If you’re trying to decide between Binance and OKX in 2025, you’re looking at two industry giants with different strengths. Both exchanges offer competitive trading fees and strong security features, making them popular choices for crypto traders worldwide.

Binance supports over 400 cryptocurrencies while OKX offers more than 300, giving you plenty of options regardless of which platform you choose. The difference comes down to what you value most – Binance is known for its user-friendly interface and market dominance, while OKX stands out with its advanced trading features.

When comparing staking options, both exchanges provide good returns. Binance offers between 0.5% and 11.2% APR for staking, while OKX has comparable rates. Your choice might depend on the specific cryptocurrencies you plan to trade and whether you prefer a simpler experience or more advanced trading tools.

Binance Vs OKX: At A Glance Comparison

When choosing between Binance and OKX in 2025, several key differences stand out.

Trading Fees:

OKX offers slightly lower trading fees compared to Binance, giving you a small advantage for frequent traders.

Cryptocurrency Selection:

Binance supports over 400 cryptocurrencies, providing more trading options than OKX.

| Feature | Binance | OKX |

|---|---|---|

| Trading Fees | Competitive | Slightly lower |

| Crypto Selection | 400+ | Fewer options |

| User Satisfaction | 8.0 overall score | 9.2 requirements score |

| Trading Focus | Spot trading (76% of users) | Strong in derivatives |

User satisfaction data shows OKX scores higher (9.2) in meeting user requirements compared to Binance’s 8.0 overall score.

Binance is more popular for spot trading and holding strategies, with 76% of surveyed users preferring it for these activities.

OKX, alongside Bybit, shows greater strength in derivatives trading for those interested in futures and options.

Both platforms offer decentralized finance options, though Binance has more extensive offerings in this area.

Your choice between these exchanges should depend on your specific needs. Consider whether you prioritize lower fees, wider cryptocurrency selection, or specific trading types.

Binance Vs OKX: Trading Markets, Products & Leverage Offered

Both Binance and OKX offer impressive trading options, but they differ in some key areas. Let’s look at what each platform provides.

Trading Markets

| Feature | Binance | OKX |

|---|---|---|

| Cryptocurrency pairs | 350+ | 300+ |

| Fiat currencies | Multiple options | More limited |

| Token types | Major coins, altcoins, tokens | Major coins, altcoins, tokens |

Trading Products

Both exchanges offer spot trading, futures, options, and swap contracts. You can also find staking opportunities and earn interest on your crypto holdings.

Binance has a more extensive ecosystem with Binance Launchpad for new token offerings and a broader range of DeFi products.

OKX stands out with its advanced trading tools and slightly more intuitive interface for derivatives trading. Their trading bot options are also well-regarded by experienced traders.

Leverage Options

Both platforms allow up to 10x leverage for margin trading. This means you can borrow funds to increase your potential returns (and risks).

OKX tends to have slightly lower fees for leveraged trading, with maker fees at 0.08% compared to Binance’s 0.1%.

Trading Experience

Binance offers more educational resources for beginners, while OKX provides more advanced analytics tools for experienced traders.

You’ll find mobile apps available from both exchanges with similar functionality, allowing you to trade on the go.

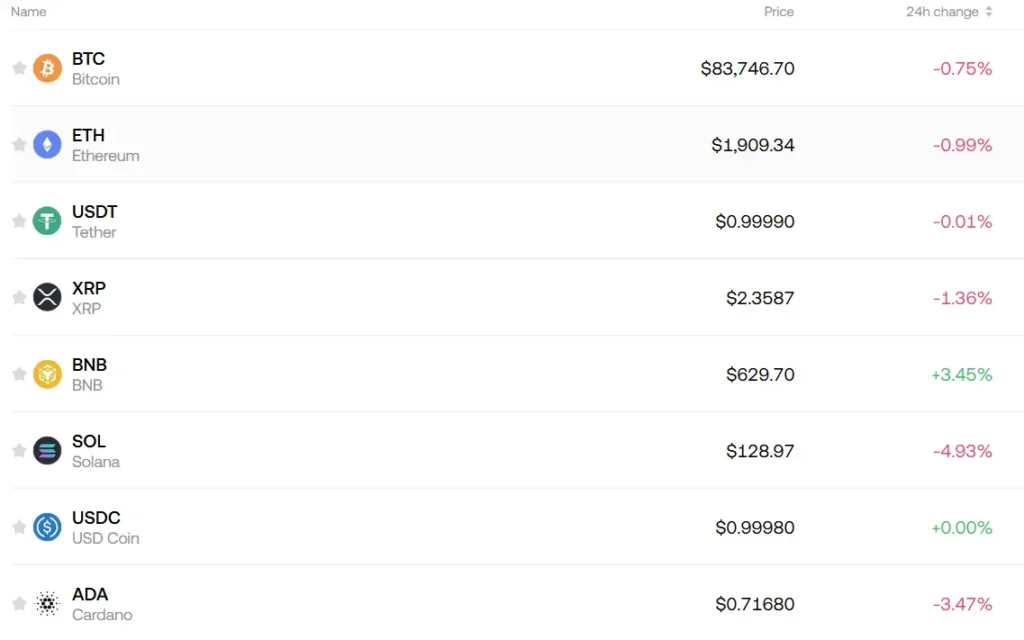

Binance Vs OKX: Supported Cryptocurrencies

When choosing between Binance and OKX, the range of available cryptocurrencies is a key factor to consider. Binance currently supports over 400 crypto assets, giving you access to a wider selection of trading options.

OKX offers a slightly smaller but still substantial selection with more than 300 cryptocurrencies available on their platform. Both exchanges cover all major cryptocurrencies like Bitcoin, Ethereum, and Solana.

The difference in supported assets might matter if you’re interested in trading more obscure altcoins or newer tokens. Binance typically adds new cryptocurrencies faster and supports a broader range of smaller market cap coins.

Here’s a quick comparison of their cryptocurrency support:

| Feature | Binance | OKX |

|---|---|---|

| Total cryptocurrencies | 400+ | 300+ |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Altcoin variety | Excellent | Very Good |

| New coin listings | Frequent | Regular |

Both exchanges regularly add new cryptocurrencies to their platforms as the market evolves. This means their selections continue to grow over time.

For most traders, either exchange will offer enough variety. However, if you specifically need access to certain niche tokens, it’s worth checking if they’re available on your preferred platform before signing up.

Binance Vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and OKX, fees play a big role in your decision. Based on recent data from 2025, both exchanges offer competitive fee structures, but there are key differences to note.

Trading Fees

Binance has slightly lower trading fees compared to OKX. This gives Binance a small edge for frequent traders who want to save on costs.

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Binance | 0.1% | 0.1% |

| OKX | 0.08-0.1% | 0.1-0.15% |

Both platforms offer fee discounts based on your trading volume and if you hold their native tokens.

Deposit Fees

Good news! Both Binance and OKX offer free deposits for most cryptocurrencies. For fiat currencies, methods like ACH transfers are typically free on both platforms.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both exchanges. Binance often charges slightly higher withdrawal fees for some popular coins.

OKX may have more favorable withdrawal fees for certain cryptocurrencies, making it worth comparing the specific coins you plan to trade.

Remember that fees can change based on market conditions and platform updates. It’s smart to check both exchanges’ current fee pages before making your final decision.

Binance Vs OKX: Order Types

Both Binance and OKX offer a variety of order types to meet different trading strategies and needs. Understanding these options helps you choose the exchange that best fits your trading style.

Basic Order Types (Available on Both Platforms):

- Market orders (instant execution at market price)

- Limit orders (execution at specified price or better)

- Stop-limit orders (places limit order when price reaches trigger point)

Binance provides trailing stop orders, which automatically adjust your stop price as the market moves in your favor. This feature is particularly useful for capturing profits in volatile markets.

OKX also offers trailing stop functionality, allowing you to set orders that move with market trends. Their platform is designed with an intuitive interface that many beginners find easier to navigate.

Advanced Order Types:

| Order Type | Binance | OKX |

|---|---|---|

| OCO (One Cancels Other) | ✓ | ✓ |

| Post Only | ✓ | ✓ |

| Time-weighted Average Price | ✓ | ✓ |

| Iceberg Orders | ✓ | ✓ |

Binance’s platform tends to appeal more to experienced traders who use complex trading setups and strategies. Their order execution speed is generally recognized as being very fast.

OKX’s mobile app provides a smoother user experience for placing different order types on the go. This makes it convenient if you trade primarily from your phone.

When testing either platform, you can practice using these order types in their demo environments before committing real funds.

Binance Vs OKX: KYC Requirements & KYC Limits

Both Binance and OKX require Know Your Customer (KYC) verification for all account levels. This is a standard security measure in the cryptocurrency exchange industry to prevent fraud and comply with regulations.

Binance’s KYC process requires users to submit personal information and identification documents. You’ll need to provide your name, address, and a government-issued ID. Facial verification is also part of their security protocol.

OKX follows similar procedures, requiring personal details and identity verification. Their system also uses facial recognition technology to confirm your identity matches your submitted documents.

KYC Verification Levels and Limits Comparison:

| Feature | Binance | OKX |

|---|---|---|

| Basic Verification | Required for all accounts | Required for all accounts |

| ID Documents | Government-issued ID | Government-issued ID |

| Facial Verification | Yes | Yes |

| Fiat Support | 90+ currencies | Multiple currencies |

The KYC verification process for both platforms typically takes 1-3 business days to complete, depending on verification volume.

Without completing KYC, you won’t be able to use most features on either platform. This includes deposits, withdrawals, and trading beyond very minimal amounts.

Binance offers support for more fiat currencies (90+) for purchases and withdrawals after KYC verification is complete.

Both exchanges have implemented these strict verification requirements to maintain regulatory compliance in the jurisdictions where they operate.

Binance Vs OKX: Deposits & Withdrawal Options

When choosing between Binance and OKX, deposit and withdrawal options play a key role in your experience. Both exchanges offer multiple ways to add funds to your account and cash out.

Binance provides more fee-free deposit methods compared to OKX. This means you can add money to your Binance account without extra charges through several payment options.

For crypto deposits, both platforms support a wide range of tokens. You can easily transfer your existing crypto from wallets or other exchanges to either platform.

Withdrawal Options Comparison:

| Feature | Binance | OKX |

|---|---|---|

| Fiat withdrawal methods | Credit/debit cards, bank transfers, P2P | Credit/debit cards, bank transfers, P2P |

| Crypto withdrawals | 350+ cryptocurrencies | 300+ cryptocurrencies |

| Withdrawal speed | Varies by network | Varies by network |

Withdrawal fees tend to be lower on Binance for most cryptocurrencies. This becomes important if you make frequent withdrawals, as these fees can add up over time.

Both exchanges implement withdrawal limits based on your verification level. The more personal information you verify, the higher your withdrawal limits become.

Processing times for withdrawals are similar on both platforms. Crypto withdrawals typically process within minutes, while fiat withdrawals may take 1-5 business days depending on your bank and location.

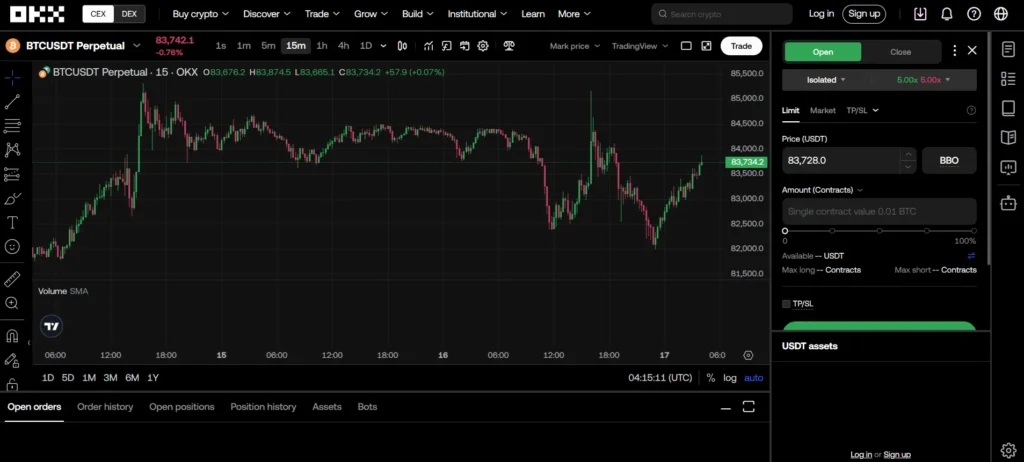

Binance Vs OKX: Trading & Platform Experience Comparison

When choosing between Binance and OKX, your trading experience will differ in several key ways. Both platforms offer comprehensive trading options, but with notable differences.

User Interface

- Binance: More complex interface with many features

- OKX: Cleaner, more beginner-friendly layout

Binance’s platform packs more tools and options, which can feel overwhelming for new users. OKX offers a more streamlined experience that beginners might find easier to navigate.

Trading Features

| Feature | Binance | OKX |

|---|---|---|

| Trading pairs | 350+ | 300+ |

| Order types | Standard + advanced | Standard + advanced |

| Trading fees | Competitive | Slightly lower than Binance |

| Mobile app | Highly rated | User-friendly |

OKX has slightly lower trading fees, which might save you money on frequent trades. Binance offers more trading pairs, giving you access to a wider variety of cryptocurrencies.

Trading Tools

Both exchanges provide advanced charting tools, but Binance offers more technical indicators. OKX’s platform includes simpler charts that work well for basic analysis.

Performance

Binance typically handles high trading volume better, with fewer outages during market peaks. OKX has improved its stability but may experience occasional slowdowns during extreme market conditions.

Your experience will depend on your trading style. If you’re an experienced trader who values variety and advanced tools, Binance might be your preference. If you want a cleaner interface with lower fees, OKX could be the better choice.

Binance Vs OKX: Liquidation Mechanism

Liquidation happens when your trading position can’t maintain the required margin level. Both Binance and OKX have systems to handle this, but they work a bit differently.

Binance uses a tiered liquidation model. When your margin ratio falls below certain thresholds, you’ll first receive warnings. If the situation worsens, partial liquidation might occur before full liquidation.

OKX employs a similar system but with some unique features. Their platform includes a “liquidation warning line” that gives you advance notice before any action is taken.

Key Differences:

| Feature | Binance | OKX |

|---|---|---|

| Warning System | Multiple tiers | Warning line + notifications |

| Partial Liquidation | Available | Available |

| Liquidation Data | May be underreported (per search results) | May be underreported (per search results) |

Recent reports suggest both exchanges might underestimate liquidation data. This could affect your understanding of market volatility and risk assessment.

Binance offers slightly more liquidity, which can impact how quickly positions are closed during liquidation events. This means potentially better prices when your positions get liquidated.

OKX provides liquidation calculator tools that help you predict potential liquidation prices based on your positions. This gives you better preparation for market movements.

You should consider these liquidation mechanisms when choosing between these exchanges, especially if you plan to use leverage or margin trading.

Binance Vs OKX: Insurance

When choosing between Binance and OKX, insurance is an important factor to consider for your crypto assets’ safety.

OKX offers a clear advantage with its dedicated insurance fund. This fund helps protect users against unexpected losses and system failures. According to recent reports, OKX has strengthened its insurance protection in 2025.

Binance also has security measures but takes a different approach. They maintain a SAFU (Secure Asset Fund for Users) which holds a portion of trading fees to cover potential losses in extreme cases.

Here’s how the two exchanges compare on insurance:

| Feature | Binance | OKX |

|---|---|---|

| Insurance Fund | SAFU Fund | Dedicated Insurance Fund |

| Coverage | Limited to extreme cases | More comprehensive coverage |

| Transparency | Regular fund value updates | Detailed protection policies |

| User Protection | Focus on system security | Additional insurance layer |

You should note that neither exchange offers complete protection for all scenarios. Market volatility risks remain your responsibility as a trader.

OKX’s insurance approach might give you more peace of mind if security is your top priority. Their additional layer of protection can be valuable for both new and experienced traders.

Before deciding, check each platform’s current insurance terms as they may update their policies regularly.

Binance Vs OKX: Customer Support

When choosing a crypto exchange, good customer support can make a big difference in your trading experience. Both Binance and OKX have invested in their support systems to help users navigate their platforms.

Binance offers 24/7 customer service through multiple channels including live chat, email support, and a comprehensive help center. Their support team typically responds quickly to inquiries, usually within minutes for live chat and within 24 hours for email tickets.

OKX also provides round-the-clock support with similar contact options. Many users report that OKX’s customer service representatives are knowledgeable and can resolve technical issues efficiently.

Both exchanges offer:

- Live chat support

- Email ticket systems

- Extensive knowledge bases

- FAQ sections

- Community forums

Binance has a slight edge in multilingual support, serving users in more languages than OKX. This can be helpful if English isn’t your first language.

OKX stands out with its active bot community support, which is particularly useful if you’re using trading bots on their platform.

Response times for both exchanges are comparable, with most issues being addressed within 24 hours. Complex problems might take longer to resolve on either platform.

For beginners, Binance’s help resources might be more user-friendly, while OKX’s support system tends to cater well to more experienced traders.

Binance Vs OKX: Security Features

Both Binance and OKX put security at the forefront of their operations, offering several features to protect your assets.

Binance implements AI risk control solutions along with identity and facial recognition for account protection. They store most user funds in cold wallets, keeping them offline and away from potential hackers.

OKX also uses cold storage for the majority of assets and provides additional peace of mind through insurance coverage for digital assets.

Both exchanges require KYC (Know Your Customer) verification to confirm your identity before you can access all platform features. This adds an extra layer of security against fraud.

Common Security Features:

- Two-factor authentication (2FA)

- Advanced encryption

- Cold wallet storage

- Anti-phishing codes

- Withdrawal whitelisting

Binance offers customizable security settings that let you tailor protection levels to your comfort. Their security suite includes withdrawal confirmations and suspicious activity monitoring.

OKX stands out with its robust advanced trading tools that include security features designed specifically for active traders.

Security Feature Comparison:

| Feature | Binance | OKX |

|---|---|---|

| Cold Storage | Yes | Yes |

| 2FA | Yes | Yes |

| KYC Requirements | Yes | Yes |

| Insurance | Limited | More extensive |

| Security Tools | AI-driven | Trading-focused |

You should enable all available security features regardless of which platform you choose to maximize protection for your crypto assets.

Is Binance A Safe & Legal To Use?

Binance has established itself as one of the most secure cryptocurrency exchanges in the market. The platform employs AI risk control solutions along with identity and facial verification to protect users’ accounts.

For your funds’ safety, Binance maintains a Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund. This provides an extra layer of protection for your assets in case of security breaches.

In terms of legality, Binance’s status varies by country. The exchange has worked to become compliant in many regions, though some countries have restrictions on its services.

Key Security Features:

- Two-factor authentication (2FA)

- Advanced encryption for data protection

- Cold storage for majority of user funds

- Anti-phishing codes

- Withdrawal address management

Keeping small to moderate amounts on Binance is generally considered safe, but for larger holdings, you should consider using a hardware wallet for additional security.

Legal Considerations by Region:

| Region | Legal Status |

|---|---|

| US | Limited service via Binance.US |

| EU | Generally legal with KYC requirements |

| UK | Regulated with restrictions |

| Asia | Varies by country |

Remember that all exchanges carry some risk. You can enhance your security by using strong passwords, enabling all security features, and being cautious of phishing attempts.

Is OKX A Safe & Legal To Use?

OKX has established itself as one of the safer cryptocurrency exchanges in 2025. The platform has received an “AA” security rating from CertiK, ranking #3 among the safest crypto exchanges.

One notable point is that OKX has not experienced any hacking breaches to date. This clean security record helps build trust with users who are concerned about asset protection.

Security is a priority on OKX with mandatory two-factor authentication (2FA) for all accounts. This extra layer of protection helps keep your funds safe from unauthorized access.

The exchange has developed a solid reputation in the crypto industry. Like Binance, OKX is respected for implementing robust security measures and working to advance the broader cryptocurrency ecosystem.

When it comes to legality, OKX operates as a legitimate platform for buying Bitcoin and other cryptocurrencies. However, availability may vary based on your location due to different regulatory requirements across countries.

For safety-conscious traders, OKX offers:

- Mandatory 2FA protection

- No history of security breaches

- Strong industry reputation

- Regular security audits

You should always verify that OKX is available and compliant with regulations in your specific country before creating an account and depositing funds.

Frequently Asked Questions

Choosing between Binance and OKX involves understanding key differences in their fees, user experience, liquidity, and security features. Both exchanges offer competitive services but differ in specific areas that might matter to your trading style.

What are the differences in trading fees between Binance and OKX?

Binance typically charges 0.1% for spot trading, with a 25% discount when using BNB tokens. Their fee structure is tiered based on your 30-day trading volume and BNB holdings.

OKX has a similar base fee of 0.1% for makers and 0.15% for takers. They offer discounts based on trading volume and holding their native OKB token.

Both platforms provide fee reductions for high-volume traders, but Binance often has slightly lower fees overall when factoring in all potential discounts.

How do the user experiences of Binance and OKX compare?

Binance offers a more beginner-friendly interface with a clean design and intuitive navigation. Their mobile app is highly rated for ease of use and functionality.

OKX provides a more technical interface that appeals to advanced traders. Their platform includes more detailed charts and analytical tools but has a steeper learning curve.

Both exchanges offer demo accounts, but OKX’s trading simulator is more comprehensive for practicing strategies without risking real funds.

Which platform offers better liquidity and price stability, Binance or OKX?

Binance consistently maintains higher trading volumes and deeper liquidity pools across most trading pairs. This typically results in tighter spreads and less slippage when executing large orders.

OKX offers good liquidity for major cryptocurrencies but may have wider spreads for some altcoins and during volatile market conditions.

Trading volume on Binance often exceeds $10 billion daily, while OKX typically ranges between $1-5 billion, creating a noticeable difference in execution quality for large trades.

What are the security features of Binance compared to those of OKX?

Binance employs AI risk control systems, facial recognition, and maintains the SAFU fund (Secure Asset Fund for Users) to protect user assets. They require KYC verification and offer whitelisting for withdrawals.

OKX implements multi-signature wallets, cold storage for 95% of assets, and regular security audits. They also offer account protection features like anti-phishing codes.

Both exchanges have histories of security incidents but have significantly improved their security protocols in recent years.

How do withdrawal processes differ between Binance and OKX?

Binance processes withdrawals relatively quickly, typically within 30 minutes for most cryptocurrencies. They implement a tiered verification system where withdrawal limits increase with higher verification levels.

OKX offers similar withdrawal speeds but may have slightly higher fees for some tokens. Their withdrawal limit structure is also tied to verification level.

Both platforms implement security measures like withdrawal address whitelisting and email confirmations, but Binance usually has more frequent withdrawal hold periods during system maintenance.

Can users access a wider range of cryptocurrencies on Binance or OKX?

Binance supports over 350 cryptocurrencies and more than 1,200 trading pairs, making it one of the most comprehensive exchanges for crypto variety.

OKX offers around 300 cryptocurrencies and approximately 600 trading pairs. They sometimes list niche tokens before Binance does.

Both exchanges regularly add new listings, but Binance typically maintains a broader selection of mainstream cryptocurrencies while OKX occasionally features more specialized tokens and newer projects.

Binance Vs OKX Conclusion: Why Not Use Both?

Both Binance and OKX stand as top cryptocurrency exchanges in 2025, each with their own strengths. Choosing between them doesn’t have to be an either/or decision.

Using both platforms can give you access to the best of both worlds. Binance offers an extensive ecosystem and slightly better incentives, while OKX provides lower trading fees and advanced trading tools.

Key advantages of using both:

- Broader asset selection: Access more cryptocurrencies and trading pairs

- Risk distribution: Spread your assets across multiple platforms for security

- Fee optimization: Use each platform when its fee structure benefits your trading style

Many experienced traders maintain accounts on both exchanges to take advantage of different promotions, liquidity pools, and market opportunities.

For beginners, you might start with one platform that feels most comfortable, then expand to the second as you gain confidence. Both exchanges are suitable for traders of any skill level or trading volume.

Consider your priorities:

- Trading fees

- Available cryptocurrencies

- User interface preferences

- Security features

- Additional services (staking, lending, etc.)

If you decide to use both, be sure to keep track of your assets across platforms and maintain proper security practices for all your accounts.