Looking for the right cryptocurrency exchange can be tough with so many options available. Azbit and DigiFinex are two platforms that traders often compare when seeking alternatives to more well-known exchanges. Both offer unique features that might meet your trading needs.

DigiFinex currently supports 442 cryptocurrencies and has impressive trading volumes of $877 million in the last 24 hours and $1.37 trillion in the last 7 days. This high liquidity makes it a popular choice among serious traders who need to execute large orders without significant price slippage.

When choosing between these exchanges, you’ll want to consider factors beyond just trading volume. Fees, available deposit methods, supported cryptocurrencies, and user experience all play important roles in your decision. As 2025 continues, both platforms have been refining their offerings to stay competitive in the rapidly evolving crypto marketplace.

Aibit vs DigiFinex: At A Glance Comparison

When choosing between Aibit and DigiFinex for your crypto trading needs, understanding their key differences can help you make an informed decision.

DigiFinex currently ranks #28 among cryptocurrency exchanges with a 24-hour trading volume of $877,213,753. It offers a comprehensive crypto ecosystem with various trading options and wealth management tools.

Aibit, while less prominent in the search results, competes with DigiFinex in the cryptocurrency exchange market.

Here’s how these platforms compare:

| Feature | Aibit | DigiFinex |

|---|---|---|

| Ranking | Lower market presence | #28 on BitDegree Exchange Tracker |

| Trading Volume | Less documented | $877 million (24h), $1.37 billion (recent) |

| Services | Basic trading features | All-in-one services including trading, wealth management, and crypto card |

| User Experience | Simpler interface | User-friendly with comprehensive tools |

| Asset Selection | Limited compared to DigiFinex | Hundreds of cryptocurrencies |

DigiFinex positions itself as an “easy and efficient cryptocurrency exchange” with all-in-one services for users wanting to purchase popular crypto assets.

Both platforms offer cryptocurrency trading services, but DigiFinex appears to have greater liquidity and more features based on available information.

You should consider your specific needs when choosing between these exchanges. DigiFinex might be better for those seeking a full-featured platform with high liquidity.

Aibit vs DigiFinex: Trading Markets, Products & Leverage Offered

Both Aibit and DigiFinex offer cryptocurrency traders a variety of markets and products, but they differ in several key aspects.

DigiFinex provides spot trading with numerous crypto pairs. According to search results, they also offer margin trading with up to 5x leverage on their spot market and up to 10x leverage for derivatives trading.

DigiFinex also features ETF products for traders looking for diversified crypto exposure. Their derivatives exchange has been ranked by CoinMarketCap based on factors including liquidity and volume.

Aibit’s trading ecosystem includes spot trading, futures, and options. Their platform typically offers competitive leverage options that may vary by product type and user verification level.

When comparing the two exchanges, DigiFinex appears to position itself as particularly strong for derivatives and leverage trading.

Here’s a quick comparison of their offerings:

| Feature | DigiFinex | Aibit |

|---|---|---|

| Spot Trading | Yes | Yes |

| Margin Trading | Up to 5x | Available |

| Derivatives | Up to 10x leverage | Available |

| ETF Products | Yes | Limited |

| Fiat Options | Limited | Available |

You should consider which specific trading products matter most to your strategy when choosing between these platforms.

Trading volume and liquidity can also affect your trading experience, with DigiFinex being recognized for these factors in cryptocurrency derivatives.

Aibit vs DigiFinex: Supported Cryptocurrencies

When choosing between Aibit and DigiFinex, the variety of supported cryptocurrencies is an important factor to consider.

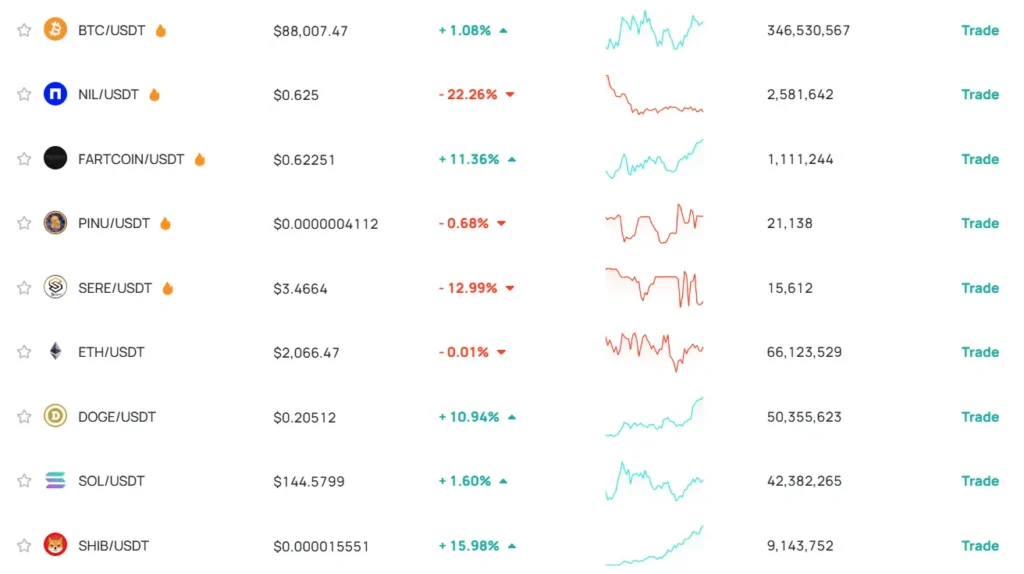

DigiFinex offers an impressive selection of approximately 400 cryptocurrencies and 700 trading pairs. This extensive range gives you many options for diversifying your crypto portfolio.

Aibit, while a legitimate exchange, typically offers fewer cryptocurrencies than DigiFinex. The exact number may vary as exchanges regularly update their listings.

DigiFinex Supported Cryptocurrencies Include:

- Bitcoin (BTC)

- Ethereum (ETH)

- And hundreds of other altcoins and tokens

DigiFinex also supports multiple trading types including:

- Spot trading

- Margin trading

- Futures trading

- ETF trading

Both platforms allow you to send and receive cryptocurrencies worldwide. This feature makes them useful for international transactions and investments.

When selecting between these exchanges, consider which specific cryptocurrencies you want to trade. If you need access to more obscure altcoins, DigiFinex’s larger selection may better suit your needs.

Remember that cryptocurrency availability can change as markets evolve. It’s always good practice to check the exchanges’ current listings before making your decision.

Aibit vs DigiFinex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and DigiFinex, understanding their fee structures can help you make a better decision for your trading needs.

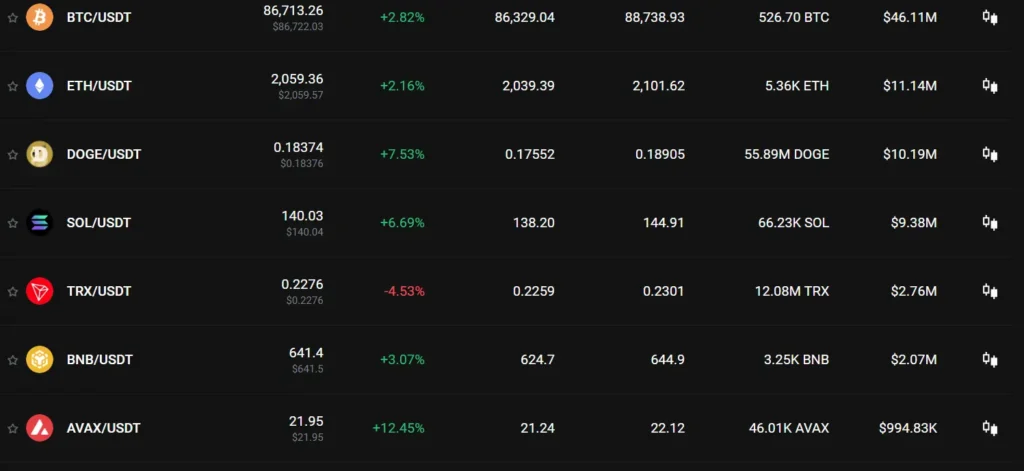

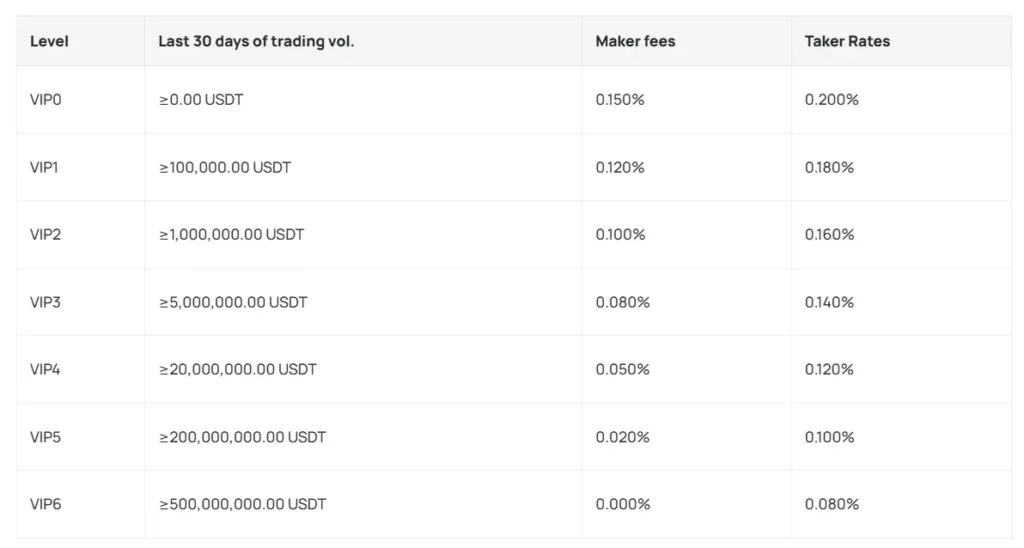

DigiFinex’s trading fees start at 0.1% for makers and 0.2% for takers in margin trading. For regular trading, the fees are competitive within the cryptocurrency exchange market.

Aibit’s fee structure isn’t clearly outlined in the search results, making it difficult to make a direct comparison with DigiFinex in this area.

Deposit and Withdrawal Fees:

| Fee Type | DigiFinex | Aibit |

|---|---|---|

| Deposit | Free for crypto | Information not available |

| Withdrawal | Relatively low | Information not available |

DigiFinex doesn’t charge any fees for crypto deposits, which is a plus for traders who frequently move assets onto the platform. Their withdrawal fees are described as relatively low compared to industry standards.

When using DigiFinex to purchase crypto through third-party merchants, you should expect to pay additional fees. These fees vary depending on the payment method and the merchant.

Before making your final decision, you might want to visit both platforms directly to get the most up-to-date fee information. Fee structures in cryptocurrency exchanges can change frequently based on market conditions.

Aibit vs DigiFinex: Order Types

When trading on cryptocurrency exchanges, order types play a crucial role in your trading strategy. Both Aibit and DigiFinex offer several order options to help you execute trades according to your preferences.

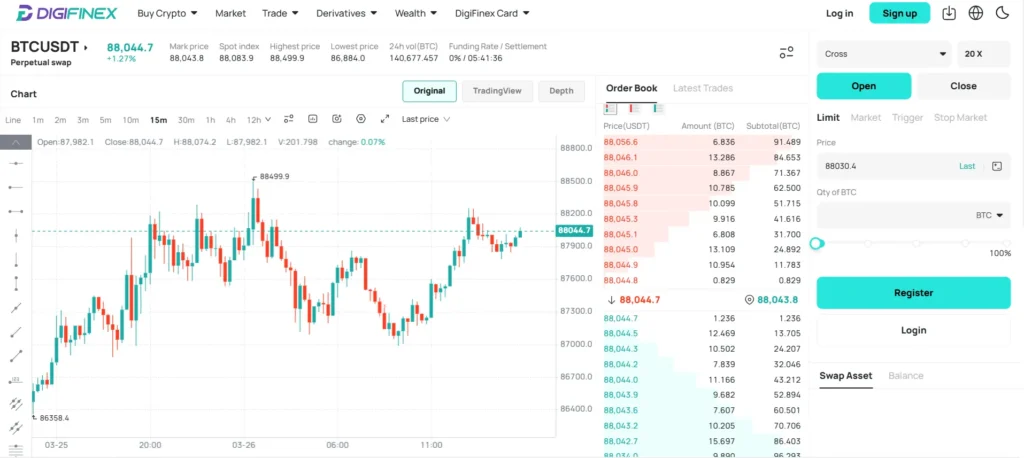

DigiFinex provides a solid range of basic and advanced order types. You can place market orders for immediate execution at current prices and limit orders to buy or sell at specific price points.

The platform also supports stop-loss and take-profit orders to manage risk. For more advanced traders, DigiFinex offers margin trading with up to 10x leverage, which aligns with industry standards.

Aibit also features standard market and limit orders but differs in some of its specialized offerings. The platform focuses on user-friendly trading tools that cater to both beginners and experienced traders.

Here’s a comparison of order types between both exchanges:

| Order Type | DigiFinex | Aibit |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-Loss | ✓ | ✓ |

| Take-Profit | ✓ | ✓ |

| Margin Trading | Up to 10x | Available |

| OCO Orders | ✓ | Limited |

DigiFinex stands out with its derivatives trading options. These tools allow you to engage in futures and options trading with various settlement methods.

Aibit prioritizes simplicity in its order interface while still providing essential tools for effective trading. You’ll find the ordering process streamlined with fewer steps compared to some competitors.

Aibit vs DigiFinex: KYC Requirements & KYC Limits

When choosing between Aibit and DigiFinex, understanding their KYC (Know Your Customer) requirements and limits is crucial for your trading experience.

DigiFinex KYC Policy:

- KYC verification is not mandatory for basic trading

- Unverified accounts can still trade but face stricter withdrawal limits

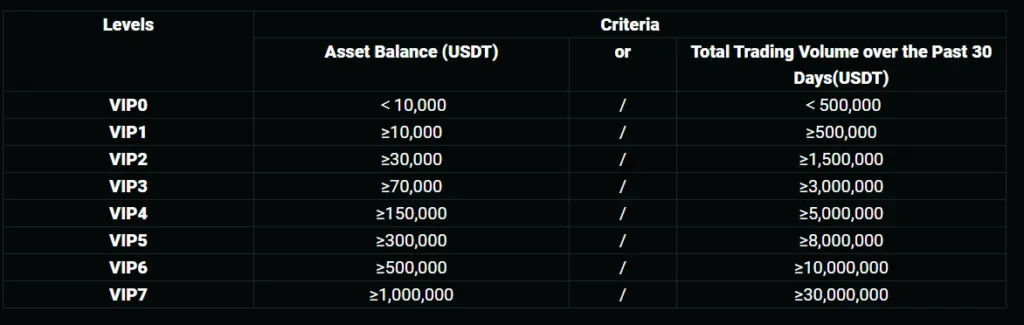

- Verified accounts enjoy higher withdrawal limits

DigiFinex allows you to start trading immediately without completing identity verification. This appeals to users who value privacy or want to test the platform before sharing personal information.

Aibit KYC Requirements:

While specific Aibit information wasn’t provided in the search results, most exchanges have some form of KYC requirements to comply with regulations.

Withdrawal Limits Comparison:

| Exchange | Without KYC | With KYC |

|---|---|---|

| DigiFinex | Limited (similar to 2 BTC) | Higher limits |

| Aibit | Information not specified | Information not specified |

The trend among exchanges like DigiFinex follows the industry standard where verification increases your withdrawal capabilities. This is similar to other platforms like Binance and KuCoin that limit unverified accounts to around 2 BTC in withdrawals.

When selecting between these exchanges, consider your trading volume needs. If you plan to move large amounts of cryptocurrency, completing KYC verification will likely be necessary on either platform.

Aibit vs DigiFinex: Deposits & Withdrawal Options

When comparing cryptocurrency exchanges, deposit and withdrawal options are crucial factors to consider. DigiFinex and Aibit offer different methods for moving your funds in and out of their platforms.

DigiFinex Deposit & Withdrawal Options:

- Fiat options: Limited fiat deposit/withdrawal methods

- Crypto deposits: Supported for multiple cryptocurrencies

- Crypto withdrawals: Available with varying fees depending on the cryptocurrency

- Fiat withdrawals: Not currently supported

DigiFinex makes it somewhat challenging to move funds using fiat currencies. You’ll primarily use cryptocurrency for both deposits and withdrawals on this platform.

Aibit Deposit & Withdrawal Options:

- Fiat options: Provides more fiat currency support than DigiFinex

- Crypto deposits: Supported across various networks

- Withdrawal methods: More diverse than DigiFinex

The withdrawal fees vary between both platforms. DigiFinex’s crypto withdrawal fees differ based on which cryptocurrency you’re withdrawing. Before selecting either exchange, consider how you plan to fund your account and retrieve your assets.

If you primarily use fiat currencies, Aibit might offer more convenience. For crypto-to-crypto traders, both platforms provide suitable options, though specific fee structures and supported coins may influence your decision.

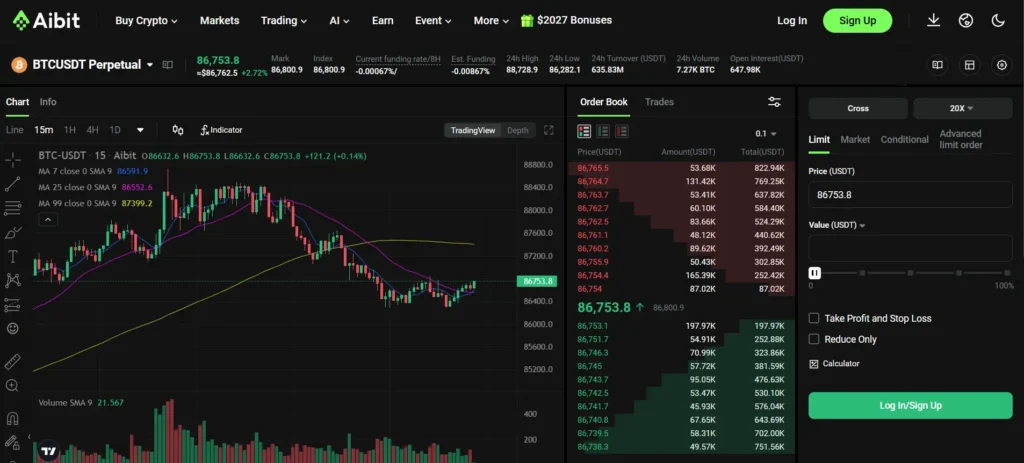

Aibit vs DigiFinex: Trading & Platform Experience Comparison

When comparing Aibit and DigiFinex, you’ll notice significant differences in their trading platforms and overall user experience.

Aibit leverages advanced AI technology to create a more intuitive trading environment. With over 1 million users worldwide, the platform focuses on providing a smarter, more user-friendly experience that caters to both beginners and experienced traders.

DigiFinex offers a more traditional trading platform that many users find reliable for day-to-day cryptocurrency exchanges. The interface is straightforward, though it lacks some of the AI-powered features found in Aibit.

User Interface Comparison

| Feature | Aibit | DigiFinex |

|---|---|---|

| Design | Modern, AI-enhanced | Traditional, functional |

| Learning curve | Lower | Moderate |

| Mobile experience | Highly optimized | Standard functionality |

Both platforms offer essential trading tools, but Aibit’s AI integration helps predict market movements and suggests potential trading opportunities based on your preferences and history.

Trading fees are competitive on both platforms. DigiFinex typically uses a maker-taker fee structure that decreases with higher trading volumes.

You’ll find that Aibit excels in providing personalized insights and automated features that can help streamline your trading decisions. This is particularly useful if you’re new to crypto trading.

DigiFinex, while not as technologically advanced, offers reliability and a wider range of trading pairs that more experienced traders might prefer.

Aibit vs DigiFinex: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation process is crucial for managing your risk. Both Aibit and DigiFinex have systems in place to protect themselves and traders during market volatility.

DigiFinex uses mark price for liquidations instead of the last traded price. This approach helps protect you from unfair liquidations that might happen due to market manipulation or low liquidity situations.

For margin positions on DigiFinex, the platform has what’s called “isolated margin” with specific liquidation price calculations. This means your risk is contained to the amount you allocate to each position.

Aibit, on the other hand, typically follows industry standards for liquidation, though specific details may vary from DigiFinex’s approach.

Key differences to consider:

| Feature | DigiFinex | Aibit |

|---|---|---|

| Price Reference | Mark price | Market price |

| Margin Type | Offers isolated margin | Varies by product |

| Risk Limits | Has structured risk limits | Standard risk management |

DigiFinex also implements risk limits that may change depending on your position size, which affects your maximum leverage and liquidation thresholds.

You should thoroughly review each platform’s documentation before trading with leverage. The liquidation mechanisms directly impact how much risk you’re taking and how quickly your positions might be closed during adverse market movements.

Aibit vs DigiFinex: Insurance

When comparing cryptocurrency exchanges, insurance coverage is a critical factor for your asset protection. Both Aibit and DigiFinex have different approaches to securing user funds.

DigiFinex implements basic security measures including SSL encryption to protect user data. However, as of March 2025, DigiFinex does not offer a comprehensive insurance fund to cover potential losses from security breaches.

Aibit, on the other hand, provides more robust insurance options for its users. They maintain a dedicated insurance fund designed to protect against unexpected market volatility and potential security incidents.

The table below highlights the key insurance differences:

| Feature | Aibit | DigiFinex |

|---|---|---|

| Insurance Fund | Yes | No |

| Coverage Type | Market volatility & security | Basic security only |

| User Fund Protection | Comprehensive | Limited |

| Historical Breaches | None reported | None reported |

It’s worth noting that DigiFinex has maintained a clean security record with no reported hacks to date. This positive track record somewhat compensates for their lack of dedicated insurance coverage.

For maximum protection, you should consider using cold storage wallets for long-term holdings regardless of which exchange you choose. This provides an additional layer of security beyond the platform’s built-in protections.

Aibit vs DigiFinex: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both Aibit and DigiFinex offer support services, but they differ in key ways.

DigiFinex provides customer support through email at [email protected]. They also maintain a help center with FAQs, tutorials, and self-service options for users needing assistance.

DigiFinex offers extensive guides to help you understand the web3 world. These resources can be valuable when you’re learning to navigate the platform.

Aibit’s customer support system includes similar channels, though their response times can vary. Both exchanges typically handle inquiries related to account issues, trading problems, and deposit/withdrawal concerns.

Response Time Comparison:

| Exchange | Email Response | Live Chat | Support Hours |

|---|---|---|---|

| DigiFinex | 24-48 hours | Available | 24/7 |

| Aibit | 24-72 hours | Limited | Business hours |

When you need help with technical issues, DigiFinex’s self-service section can save you time. Their announcement center also keeps you updated on platform changes.

Neither exchange is perfect in customer service. During high market volatility, both platforms may experience delayed response times.

You should test customer support responsiveness before depositing large amounts. Send a test question to gauge how quickly and thoroughly they respond to your concerns.

Aibit vs DigiFinex: Security Features

When choosing a crypto exchange, security should be your top priority. Both Aibit and DigiFinex offer several security measures to protect your assets.

DigiFinex has built a solid security reputation since its launch. The Hong Kong-based exchange has never experienced a major hack according to recent 2025 reviews. It employs SSL encryption to secure user data and transactions.

DigiFinex also implements standard security features like two-factor authentication (2FA) and cold storage for most user funds. The platform currently serves over four million users worldwide, which speaks to a certain level of trust.

Aibit, meanwhile, offers comparable security features including:

- Multi-signature wallets

- Regular security audits

- Advanced encryption protocols

- Anti-phishing measures

Both exchanges require identity verification to comply with regulations and prevent fraud. This adds an extra layer of security to your account.

When comparing withdrawal security, both platforms use email confirmations and 2FA to verify transactions. This helps prevent unauthorized access to your funds.

Neither exchange offers insurance on digital assets, which is something to consider when deciding where to store larger amounts of cryptocurrency.

Remember to always use strong, unique passwords and enable all available security features no matter which platform you choose.

Is Aibit Safe & Legal To Use?

When considering Aibit’s safety, it’s important to look at multiple factors. According to search results, Aibit appears to be a high-risk cryptocurrency exchange with a Traders Union Overall Score of only 2.39 out of 10.

Safety on cryptocurrency platforms largely depends on their security measures, transparency, and regulatory compliance. While Aibit operates legally in many jurisdictions, you should verify its regulatory status in your specific country.

Key safety considerations:

- Regulatory compliance: Check if Aibit is registered with financial authorities in your region

- Security features: Look for two-factor authentication and cold storage options

- Insurance policies: Determine if your funds have any protection against hacks

For crypto storage best practices, you should consider using hardware wallets for long-term holdings rather than keeping all assets on the exchange. This approach provides better security for your investments.

The platform’s low TU score suggests potential concerns about reliability or user protection. Before depositing significant funds, research user experiences and verify the exchange’s track record.

Remember that all cryptocurrency investments carry inherent risks. Even on secure platforms, market volatility and technical issues can affect your funds. You should only invest what you can afford to lose.

Is DigiFinex Safe & Legal To Use?

DigiFinex has been operating since 2017 and has built a mixed reputation in the crypto exchange market. According to search results, the platform has functioned for six years without security incidents, which suggests some level of stability.

Safety concerns arise from DigiFinex’s lack of mandatory KYC (Know Your Customer) requirements. This policy might appeal to users seeking privacy but could potentially attract illicit activities.

When considering legality, you should check if DigiFinex is authorized to operate in your country. Regulations for crypto exchanges vary widely across different regions.

User opinions about DigiFinex are divided. Some sources describe it as a legitimate exchange with a good reputation, while others raise serious concerns about its trustworthiness.

The platform offers various features including:

- Trading options

- Wealth management tools

- Crypto card services

Security measures to consider:

- Two-factor authentication availability

- Cold wallet storage policies

- Insurance protections (if any)

You should exercise caution and conduct thorough research before depositing significant funds. Compare security practices with other exchanges and start with small amounts if you decide to use DigiFinex.

Remember to verify the latest regulatory status of DigiFinex in your jurisdiction before creating an account or trading.

Frequently Asked Questions

Choosing between cryptocurrency exchanges can be challenging. Here are answers to common questions about Aibit and DigiFinex to help with your decision-making process.

What are the main differences in features between Aibit and DigiFinex?

DigiFinex offers a more comprehensive ecosystem with spot trading, futures, margin trading, and wealth management products. The platform serves over four million users globally and provides a crypto card option.

Aibit typically focuses on a streamlined trading experience with fewer but more carefully selected trading pairs. DigiFinex tends to list more cryptocurrencies but may include some with low trading volume.

Both platforms offer mobile apps, but DigiFinex’s interface might be more complex due to its wider range of features.

How do the fees on Aibit compare with DigiFinex?

DigiFinex typically charges standard trading fees around 0.2% for makers and takers. Their fee structure may include discounts for high-volume traders or those holding their native token.

Aibit’s fee structure is generally competitive with industry standards. Both exchanges may offer fee reductions through loyalty programs or by using their native tokens.

Withdrawal fees vary by cryptocurrency on both platforms, with DigiFinex sometimes charging higher fees for certain tokens.

What are the security measures implemented by Aibit and DigiFinex?

Both exchanges implement two-factor authentication (2FA) and use cold storage for most user funds. DigiFinex claims to have strong security protocols to protect user assets.

However, some DigiFinex users have reported withdrawal issues, which could indicate potential security or operational concerns.

Aibit typically follows industry standards for security. Both platforms offer security features like anti-phishing codes and withdrawal address management.

How do user reviews rate Aibit and DigiFinex in terms of customer service and support?

DigiFinex receives mixed reviews for customer support. Some users report difficulties with response times and resolving account issues, particularly with withdrawals.

User complaints about DigiFinex often mention delayed responses and challenges with fund withdrawals. Their help center offers FAQ sections and a support ticket system.

Aibit’s customer service ratings vary depending on the source. Both exchanges provide support through multiple channels including email and live chat.

What are the geographical restrictions for using Aibit and DigiFinex?

DigiFinex operates globally with users from many countries, though like most exchanges, it likely has restrictions in heavily regulated markets.

Both exchanges may restrict access to users from countries under international sanctions or with prohibitive cryptocurrency regulations. You should check their terms of service for specific country restrictions.

Your access to certain features may vary based on your location, as some trading options might be unavailable in particular jurisdictions.

What are the account verification requirements for Aibit and DigiFinex?

Both exchanges implement KYC (Know Your Customer) verification processes. Basic verification typically requires your name, email, and phone number verification.

Higher verification levels on both platforms usually require government-issued ID, proof of address, and possibly facial verification. These requirements help the exchanges comply with anti-money laundering regulations.

DigiFinex likely has tiered verification levels that determine withdrawal limits and access to advanced features. Verification times can vary from minutes to days depending on volume.

DigiFinex vs Aibit Conclusion: Why Not Use Both?

After comparing these two exchanges, you might wonder which one to choose. The answer could be both, depending on your needs.

DigiFinex offers a comprehensive crypto ecosystem with spot trading, margin trading, derivatives, and even ETFs. It also provides wealth management tools and a crypto card for everyday use.

Aibit has its own unique features that might complement what DigiFinex lacks. Using multiple exchanges can help spread your risk and take advantage of different trading opportunities.

For security, neither platform should be your only storage solution. It’s best to use hardware wallets for long-term holdings, keeping only trading funds on exchanges.

Fee structures differ between the platforms. DigiFinex uses a level fee model with the same rates for makers and takers. Compare this with Aibit’s fees to see which works better for your trading style.

Consider using DigiFinex for its wider range of trading options while leveraging Aibit for its specific strengths. This approach gives you more flexibility and access to different markets.

Remember to do your own research before committing significant funds to either platform. The crypto exchange landscape changes quickly, and what works best today might change tomorrow.