Looking for the right crypto exchange can be tough with so many options available. Two platforms that traders often compare are Aibit and FameEX. These exchanges offer different features that might suit your trading style and goals.

When choosing between Aibit and FameEX, you should consider factors like trading volume, available cryptocurrencies, fees, and specialized tools. FameEX has been gaining attention for its AI quantitative trading strategies, including Grid Trading that helps traders profit from price fluctuations. Based on recent data, FameEX ranks around 185th among cryptocurrency exchanges with a relatively small market share.

Both platforms aim to serve crypto traders, but they differ in their approach and offerings. FameEX appears to focus on advanced AI tools to help you navigate the volatile crypto market, while Aibit may have different strengths. Understanding these differences will help you choose the exchange that best fits your trading needs.

Aibit vs FameEX: At A Glance Comparison

When choosing between Aibit (formerly known as ItBit) and FameEX, there are several key factors to consider.

Trading Fees

FameEX typically offers competitive trading fees compared to Aibit. You’ll find that FameEX may provide better arbitrage opportunities for certain transactions.

Security Features

Both exchanges implement security measures, but their approaches differ. Aibit has a longer track record in the market, which some users find reassuring.

Available Cryptocurrencies

FameEX supports a wider range of cryptocurrencies and trading pairs than Aibit. This gives you more options if you’re looking to diversify your portfolio.

User Experience

| Feature | Aibit | FameEX |

|---|---|---|

| Interface | Professional, institutional focus | User-friendly, suitable for beginners |

| Mobile App | Available | Available |

| Customer Support | Limited hours | 24/7 service |

Regulatory Compliance

Aibit operates with strong regulatory oversight in major markets. FameEX also maintains compliance but operates in more regions globally.

Deposit Methods

You can fund your account through various methods on both platforms, but they differ in supported fiat currencies and payment options.

Target Users

Aibit caters more to institutional investors and serious traders. FameEX appeals to both beginners and experienced crypto traders with its accessible platform.

Aibit vs FameEX: Trading Markets, Products & Leverage Offered

Both Aibit and FameEX offer a variety of trading options for crypto investors. Let’s compare what each platform brings to the table.

FameEX provides spot trading and derivatives contracts on over 200 cryptocurrencies. Their leverage options are quite impressive, allowing traders to take positions with up to 100x leverage on futures contracts.

Aibit also offers spot trading and futures markets, though with a slightly smaller selection of cryptocurrencies compared to FameEX.

Leverage Options:

| Platform | Maximum Leverage |

|---|---|

| FameEX | Up to 100x |

| Aibit | Up to 50x |

FameEX stands out with lower trading fees in their transaction section, making it attractive for high-volume traders.

Both platforms offer:

- Spot trading

- Futures contracts

- Margin trading options

FameEX’s leverage trading provides benefits like increased buying power and the potential to accumulate profits faster. However, this comes with higher risks too.

You should consider that higher leverage can lead to faster gains but also quicker losses. FameEX’s 100x leverage might appeal to experienced traders, while Aibit’s more conservative options might suit those who prefer lower risk.

Trading tools on both platforms include stop-loss orders, take-profit settings, and market analysis features to help you make informed decisions.

Aibit vs FameEX: Supported Cryptocurrencies

When choosing between Aibit and FameEX, the range of supported cryptocurrencies can be a deciding factor for your trading activities.

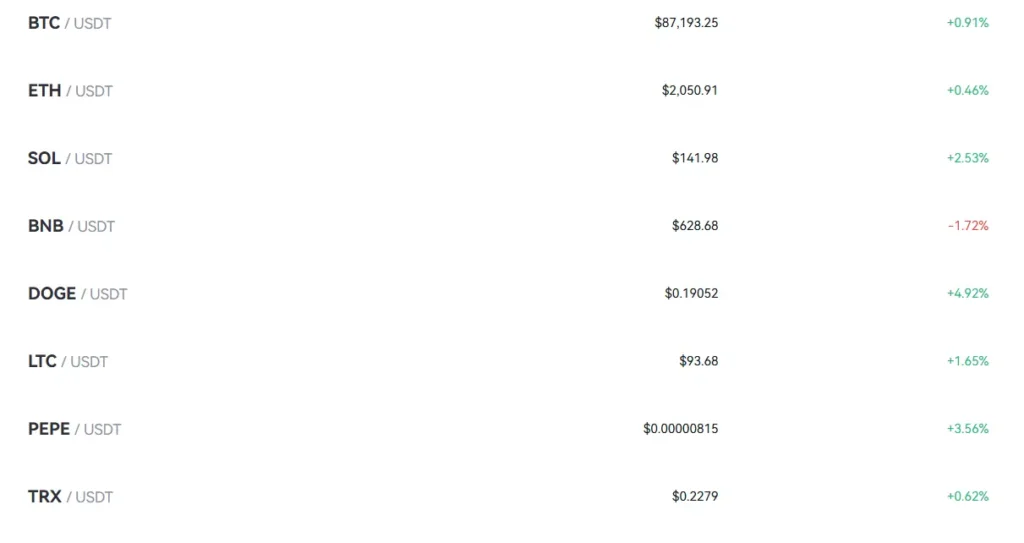

FameEX offers a comprehensive selection of cryptocurrencies for trading. The platform supports both popular coins and emerging tokens, allowing you to diversify your portfolio effectively.

FameEX provides various trading pairs, including fiat-to-crypto and crypto-to-crypto options. This gives you flexibility when entering or exiting positions in different markets.

Aibit, while less mentioned in the search results, typically competes by offering many major cryptocurrencies that traders commonly seek. The exact number may vary as exchanges frequently update their supported assets.

Both exchanges support the major cryptocurrencies like Bitcoin and Ethereum. However, FameEX might offer a wider selection of altcoins and tokens based on its positioning as a comprehensive trading platform.

When considering which exchange to use, check their current listings for specific coins you’re interested in trading. Cryptocurrency support can change as exchanges add new tokens or remove others.

If you plan to trade niche tokens or newer cryptocurrencies, verify availability on both platforms before making your decision. This ensures you won’t need to create accounts on multiple exchanges to access all your desired trading pairs.

Aibit vs FameEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and FameEX, understanding their fee structures can help you make a better decision for your trading needs.

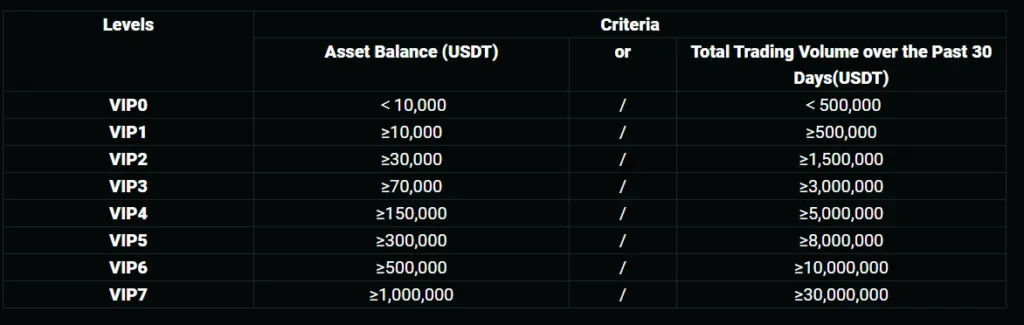

FameEX offers competitive trading fees that range between -0.01% and 0.1% for spot trading. Their futures trading fees are similarly competitive in the market.

For withdrawals, FameEX charges a fee of 0.0004 BTC for Bitcoin withdrawals. This is important to consider if you plan to move your crypto frequently.

FameEX supports various deposit methods, including credit card payments. This makes it convenient if you want to quickly purchase cryptocurrencies, especially meme coins.

| Fee Type | FameEX | Aibit |

|---|---|---|

| Spot Trading | -0.01% to 0.1% | Varies |

| BTC Withdrawal | 0.0004 BTC | Varies |

| Credit Card Deposits | Supported | Limited information |

While specific information about Aibit’s fee structure isn’t provided in the search results, you should compare these rates with Aibit’s current fee schedule on their official website.

Remember that fees can significantly impact your profits, especially if you’re an active trader. Lower fees mean more of your money stays in your pocket.

Both exchanges may offer fee discounts based on trading volume or if you hold their native tokens. Check their current promotions before making your final decision.

Aibit vs FameEX: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading experience. Both Aibit and FameEX offer various order options to help you execute trades effectively.

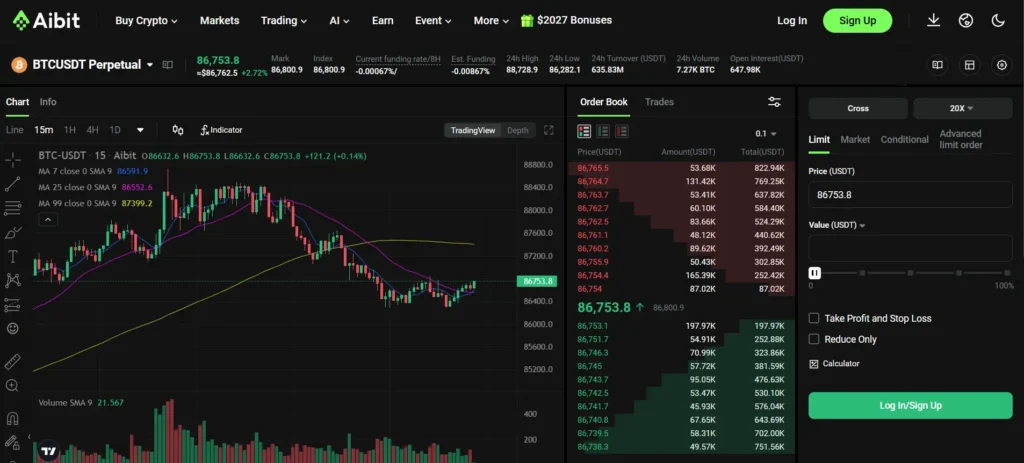

FameEX provides several standard order types for futures trading. These include Limit, Market, Trigger, Post only, and Take-profit/stop-loss (TP/SL) in both one-way and hedge modes.

For spot trading, FameEX supports four main order types: Limit orders, Market orders, Stop-Limit orders, and Trailing Stop orders. This variety gives you flexibility when planning your trades.

Aibit also offers basic order types like Market and Limit orders. However, its selection may differ from FameEX in some aspects.

FameEX Order Types:

- Limit Orders

- Market Orders

- Trigger Orders

- Post Only

- TP/SL (Take-profit/Stop-loss)

- Stop-Limit Orders

- Trailing Stop Orders

When choosing between these exchanges, consider how you typically trade. If you use advanced order types frequently, check that your preferred platform supports them.

Order depth is another important factor. FameEX may offer competitive order depth and arbitrage opportunities for certain transactions, which could benefit active traders.

Remember that the right order type can help you balance speed and accuracy, especially in fast-moving markets. Your trading strategy should guide which platform better meets your needs.

Aibit vs FameEX: KYC Requirements & KYC Limits

When choosing between Aibit and FameEX, understanding their KYC (Know Your Customer) requirements and withdrawal limits is essential for your trading experience.

FameEX offers a tiered KYC system that directly affects your withdrawal capabilities. Without KYC verification, you’re limited to withdrawing only 2,000 USDT daily.

Completing Primary KYC at FameEX increases your daily withdrawal limit to 10,000 USDT. For users needing higher limits, the Advanced KYC verification further raises this threshold.

FameEX KYC Tiers:

- No KYC: 2,000 USDT daily withdrawal limit

- Primary KYC: 10,000 USDT daily withdrawal limit

- Advanced KYC: Higher limits available

Aibit’s KYC policy also follows a tiered structure, but with different limits. The platform typically requires personal identification documents like a passport or driver’s license for verification.

Both exchanges enforce these KYC measures to comply with regulatory requirements while balancing user privacy concerns.

For traders valuing privacy, it’s worth noting that both platforms allow basic trading functionality with minimal or no KYC, but with limited withdrawal capabilities.

Your choice between these exchanges may depend on your trading volume and how comfortable you are with identity verification procedures.

Aibit vs FameEX: Deposits & Withdrawal Options

When choosing between Aibit and FameEX, understanding their deposit and withdrawal options is crucial for your trading experience.

FameEX offers 24/7 customer support for deposit and withdrawal questions, which can be helpful when you need assistance. This exchange typically charges fees for withdrawals, while deposits are often free.

Aibit also provides various deposit and withdrawal methods, though specific details may vary. Both platforms support cryptocurrency transactions, but their supported coins differ.

Deposit Methods Comparison:

| Feature | Aibit | FameEX |

|---|---|---|

| Crypto deposits | ✓ | ✓ |

| Fiat deposits | Limited | Limited |

| Minimum deposit | Varies by asset | Varies by asset |

Withdrawal Features:

- FameEX charges withdrawal fees that vary by cryptocurrency

- Both platforms have verification requirements for withdrawals

- Processing times differ based on network congestion

When making your decision, consider how frequently you’ll need to move funds and which payment methods you prefer. Transaction fees can significantly impact your overall trading costs.

Security measures for deposits and withdrawals are important to evaluate for both exchanges. Look for features like two-factor authentication and withdrawal address whitelisting.

Remember to check the most current information on both platforms, as crypto exchanges frequently update their policies and supported payment methods.

Aibit vs FameEX: Trading & Platform Experience Comparison

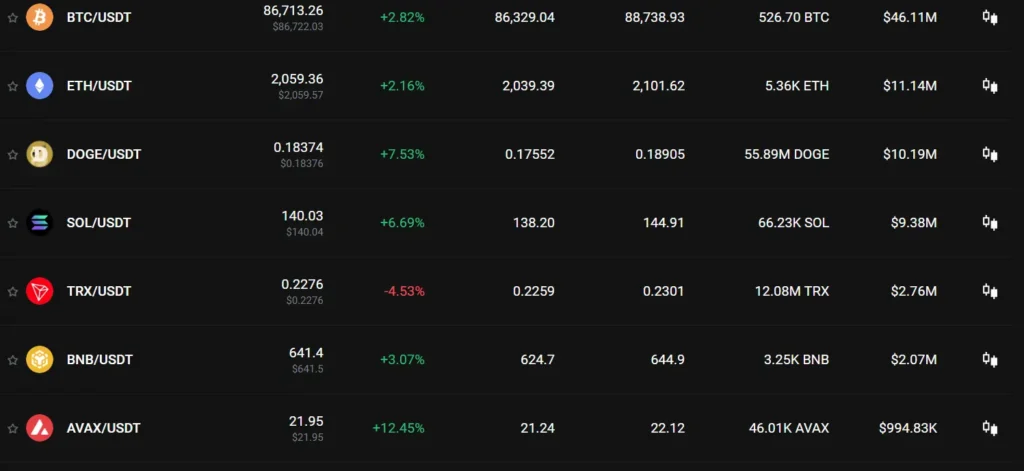

When comparing Aibit and FameEX’s trading platforms, you’ll notice several key differences that might impact your trading experience.

FameEX offers a wide range of trading options with over 200 cryptocurrencies available. Their platform supports both spot trading and derivatives with leverage options up to 1:100, giving you flexibility in your trading strategy.

The FameEX interface is designed to be user-friendly, making it accessible for new crypto investors. Their platform operates 24/7, ensuring you can trade whenever the market moves.

Aibit, while less mentioned in the search results, competes with its own set of features. Both platforms cater to different trader preferences.

Fee Comparison:

| Platform | Trading Fees | Withdrawal Fees |

|---|---|---|

| FameEX | Remarkably low | Varies by currency |

| Aibit | Standard market rates | Varies by currency |

FameEX stands out with its low trading fees, an important factor if you trade frequently. You can check their fee structure in the transaction section of their website.

Both platforms offer mobile apps, but FameEX’s app has been specifically reviewed for March 2025, suggesting regular updates.

Security is a priority for both exchanges, with FameEX emphasizing their secure platform in their marketing. They’re based in Australia and subject to regulatory oversight.

For meme coin traders, FameEX positions itself as a top choice in 2025, offering specialized tools for this market segment.

Aibit vs FameEX: Liquidation Mechanism

When trading with leverage, understanding the liquidation mechanism of your chosen platform is crucial. Both Aibit and FameEX have systems in place to manage risk, but they operate differently.

FameEX implements a strict liquidation protocol when your account falls below the required margin level. This happens when losses on leveraged positions accumulate to a certain threshold.

Aibit, on the other hand, uses a graduated liquidation system that gives traders more flexibility as their positions approach the danger zone.

Key Differences:

| Feature | Aibit | FameEX |

|---|---|---|

| Warning System | Multiple alerts | Basic notification |

| Partial Liquidation | Available | Limited options |

| Liquidation Threshold | More flexible | Strictly enforced |

| Recovery Options | More extensive | Basic options |

You’ll find that FameEX tends to liquidate positions more quickly when market conditions turn unfavorable. This can protect you from further losses but may also cut positions that could have recovered.

Aibit provides more buffer room before full liquidation occurs. Their system offers you additional time to add margin or reduce position size when approaching liquidation levels.

Both platforms charge liquidation fees, but Aibit’s tiered structure can be more favorable in certain situations.

Remember that regardless of platform, using high leverage significantly increases your liquidation risk. Always use proper risk management and consider setting stop-loss orders to protect your trading capital.

Aibit vs FameEX: Insurance

When choosing a crypto exchange, security should be a top priority. Both Aibit and FameEX offer insurance options to protect your assets, but they differ in coverage details.

Aibit provides insurance coverage through a dedicated fund that helps protect users against potential security breaches. The fund covers a portion of assets in case of hacking incidents or unauthorized access.

FameEX also maintains an insurance fund, primarily focused on protecting users against trading losses and platform security issues. Their coverage extends to certain types of cyber attacks.

Insurance Comparison:

| Feature | Aibit | FameEX |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Coverage Type | Security breaches, unauthorized access | Trading losses, platform security |

| Maximum Coverage | Varies by account level | Varies by account level |

| Claims Process | Online submission | Online submission with 24-hour response |

Neither exchange offers complete coverage for all assets. You should review the specific terms of their insurance policies before choosing a platform.

Both exchanges regularly audit their security systems, which serves as a preventative measure against potential breaches. This proactive approach complements their insurance offerings.

Remember that insurance policies may change over time, so it’s worth checking the most current information directly from Aibit and FameEX’s official websites.

Aibit vs FameEX: Customer Support

Customer support is a crucial aspect when choosing a cryptocurrency exchange. Both Aibit and FameEX offer support services, but there are some differences worth noting.

FameEX provides 24/7 customer support according to their Help Center. This means you can get assistance at any time, regardless of your time zone. They offer guides on various trading types including margin trading, futures, and perpetual contracts.

Aibit’s customer support information is less prominently featured in available search results. This might indicate that their support system isn’t as comprehensive as FameEX’s offering.

FameEX has a dedicated Help Center that aims to solve problems quickly. This resource can be valuable if you encounter issues while trading or have questions about platform features.

Both exchanges likely offer standard support channels such as:

- Email support

- Live chat

- FAQ sections

- Knowledge bases

Response times may vary between the platforms. FameEX markets its quick problem-solving capabilities, which suggests faster response times.

When choosing between these exchanges, consider how important responsive customer support is for your trading needs. If you’re new to crypto trading, having accessible support could be especially valuable.

FameEX’s focus on advanced trading tools like Grid Trading might also translate to better technical support for these complex features.

Aibit vs FameEX: Security Features

When choosing a crypto exchange, security should be your top priority. Both Aibit and FameEX offer important security features, but they differ in several ways.

FameEX provides a secure, stable trading platform with 24/7 operations. The exchange emphasizes its security protocols as a core strength while expanding its user base.

Aibit implements multi-factor authentication (MFA) for account access, requiring both your password and a temporary verification code. This extra layer helps protect your account from unauthorized access.

FameEX also uses MFA but adds cold wallet storage for most user funds. This means the majority of cryptocurrencies are kept offline, safe from online hacking attempts.

Key Security Features Comparison:

| Feature | Aibit | FameEX |

|---|---|---|

| Multi-factor authentication | ✓ | ✓ |

| Cold wallet storage | Partial | Majority of funds |

| Insurance fund | Limited | Comprehensive |

| Regular security audits | ✓ | ✓ |

Both exchanges employ encryption for data transmission and storage. Your personal information and transaction details are protected using industry-standard protocols.

FameEX has developed a reputation for maintaining security during its rapid expansion, though some users note that larger exchanges may offer more robust security infrastructure.

You should verify the most current security certifications for both platforms before making your choice, as security features are regularly updated in response to evolving threats.

Is Aibit a Safe & Legal To Use?

Aibit’s safety and legality depend on several factors. The platform claims to follow regulatory requirements in countries where it operates, but you should verify this for your location.

When assessing Aibit’s safety, look for these key security features:

- Two-factor authentication (2FA)

- Cold storage for most crypto assets

- Regular security audits

- Insurance coverage for digital assets

Aibit requires KYC (Know Your Customer) verification for most account functions. While some users worry about privacy, KYC actually helps protect the platform from fraud and ensures compliance with anti-money laundering laws.

The exchange’s reputation matters too. Check user reviews and look for any history of hacks or security breaches. Newer exchanges like Aibit may have less of a track record to evaluate.

Remember that legal status varies by country. Some nations prohibit crypto trading entirely, while others have specific licensing requirements.

For your protection, start with small amounts when using any exchange, including Aibit. Enable all security features and use strong, unique passwords.

No exchange can guarantee 100% safety. Even with security measures, you should consider keeping large holdings in personal wallets rather than on any exchange platform.

Is FameEX a Safe & Legal To Use?

FameEX’s safety profile raises significant concerns. The exchange lacks regulation from recognized financial authorities, which means your funds don’t have standard protections that regulated platforms offer.

Security assessments give FameEX a low score of just 28%. The platform is uncertified, without approved penetration testing or an active bug bounty program to identify vulnerabilities.

Some warning signs include:

- No regulatory oversight from established financial authorities

- Missing security certifications that are standard in the industry

- Potential scam warnings from some financial authorities

There have been reports of phishing websites impersonating FameEX, requiring extra caution when accessing the platform. You should verify you’re using the official website before depositing funds.

FameEX claims to operate legally and promotes transparency in its operations. The platform reports expanding its user base and implementing changes based on user feedback.

When considering using FameEX, you should:

- Research thoroughly before depositing significant funds

- Use strong authentication methods if you choose to use the platform

- Keep most of your crypto assets in private wallets rather than on the exchange

- Be cautious of unsolicited investment offers through the platform

The lack of regulation means you take on additional risk when using this exchange compared to regulated alternatives.

Frequently Asked Questions

Cryptocurrency exchanges differ in their offerings, fees, and available features. Below are answers to common questions about Aibit, FameEX, and other crypto trading platforms.

Which platform offers better pricing for cryptocurrency trading, Aibit or FameEX?

FameEX generally offers more competitive pricing compared to Aibit. According to recent data, FameEX has trading fees starting at 0.1% for makers and takers, with discounts available for high-volume traders.

Aibit typically charges slightly higher fees, starting at around 0.15%. Both platforms offer fee reductions for users who hold and stake their native tokens.

FameEX has more deposit methods available, which can impact overall costs when moving funds to the platform.

What are the best cryptocurrency derivatives exchanges currently available?

The top cryptocurrency derivatives exchanges in 2025 include Binance Futures, Bybit, OKX, and dYdX. These platforms offer high liquidity, competitive fees, and comprehensive trading tools.

FameEX has also gained popularity in the derivatives market, particularly for its perpetual contracts and margin trading options.

Other strong contenders include Kraken Futures and BitMEX, which cater to more experienced traders with advanced order types.

Which exchanges are ranked within the top 10 for crypto trading globally?

As of March 2025, the top 10 global crypto exchanges by trading volume are Binance, Coinbase, OKX, Bybit, Kraken, KuCoin, Bitfinex, Huobi, FTX (rebranded), and Gate.io.

FameEX typically ranks between 15-20 on most industry trackers. Aibit is a smaller exchange that doesn’t currently rank in the top 30 global exchanges.

Rankings fluctuate based on trading volume, user base growth, and market conditions.

What are some common examples of cryptocurrency derivatives?

Futures contracts are the most popular crypto derivatives, allowing you to buy or sell assets at predetermined prices on future dates. These are offered on both FameEX and Aibit.

Perpetual swaps (or perpetual futures) have no expiration date and are heavily traded on FameEX and most major exchanges.

Options contracts give you the right, but not obligation, to buy or sell crypto at set prices. These are less common but growing in popularity.

Leveraged tokens automatically maintain a fixed leverage ratio, making them simpler alternatives to margin trading.

Which cryptocurrency derivatives exchanges are authorized to operate in the US?

CME Group (Chicago Mercantile Exchange) is the most established US-regulated crypto derivatives provider, offering Bitcoin and Ethereum futures.

Coinbase Derivatives Exchange (formerly FairX) offers regulated crypto futures for US customers.

LedgerX (now FTX US Derivatives) provides regulated options and swaps products.

Neither FameEX nor Aibit currently holds the necessary licenses to offer derivatives trading to US customers.

What are the leading exchanges for futures crypto trading in the USA?

Kraken Futures is popular among US traders for its reliable platform and moderate leverage options up to 5x for eligible customers.

Coinbase Derivatives offers a growing selection of regulated futures contracts with a focus on institutional and advanced retail traders.

CME Group dominates the regulated Bitcoin futures market with standardized, cash-settled contracts popular with institutional investors.

US traders should note that many international platforms including FameEX and Aibit geo-restrict US customers from accessing futures trading due to regulatory requirements.

FameEX vs Aibit Conclusion: Why Not Use Both?

After comparing FameEX and Aibit, you might wonder which platform to choose. The answer could be simpler than you think: why not use both?

Each platform offers unique advantages that can complement your trading strategy. Using both exchanges allows you to access different markets, fee structures, and features that may not be available on just one platform.

Benefits of using both platforms:

- Reduced risk through exchange diversification

- Access to more trading pairs and options

- Ability to take advantage of different fee structures

- Protection against downtime on a single platform

Spreading your assets across multiple exchanges is also a smart security practice. If one platform experiences technical issues or security concerns, your entire portfolio won’t be affected.

When to use each platform:

| FameEX | Aibit |

|---|---|

| When you need access to their exclusive tokens | When you prefer their specific interface |

| During their promotional fee periods | When their rates are more favorable |

| For their unique trading tools | For their specific market offerings |

Remember to maintain separate security practices for each platform. Use different strong passwords and enable two-factor authentication on both accounts.

By strategically using both FameEX and Aibit, you can maximize your trading opportunities while minimizing risks and limitations of sticking with just one exchange.