Are you trying to decide between Binance and Poloniex for your crypto trading needs? These popular exchanges offer different features that might influence your choice.

Binance scores higher overall with an 8.0 rating compared to Poloniex, and also provides better customer support according to user feedback. However, Poloniex supports more cryptocurrencies (563) than Binance (415), which might matter if you’re looking to trade specific coins.

When comparing these exchanges, you’ll want to consider factors like fees, available trading pairs, and security features. Binance has quickly risen to become one of the top exchanges by trading volume since its founding in 2017, making it a popular choice for many traders.

Binance Vs Poloniex: At A Glance Comparison

Binance and Poloniex are two popular cryptocurrency exchanges that offer different features and benefits. When comparing these platforms, several key factors stand out.

Overall Rating

| Exchange | Overall Score |

|---|---|

| Binance | 8.0 |

| Poloniex | Lower than Binance |

Customer Support

Binance provides better customer support with a G2 rating of 7.1. Poloniex falls behind with a rating of 4.3, which suggests you might face more challenges getting help when needed.

Fee Structure

Binance has a clear advantage with its competitive fee structure. The platform offers lower trading fees compared to Poloniex, making it more cost-effective for frequent traders.

Trading Volume

Binance consistently ranks higher in trading volume on cryptocurrency exchange listings. This higher liquidity means you can execute trades more easily without significant price slippage.

User Experience

Both platforms offer different user interfaces. Binance provides a more comprehensive trading experience with multiple options for beginners and advanced traders.

Available Cryptocurrencies

You’ll find a wider selection of cryptocurrencies on Binance compared to Poloniex, giving you more trading opportunities and portfolio diversification options.

Security Features

Both exchanges implement security measures to protect your assets, but Binance has invested heavily in security infrastructure since its founding.

Binance Vs Poloniex: Trading Markets, Products & Leverage Offered

Binance and Poloniex both offer a wide range of trading options, but they differ in several important ways.

When it comes to cryptocurrency selection, Poloniex has an edge with support for 563 cryptocurrencies compared to Binance’s 415. This gives you more options if you’re looking to trade less common altcoins.

Both exchanges offer spot trading, but Binance provides a more extensive suite of additional products:

Trading Products Comparison:

| Feature | Binance | Poloniex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | Limited |

| Options | ✓ | ✗ |

| Margin Trading | ✓ | ✓ |

| Staking | ✓ | ✓ |

Binance is known for offering leverage trading with options up to 125x on certain trading pairs. This is particularly appealing if you’re an experienced trader looking to maximize potential returns.

Poloniex does offer margin trading but with more conservative leverage options, making it potentially safer for newer traders.

Trading interfaces differ between the platforms. Binance offers both basic and advanced trading views to accommodate different experience levels. Poloniex’s interface is functional but may not be as intuitive for beginners.

Liquidity is another key factor to consider. Binance consistently maintains higher trading volumes, which means your orders are likely to be filled faster and with less price slippage.

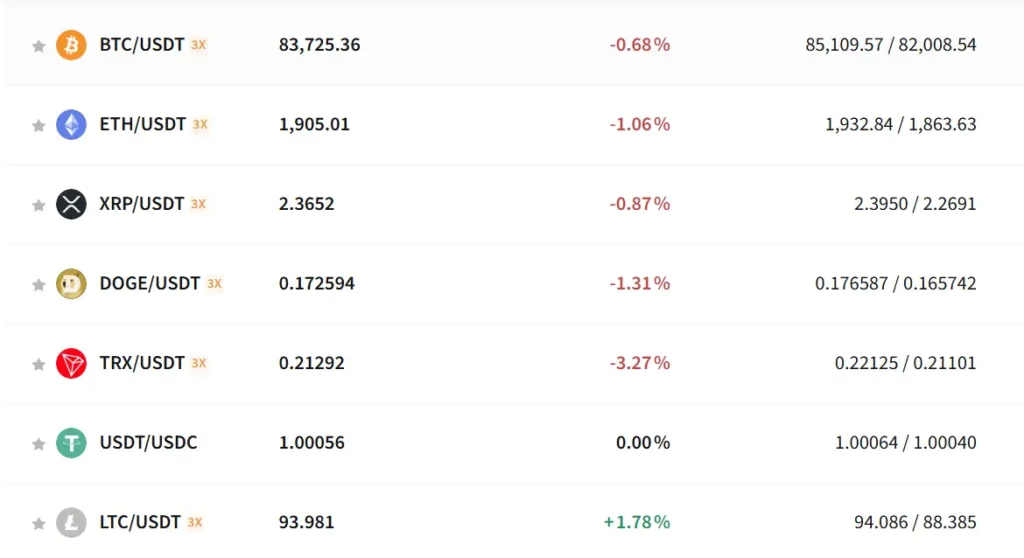

Binance Vs Poloniex: Supported Cryptocurrencies

When choosing between Binance and Poloniex, the variety of cryptocurrencies available for trading is an important factor to consider.

According to recent data, Poloniex supports approximately 563 cryptocurrencies, while Binance offers around 415 cryptocurrencies. This gives Poloniex an edge in terms of sheer variety.

However, numbers don’t tell the whole story. You should consider which specific cryptocurrencies you’re interested in trading.

Binance Strengths:

- Better support for high market cap cryptocurrencies

- More trading pairs with stable coins

- Stronger options for new token listings

Poloniex Strengths:

- Greater variety of altcoins

- More niche cryptocurrency options

- Better selection of certain token types

Both exchanges cover all major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. The differences become apparent when you look at more specialized tokens or newer projects.

You might find that Binance typically adds new high-profile tokens faster, especially those with larger market capitalizations. Poloniex, on the other hand, sometimes offers more experimental or smaller market cap cryptocurrencies.

Before choosing an exchange based solely on cryptocurrency selection, check if the specific coins you want to trade are available. The platform that supports your preferred cryptocurrencies should rank higher in your decision-making process.

Binance Vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and Poloniex, fees play a crucial role in your decision. Based on 2025 data, Binance offers more competitive trading fees than Poloniex.

Binance’s trading fees can be as low as 0.6%, making it a cost-effective option for frequent traders. This fee structure gives Binance a clear advantage over Poloniex in direct comparisons.

Trading Fee Comparison:

| Exchange | Standard Trading Fee |

|---|---|

| Binance US | Up to 0.6% |

| Poloniex | Higher than Binance |

Both platforms offer tiered fee structures, meaning you pay less as your trading volume increases. However, Binance consistently maintains lower rates across all tiers.

For deposit methods, both exchanges support various options. Binance typically offers more flexibility in how you can fund your account.

Withdrawal fees vary by cryptocurrency on both platforms. These fees change regularly based on network conditions and the specific coin you’re withdrawing.

User ratings suggest greater satisfaction with Binance’s fee structure. On G2, Binance scores 3.9 out of 5 compared to Poloniex’s 3.5, indicating users find more value in Binance’s pricing model.

If minimizing costs is your priority, Binance appears to be the more economical choice between these two exchanges in the current market.

Binance Vs Poloniex: Order Types

When trading on cryptocurrency exchanges, the variety of order types affects your trading strategy. Both Binance and Poloniex offer several order options, but they differ in some important ways.

Binance provides a more extensive range of order types. You can access:

- Market orders (instant execution at current price)

- Limit orders (set your desired price)

- Stop-limit orders (triggers at a certain price)

- OCO orders (one-cancels-the-other)

- Trailing stop orders

Poloniex offers fewer order types, focusing on the basics:

- Market orders

- Limit orders

- Stop-limit orders

Binance’s advanced order types give you more flexibility for complex trading strategies. The trailing stop orders are particularly useful for protecting profits as prices move up.

For new traders, Poloniex’s simpler approach might be easier to understand. You won’t get overwhelmed by too many choices.

The order book display also differs between platforms. Binance’s interface shows more detailed market depth, making it easier to see potential price movements.

Both exchanges allow you to view your order history and active orders, but Binance’s layout is generally more user-friendly.

If you plan to use advanced trading strategies, Binance’s wider selection of order types gives you a clear advantage. For simple buy and sell transactions, either platform will meet your basic needs.

Binance Vs Poloniex: KYC Requirements & KYC Limits

Binance puts a strong emphasis on security and KYC (Know Your Customer) verification. When you sign up, you’ll need to provide personal information and complete identity verification using official documents.

This verification process is mandatory for accessing Binance’s full features and higher trading limits. Binance’s approach aligns with global regulatory standards.

In contrast, Poloniex offers a more flexible approach to KYC requirements. According to recent information, Poloniex allows users to trade cryptocurrencies without requiring KYC verification.

This no-verification policy is a significant advantage for users who value privacy or want to start trading immediately. However, your trading limits will be restricted without verification.

Here’s a simple comparison of KYC requirements:

| Exchange | KYC Required | Verification Process |

|---|---|---|

| Binance | Yes | Personal info + ID documents |

| Poloniex | No (for basic trading) | Optional for higher limits |

Without KYC verification on Poloniex, you can still engage in basic trading activities. Your withdrawal limits will be capped, though the specific amounts may vary.

Binance’s stricter KYC policy provides better security but requires more time to set up. Poloniex offers quicker access but with limited functionality until verification.

Your choice between these platforms may depend on how you value privacy versus access to advanced features and higher trading limits.

Binance Vs Poloniex: Deposits & Withdrawal Options

When choosing between Binance and Poloniex, understanding your deposit and withdrawal options is crucial for managing your crypto assets effectively.

Binance offers a wider range of deposit methods compared to Poloniex. You can fund your Binance account using bank transfers, credit/debit cards, and various third-party payment processors.

Poloniex is more limited in this regard, primarily focusing on cryptocurrency deposits rather than fiat currency options.

For withdrawal options, both exchanges support cryptocurrency withdrawals to external wallets. However, Binance provides more flexibility with fiat withdrawals to bank accounts in many regions.

Here’s a quick comparison of the deposit and withdrawal options:

| Feature | Binance | Poloniex |

|---|---|---|

| Crypto deposits | Extensive (300+ coins) | Good (75+ coins) |

| Fiat deposits | Yes (bank transfer, cards) | Limited |

| Withdrawal speed | Fast | Average |

| Withdrawal fees | Competitive | Slightly higher |

Remember that withdrawal fees vary by cryptocurrency on both platforms. Binance typically has more competitive withdrawal fees, which can save you money with frequent transactions.

Verification requirements also affect your withdrawal limits. Both exchanges require KYC verification for higher withdrawal limits, but Binance offers higher limits overall once verified.

Processing times for withdrawals are generally faster on Binance, especially for popular cryptocurrencies like Bitcoin and Ethereum.

Binance Vs Poloniex: Trading & Platform Experience Comparison

When choosing between Binance and Poloniex, platform experience plays a crucial role in your trading journey. Both exchanges offer distinct interfaces and trading features worth considering.

Binance provides a smoother user experience with an intuitive interface. According to BitDegree, Binance has a higher overall score of 8.0 compared to Poloniex. This reflects in its more user-friendly design.

User ratings support this assessment. G2 reports show Binance with a 3.9 star rating, outperforming Poloniex’s 3.5 stars. This suggests traders find Binance more satisfying to use.

Trading Features Comparison:

| Feature | Binance | Poloniex |

|---|---|---|

| User Interface | More intuitive | Functional but less refined |

| Mobile Experience | Better rated app | Basic functionality |

| Trading Tools | More comprehensive | Limited options |

| Platform Stability | More reliable | Occasional issues |

Both platforms offer spot and margin trading, but Binance provides more advanced trading options. You’ll find a wider range of order types and analytical tools on Binance.

Poloniex does have strengths in certain areas. Its interface is simpler, which some beginners might prefer. However, as you advance in your trading journey, you may find its limitations restrictive.

The platform stability factor cannot be overlooked. Binance generally experiences fewer outages during high market volatility, ensuring you can execute trades when needed.

Binance Vs Poloniex: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for your financial safety. Both Binance and Poloniex have systems in place to protect themselves when markets move against traders’ positions.

Binance uses a tiered liquidation process. Your position enters risk territory when it reaches around 80% of your collateral value. The platform sends warnings before taking action.

Poloniex employs a more straightforward approach. Their system automatically closes positions when they reach predetermined margin requirements, typically with less warning than Binance provides.

Key differences:

| Feature | Binance | Poloniex |

|---|---|---|

| Warning system | Multiple alerts | Limited notifications |

| Liquidation speed | Gradual process | Relatively quicker |

| Partial liquidation | Available | Limited options |

| Insurance fund | Robust protection | Smaller fund |

Binance offers partial liquidation features that help you maintain some position during volatile markets. This can prevent total losses when prices swing temporarily.

Poloniex’s liquidation tends to be more abrupt. You might find your entire position closed with less opportunity to add funds to prevent it.

Both platforms calculate liquidation prices based on your leverage level, position size, and available margin. Higher leverage means liquidation prices sit closer to your entry point.

You should monitor your positions carefully on either platform. Setting stop-losses below liquidation prices can help you exit on your terms rather than facing forced liquidation.

Binance Vs Poloniex: Insurance

When comparing crypto exchanges, insurance protection is a crucial factor to consider for your investments. Both Binance and Poloniex offer some form of insurance coverage, but they differ in important ways.

Binance maintains a Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund. This fund holds approximately 10% of all trading fees collected and is designed to protect users in case of security breaches.

Poloniex, on the other hand, doesn’t have a dedicated insurance fund like SAFU. However, they do keep the majority of user assets in cold storage to minimize risk.

Neither platform offers comprehensive insurance coverage like traditional financial institutions. Most crypto holdings aren’t protected against market volatility, only against specific security incidents.

Here’s a quick comparison of their insurance offerings:

| Feature | Binance | Poloniex |

|---|---|---|

| Dedicated Insurance Fund | Yes (SAFU) | No |

| Cold Storage Security | Yes | Yes |

| Coverage for All Assets | No | No |

| Coverage for Market Losses | No | No |

You should note that both exchanges prioritize prevention over insurance. They implement strong security measures like two-factor authentication and strict withdrawal procedures.

For maximum protection, consider storing your long-term crypto holdings in a personal hardware wallet rather than leaving them on either exchange.

Binance Vs Poloniex: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. This aspect often becomes crucial when you face account issues or have urgent questions.

Based on user feedback, Binance outperforms Poloniex in customer support quality. G2 ratings show Binance with a solid 7.1 rating compared to Poloniex’s 4.3 for support services.

Binance offers multiple support channels including live chat, ticket systems, and an extensive knowledge base. Their 24/7 support team typically responds to inquiries faster than Poloniex.

Poloniex provides support primarily through tickets and email. Users often report longer wait times for responses compared to Binance.

Support Comparison:

| Feature | Binance | Poloniex |

|---|---|---|

| Support Rating | 7.1/10 | 4.3/10 |

| Available Channels | Live chat, tickets, FAQ | Tickets, email, FAQ |

| Response Time | Faster | Slower |

| 24/7 Availability | Yes | Limited |

If you value quick responses and multiple support options, Binance may be the better choice for your needs. Their higher rating reflects user satisfaction with issue resolution and response times.

Remember that support experiences can vary depending on your specific issue and the current platform traffic. During high-volume trading periods, both exchanges may experience longer response times.

Binance Vs Poloniex: Security Features

When choosing a crypto exchange, security should be your top priority. Both Binance and Poloniex have implemented strong security measures to protect user assets.

Two-Factor Authentication (2FA) is available on both platforms. This adds an extra layer of protection beyond just your password. You can set up 2FA through authenticator apps or SMS verification.

Binance offers Advanced Access Control that lets you manage which devices can access your account. You can also set up IP address restrictions to prevent logins from unfamiliar locations.

Poloniex provides Email Confirmations for withdrawals, helping to prevent unauthorized transactions. If someone tries to withdraw your funds, you’ll receive an alert.

Cold Storage practices are used by both exchanges. This means most user funds are kept offline, safe from potential online attacks.

Binance has its Secure Asset Fund for Users (SAFU), which sets aside a portion of trading fees to protect users in case of security breaches. This gives you added protection if something goes wrong.

Poloniex implements Regular Security Audits to identify and fix potential vulnerabilities before they can be exploited.

Both exchanges offer Account Monitoring systems that track unusual activities and may temporarily freeze accounts if suspicious behavior is detected.

Withdrawal Limits are in place on both platforms, reducing potential losses if your account is compromised.

In terms of historical security performance, Binance has experienced some breaches but compensated affected users. Poloniex has also faced security challenges but continues to strengthen its measures.

Is Binance A Safe & Legal To Use?

Binance implements strong security measures to protect your crypto assets. According to Security.org, Binance stores most cryptocurrency in “cold wallets” disconnected from the internet, making them less vulnerable to hacking attempts.

No exchange is 100% safe, including Binance. Like all exchanges, it faces potential security risks. However, Binance has built a reputation for maintaining security standards that many users trust.

Binance’s legal status varies by location. In some countries, Binance operates with full approval, while in others it faces restrictions. Binance US was specifically created to comply with US regulations.

Key Security Features:

- Two-factor authentication (2FA)

- Address whitelisting

- Anti-phishing codes

- Regular security audits

The exchange also maintains an insurance fund called SAFU (Secure Asset Fund for Users) to protect users in case of security breaches.

When considering safety, you should also evaluate your own security practices. Using strong passwords, enabling all security features, and limiting the amount kept on exchanges improves your protection.

Binance receives better support ratings than Poloniex, scoring 7.1 compared to Poloniex’s 4.3 on G2. This suggests Binance might respond more effectively during security incidents or account issues.

Remember to verify Binance’s current legal status in your country before using their services, as regulations change frequently in the crypto space.

Is Poloniex A Safe & Legal To Use?

Poloniex offers several security features to protect your funds. The exchange uses two-factor authentication (2FA) to add an extra layer of protection for your account. This matches the security standards offered by Binance.

The exchange has faced some regulatory challenges over the years. In some countries, Poloniex operates without restrictions, while in others it faces scrutiny or is banned completely.

For U.S. users, it’s important to note that Poloniex stopped serving American customers in 2019 due to regulatory uncertainty. This is a key difference from Binance, which created a separate platform (Binance.US) for American users.

Poloniex implements standard security protocols for crypto exchanges, including:

- Two-factor authentication (2FA)

- Cold storage for most user funds

- Wallet management systems

- KYC (Know Your Customer) verification requirements

The exchange has experienced security incidents in the past, including a 2014 hack. However, they have since improved their security measures.

Before using Poloniex, you should check if it’s legal in your country. Regulations around cryptocurrency exchanges change frequently, so what’s legal today might not be tomorrow.

When using Poloniex, always enable all available security features and use strong, unique passwords to protect your funds.

Frequently Asked Questions

Traders often have specific questions when choosing between Binance and Poloniex exchanges. These common questions address key differences in fees, security, available cryptocurrencies, support quality, user experience, and trading options.

What are the differences in trading fees between Binance and Poloniex?

Binance offers more competitive trading fees compared to Poloniex. The fee structure on Binance starts lower and decreases based on your trading volume and BNB holdings.

Poloniex charges slightly higher fees for most traders. According to recent comparisons, Binance maintains its edge in the fee category across most trading pairs.

If you trade frequently or in large volumes, the difference in fees between these platforms could significantly impact your trading costs over time.

How do the security measures compare between Binance and Poloniex?

Both exchanges implement two-factor authentication (2FA) and cold storage solutions. Binance has invested heavily in its Secure Asset Fund for Users (SAFU) to protect customer assets in emergency situations.

Poloniex maintains strong security protocols but has experienced some security incidents in its history. Binance regularly updates its security measures and has a more robust risk management system.

You should enable all available security features regardless of which platform you choose.

What variety of cryptocurrencies are available on Binance versus Poloniex?

Binance supports a significantly larger selection of cryptocurrencies and trading pairs than Poloniex. You’ll find hundreds of coins and tokens on Binance, including most major cryptocurrencies and many smaller altcoins.

Poloniex offers a decent variety but focuses more on established cryptocurrencies. The difference in selection can matter if you’re interested in trading newer or more obscure tokens.

Both platforms regularly add new listings, but Binance typically introduces new cryptocurrencies more quickly.

Which exchange offers better customer support, Binance or Poloniex?

Binance provides higher-rated customer support according to user feedback. With a G2 rating of 7.1, Binance outperforms Poloniex’s 4.3 rating in this category.

You can access Binance support through multiple channels including live chat, tickets, and a comprehensive help center. Response times on Binance tend to be faster during high-volume periods.

Poloniex offers standard support options but users report longer wait times and less satisfactory issue resolution.

How do the user interfaces of Binance and Poloniex differ for new traders?

Binance offers both basic and advanced interfaces to accommodate different experience levels. New traders can use Binance Lite for a simplified experience before moving to the more feature-rich standard interface.

Poloniex has a straightforward interface but lacks some of the beginner-friendly features found on Binance. The learning curve can be steeper for first-time crypto traders.

Both platforms offer mobile apps, but Binance’s app receives higher ratings and offers more functionality for trading on the go.

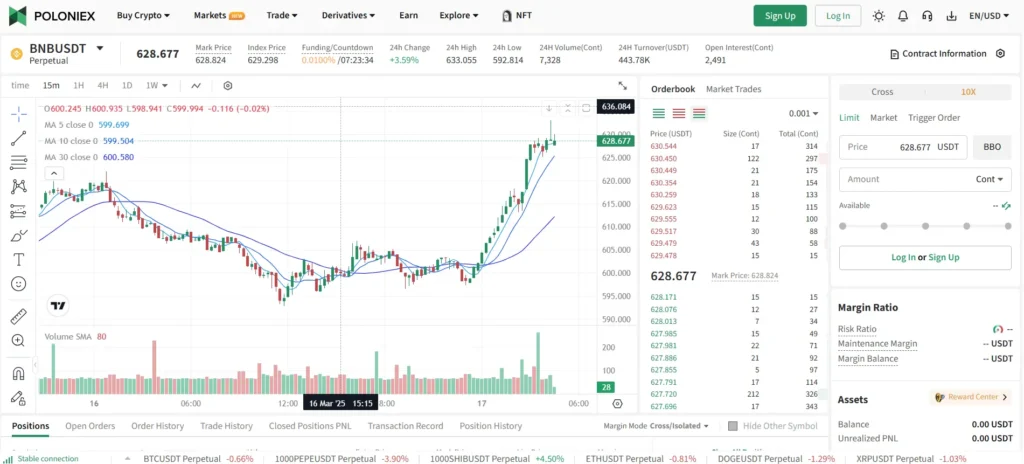

What are the margin and futures trading options on Binance compared to Poloniex?

Binance provides extensive margin and futures trading options with high leverage possibilities. You can access isolated and cross margin modes with various leverage levels depending on your verification level.

Futures trading on Binance includes USDⓈ-M and COIN-M contracts with leverage up to 125x on some pairs. Binance also offers more advanced trading tools for derivatives.

Poloniex has more limited margin trading options and doesn’t match Binance’s extensive futures trading platform. If advanced trading options are important to you, Binance offers a more comprehensive suite of tools.

Poloniex Vs Binance Conclusion: Why Not Use Both?

After comparing these two crypto exchanges, you might wonder if you need to choose just one. The truth is, you don’t have to pick a single platform.

Both exchanges offer unique benefits. Binance stands out with lower trading fees and a better user experience, scoring 8.0 overall compared to Poloniex’s lower rating.

Binance also offers stronger customer support, with users giving it a 7.1 rating versus Poloniex’s 4.3. This can be crucial when you need help with your trades or account issues.

However, Poloniex may occasionally offer different trading pairs or coins that aren’t available on Binance. This creates potential arbitrage opportunities between the two platforms.

You might consider using:

- Binance for most of your regular trading activities

- Poloniex for specific coins or trading pairs not found on Binance

Using both exchanges gives you more flexibility and access to a wider range of cryptocurrencies. It also allows you to take advantage of price differences between platforms.

Just remember to keep track of your assets across both exchanges and be aware of the fee structures for each. Many experienced traders maintain accounts on multiple exchanges to maximize their options.