When choosing a cryptocurrency exchange, two popular options often come up in comparison: Binance and DigiFinex. Both platforms offer cryptocurrency trading services, but they differ in several key aspects that might influence your decision.

Binance generally offers more trading pairs, higher liquidity, and is more widely used globally compared to DigiFinex. However, DigiFinex has been growing its presence in the crypto market by providing unique financial services and wealth management options that might appeal to certain traders.

Your trading needs will ultimately determine which platform works better for you. Factors to consider include trading fees, available cryptocurrencies, security features, and user interface. Understanding these differences can help you make an informed choice for your crypto trading journey.

Binance vs DigiFinex: At A Glance Comparison

Binance and DigiFinex are two popular cryptocurrency exchanges that offer different features and benefits for traders.

Trading Volume & Popularity

- Binance: World’s largest exchange by trading volume

- DigiFinex: Smaller but growing exchange based in Singapore

Available Cryptocurrencies

| Exchange | Number of Coins |

|---|---|

| Binance | 350+ |

| DigiFinex | 300+ |

Fee Structure

Binance offers slightly more competitive trading fees, with standard fees at about 0.1% per trade. DigiFinex’s fees are slightly higher but still reasonable for most traders.

Security Features

Both exchanges have strong security measures. Binance has SAFU (Secure Asset Fund for Users) to protect users in case of breaches. DigiFinex employs multi-signature wallets and cold storage.

User Interface

Binance provides both basic and advanced trading interfaces to suit different experience levels. DigiFinex offers a clean, intuitive interface that many beginners find approachable.

Regulatory Compliance

Binance has faced regulatory challenges in multiple countries but has worked to address them. DigiFinex operates primarily in Asian markets and has fewer global regulatory issues.

Mobile Experience

Both exchanges offer mobile apps for iOS and Android. Binance’s app has more features and higher ratings from users.

When choosing between these exchanges, consider your trading needs, geographic location, and the specific cryptocurrencies you want to trade.

Binance vs DigiFinex: Trading Markets, Products & Leverage Offered

Binance offers a much larger selection of cryptocurrencies than DigiFinex. You can access over 350+ cryptocurrencies on Binance, while DigiFinex supports approximately 200+ digital assets.

Both exchanges provide spot trading, but Binance has a more extensive range of trading products. You’ll find futures, options, leveraged tokens, and margin trading on Binance with leverage up to 125x on certain futures contracts.

DigiFinex offers futures trading with up to 100x leverage, which is slightly lower than Binance’s maximum. However, both platforms provide enough leverage for most traders’ needs.

Trading Products Comparison:

| Feature | Binance | DigiFinex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ (Up to 125x) | ✓ (Up to 100x) |

| Options | ✓ | ✗ |

| Margin Trading | ✓ | ✓ |

| Leveraged Tokens | ✓ | ✗ |

Binance also offers more trading pairs, especially for altcoins. You can find unique trading pairs that aren’t available on many other exchanges, making it easier to trade between different cryptocurrencies without converting to Bitcoin or Ethereum first.

DigiFinex focuses more on Asian markets and offers some region-specific tokens that might not be available on Binance. This could be valuable if you’re interested in certain regional projects.

Both platforms provide trading bots and advanced charting tools, but Binance’s tools are generally more sophisticated and offer better technical analysis capabilities.

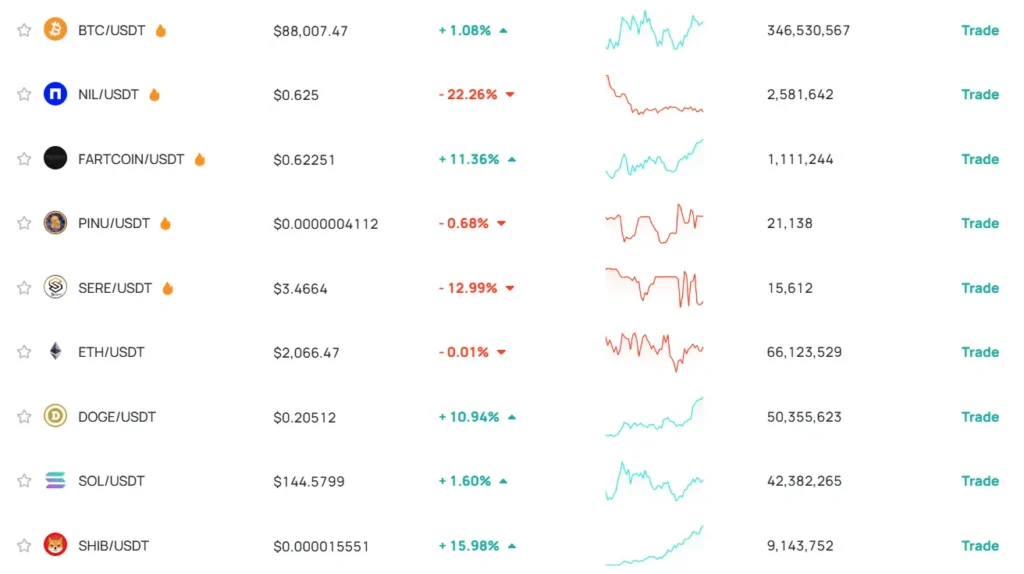

Binance vs DigiFinex: Supported Cryptocurrencies

Binance stands as the leader in cryptocurrency variety, supporting over 350 different cryptocurrencies and tokens. This extensive selection gives you access to both major coins and emerging altcoins all in one platform.

DigiFinex offers a smaller but still substantial selection with approximately 100+ cryptocurrencies available for trading. While fewer than Binance, this still covers most major coins that the average trader needs.

Key Differences in Cryptocurrency Support:

| Feature | Binance | DigiFinex |

|---|---|---|

| Number of cryptocurrencies | 350+ | 100+ |

| Fiat currency support | Multiple options | Limited options |

| Token launches | Regular new listings | Less frequent additions |

Binance regularly adds new cryptocurrencies through its Binance Launchpad program, giving you early access to emerging projects. This makes it particularly valuable if you’re interested in new token opportunities.

DigiFinex focuses more on established cryptocurrencies, making it a good choice if you prefer trading well-known coins with proven track records.

Both platforms support the major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. Your choice might depend on whether you need the extensive variety Binance offers or if DigiFinex’s selection covers your trading needs.

Trading pairs also differ between the platforms. Binance provides more trading pairs, allowing you to directly exchange between a wider variety of cryptocurrencies without converting to intermediary coins first.

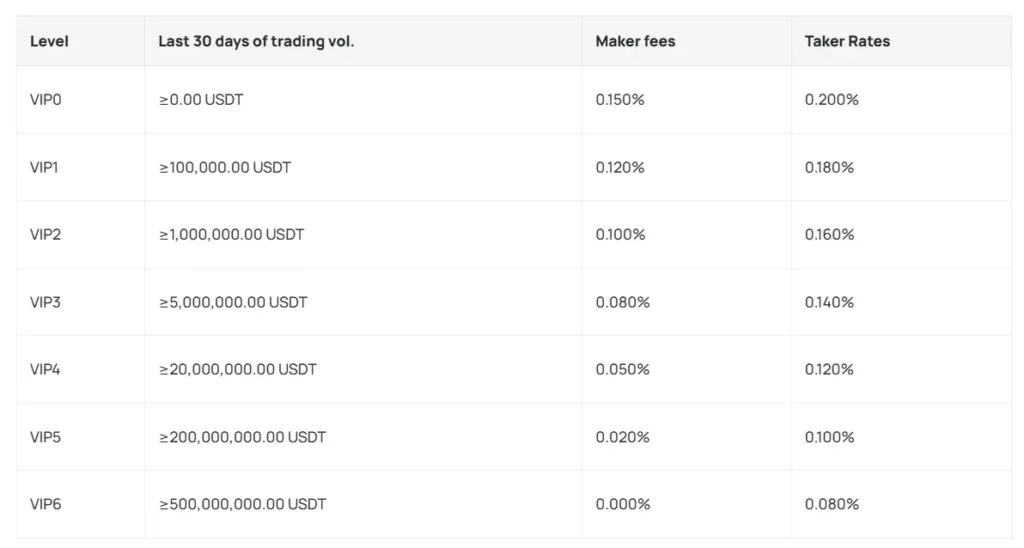

Binance vs DigiFinex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and DigiFinex, fees play a crucial role in your decision. Both exchanges have different fee structures that can impact your trading costs.

Trading Fees

Binance offers competitive maker and taker fees that decrease as your trading volume increases. Basic users typically pay 0.1% per trade, but this can drop to as low as 0.02% for high-volume traders.

DigiFinex generally charges slightly higher fees than Binance. Their standard trading fee is around 0.2% per trade, which can also decrease based on volume and token holdings.

Fee Reduction Options

Binance lets you reduce fees by:

- Using BNB to pay for fees (25% discount)

- Increasing your VIP level through trading volume

- Holding BNB in your account

DigiFinex offers discounts when you:

- Use DFT (their native token) for fees

- Increase your trading volume

Deposit & Withdrawal Fees

Binance has free crypto deposits, while withdrawal fees vary by cryptocurrency. These fees are typically lower than industry averages.

DigiFinex also offers free deposits. Their withdrawal fees tend to be slightly higher than Binance for most cryptocurrencies.

Payment Method Fees

When using fiat currency, Binance charges different fees based on your payment method:

- Credit/debit cards: 1-2% fee

- Bank transfers: Often lower fees, sometimes free

DigiFinex has fewer fiat options and generally charges higher fees for fiat transactions compared to Binance.

Binance vs DigiFinex: Order Types

When you trade on cryptocurrency exchanges, order types matter. They determine how you buy and sell assets.

Binance offers three main order types:

- Limit Orders: Set your price, and the order executes only at that price or better

- Market Orders: Buy or sell immediately at the current market price

- Stop-Limit Orders: Automatically trigger a limit order when the price reaches a specific level

DigiFinex has a more basic offering with just two order types:

- Limit Orders: Set your price for execution

- Market Orders: Execute trades at current market rates

This difference matters for traders who use advanced strategies. Binance gives you more control with its stop-limit feature, which helps manage risk during volatile market conditions.

If you’re a beginning trader, both platforms offer the essential order types you’ll need most often. However, if you use more complex trading strategies, Binance’s additional order options might better suit your needs.

The simplicity of DigiFinex might appeal to new traders who don’t want to be overwhelmed by choices. But as you grow more experienced, you might find its limited order selection restrictive.

Trading flexibility is an important factor to consider when choosing between these exchanges.

Binance vs DigiFinex: KYC Requirements & KYC Limits

Both Binance and DigiFinex have different approaches to Know Your Customer (KYC) verification, which affects how you can use their platforms.

On Binance, you can actually trade without completing KYC verification, but with limitations. Unverified accounts can trade up to 2 BTC per day. This gives you some flexibility if you’re looking to trade smaller amounts.

For EU users on Binance, there are special provisions allowing accounts with lowered KYC requirements, though these are limited to just one fiat transaction under 1,000 EUR.

DigiFinex’s KYC requirements show some inconsistency in the search results. Some sources indicate KYC is not required for basic trading, while others state it is mandatory before any deposits or trades.

What’s clear is that on DigiFinex, verified accounts enjoy higher withdrawal limits compared to unverified ones. This creates an incentive to complete verification if you plan to move larger amounts of crypto.

Here’s a quick comparison:

| Platform | KYC Required? | Unverified Limits | Benefits of Verification |

|---|---|---|---|

| Binance | Not for basic trading | Up to 2 BTC/day | Higher limits, fiat access |

| DigiFinex | Conflicting info | Limited withdrawals | Higher withdrawal limits |

Consider your trading volume and withdrawal needs when choosing between these exchanges based on their KYC policies.

Binance vs DigiFinex: Deposits & Withdrawal Options

When choosing between Binance and DigiFinex, understanding their deposit and withdrawal options is crucial for smooth transactions.

Binance offers more deposit methods compared to DigiFinex. You can fund your Binance account through bank transfers, credit/debit cards, and various third-party payment systems.

DigiFinex has fewer deposit options, primarily focusing on cryptocurrency deposits and some limited fiat options.

Withdrawal speeds differ between the platforms. KuCoin (a competitor) and DigiFinex typically process withdrawals faster than Binance, especially during high network congestion periods.

Both exchanges support a wide range of cryptocurrencies for deposits and withdrawals, but Binance generally supports more coins overall.

Fees structure:

| Platform | Crypto Withdrawal Fees | Fiat Withdrawal Fees |

|---|---|---|

| Binance | Varies by crypto | Depends on method |

| DigiFinex | Generally higher | Limited options |

Binance typically offers lower withdrawal fees for most cryptocurrencies. This can be significant for traders who make frequent withdrawals.

Security for deposits and withdrawals is stronger on Binance, with more verification layers and security protocols. You’ll find more robust protection for your funds during the deposit and withdrawal process.

DigiFinex does provide basic security measures, but lacks some of the advanced features Binance offers for transaction security.

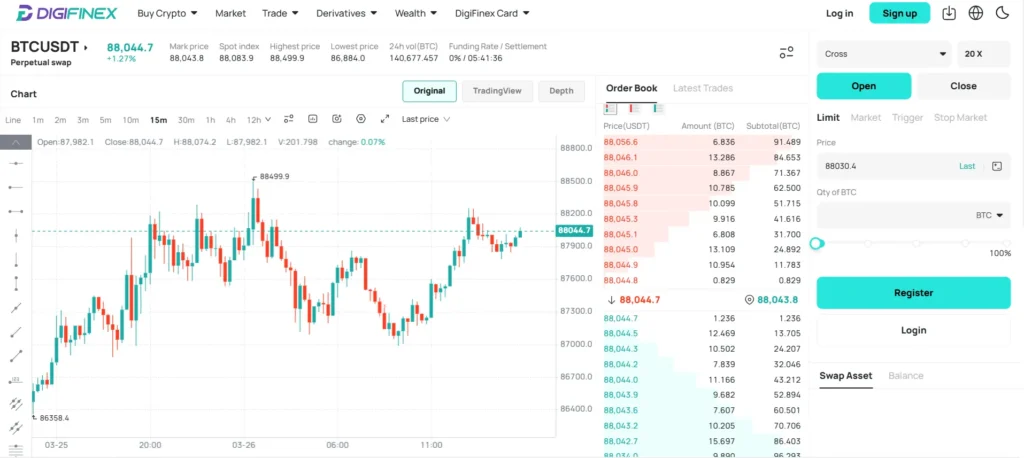

Binance vs DigiFinex: Trading & Platform Experience Comparison

Binance offers a more robust trading experience with its intuitive interface that works well for both beginners and advanced traders. You’ll find basic and advanced chart views, plus over 350 cryptocurrencies to trade.

DigiFinex provides a clean, straightforward platform but with fewer trading pairs (around 200+ cryptocurrencies). The platform is easy to navigate but lacks some of the advanced features Binance offers.

Trading Fees Comparison:

| Exchange | Maker Fee | Taker Fee | Withdrawal Fees |

|---|---|---|---|

| Binance | 0.1% | 0.1% | Varies by coin |

| DigiFinex | 0.2% | 0.2% | Slightly higher |

Binance’s mobile app receives higher ratings across app stores and offers a more seamless experience between desktop and mobile trading. DigiFinex’s app is functional but sometimes experiences lag during high-volume trading periods.

When it comes to liquidity, Binance significantly outperforms with daily trading volumes often exceeding $10 billion. This means your orders are filled faster with less price slippage.

Key Platform Features:

- Binance: Futures trading, margin trading, staking, launchpad, and extensive educational resources

- DigiFinex: Spot trading, OTC trading, and some staking options

Binance’s customer support includes live chat and ticket systems with generally faster response times. DigiFinex offers email support and a help center, but response times can be longer during busy periods.

Binance vs DigiFinex: Liquidation Mechanism

When trading with leverage on exchanges like Binance and DigiFinex, understanding their liquidation mechanisms is crucial for managing risk.

Binance uses a tiered liquidation system that gradually reduces your position instead of closing it all at once when your margin ratio falls below maintenance requirements. This gives you a chance to add funds before complete liquidation occurs.

DigiFinex employs a similar risk management approach but with some differences in execution. Their system monitors positions continuously and issues margin calls when your collateral approaches dangerous levels.

Liquidation Thresholds:

- Binance: Typically triggers at 80% of your collateral value

- DigiFinex: Often begins liquidation processes at around 75-80% of collateral

Both platforms send notifications before liquidation, but Binance’s warning system is generally more robust with multiple alerts through email, app, and on-platform messages.

DigiFinex may impose more restrictions on withdrawing funds during volatile market conditions, which could affect your ability to manage positions effectively.

Liquidation Fees:

| Platform | Typical Liquidation Fee |

|---|---|

| Binance | 0.5-2% depending on asset |

| DigiFinex | 1-3% depending on asset |

You should carefully review each platform’s specific liquidation policies before trading with leverage, as these mechanisms directly impact your risk exposure and potential losses during market volatility.

Binance vs DigiFinex: Insurance

When comparing crypto exchanges, insurance protection is a crucial factor to consider for your assets’ security. Both Binance and DigiFinex have different approaches to protecting user funds.

Binance offers a Secure Asset Fund for Users (SAFU), which allocates 10% of trading fees to an emergency insurance fund. This fund, worth hundreds of millions of dollars, helps protect users in case of security breaches or hacks.

DigiFinex doesn’t appear to have a comparable dedicated insurance fund like SAFU. Their protection relies more heavily on their security measures rather than a specific insurance mechanism.

Both exchanges implement cold storage solutions to keep most user assets offline and safe from online threats. This isn’t technically insurance but serves as a primary security measure.

Binance provides more transparency about their insurance mechanisms, making it easier for you to understand how your funds might be protected in worst-case scenarios.

Neither exchange offers the kind of comprehensive insurance that traditional financial institutions provide. This is common in the crypto industry, where regulated insurance options remain limited.

Before choosing an exchange, you should check their current insurance policies as they may change over time. Consider how much of your funds you’re comfortable storing on either platform given their insurance differences.

Binance vs DigiFinex: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both Binance and DigiFinex offer support options, but they differ in important ways.

Binance provides customer support through multiple channels. You can reach them via:

- 24/7 live chat

- Support tickets

- Extensive FAQ section

- Community forums

Response times on Binance typically range from minutes to a few hours for urgent issues. For more complex problems, you might wait 1-2 days.

DigiFinex also offers several support options:

- Live chat (with more limited hours)

- Email support

- Help center documentation

- Telegram community

DigiFinex generally has slightly longer response times compared to Binance. You might wait several hours for initial responses, especially during busy periods.

Both platforms offer support in multiple languages. Binance supports more languages overall, which is helpful if English isn’t your primary language.

The quality of support also varies. Binance’s larger team often provides more detailed and technically accurate responses. Their agents typically have more training on complex trading issues.

DigiFinex’s support team is smaller but can be more personalized in some cases. You might find their agents more attentive to your specific situation.

Neither platform offers phone support, which remains a limitation for users who prefer talking to a real person.

Binance vs DigiFinex: Security Features

When choosing a crypto exchange, security should be your top priority. Both Binance and DigiFinex offer various security features to protect your assets and personal information.

Binance is known for its strong security measures. It uses two-factor authentication (2FA), advanced encryption, and cold storage for most user funds. Binance also has a Secure Asset Fund for Users (SAFU), which acts as an emergency insurance fund.

DigiFinex provides similar security basics like 2FA and encryption protocols. However, it’s worth noting that DigiFinex offers KYC-free trading options, which some users prefer for privacy reasons.

Key Security Features Comparison:

| Feature | Binance | DigiFinex |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | SAFU | Not specified |

| KYC Requirements | Stricter | More flexible |

| Security History | Strong track record | Less established |

You should consider that Binance has a longer history in the market and has demonstrated resilience against hacking attempts. This experience may give you more confidence in their security systems.

Both platforms use security features for protecting account details and transactions. Your choice might depend on whether you prioritize stronger verification protocols or more privacy in your trading activities.

Is Binance a Safe & Legal To Use?

Binance is generally considered a safe cryptocurrency exchange. The platform keeps most of its crypto assets in “cold wallets” that aren’t connected to the internet, which helps protect user funds from hacking attempts.

Security features on Binance include two-factor authentication (2FA), address whitelisting, and advanced encryption to protect your personal information.

However, safety doesn’t always mean worry-free. Binance has faced some security breaches in the past, though the exchange has typically covered customer losses.

Legal status varies by location:

- Binance has faced regulatory challenges in several countries

- Binance.US was created specifically for American users to comply with US regulations

- Some countries have restricted or banned Binance operations

You should check if Binance is legal in your country before signing up. The exchange’s regulatory status continues to evolve as governments develop clearer crypto regulations.

For extra safety when using Binance:

- Enable all security features

- Use strong, unique passwords

- Consider using a hardware wallet for large amounts

- Keep only trading funds on the exchange

While Binance works to maintain compliance, you should stay updated on changing regulations that might affect your ability to use the platform in your location.

Is DigiFinex a Safe & Legal To Use?

DigiFinex appears to be a safe and legitimate cryptocurrency exchange. Operating since 2017, it has built a good reputation among users and has never experienced a security breach or hack.

The exchange implements standard security measures like SSL encryption to protect user data and transactions. For account protection, DigiFinex follows Anti-Money Laundering (AML) regulations by requiring Know Your Customer (KYC) verification.

Users should note that DigiFinex handles proof of reserves in-house rather than through third-party auditors. This means the exchange itself oversees its funds, which some users might view as less transparent than exchanges with external audits.

When comparing DigiFinex to other platforms like Binance and KuCoin, safety considerations should be part of your decision. All three exchanges have different security approaches, but DigiFinex has maintained a reliable operation throughout its existence.

Before using DigiFinex, verify it’s legal in your country as cryptocurrency regulations vary worldwide. While the exchange is accessible globally, certain features may be restricted in some regions due to local laws.

For maximum security when using DigiFinex or any exchange, enable all available security features like two-factor authentication and use strong, unique passwords for your account.

Frequently Asked Questions

Traders looking to choose between Binance and DigiFinex often have specific concerns about fees, available cryptocurrencies, and platform features. Below are answers to common questions that can help you make an informed decision based on your trading needs.

What are the key differences between Binance and DigiFinex trading platforms?

Binance is generally more popular and offers a comprehensive ecosystem with more trading features. DigiFinex provides a fully-fledged crypto ecosystem but with a different focus.

Binance typically has higher trading volumes and liquidity compared to DigiFinex. This can result in faster trade execution and less price slippage for you as a trader.

The user interfaces differ noticeably, with Binance often praised for its intuitive design despite its many features.

Which exchange offers a wider range of cryptocurrencies, Binance or DigiFinex?

Binance typically offers a larger selection of cryptocurrencies and trading pairs. The platform is known for its extensive listing of both established coins and newer tokens.

DigiFinex supports a good number of cryptocurrencies but may have some tokens not found on Binance. Some coins on DigiFinex have very low trading volumes, which can affect liquidity.

You should check both platforms for specific cryptocurrencies you’re interested in trading, as listings change regularly.

How do the security features of Binance compare with those of DigiFinex?

Binance employs multiple security measures including two-factor authentication, address whitelisting, and its Secure Asset Fund for Users (SAFU) to protect customer assets.

DigiFinex also offers standard security features like two-factor authentication and cold storage for most user funds.

Binance has faced security challenges in the past but has generally responded quickly to address vulnerabilities, while DigiFinex has maintained a relatively clean security record.

What are the respective fees and commission structures for Binance and DigiFinex?

Binance typically charges 0.1% per trade for both makers and takers on its standard fee tier. This can be reduced by using BNB tokens or increasing your trading volume.

DigiFinex has a fee structure of 0.1% for makers and 0.2% for takers in margin trading, slightly higher than Binance’s equivalent rates.

Both exchanges offer fee discounts based on trading volume and platform token holdings, but the specific structures and benefits differ.

Can users from all countries access Binance and DigiFinex services equally?

No, both exchanges have restrictions based on your location. Binance has specific versions for different regions, with Binance.US serving American customers with more limited features.

DigiFinex also has geographical restrictions and may not be available in certain countries due to regulatory concerns.

You should check the current terms of service for both platforms to confirm availability in your region, as regulatory situations change frequently.

Between Binance and DigiFinex, which platform is more user-friendly for beginner traders?

Binance offers a simple interface option specifically designed for beginners, along with extensive educational resources and guides to help new traders get started.

DigiFinex has a relatively straightforward interface but may not offer as many educational resources or beginner-focused features as Binance.

If you’re new to crypto trading, Binance’s larger user community means more tutorials and support forums are available to help you navigate the platform.

Binance vs DigiFinex Conclusion: Why Not Use Both?

Both Binance and DigiFinex offer strong options for crypto traders. Binance stands out with its larger size, more robust platform, and better customer experience according to many users.

DigiFinex offers slightly better maker fees for margin trading compared to Binance, though taker fees remain somewhat high. This might benefit certain trading strategies.

The platforms differ in how you can purchase crypto. Binance allows direct purchases, while DigiFinex uses third-party payment gateways like Simplex and Banxa.

You might consider using both exchanges to take advantage of their unique strengths. Binance could serve as your primary platform for its reliability and broader features, while DigiFinex might be useful for specific trades or tokens not available elsewhere.

Keep in mind that all cryptocurrency exchanges carry volatility risk. Prices can change rapidly, affecting the value of your assets regardless of which platform you choose.

Your trading volume and preferences should guide your decision. If you’re an active trader, you might benefit from DigiFinex’s tiered fee structure, which resembles Binance’s model but with some differences.

Using multiple exchanges also helps spread risk and gives you access to more trading pairs and opportunities. Just remember to keep track of your assets across platforms for tax and security purposes.