Choosing a cryptocurrency exchange can be a tough decision. Today, we’re comparing two popular platforms: Binance and Bitunix. Each exchange offers unique features that might suit different trading needs.

Bitunix stands out for its user-friendly interface and bonus incentives, while Binance is known for its advanced trading features and position as one of the top exchanges by trading volume. Your choice between these platforms will ultimately depend on what you value most as a trader – simplicity and rewards or comprehensive tools and liquidity.

When evaluating these exchanges, you should consider factors like security features, available cryptocurrencies, fee structures, and user experience. Bitunix offers proof of reserves for added security, which some users find reassuring. Binance, established in 2017, quickly rose to prominence and maintains a leading position in the crypto exchange market.

Binance Vs Bitunix: At A Glance Comparison

When choosing between Binance and Bitunix, you need to understand their key differences. Both platforms serve as cryptocurrency exchanges but have distinct features that may influence your decision.

Binance is one of the largest crypto exchanges globally, known for its wide range of available coins and trading pairs. It offers a comprehensive platform with various trading options.

Bitunix is a newer exchange that has been gaining attention. According to user reviews, some consider it better than top-tier exchanges. A notable advantage is that Bitunix provides proof of reserves, enhancing security for users.

Interest Rates and Features:

| Feature | Binance | Bitunix |

|---|---|---|

| BTC Interest Rate | 0.28% | Not specified in results |

| Compounding | No | Not specified in results |

| Security | Standard | Proof of reserves |

When comparing trading volumes, Binance typically ranks higher on lists like CoinMarketCap and CoinGecko. These platforms rank exchanges based on traffic, liquidity, trading volumes, and legitimacy.

You can find detailed comparisons of both platforms on Capterra UAE 2025, which includes feature breakdowns, pricing, and user reviews. This resource also provides information about trial versions for both exchanges.

Your choice between these platforms should depend on your specific needs – whether you prioritize established reputation, security features, or interest rates on your crypto holdings.

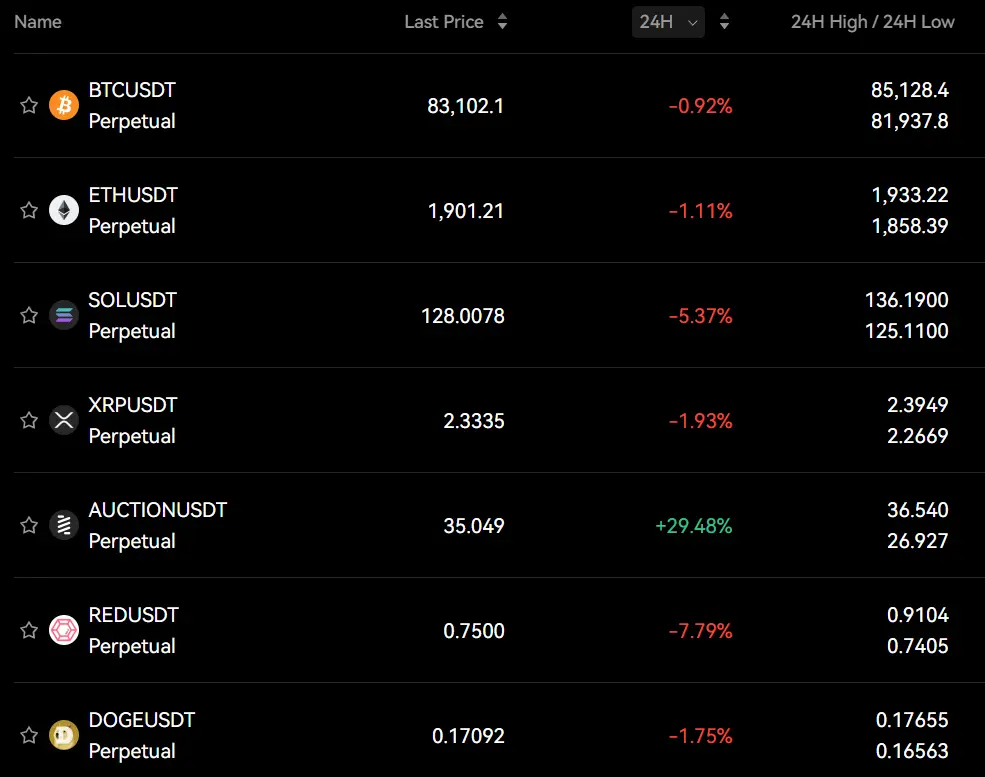

Binance Vs Bitunix: Trading Markets, Products & Leverage Offered

Binance and Bitunix both offer a variety of trading options, but they differ in several important ways.

Binance provides access to over 350 cryptocurrencies and supports both spot and derivatives trading. You can trade with leverage up to 125x on Bitcoin and Ethereum, and up to 100x on other cryptocurrencies.

Bitunix supports over 270 cryptocurrencies and also focuses on both spot and derivatives trading. Their leverage options aren’t as widely advertised as Binance’s.

Trading Products Comparison:

| Feature | Binance | Bitunix |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | ✓ | Limited |

| Max Leverage | Up to 125x | Not specified |

| Margin Types | Cross & Isolated | Not specified |

Binance charges interest on a 24-hour basis for margin trading. The interest is calculated based on the amount you borrow.

You’ll find more advanced trading products on Binance, including options and leveraged tokens. This makes it better suited for experienced traders looking for sophisticated tools.

Bitunix offers a solid range of trading pairs but doesn’t match Binance’s extensive selection. It’s worth noting that Binance ranks as one of the top cryptocurrency derivatives exchanges globally.

For beginners, both platforms offer basic spot trading. However, if you’re looking for advanced trading features with high leverage options, Binance provides more comprehensive choices.

Binance Vs Bitunix: Supported Cryptocurrencies

When choosing between Binance and Bitunix, the number and variety of cryptocurrencies available is an important factor to consider.

Binance is known for its extensive selection, supporting over 350 cryptocurrencies for trading. This includes all major coins like Bitcoin, Ethereum, and Solana, as well as many smaller altcoins and tokens.

Bitunix offers a more focused selection, supporting approximately 270 cryptocurrencies according to recent data. While this is fewer than Binance, it still covers most major coins that the average trader might need.

Here’s a quick comparison of their cryptocurrency support:

| Feature | Binance | Bitunix |

|---|---|---|

| Total cryptocurrencies | 350+ | 270+ |

| Major coins (BTC, ETH, etc.) | Yes | Yes |

| Stablecoins | All major options | Most popular options |

| New/emerging tokens | Extensive selection | More selective |

Binance typically adds new coins more frequently, which can be beneficial if you’re looking to trade newly launched tokens. You’ll find more obscure or niche cryptocurrencies on Binance.

Bitunix takes a more curated approach to listing new cryptocurrencies. This might mean fewer options, but it could also mean less exposure to highly speculative tokens.

For most traders, both exchanges will offer enough variety for typical trading needs. Your choice might depend on whether you value having the maximum number of options or prefer a more streamlined selection.

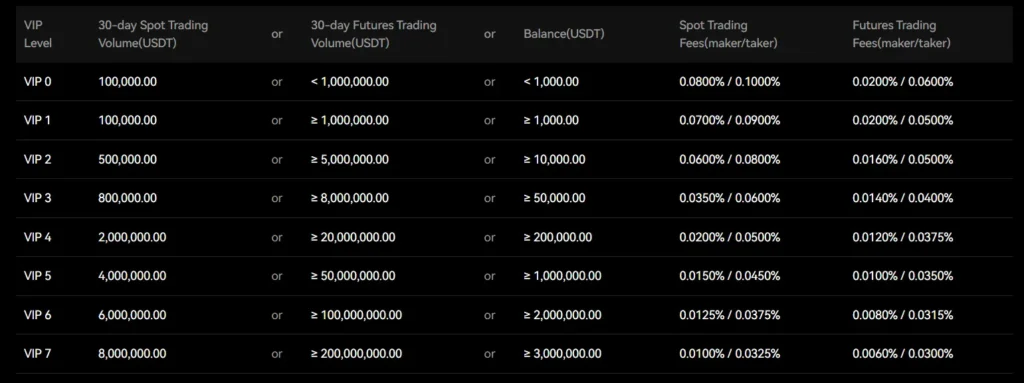

Binance Vs Bitunix: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and Bitunix, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| Binance | Starting at 0.1% | Starting at 0.1% |

| Bitunix | Starting at 0.1% | Starting at 0.1% |

Both exchanges offer competitive base trading fees. However, there are some key differences to consider.

Binance requires KYC (Know Your Customer) verification to access these rates. This makes it less accessible if you value privacy.

Bitunix offers similar spot fees without mandatory KYC requirements. This gives you more flexibility if privacy is important to you.

Deposit and Withdrawal Fees

Deposit fees are generally free on both platforms, but withdrawal fees vary by cryptocurrency. These fees change based on network conditions and the specific coin you’re withdrawing.

Binance offers fee discounts if you hold their native token (BNB) and use it to pay for fees. This can reduce your overall trading costs if you’re a frequent trader.

Both exchanges update their fee structures regularly. It’s worth checking their official websites for the most current rates before making significant trades.

For US users, note that Binance.US has slightly higher fees than the international version, typically ranging from 0.38-0.57% per transaction.

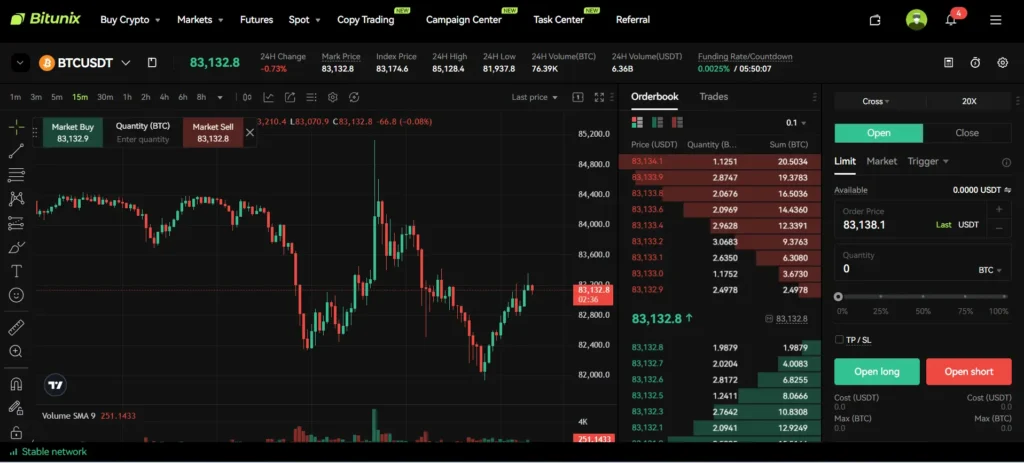

Binance Vs Bitunix: Order Types

When trading crypto, the types of orders you can place make a big difference in your strategy. Both Binance and Bitunix offer various order types to help you trade effectively.

Binance provides a comprehensive set of order options. You can use market orders for immediate execution at current prices, limit orders to buy or sell at specific prices, and stop-limit orders to manage risk.

Bitunix is known for its innovative approach to order placement. According to search results, Bitunix allows you to execute all order types directly on the chart, which can make trading more intuitive.

Both platforms support real-time tracking of orders, but Bitunix emphasizes this feature in its user experience.

Here’s a comparison of basic order types available on both platforms:

| Order Type | Binance | Bitunix |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop-Limit | ✓ | ✓ |

| OCO (One Cancels Other) | ✓ | ✓ |

| Chart-based execution | Limited | Enhanced |

Bitunix has been gaining popularity as a derivatives exchange. Its interface may be more appealing if you prefer visual trading directly on charts.

For beginners, both platforms can seem complex at first. However, Bitunix might offer a more streamlined experience for chart-based traders.

The right choice depends on your trading style and preferences. Consider trying both to see which order execution system feels more natural to you.

Binance Vs Bitunix: KYC Requirements & KYC Limits

Binance and Bitunix have different approaches to KYC (Know Your Customer) requirements, which may influence your choice between these exchanges.

Binance KYC Policy:

- Requires KYC verification for almost all services

- You cannot access most Binance products without completing KYC

- Once verified, higher trading and withdrawal limits become available

Bitunix KYC Policy:

- Does not require mandatory KYC verification for basic trading

- Allows users to trade cryptocurrencies without identity verification

- Sets daily withdrawal limits of up to 500,000 USDT without KYC

This difference in KYC requirements represents one of the most significant distinctions between these platforms. Bitunix has positioned itself as one of the fastest-growing “no KYC exchanges” since its establishment in 2021.

If privacy is your priority, Bitunix offers more flexibility. You can trade and withdraw funds (within limits) without sharing personal information.

For Binance users, completing the verification process is essentially mandatory to use the platform effectively. While you can create an account without KYC, you’ll have extremely limited functionality.

Your choice between these exchanges may depend on how you value privacy versus access to advanced features. Bitunix offers simplicity with reasonable transaction fees, while Binance provides more comprehensive services after verification.

Binance Vs Bitunix: Deposits & Withdrawal Options

When choosing between Binance and Bitunix, deposit and withdrawal options play a key role in your trading experience.

Binance offers a wide range of deposit methods including bank transfers, credit/debit cards, and P2P trading. You can deposit over 350 cryptocurrencies directly.

Bitunix provides fewer deposit options but focuses on making the process simpler for beginners. Their interface is more user-friendly, which new traders might prefer.

For withdrawals, Binance typically processes requests within 24 hours. They have higher daily withdrawal limits for verified accounts, which benefits high-volume traders.

Bitunix processes withdrawals faster in some cases, often completing them within a few hours. Their fee structure for withdrawals is generally lower than Binance, making it more cost-effective.

Here’s a quick comparison:

| Feature | Binance | Bitunix |

|---|---|---|

| Deposit Methods | Bank transfers, cards, P2P, 350+ cryptocurrencies | Fewer options but simpler process |

| Withdrawal Speed | Within 24 hours | Often within a few hours |

| Fees | Higher withdrawal fees | Lower withdrawal fees |

| User Experience | More complex | More user-friendly |

Both platforms require KYC verification for fiat withdrawals, but Bitunix has a more streamlined verification process.

You should consider which currencies you plan to trade most often, as this will impact your deposit and withdrawal options on either platform.

Binance Vs Bitunix: Trading & Platform Experience Comparison

When choosing between Binance and Bitunix, the trading experience differs in several key ways. Both platforms offer cryptocurrency trading, but with distinct features and interfaces.

Binance is known for its comprehensive trading tools and high liquidity. You’ll find advanced charting options and a wide variety of order types to execute your trading strategy.

Bitunix offers a more streamlined experience that many users find easier to navigate. Based on search results, some users consider Bitunix better than top-tier exchanges like Binance.

Security Features:

- Bitunix: Implements proof of reserves for added security

- Binance: Uses SAFU fund to protect user assets

Fee Comparison:

| Feature | Binance | Bitunix |

|---|---|---|

| Trading Fees | Varies by volume | Competitive rates |

| Compounding | No | Not specified |

| BTC Rate | Not specified | 0.28% |

The user interface on Binance can feel overwhelming for beginners with its many features and options. You might need time to learn the platform’s full capabilities.

Bitunix appears to focus on simplicity without sacrificing functionality. This makes it potentially more appealing if you’re new to crypto trading.

Trading volume is significantly higher on Binance, which can mean better liquidity for popular trading pairs. This allows you to execute larger trades with less price impact.

Binance Vs Bitunix: Liquidation Mechanism

When trading on margin or futures platforms, it’s important to understand how exchanges handle liquidations. Liquidation happens when your position can’t meet the minimum margin requirements.

Binance uses a tiered liquidation mechanism that gradually reduces positions rather than closing them all at once. This approach helps prevent market crashes during volatile periods.

Bitunix, as a newer exchange focusing on both spot and derivatives trading, also employs a liquidation system to protect users from excessive losses.

Recent market volatility has shown differences in how these platforms handle liquidations. According to Phoenix data, Binance wasn’t among the exchanges with the highest liquidation values, while other platforms like Bitfinex reached $144.68 million in liquidations.

Key Differences:

| Feature | Binance | Bitunix |

|---|---|---|

| Liquidation Warning | Provides alerts | Basic notifications |

| Partial Liquidation | Yes | Limited |

| Insurance Fund | Large reserve | Smaller but growing |

| Auto-Deleveraging | Used when insurance fund insufficient | Similar approach |

You can set stop-loss orders on both platforms to prevent liquidations before they happen. This is especially important during times of high market volatility.

Binance offers more advanced liquidation prevention tools, while Bitunix provides a more straightforward approach that may be easier for beginners to understand.

Binance Vs Bitunix: Insurance

When choosing a crypto exchange, insurance is a critical factor for protecting your assets. Both Binance and Bitunix offer different approaches to security and insurance.

Binance maintains a Secure Asset Fund for Users (SAFU), which holds 10% of all trading fees. This fund acts as insurance to protect user funds in extreme cases like hacks.

Bitunix emphasizes its proof of reserves system as mentioned in search results. This transparency measure allows users to verify that the exchange actually holds the assets it claims.

Neither exchange offers traditional insurance like FDIC protection that banks provide. Your crypto assets face different risks than traditional banking.

Binance Insurance Features:

- SAFU emergency fund

- Regular security audits

- Cold storage for majority of assets

Bitunix Insurance Features:

- Proof of reserves verification

- Security protocols for asset protection

- Cold wallet storage systems

You should consider these insurance differences when deciding between exchanges. The right choice depends on your risk tolerance and trading needs.

Remember that even with these protections, you should practice good security habits. Use strong passwords, enable two-factor authentication, and consider hardware wallets for long-term storage.

Binance Vs Bitunix: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both Binance and Bitunix offer support options, but there are notable differences.

Binance provides customer support through multiple channels including email tickets, chat support, and an extensive FAQ section. Response times can vary widely, often taking 24-48 hours during busy periods.

Bitunix, according to search results, has received high praise for its customer service. Trustpilot reviews mention Bitunix as one of the best crypto exchanges for customer support.

Comparison of Support Features:

| Feature | Binance | Bitunix |

|---|---|---|

| Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Response Time | Variable (24-48 hours) | Generally faster |

| User Ratings | Mixed | Highly rated |

You’ll find Binance’s support system more robust with extensive documentation, but potentially slower during peak times. Their large user base means support teams handle a massive volume of requests daily.

Bitunix, being a smaller but growing exchange, appears to prioritize customer service quality. This focus on support may be part of their strategy to compete with larger exchanges like Binance.

If immediate support is important for your trading activities, Bitunix might be the better choice based on user feedback. However, Binance offers more comprehensive self-help resources if you prefer finding answers without contacting support.

Binance Vs Bitunix: Security Features

When choosing a crypto exchange, security should be your top priority. Both Binance and Bitunix offer strong security features, but with some key differences.

Proof of Reserves

Bitunix stands out by providing proof of reserves, which adds an extra layer of security. This means you can verify that the platform actually holds the assets it claims to have.

Binance, while established longer, has faced some regulatory challenges in different countries. However, it maintains strong security protocols including two-factor authentication (2FA) and address whitelisting.

Security Measures Comparison

| Feature | Binance | Bitunix |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Proof of Reserves | Limited | ✓ |

| Insurance Fund | ✓ | ✓ |

| Regulatory Compliance | Varies by region | Growing |

Bitunix focuses heavily on security while maintaining a user-friendly experience. The platform prioritizes keeping your assets safe while still providing access to features like high leverage trading.

Both exchanges employ cold storage solutions to keep the majority of funds offline and safe from potential hackers. This is an industry standard that helps protect your investments.

You should enable all available security features regardless of which platform you choose. Always use strong passwords, enable 2FA, and consider using a hardware wallet for long-term storage.

Is Binance A Safe & Legal To Use?

Binance is generally considered a safe platform for cryptocurrency trading. The exchange stores most of its crypto assets in “cold wallets” that aren’t connected to the internet, protecting them from online threats.

For your personal data, Binance employs encryption to safeguard your information. This helps keep your sensitive details secure from potential breaches.

Regarding legality, Binance operates differently across various regions. Binance.US was specifically created to comply with U.S. regulations, as the main Binance platform faces restrictions in certain countries.

Key Safety Features:

- Cold storage for most crypto assets

- Encrypted personal data

- Two-factor authentication options

- Regular security audits

However, it’s worth noting that Binance operates under more restricted jurisdictions than some alternatives like Bitunix. This means your access to Binance services might be limited depending on where you live.

Before using Binance, you should check if it’s legally available in your country. Some regions have banned or restricted access to cryptocurrency exchanges, including Binance.

While Binance has built a reputation as a reputable exchange, always use standard security practices. Enable two-factor authentication, use strong passwords, and never share your private keys with anyone.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to be a secure cryptocurrency exchange based on available information. The platform prioritizes user security and has not experienced any hacks to date. This clean security record is important when choosing where to trade crypto.

The exchange operates in over 100 countries and emphasizes regulatory compliance. They follow anti-money laundering (AML) policies and counter-terrorism financing protocols to ensure ethical trading.

Bitunix offers additional security features that may give you peace of mind:

- Proof of reserves system to verify funds

- Complete licensing for operations

- Funds custody for an extra layer of protection

When comparing it to other exchanges, some users find Bitunix safer than even top-tier platforms. The exchange’s focus on compliance helps protect users from potential legal issues.

Before signing up, you should check if Bitunix is available in your country. While it operates in many regions, availability varies based on local regulations.

Always remember that cryptocurrency trading involves risks regardless of the platform. Even secure exchanges can’t eliminate market volatility or investment risks.

Frequently Asked Questions

Here are answers to common questions about Binance and Bitunix exchanges. These questions cover important aspects like security, fees, user experience, and available cryptocurrencies.

What are the main differences in security features between Binance and Bitunix?

Binance uses multiple security layers including two-factor authentication, address whitelisting, and cold storage for most assets. They also maintain a Secure Asset Fund for Users (SAFU) to protect customer funds in case of breaches.

Bitunix emphasizes its proof of reserves system which allows users to verify that their deposits are fully backed. This transparency feature gives users additional confidence in the platform’s security.

Both exchanges use encryption technology, but Binance has a longer track record of security management through various market cycles.

How do Binance and Bitunix compare in terms of transaction fees and costs?

Binance typically charges 0.1% for standard trading fees, with discounts available when using BNB tokens or for high-volume traders. Their fee structure is tiered based on trading volume and BNB holdings.

Bitunix appears to offer competitive fees that may be lower for certain transactions. The exact fee structure varies by transaction type and user level.

Withdrawal fees differ between the platforms, with each charging varying amounts based on the specific cryptocurrency being withdrawn.

What distinguishes the user experience on Binance from that on Bitunix?

Binance offers a feature-rich but potentially complex interface with advanced trading tools, charts, and options. This makes it powerful for experienced traders but possibly overwhelming for beginners.

Bitunix provides a more streamlined, user-friendly experience that prioritizes simplicity. Based on search results, Bitunix has “easier usability” compared to Binance’s more advanced features.

Both platforms offer mobile apps, but they differ in navigation style and available features for on-the-go trading.

How do the trading volumes and liquidity of Binance and Bitunix compare?

Binance maintains significantly higher trading volumes as one of the world’s largest cryptocurrency exchanges. This results in deeper liquidity pools and tighter spreads for most trading pairs.

Bitunix has lower overall trading volumes as a newer and smaller exchange. This can sometimes lead to wider spreads and potential slippage when trading less common pairs.

Liquidity differences are most noticeable during high market volatility or when trading less popular cryptocurrencies.

Which platform, Binance or Bitunix, offers a wider variety of cryptocurrencies?

Binance supports over 350 cryptocurrencies and thousands of trading pairs, making it one of the most comprehensive exchanges for crypto variety. You’ll find nearly every major coin and many smaller altcoins.

Bitunix offers a more limited selection of cryptocurrencies, focusing on established coins and tokens. The exact number isn’t specified in the search results.

The difference in available cryptocurrencies may impact your choice if you’re looking to trade specific altcoins or newer tokens.

How do Binance and Bitunix differ in their customer support and service quality?

Binance provides 24/7 customer support through multiple channels including chat, email, and an extensive knowledge base. Response times can vary based on ticket volume and issue complexity.

Bitunix’s customer support infrastructure appears to be developing, though specific details about their support system aren’t clear from the search results.

Both platforms offer self-service help sections, but Binance likely has more comprehensive documentation due to its larger size and longer history.

Binance Vs Bitunix Conclusion: Why Not Use Both?

Both Binance and Bitunix offer unique advantages that might benefit your crypto trading journey. There’s no rule saying you must choose just one platform.

Binance provides a well-established ecosystem with extensive market options and liquidity. However, it has stricter jurisdictional limitations and KYC requirements that might restrict access for some users.

Bitunix stands out with its accessibility features. You don’t need KYC verification or VPN usage to create an account and start trading. This platform also offers proof of reserves for added security assurance.

Your trading goals should guide your platform choice. If you want maximum asset selection and don’t mind identity verification, Binance might be your primary choice. For quick access without KYC barriers, Bitunix could be more suitable.

Consider using Binance for spot trading and long-term investments while utilizing Bitunix for derivatives and futures trading. This approach lets you leverage the strengths of both platforms.

Remember that all crypto trading involves significant risks. Never invest more than you can afford to lose, regardless of which platform you choose.

The crypto market evolves rapidly, so stay informed about changes to either platform’s policies, fees, and features. What works best for your trading strategy today might change as both exchanges continue to develop.