Choosing the right crypto exchange can make a big difference in your trading experience. Aibit and OKX are two popular platforms that offer various features and services for crypto traders.

Both Aibit and OKX provide competitive fee structures, with OKX often recognized for having some of the lowest fees among major exchanges. This can help you save money, especially if you trade frequently or in large volumes.

As you compare these platforms, you’ll want to look at security features, trading options, and user interface. OKX has been in the news recently for helping track stolen assets after security incidents at other exchanges, showing their commitment to security in the crypto space. Your choice between Aibit and OKX will depend on your specific trading needs and priorities.

Aibit vs OKX: At A Glance Comparison

When choosing between Aibit and OKX for your crypto trading needs, understanding their key differences can help you make an informed decision.

Trading Fees

| Exchange | Spot Trading | Futures Trading |

|---|---|---|

| Aibit | Competitive | Mid-range |

| OKX | Higher | Lower |

User Experience

Aibit offers a streamlined interface that’s easier for beginners to navigate. OKX provides a more feature-rich platform that experienced traders might prefer.

Available Assets

OKX takes the lead with more trading pairs and cryptocurrencies available. This gives you more options if you’re looking to diversify your portfolio.

Security Features

Both exchanges implement strong security measures, including two-factor authentication and cold storage for funds. OKX has been operating longer with a solid security track record.

Additional Features

OKX excels in Web3, DeFi, and NFT innovation compared to Aibit. You’ll find more advanced trading tools and features on OKX, making it suitable for professional traders.

Liquidity

OKX generally provides higher liquidity across its markets, which means better price execution for your trades, especially with larger orders.

Mobile Experience

Both exchanges offer mobile apps, but user reviews suggest OKX’s app provides more functionality while maintaining ease of use.

Customer Support

Aibit typically offers faster response times, while OKX provides more comprehensive educational resources and trading guides.

Aibit vs OKX: Trading Markets, Products & Leverage Offered

When comparing Aibit and OKX, trading options are a key differentiator for crypto traders like you.

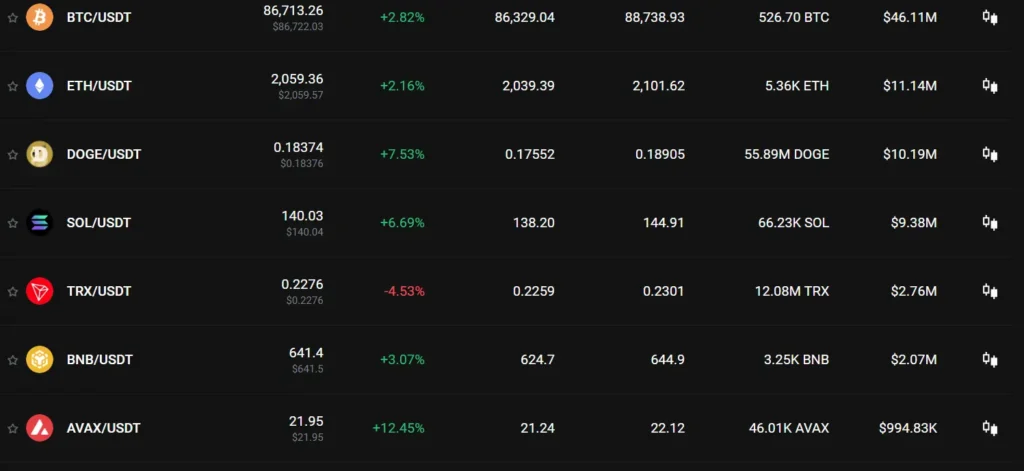

OKX offers over 350 cryptocurrency trading pairs and supports both spot and margin trading. The platform also provides futures contracts, options, and swap trading for more advanced users.

Aibit’s selection is somewhat smaller but still comprehensive with a focus on major cryptocurrencies and emerging altcoins. Their interface is often praised for being more beginner-friendly.

Leverage Options:

| Exchange | Maximum Leverage | Available Markets |

|---|---|---|

| OKX | Up to 125x | Futures, Margin, Perpetual Swaps |

| Aibit | Up to 100x | Futures, Margin Trading |

OKX has a slight edge with higher leverage options, but both platforms offer substantial leverage for experienced traders. Remember that higher leverage means higher risk.

Product Diversity:

- OKX: DeFi integration, NFT marketplace, Web3 wallet, copy trading, demo account

- Aibit: Savings products, staking options, launchpad for new projects

OKX leads in Web3 innovation and DeFi integration as noted in comparison reports. Their platform includes more advanced features for experienced traders.

You’ll find Aibit’s products more streamlined and possibly easier to navigate if you’re newer to crypto trading.

Both exchanges offer mobile apps that let you trade on the go, with real-time market data and alerts for price movements.

Aibit vs OKX: Supported Cryptocurrencies

When choosing between Aibit and OKX, the range of supported cryptocurrencies is an important factor to consider for your trading needs.

OKX offers an extensive selection of cryptocurrencies, making it a strong choice for traders seeking variety. The platform supports over 350 cryptocurrencies and more than 600 trading pairs, giving you plenty of options.

Aibit, being a newer exchange, typically offers a more focused selection of cryptocurrencies. While it includes major coins like Bitcoin and Ethereum, its overall offering is smaller compared to established exchanges like OKX.

OKX Cryptocurrency Highlights:

- 350+ cryptocurrencies

- 600+ trading pairs

- Strong support for DeFi tokens

- Regular addition of new tokens

Aibit Cryptocurrency Highlights:

- Major cryptocurrencies (BTC, ETH, etc.)

- Selected altcoins

- Limited but growing token selection

If you’re looking to trade less common altcoins or want access to a wide variety of tokens, OKX likely offers the better selection. Their platform consistently adds new cryptocurrencies as they gain popularity.

For traders focused primarily on major cryptocurrencies, Aibit’s offering may be sufficient for your needs. The platform is still expanding its selection as it grows in the market.

The difference in cryptocurrency selection reflects each platform’s market position – OKX as an established exchange with comprehensive offerings versus Aibit as a developing platform with a more targeted approach.

Aibit vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and OKX, fees play a crucial role in your decision. Let’s break down how these exchanges compare in terms of costs.

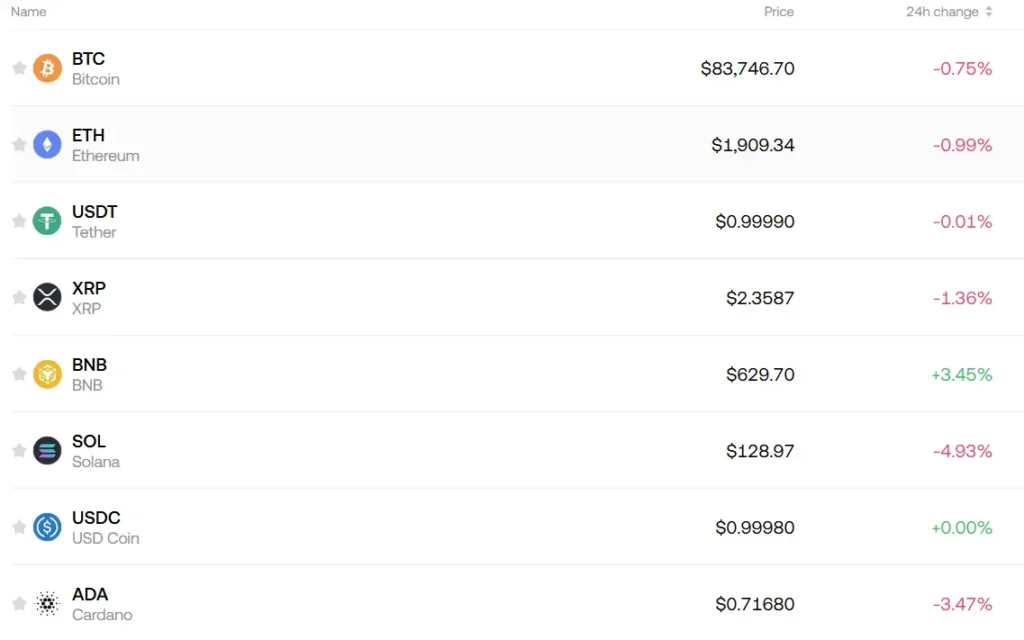

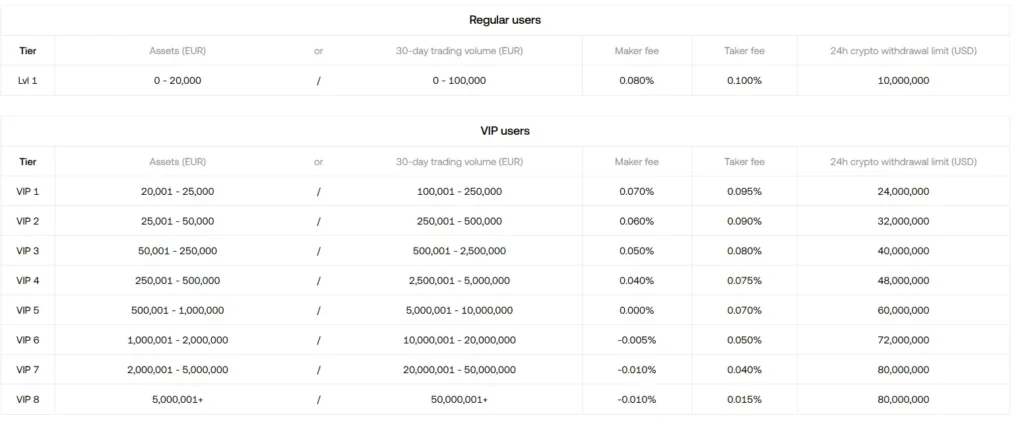

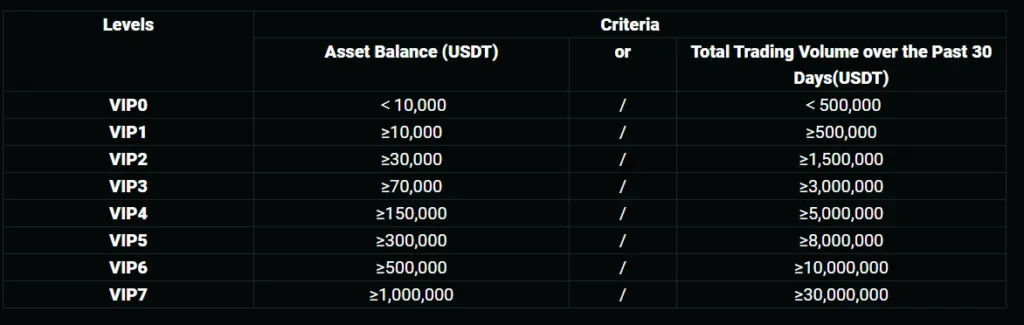

OKX offers competitive trading fees starting at 0.08% for makers and 0.10% for takers. These fees decrease as your trading volume increases through their tier-based structure.

For futures trading on OKX, fees are even lower with maker fees as low as 0.02% and taker fees at 0.05%. This makes OKX attractive for high-volume traders.

Aibit’s fee structure is also competitive, though not as extensively documented in recent comparisons. You’ll want to check their current rates as crypto exchange fees can change quickly.

Withdrawal Fees Comparison:

| Exchange | Crypto Withdrawal | Fiat Support |

|---|---|---|

| OKX | Varies by crypto | Better |

| Aibit | Varies by crypto | Limited |

OKX appears to have better fiat support options, which might save you money when moving between crypto and traditional currency.

Remember that withdrawal fees depend on the specific cryptocurrency you’re transferring. Some networks have higher fees than others regardless of the exchange.

Beyond basic fees, look at additional costs like deposit fees, network fees, and any premium features that might require extra payment on either platform.

Aibit vs OKX: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both Aibit and OKX offer various order types to help you execute trades effectively.

OKX provides several basic order types including limit orders, which let you buy or sell a specific amount at a set price or better. This gives you control over your entry and exit points in the market.

Aibit also offers limit orders, along with market orders that execute immediately at the current market price. Both platforms support these fundamental order types that most traders regularly use.

For more advanced trading, OKX includes stop orders, trailing stops, and OCO (One-Cancels-Other) orders. These tools help you manage risk and automate your trading strategy based on market movements.

Aibit’s advanced order selection includes similar options, though OKX generally offers a wider variety of specialized order types for experienced traders.

Order Type Comparison:

| Order Type | OKX | Aibit |

|---|---|---|

| Limit Order | ✓ | ✓ |

| Market Order | ✓ | ✓ |

| Stop Loss | ✓ | ✓ |

| Take Profit | ✓ | ✓ |

| Trailing Stop | ✓ | Limited |

| OCO Orders | ✓ | ✓ |

OKX tends to provide more detailed customization options for each order type, which can be helpful if you’re an active trader who needs precise control over your positions.

Both platforms offer mobile and desktop interfaces that make placing different order types straightforward, though OKX’s documentation and guides for using these features are more comprehensive.

Aibit vs OKX: KYC Requirements & KYC Limits

When choosing between Aibit and OKX, understanding their KYC (Know Your Customer) requirements can help you make an informed decision.

OKX offers both KYC and non-KYC options for users. While verification is not mandatory to use OKX, completing it provides additional benefits and higher trading limits.

For non-KYC users on OKX, there are specific limits based on your location. Users in the USA can trade up to $10,000, while European users face a lower limit of €2,000.

Aibit operates similarly to Bybit in its platform structure but differs in KYC requirements. It offers a more streamlined experience for users seeking privacy.

OKX KYC Levels:

- Basic (No KYC): Limited withdrawal amounts and features

- Verified: Higher limits and access to more services

- Advanced: Maximum platform benefits

Aibit KYC Approach:

- Focuses on providing non-KYC options

- Offers both physical and virtual cards

- Virtual cards require no identity verification

The cryptocurrency exchange landscape is shifting toward stricter compliance, especially after Binance’s $4.3 billion settlement. This regulatory scrutiny may impact both platforms’ KYC policies in the future.

Your choice between these exchanges should factor in your privacy preferences, trading volume needs, and geographical restrictions that may apply.

Aibit vs OKX: Deposits & Withdrawal Options

When choosing between Aibit and OKX, deposit and withdrawal options play a crucial role in your trading experience. Let’s examine how these exchanges compare in this area.

OKX doesn’t charge fees for cryptocurrency deposits, which is standard across most exchanges. However, you will need to pay network fees for blockchain transactions when withdrawing.

OKX offers support for a wide range of deposit methods. You can buy crypto using over 129 supported payment options, making it accessible regardless of your location or preferred payment method.

For fiat transactions, OKX generally provides better support than competitors like Bybit. This makes it easier for you to move between traditional currency and crypto as needed.

Deposit Methods Comparison:

- OKX: 129+ payment options, strong fiat support

- Aibit: Limited payment options (varies by region)

Withdrawal Features:

- OKX: Multiple withdrawal options, standard network fees apply

- Aibit: Basic withdrawal functionality, competitive fees

While specific information about Aibit’s deposit and withdrawal systems is limited in the search results, OKX appears to offer more comprehensive options. The extensive payment methods and established fiat support give OKX an advantage in this category.

You should check both platforms’ current fee structures before deciding, as these can change based on market conditions and platform updates.

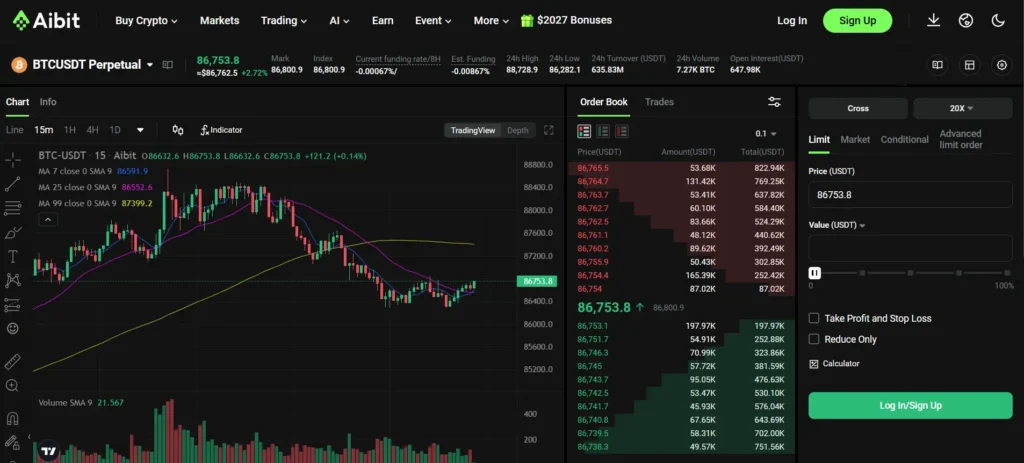

Aibit vs OKX: Trading & Platform Experience Comparison

When comparing Aibit and OKX, trading experience and platform features are crucial factors to consider for your crypto journey.

User Interface

Aibit offers a clean, straightforward interface that’s easy to navigate for beginners. OKX provides a more feature-rich dashboard that might feel overwhelming at first but offers more tools for analysis.

Trading Tools

| Feature | Aibit | OKX |

|---|---|---|

| Order Types | Market, Limit, Stop-loss | Market, Limit, Stop-loss, OCO, Trailing stop |

| Charts | Basic TradingView | Advanced TradingView with more indicators |

| Mobile App | Simple, focused | Comprehensive but complex |

OKX excels in offering advanced trading tools, while Aibit prioritizes simplicity without sacrificing essential functions.

Trading Fees

OKX typically offers lower base trading fees compared to Aibit, especially for futures trading. However, both platforms provide fee discounts based on trading volume and token holdings.

Available Markets

OKX supports a wider range of trading pairs and markets than Aibit. You’ll find more altcoins and DeFi tokens on OKX, while Aibit focuses on major cryptocurrencies.

Platform Stability

Both platforms maintain good uptime, but OKX has a slight edge during high-volatility market periods with less slowdown or performance issues.

Web3 Integration

OKX leads with better Web3, DeFi, and NFT support. Their platform connects more seamlessly with decentralized applications, giving you more options beyond traditional trading.

Aibit vs OKX: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding liquidation mechanisms is crucial for your risk management. Both Aibit and OKX have systems in place to protect themselves when your position approaches a point where you cannot cover potential losses.

OKX uses a tiered liquidation system based on their own pricing methodology. This approach considers market data from multiple sources to determine fair prices for liquidation events.

Aibit’s liquidation mechanism follows a similar principle but may differ in specific thresholds and warning systems. Both platforms will notify you when your position approaches the liquidation price.

The margin ratio is a key factor in both systems. When your margin ratio falls below required levels, you’ll first receive margin calls as warnings.

Key Liquidation Differences:

| Feature | Aibit | OKX |

|---|---|---|

| Liquidation Warnings | Yes | Yes |

| Partial Liquidation | Available | Available |

| Liquidation Price Calculation | Based on position size and leverage | Based on comprehensive pricing methodology |

| Insurance Fund | Yes | Yes |

You should regularly monitor your positions on either platform to avoid unexpected liquidations. Setting stop-loss orders below liquidation prices is a good practice.

Both exchanges maintain insurance funds to handle liquidation events that don’t execute at expected prices. These funds help protect traders from negative balance scenarios.

Remember that high volatility periods can lead to faster liquidations. Your liquidation risk increases with higher leverage ratios.

Aibit vs OKX: Insurance

When choosing a crypto exchange, insurance is a critical factor to consider. This protection can safeguard your assets in case of hacks or security breaches.

OKX Insurance Status:

- No insurance coverage for user assets

- Explicitly states this limitation in their Terms and Conditions

- Users bear all risks of asset loss

Aibit Insurance Status:

- Offers a dedicated protection fund

- Covers certain types of security incidents

- Has clearer policies about asset protection than OKX

Insurance options vary significantly between these platforms. OKX is quite direct about not providing insurance protection, placing responsibility on users to understand these risks.

Aibit takes a different approach by implementing a protection fund that can help mitigate losses in specific circumstances. This gives you an added layer of security when trading on their platform.

Before selecting either exchange, you should carefully review their current insurance policies. These terms can change over time, so checking the most recent documentation is essential.

Remember that even with insurance, no crypto exchange offers complete protection. Your trading strategy should always include personal security measures regardless of which platform you choose.

Aibit vs OKX: Customer Support

When choosing between crypto exchanges, customer support can make a big difference in your trading experience. Both Aibit and OKX offer support options, but they differ in quality and response times.

OKX’s customer service has received mixed reviews. Some users report frustrating experiences with automated responses and difficulty reaching human agents. According to search results, some customers have complained about sending multiple emails only to receive robot replies.

In contrast, Aibit (which appears to be related to Bybit based on the search context) seems to focus on providing more personalized customer service. However, specific details about Aibit’s support quality aren’t clearly mentioned in the search results.

Response time is important when you have urgent issues with your crypto assets. OKX has been criticized by some users for slow resolution times, while others report quick solutions to their problems.

Both exchanges offer standard support channels:

- Email support

- Live chat

- Help center documentation

- Community forums

If you value responsive customer service, it’s worth considering that Binance and OKX have been noted for quick resolutions according to one search result, though individual experiences may vary.

Before choosing either platform, check recent reviews about their current support quality as this can change over time.

Aibit vs OKX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Aibit and OKX offer strong protection for your assets, but they differ in their approaches.

OKX implements multiple security layers including Multi-Factor Authentication (MFA) and cold storage solutions for crypto assets. Their system uses anti-phishing codes to prevent unauthorized access to your account.

OKX recently launched “OKX Protect,” which features 9 major security mechanisms. These include advanced AI monitoring systems that detect suspicious activities and 24/7 expert support for immediate assistance.

Aibit also prioritizes security with similar features like two-factor authentication and offline storage options. However, they haven’t publicized their security infrastructure as extensively as OKX has.

Key Security Features Comparison:

| Feature | OKX | Aibit |

|---|---|---|

| Cold Storage | Yes | Yes |

| Multi-Factor Authentication | Yes | Yes |

| AI Monitoring | Yes | Limited |

| Anti-phishing Tools | Yes | Basic |

| 24/7 Support | Yes | Yes |

| Real-time Fraud Prevention | Advanced | Standard |

OKX seems to have a slight edge in security innovation with their more transparent approach and advanced AI monitoring tools.

You should consider enabling all available security features regardless of which platform you choose. This includes using strong, unique passwords and activating all authentication options offered.

Is Aibit Safe & Legal To Use?

Aibit’s safety and legality depend on several factors you should consider before using the platform. While the search results don’t specifically mention Aibit, we can evaluate it using general crypto exchange safety principles.

First, check if Aibit is registered and licensed in your country. Legitimate exchanges typically comply with local regulations and obtain proper licenses to operate legally.

Security features to look for:

- Two-factor authentication (2FA)

- Cold storage for most funds

- Regular security audits

- Insurance against hacks

The regulatory status varies by location. Some countries have banned crypto exchanges entirely, while others require specific registrations and compliance measures.

Unlike OKX, which has established compliance in regions like Europe and Australia, you’ll need to verify Aibit’s regulatory status in your jurisdiction.

Risk factors to consider:

- History of security breaches

- Transparency about company structure

- Clarity of terms and conditions

- Quality of customer support

You should research Aibit’s track record with security incidents. Major exchanges often publish security protocols and fund protection measures on their websites.

Remember that even legitimate exchanges carry risks. Never invest more than you can afford to lose, and consider using hardware wallets for long-term storage of your assets.

Is OKX Safe & Legal To Use?

OKX is generally considered a safe and legal exchange for cryptocurrency trading. It has received an “AA” rating from CertiK and ranks #3 among the safest crypto exchanges in 2025.

The platform has not experienced any security breaches since 2017, which speaks to its improved security measures. This track record is important when considering where to trade your digital assets.

OKX operates with regulatory licenses in several jurisdictions, making it a legitimate platform in many countries. However, you should always check if OKX is legal in your specific location, as cryptocurrency regulations vary worldwide.

Key safety features of OKX include:

- Two-factor authentication (2FA)

- Cold storage for most user funds

- Regular security audits

- Anti-phishing codes

When using OKX, you can enhance your security by:

- Enabling all security features

- Using unique, strong passwords

- Moving large holdings to a personal wallet

- Verifying website URLs before logging in

OKX is widely recognized as one of the top cryptocurrency exchanges where you can safely buy Bitcoin and other cryptocurrencies. Their platform combines security with extensive trading options.

Remember that while OKX has strong security, no exchange is 100% immune to risks. Consider using hardware wallets for long-term storage of significant crypto holdings.

Frequently Asked Questions

Traders considering Bybit and OKX often have specific concerns about fees, security, and platform features. These questions address key differences that can help you make an informed decision when choosing between these popular exchanges.

What are the primary differences in fees between Bybit and OKX?

OKX generally charges higher fees than Bybit due to their inclusion of third-party merchants in transactions. Bybit’s maker-taker fee structure starts at 0.1% for makers and 0.1% for takers, decreasing with higher trading volumes.

OKX’s standard trading fees begin at 0.1% for makers and 0.15% for takers. Both exchanges offer fee discounts for users who hold their native tokens or maintain high trading volumes.

For withdrawals, Bybit typically offers more competitive rates, especially for popular coins like Bitcoin and Ethereum.

Which has higher liquidity and trading volume, Bybit or OKX?

OKX currently maintains higher overall liquidity and trading volume compared to Bybit. OKX ranks consistently among the top 5 exchanges globally by volume, while Bybit usually places in the top 10.

This difference is most noticeable during high volatility periods when OKX’s deeper order books provide better price execution and less slippage for large trades.

For popular trading pairs like BTC/USDT and ETH/USDT, both exchanges offer excellent liquidity. However, OKX has an advantage with altcoins and more exotic trading pairs.

How do the security features of Bybit compare with those of OKX?

Both exchanges implement strong security measures including two-factor authentication, anti-phishing codes, and advanced encryption protocols. OKX holds approximately 95% of user assets in cold storage, while Bybit maintains a similar security approach.

OKX has invested heavily in security infrastructure and has faced fewer notable incidents in recent years. They also offer more comprehensive security settings in their user interface.

Bybit provides a dedicated security section in their app with regular security checkups and anti-fraud systems. Neither exchange has experienced major hacks in their recent history.

What are the advantages of using Bybit over OKX for cryptocurrency trading?

Bybit offers a more intuitive user interface that many beginners find easier to navigate. Their mobile app receives higher user ratings for reliability and responsiveness compared to OKX.

Bybit’s customer support is generally considered more responsive, with 24/7 live chat support in multiple languages. They also provide more educational resources for new traders.

For derivatives traders, Bybit offers more flexible leverage options and a wider range of contract types. Their trading engine experiences fewer overloads during market volatility.

What range of cryptocurrencies is offered by Bybit versus OKX?

OKX supports over 300 cryptocurrencies, significantly more than Bybit’s selection of approximately 150-180 tokens. This gives OKX users access to more emerging projects and niche investments.

For derivative products, both exchanges offer similar coverage of major cryptocurrencies, but OKX provides more exotic pairs and innovative derivative products like leveraged tokens.

OKX also leads in offering tokenized stocks and commodities, allowing traders to diversify beyond pure crypto assets on the same platform.

What are users’ experiences and reviews on the reliability of OKX’s platform?

Most users report that OKX’s platform offers good reliability with minimal unexpected downtime. During the 2021 bull market, some users experienced temporary access issues during peak trading moments.

OKX receives praise for its Web3 wallet integration and DeFi capabilities. Users particularly appreciate the platform’s advanced charting tools and technical analysis features.

Common complaints include occasional delays in customer support response times and a steeper learning curve for beginners. Long-term traders generally report satisfaction with platform stability during both normal and high-volume trading periods.

Aibit vs OKX Conclusion: Why Not Use Both?

When comparing Aitbit and OKX platforms, it’s not always about choosing one over the other. Each system offers unique benefits that can complement your overall strategy.

Aibit might excel in user-friendly interfaces and beginner accessibility, while OKX could offer more advanced features for experienced users. This creates an opportunity to leverage both platforms.

Benefits of Using Both:

- Diversification of resources

- Access to different feature sets

- Reduced dependency on a single platform

Many users find that using Aibit for certain tasks and OKX for others provides a more comprehensive solution. This dual approach allows you to tap into the strengths of each system.

Consider your specific needs when deciding how to balance your usage. You might use Aibit for daily activities and OKX for more specialized functions.

When to Consider Both:

- When you need features exclusive to each platform

- If you’re managing different types of projects

- When seeking redundancy for important functions

The “either/or” mentality isn’t always necessary in the digital world. Using both Aibit and OKX can create a more robust system that addresses various requirements.

Remember that your strategy should align with your goals. The best approach is often the one that provides the most value for your specific situation.