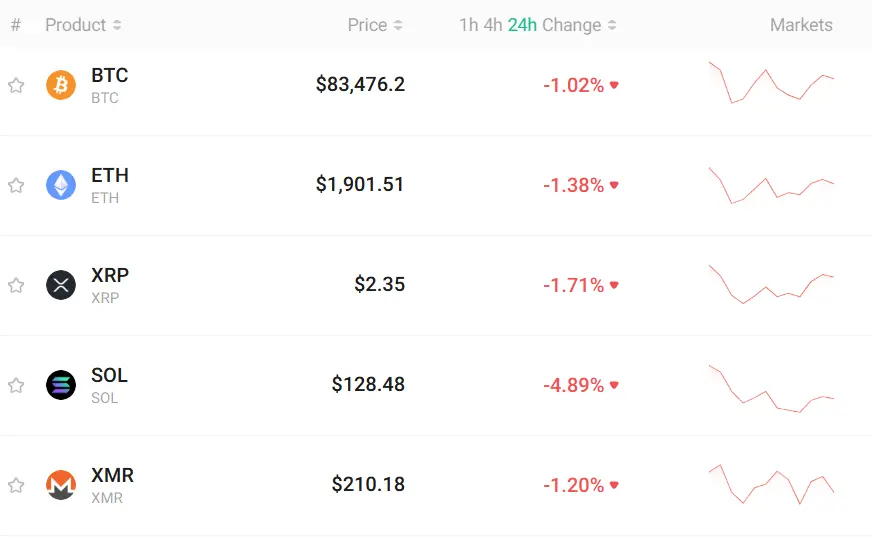

Choosing the right crypto exchange can make a big difference in your trading experience. Binance and KuCoin stand out as popular options in 2025, each with unique features that might suit your specific needs.

Both Binance and KuCoin offer competitive fee structures, though KuCoin generally has lower withdrawal fees at around 0.1% compared to Binance’s higher rates. When it comes to leverage trading, Binance has reduced its maximum leverage to 50x for many trading pairs, while KuCoin still offers up to 100x leverage for traders looking for higher risk options.

Another key difference is that Binance provides a fiat on-ramp, allowing you to directly purchase crypto with traditional currency. KuCoin lacks this feature, which might be important if you’re just starting your crypto journey. Both exchanges maintain solid reputations for reliability and security, making either a viable choice depending on your trading priorities.

Binance vs KuCoin: At A Glance Comparison

When choosing between Binance and KuCoin, understanding their key differences can help you make the right decision for your crypto trading needs.

Trading Fees:

KuCoin offers lower trading fees compared to Binance, making it potentially more cost-effective for frequent traders.

Cryptocurrency Selection:

KuCoin provides access to more cryptocurrency assets for trading and exchanging than Binance. This gives you more options if you’re interested in trading alternative coins.

Leverage Trading:

| Exchange | Maximum Leverage |

|---|---|

| KuCoin | Up to 100x |

| Binance | Reduced to 50x |

Purchase Options:

Both exchanges allow you to buy crypto with your local currency through P2P trading. On KuCoin, you can purchase or exchange USDT, BTC, and ETH.

Customer Support:

According to user reviews, Binance scores higher in support quality with a rating of 7.1 compared to KuCoin’s 5.6. This suggests you might get better assistance on Binance when facing issues.

Platform for US Users:

Binance has a specific platform for US users (Binance.US), while KuCoin’s availability may differ. Check current regulations before signing up if you’re based in the United States.

Binance vs KuCoin: Trading Markets, Products & Leverage Offered

Both Binance and KuCoin offer a wide range of trading options for crypto enthusiasts. These platforms support spot trading, margin trading, and derivatives.

Binance provides access to over 350 cryptocurrencies and supports futures trading with leverage up to 125x. You can also find options trading, liquid swap, and staking services on this platform.

KuCoin offers trading for approximately 700+ cryptocurrencies, making it an excellent choice if you’re looking for lesser-known altcoins. Their futures platform allows up to 100x leverage.

Trading Products Comparison:

| Feature | Binance | KuCoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Futures | ✓ (up to 125x) | ✓ (up to 100x) |

| Options | ✓ | Limited |

| Number of Coins | 350+ | 700+ |

KuCoin stands out for its Trading Bot features, which allow you to automate your trading strategies without coding knowledge. This includes grid trading, DCA bots, and futures bots.

Binance excels with its Launchpad platform for new token offerings and its extensive liquidity pools. The trading volume on Binance is typically higher, which means better order execution for popular pairs.

If you’re interested in trading a wide variety of altcoins, KuCoin might be your better option. For traders focused on mainstream cryptocurrencies with high liquidity, Binance often provides better market depth.

Binance vs KuCoin: Supported Cryptocurrencies

When choosing between Binance and KuCoin, the range of available cryptocurrencies is a key factor to consider for your trading strategy.

KuCoin offers a wider selection of cryptocurrencies than Binance. According to recent data, KuCoin supports more different crypto assets for trading and exchanging.

Binance, despite having fewer coins, still maintains an impressive selection of mainstream cryptocurrencies. The platform focuses on quality over quantity, ensuring the tokens available meet certain standards.

Cryptocurrency Support Comparison:

| Feature | Binance | KuCoin |

|---|---|---|

| Total cryptocurrencies | Large selection | Larger selection |

| Focus | Mainstream + select altcoins | Wide range of altcoins |

| New coin listings | Regular but selective | Frequently adds new projects |

| Token standards | Multiple chains supported | Multiple chains supported |

KuCoin is often called the “People’s Exchange” because it frequently lists newer, smaller market cap cryptocurrencies before they reach larger exchanges.

You might prefer Binance if you mainly trade popular cryptocurrencies and value platform security and liquidity over coin variety.

Choose KuCoin if you’re looking to discover promising new projects early or need access to specific altcoins not available on Binance.

Both exchanges regularly update their listings, so you should check their current offerings before making your final decision.

Binance vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and KuCoin, fees play a crucial role in your decision. Let’s compare their fee structures to help you make an informed choice.

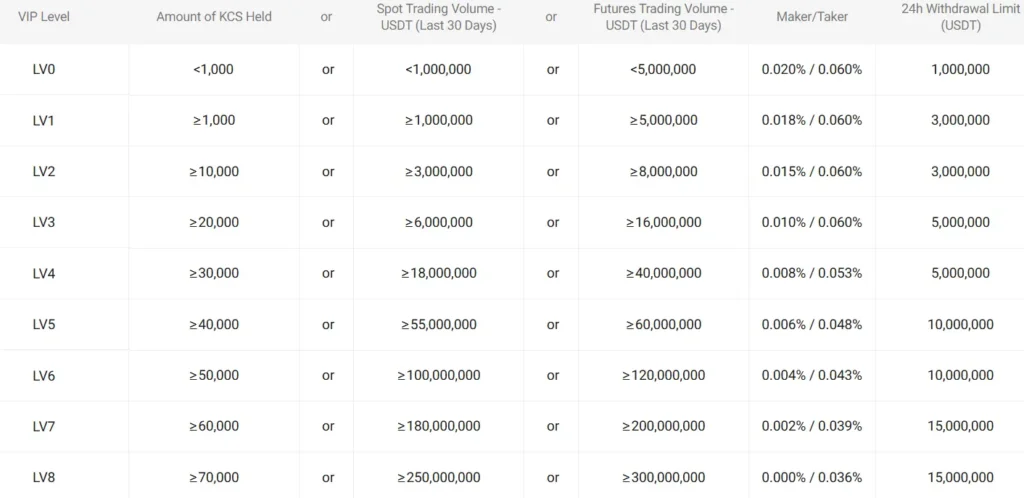

Both exchanges have competitive trading fees, but there are notable differences. KuCoin’s trading fees can go as low as 0.05%, which is extremely competitive in the market.

Binance, on the other hand, offers varying fee rates based on your trading volume and whether you hold their native token.

Deposit Fees:

| Exchange | Crypto Deposit | Fiat Deposit |

|---|---|---|

| Binance | Free | Varies |

| KuCoin | Free (most cryptocurrencies) | Higher (third-party involved) |

For withdrawals, KuCoin claims to have fees around 0.1%, which is significantly lower than Binance according to some sources. However, actual withdrawal costs depend on the specific cryptocurrency and network you choose.

High-volume traders might benefit more from KuCoin’s fee structure, while Binance tends to offer better discounts for holders of its native BNB token.

Remember that fees can change, so it’s worth checking the official websites for the most current rates. The right choice depends on your trading habits, preferred cryptocurrencies, and typical transaction sizes.

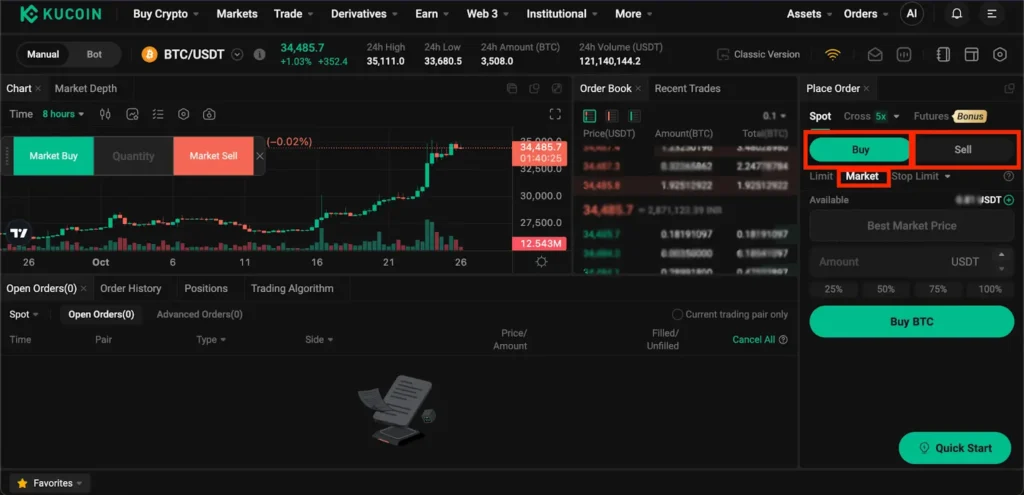

Binance vs KuCoin: Order Types

Both Binance and KuCoin offer a variety of order types to help you execute trades based on your strategy. Understanding these options can improve your trading experience.

Binance provides the standard market, limit, and stop-limit orders that most traders use regularly. You’ll also find OCO (One-Cancels-the-Other) orders, which combine a limit order with a stop-limit order.

KuCoin matches these basic order types and adds some specialized options. Both platforms support advanced trading features like iceberg orders that help hide the total size of large trades.

Common Order Types on Both Platforms:

- Market Orders (execute immediately at current price)

- Limit Orders (execute only at your specified price or better)

- Stop-Limit Orders (activate a limit order when price reaches trigger point)

- OCO Orders (One-Cancels-the-Other)

For margin trading, both exchanges offer similar order functionality. The interfaces differ slightly, with KuCoin often considered more beginner-friendly for placing complex orders.

Binance edges ahead with its wider range of conditional orders and trading bots on its platform. However, KuCoin’s Trading Bot feature offers automated strategies that are particularly helpful for newer traders.

The mobile apps for both exchanges support most order types, though some advanced features may only be available on their web platforms.

Binance vs KuCoin: KYC Requirements & KYC Limits

Binance and KuCoin have different approaches to Know Your Customer (KYC) verification, affecting how you can use each platform.

Binance KYC Policy:

- Mandatory KYC since 2018

- All users must verify identity to access trading and withdrawals

- Complete verification required for full platform functionality

Binance takes a strict approach to identity verification. You cannot use most features without completing KYC, making it less appealing if privacy is your priority.

KuCoin KYC Policy:

- Previously more flexible with tiered verification

- KYC2 verification can take up to 2 working days due to high demand

- More relaxed than Binance but still has limits for unverified users

KuCoin has traditionally offered more flexibility. Their tiered system allows basic functions without full verification, though higher withdrawal limits require KYC completion.

Withdrawal Limits Comparison:

| Exchange | Unverified Limits | Verified Limits |

|---|---|---|

| Binance | Very restricted | High limits based on verification level |

| KuCoin | Limited but usable | Increased limits after verification |

If privacy is important to you, KuCoin’s approach might seem more accommodating. However, both exchanges now require KYC for full functionality, following industry trends toward greater regulation compliance.

The verification process on KuCoin is generally simpler than Binance, but might take longer due to high demand during busy periods.

Binance vs KuCoin: Deposits & Withdrawal Options

Both Binance and KuCoin offer various ways to deposit and withdraw funds. Understanding these options can help you choose the exchange that best fits your needs.

Deposit Fees

Neither Binance nor KuCoin charges fees for cryptocurrency deposits. This is good news if you’re transferring digital assets from another wallet or exchange.

Deposit Methods

Binance provides more fiat currency deposit options compared to KuCoin. You can deposit via bank transfer, credit/debit cards, and various payment services on Binance.

KuCoin focuses more on crypto deposits but does offer P2P trading for purchasing USDT, BTC, and ETH with local currencies.

Withdrawal Fees

Both exchanges charge withdrawal fees that vary by cryptocurrency. These fees reflect the network transaction costs and are subject to change based on blockchain conditions.

Withdrawal Limits

Your withdrawal limits on both platforms depend on your verification level. Higher verification levels unlock larger daily withdrawal amounts.

Binance typically offers higher withdrawal limits for verified users compared to KuCoin.

Processing Times

Crypto withdrawals on both platforms usually process within minutes, though network congestion can cause delays.

Fiat withdrawals may take 1-5 business days depending on your payment method and location.

Security Measures

Both exchanges implement withdrawal address whitelisting and require email or SMS confirmation for added security when moving your funds.

Binance vs KuCoin: Trading & Platform Experience Comparison

Both Binance and KuCoin offer different trading interfaces to match your experience level. Binance provides a “Classic” mode for simple trading and an “Advanced” screen for more experienced traders. KuCoin similarly offers “Lite” and “Advanced” options.

Binance tends to excel in overall user experience with higher ratings for ease of use. Many traders find Binance’s interface more intuitive and easier to navigate, especially for beginners.

KuCoin stands out with its focus on altcoins and social trading features. If you’re interested in trading less common cryptocurrencies, KuCoin often lists them before larger exchanges do.

Trading Features Comparison:

| Feature | Binance | KuCoin |

|---|---|---|

| User Interface | More polished, higher rated | Slightly less intuitive |

| Coin Variety | Extensive | More altcoins |

| Trading Tools | Comprehensive | Strong, with unique social features |

| Mobile Experience | Very strong | Good, but less refined |

KuCoin offers innovative social trading tools that let you follow successful traders’ strategies. This can be helpful if you’re still learning.

Binance’s ecosystem is more extensive, with better integration between different services. This makes for a smoother overall experience if you use multiple crypto services.

Your trading style matters in choosing between these platforms. Binance works better for those wanting a straightforward, polished experience. KuCoin might suit you better if you value access to newer coins and social trading features.

Binance vs KuCoin: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. This process helps exchanges manage risk when your position moves against you.

Binance Liquidation Process

Binance uses a tiered liquidation system. When your margin ratio drops below the maintenance margin requirement (typically 80%), you’ll receive a margin call notification.

If you don’t add more funds and your margin ratio falls further (around 40%), partial liquidation begins. This gives you a chance to salvage part of your position.

Complete liquidation occurs only when your margin ratio drops extremely low. Binance’s insurance fund helps protect traders from excessive losses during volatile market conditions.

KuCoin Liquidation Process

KuCoin employs a more straightforward liquidation approach. When your position reaches its liquidation price, KuCoin will close it immediately.

KuCoin provides a “Price Protection Mechanism” that helps prevent unfair liquidations during short-term price spikes. This feature is especially helpful during volatile trading conditions.

Key Differences

| Feature | Binance | KuCoin |

|---|---|---|

| Warning System | Multiple alerts | Single warning |

| Liquidation Type | Tiered/partial | Complete |

| Protection Mechanism | Insurance fund | Price protection |

| Transparency | Detailed liquidation data | Basic information |

You’ll find Binance’s system more forgiving with its partial liquidation approach. However, KuCoin’s price protection mechanism might save you during market volatility.

Both platforms offer liquidation calculator tools to help you assess risk before opening leveraged positions.

Binance vs KuCoin: Insurance

When choosing a crypto exchange, security should be a top priority. Both Binance and KuCoin offer insurance options to protect your assets.

KuCoin maintains a dedicated insurance fund that serves as an emergency backup in case of security breaches. This fund is specifically designed to cover potential losses if the exchange experiences a hack.

KuCoin also stores most user funds in cold storage, keeping them offline and away from potential online threats. They enhance security further with two-factor authentication (2FA).

Binance also takes security seriously with its Secure Asset Fund for Users (SAFU). This fund was created in 2018 and allocates a portion of trading fees to protect user assets in extreme cases.

Both exchanges have experienced security incidents in the past. KuCoin suffered a significant hack in 2020 but managed to recover most stolen funds. Binance has also faced security challenges but has generally responded effectively.

Key Insurance Differences:

- KuCoin: Dedicated insurance fund + cold storage + 2FA

- Binance: SAFU fund + advanced security protocols

If you’re particularly concerned about asset protection, both exchanges offer reasonable security measures, but their specific approaches differ slightly in implementation.

Remember to enable all available security features on whichever platform you choose to add an extra layer of protection for your crypto assets.

Binance vs KuCoin: Customer Support

When choosing between Binance and KuCoin, customer support can be a deciding factor. Both exchanges have invested in improving their support systems as they’ve grown.

Binance has a larger support team, which matches its bigger user base of around 224 million users. KuCoin serves approximately 30 million active users with its support staff.

Support Quality Ratings:

- Binance: 7.1/10

- KuCoin: 5.6/10

Users generally report more satisfaction with Binance’s support quality. This higher rating suggests you might get more effective help when facing issues on Binance.

Both exchanges offer similar support channels including:

- Live chat

- Ticket systems

- Email support

- FAQ sections

- Knowledge bases

Response times can vary based on inquiry complexity and current platform traffic. During high-volume trading periods or major market movements, you might experience longer wait times on both platforms.

Language support is more extensive on Binance, which can be important if English isn’t your first language. KuCoin has improved its multilingual support but still offers fewer language options than Binance.

Both exchanges have scaled up their support teams impressively over recent years. This expansion reflects their commitment to handling user issues as their platforms grow in popularity.

Binance vs KuCoin: Security Features

When choosing between Binance and KuCoin, security should be a top priority for your crypto investments. Both exchanges offer essential protection measures, but there are some notable differences.

Binance provides strong security protocols including two-factor authentication (2FA), anti-phishing codes, and biometric login options. Their funds are primarily kept in cold storage, away from potential online threats.

KuCoin similarly offers 2FA login protection, security questions, and anti-phishing safety measures. Their security system includes cold storage for most assets, though not as comprehensive as Binance’s approach.

Based on industry assessments, Binance generally edges out KuCoin in overall security. Binance has invested heavily in security infrastructure and has a more robust system for protecting user assets.

Key Security Features Comparison:

| Feature | Binance | KuCoin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Anti-Phishing Protection | ✓ | ✓ |

| Biometric Login | ✓ | ✓ |

| Cold Storage | Extensive | Partial |

| Security Questions | ✓ | ✓ |

| Overall Security Rating | Higher | Good |

You should enable all available security features regardless of which platform you choose. This includes setting up 2FA, using unique passwords, and being alert to phishing attempts.

Remember that no exchange is completely immune to security risks, so consider keeping large holdings in personal wallets rather than on exchanges for maximum protection.

Is Binance A Safe & Legal To Use?

Binance is generally considered a safe cryptocurrency exchange with strong security measures in place. The platform uses two-factor authentication (2FA) and stores most user funds in cold storage to protect against hacks.

One standout security feature is Binance’s SAFU (Secure Asset Fund for Users). This emergency insurance fund helps protect users if a security breach occurs.

The legality of using Binance depends on your location. Due to regulatory issues, Binance has restrictions in some countries, including:

- United States (limited access via Binance.US)

- United Kingdom

- Ontario, Canada

- Singapore

Key Security Features:

- Two-factor authentication

- Cold wallet storage

- Anti-phishing codes

- Address whitelisting

- SAFU fund

Binance regularly undergoes security audits and has responded quickly to past security incidents. The exchange has also improved its KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to comply with regulations.

Before using Binance, check if it’s legal in your country or region. Regulations change frequently, so it’s worth verifying the current status.

While Binance is considered reputable in the industry, remember that all cryptocurrency exchanges carry some risk. Never invest more than you can afford to lose, and consider using a hardware wallet for long-term storage of large amounts.

Is KuCoin A Safe & Legal To Use?

KuCoin has established itself as a legitimate cryptocurrency exchange in the market. The platform implements strong security measures to protect user assets and information.

In 2020, KuCoin experienced a major security breach where hackers stole significant funds. However, the exchange responded by enhancing their security protocols, and all affected users eventually recovered their assets.

Today, KuCoin uses multiple security features including:

- Two-factor authentication (2FA)

- Advanced encryption

- Cold storage for most user funds

- Regular security audits

From a legal standpoint, KuCoin operates in many countries worldwide. However, regulations vary by location, so you should verify if using KuCoin is permitted in your country.

KuCoin implements Know Your Customer (KYC) procedures to comply with anti-money laundering regulations. While basic functions are available without verification, completing KYC gives you access to higher withdrawal limits and additional features.

The exchange maintains insurance funds to protect users against potential losses. This adds an extra layer of protection for your investments.

When comparing KuCoin to Binance, both exchanges meet high industry security standards. They take user safety seriously and continue to improve their security measures as the cryptocurrency landscape evolves.

Frequently Asked Questions

Traders comparing Binance and KuCoin need clear answers about fees, security measures, trading volumes, and platform features. These common questions highlight the key differences that may influence your choice between these popular exchanges.

What are the key differences in fees between Binance and KuCoin?

Binance typically charges 0.1% for standard trading fees, which can be reduced further by using BNB tokens or reaching higher trading volumes. This makes it one of the more competitive exchanges for frequent traders.

KuCoin’s basic trading fee structure starts at 0.1% as well, but its discount system works differently. KuCoin uses KCS tokens for fee reductions and offers a slightly different tier structure for high-volume traders.

For withdrawal fees, Binance often has lower costs for popular cryptocurrencies, though this varies by specific coin. KuCoin sometimes charges higher withdrawal fees, but offers more free withdrawal options for certain tokens.

How does the security of Binance compare with that of KuCoin?

Binance implements robust security measures including two-factor authentication, address whitelisting, and its Secure Asset Fund for Users (SAFU) which acts as an emergency insurance fund. Binance also conducts regular security audits.

KuCoin offers similar security features like 2FA and multi-layer encryption but has experienced a major hack in 2020. However, KuCoin fully reimbursed affected users, demonstrating strong crisis management.

Both exchanges use cold storage for most funds, but Binance’s larger size has allowed it to invest more extensively in advanced security infrastructure and dedicated security teams.

What trade volume differences can traders expect between Binance and KuCoin?

Binance consistently ranks at the top of exchanges by trading volume, often processing billions in daily trades. This high liquidity means less slippage for large orders and more stable prices for popular trading pairs.

KuCoin handles significantly lower volumes compared to Binance, but still maintains respectable liquidity for a mid-sized exchange. Daily trading volumes on KuCoin typically range in the hundreds of millions.

The volume difference becomes most noticeable during volatile market conditions, where Binance’s deeper order books provide more stability. KuCoin may experience more price fluctuations during high-activity periods.

How do user experiences vary between using Binance and KuCoin?

Binance offers a comprehensive but potentially overwhelming interface with extensive tools and options. Experienced traders appreciate the depth, while beginners might find the learning curve steep.

KuCoin provides a more streamlined and user-friendly experience with its intuitive layout. Its social trading features like copy trading make it particularly appealing to newer crypto traders.

Customer support experiences differ as well, with KuCoin often receiving better feedback for response times. Binance’s massive user base can sometimes result in longer wait times for support issues.

Which platform offers more diverse and comprehensive trading pairs, Binance or KuCoin?

Binance leads in total number of trading pairs with over 350 cryptocurrencies and 1,000+ trading pairs available. This includes major coins and many smaller altcoins with various fiat pairing options.

KuCoin positions itself as “The People’s Exchange” with a focus on listing emerging projects early. While offering fewer total pairs than Binance, KuCoin frequently lists new tokens before they reach larger exchanges.

For traders seeking specific niche altcoins, KuCoin sometimes provides access to projects not yet available on Binance. Both exchanges regularly add new listings, but their approaches to token selection differ slightly.

What are the advantages and disadvantages of the staking services on Binance versus KuCoin?

Binance offers a wider range of staking options with its Locked Staking, DeFi Staking, and Binance Earn programs. The platform typically provides competitive APY rates and a user-friendly staking process.

One disadvantage of Binance staking is that some of the best rates require longer lock-up periods. Some users also report occasional difficulties with redemption processes during high-demand periods.

KuCoin’s Pool-X staking platform offers flexible terms with some unique tokens not available elsewhere. KuCoin typically provides more flexible unstaking options but sometimes with slightly lower yields than Binance’s locked staking.

Binance vs KuCoin Conclusion: Why Not Use Both?

After comparing Binance and KuCoin, it’s clear that both exchanges have their strengths. Binance offers lower trading fees and is known for its intuitive user experience. Its platform is generally easier to navigate, especially for beginners.

KuCoin, while having slightly higher fees, offers access to a wider range of altcoins that might not be available on Binance. This makes it attractive for traders looking for emerging projects and potentially high-reward investments.

In terms of security, both exchanges maintain high industry standards. You can feel reasonably confident about the safety of your assets on either platform, though no exchange is completely risk-free.

Why choose just one?

You might benefit from using both exchanges strategically. Here’s how:

- Use Binance for larger trades and popular coins to take advantage of lower fees

- Use KuCoin to access niche altcoins not available elsewhere

- Leverage Binance’s better fiat on-ramp features for depositing funds

- Explore KuCoin’s unique features like trading bots and earning opportunities

By maintaining accounts on both platforms, you can maximize your trading options while minimizing fees. This approach gives you the flexibility to choose the right platform for each specific trading need.

Remember to follow proper security practices regardless of which exchange you use. Enable two-factor authentication, use strong passwords, and consider hardware wallets for long-term storage of significant holdings.