Choosing the right cryptocurrency exchange can make a big difference in your trading experience. In 2025, Binance and Bybit remain top choices for crypto traders worldwide. While both platforms offer competitive fees and user-friendly interfaces, they differ in significant ways that might affect your decision.

Binance continues to dominate the market with more trading pairs and a wider range of products compared to Bybit. This larger selection gives you more options when diversifying your portfolio or exploring niche cryptocurrencies. However, Bybit has built a strong reputation for its derivatives trading platform and intuitive user experience.

Your trading style and needs should guide your choice between these exchanges. If you value variety and ecosystem depth, Binance may be your better option. If you prefer specialized features for derivatives trading with a simpler interface, Bybit might better suit your needs. Both platforms maintain competitive fee structures, though their specific offerings continue to evolve in the fast-paced crypto market.

Binance Vs Aibit: At A Glance Comparison

When choosing between Binance and Aibit for your crypto trading needs, understanding their key differences can help you make the right choice.

Binance holds a stronger position in the market with a higher overall score of 8.1 according to comparison data. It ranks 6th with a Triple-A security rating, making it a trusted option for many traders.

Trading Options:

- Binance: Excellent for spot trading (preferred by 76% of surveyed users)

- Aibit: Better suited for derivatives and futures trading

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| Binance | Lower overall | Varies by asset |

| Aibit | Higher for some pairs | Competitive |

Binance offers more trading pairs and supports a wider range of fiat currencies, giving you more flexibility when entering or exiting the crypto market.

Security is a critical consideration for your crypto assets. Binance’s Triple-A rating provides stronger protection compared to Aibit’s lower security ranking.

For new traders, Binance’s user interface might feel overwhelming due to its extensive features. Aibit offers a more straightforward experience that you might find easier to navigate.

Both platforms provide mobile apps, but Binance’s app offers more functionality and tends to be more stable during high market volatility.

Binance Vs Aibit: Trading Markets, Products & Leverage Offered

Binance offers a more extensive range of trading markets compared to Aibit. With Binance, you can access over 350 cryptocurrencies for spot trading, while Aibit provides fewer options.

For product diversity, Binance clearly takes the lead with:

- Spot trading

- Futures contracts

- Options trading

- Margin trading

- Staking opportunities

- Savings products

Aibit focuses mainly on spot and futures trading, with fewer additional products in their ecosystem.

When it comes to leverage trading, both platforms allow you to amplify your position sizes:

| Exchange | Maximum Leverage | Margin Types | Interest Calculation |

|---|---|---|---|

| Binance | Up to 125x | Cross & Isolated | 24-hour basis |

| Aibit | Up to 100x | Cross & Isolated | Daily calculation |

Binance provides more futures markets than Aibit, giving you access to a wider range of leveraged trading opportunities. This is especially valuable if you’re looking to diversify your trading strategy.

For derivatives traders, Binance offers advanced tools and a larger selection of markets. You’ll find the platform more suitable for high-volume trading across different product categories.

Aibit does provide a simpler interface that might be easier to navigate for beginners interested in leverage trading. Their platform focuses on core offerings rather than overwhelming you with options.

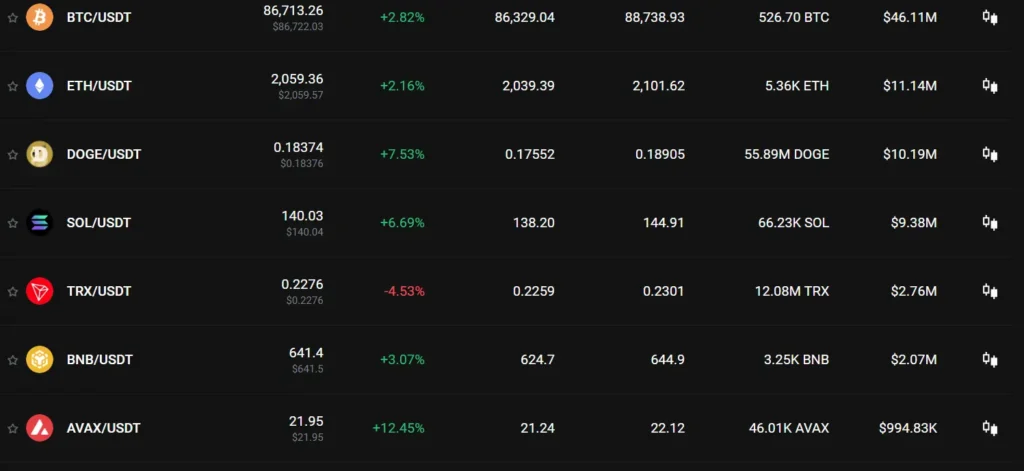

Binance Vs Aibit: Supported Cryptocurrencies

Binance stands out with its impressive range of over 600 cryptocurrencies available for trading. This extensive selection makes it one of the most diverse platforms in terms of crypto offerings.

Aibit, while growing in popularity, offers a more limited selection of cryptocurrencies compared to Binance.

When choosing between these exchanges, consider which specific coins you want to trade. Binance supports major cryptocurrencies like Bitcoin and Ethereum, but also hosts hundreds of altcoins and tokens from various blockchain projects.

Here’s a quick comparison of cryptocurrency support:

| Feature | Binance | Aibit |

|---|---|---|

| Number of cryptocurrencies | 600+ | Fewer options |

| Major coins (BTC, ETH) | ✓ | ✓ |

| Altcoin variety | Extensive | Limited |

| New token listings | Frequent | Less frequent |

Binance regularly adds new cryptocurrencies to its platform, giving you access to emerging projects and tokens. This makes it particularly attractive if you’re interested in exploring beyond mainstream cryptocurrencies.

For newer traders who only need access to popular cryptocurrencies, Aibit’s more focused selection might be sufficient for your needs.

You should check both platforms’ current listings before deciding, as supported cryptocurrencies can change over time as the market evolves and new projects emerge.

Binance Vs Aibit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Binance and Aibit, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Spot Trading Fees | Futures Taker Fees |

|---|---|---|

| Binance | Up to 0.1% | 0.05% |

| Aibit | Up to 0.1% | 0.055% |

Both platforms offer similar spot trading fees, but Binance has a slight edge with lower futures taker fees compared to Aibit.

Deposit Fees

Neither Binance nor Aibit typically charges fees for crypto deposits. This is standard across most major exchanges.

Withdrawal Fees

Withdrawal fees vary based on the cryptocurrency you’re moving. Binance often has competitive withdrawal fees that change based on network conditions.

Aibit also uses a dynamic fee structure for withdrawals that adjusts based on blockchain network congestion.

Fee Discounts

You can reduce your trading costs on both platforms. Binance offers fee discounts when you hold their native BNB token or increase your trading volume.

Aibit provides similar volume-based discounts to reward active traders.

Payment Method Fees

When using fiat currencies, both exchanges charge additional fees. Credit card deposits typically cost more than bank transfers on both platforms.

Always check the current fee schedules before trading, as both exchanges update their fee structures periodically to stay competitive in the market.

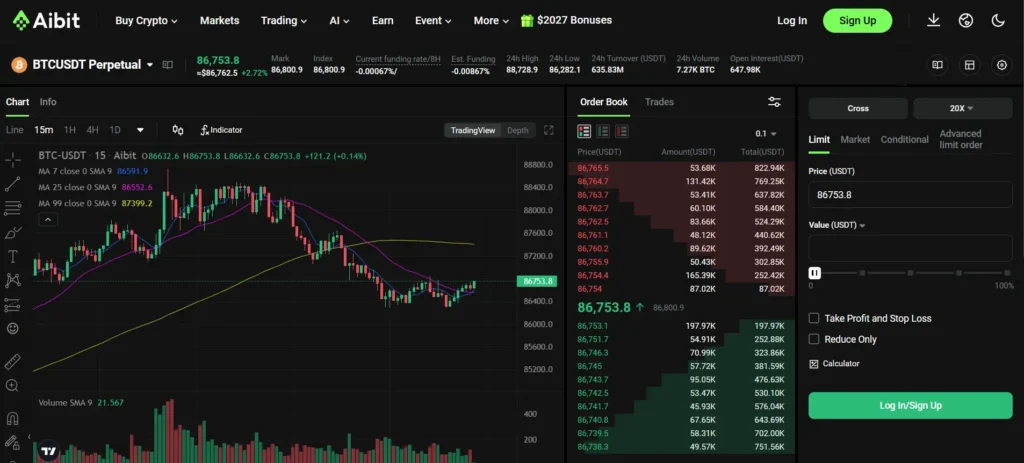

Binance Vs Aibit: Order Types

When trading on cryptocurrency exchanges, order types are essential tools that determine how your trades are executed. Binance offers a comprehensive range of order options for traders.

Binance provides several basic order types including Market and Limit orders. Market orders execute immediately at the current market price, while Limit orders allow you to set a specific price for buying or selling.

For more advanced trading, Binance features Stop-Limit orders, Stop Market orders, and Trailing Stop orders. These help manage risk by automatically executing trades when certain price conditions are met.

Binance also supports conditional order settings like Post Only, Iceberg, and Time in Force options. These give you more control over how your orders interact with the market.

Aibit, being a newer exchange, typically offers a more streamlined selection of order types. They usually provide the fundamental Market and Limit orders that cover basic trading needs.

Aibit may not have all the advanced conditional orders that Binance offers. This makes Binance potentially better suited for experienced traders who need sophisticated order types.

Here’s a quick comparison of common order types:

| Order Type | Binance | Aibit |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop-Limit | ✓ | Limited |

| Trailing Stop | ✓ | May not offer |

| Post Only | ✓ | Limited |

If you’re an advanced trader, Binance’s variety of order types gives you more flexibility. However, if you prefer simplicity, Aibit’s streamlined options might be sufficient.

Binance Vs Aibit: KYC Requirements & KYC Limits

Binance and Aibit have different approaches to KYC (Know Your Customer) procedures that affect how you can use their platforms.

Binance uses a tiered KYC system. For EU users, you can open an account with lower KYC requirements, but you’ll be limited to just one fiat transaction under 1,000 EUR.

Without completing KYC on Binance, you can create an account and use basic functions, but withdrawal amounts will be limited. This is part of Binance’s compliance efforts.

Binance KYC Level 1 requires basic information:

- Name

- Date of birth

- Basic personal details

For higher verification levels, Binance requires:

- Front and back of ID card

- Proof of address

- Facial verification video

Aibit generally has simpler KYC procedures than Binance. Their verification process is more streamlined and often requires fewer steps for basic account setup.

However, both platforms follow regulatory requirements in the jurisdictions they operate in.

Withdrawal Limits Comparison:

| Platform | Unverified | Basic KYC | Full KYC |

|---|---|---|---|

| Binance | Very limited | Moderate limits | High limits |

| Aibit | Small amount | Higher than Binance | Comparable to Binance |

Your choice between these platforms may depend on how comfortable you are with sharing personal information and what transaction volumes you need.

Remember that KYC requirements can change as regulations evolve, so it’s worth checking each platform’s current policies before signing up.

Binance Vs Aibit: Deposits & Withdrawal Options

When comparing Binance and Aibit’s deposit and withdrawal options, there are several key differences to consider. Both platforms offer various methods to fund your account and cash out your assets.

Deposit Methods:

- Binance: Supports crypto deposits, bank transfers, credit/debit cards, and P2P trading

- Aibit: Primarily focuses on crypto deposits with more limited fiat options

Binance provides fee-free and low-fee bank deposit options, making it an excellent crypto-to-fiat gateway. This gives you more flexibility when adding funds to your account.

Withdrawal Fees:

| Exchange | Crypto Withdrawal | Fiat Withdrawal |

|---|---|---|

| Binance | Lower fees | Multiple options |

| Aibit | Higher fees | Limited options |

Binance stands out with lower crypto withdrawal fees compared to Aibit. This can save you money, especially if you frequently move assets off the exchange.

Both platforms have zero deposit fees, which is a common practice among major exchanges. However, the withdrawal process differs significantly between the two.

Processing times also vary between the platforms. Binance typically processes withdrawals faster, particularly for popular cryptocurrencies like Bitcoin and Ethereum.

You’ll find that Binance offers more comprehensive on-ramp and off-ramp solutions if you need to convert between fiat currencies and cryptocurrencies regularly.

Binance Vs Aibit: Trading & Platform Experience Comparison

When comparing Binance and Aibit trading platforms, several key differences stand out. Binance offers a more comprehensive selection of trading pairs, making it suitable for traders who want access to a wide variety of cryptocurrencies.

The user interface on Binance can feel overwhelming for beginners due to its numerous features. Aibit, while having fewer options, provides a cleaner interface that new traders might find easier to navigate.

Trading Tools Comparison:

| Feature | Binance | Aibit |

|---|---|---|

| Trading pairs | 350+ | Limited selection |

| Chart tools | Advanced | Basic |

| Mobile app | Comprehensive | User-friendly |

| Order types | Multiple | Standard |

Binance excels in trading volume, which contributes to better liquidity. This means you can execute larger trades with less price slippage compared to Aibit.

For derivatives trading, Binance offers up to higher leverage options. This appeals to experienced traders looking for greater exposure with less capital.

Both platforms provide spot trading capabilities, but Binance has more advanced features like OCO (One-Cancels-the-Other) orders and more detailed charting tools.

Aibit’s platform may load faster and experience fewer outages during high-volume trading periods. This reliability can be crucial when making time-sensitive trades.

The mobile experience differs between the two. Binance’s app packs more features but can feel cluttered. Aibit focuses on simplicity, making it easier to execute basic trades on the go.

Binance Vs Aibit: Liquidation Mechanism

Liquidation happens when traders can’t maintain minimum margin requirements for their positions. Both Binance and Aibit have systems to handle these situations, but they work differently.

Binance uses a structured approach focusing on two key prices: the liquidation price and the bankruptcy price. When your position reaches the liquidation price, Binance’s system automatically begins closing your position.

This process helps protect both you and the exchange from bigger losses. Recent data shows over 135,000 traders were liquidated during market volatility on Binance and other exchanges.

Aibit, meanwhile, approaches liquidations with its own mechanism. While less information is publicly available about Aibit’s specific process, all exchanges must have these safety nets.

Key Differences:

| Feature | Binance | Aibit |

|---|---|---|

| Liquidation Trigger | Based on liquidation price | Platform specific |

| Transparency | Well-documented process | Less publicly documented |

| Market Impact | Can lead to mass liquidations during volatility | Varies based on market conditions |

You should consider these liquidation mechanisms when choosing between platforms. Your trading style and risk tolerance will determine which system works better for you.

Binance has faced some criticism and legal challenges related to liquidations. Some users claim “spoofy bots” caused mass liquidations on May 19, 2021, leading to class action lawsuits.

Understanding how each platform handles liquidations can help you prepare for market volatility and potentially avoid account liquidation.

Binance Vs Aibit: Insurance

When trading cryptocurrency, protection against potential losses is crucial. Both Binance and Aibit offer insurance options, but they differ in coverage and implementation.

Binance maintains a Secure Asset Fund for Users (SAFU), which holds 10% of all trading fees. This fund currently exceeds $1 billion and serves as emergency protection if security breaches occur.

Aibit’s insurance approach focuses on protecting user funds through a tiered system based on account levels. The coverage limits increase as your trading volume grows.

Binance Insurance Features:

- SAFU protection for all users

- Coverage for security breaches

- No additional cost to users

- Transparent fund size reporting

Aibit Insurance Features:

- Tiered coverage based on account level

- Specific protection for derivatives trading

- Optional additional coverage (fees apply)

- Regular proof-of-reserves audits

For active traders, Binance’s larger user base (approximately 224 million) offers stability that indirectly strengthens their insurance capacity. Aibit, with roughly 62 million users, provides more personalized coverage options.

Neither exchange guarantees complete protection against market volatility or price fluctuations. Their insurance primarily addresses security incidents and exchange failures.

You should verify the current insurance policies on both platforms before making your decision, as coverage terms can change and vary by region.

Binance Vs Aibit: Customer Support

Binance has a robust customer support system featuring an advanced AI bot. This bot suggests solutions based on the details you provide and lets you browse through common issues.

Binance’s customer service department is their largest team. It includes agents who handle immediate user inquiries, training staff, quality assurance specialists, and token recovery experts.

When you need help on Binance, you can access their AI-powered support system directly through their platform. The system is designed to quickly address common problems and guide you to solutions.

Aibit’s customer support, by comparison, offers standard service options but lacks the advanced AI capabilities that Binance provides. Their support team is smaller and may have longer response times.

Both exchanges offer email support, but Binance typically responds faster due to their larger team size. You might wait several hours for Aibit versus a shorter time with Binance.

For urgent issues, Binance offers more channels to get help. Their extensive knowledge base also means you can often find answers without waiting for agent assistance.

Neither platform offers phone support, which is common in the crypto exchange industry. Both rely primarily on ticket-based systems and chat support.

If customer service is a priority for you, Binance’s larger team and AI-powered system give it an edge over Aibit in most support scenarios.

Binance Vs Aibit: Security Features

When choosing a crypto exchange, security should be your top priority. Both Binance and Aibit offer various safety measures to protect your investments.

Binance currently ranks 6th with a Triple-A security rating according to Certified, making it one of the more secure platforms in the crypto space. The exchange implements several protective measures for your assets.

Binance Security Features:

- Two-factor authentication (2FA)

- Advanced encryption for data protection

- SAFU fund (Secure Asset Fund for Users)

- Comprehensive KYC procedures

- Cold wallet storage for majority of assets

Aibit (note: limited information is available in the search results) appears to be a newer exchange compared to the well-established Binance. When considering Aibit’s security, you should look for these essential features.

Important Security Considerations:

- Insurance coverage for funds

- Regulatory compliance

- Transparency in operations

- History of security incidents

- Cold storage policies

You should verify if Aibit offers similar security standards as Binance before making your decision. Check for user reviews and security certifications.

Remember to enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious of phishing attempts.

Is Binance A Safe & Legal To Use?

Binance is generally considered a safe cryptocurrency exchange, but with some important points to consider. The platform keeps most of its cryptocurrency in “cold wallets” that aren’t connected to the internet, which helps protect assets from hackers.

For your personal information, Binance uses encryption to safeguard your data. This is essential when you’re providing the verification documents needed for their KYC (Know Your Customer) process.

Binance has faced legal challenges in the past. The company was sued for alleged fraudulent activity, illegal securities, and market manipulation. This has raised some concerns about its operations.

If you’re in the US, you should use Binance.US, which is a separate platform specifically designed to comply with US regulations. The main Binance.com site isn’t legally available to US residents.

Key Security Features:

- Two-factor authentication (2FA)

- Anti-phishing code

- Device management

- Address whitelisting

Legal Status by Region:

| Region | Status |

|---|---|

| US | Legal (Binance.US only) |

| UK | Restricted (regulatory issues) |

| EU | Varies by country |

| Asia | Generally legal with exceptions |

To keep your assets safer on Binance, use all available security features and consider moving large holdings to a personal hardware wallet when not actively trading.

Is Aibit A Safe & Legal To Use?

Aibit’s safety profile needs careful evaluation before you commit your crypto assets. Based on available information, Aibit appears to be a lesser-known exchange compared to established platforms like Binance and Bybit.

When assessing Aibit’s safety, you should look for key security features such as two-factor authentication (2FA), cold storage for most funds, and regular security audits. These are industry standards that reputable exchanges maintain.

The legal status of Aibit varies by country. You should verify if Aibit is properly registered and compliant with regulations in your jurisdiction. This is crucial because using an unlicensed exchange can expose you to legal risks.

Important safety considerations:

- Check for regulatory compliance in your country

- Look for transparent security measures

- Verify insurance coverage for user funds

- Research the company’s history and leadership team

Many crypto experts recommend not keeping large amounts of assets on any exchange. The safest practice is to use hardware wallets like Ledger or Trezor for long-term storage of significant crypto holdings.

Before using Aibit, research recent user reviews and experiences. This helps you gauge the platform’s reliability and customer service quality.

Remember that the crypto exchange landscape changes rapidly. Regulations evolve and platform security can shift over time.

Frequently Asked Questions

Traders often wonder about specific differences between cryptocurrency exchanges when deciding where to invest their money. Here are answers to common questions about various exchanges compared to Binance.

How do fees compare between Bybit and Binance for trading cryptocurrencies?

Binance typically offers lower spot trading fees than Bybit, with standard fees starting at 0.1% for makers and takers. Bybit’s standard fees start at 0.1% for makers and 0.1% for takers.

Both exchanges offer fee discounts based on trading volume and token holdings. Binance users can reduce fees by holding BNB tokens, while Bybit offers similar discounts for its native tokens.

For derivatives trading, Bybit sometimes offers more competitive rates, especially for futures contracts where fees can be as low as 0.02% for makers.

What are the differences in security measures between OKX and Binance?

Both Binance and OKX employ two-factor authentication, cold storage for most funds, and regular security audits. Binance maintains a larger Secure Asset Fund for Users (SAFU) to protect against potential breaches.

Binance has faced more public security incidents but has demonstrated strong recovery protocols. OKX implements a comprehensive account security system with multiple verification layers.

Binance offers more advanced security features like anti-phishing codes, withdrawal address management, and device management options compared to OKX.

Which platform offers a better user experience, Bybit or Binance?

Binance provides a more comprehensive but potentially overwhelming interface with extensive features and trading options. Bybit offers a cleaner, more intuitive interface that many beginners find easier to navigate.

Binance’s mobile app receives higher ratings than Bybit’s for reliability and feature completeness. Both platforms offer demo accounts, but Bybit’s paper trading feature is particularly praised for helping new traders practice.

Bybit excels in contract trading interfaces, while Binance offers better integration between different products like spot, futures, and savings in one account.

Is there a cryptocurrency exchange that is considered superior to Binance in terms of features?

No single exchange completely outperforms Binance in overall features. Kraken may offer better security measures and compliance, while Coinbase provides a more beginner-friendly interface.

FTX (before its collapse) offered innovative derivatives products that some traders preferred over Binance’s offerings. For specific needs, exchanges like KuCoin provide access to more micro-cap altcoins than Binance.

Binance maintains the edge in overall feature diversity, liquidity depth, and global availability despite regulatory challenges in some regions.

What are the pros and cons of using Bybit versus Binance for leveraged trading?

Bybit offers higher leverage options (up to 100x) compared to Binance’s maximum of 20x in many regions. Bybit’s interface is more focused on derivatives trading, with clearer position management tools.

Binance provides better liquidity for most trading pairs, which results in less slippage during large trades. Bybit has a more forgiving liquidation process with partial liquidations rather than full position closures.

Binance offers a wider variety of margin assets, while Bybit excels in BTC and ETH perpetual contracts specifically. Insurance funds differ significantly, with Binance maintaining a larger fund for user protection.

How do the coin selections and market options of Binance and Bybit differ?

Binance lists substantially more cryptocurrencies (500+) compared to Bybit’s more limited selection (approximately 160-180 coins). Binance typically adds new tokens faster and offers more trading pairs.

Bybit focuses primarily on major cryptocurrencies and select altcoins with high trading volumes. Both exchanges offer spot, futures, and options markets, but Binance provides more specialized products like leveraged tokens and liquid swap options.

Binance’s launchpad for new token offerings gives users access to emerging projects, a feature that Bybit lacks. Trading volumes are generally higher on Binance, providing better liquidity for most assets.

Aibit Vs Binance Conclusion: Why Not Use Both?

Both Binance and Aibit offer valuable features for crypto traders. Using both platforms can give you more trading options and better risk management.

Binance has been around longer and offers more cryptocurrency pairs. This makes it great for traders who want variety and established reliability.

Aibit (which appears to be confused with Bybit in the search results) has its own strengths that complement what Binance offers.

Key reasons to use both platforms:

- Fee optimization – You can choose the platform with lower fees for specific transactions

- Different trading pairs – Access more markets and opportunities

- Risk distribution – Don’t keep all your assets on one exchange

- Feature comparison – Use the best tools from each platform

The crypto market moves quickly, and having accounts on multiple exchanges keeps your options open. You can take advantage of temporary price differences or special promotions.

Setting up accounts on both platforms takes minimal time but provides maximum flexibility. Each has different security measures, which adds another layer of protection for your overall crypto strategy.

Remember to verify the current fees, available cryptocurrencies, and security features on both platforms before trading, as these details can change frequently in the crypto world.