Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Aibit and Poloniex are two platforms that offer various features for crypto traders, but they have distinct differences worth exploring.

When comparing Aibit vs Poloniex, you’ll find that each platform has unique strengths in terms of available cryptocurrencies, fee structures, and trading features. While Poloniex has been in the industry longer with a score of about 6.0 according to recent evaluations, both exchanges continue to evolve their offerings to attract different types of traders.

If you’re deciding between these two exchanges, it’s important to consider factors like security measures, user interface, and supported trading pairs. Many traders also look at margin trading options, with Poloniex offering lending features that some find advantageous compared to other exchanges.

Aibit Vs Poloniex: At A Glance Comparison

When choosing between Aibit and Poloniex for your cryptocurrency trading needs, several key differences stand out. Both platforms offer digital asset trading, but they cater to different user preferences.

User Experience

- Poloniex: Beginner-friendly interface with access to 200+ cryptocurrencies

- Aibit: Newer platform with a streamlined design focused on simplicity

Trading Features Comparison

| Feature | Aibit | Poloniex |

|---|---|---|

| Cryptocurrencies | 150+ | 200+ |

| Trading Fees | 0.1-0.2% | 0.1-0.25% |

| Mobile App | Yes | Yes |

| Margin Trading | Limited | Yes |

| Staking Options | Basic | Extensive |

Security Measures

Poloniex has been operating longer, giving it more time to develop security protocols. Aibit implements modern security features but has a shorter track record in the industry.

Global Availability

You can access Poloniex from most countries worldwide. Aibit has more regional restrictions, so check your location’s eligibility before signing up.

Customer Support

Poloniex offers 24/7 support through multiple channels. Aibit provides email and chat support with somewhat limited hours compared to competitors.

The right choice depends on your specific trading needs. Poloniex might suit you better if you want access to more cryptocurrencies and an established platform. Aibit could be preferable if you value lower fees and a simpler interface.

Aibit Vs Poloniex: Trading Markets, Products & Leverage Offered

Aibit and Poloniex both offer a variety of trading options for cryptocurrency enthusiasts, but they differ in several key areas.

Poloniex Trading Markets & Products:

- Spot trading with numerous cryptocurrency pairs

- Futures trading with up to 100x leverage

- Margin trading with up to 5x leverage

- Lending services for earning interest on crypto holdings

Poloniex has been around longer in the crypto space and offers a substantial range of altcoins for trading.

Aibit Trading Markets & Products:

- Spot trading with popular crypto pairs

- Derivatives trading options

- Lower leverage options compared to Poloniex

When comparing leverage options, Poloniex clearly takes the lead with its 100x leverage for futures trading. This appeals to experienced traders looking for higher risk-reward potential.

Your trading style will determine which platform works better for you. If you’re seeking extensive leverage options and a wide variety of altcoins, Poloniex might be your preference.

For beginners, Aibit’s more modest leverage offerings could be considered safer, reducing the risk of significant losses that can occur with high-leverage trading.

Both exchanges continue to evolve their product offerings to stay competitive in the fast-changing crypto market of 2025.

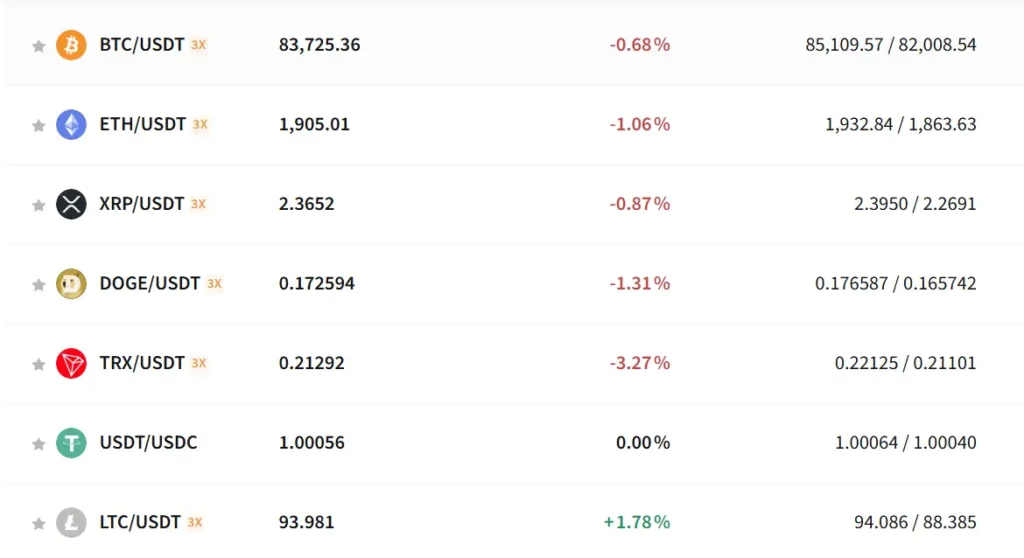

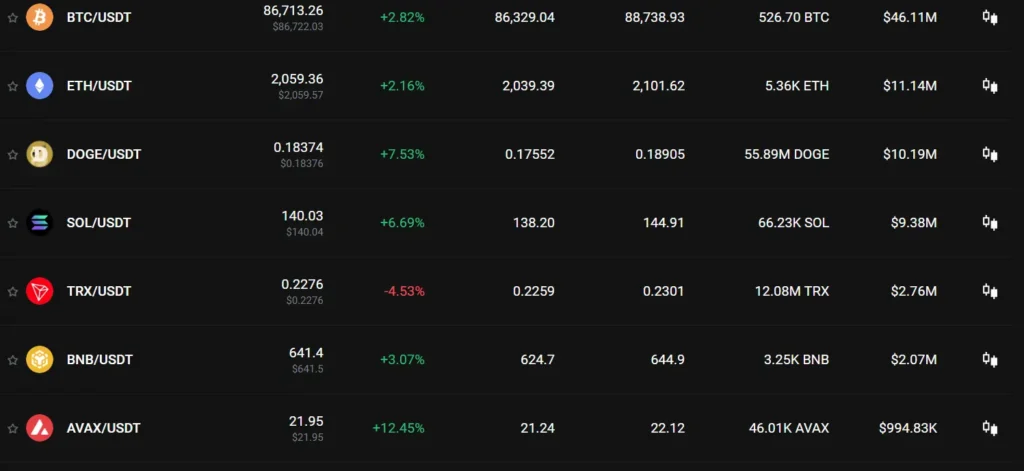

Aibit Vs Poloniex: Supported Cryptocurrencies

When choosing between Aibit and Poloniex, the range of supported cryptocurrencies is an important factor to consider for your trading needs.

Poloniex offers a substantial selection of cryptocurrencies including popular options like Bitcoin (BTC) and Ethereum (ETH). Based on recent information, Poloniex supports numerous altcoins and trading pairs.

Aibit’s cryptocurrency selection is more limited compared to Poloniex. However, Aibit focuses on providing quality trading options rather than quantity.

Here’s a comparison of supported cryptocurrencies between the two platforms:

| Feature | Poloniex | Aibit |

|---|---|---|

| Bitcoin (BTC) | ✅ | ✅ |

| Ethereum (ETH) | ✅ | ✅ |

| Trading Pairs | 320+ USDT pairs | Fewer pairs |

| Altcoin Variety | Extensive | Limited |

Poloniex has an advantage when it comes to cryptocurrency variety. With over 320 USDT/M trading pairs available, you’ll find more options for diversifying your crypto portfolio.

If you’re looking to trade less common altcoins, Poloniex might be the better choice. Their platform has historically supported a wider range of cryptocurrencies and continues to add new options.

For beginners or traders focused primarily on major cryptocurrencies, either platform could meet your needs. However, advanced traders seeking variety will likely prefer Poloniex’s more extensive offerings.

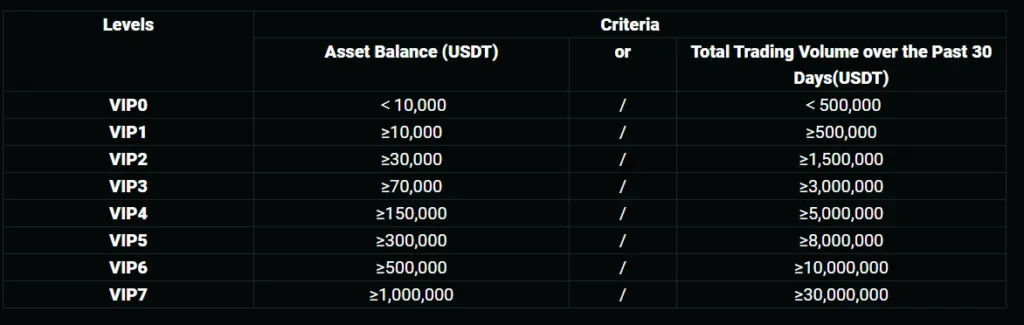

Aibit Vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and Poloniex, understanding their fee structures is crucial for maximizing your trading profits.

Poloniex Trading Fees:

- Maker fees start at 0.145%

- Taker fees start at 0.155%

- Fees can be reduced by increasing your trading volume

Poloniex uses a tiered fee structure that rewards active traders. The more you trade, the lower your fees become.

Aibit Trading Fees:

- Generally competitive with other major exchanges

- Offers discounts for users who hold their native token

For deposit fees, both platforms offer free crypto deposits. However, fiat deposits may incur charges depending on your payment method.

Withdrawal Fees Comparison:

| Crypto | Poloniex | Aibit |

|---|---|---|

| Bitcoin | Network fee | Network fee |

| Ethereum | Variable | Variable |

| USDT | Depends on network | Depends on network |

Both exchanges adjust withdrawal fees based on network congestion. During busy periods, these fees may increase.

Poloniex offers more trading pairs than Aibit, which might be important if you trade less common cryptocurrencies.

Remember that fees can change quickly in the crypto world. Always check the exchanges’ official fee pages before making your decision.

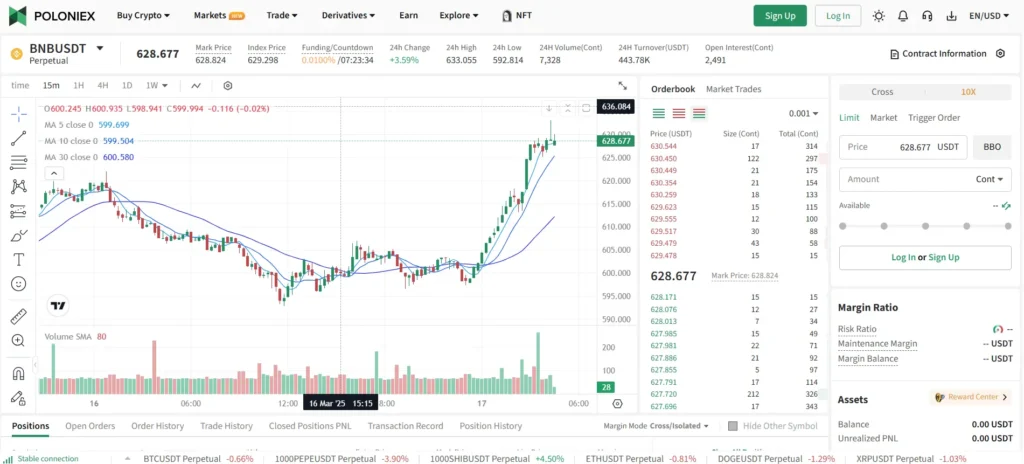

Aibit Vs Poloniex: Order Types

When trading on cryptocurrency exchanges, the types of orders available can significantly impact your trading strategy. Let’s compare the order types offered by Aibit and Poloniex.

Poloniex provides three main order types for spot trading: limit, market, and stop-limit orders (which includes stop-market). These basic order types give you control over your entry and exit points in the market.

For futures trading, Poloniex expands its offerings to four different order types, designed to help you trade more efficiently like a professional.

Poloniex also offers trailing stop orders through platforms like GoodCrypto. This feature can help increase your profit potential by automatically adjusting your stop price as the market moves in your favor.

Aibit, on the other hand, typically offers standard order types similar to most exchanges. These include market orders for immediate execution at current prices and limit orders for execution at specific price points.

Poloniex Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Stop-market orders

- Trailing stop orders (via third-party tools)

Aibit Order Types:

- Market orders

- Limit orders

- Additional advanced orders may vary

The variety of order types on both platforms gives you flexibility in how you approach the market. Your choice between Aibit and Poloniex might depend on which specific order types better suit your trading strategy.

Aibit Vs Poloniex: KYC Requirements & KYC Limits

When choosing between Aibit and Poloniex, understanding their KYC (Know Your Customer) requirements can help you decide which platform better suits your privacy needs.

Poloniex offers a significant advantage for users seeking privacy. You can withdraw up to $10,000 per day without completing KYC verification. This is one of the higher no-KYC limits available in the crypto exchange market.

If you need higher withdrawal limits on Poloniex, you can complete their KYC process to access their Level 2 account tier. This verification increases your daily withdrawal limit to $500,000.

Aibit, on the other hand, follows a more traditional approach to KYC. You’ll typically need to complete verification before making significant withdrawals or accessing full platform features.

Comparison at a glance:

| Feature | Poloniex | Aibit |

|---|---|---|

| No-KYC withdrawal limit | Up to $10,000 daily | Limited |

| KYC-verified limit | $500,000 daily (Level 2) | Varies based on verification level |

| Verification process | Two-tier system | Standard verification process |

The no-KYC option at Poloniex came after their exit from the US market, making it more accessible for users who prefer privacy.

Remember that KYC requirements can change based on regulatory developments. Always check the latest policies on both platforms before making your decision.

Aibit Vs Poloniex: Deposits & Withdrawal Options

When choosing between Aibit and Poloniex, understanding their deposit and withdrawal options is crucial for your trading experience.

Poloniex Deposit Methods:

- Bank Transfers

- VISA/Mastercard

- Apple Pay

- Cryptocurrency deposits

Poloniex charges third-party fees of 3.5% or $10 (whichever is higher) for fiat deposits. This can impact your overall trading costs if you frequently add funds.

Withdrawal Concerns with Poloniex:

Some users have reported issues with Poloniex’s withdrawal system. In some cases, withdrawals for specific coins like BCH have been closed for months at a time, which can lock your funds on the platform.

Aibit Deposit and Withdrawal Options:

Aibit offers cryptocurrency deposits and withdrawals, focusing primarily on crypto-to-crypto transactions. Their fee structure is generally competitive in the market.

You should consider checking the current status of withdrawal options for any coins you plan to trade on either platform. This is especially important if you might need quick access to your funds.

Both exchanges support various cryptocurrencies, but Poloniex offers more traditional payment methods if you need to deposit fiat currency. However, these convenience options come with additional fees.

Always verify the most recent deposit and withdrawal policies before committing to either platform, as these terms can change frequently in the crypto exchange market.

Aibit Vs Poloniex: Trading & Platform Experience Comparison

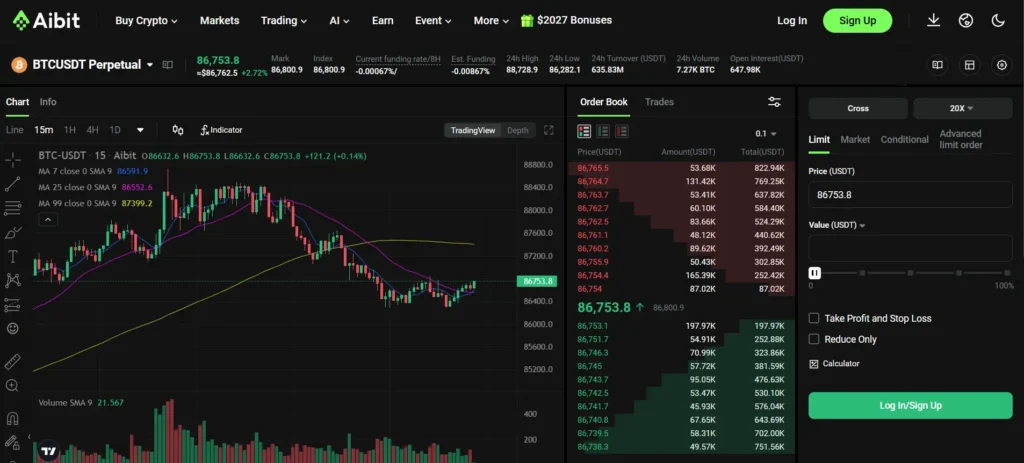

When choosing between Aibit and Poloniex, the trading platform experience can make a big difference in your daily crypto activities.

Poloniex offers a well-established interface that many traders find familiar. The platform supports over 100 cryptocurrencies and provides both basic and advanced trading views to suit different skill levels.

Aibit, while newer to the market, focuses on a streamlined user experience with modern design elements. Its interface tends to be more intuitive for beginners while still offering advanced features.

User Interface Comparison:

- Poloniex: Traditional exchange layout, data-dense screens

- Aibit: Modern, cleaner interface with customizable widgets

Trading tools differ between the platforms as well. Poloniex provides extensive charting tools and technical analysis features that experienced traders appreciate. Aibit offers similar capabilities but with a greater emphasis on visual simplicity.

Mobile trading experiences also vary significantly. Poloniex’s mobile app includes most desktop features but can feel crowded on smaller screens. Aibit’s mobile platform was designed with mobile-first principles, making it more responsive.

Trading Features:

| Feature | Aibit | Poloniex |

|---|---|---|

| Order Types | Market, Limit, Stop | Market, Limit, Stop, OCO |

| Charting Tools | Intermediate | Advanced |

| Mobile Experience | Excellent | Good |

| Trading View Integration | Yes | Yes |

Both platforms offer API access for algorithmic trading, though Poloniex has more established documentation due to its longer market presence.

Aibit Vs Poloniex: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for your risk management. Both Aibit and Poloniex have systems in place to handle positions at risk.

Aibit uses a tiered liquidation approach. Your position enters a warning zone when your margin ratio drops below certain thresholds. This gives you time to add funds before full liquidation occurs.

Poloniex employs a more straightforward liquidation method. When your position’s maintenance margin requirement isn’t met, liquidation begins automatically without multiple warning stages.

Liquidation Fee Comparison:

| Exchange | Liquidation Fee | Partial Liquidation |

|---|---|---|

| Aibit | 0.5-1.5% | Yes |

| Poloniex | 1-2% | Limited |

Aibit offers partial liquidation, allowing only a portion of your position to be closed when possible. This helps preserve some of your trading position during market volatility.

Poloniex’s system typically liquidates the entire position at once. This can be more abrupt but creates a clean slate for traders.

Both platforms use liquidation funds to protect against negative balances. However, Aibit’s insurance fund is generally more robust against extreme market conditions.

The warning time before full liquidation is longer on Aibit, giving you more opportunity to save your position by adding margin. Poloniex moves more quickly to liquidation to protect the platform from losses.

Aibit Vs Poloniex: Insurance

When choosing a cryptocurrency exchange, insurance coverage is a critical factor to consider for your asset protection.

Aibit offers insurance protection for users’ funds through a dedicated reserve fund. This fund is designed to cover potential losses in case of security breaches or hacks.

Poloniex has faced security challenges, including a $100 million hack in November 2023. According to recent information, the exchange has been working to resume operations and withdrawals after this security incident.

Neither exchange provides FDIC insurance, which is common among crypto platforms since government-backed insurance typically doesn’t cover digital assets.

Here’s a quick comparison of their insurance offerings:

| Feature | Aibit | Poloniex |

|---|---|---|

| Reserve Fund | Yes | Limited |

| External Insurance | Limited | No |

| Recovery History | Good track record | Recently recovering from $100M hack |

| Fund Segregation | Yes | Yes |

You should carefully evaluate the insurance protections when deciding between these exchanges. Poloniex’s recent security issues might be concerning, while Aibit’s reserve fund system provides a basic safety net.

Remember that even with insurance protection, it’s always safer to keep large holdings in personal wallets rather than leaving them on any exchange long-term.

Aibit Vs Poloniex: Customer Support

When choosing between cryptocurrency exchanges, customer support can make or break your experience. Both Aibit and Poloniex offer support services, but there are notable differences.

Poloniex has improved its customer support over recent years. According to search results, they provide educational articles, guides, and FAQs to help users navigate their platform. Some users report that Poloniex’s customer service is better than other exchanges like Cryptopia.

However, Poloniex has faced criticism in the past. The platform experienced overwhelmed customer support as early as 2017, though recent reports suggest slight improvements. Some users have reported negative experiences, including claims of unresolved issues with funds.

Aibit’s customer support offerings aren’t detailed in the search results. Based on general knowledge about cryptocurrency exchanges, you should expect basic support channels like email tickets, possibly live chat, and a knowledge base.

When deciding between these platforms, consider these customer support factors:

- Response Time: How quickly can you expect a reply?

- Support Channels: Email, live chat, phone support?

- Self-Help Resources: Quality of FAQs and guides

- Language Options: Support in your preferred language?

Your experience may vary depending on your specific issues and when you contact support. Before choosing either platform, it might help to test their responsiveness with a simple question.

Aibit Vs Poloniex: Security Features

When choosing a crypto exchange, security should be your top priority. Let’s compare how Aibit and Poloniex protect your assets.

Poloniex Security History

Poloniex has experienced security issues in the past. In early 2014, the exchange suffered from a vulnerability that led to an exploit. This breach remains a concern for some users.

In contrast, some competitors like Bitget have maintained better security records with no major hacks reported.

Two-Factor Authentication (2FA)

Both exchanges offer two-factor authentication. This adds an extra layer of security when you log in or make withdrawals.

Cold Storage Practices

Poloniex stores most user funds in cold wallets, keeping them offline and away from potential hackers. Aibit also implements cold storage solutions, though specific percentages aren’t widely published.

Account Security Features

| Feature | Aibit | Poloniex |

|---|---|---|

| Email verification | ✓ | ✓ |

| Anti-phishing codes | ✓ | ✓ |

| IP address monitoring | ✓ | ✓ |

| Withdrawal confirmations | ✓ | ✓ |

KYC Requirements

Poloniex requires KYC verification for higher withdrawal limits. Aibit’s KYC policies vary by region and transaction amount.

If anonymity is important to you, note that both exchanges have implemented more stringent verification requirements in recent years.

Remember to always use strong passwords and enable all available security features regardless of which platform you choose.

Is Aibit A Safe & Legal To Use?

Aibit operates as a regulated cryptocurrency exchange in most regions. You should check if it’s licensed to operate in your country before signing up.

The platform employs standard security measures including two-factor authentication (2FA) and cold storage for most user funds. This helps protect your assets from potential hacking attempts.

Aibit requires KYC (Know Your Customer) verification for higher trading tiers, which is a sign of compliance with international regulations.

Security features include:

- Two-factor authentication

- Cold storage for majority of funds

- Regular security audits

- Withdrawal confirmations

While Aibit hasn’t experienced any major security breaches to date, no exchange is completely immune to risks. You should always use strong passwords and enable all available security features.

The platform’s insurance policy covers digital assets against theft from their hot wallet system, but has limitations. You should understand what is and isn’t covered.

For maximum security, consider keeping only trading funds on the exchange. Store larger holdings in personal hardware wallets where you control the private keys.

Remember to review Aibit’s terms of service and privacy policy before creating an account to understand how your data will be handled and what legal protections you have as a user.

Is Poloniex A Safe & Legal To Use?

Poloniex is a legitimate cryptocurrency exchange that has been operating since its founding in the USA. It offers several security measures, including 2-factor authentication for API use and withdrawals.

The platform has worked on improving its security features over time. However, it’s important to know that Poloniex has experienced two hacks in the past, with one vulnerability exploit occurring in early 2014.

The exchange has also faced regulatory action from the SEC. This is something to consider when evaluating its legal standing in your jurisdiction.

When comparing safety features with other exchanges:

| Security Feature | Poloniex Status |

|---|---|

| 2-Factor Authentication | Available |

| API Security | Required |

| Withdrawal Protection | Required |

If you decide to use Poloniex, taking additional security precautions is recommended. Never keep large amounts of cryptocurrency on any exchange long-term.

You should also verify that Poloniex is legally available in your country before using it. Regulations around cryptocurrency exchanges vary significantly by location.

While Poloniex has improved its security over time, remain cautious as with any cryptocurrency platform. The crypto space inherently carries risks regardless of which exchange you choose.

Frequently Asked Questions

Traders considering either Aibit or Poloniex need answers to several key comparison points. These questions address security measures, fee structures, and user experience differences that can help you make an informed choice.

What are the security features of Aibit compared to Poloniex?

Aibit employs multi-signature wallets and cold storage for most user funds, with regular security audits conducted by third parties. They offer two-factor authentication (2FA) and IP address monitoring as standard account protections.

Poloniex provides similar 2FA options but has faced security challenges in the past. Based on search results, some users have reported difficulties recovering accounts after losing access to authentication devices.

Both exchanges use encryption for data protection, but Aibit has implemented additional anti-phishing measures like customizable email verification codes.

Can you explain the fee structures for trading on Aibit and Poloniex?

Aibit operates on a tiered fee structure where your trading volume directly impacts costs. Maker fees range from 0.1% to 0.02% while taker fees span from 0.15% to 0.04% depending on your 30-day trading volume.

Poloniex also uses a volume-based fee model but typically starts with slightly higher base rates. Standard spot trading fees begin at 0.155% for takers and 0.08% for makers.

Withdrawal fees vary by cryptocurrency on both platforms, with Aibit generally offering more competitive rates for popular coins like Bitcoin and Ethereum.

What variety of cryptocurrencies can traders find on Aibit versus those on Poloniex?

Aibit supports approximately 150+ cryptocurrencies with regular additions of emerging tokens and projects. Their selection focuses on established coins with strong market presence and carefully vetted newer assets.

Poloniex historically offered a wide range of altcoins and was known for listing many smaller cap cryptocurrencies. However, after regulatory changes, particularly affecting US users as mentioned in the search results, their available selection has been adjusted.

Both exchanges provide spot trading pairs with BTC, ETH, and stablecoin options, but Aibit tends to add new listings more conservatively after thorough compliance reviews.

How user-friendly are the interfaces of Aibit and Poloniex for novice traders?

Aibit’s interface features a clean dashboard with simplified trading views for beginners and advanced charting tools for experienced users. Their mobile app mirrors the web platform’s functionality with intuitive navigation.

Poloniex offers a more technical interface that can be overwhelming for first-time traders. Their platform includes comprehensive trading tools but requires more time to master than more streamlined alternatives.

Both exchanges provide educational resources, but Aibit offers more guided tutorials and walkthrough videos specifically designed for cryptocurrency newcomers.

What customer support options are available on Aibit compared to Poloniex?

Aibit provides 24/7 customer support through live chat, email ticketing, and an extensive knowledge base. Response times typically range from minutes for live chat to under 24 hours for complex email inquiries.

Poloniex offers primarily ticket-based support with varying response times. The search results indicate some users have experienced frustration with Poloniex’s customer service, particularly regarding account access issues.

Both platforms maintain active social media channels, but Aibit’s community managers tend to be more responsive to direct user questions on these platforms.

How do the withdrawal processes differ between Aibit and Poloniex?

Aibit processes most cryptocurrency withdrawals automatically, with verification required only for amounts exceeding certain thresholds. Lower-tier accounts typically have daily withdrawal limits of 2 BTC equivalent, which increase with account verification levels.

Poloniex implements mandatory review periods for withdrawals, which can take several hours to complete. According to search results, US residents are losing access to Poloniex services, which impacts withdrawal options for those users.

Both exchanges require email confirmation and 2FA verification for withdrawals, but Aibit offers more customizable security settings for withdrawal approvals.

Poloniex Vs Aibit Conclusion: Why Not Use Both?

When comparing Poloniex and Aibit, you might wonder if you need to choose just one platform. The answer is that you don’t have to pick only one exchange.

Using both Poloniex and Aibit can give you access to different trading pairs, fee structures, and features that might not be available on a single platform.

Poloniex offers advanced trading features like margin trading and various order types. However, it’s important to note that as of recent announcements, Poloniex is shutting down operations for US users.

Aibit has its own set of advantages, including different coins and possibly different fee structures compared to Poloniex.

Benefits of using both platforms:

- Access to a wider range of cryptocurrencies

- Ability to take advantage of price differences between exchanges

- Reduced risk through diversification of exchange usage

- Different fee structures might benefit different types of trades

Remember to consider your location when choosing. If you’re a US resident, you’ll need to be aware of Poloniex’s recent changes to their service availability.

For optimal security, don’t keep large amounts of cryptocurrency on either exchange long-term. Transfer your assets to secure wallets when you’re not actively trading.