When choosing a cryptocurrency exchange, Binance and MEXC often top the list for traders in 2025. These platforms offer different advantages that might suit your specific trading needs and preferences.

MEXC stands out with more competitive trading fees for both spot and futures markets compared to Binance, making it potentially more cost-effective for frequent traders. While Binance maintains its strong global reputation and security measures including two-factor authentication, MEXC attracts users with its vast coin offerings and no mandatory KYC policy for certain account levels.

Both exchanges prioritize security, but they differ in fee structures. Binance uses a tiered system where high-volume traders pay lower fees, while MEXC offers low trading fees even for those with smaller trading volumes. Your choice between these platforms will ultimately depend on what matters most to you – whether that’s lower fees, coin variety, or security features.

Binance vs MEXC: At A Glance Comparison

Binance and MEXC are two popular cryptocurrency exchanges that offer different features and benefits. Here’s how they compare side by side:

Trading Fees:

- Binance: Uses a tiered fee structure where high-volume traders pay lower fees

- MEXC: Offers low trading fees even for low-volume traders

Exchange Volume:

| Exchange | Ranking by Volume |

|---|---|

| Binance | Typically higher |

| MEXC | Lower but growing |

Trading Options:

Both exchanges offer leverage trading, but they differ in their approach. MEXC is known for listing a wider variety of new tokens before they appear on larger exchanges.

User Experience:

Binance has a more established platform with a robust set of tools for traders. MEXC offers a simpler interface that some beginners might find easier to navigate.

Security Features:

Both exchanges implement standard security measures like two-factor authentication and cold storage for funds. Binance has a larger security team and more resources dedicated to protecting user assets.

Availability:

Binance faces regulatory challenges in some countries which limits access for certain users. MEXC may be available in regions where Binance is restricted.

You should consider your trading volume, preferred tokens, and regional availability when choosing between these exchanges.

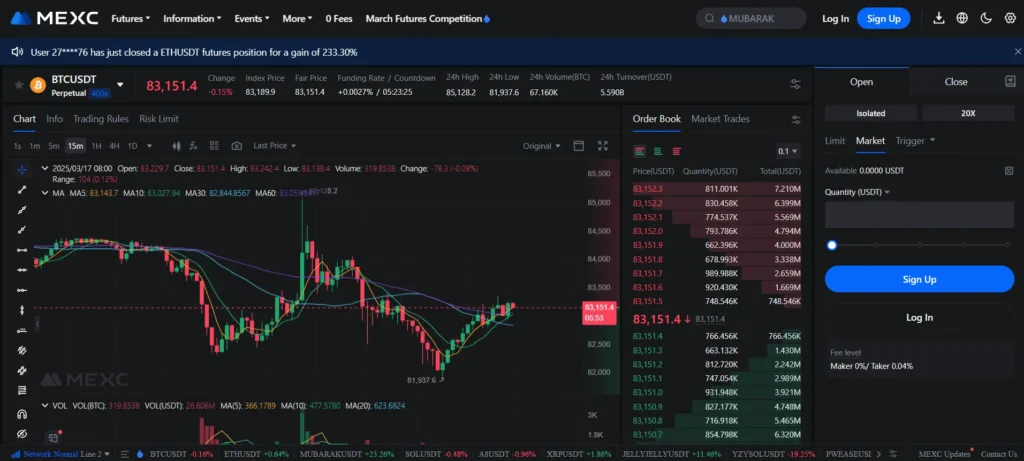

Binance vs MEXC: Trading Markets, Products & Leverage Offered

When choosing between Binance and MEXC, you’ll find significant differences in their trading offerings.

Binance provides a more extensive ecosystem with a wider range of trading products. You can access spot trading for over 350 cryptocurrencies, futures contracts, options, and various derivative products.

MEXC offers a competitive selection with spot trading available for numerous cryptocurrencies. While its ecosystem is still developing, MEXC has been expanding its offerings rapidly.

Leverage Options:

| Exchange | Maximum Leverage |

|---|---|

| Binance | Up to 125x |

| MEXC | Up to 200x |

MEXC stands out with higher maximum leverage of 200x compared to Binance’s 125x. This might appeal to you if you’re an experienced trader seeking higher risk-reward opportunities.

Both platforms offer:

- Spot trading

- Futures contracts

- Margin trading

- Staking options

Binance provides more advanced trading features like Grid Trading and Bot automation. You’ll also find a broader selection of trading pairs on Binance, especially for less common altcoins.

MEXC has gained popularity for listing new tokens faster than Binance. If you’re interested in emerging cryptocurrencies and early investment opportunities, MEXC might better serve your needs.

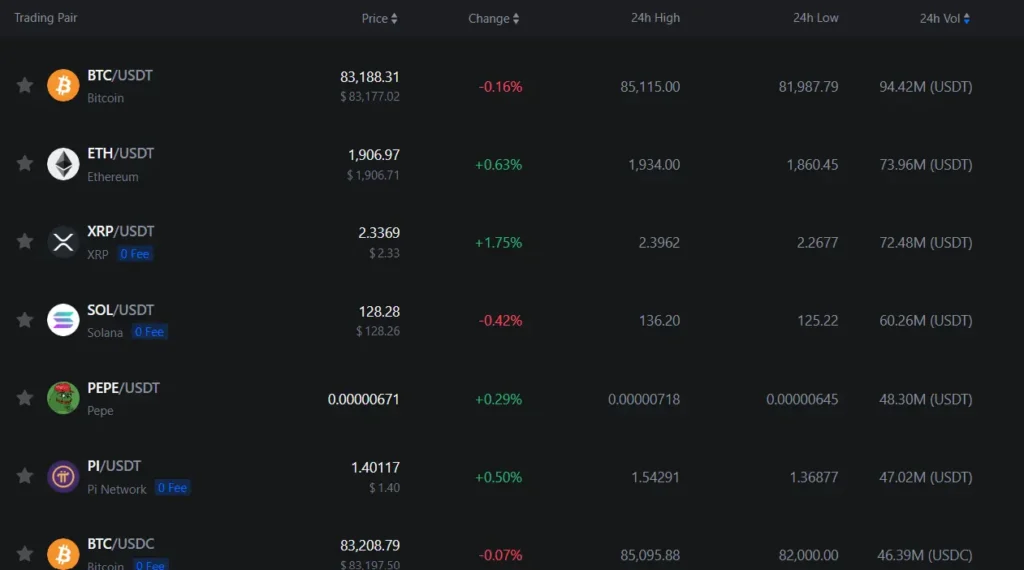

Binance vs MEXC: Supported Cryptocurrencies

When choosing a crypto exchange, the variety of available cryptocurrencies is a key factor to consider. Both Binance and MEXC offer impressive selections, but there are notable differences.

MEXC takes the lead in sheer numbers, supporting over 2,800 cryptocurrencies. This makes it an excellent choice if you’re interested in trading newer or more obscure tokens.

Binance offers fewer cryptocurrencies overall but still maintains a substantial selection. The platform focuses on including well-established coins and tokens with higher market caps and trading volumes.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | MEXC | Binance |

|---|---|---|

| Total cryptocurrencies | 2,800+ | 350+ |

| New token listings | Frequent | Selective |

| Trading pairs | Numerous | Extensive |

Both exchanges regularly add new cryptocurrencies to their platforms. MEXC tends to list new tokens more quickly, which can give you early access to emerging projects.

Binance typically has a more rigorous vetting process before adding new cryptocurrencies. This can mean fewer options but potentially higher-quality listings.

Your choice between the two may depend on what you want to trade. If you’re looking for mainstream cryptocurrencies, both platforms will serve you well. For those seeking access to a wider range of altcoins and newer tokens, MEXC’s larger selection might be more appealing.

Binance vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and MEXC, trading fees play a major role in your decision. Based on recent 2025 data, MEXC generally offers more competitive trading fees than Binance.

For spot trading, MEXC charges about 0.1% for makers and 0.2% for takers. This is cheaper than Binance’s standard fee structure.

Binance uses a VIP tier system where your fees decrease as you trade more volume and hold more BNB tokens. MEXC also offers discounts, but their base rates start lower.

Spot Trading Fees Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| MEXC | 0.1% | 0.2% |

| Binance | Higher base rate | Higher base rate |

For futures trading, MEXC again holds the advantage with lower fees. This makes MEXC particularly attractive if you’re an active trader who wants to maximize profits.

Withdrawal fees also favor MEXC. You’ll pay less to move your crypto off the platform compared to Binance.

Both exchanges offer ways to reduce your fees. Binance requires you to hold their native token (BNB) while MEXC has its own discount system.

If minimizing trading costs is your priority, MEXC appears to be the better choice in 2025. However, Binance may offer other advantages that could balance out the higher fee structure.

Binance vs MEXC: Order Types

Both Binance and MEXC offer a variety of order types to help you execute trades according to your strategy. Understanding these options can improve your trading experience.

Binance Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

- Trailing stop orders

- Post-only orders

MEXC Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Stop-market orders

- Conditional orders

Both exchanges support the most essential order types like market and limit orders. These basic options let you buy or sell at current market prices or set specific price targets.

Binance offers more advanced order types, particularly with its OCO and trailing stop features. These tools give you more control in volatile market conditions.

MEXC’s conditional orders are useful for setting up complex trading scenarios. You can create trades that execute only when certain market conditions are met.

For new traders, both platforms offer enough variety to get started. However, experienced traders might prefer Binance’s more extensive options for sophisticated trading strategies.

The user interface for placing orders is generally more straightforward on MEXC, making it easier for beginners to navigate different order types.

Remember that mastering different order types can significantly improve your trading outcomes and help you manage risk more effectively.

Binance vs MEXC: KYC Requirements & KYC Limits

Binance and MEXC differ significantly in their Know Your Customer (KYC) policies, which affects how you can use these platforms.

Binance KYC Requirements:

- Mandatory KYC verification for all users

- Required to access full platform functionality

- Necessary for fiat transactions

- Provides better regulatory compliance

Binance requires you to complete identity verification before you can fully use their platform. This includes submitting identification documents and sometimes proof of address.

MEXC KYC Requirements:

- Optional KYC policy

- Allows withdrawals of up to 30 BTC per day without KYC

- Less stringent verification process

- Has still obtained compliance certificates in several jurisdictions

MEXC’s approach gives you more flexibility if you prefer privacy. You can trade and withdraw significant amounts without going through identity verification.

Why This Matters:

If privacy is your priority, MEXC’s optional KYC might appeal to you. However, Binance’s mandatory verification offers stronger regulatory protection and easier fiat transactions.

Your choice depends on what you value more – privacy and convenience (MEXC) or regulatory compliance and full platform access (Binance).

Remember that regulations change frequently in the crypto world. Both exchanges must adapt to new rules, which may affect their KYC policies in the future.

Binance vs MEXC: Deposits & Withdrawal Options

When choosing between Binance and MEXC, understanding deposit and withdrawal options is crucial for managing your crypto assets effectively.

Binance offers a wide range of deposit methods including bank transfers, credit/debit cards, and P2P trading. You can fund your account with numerous fiat currencies depending on your region.

MEXC also supports multiple deposit options, though slightly fewer than Binance. You can use bank transfers and some credit/debit cards, but availability varies by location.

For crypto deposits, both exchanges support a large number of cryptocurrencies and tokens. Binance has a slight edge with more supported networks for major coins like Bitcoin and Ethereum.

Withdrawal options comparison:

| Feature | Binance | MEXC |

|---|---|---|

| Crypto withdrawals | 350+ coins | 300+ coins |

| Fiat withdrawals | Bank transfer, card | Bank transfer |

| Withdrawal fees | Varies by asset | Generally competitive |

| Processing time | 1-2 hours (crypto) | 1-3 hours (crypto) |

Withdrawal fees on MEXC are competitive and sometimes lower than Binance for certain tokens. This makes MEXC potentially more cost-effective if you frequently withdraw smaller amounts.

Both platforms implement withdrawal limits based on your verification level. Higher verification tiers on either platform will increase your daily and monthly withdrawal limits.

Security measures for withdrawals include two-factor authentication, email confirmations, and withdrawal address whitelisting on both exchanges.

Binance vs MEXC: Trading & Platform Experience Comparison

When choosing between Binance and MEXC, the trading interface and overall experience can greatly impact your success.

Binance offers a polished, user-friendly interface that works well for both beginners and experienced traders. The platform features advanced charting tools, multiple order types, and a clean layout.

MEXC provides a similar trading experience but with some notable differences. Many users find MEXC’s interface slightly less intuitive at first, though it becomes familiar with use.

Both exchanges offer:

- Web platforms

- Mobile apps

- Advanced trading features

- Real-time market data

Fee Structures differ significantly between the platforms. Binance uses a tiered approach where trading fees decrease as your volume increases. MEXC offers low fees even for traders with smaller volumes, making it potentially more cost-effective for new or casual traders.

Coin Selection is another key difference. MEXC lists over 1,600 cryptocurrencies, while Binance offers around 380+. If you’re looking to trade newer or more obscure tokens, MEXC might be your better option.

Security features on both platforms include two-factor authentication (2FA) and regular security audits. Your funds are generally well-protected on either exchange.

The trading experience on both platforms includes spot trading, futures, options, and staking opportunities. Your specific needs will determine which platform feels more comfortable.

Binance vs MEXC: Liquidation Mechanism

Both Binance and MEXC have liquidation mechanisms to protect traders from severe losses in volatile markets. These systems automatically close positions when they fall below certain thresholds.

Binance uses a tiered liquidation system that begins with warnings at specific margin ratios. Your position enters liquidation when your margin ratio falls below the maintenance margin requirement (typically 0.5-1.5% depending on the asset).

MEXC follows a similar approach but often provides slightly more buffer time before full liquidation occurs. This can give you extra moments to add funds and prevent complete position closure.

Key Differences:

| Feature | Binance | MEXC |

|---|---|---|

| Initial Warnings | Multiple notifications | Fewer staged alerts |

| Liquidation Speed | Very rapid execution | Slightly more gradual |

| Partial Liquidation | Available on select contracts | More widely implemented |

| Insurance Fund | Larger reserve fund | Smaller but growing fund |

Binance typically has a more robust insurance fund to handle liquidations during extreme volatility. This can sometimes result in better closing prices for liquidated positions.

MEXC’s liquidation mechanism is often considered more forgiving for newer traders. You might find the slightly longer buffer period helpful if you’re still learning position management.

Both exchanges provide liquidation calculators to help you estimate when your positions might be at risk. Using these tools can help you set appropriate stop-losses and avoid unexpected liquidations.

Binance vs MEXC: Insurance

When choosing a crypto exchange, security measures like insurance matter a lot. Both Binance and MEXC have systems to protect your assets, but they differ in approach.

Binance offers a Secure Asset Fund for Users (SAFU), which holds 10% of all trading fees. This fund serves as an emergency insurance to protect user funds in extreme cases like hacks.

MEXC also implements security protections but doesn’t advertise a specific insurance fund like Binance’s SAFU. They focus on preventative security measures including regular security audits and two-factor authentication.

Both exchanges use cold storage for most user funds. This keeps your crypto offline and safe from online threats.

Neither exchange offers the same type of insurance that traditional banks provide (like FDIC insurance in the US). Your crypto assets aren’t protected against market volatility.

If security is your top priority, Binance may have an edge with its dedicated SAFU fund. However, both platforms emphasize robust security practices to safeguard your investments.

Before depositing large amounts, you should verify the current insurance policies on both platforms as these can change over time.

Remember that the best protection is following good security practices yourself – enable all security features and use strong, unique passwords.

Binance vs MEXC: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your trading experience. Both Binance and MEXC offer several support channels, but they differ in key ways.

Binance provides 24/7 customer support through live chat, email, and an extensive help center. You can get answers quickly through their chat function for urgent issues. Their support team handles multiple languages to serve their global user base.

MEXC also offers 24/7 support with live chat and email options. Many users report that MEXC’s response times are competitive, though sometimes slightly longer than Binance during peak periods.

Both platforms maintain active community forums where you can find answers to common questions. Binance’s larger user base means more community-generated solutions are available.

For new users, Binance offers more comprehensive tutorials and guides. Their help center includes detailed articles, videos, and FAQs that cover most issues you might encounter.

MEXC’s support shines in personalized assistance. Some users report more detailed responses to complex problems compared to Binance’s sometimes template-like answers.

Response times comparison:

| Support Channel | Binance | MEXC |

|---|---|---|

| Live Chat | 5-15 minutes | 10-30 minutes |

| 1-24 hours | 6-48 hours | |

| Social Media | 2-12 hours | 3-24 hours |

Both exchanges offer solid support options. Your choice might depend on whether you value Binance’s extensive resources or MEXC’s personalized approach.

Binance vs MEXC: Security Features

Both Binance and MEXC prioritize user security through multiple protective measures. When choosing between these exchanges, understanding their security features is crucial for protecting your investments.

Binance Security Highlights:

- Two-factor authentication (2FA)

- Advanced encryption protocols

- SAFU fund (Secure Asset Fund for Users)

- Regular security audits

- Anti-phishing codes

- Address whitelisting

Binance has faced regulatory challenges in various countries, which has prompted them to strengthen their security measures. Their SAFU fund specifically sets aside money to protect users in case of security breaches.

MEXC Security Highlights:

- Two-factor authentication (2FA)

- Regular security audits

- Multi-signature wallets

- SSL encryption

- Anti-DDoS protection

- Cold storage for majority of assets

MEXC has experienced fewer major security incidents than Binance. According to recent comparisons, MEXC has faced less regulatory scrutiny, which some consider a security advantage.

Both platforms use similar basic security technologies, but they implement them differently. You should enable all available security features regardless of which platform you choose.

Neither exchange is immune to threats, so it’s best practice to keep only trading funds on these platforms. Consider hardware wallets for long-term storage of your crypto assets.

Is Binance a Safe & Legal To Use?

Binance is generally considered a safe cryptocurrency exchange with strong security measures in place. The platform protects user accounts through Two Factor Authentication (2FA), which adds an extra layer of security to your login process.

Most of Binance’s cryptocurrency holdings are stored in “cold wallets” that aren’t connected to the internet. This significantly reduces the risk of hacking.

Despite its security features, Binance has faced some notable security breaches in the past. This has led some users to diversify their assets across multiple platforms, including MEXC.

From a legal standpoint, Binance’s status varies by country. The exchange has faced regulatory challenges in several jurisdictions, requiring them to adapt their services accordingly.

Key security features of Binance include:

- Two-Factor Authentication (2FA)

- Cold storage for majority of funds

- Advanced encryption methods

- Regular security audits

While Binance is working to comply with regulations worldwide, you should always verify its legal status in your specific country before using the platform.

The exchange demonstrates a commitment to user protection despite past issues. Their security team actively works to address vulnerabilities and improve their systems.

Is MEXC a Safe & Legal To Use?

MEXC has operated since 2018 without any reported hacks or loss of user funds, which speaks to its security record. The exchange implements several safety measures including regular security audits and two-factor authentication (2FA) to protect users.

As of 2025, MEXC requires KYC (Know Your Customer) verification, a change from their previous no-KYC policy. This shift suggests compliance with global regulatory standards.

The platform is available in most countries, even some with strict cryptocurrency regulations. However, you should always check if MEXC is legally accessible in your specific location before creating an account.

Some concerns have been raised about MEXC allegedly banning profitable traders and withholding funds. While these claims exist, they should be viewed with caution as they haven’t been widely verified.

Security Features:

- Two-factor authentication (2FA)

- Regular security audits

- No history of being hacked

Legal Considerations:

- Mandatory KYC verification as of 2024

- Wide global availability

- Legal status varies by country

When comparing MEXC to other exchanges like Binance, both prioritize security, but you should research the specific regulatory status in your country before trading.

Frequently Asked Questions

Choosing between Binance and MEXC involves understanding their fees, security measures, available cryptocurrencies, trading volumes, unique features, and user experiences. These factors directly impact your trading success and overall satisfaction with either platform.

What are the key differences in transaction fees between Binance and MEXC?

MEXC offers lower fees compared to Binance, especially for spot trading. This fee advantage makes MEXC more appealing if you’re a frequent trader concerned about transaction costs.

Binance charges a standard 0.1% spot trading fee, which can be reduced by using BNB or reaching higher trading volumes.

MEXC’s fee structure starts at 0.2% for makers and 0.2% for takers, but their discount programs often result in lower effective rates than Binance for many users.

How does the security of Binance compare to that of MEXC?

Binance has invested heavily in security protocols with features like SAFU (Secure Asset Fund for Users) that protects user funds in case of breaches. They employ a multi-tier and multi-clustered system architecture.

MEXC implements strong security measures including cold wallet storage and two-factor authentication, but lacks the reputation and track record of Binance in this area.

Both exchanges require KYC verification, though Binance’s verification process is typically more stringent and comprehensive.

What variety of cryptocurrencies are available on Binance versus MEXC?

MEXC significantly outpaces Binance in cryptocurrency offerings with approximately 1,690+ coins available for trading. This makes it an excellent choice if you’re looking for newly launched or niche tokens.

Binance offers around 380+ cryptocurrencies, focusing more on established coins with higher market capitalizations and liquidity.

MEXC often lists new projects earlier than Binance, giving you access to potential high-growth tokens before they reach larger exchanges.

How do the trading volumes of Binance and MEXC exchanges compare?

Binance dominates the crypto exchange market with daily trading volumes often exceeding $20 billion. This high liquidity means less slippage and better price execution for your trades.

MEXC’s daily trading volume is significantly lower, typically in the hundreds of millions of dollars range. This can affect liquidity for some trading pairs.

The volume difference means that Binance generally provides better liquidity for major cryptocurrencies, while MEXC might offer better opportunities in smaller cap coins.

What are the unique features that distinguish Binance from MEXC?

Binance offers a wider ecosystem including Binance Academy, Binance Launchpad, and Binance Smart Chain. Their Earn program provides various staking and savings options.

MEXC focuses on listing new tokens quickly and offers an assessment system that helps you evaluate potential investments. Their Kickstarter program allows users to vote for new listings.

Binance provides more advanced trading tools and charts, while MEXC excels at offering innovative trading products for emerging cryptocurrencies.

How do user experiences differ when using Binance as opposed to MEXC?

Binance’s interface is more polished and intuitive, with extensive educational resources that help new traders navigate the platform. Their mobile app is highly rated and feature-rich.

MEXC has a steeper learning curve with a somewhat cluttered interface. However, experienced traders appreciate its comprehensive functionalities and access to a wider range of trading pairs.

Customer support response times tend to be faster on Binance, though MEXC has improved in this area recently with 24/7 live chat support.

MEXC vs Binance Conclusion: Why Not Use Both?

After comparing MEXC and Binance, it’s clear that both exchanges offer unique benefits. Instead of choosing just one, you might consider using both platforms to maximize your trading experience.

MEXC shines with its clean, minimalist design that’s easier to navigate for beginners. Its fee structure is also more straightforward, offering low trading fees even for users who don’t trade in high volumes.

Binance, on the other hand, offers a more feature-rich experience with two user interfaces. It uses a tiered fee structure that rewards high-volume traders with lower fees.

Security Features Comparison:

- Both prioritize security of user funds

- Both utilize cold wallet storage

- Both offer 2FA (Two-Factor Authentication)

- Binance adds withdrawal whitelisting for extra protection

For leverage trading, each platform has different strengths. This is where using both exchanges might make sense—you can take advantage of MEXC for certain trades and Binance for others.

You might prefer MEXC when you need:

- Simpler interface

- Consistent low fees regardless of volume

- Less complex features

Choose Binance when you need:

- More advanced trading tools

- Lower fees for high-volume trading

- Additional security features

By maintaining accounts on both platforms, you can select the best option for each specific trading need rather than limiting yourself to just one exchange.