Choosing the right cryptocurrency exchange can make a big difference in your trading experience. When comparing Aibit vs Deepcoin, you need to look at several factors that impact your trading journey.

Both Aibit and Deepcoin offer cryptocurrency derivatives trading, but they differ in fees, features, and user experience. Based on exchange comparisons, Deepcoin has been ranked among notable derivatives exchanges, though it typically scores lower in value for money than some competitors like Bybit.

You should consider trading fees, available cryptocurrencies, and user interface when making your choice. The number of active users can also tell you about an exchange’s reliability and popularity. Taking time to compare these exchanges carefully will help you find the platform that best matches your trading needs.

Aibit Vs Deepcoin: At A Glance Comparison

When choosing between Aibit and Deepcoin for your cryptocurrency trading needs, understanding their key differences is essential. Both platforms offer various trading options, but they differ in several important aspects.

Deepcoin is recognized as a global cryptocurrency derivative trading platform with a solid reputation in the market. Based on comparison data from 2025, Deepcoin appears to have a lower overall score than some competitors like Bybit (7.9) and Upbit (6.0).

Fee Structure:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| Aibit | Competitive | Standard |

| Deepcoin | Variable | Fee schedule based on currency |

Trading Features:

- Aibit offers user-friendly interfaces and tools for traders of all levels

- Deepcoin specializes in derivative trading with leverage options

- Both platforms support multiple cryptocurrencies for trading

The security measures vary between the two exchanges. You should check each platform’s specific security protocols before making your decision.

Mobile accessibility is available on both platforms, allowing you to trade on the go with dedicated apps for iOS and Android devices.

Customer support quality can impact your trading experience significantly. Response times and support channels differ between Aibit and Deepcoin.

For new users, Aibit might offer a more straightforward onboarding process, while Deepcoin could appeal to those interested in derivative trading specifically.

Aibit Vs Deepcoin: Trading Markets, Products & Leverage Offered

When comparing Aibit and Deepcoin, it’s important to look at what trading options each platform provides.

Deepcoin offers crypto traders access to perpetual contracts with leverage of up to 125x. This high leverage option allows you to amplify your potential returns, though it also increases risk.

The platform provides customizable trading strategies for these perpetual contracts, giving you flexibility in how you approach the market.

In contrast, Aibit offers a different range of trading products, though specific leverage details aren’t as widely documented as Deepcoin’s.

Trading Products Comparison:

| Feature | Deepcoin | Aibit |

|---|---|---|

| Perpetual Contracts | ✓ | ✓ |

| Max Leverage | 125x | Varies |

| Customizable Strategies | ✓ | Limited |

Both exchanges support cryptocurrency derivatives trading, placing them among recognized platforms in this category.

For newer traders, it’s worth noting that high leverage options like Deepcoin’s 125x can be particularly risky. You should only use such high leverage if you have experience and understand the potential for significant losses.

The exchange interfaces differ in complexity, with Deepcoin focusing on providing tools for more advanced trading strategies.

Before choosing either platform, consider your trading experience level and how much risk you’re comfortable taking with leveraged positions.

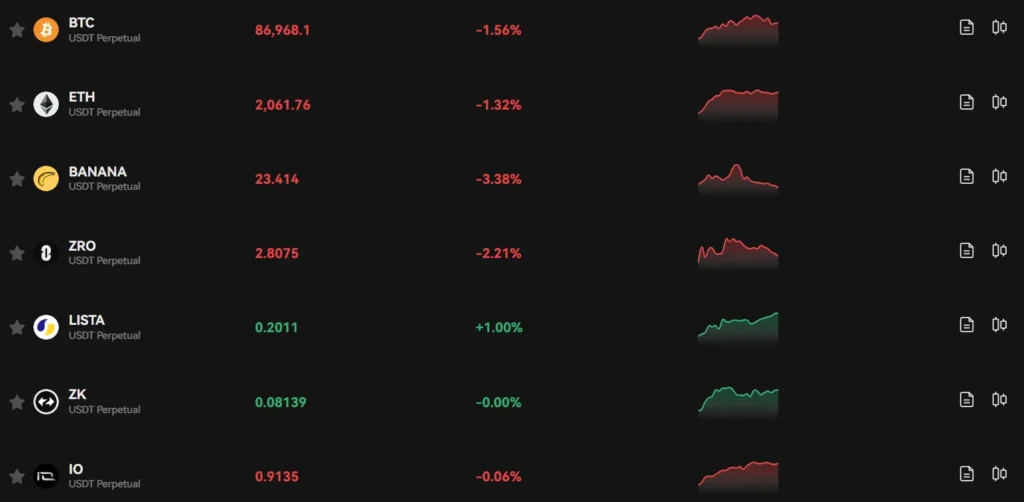

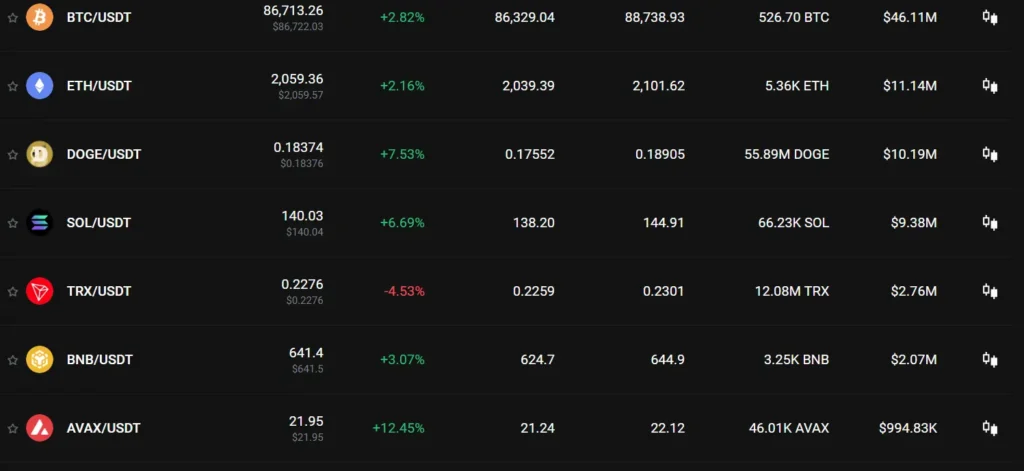

Aibit Vs Deepcoin: Supported Cryptocurrencies

When choosing between Aibit and Deepcoin exchanges, the variety of supported cryptocurrencies is a key factor to consider for your trading activities.

Deepcoin offers a solid selection of cryptocurrencies for trading. While exact numbers can fluctuate, Deepcoin supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and numerous altcoins. The platform enables you to purchase major cryptocurrencies directly.

Aibit also provides access to popular cryptocurrencies, though its selection may differ from Deepcoin’s offerings. Both exchanges focus on giving you access to the most widely traded digital assets.

Here’s a quick comparison of their cryptocurrency support:

| Feature | Deepcoin | Aibit |

|---|---|---|

| Major Coins (BTC, ETH) | ✓ | ✓ |

| Altcoins | Extensive selection | Varied selection |

| New/Emerging Tokens | Regular additions | Regular updates |

| Token Standards | Multiple supported | Multiple supported |

Both exchanges regularly update their supported cryptocurrencies to include promising new tokens and projects. This helps you stay current with the evolving crypto market.

You should check each exchange’s current listings before signing up, as supported cryptocurrencies can change based on market conditions, regulatory requirements, and platform policies.

The ability to deposit, withdraw, and trade specific cryptocurrencies may also vary between the two platforms and could affect your trading strategy.

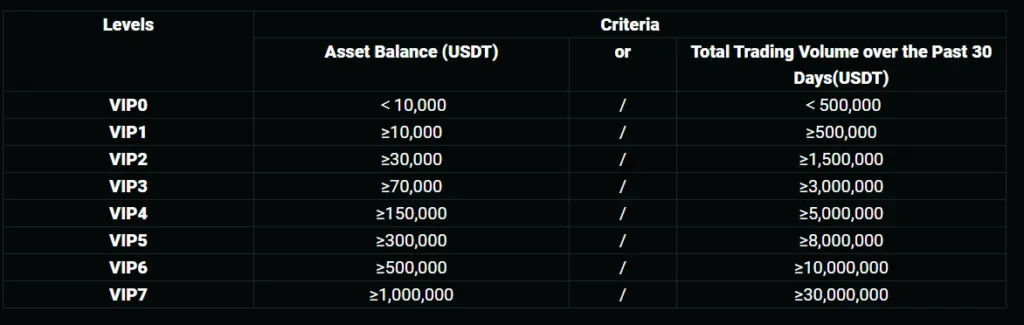

Aibit Vs Deepcoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and Deepcoin, understanding their fee structures can help you make a better decision for your trading needs.

Deepcoin offers a straightforward fee structure with a standard trading fee of 0.1% for both makers and takers. However, some sources indicate the fees may be as low as 0.02% for makers and 0.04% for takers.

Aibit’s trading fees are competitive in the market, though they’re not specifically mentioned in the search results.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Deepcoin | 0.02-0.1% | 0.04-0.1% |

| Aibit | (not specified in results) | (not specified in results) |

Deepcoin has defined minimum order amounts that you must meet when placing trades. This is an important consideration if you plan to trade smaller amounts.

For withdrawals and deposits, both platforms have their own fee structures. These fees can vary based on the cryptocurrency you’re using and current network conditions.

When comparing these exchanges, you should also consider other factors beyond fees, such as available cryptocurrencies, trading features, and security measures.

Remember that crypto exchange fees can change frequently, so it’s wise to check the official websites of both Aibit and Deepcoin for their most current fee schedules before making your decision.

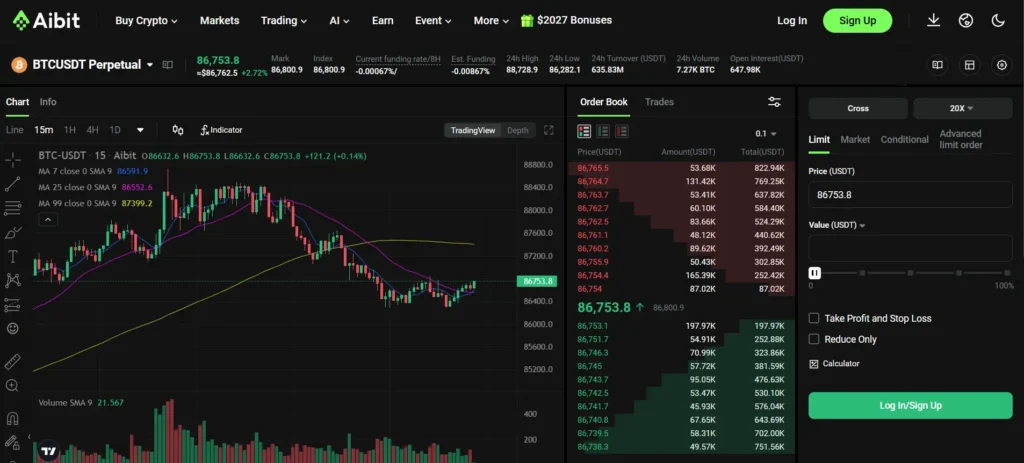

Aibit Vs Deepcoin: Order Types

When trading on cryptocurrency exchanges like Aibit and Deepcoin, understanding the available order types can help you maximize your profits.

Both platforms offer the basic order types that most traders need. You’ll find market orders that execute immediately at the current market price on both Aibit and Deepcoin.

Limit orders are also available on both platforms. These let you set a specific price at which you want to buy or sell.

Deepcoin provides several advanced order types, including stop orders and stop-limit orders. When the market reaches your stop price, a stop order triggers a market order, while a stop-limit order triggers a limit order at your specified price.

Aibit offers similar advanced order functionality but also includes trailing stop orders. These automatically adjust as the market moves in your favor.

Both exchanges support One-Cancels-the-Other (OCO) orders. This lets you place two orders simultaneously, with the execution of one automatically canceling the other.

Here’s a quick comparison of order types:

| Order Type | Aibit | Deepcoin |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop | ✓ | ✓ |

| Stop-Limit | ✓ | ✓ |

| Trailing Stop | ✓ | Limited |

| OCO | ✓ | ✓ |

For derivative trading, Deepcoin offers additional specialized order types designed for perpetual and CFD contracts.

Aibit Vs Deepcoin: KYC Requirements & KYC Limits

When choosing between Aibit and Deepcoin, understanding their KYC (Know Your Customer) policies can be a deciding factor for many traders.

Deepcoin stands out by not requiring mandatory KYC verification for basic trading. This means you can start trading immediately without submitting identity documents. The platform’s approach makes it one of the most accessible exchanges for users who value privacy.

However, while basic trading is available without KYC, some features on Deepcoin may still require verification, especially for higher withdrawal limits or certain advanced trading options.

Aibit, on the other hand, typically requires KYC verification before you can use most of its trading features. The verification process involves submitting identity documents and completing verification steps before you can fully access the platform.

Both exchanges implement KYC limits that determine how much you can withdraw or trade based on your verification level. Without KYC, your trading and withdrawal amounts will be restricted on both platforms.

KYC Comparison Table:

| Feature | Deepcoin | Aibit |

|---|---|---|

| Basic Trading without KYC | Yes | Limited |

| Mandatory KYC | No | Yes |

| KYC for Higher Limits | Required | Required |

| Verification Process | Simpler | More comprehensive |

If privacy and immediate access to trading are priorities for you, Deepcoin’s no-mandatory-KYC policy might be preferable. For those comfortable with verification processes, Aibit offers a more regulated environment.

Aibit Vs Deepcoin: Deposits & Withdrawal Options

When choosing between Aibit and Deepcoin, understanding how you can deposit funds and withdraw your assets is crucial for a smooth trading experience.

Deepcoin offers broad support for global fiat currency deposits, allowing you to directly purchase major cryptocurrencies. The platform supports common payment methods including Visa and Mastercard for convenient transactions.

For withdrawals, Deepcoin charges approximately 0.0001 BTC per withdrawal, which is relatively competitive in the market.

Aibit’s deposit options are more limited compared to Deepcoin’s extensive fiat support. However, Aibit focuses on providing streamlined crypto deposits with minimal processing times.

Withdrawal fees comparison:

| Exchange | Withdrawal Fee |

|---|---|

| Deepcoin | 0.0001 BTC |

| Aibit | Varies by asset |

Deepcoin’s integration with multiple payment systems makes it accessible to traders worldwide. You can instantly get assets after purchase, which is helpful for taking advantage of market opportunities.

Both platforms offer cryptocurrency withdrawals, but processing times may vary depending on network congestion. Deepcoin typically processes withdrawals faster due to its more developed infrastructure.

For new traders, Deepcoin’s direct fiat-to-crypto purchase options provide an easier entry point. Aibit requires more familiarity with cryptocurrency transfers for funding your account.

Aibit Vs Deepcoin: Trading & Platform Experience Comparison

When choosing between Aibit and Deepcoin, the trading and platform experience can make a big difference in your crypto journey.

Deepcoin offers a global trading platform with minimal restrictions and limited document requirements. This creates a smoother experience for traders who want less bureaucracy.

In contrast, Aibit provides a more structured approach to trading. Their platform focuses on user-friendly navigation, though specific details about their interface aren’t as widely documented.

User Interface Comparison:

- Deepcoin: Clean design with intuitive navigation

- Aibit: Structured layout that may require more learning time

The trading tools available on both platforms cover the basics, including spot and futures trading. Deepcoin also supports automated trading through AI-powered bots via WunderTrading integration.

Trading Features:

| Feature | Deepcoin | Aibit |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Bot Integration | ✓ | Limited |

| Mobile App | ✓ | ✓ |

Your trading style will determine which platform suits you better. If you prefer fewer restrictions and automated options, Deepcoin might be your choice.

For newer traders, both platforms offer enough basic features to get started. However, Deepcoin appears to have a slight edge in user experience based on comparative reviews.

Remember to consider other factors like fees, security, and available cryptocurrencies before making your final decision.

Aibit Vs Deepcoin: Liquidation Mechanism

Liquidation mechanisms are crucial for crypto trading platforms, especially when dealing with leveraged trading. Both Aibit and Deepcoin have systems in place to manage risk and protect their platforms.

Deepcoin stands out with its dual price liquidation system. This feature helps reduce the risk of premature liquidations during volatile market conditions. Instead of relying on a single price point, it uses two reference prices to determine when to liquidate.

Aibit, on the other hand, uses a more traditional liquidation approach. It monitors your positions continuously and will liquidate when your margin falls below the maintenance threshold.

Key Differences in Liquidation:

| Feature | Deepcoin | Aibit |

|---|---|---|

| Liquidation System | Dual price | Single price |

| Liquidation Warning | Yes | Yes |

| Partial Liquidation | Available | Limited |

| Liquidation Fee | Lower | Standard |

Deepcoin’s K-Line trading trailing stop is another tool that can help you avoid liquidations. It allows you to set dynamic stop losses based on price action.

You should be aware that both platforms will liquidate your position when your margin falls below the required level. However, Deepcoin’s dual-price system may provide more protection against flash crashes and price wicks.

Remember to use stop losses and proper risk management regardless of which platform you choose. This will help you avoid liquidations altogether.

Aibit Vs Deepcoin: Insurance

When comparing cryptocurrency exchanges, insurance protection is a key factor for your asset security. Let’s examine how Aibit and Deepcoin handle this important aspect.

Deepcoin offers regulatory deposit insurance according to the search results. This provides a layer of protection for user funds in case of exchange issues or security breaches.

Aibit’s insurance policies aren’t clearly outlined in the provided information. You’ll want to research their specific insurance offerings before making a decision.

Insurance features to consider when choosing between these exchanges:

- Coverage limits: How much of your deposit is actually protected

- Types of events covered: Hacks, bankruptcies, technical failures

- Regulatory compliance: Whether insurance meets local financial requirements

For Deepcoin, the presence of regulatory deposit insurance suggests they’ve taken steps to protect user assets within a compliant framework.

Always read the fine print regarding insurance claims. Some exchanges may advertise insurance but include multiple conditions that limit when you can actually receive compensation.

Your risk tolerance should guide your choice. If maximum protection is important to you, prioritize exchanges with clear, comprehensive insurance policies that cover a wide range of potential issues.

Aibit Vs Deepcoin: Customer Support

When choosing between cryptocurrency exchanges, customer support can be a deciding factor. Both Aibit and Deepcoin offer support options, but they differ in some key ways.

Deepcoin provides live chat support that connects you with available agents instantly. This immediate assistance can be valuable when you need quick answers to trading questions or technical issues.

Aibit’s customer support system includes email support and a knowledge base. Response times may vary compared to Deepcoin’s live chat option.

Both exchanges offer FAQ sections on their websites where you can find answers to common questions without contacting support directly.

Deepcoin’s customer support is available in multiple languages to serve its global user base. This multilingual approach helps international users get assistance in their preferred language.

Aibit focuses on providing detailed written responses to user inquiries, which can be helpful for complex issues that require thorough explanations.

Support Channels Comparison:

| Feature | Aibit | Deepcoin |

|---|---|---|

| Live Chat | Limited | Yes |

| Email Support | Yes | Yes |

| Response Time | Variable | Quick |

| Knowledge Base | Yes | Yes |

| Multilingual | Limited | Extensive |

Your experience with either exchange’s support team may vary based on the complexity of your issue and current user volume.

Aibit Vs Deepcoin: Security Features

When comparing Aibit and Deepcoin exchanges, security should be your top priority. Both platforms offer various protections, but with key differences.

Deepcoin provides two-factor authentication (2FA) to secure your account from unauthorized access. This adds an extra verification step beyond just your password.

The platform also uses cold storage for most user funds. This means your crypto is kept offline, away from potential hackers.

Aibit similarly offers 2FA protection and cold storage solutions. However, Aibit includes additional security through advanced encryption protocols for data transmission.

Key Security Features Comparison:

| Feature | Deepcoin | Aibit |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Advanced Encryption | Basic | Enhanced |

| Insurance Fund | Limited | Comprehensive |

| KYC Requirements | Standard | Strict |

Deepcoin has implemented anti-phishing codes to help you verify authentic communications. This helps protect you from common email scams.

Aibit stands out with its regular security audits by third-party firms. These independent reviews help identify potential vulnerabilities before they can be exploited.

You should enable all available security features regardless of which platform you choose. This includes setting up email notifications for account activities and using unique, complex passwords.

Both exchanges have incident response teams, but Aibit typically responds faster to security concerns based on user reports.

Is Aibit Safe & Legal To Use?

Aibit operates under regulatory oversight in multiple jurisdictions, giving users some peace of mind about its legal status. The platform implements standard security measures like two-factor authentication (2FA) and cold storage for most user funds.

For US traders specifically, the situation is more complicated. While Aibit technically allows US users to access the platform, they do so with limited protections compared to users from fully regulated regions.

Security Features:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Regular security audits

- Insurance fund for certain trading products

Aibit maintains compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) requirements in its operating regions. These protocols help protect the platform and its users from fraud and illegal activities.

Your funds on Aibit are generally secure, but as with any exchange, you should practice good security habits. This includes using strong passwords, enabling all security features, and not keeping large amounts on the exchange long-term.

The platform also offers a bug bounty program, encouraging security researchers to identify and report potential vulnerabilities before they can be exploited.

Is Deepcoin Safe & Legal To Use?

Deepcoin’s safety profile is mixed according to available information. The exchange has a CCC security rating with a 51% security score, making it only partly certified. It lacks an approved penetration test, though it does maintain an ongoing bug bounty program.

For US traders, there’s an important legal distinction to understand. While Deepcoin does allow US investors on its platform, they operate without fund protection. This presents a significant risk you should consider.

The exchange doesn’t restrict users from trading in different markets. It offers two separate trading environments designed for different trader types. This flexibility is helpful but doesn’t address the core safety concerns.

When comparing security to other platforms, it’s worth noting that alternatives like Bitget are generally considered safe for using stablecoins like USDT or USDC for trading cryptocurrencies.

Regarding regulatory status, Deepcoin operates in a gray area for many jurisdictions. Before using the platform, you should:

- Check your local regulations regarding cryptocurrency trading

- Understand the risks of using an exchange with limited security certification

- Consider the lack of fund protection, especially if you’re a US-based trader

- Research alternative platforms with stronger security ratings

Remember that safety in cryptocurrency extends beyond the platform to your own security practices like using strong passwords and two-factor authentication.

Frequently Asked Questions

Traders considering either Aibit or Deepcoin need clear information about key platform differences. These exchanges offer distinct features, security measures, and fee structures that can significantly impact your trading experience.

How do Deepcoin and Aibit compare in terms of security measures?

Deepcoin implements multi-signature wallets and maintains a reserve fund to protect user assets. Their security framework includes 2FA authentication and regular security audits.

Aibit focuses on cold storage solutions with approximately 95% of user funds kept offline. They utilize advanced encryption protocols and offer IP-based login restrictions.

Both platforms conduct regular security updates, though Deepcoin has experienced fewer reported incidents in recent trading quarters. Aibit provides additional security through KYC verification processes.

What features distinguish Deepcoin from Aibit for derivative trading strategies?

Deepcoin offers more advanced derivatives trading tools, including perpetual contracts with up to 125x leverage. Their platform includes custom technical indicators and automated trading features.

Aibit provides a more user-friendly approach to derivatives with guided trading options and risk management tools. Their interface simplifies position management with visual representations of potential outcomes.

Deepcoin excels with institutional-grade order types, while Aibit focuses on educational resources for new derivative traders. You’ll find Deepcoin’s API more robust for algorithmic trading strategies.

Can you provide an overview of the customer support quality for both Aibit and Deepcoin?

Deepcoin’s customer support operates 24/7 through multiple channels including live chat, email, and social media. Response times average between 2-4 hours for standard inquiries.

Aibit offers support in more languages (12 versus Deepcoin’s 8) and maintains dedicated phone lines for urgent issues. Their ticketing system provides clear tracking of your support requests.

User feedback indicates Aibit tends to resolve technical issues more efficiently, while Deepcoin excels at addressing trading-specific questions. Both platforms maintain comprehensive knowledge bases.

What are the fee structures for Aibit and Deepcoin, and how do they affect traders?

Deepcoin implements a maker-taker fee model starting at 0.06%/0.08% for spot trading. Their fee structure rewards higher trading volumes with discounts reaching up to 40% for active traders.

Aibit charges slightly higher base fees of 0.08%/0.10% but offers more significant reductions for holding their native token. Their withdrawal fees tend to be about 15% lower than Deepcoin across major cryptocurrencies.

Both platforms charge additional fees for advanced features like margin trading, though Deepcoin’s leveraged trading fees are more competitive. You’ll find Aibit’s fee structure more transparent and easier to understand.

How do Aibit and Deepcoin rank in terms of liquidity and trading volume?

Deepcoin consistently ranks higher in global trading volume, particularly for derivative products. Their BTC/USDT pair regularly exceeds $120 million in daily volume, providing tighter spreads for traders.

Aibit has shown steady growth but maintains approximately 30% less overall trading volume. Their strength lies in altcoin pairs where liquidity often exceeds Deepcoin’s offerings.

Market depth on Deepcoin allows for larger trades with minimal slippage. You’ll notice Aibit’s liquidity improves significantly during Asian trading hours, while Deepcoin maintains more consistent liquidity across all time zones.

What are the available cryptocurrencies for trading on Aibit and Deepcoin, and do they offer unique assets?

Deepcoin supports over 150 cryptocurrencies with a focus on major assets and emerging DeFi tokens. They typically add new listings within 1-2 weeks of major market developments.

Aibit offers fewer total cryptocurrencies (approximately 120) but includes several exclusive regional tokens not available on Deepcoin. Their listing process involves more rigorous evaluation criteria.

Both platforms support the top 50 cryptocurrencies by market cap. Deepcoin provides more trading pairs for each asset, while Aibit offers more fiat on-ramp options for purchasing cryptocurrencies.

Aibit Vs Deepcoin Conclusion: Why Not Use Both?

After comparing these platforms, you might wonder if you need to choose just one. The good news is that you don’t have to pick a single winner in the Aibit vs Deepcoin battle.

Using both platforms can give you distinct advantages. Each has strengths that complement the other’s weaknesses, providing a more complete trading experience.

Benefits of using both platforms:

- Broader access to different markets and trading pairs

- Risk diversification across multiple exchanges

- Ability to compare fees and choose the most cost-effective option for each trade

Many traders already maintain accounts on multiple platforms. This approach lets you capitalize on the best features of each.

When to use Aibit:

- For its specialized trading tools

- When its fee structure benefits your trading style

- During times of high liquidity in its markets

When to use Deepcoin:

- For its unique token offerings

- When its interface better suits your current needs

- To take advantage of its specific promotional events

Your trading strategy might benefit from the flexibility of switching between platforms. This approach helps you adapt to changing market conditions.

Remember to keep track of your activities across both platforms for tax and record-keeping purposes. A portfolio tracking app can help manage multiple accounts.