Choosing the right cryptocurrency exchange can be a game-changer for your trading experience. Binance and WhiteBIT are two popular platforms that offer different advantages depending on what you’re looking for as a trader or investor. While Binance provides a wider selection of cryptocurrencies and more extensive educational resources, WhiteBIT stands out with its demo trading feature that lets you practice before risking real money.

Both exchanges differ in their fee structures, security measures, and available trading options. Binance has established itself as one of the largest exchanges globally, but WhiteBIT has been gaining attention for its user-friendly interface and specific features that appeal to both beginners and experienced traders.

As you compare these platforms in 2025, you’ll want to consider factors like trading fees, supported cryptocurrencies, deposit methods, and security features to determine which exchange better suits your needs. The differences between these platforms might seem subtle, but they can significantly impact your trading success and overall experience.

Binance vs WhiteBIT: At A Glance Comparison

When choosing between Binance and WhiteBIT, understanding their key differences can help you make the right decision for your crypto trading needs.

Trading Volume & Size

Binance is significantly larger, with higher daily trading volumes and more users worldwide. WhiteBIT, while smaller, has been growing steadily in the European market.

Available Cryptocurrencies

| Exchange | Number of Coins |

|---|---|

| Binance | Larger selection |

| WhiteBIT | Fewer options |

Fee Structure

Both exchanges offer competitive fees, but they structure them differently. Binance typically has lower trading fees for high-volume traders, while WhiteBIT may offer better rates for beginners.

Unique Features

- Binance: More extensive educational resources

- WhiteBIT: Demo trading feature for practice

Security Measures

Both exchanges implement strong security protocols including two-factor authentication and cold storage for funds.

User Interface

WhiteBIT offers a simpler, more beginner-friendly interface. Binance provides more advanced tools but can feel overwhelming if you’re new to crypto trading.

Regulatory Compliance

Each exchange operates under different regulatory frameworks. Your location may determine which exchange is more suitable for your needs.

Customer Support

Support options vary between platforms, with both offering chat support and knowledge bases to help resolve your issues.

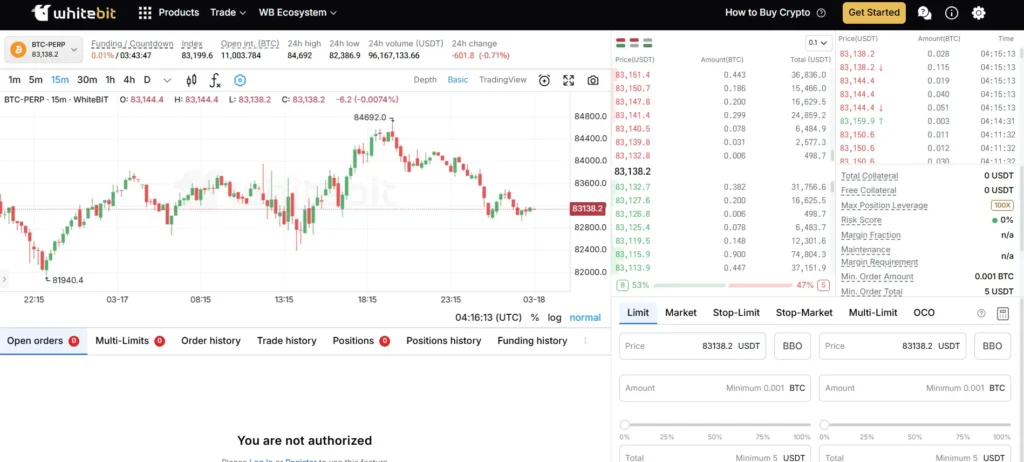

Binance vs WhiteBIT: Trading Markets, Products & Leverage Offered

Binance offers more trading options with over 350 cryptocurrencies compared to WhiteBIT’s 300+ assets. This gives you a wider selection of digital assets to trade.

Both exchanges provide spot trading where you can buy and sell crypto directly. They also offer futures trading for those looking to speculate on price movements without owning the actual asset.

Leverage Options:

| Exchange | Maximum Leverage |

|---|---|

| Binance | Up to 125x |

| WhiteBIT | Up to 100x |

Binance provides slightly higher leverage options, allowing you to amplify your potential profits (and risks) more than on WhiteBIT.

Both platforms offer margin trading, letting you borrow funds to increase your trading position. This can enhance your potential returns but also increases risk.

Binance stands out with its wide range of additional products including:

- Binance Earn (staking)

- Binance Launchpad for new token sales

- Binance Pay

- NFT marketplace

WhiteBIT also offers staking options and a referral program, but has fewer additional products compared to Binance’s extensive ecosystem.

For advanced traders, both platforms provide API access, allowing you to implement automated trading strategies. They also offer mobile apps so you can trade on the go.

Binance vs WhiteBIT: Supported Cryptocurrencies

When choosing a crypto exchange, the variety of available cryptocurrencies is a key factor to consider. Both Binance and WhiteBIT offer impressive selections, but there are some differences worth noting.

Binance supports over 350 cryptocurrencies, making it one of the most comprehensive exchanges on the market. This wide selection gives you access to both major coins and lesser-known altcoins.

WhiteBIT isn’t far behind with support for more than 300 digital assets. While slightly smaller than Binance’s offering, it still provides you with plenty of trading options.

Both platforms cover all the major cryptocurrencies like Bitcoin, Ethereum, and Solana. They also include popular altcoins and tokens needed for various DeFi applications.

The difference of approximately 50 cryptocurrencies may matter if you’re looking for very specific or niche tokens. In such cases, Binance might have a slight edge.

However, for most traders, WhiteBIT’s 300+ cryptocurrencies will be more than sufficient for building a diverse portfolio.

It’s worth checking each platform directly if you’re interested in a specific cryptocurrency, as their listings are regularly updated. New tokens are frequently added to both exchanges as the crypto market evolves.

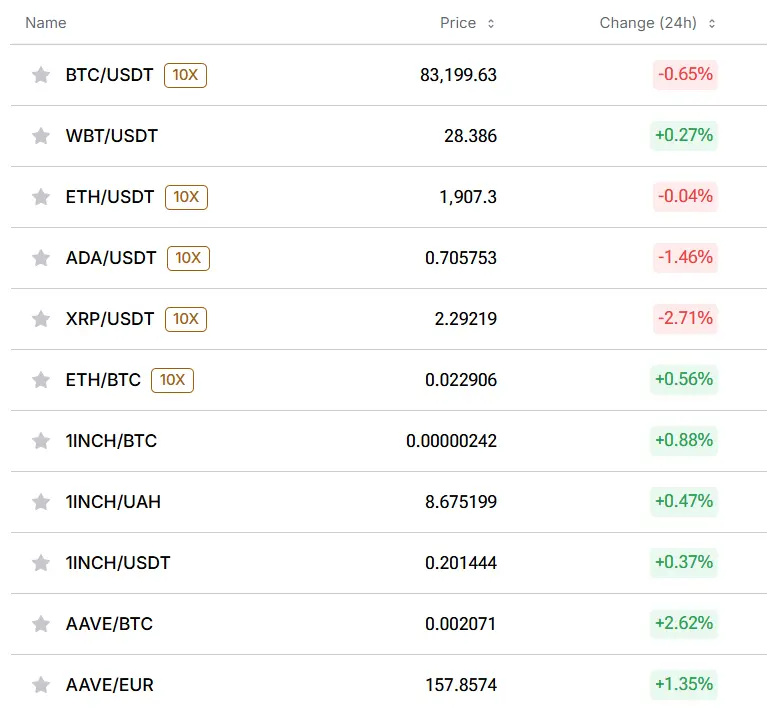

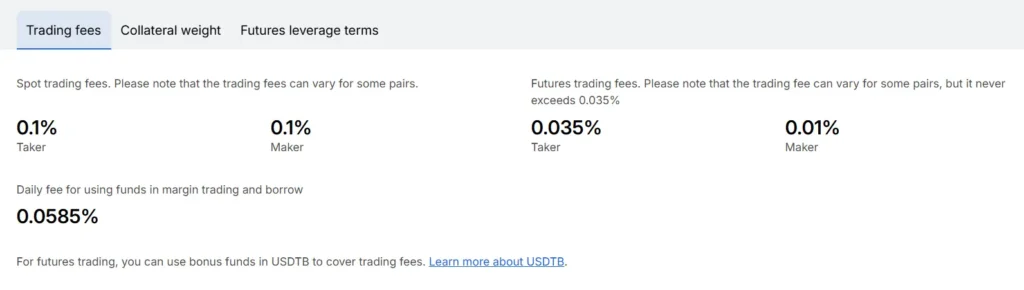

Binance vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and WhiteBIT, understanding the fee structure is crucial for your trading strategy. Both exchanges offer competitive rates, but there are some key differences to consider.

Trading Fees:

Both exchanges have similar futures trading fees. The taker fee is 0.05% on both platforms, while the maker fee is 0.02%. These rates are competitive in the crypto exchange market.

Deposit Fees:

Good news for traders – neither Binance nor WhiteBIT charges deposit fees. You can fund your account without extra costs on both platforms.

Withdrawal Fees:

This is where you’ll see some differences. WhiteBIT charges approximately 0.0004 BTC for Bitcoin withdrawals and 0.00367 ETH for Ethereum withdrawals.

Binance’s withdrawal fees vary by cryptocurrency, ranging from 0% to 3.5%. The exact fee depends on the specific coin and network you choose for the transaction.

| Fee Type | WhiteBIT | Binance |

|---|---|---|

| Futures Taker | 0.05% | 0.05% |

| Futures Maker | 0.02% | 0.02% |

| Deposit | None | None |

| BTC Withdrawal | 0.0004 BTC | Varies |

| ETH Withdrawal | 0.00367 ETH | Varies |

When selecting between these exchanges, consider your trading volume and which cryptocurrencies you’ll withdraw most often. The withdrawal fees might impact your overall profits, especially if you make frequent transactions.

Binance vs WhiteBIT: Order Types

When trading cryptocurrencies, order types can make a big difference in your strategy. Both Binance and WhiteBIT offer various order options to meet different trading needs.

Binance Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

- Trailing stop orders

- Post-only orders

Binance provides more advanced order types that cater to experienced traders. Their trailing stop feature is particularly useful for maximizing profits in volatile markets.

WhiteBIT Order Types:

- Market orders

- Limit orders

- Stop orders

- Stop-limit orders

- Demo trading orders

WhiteBIT stands out with its demo trading feature. This allows you to practice trading strategies without risking real money. It’s especially valuable for beginners learning the ropes.

Both exchanges support the essential market and limit orders that most traders regularly use. Market orders execute immediately at the current price, while limit orders execute only at your specified price or better.

For risk management, both platforms offer stop-limit orders to help protect your investments during market downturns.

If you’re an advanced trader looking for specialized order types, Binance offers more options. However, if you want to practice strategies before using real funds, WhiteBIT’s demo trading feature gives you that opportunity.

Binance vs WhiteBIT: KYC Requirements & KYC Limits

Both Binance and WhiteBIT require users to complete KYC (Know Your Customer) verification to access their full range of services. These processes help the exchanges comply with anti-money laundering (AML) regulations.

Binance KYC Requirements:

- Basic verification requires personal information and ID document upload

- EU users can open accounts with lowered KYC requirements but face limitations

- EU users with simplified KYC can only make fiat transactions below 1,000 EUR

Binance operates under various regulatory jurisdictions worldwide, adjusting their KYC process based on your location and the services you need.

WhiteBIT KYC Requirements:

- Full access to WhiteBIT requires complete identity verification

- Follows strict AML regulations through authorized regulators

- Focuses on platform security through comprehensive verification

Without completing KYC on WhiteBIT, you’ll face restricted access to the platform’s features. The exchange prioritizes security and regulatory compliance.

Both exchanges use KYC as a way to protect users and comply with international financial regulations. The verification processes are similar, requiring identification documents and personal information.

Your choice between these exchanges may depend on how quickly you need verification or if you’re comfortable with providing the required documentation.

Binance vs WhiteBIT: Deposits & Withdrawal Options

When choosing between Binance and WhiteBIT, deposit and withdrawal options play a crucial role in your trading experience. Both exchanges offer multiple methods, but they differ in important ways.

Binance supports a wider range of deposit options. You can fund your account through bank transfers, credit/debit cards, and various payment processors like Advcash and Simplex. Binance also allows P2P trading for deposits in many countries.

WhiteBIT offers fewer deposit methods but still covers the basics. You can use bank transfers (SEPA for European users) and credit cards to fund your account.

For withdrawal methods, both platforms support:

- Cryptocurrency withdrawals

- Bank transfers

- Card withdrawals (with some limitations)

Fee comparison:

| Platform | Crypto Withdrawal Fees | Fiat Withdrawal Fees |

|---|---|---|

| Binance | Varies by cryptocurrency | Depends on method (0.1% for SEPA) |

| WhiteBIT | Varies by cryptocurrency | Fixed fees based on currency and method |

Processing times also differ between the exchanges. Binance typically processes crypto withdrawals faster, often within minutes. WhiteBIT may take slightly longer for some cryptocurrencies.

For fiat withdrawals, both platforms are subject to banking hours and verification requirements. You should expect 1-5 business days for most fiat withdrawals, depending on your location and banking system.

Always verify the current fees and limits on both platforms before making transactions, as they may change over time.

Binance vs WhiteBIT: Trading & Platform Experience Comparison

When choosing between Binance and WhiteBIT, the trading experience is a key factor to consider. Both platforms offer distinct interfaces that cater to different types of traders.

WhiteBIT provides a more user-friendly experience, making it particularly suitable if you’re new to cryptocurrency trading. Its clean interface and intuitive design help you navigate the platform with ease.

Binance, while powerful, comes with a steeper learning curve. The platform offers more advanced tools and features that experienced traders might appreciate.

Key Platform Differences:

| Feature | Binance | WhiteBIT |

|---|---|---|

| User Interface | Complex, feature-rich | Clean, beginner-friendly |

| Trading Tools | Extensive charting, many indicators | Simplified but effective tools |

| Mobile Experience | Comprehensive app | Streamlined mobile interface |

| Trading Pairs | Larger selection | Fewer but well-curated options |

Both exchanges offer futures trading capabilities. WhiteBIT’s advanced trading tools work well for both beginners and experienced traders looking for a robust platform.

You’ll find that Binance’s interface can sometimes feel overwhelming with its wealth of options and data. WhiteBIT focuses on delivering essential information without cluttering the screen.

The mobile experience varies too. Binance packs nearly all desktop features into its app, while WhiteBIT offers a more streamlined mobile approach that focuses on core functionality.

Binance vs WhiteBIT: Liquidation Mechanism

Liquidation in crypto trading happens when your position cannot be maintained due to insufficient margin. Both Binance and WhiteBIT have mechanisms to handle this process, but they differ in several ways.

Binance uses a tiered liquidation system that gradually closes positions as they approach the liquidation price. This can help you avoid complete liquidation in some cases. The exchange sends warnings when your margin ratio falls below certain thresholds.

WhiteBIT, on the other hand, offers a valuable demo trading feature that lets you practice and understand liquidation risks without using real funds. This is especially helpful for beginners who want to learn about leverage trading.

Both platforms use an insurance fund to protect traders from negative balances. However, Binance’s larger market size means its insurance fund is more substantial.

The liquidation fees also differ between the exchanges. Binance typically charges a liquidation fee of 0.5%, while WhiteBIT’s fees may vary depending on the trading pair.

Liquidation Prevention Tools:

- Binance: Stop-loss orders, trailing stops, liquidation alerts

- WhiteBIT: Demo accounts, price alerts, partial close options

Your liquidation risk also depends on the leverage you use. Binance offers higher leverage options on some pairs, which increases potential profits but also raises liquidation risk.

WhiteBIT may be more suitable if you’re new to leverage trading due to its educational tools and demo feature. Binance might be better if you need more advanced liquidation management options.

Binance vs WhiteBIT: Insurance

When choosing a crypto exchange, understanding insurance coverage is crucial for your financial security. Both Binance and WhiteBIT offer protection for users’ funds, but with different approaches.

Binance maintains a Secure Asset Fund for Users (SAFU), which is funded by allocating a portion of trading fees. This emergency insurance fund aims to protect users’ funds in extreme cases. As of 2025, the SAFU fund holds significant reserves to cover potential losses.

WhiteBIT also provides insurance protection but focuses on cold storage security. They keep 96% of all assets in cold wallets, reducing the risk of online hacks.

Neither exchange offers full insurance coverage like traditional banks with FDIC insurance. Your crypto assets are primarily protected through security measures rather than comprehensive insurance policies.

Binance has a better track record of reimbursing users after security incidents. In past hacks, they’ve used the SAFU fund to ensure users didn’t lose funds.

WhiteBIT has experienced fewer security incidents, partly due to their stricter security protocols and smaller user base.

Insurance Comparison:

| Feature | Binance | WhiteBIT |

|---|---|---|

| Insurance Fund | SAFU | Limited |

| Cold Storage | 90% | 96% |

| Historical Reimbursements | Yes | Limited history |

| Third-party Insurance | Partial | Minimal |

You should note that both exchanges regularly update their insurance policies, so check their current terms before making your decision.

Binance vs WhiteBIT: Customer Support

When choosing a cryptocurrency exchange, customer support can make a big difference in your experience. Let’s compare how Binance and WhiteBIT handle customer support.

Binance offers 24/7 customer support, giving you access to help whenever you need it. This round-the-clock service can be especially valuable in the fast-moving crypto market.

WhiteBIT, on the other hand, operates on working days only. This limited availability might be inconvenient if you encounter issues during weekends or holidays.

Support Channels Comparison:

| Support Feature | WhiteBIT | Binance |

|---|---|---|

| Working Hours | Working days only | 24/7 |

| Email Support | Yes | Yes |

| Phone Support | No | Yes |

| Live Chat | No | Yes |

Binance clearly offers more ways to get help. With phone support, email, and live chat options, you can choose the method that works best for your situation.

WhiteBIT’s support is more limited, with email being the primary contact method. This might mean longer wait times for responses to your questions or concerns.

If you value quick resolution to problems, Binance’s multiple support channels and constant availability give it a clear advantage. This comprehensive support system can be particularly helpful for new traders who might need more guidance.

Binance vs WhiteBIT: Security Features

When choosing a crypto exchange, security should be your top priority. Both Binance and WhiteBIT offer strong protection measures, but with some key differences.

Binance provides robust security through its SAFU (Secure Asset Fund for Users) which protects user funds in case of breaches. They also implement two-factor authentication (2FA), anti-phishing codes, and advanced verification requirements.

WhiteBIT focuses heavily on security as well, maintaining up to 96% of assets in cold storage. Their platform includes 2FA, anti-phishing protection, and regular security audits to ensure system integrity.

Key Security Features Comparison:

| Feature | Binance | WhiteBIT |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | Majority of funds | Up to 96% of funds |

| Insurance Fund | SAFU fund | Available |

| Anti-Phishing | ✓ | ✓ |

| KYC Requirements | Multiple tiers | Required for withdrawals |

| Penetration Testing | Regular | Regular |

WhiteBIT has earned recognition for its user-friendly security approach, making protection measures accessible even to beginners. Their withdrawal confirmation process adds an extra layer of safety.

Binance offers more advanced security options for experienced traders, including IP and device restrictions, and customizable API permissions.

Your choice between these exchanges may depend on your comfort with security features. WhiteBIT might feel more approachable for newer users, while Binance provides more customization for security-conscious advanced traders.

Is Binance Safe & Legal To Use?

Binance is generally considered a safe cryptocurrency exchange for users. The platform employs Two Factor Authentication (2FA) to protect user accounts from unauthorized access.

Your personal data is also protected through encryption technology, making it difficult for hackers to access your information. This helps safeguard both your identity and assets.

Regarding legality, Binance’s status varies by country. The exchange is regulated in several regions, including Spain and Australia according to the search results.

However, Binance is not available in some countries:

- United States (restricted access to Binance.com; users must use Binance.US instead)

- Canada (restricted access)

Binance.US was created specifically for American users to comply with U.S. regulations. This separate platform has different features and may have fewer trading options than the main Binance exchange.

Before creating an account, you should verify Binance’s legal status in your country. Regulations change frequently in the crypto world.

For added security, consider these practices when using Binance:

- Enable all available security features

- Use a strong, unique password

- Store large amounts of cryptocurrency in a personal wallet

- Be cautious of phishing attempts

Trading on any exchange involves risks, so only invest what you can afford to lose.

Is WhiteBIT Safe & Legal To Use?

WhiteBIT prioritizes security, with over 95% of funds stored in cold wallets to protect against online threats. The exchange follows KYC (Know Your Customer) and AML (Anti-Money Laundering) guidelines to ensure a secure trading environment.

Regarding regulation, WhiteBIT is legally authorized to operate in Spain, similar to Binance. However, it lacks regulatory approval in certain regions where Binance has established compliance.

Important geographical restrictions apply:

- WhiteBIT is not available in the United States

- Canadian residents cannot access the platform

- Availability varies in other countries

The exchange implements multi-factor authentication to add an extra layer of security for your account. This helps protect your assets from unauthorized access.

WhiteBIT’s emphasis on security practices makes it a relatively safe option for traders in regions where it operates legally. Before signing up, you should verify that WhiteBIT can legally serve customers in your location.

For maximum security, consider using all available security features if you choose WhiteBIT as your exchange. This includes strong passwords and all authentication options offered.

Frequently Asked Questions

Traders often have specific concerns when choosing between Binance and WhiteBIT. Below are answers to common questions about these exchanges’ features, limitations, and comparative benefits.

What are the distinctive advantages of using Binance over other exchanges?

Binance offers an exceptionally wide range of cryptocurrencies, with over 350 coins available for trading. This diversity gives you more options than most competitors, including WhiteBIT.

Binance also provides advanced trading tools like futures trading, margin options, and an extensive set of charting capabilities. The exchange’s high liquidity means you can execute large trades with minimal slippage.

The Binance ecosystem includes additional services such as Binance Academy, Launchpad, and Binance Card, creating a comprehensive platform beyond just trading.

Are there any geographical restrictions for users on WhiteBIT?

WhiteBIT does have some geographical restrictions. The platform is unavailable to users in the United States, Canada, and several other countries due to regulatory concerns.

Before signing up, you should check the current list of restricted countries on WhiteBIT’s terms of service. These restrictions can change as regulations evolve in different regions.

WhiteBIT focuses primarily on European markets, with strong presence in Ukraine and other Eastern European countries.

How does WhiteBIT compare in terms of security measures with Binance?

WhiteBIT stores 96% of user assets in cold wallets, providing strong protection against online hacking attempts. The platform has never experienced a major security breach since its launch.

Binance implements a Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund. Both exchanges offer two-factor authentication, anti-phishing codes, and withdrawal address whitelisting.

WhiteBIT has earned an AAA rating from CER for its security practices, while Binance’s security system includes AI-powered risk monitoring.

Which exchange offers more diverse trading pairs and market options?

Binance clearly leads in trading pair diversity with over 1,200 trading pairs compared to WhiteBIT’s approximately 400 pairs. This gives Binance users access to more market combinations.

WhiteBIT focuses on quality over quantity, offering carefully selected trading pairs. However, if you’re looking for obscure altcoins or newly launched tokens, Binance typically lists them faster.

Both exchanges support spot trading, but Binance offers more advanced options including futures, options, margin trading, and leveraged tokens.

What are the fee structures for Binance and WhiteBIT, and how do they compare?

Binance charges maker/taker fees starting at 0.1%, which can be reduced by using BNB for payment or increasing your trading volume. This fee structure is slightly lower than industry averages.

WhiteBIT’s fee structure begins at 0.1% for both maker and taker orders. The platform offers fee discounts based on your 30-day trading volume and WBT token holdings.

Both exchanges charge varying fees for deposits and withdrawals depending on the payment method and cryptocurrency network used.

Can users benefit from staking or earning passive income on both Binance and WhiteBIT platforms?

Binance offers extensive earning opportunities through Binance Earn, including flexible savings, locked staking, DeFi staking, and liquidity farming. You can earn passive income on a wide range of assets.

WhiteBIT provides staking options but with fewer supported cryptocurrencies than Binance. The platform offers competitive APY rates on certain coins through their WhiteBIT Earn program.

Both exchanges update their staking options regularly, but Binance typically provides more diverse ways to earn passive income across different risk levels.

WhiteBIT vs Binance Conclusion: Why Not Use Both?

Both WhiteBIT and Binance offer unique strengths that might benefit you as a crypto trader. Binance provides a more extensive range of educational resources and generally lower trading fees at 0.1%, with additional discounts available.

WhiteBIT stands out with its demo trading feature, which gives you hands-on practice without risking real money. This can be especially valuable if you’re new to crypto trading or want to test strategies.

When it comes to supported cryptocurrencies and features, Binance typically offers more options. However, WhiteBIT may provide specific coins or services that Binance doesn’t.

Using both platforms could give you:

- Access to a wider range of cryptocurrencies

- Different fee structures for various trading needs

- Backup options if one platform experiences downtime

- The ability to compare real-time prices for better trades

Many experienced traders maintain accounts on multiple exchanges to take advantage of price differences and unique features. You might use WhiteBIT’s demo mode to practice, then execute larger trades on Binance to benefit from lower fees.

Remember to consider your specific needs. If you primarily trade popular cryptocurrencies and value lower fees, Binance might be sufficient. If you appreciate WhiteBIT’s interface or specific features, it could be your main platform.

The crypto world changes quickly, so having access to multiple exchanges keeps your options open.