Choosing the right crypto exchange can have a big impact on your trading success. When comparing Aibit and PrimeXBT, you’ll find important differences in their fees, features, and user experience that could affect your profits.

Based on recent comparisons, PrimeXBT offers more asset classes on one platform, while exchanges like Bybit typically provide lower fees – around 0.1% for spot trading compared to PrimeXBT’s higher rates. This fee difference can add up quickly if you trade often.

Both platforms aim to serve traders in many countries, with PrimeXBT reaching users in over 150 countries. You should consider what matters most to you – whether that’s having many markets in one place, paying lower fees, or using specific trading tools that might be available on one platform but not the other.

Aibit vs PrimeXBT: At A Glance Comparison

When choosing between Aibit and PrimeXBT for crypto trading, several key factors will impact your experience.

Both platforms offer cryptocurrency trading options, but they differ in several important ways.

Trading Features

| Feature | Aibit | PrimeXBT |

|---|---|---|

| Asset Types | Cryptocurrencies | Cryptocurrencies, Forex, Commodities |

| Leverage | Up to 100x | Up to 200x |

| Trading Interface | User-friendly | Professional-grade |

| Mobile App | Yes | Yes |

Fees & Costs

PrimeXBT typically charges higher fees compared to some competitors. This is something to consider if you plan to trade frequently.

Aibit offers a more competitive fee structure for standard trades, which can save you money over time.

Security Measures

Both platforms implement security features, but you should research their specific protocols:

- Two-factor authentication

- Cold storage for funds

- Regular security audits

User Experience

PrimeXBT offers a professional trading interface that might feel complex if you’re new to trading.

Aibit provides a more straightforward experience that balances functionality with ease of use.

Customer Support

Customer service quality varies between these platforms. PrimeXBT offers support through multiple channels, while Aibit’s responsiveness has been noted as an area for improvement.

Aibit vs PrimeXBT: Trading Markets, Products & Leverage Offered

When comparing Aibit and PrimeXBT, their trading markets, products, and leverage options show significant differences that impact your trading experience.

Trading Markets & Assets

| Platform | Cryptocurrencies | Traditional Markets |

|---|---|---|

| Aibit | Bitcoin, Ethereum, and altcoins | Limited traditional assets |

| PrimeXBT | Bitcoin, Ethereum, Litecoin, and other major cryptocurrencies | Forex, commodities, indices, stocks |

PrimeXBT offers a wider range of asset classes, making it suitable if you want to diversify beyond crypto.

Leverage Offerings

PrimeXBT provides impressive leverage of up to 200x on certain assets, significantly higher than many competitors. This gives you more trading power with less capital.

Aibit typically offers more conservative leverage options, which might be safer for beginners but less attractive if you’re seeking high-risk, high-reward opportunities.

Trading Products

- PrimeXBT: Spot trading, futures, options, perpetual contracts, and copy trading

- Aibit: Primarily focuses on spot and derivatives trading with a simpler product lineup

The Covesting feature on PrimeXBT lets you follow successful traders, which isn’t available on Aibit.

Your trading style should guide your choice between these platforms. If you need diverse markets and high leverage, PrimeXBT holds the advantage. For straightforward crypto trading with moderate leverage, Aibit might suit your needs better.

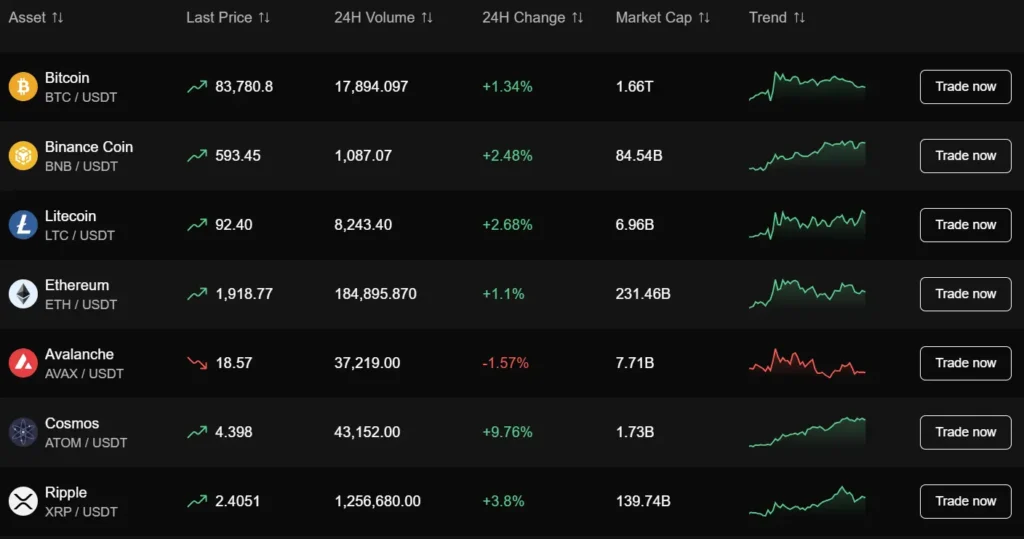

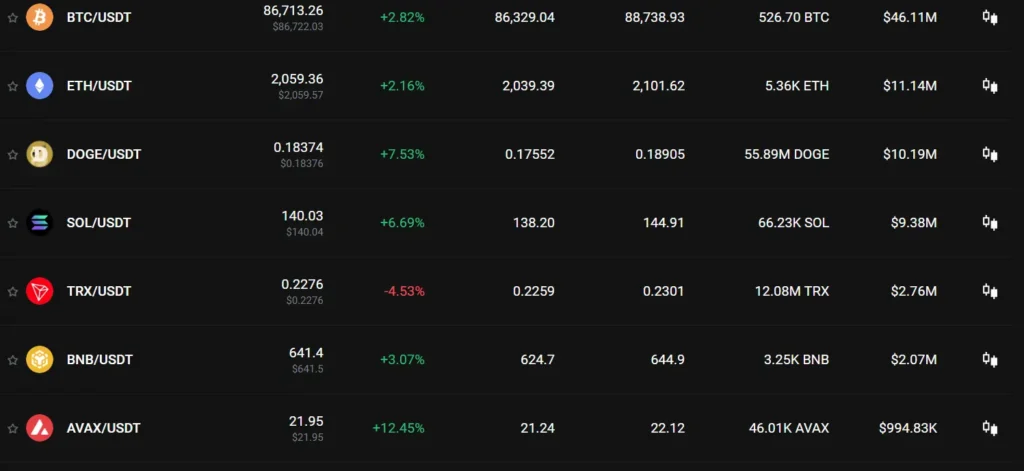

Aibit vs PrimeXBT: Supported Cryptocurrencies

When choosing between Aibit and PrimeXBT, the range of supported cryptocurrencies is an important factor to consider. PrimeXBT offers access to approximately 40 crypto assets and derivatives, which is significantly fewer than some competitors in the market.

PrimeXBT supports only 5 cryptocurrencies for deposits, making it somewhat limited for users who hold diverse crypto portfolios. This restriction may affect your trading options if you want to use less common tokens.

In comparison, Aibit offers a moderately sized selection of cryptocurrencies. While not as extensive as some major exchanges like Bybit (which supports over 500 crypto assets), Aibit provides enough variety for most traders.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Number of Supported Cryptocurrencies | Deposit Options |

|---|---|---|

| PrimeXBT | ~40 | 5 cryptocurrencies |

| Aibit | Moderate selection | Multiple options |

If you prioritize having access to a wide range of cryptocurrencies, PrimeXBT’s limited selection might be a drawback. However, if you mainly trade popular cryptocurrencies like Bitcoin or Ethereum, both platforms will likely meet your needs.

It’s worth noting that PrimeXBT does offer other markets besides crypto, including Forex, commodities, and stock indices, which might compensate for its more limited crypto selection.

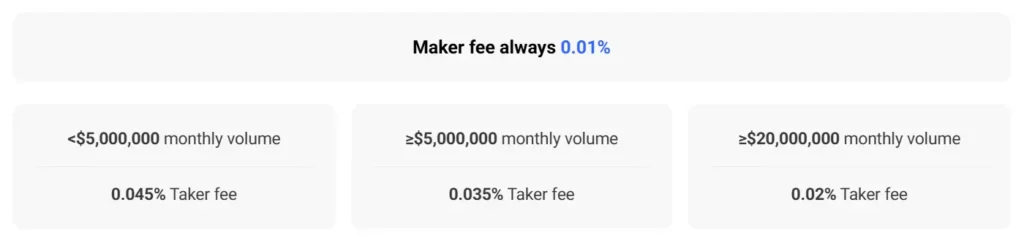

Aibit vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and PrimeXBT, understanding their fee structures can help you make a better decision for your trading needs.

PrimeXBT charges a competitive 0.05% trading fee across its platform. This flat fee structure makes it straightforward to calculate your costs when executing trades.

Aibit’s fee structure differs, though specific rates aren’t mentioned in the provided information. Based on industry standards, crypto exchanges typically charge between 0.1% to 0.5% per trade.

For comparison, Bybit (another competitor) charges up to 0.1% for trading fees, which is lower than many platforms but still higher than PrimeXBT’s 0.05%.

Trading Fee Comparison:

| Platform | Trading Fee |

|---|---|

| PrimeXBT | 0.05% |

| Aibit | Not specified |

PrimeXBT is known for having some of the industry’s lowest fees, particularly for futures trading. This makes it attractive if you’re a high-volume trader where small fee differences add up quickly.

Regarding deposit and withdrawal fees, these can vary based on the cryptocurrency you’re using. Neither platform charges account fees, which is a plus for casual traders.

You should also consider other factors beyond fees, such as platform security, available trading pairs, and user interface when making your final decision between Aibit and PrimeXBT.

Aibit vs PrimeXBT: Order Types

When trading on cryptocurrency exchanges, order types are essential tools that help you execute trades according to your strategy. Both Aibit and PrimeXBT offer several order types to meet different trading needs.

PrimeXBT provides a professional-grade trading environment with various order options. You can place Market orders for immediate execution at the current price. Limit orders allow you to set a specific price at which you want to buy or sell.

PrimeXBT also offers Stop orders to help manage risk by automatically executing when the market reaches a certain price. The platform features OCO (One-Cancels-the-Other) orders, which combine limit and stop orders.

Aibit also supports the standard order types found on most exchanges. You can use market and limit orders for basic trading needs. Their platform includes stop-loss and take-profit options to help protect your positions.

Both platforms provide tools for more advanced trading strategies, but PrimeXBT tends to offer more sophisticated order types for professional traders.

The trading interface on both platforms is designed to make placing orders straightforward. You can easily select your order type, enter your desired price, and execute your trade.

Your trading style and experience level will determine which platform’s order types better suit your needs. Beginners might appreciate Aibit’s simpler approach, while experienced traders may prefer PrimeXBT’s more comprehensive options.

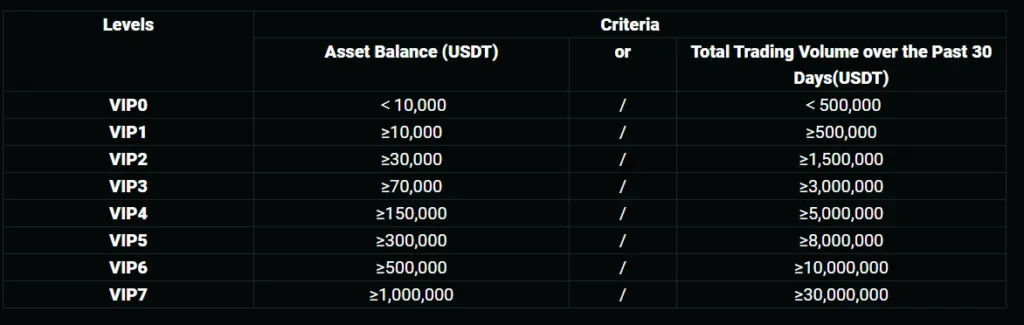

Aibit vs PrimeXBT: KYC Requirements & KYC Limits

PrimeXBT stands out in the crypto exchange market by making KYC verification optional. You can create an account and begin trading with just your email address, without sharing personal information.

This approach reflects PrimeXBT’s commitment to user privacy. However, the platform does reserve the right to impose trading and withdrawal limits before you complete their Customer Due Diligence (CDD) procedure.

While specific limit amounts aren’t mentioned in the search results, it’s common for no-KYC exchanges to restrict withdrawal amounts until verification is completed.

Aibit’s KYC requirements differ from PrimeXBT, though specific details aren’t provided in the search results. Most exchanges implement some form of verification process to comply with regulations.

When choosing between these platforms, consider how important privacy is to your trading strategy. If maintaining anonymity is a priority, PrimeXBT’s optional KYC policy might appeal to you.

Trading fees on PrimeXBT are structured as 0.01% for makers and between 0.045%-0.02% for takers, depending on your trading volume.

Remember that while no-KYC options provide privacy benefits, they may come with certain limitations on functionality or withdrawal amounts compared to fully verified accounts.

Aibit vs PrimeXBT: Deposits & Withdrawal Options

When choosing between Aibit and PrimeXBT, deposit and withdrawal options play a crucial role in your trading experience.

PrimeXBT offers various free deposit methods for both cryptocurrency and fiat currencies. However, according to recent 2025 data, the platform lacks free withdrawal options, which may impact your overall costs.

Aibit provides a more balanced approach with competitive deposit and withdrawal options. Their platform supports multiple cryptocurrencies for both deposits and withdrawals, often with lower fees compared to PrimeXBT.

Deposit Methods Comparison:

| Method | Aibit | PrimeXBT |

|---|---|---|

| Cryptocurrency | Yes | Yes |

| Fiat | Limited | Yes |

| Free Deposits | Yes | Yes |

Withdrawal Options:

- Aibit: Offers multiple withdrawal methods with reasonable fees

- PrimeXBT: Limited free withdrawal options with higher fees on average

Processing times also differ between platforms. Aibit typically processes withdrawals faster, usually within 24 hours. PrimeXBT may take longer depending on the method chosen.

For traders focused on cost-efficiency, Aibit’s withdrawal structure tends to be more advantageous. You’ll find their fee schedule more transparent and generally lower than PrimeXBT’s options.

Consider your trading frequency and volume when making your choice. High-volume traders might find the difference in withdrawal fees significant over time.

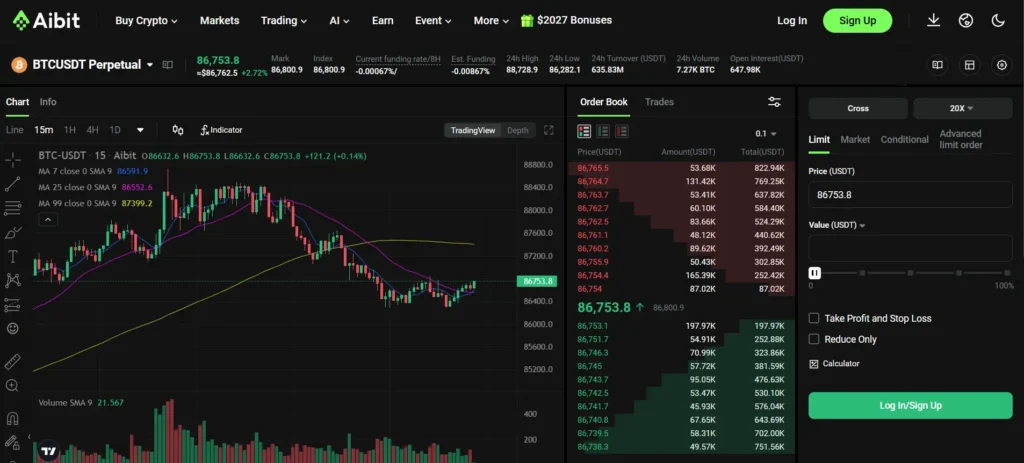

Aibit vs PrimeXBT: Trading & Platform Experience Comparison

When comparing Aibit and PrimeXBT’s trading platforms, you’ll notice significant differences in user experience and functionality.

PrimeXBT offers a professional-grade interface that may feel overwhelming for beginners. The platform includes advanced charting tools, multiple order types, and a customizable dashboard that experienced traders appreciate.

Aibit, on the other hand, provides a more streamlined interface that balances functionality with accessibility. New users can navigate the platform more easily while still accessing essential trading features.

Trading Tools Comparison:

| Feature | Aibit | PrimeXBT |

|---|---|---|

| Charting Tools | Intermediate | Advanced |

| Mobile App | User-friendly | Feature-rich |

| Order Types | Basic + Stop orders | Extended range |

| Demo Account | Yes | Yes |

PrimeXBT stands out with its Covesting copy trading feature, allowing you to follow successful traders automatically. This is particularly useful if you’re learning or prefer passive investment strategies.

Aibit’s platform tends to be more responsive, with fewer reported downtime issues during high market volatility compared to PrimeXBT.

Both platforms offer leverage trading, though PrimeXBT typically provides higher maximum leverage options. However, this comes with increased risk that you should carefully consider.

The mobile experience differs notably between the two. PrimeXBT’s mobile app packs most desktop features but can feel cluttered. Aibit’s mobile solution prioritizes simplicity while maintaining core functionality.

Aibit vs PrimeXBT: Liquidation Mechanism

When trading with leverage, understanding how liquidations work is crucial for your success. Both Aibit and PrimeXBT have liquidation mechanisms in place to manage risk.

PrimeXBT implements a straightforward liquidation process. When your position approaches the liquidation price, the system automatically closes your trade to prevent further losses. PrimeXBT offers leverage up to 200x for crypto assets, which means higher profit potential but also increased liquidation risk.

Aibit’s liquidation mechanism works similarly but with some differences in execution. The platform monitors your margin ratio constantly, triggering liquidation when your account can no longer support open positions.

Key Differences:

| Feature | PrimeXBT | Aibit |

|---|---|---|

| Max Leverage | Up to 200x for crypto | Varies by asset |

| Liquidation Warning | Limited advance notice | Progressive warnings |

| Partial Liquidation | Not always available | More flexible options |

You should monitor your positions closely on both platforms. Setting stop-loss orders can help prevent liquidations before they happen.

PrimeXBT’s higher leverage options (up to 200x) mean your positions can be liquidated more quickly during volatile market movements. This requires extra caution when setting position sizes.

Both platforms use margin calls as a warning system, but the exact implementation differs. You’ll receive notifications when your positions approach dangerous territory.

Aibit vs PrimeXBT: Insurance

When trading cryptocurrencies, protecting your funds is critical. Both Aibit and PrimeXBT offer different approaches to insurance.

Aibit provides a dedicated insurance fund to protect users against severe market volatility. This fund helps cover losses during extreme market conditions when liquidations happen rapidly.

PrimeXBT also maintains an insurance fund, but based on available information, it appears to be smaller than some competitors like Bybit. The platform focuses more on advanced risk management tools rather than extensive insurance coverage.

Neither platform offers FDIC-like insurance that you might find with traditional financial institutions. This is common in the crypto world.

Key Insurance Differences:

| Feature | Aibit | PrimeXBT |

|---|---|---|

| Insurance Fund | Yes | Yes (smaller) |

| Coverage Scope | Trading losses during extreme volatility | Limited coverage for system failures |

| Third-Party Insurance | No | No |

| User Protection Policy | Moderate | Basic |

You should always use additional security measures regardless of platform choice. Enable two-factor authentication and keep the majority of your assets in cold storage when not actively trading.

Remember that even with insurance funds, cryptocurrency trading carries significant risks. These insurance funds primarily protect the platforms themselves, with only secondary benefits to individual traders in specific situations.

Aibit vs PrimeXBT: Customer Support

When trading cryptocurrency, reliable customer support can make a big difference in your experience. Both Aibit and PrimeXBT offer support services, but they differ in availability and methods.

PrimeXBT provides responsive customer service through multiple channels. They offer a Help Centre with guides and FAQs for self-service solutions. For more personal assistance, they have email support and live chat options that respond quickly to your questions.

Aibit’s support system focuses on efficiency and accessibility. They provide standard support channels including email tickets and a knowledge base. Response times may vary based on your query complexity and time of day.

Both platforms offer community forums where you can connect with other traders and sometimes find answers from experienced users. These can be helpful for common questions when you don’t need official support.

Support Channel Comparison:

| Feature | PrimeXBT | Aibit |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Knowledge Base | ✓ | ✓ |

| Response Time | Generally fast | Varies |

| Weekend Support | Limited | Limited |

If you value immediate assistance, PrimeXBT’s live chat feature might give them a slight advantage. For traders who prefer detailed written responses to complex questions, both platforms provide adequate email support.

Remember that support quality can sometimes depend on your specific issue and the current platform workload, especially during high trading volume periods.

Aibit vs PrimeXBT: Security Features

When trading cryptocurrencies, security should be your top priority. Both Aibit and PrimeXBT offer security features to protect your funds, but they differ in several key areas.

PrimeXBT maintains a robust security framework designed to safeguard your assets and data. According to their security page, they implement strict measures against various threats and vulnerabilities.

Aibit also prioritizes security but takes a slightly different approach with its protection mechanisms.

Core Security Features Comparison:

| Feature | Aibit | PrimeXBT |

|---|---|---|

| Two-Factor Authentication | Yes | Yes |

| Cold Storage | Partial | Majority of funds |

| DDoS Protection | Yes | Yes |

| Data Encryption | Standard | Advanced |

| Insurance Fund | Limited | Available |

PrimeXBT offers verified users higher withdrawal limits with enhanced security protocols. This can be beneficial if you trade larger volumes.

Both platforms use security measures like email confirmations and IP monitoring to detect suspicious activities. However, PrimeXBT’s cyber security framework appears more comprehensive based on available information.

You should consider enabling all security features regardless of which platform you choose. This includes strong passwords, two-factor authentication, and withdrawal address whitelisting.

Neither platform has reported major security breaches recently, which speaks to their commitment to maintaining secure trading environments.

Is Aibit Safe & Legal To Use?

Aibit operates under standard crypto exchange security protocols, using cold storage for most assets and encryption to protect user data. However, unlike some competitors like Bybit, Aibit’s security track record isn’t as extensively documented.

For legal concerns, you should check if Aibit is allowed in your country before signing up. Using a VPN to access restricted exchanges can flag your account for suspicious activity, as noted in search results about similar platforms.

Aibit requires basic KYC (Know Your Customer) verification for higher withdrawal limits, which is standard industry practice. This helps prevent fraud but does require sharing some personal information.

Important safety considerations:

- Check Aibit’s regulatory status in your country

- Review their insurance policy for user funds

- Enable two-factor authentication

- Use unique, strong passwords

Security features like IP detection and withdrawal confirmation emails add protection to your account. Aibit generally follows industry security standards, though it may not have the same level of advanced protections as larger exchanges.

Remember that all crypto platforms carry some level of risk. You should only deposit funds you can afford to lose and consider spreading assets across multiple secure wallets.

Is PrimeXBT Safe & Legal To Use?

PrimeXBT has implemented several security measures to protect user funds and data. The platform uses robust cyber-security protocols and multiple layers of protection for your assets.

However, there are some concerns about PrimeXBT’s safety. According to search results, the exchange was not listed among the top 50 safe exchanges in Certified’s security audit, which raises some questions.

The legal status of PrimeXBT depends on your location. The platform is unregulated in many jurisdictions, which some users might consider a red flag.

When comparing PrimeXBT to competitors like Binance and Bybit, it offers higher withdrawal limits. This can be convenient for traders who move large amounts of funds.

Security Features of PrimeXBT:

- Multiple layers of protection

- Strict security measures for customer funds

- Comprehensive cyber-security implementations

Potential Concerns:

- Unregulated status in many regions

- Not listed in top 50 safe exchanges

- Lack of certain security features available on other platforms

Before using PrimeXBT, you should verify if it’s legal in your country. The platform’s legitimacy as a crypto trading service isn’t questioned, but its regulatory compliance varies by region.

For your safety, always use strong passwords and two-factor authentication when trading on any platform, including PrimeXBT.

Frequently Asked Questions

Trading platforms differ in many key aspects from fees to features. These differences can significantly impact your trading experience and success.

What are the unique features of Aibit compared to PrimeXBT?

Aibit offers an intuitive interface designed specifically for beginner traders, with built-in educational resources. This differs from PrimeXBT’s more advanced trading interface that caters to experienced traders.

Aibit specializes in spot trading with a focus on a wider range of altcoins. PrimeXBT, however, allows trading across multiple asset classes including cryptocurrencies, forex, commodities, and indices on a single platform.

PrimeXBT features advanced copy trading functionality, letting you automatically mirror successful traders’ strategies. Aibit focuses more on providing analytical tools that help you develop your own trading approach.

How do Aibit’s trading fees compare to PrimeXBT’s structure?

Aibit typically charges a flat fee structure of 0.1% per transaction for both makers and takers. This straightforward approach makes cost calculations simple for traders of all levels.

PrimeXBT features lower trading fees generally, starting at 0.05% for cryptocurrencies. The platform employs a tiered structure where higher trading volumes result in lower fees.

Both platforms offer fee discounts when using their native tokens for fee payment. PrimeXBT occasionally provides special promotions that can temporarily reduce fees for new users.

What level of customer support does Aibit offer versus PrimeXBT?

Aibit provides 24/7 customer support through live chat, email, and an extensive knowledge base. Their response times average under 1 hour for most inquiries.

PrimeXBT offers multilingual support through several channels including ticket systems and live chat. Their team is known for addressing technical trading issues efficiently.

Both platforms maintain active community forums where users can discuss trading strategies and platform features. Aibit tends to have more beginner-friendly support resources compared to PrimeXBT’s technical documentation.

How do the security measures between Aibit and PrimeXBT differ?

Aibit employs industry-standard security protocols including two-factor authentication and cold wallet storage for the majority of user funds. Their platform undergoes regular security audits.

PrimeXBT implements two-factor authentication and advanced security features like SSL encryption. The platform stores most user assets in cold wallets to protect against online threats.

Both platforms offer IP address whitelisting and email confirmations for withdrawals. PrimeXBT has never experienced a major security breach, which adds to its reputation for safety.

What are the account verification requirements for Aibit compared to those of PrimeXBT?

Aibit requires basic KYC verification including government ID and proof of address for accounts with withdrawal limits exceeding $2,000 daily. The verification process typically takes 1-2 business days.

PrimeXBT features high withdrawal limits for verified users. Their verification process requires identity documentation and sometimes additional verification steps for higher-tier account access.

Both platforms allow basic account creation with just an email address. However, full platform functionality requires completing the respective verification processes.

Are there any restrictions on the usage of Aibit or PrimeXBT in certain countries?

Aibit is unavailable in certain jurisdictions including the United States, Iran, North Korea, and regions subject to international sanctions. Their terms of service explicitly prohibit users from these areas.

PrimeXBT does not provide services to residents of the United States, United Kingdom, Canada, and several other countries due to regulatory requirements. Users must verify their location during registration.

Both platforms employ IP detection and require users to confirm their country of residence. Using VPNs to circumvent these geographical restrictions violates their terms of service and may result in account termination.

PrimeXBT vs Aibit Conclusion: Why Not Use Both?

After comparing PrimeXBT and Aibit, you might wonder which platform to choose. The truth is, you don’t necessarily have to pick just one.

PrimeXBT offers a professional-grade trading experience with access to cryptocurrencies, forex, commodities, and indices. It’s known for its versatility and allows you to diversify your trading portfolio beyond just crypto.

Aibit, on the other hand, has its own unique features that might complement what PrimeXBT lacks.

Benefits of using both platforms:

- Risk diversification: Spreading your investments across multiple platforms can reduce risk

- Feature optimization: Use each platform for what it does best

- Backup access: If one platform experiences downtime, you still have trading options

You might find that PrimeXBT works better for certain types of trades while Aibit excels at others. Many experienced traders maintain accounts on multiple exchanges for this reason.

Remember that each platform has different fee structures and security measures. Be sure to use strong, unique passwords and enable two-factor authentication on both.

By familiarizing yourself with both PrimeXBT and Aibit, you gain flexibility in your trading approach. This strategy allows you to capitalize on the strengths of each platform while minimizing exposure to their individual weaknesses.