If you’re looking to trade cryptocurrency in 2025, choosing the right exchange is crucial. Aibit and WhiteBIT represent two popular options, each with unique features that might suit different trading needs.

WhiteBIT stands out as one of Europe’s largest crypto exchanges, founded in Ukraine in 2018, with impressive trading volumes reaching $2.7 trillion annually and a market capitalization of $38.9 billion. When you sign up for WhiteBIT, you receive a multicurrency wallet that can be topped up using credit cards or other payment methods, making it accessible for both beginners and experienced traders.

Understanding the differences between these platforms can help you make a better choice for your investing strategy. Factors like fees, available cryptocurrencies, security features, and user experience vary between Aibit and WhiteBIT, affecting your overall trading experience and potential returns.

Aibit Vs WhiteBIT: At A Glance Comparison

When choosing between Aibit and WhiteBIT for your cryptocurrency trading needs, understanding their key differences is essential.

WhiteBIT is Europe’s largest cryptocurrency exchange by traffic, serving 8 million users with daily trading volumes reaching up to $11 billion. It offers a secure and feature-rich trading platform.

Aibit, while less established than WhiteBIT, offers its own set of features aimed at both beginner and experienced traders.

| Feature | WhiteBIT | Aibit |

|---|---|---|

| User Base | 8+ million users | Smaller user base |

| Available Cryptocurrencies | 325+ | Fewer options |

| Security | Strong security measures | Standard security protocols |

| Trading Volume | Up to $11 billion daily | Lower trading volume |

| Trading Features | Comprehensive tools | Basic trading tools |

WhiteBIT stands out with its larger selection of cryptocurrencies and established reputation in the European market. The platform offers a wide range of trading options and tools for different trading strategies.

Aibit may appeal to you if you’re looking for a simpler interface with potentially lower fees. However, you’ll find fewer cryptocurrency options compared to WhiteBIT.

For security-conscious traders, WhiteBIT’s proven track record and larger user base might provide more confidence. The exchange has invested significantly in security infrastructure to protect user assets.

Both platforms offer mobile apps, but WhiteBIT’s app tends to have more functionality and regular updates due to its larger development team.

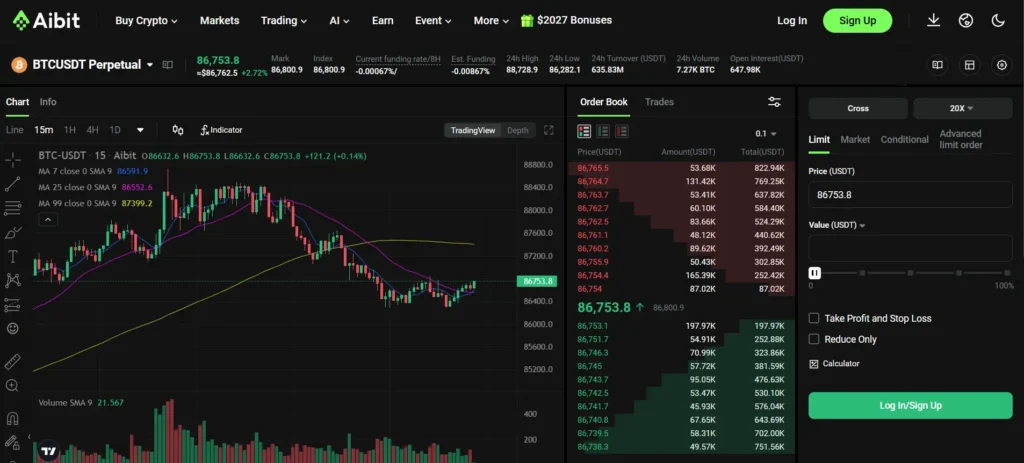

Aibit Vs WhiteBIT: Trading Markets, Products & Leverage Offered

When choosing between Aibit and WhiteBIT, understanding their trading offerings is crucial for your investment strategy.

WhiteBIT offers a comprehensive range of trading options including spot, futures, and margin markets. The exchange provides competitive leverage options and supports advanced execution strategies for experienced traders.

Aibit, while newer to the market, also offers spot trading but with a more limited selection of trading pairs compared to WhiteBIT.

Leverage Comparison:

| Exchange | Maximum Leverage | Markets Available |

|---|---|---|

| WhiteBIT | Up to 20x (varies by asset) | Spot, Futures, Margin |

| Aibit | Up to 10x (limited assets) | Primarily Spot |

WhiteBIT is considered one of Europe’s largest cryptocurrency exchanges, with strong presence in European and CIS markets but operating globally.

Product Offerings:

- WhiteBIT: Advanced trading tools, futures contracts, margin trading, staking options

- Aibit: Basic spot trading, simpler interface for beginners, limited advanced features

WhiteBIT’s partnership with Bequant has further expanded its trading capabilities, giving you access to more sophisticated execution strategies if you’re an advanced trader.

For new traders, Aibit’s simpler product lineup might be less overwhelming. However, if you need variety and advanced trading options, WhiteBIT provides more comprehensive tools and markets.

Trading volume is significantly higher on WhiteBIT, which typically results in better liquidity and tighter spreads for popular trading pairs.

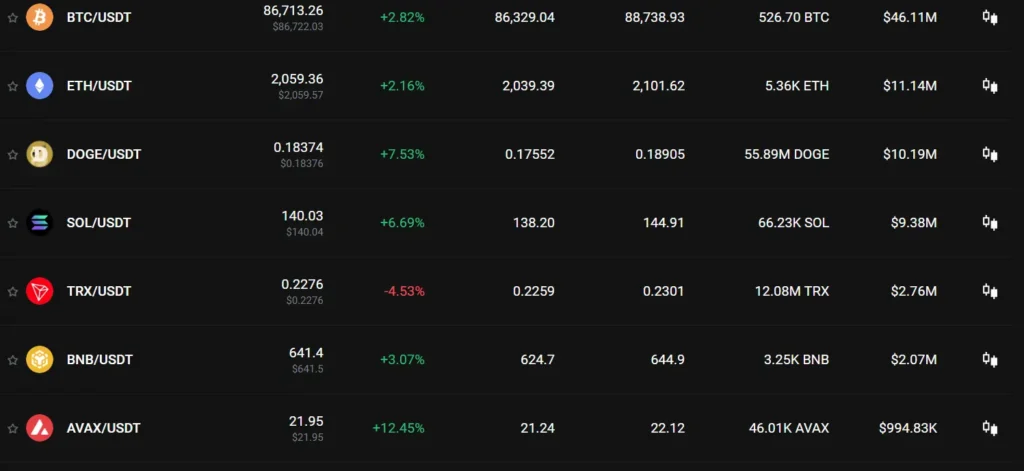

Aibit Vs WhiteBIT: Supported Cryptocurrencies

When choosing between Aibit and WhiteBIT, the variety of supported cryptocurrencies is an important factor to consider.

WhiteBIT offers an impressive selection with over 330 cryptocurrencies available for trading. This includes major assets like Bitcoin and Ethereum, along with many altcoins.

The exchange provides access to more than 550 trading pairs for spot trading. For those interested in futures trading, WhiteBIT supports over 180 futures trading pairs.

Aibit, while growing its offerings, typically supports fewer cryptocurrencies than WhiteBIT. However, Aibit does include the most popular coins and tokens that most traders regularly use.

Comparison of Supported Assets:

| Feature | WhiteBIT | Aibit |

|---|---|---|

| Total cryptocurrencies | 330+ | Fewer options |

| Trading pairs | 550+ | Limited selection |

| Futures pairs | 180+ | Basic offerings |

| Major coins (BTC, ETH) | ✓ | ✓ |

If you’re looking for extensive cryptocurrency options, WhiteBIT’s larger selection might better serve your needs. This is especially true if you trade lesser-known altcoins.

For beginners or those who focus mainly on popular cryptocurrencies, either platform could work well for your trading activities.

Remember that both exchanges regularly add new cryptocurrencies, so it’s worth checking their current listings before making your final decision.

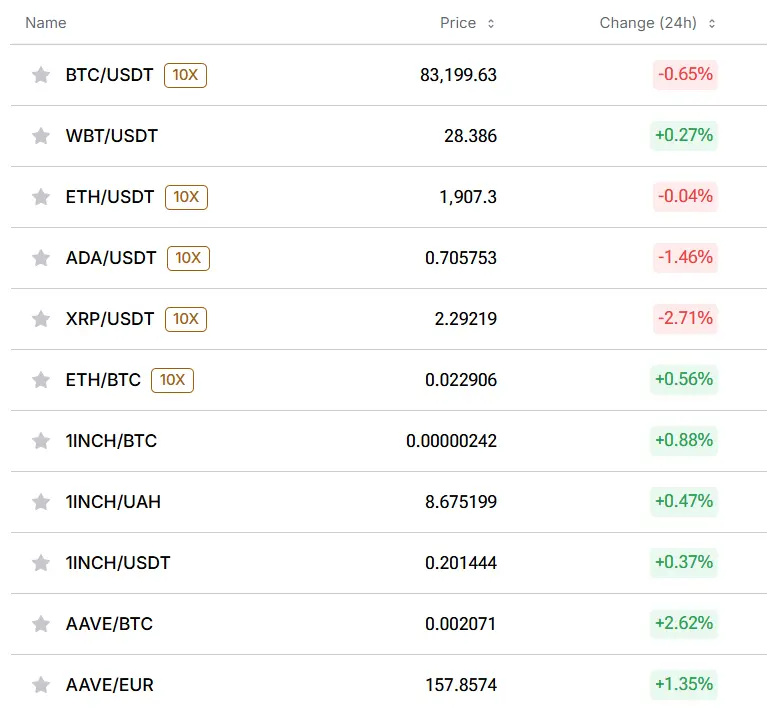

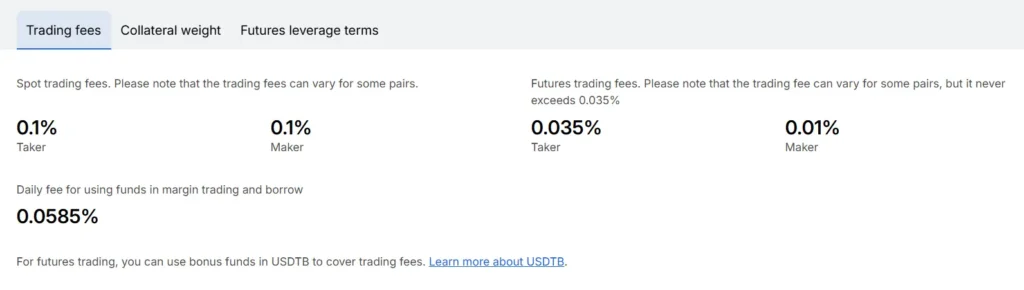

Aibit Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Aibit and WhiteBIT, fees are a critical factor in your decision-making process. Both exchanges offer competitive fee structures, but there are notable differences to consider.

WhiteBIT maintains a maker-taker fee model with 0.01% for makers and 0.035% for takers. These rates are quite competitive in the crypto exchange market in 2025.

Aibit’s trading fee structure is slightly different, though specific rates may vary based on trading volume and token holdings.

Deposit Fees Comparison:

| Exchange | Crypto Deposits | Fiat Deposits |

|---|---|---|

| WhiteBIT | Most are free | Varies by method |

| Aibit | Most are free | Varies by method |

For withdrawals, WhiteBIT charges 1.5% for Advcash withdrawals in EUR, USD, and RUB, while UAH withdrawals cost 4.5%. These fees can add up for frequent traders.

WhiteBIT provides detailed information about various transaction methods including Mastercard and ApplePay, making it easier for you to calculate potential costs.

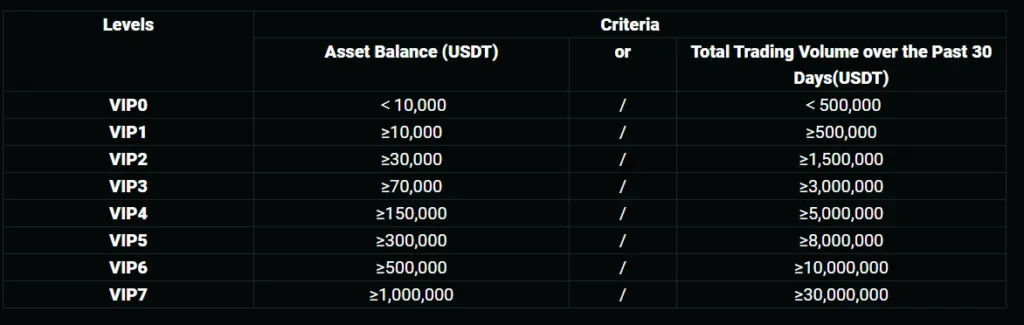

Both exchanges adjust fees based on trading volume and loyalty programs. Higher trading volumes typically result in lower fees on both platforms.

You should review the most current fee schedules on both exchange websites before making your decision, as crypto exchange fees can change with market conditions.

Aibit Vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Let’s compare the order types offered by Aibit and WhiteBIT.

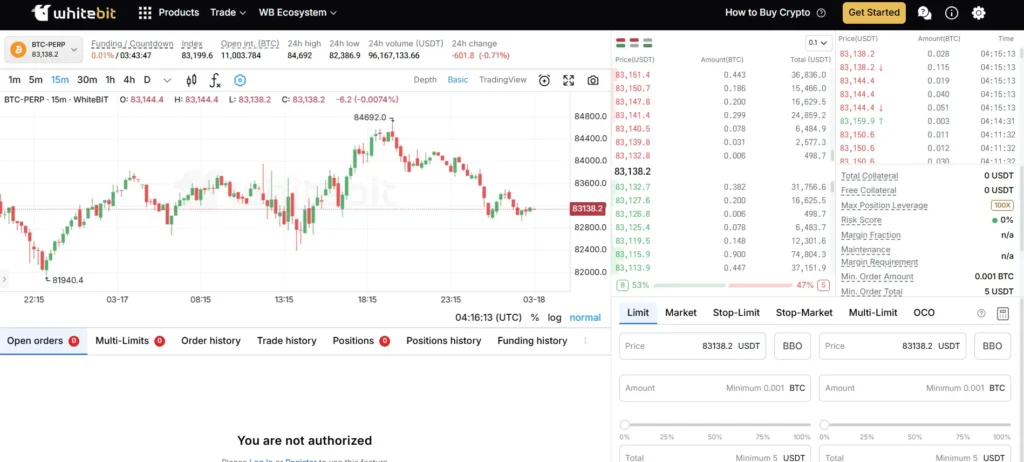

WhiteBIT provides 6 main types of trading orders:

- Market Orders: Execute immediately at current market prices

- Limit Orders: Set a specific price for buying or selling

- Multi-Limit Orders: Place multiple limit orders at once

- Stop-Limit Orders: Combine stop triggers with limit order execution

- Stop-Market Orders: Trigger market orders when price reaches set level

- OCO (One Cancels Other): Link two orders so when one executes, the other cancels

WhiteBIT also offers Trailing Stop orders, which automatically adjust your stop price as the market moves in your favor.

Aibit generally offers standard order types like market and limit orders, but has fewer specialized order types compared to WhiteBIT.

The availability of conditional orders on WhiteBIT gives you more flexibility for automated trading strategies. You can set up various scenarios to enter or exit positions without constantly monitoring the market.

When choosing between these exchanges, consider which order types best suit your trading style. If you use advanced strategies requiring conditional orders, WhiteBIT’s wider range of order types might better serve your needs.

Trading experience differs significantly between platforms based on these available order mechanisms.

Aibit Vs WhiteBIT: KYC Requirements & KYC Limits

WhiteBIT has implemented mandatory KYC (Know Your Customer) for all users who registered after September 21, 2022. If you signed up before this date, you can decide whether to complete verification.

WhiteBIT’s KYC process is an important security measure that helps prevent fraud and ensures only verified users can access the platform. All users must complete KYC when required, regardless of withdrawal amounts.

Aibit, on the other hand, offers more flexibility with its tiered KYC approach. You can start trading with minimal verification at lower levels.

WhiteBIT KYC Levels:

- Basic verification: Required for all new users

- Full verification: Needed for higher withdrawal limits

- Compliance: Follows both KYC and AML (Anti-Money Laundering) requirements

Aibit KYC Levels:

- Level 0: Basic access with email only

- Level 1: Increased limits with ID verification

- Level 2: Higher limits with additional documentation

The main difference lies in WhiteBIT’s stricter KYC policy versus Aibit’s more flexible approach. Your choice may depend on how much personal information you’re willing to share.

Remember that KYC requirements can change based on regulations in your country. Both exchanges update their policies regularly to stay compliant with international standards.

Aibit Vs WhiteBIT: Deposits & Withdrawal Options

When choosing between Aibit and WhiteBIT, deposit and withdrawal options are important factors to consider.

WhiteBIT offers multiple deposit methods including credit/debit cards, electronic wallets, and cryptocurrency transfers. The process is straightforward—just click the yellow “Deposit” button in the top menu or find it on the homepage banner.

For withdrawals, WhiteBIT supports credit/debit cards and cryptocurrencies. Each cryptocurrency has different withdrawal fees, while deposits are generally free. You can check specific fee details on their Fees page.

Aibit also provides various deposit and withdrawal options, but with some key differences. They support bank transfers, cryptocurrencies, and certain e-wallets for funding your account.

Comparison of Deposit Methods:

| Method | WhiteBIT | Aibit |

|---|---|---|

| Credit/Debit Cards | ✓ | ✓ |

| Cryptocurrency | ✓ | ✓ |

| Bank Transfer | Limited | ✓ |

| E-Wallets | ✓ | Partial |

Withdrawal Speed Comparison:

- WhiteBIT: Crypto withdrawals typically process within 1-2 hours

- Aibit: Most withdrawals complete within 24 hours

Both platforms verify your identity before allowing withdrawals for security reasons. This might take extra time for new users.

Fee structures differ between the platforms. WhiteBIT charges varying fees based on the cryptocurrency you’re withdrawing, while Aibit’s fee structure is tiered based on your account level and activity.

Aibit Vs WhiteBIT: Trading & Platform Experience Comparison

WhiteBIT offers a user-friendly interface designed for both beginners and experienced traders. The platform is well-developed with an easy-to-understand user experience that keeps amateur traders in mind.

WhiteBIT has seen significant growth, recently surpassing 5 million users. In the past year alone, they added over 1 million new users, more than doubling their user base since 2022.

Aibit, while less mentioned in the search results, competes in the same cryptocurrency exchange space. When comparing the two platforms, several factors stand out:

User Interface

- WhiteBIT: Intuitive, beginner-friendly design

- Aibit: Modern interface with focus on simplicity

Trading Features

| Feature | WhiteBIT | Aibit |

|---|---|---|

| Trading pairs | Extensive | Growing selection |

| Trading tools | Comprehensive | Basic but functional |

| Mobile support | Strong | Available |

When you’re choosing between these platforms, consider your experience level. WhiteBIT might be better if you’re new to crypto trading due to its intuitive design.

Both platforms offer the core trading functionality you’d expect, but WhiteBIT’s larger user base suggests more liquidity for your trades.

Trading fees vary between the platforms, so you’ll want to compare specific fee structures based on your typical trading volume and patterns.

Aibit Vs WhiteBIT: Liquidation Mechanism

Liquidation is a critical process in crypto trading where exchanges forcibly close a trader’s position when they lack sufficient margin to maintain it. Both Aibit and WhiteBIT implement liquidation mechanisms, but with notable differences.

WhiteBIT’s liquidation process focuses on risk management. When your margin funds become insufficient, the platform will automatically close your position to prevent further losses.

A standout feature on WhiteBIT is the Orders AutoCancel system. This helpful tool automatically cancels your open orders before liquidation occurs, giving you a safety buffer against sudden market movements.

WhiteBIT has recently improved its risk management approach to address issues with high leverage trading. These adjustments aim to prevent sudden liquidations and promote market stability.

Aibit’s liquidation mechanism operates similarly but with its own unique parameters. The platform calculates your liquidation price based on your position size and available margin.

Key Comparison Points:

| Feature | WhiteBIT | Aibit |

|---|---|---|

| Pre-liquidation Warning | Orders AutoCancel | Standard notifications |

| Risk Management | Recently improved | Standard implementation |

| Liquidation Process | Automatic position closure | Automatic position closure |

You should closely monitor your positions on both platforms to avoid liquidation. Setting stop-loss orders and using lower leverage can help reduce your liquidation risk regardless of which platform you choose.

Aibit Vs WhiteBIT: Insurance

When comparing cryptocurrency exchanges, insurance policies are vital for your asset protection. Both Aibit and WhiteBIT take different approaches to securing user funds.

WhiteBIT demonstrates strong security credentials with an AAA security rating and a perfect 100% security score according to CER.live. The exchange has also achieved CCSS Level 3 Certification through Hacken, which represents the most rigorous security framework available for crypto exchanges.

Aibit offers insurance on deposits, though with specific limitations. Their coverage applies to certain assets and has maximum reimbursement caps per user.

WhiteBIT, as Europe’s largest cryptocurrency exchange by traffic, maintains a robust security infrastructure with approved penetration testing and an ongoing bug bounty program. This proactive approach helps identify vulnerabilities before they can be exploited.

Security Comparison:

| Feature | Aibit | WhiteBIT |

|---|---|---|

| Security Rating | N/A | AAA (100% score) |

| Certifications | Basic | CCSS Level 3 |

| Insurance Type | Deposit insurance | Platform security focus |

| Bug Bounty Program | Limited | Ongoing |

Both exchanges provide multicurrency wallets upon signup, but their insurance approaches reflect different priorities. WhiteBIT emphasizes preventative security measures, while Aibit focuses more on compensation after potential incidents.

You should consider these differences when choosing which platform better matches your risk tolerance and security needs.

Aibit Vs WhiteBIT: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Let’s compare how Aibit and WhiteBIT handle user assistance.

WhiteBIT offers 24/7 customer support through multiple channels. You can reach their team anytime you encounter issues with your account or transactions.

One standout feature of WhiteBIT is their voice support option. You can speak directly with experts via phone when you need immediate assistance.

WhiteBIT’s support system is designed to be comprehensive and attentive. Their team serves users across different regions with various communication preferences.

Aibit also provides customer support, but with some differences in availability and communication channels. Their response times may vary depending on your query complexity.

Support Comparison:

| Feature | WhiteBIT | Aibit |

|---|---|---|

| 24/7 Availability | Yes | Limited |

| Voice Support | Yes | No |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Multilingual | Yes | Yes |

You’ll find WhiteBIT’s support documentation more extensive, which helps solve common issues without contacting representatives.

Both platforms offer help sections and FAQs, but WhiteBIT’s resources tend to be more detailed and user-friendly.

For new users, WhiteBIT’s attentive support system might provide a smoother onboarding experience compared to Aibit’s more streamlined approach.

Aibit Vs WhiteBIT: Security Features

When choosing a crypto exchange, security should be your top priority. Let’s compare how Aibit and WhiteBIT protect your assets.

WhiteBIT ranks among the top 5 most secure cryptocurrency exchanges globally according to CER.live. This is a significant achievement in the crypto security space.

One of WhiteBIT’s standout features is their cold storage policy. They store 96% of all digital assets in cold wallets, which significantly reduces vulnerability to hacking attempts.

WhiteBIT offers robust user protection through:

- Two-factor authentication (2FA)

- Anti-phishing tools

- Advanced encryption systems

For additional security, WhiteBIT provides anti-phishing protection to guard against common social engineering attacks that target crypto users.

Aibit also implements security measures, though they aren’t as widely recognized for their security rankings. Like many exchanges, they offer standard security protocols to protect user funds.

Security Feature Comparison:

| Feature | WhiteBIT | Aibit |

|---|---|---|

| Cold Storage | 96% of assets | Standard implementation |

| Two-Factor Authentication | Yes | Yes |

| Anti-phishing Tools | Yes | Basic protection |

| Security Ranking | Top 5 globally (CER.live) | Not specifically ranked |

You should consider these security differences when deciding which platform better meets your needs for protecting your cryptocurrency investments.

Is Aibit Safe & Legal To Use?

Aibit operates under regulatory compliance in most countries where it offers services. You should check your local laws to make sure crypto trading is permitted in your region before signing up.

The platform implements standard security features including two-factor authentication (2FA) and cold storage for most user funds. Users report that withdrawal processes include security checks to prevent unauthorized access.

Aibit uses encryption protocols to protect user data and transactions. The platform has not reported any major security breaches as of March 2025.

Your funds on Aibit are generally protected by the platform’s security systems, but as with any crypto exchange, you should follow basic security practices:

- Enable all security features offered by the platform

- Use a strong, unique password

- Never share your authentication codes

- Consider using a hardware wallet for long-term storage

Aibit maintains a dedicated security team that monitors the platform for suspicious activities. The exchange regularly updates its security measures to address new threats.

While Aibit appears to maintain adequate security standards, it doesn’t yet have the established reputation of some competitors. WhiteBIT, for comparison, has received AAA security ratings and is recognized among the top 3 safest trading platforms.

Is WhiteBIT Safe & Legal To Use?

WhiteBIT is considered one of the safest cryptocurrency exchanges, with an AAA security rating that places it among the top 3 safest trading platforms available. This well-established exchange prioritizes security for its users.

The platform employs a Web Application Firewall (WAF) to detect and block common online attacks such as cross-site scripting and SQL injection. These protective measures help keep your funds and personal information secure.

WhiteBIT was the first exchange to achieve the highest level of cryptocurrency security certification. This demonstrates their commitment to maintaining robust protection for users’ assets and data.

For traders concerned about legitimacy, WhiteBIT operates as a regulated platform that complies with industry standards. This makes it a legal option for cryptocurrency trading in most regions.

The exchange combines security with user-friendly features, making it accessible for both beginners and experienced traders. You’ll find the platform straightforward to navigate while still offering advanced trading options.

When comparing safety features across exchanges, WhiteBIT stands out for its proactive approach to security. Regular security updates and monitoring help protect against emerging threats in the cryptocurrency space.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges like Aibit and WhiteBIT. These questions cover everything from trading features to security measures and geographic availability.

What are the main differences between Aibit and WhiteBIT exchanges in terms of trading features?

WhiteBIT offers over 325 cryptocurrencies for trading while Aibit has a more limited selection. WhiteBIT provides both spot and margin trading with leverage options up to 20x.

Aibit focuses more on beginner-friendly interfaces and simplified trading options. WhiteBIT includes advanced charting tools and technical analysis features that appeal to experienced traders.

WhiteBIT charges trading fees ranging from 0.1% to 0.25%, depending on your trading volume and token holdings. Aibit typically offers competitive fee structures but with fewer tier options.

How do user reviews compare Aibit and WhiteBIT platforms?

WhiteBIT reviews often highlight its strong security features and responsive customer support. Users frequently praise WhiteBIT’s intuitive interface and reliable trading engine.

Aibit receives positive feedback for its simplicity and ease of use for newcomers. However, some reviews note limitations in advanced trading features compared to WhiteBIT.

Both exchanges have mixed reviews regarding withdrawal times, with WhiteBIT generally receiving higher marks for processing speed during normal market conditions.

In which countries is WhiteBIT legally allowed to operate?

WhiteBIT operates legally in most European countries and has expanded its services to various regions globally. The exchange complies with regulatory requirements in jurisdictions where it’s authorized.

WhiteBIT is restricted in several countries including the United States, where residents cannot access its full services due to regulatory constraints. Some features may also be limited in certain Asian markets.

Always check WhiteBIT’s current terms of service for the most up-to-date information on geographic restrictions, as these can change based on evolving regulations.

Who is the registered owner of the WhiteBIT cryptocurrency exchange?

WhiteBIT is owned by WhiteBIT Holdings Ltd, a company registered in Estonia. The exchange was founded in 2018 by Volodymyr Nosov, who serves as the CEO.

The company maintains its primary operations in Europe, with offices in several countries. WhiteBIT has established itself as one of the larger European cryptocurrency exchanges in terms of trading volume.

The management team includes professionals with backgrounds in finance, technology, and compliance to ensure the platform meets relevant regulatory standards.

What security measures do Aibit and WhiteBIT implement to protect user assets?

WhiteBIT utilizes cold storage for the majority of user funds, keeping them offline and away from potential hackers. The platform implements two-factor authentication (2FA) and advanced encryption protocols.

Aibit also employs cold wallet storage solutions and offers similar account security features. Both exchanges have anti-phishing measures and regular security audits.

WhiteBIT claims to keep up to 96% of assets in cold storage and provides insurance for some digital assets. Aibit focuses on education about security best practices for its users.

What are some well-known alternatives to WhiteBIT for cryptocurrency trading?

Binance remains the largest global exchange by volume and offers more trading pairs than both WhiteBIT and Aibit. Coinbase is popular for beginners with its user-friendly interface but charges higher fees.

Kraken provides strong security features and regulatory compliance similar to WhiteBIT. KuCoin offers a wide range of altcoins and is known for listing newer projects earlier than many competitors.

Gemini focuses on regulatory compliance and security, making it appealing to institutional investors. FTX and Bybit are popular for derivative trading with more advanced features than those offered by WhiteBIT.

WhiteBIT Vs Aibit Conclusion: Why Not Use Both?

Both WhiteBIT and Aibit offer unique advantages that can benefit your crypto trading journey. WhiteBIT stands out as a well-established exchange with over 5 million users across Europe and worldwide.

WhiteBIT prioritizes security by storing 96% of digital assets in cold wallets and has frozen over $150 million to combat crypto crime. Their competitive fees and high liquidity make them attractive for regular traders.

Aibit, while newer to the scene, brings its own strengths with innovative features and potentially different trading pairs or investment opportunities that might not be available on WhiteBIT.

Rather than choosing just one platform, consider using both exchanges to maximize your trading potential. This strategy allows you to:

- Diversify risk across multiple platforms

- Take advantage of different fee structures when beneficial

- Access a wider range of cryptocurrencies and trading pairs

- Utilize unique features specific to each platform

Many experienced traders maintain accounts on multiple exchanges to capitalize on price differences and special promotions.

The best approach is to start with the platform that meets your immediate needs, then expand to the other as you grow more comfortable with cryptocurrency trading.

Remember to prioritize security on both platforms by enabling two-factor authentication and following best practices for password management.