide support in multiple languages.

BitMEX provides support primarily through an email ticket system and has a comprehensive knowledge base. Response times may vary but are generally within 24-48 hours.

Both platforms maintain FAQ sections addressing common issues, though BingX’s interface may be more intuitive for beginners seeking help.

BitMEX Vs BingX Conclusion: Why Not Use Both?

Both BitMEX and BingX offer unique advantages for crypto traders in 2025. BitMEX stands out with its historical reputation and pioneering perpetual contracts. You won’t need to worry about rolling positions at fixed future points when using BitMEX.

BingX appeals to many users with its user-friendly interface and additional incentives. You can earn interest rewards for holding certain assets and take advantage of staking opportunities that BitMEX doesn’t offer.

The platforms differ in several key areas:

- Trading fees

- Withdrawal processes

- Supported cryptocurrencies

- User interface complexity

BitMEX tends to cater to more experienced traders with its advanced features. You might find it less beginner-friendly but powerful for sophisticated trading strategies.

BingX offers a wider range of assets and a more accessible platform. You’ll appreciate its additional features if you’re looking beyond just leverage trading.

Using both platforms could give you the best of both worlds. You can leverage BitMEX’s established perpetual contracts while enjoying BingX’s broader asset selection and reward programs.

Consider your specific trading needs when choosing between them. You might start with BingX if you’re newer to crypto trading, or use BitMEX if you focus primarily on leverage trading with established cryptocurrencies.

Many experienced traders maintain accounts on multiple platforms to access different features and opportunities as market conditions change.