When choosing a crypto exchange, comparing Aibit vs BYDFi can help you make a better decision for your trading needs. These platforms offer different features, fee structures, and trading options that might affect your experience.

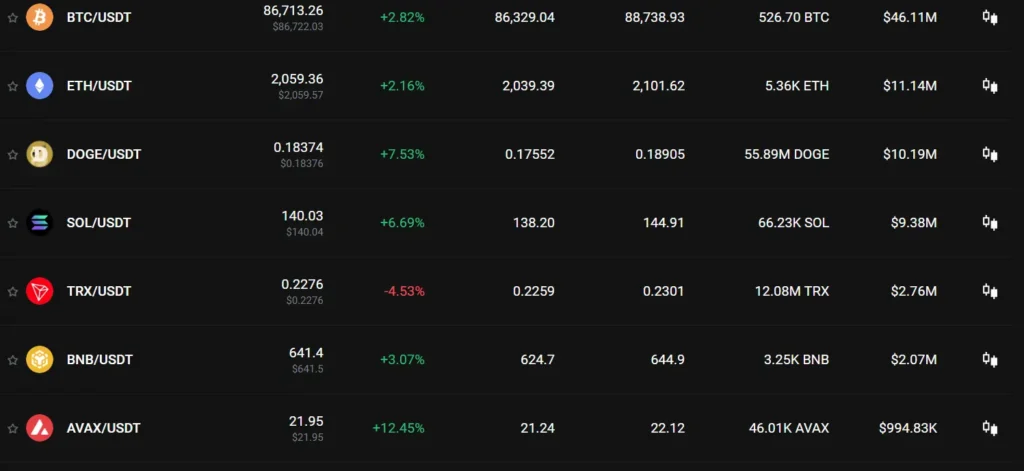

BYDFi stands out with its impressive 200x leverage for futures trading, which is significantly higher than what many competitors offer. This makes it an attractive option if you’re looking for high-leverage trading opportunities.

Both exchanges provide various trading tools, but they differ in their overall user experience and available cryptocurrencies. By understanding their unique strengths and limitations, you can select the platform that best aligns with your trading goals and experience level.

Aibit Vs BYDFi: At A Glance Comparison

When looking at Aibit and BYDFi side by side, several key differences emerge. Both platforms serve as cryptocurrency exchanges, but they cater to traders in different ways.

BYDFi (formerly known as BitYard) launched in April 2020 and has quickly gained recognition. It operates in over 150 countries and focuses on providing an improved trading experience.

| Feature | BYDFi | Aibit |

|---|---|---|

| Launch Date | April 2020 | More recent |

| Global Reach | 150+ countries | More limited |

| Overall Rating | 9.0-9.1 (according to BitDegree) | Not widely rated yet |

| Regulatory Compliance | Complies with financial industry regulations | Limited information |

BYDFi has earned high ratings from comparison sites like BitDegree, scoring between 9.0-9.1 in overall performance. When compared to other platforms like Bybit and Bitbuy, BYDFi typically scores higher.

You’ll find BYDFi emphasizes user experience as its primary goal. The platform has evolved from its BitYard origins to offer a more comprehensive set of trading services.

Aibit, being newer to the market, doesn’t have as established a reputation or as much public information available about its services and performance metrics.

Both exchanges aim to provide cryptocurrency trading services, but BYDFi has the advantage of more established operations and wider geographical coverage.

Aibit Vs BYDFi: Trading Markets, Products & Leverage Offered

Both Aibit and BYDFi offer cryptocurrency trading services, but they differ in their available markets and leverage options.

BYDFi provides leverage trading that allows you to borrow funds to increase your trading position. This platform is known for being user-friendly for both beginners and experienced traders.

When it comes to leverage, BYDFi offers competitive options similar to other major exchanges. However, based on the search results, specific leverage ratios aren’t mentioned.

In contrast, Bybit (which may be related to Aibit) offers up to 100x leverage in some markets. This platform is recognized for its advanced features and deep liquidity, especially in leveraged trading.

Trading Products Comparison:

| Feature | BYDFi | Aibit/Bybit |

|---|---|---|

| User Experience | Beginner-friendly | Advanced features |

| Leverage Trading | Available | Up to 100x |

| Liquidity | Moderate | Deep liquidity |

| Target Users | Novice and experienced | Experienced traders |

You should note that BYDFi is a relatively newer platform compared to more established exchanges like Binance and BitMEX, which also offer leverage trading.

When choosing between these platforms, consider your experience level and risk tolerance. Higher leverage means potentially higher profits but also greater risk of losses.

Aibit Vs BYDFi: Supported Cryptocurrencies

When choosing between Aibit and BYDFi, the range of supported cryptocurrencies is an important factor to consider. Each platform offers different options for your trading needs.

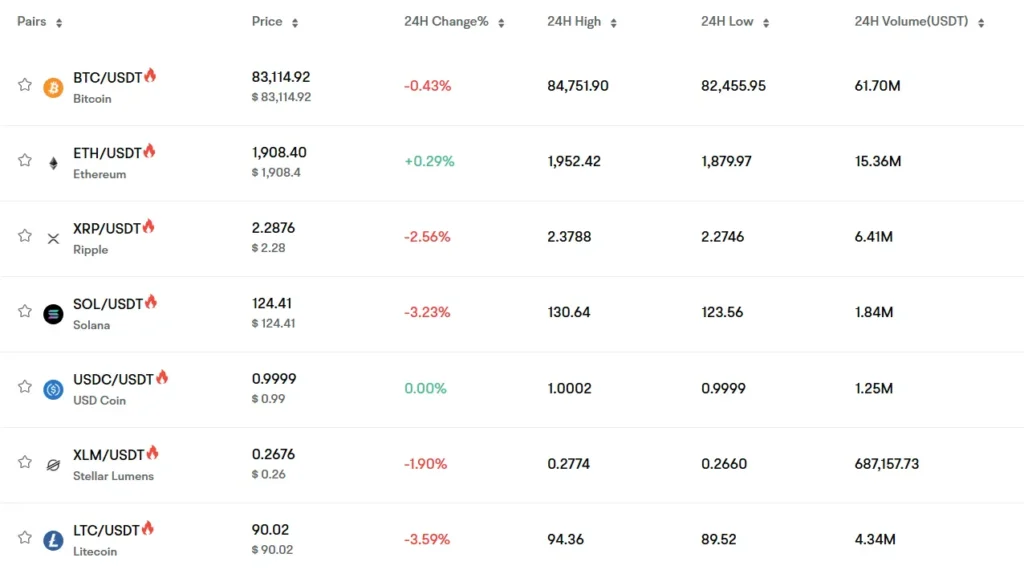

BYDFi supports major cryptocurrencies including Bitcoin, Ethereum, and Ripple. According to available information, BYDFi also enables you to trade traditional assets like Forex pairs alongside crypto.

Aibit’s cryptocurrency lineup is competitive, though specific details may vary from BYDFi’s offerings. Both exchanges aim to provide access to popular tokens that traders frequently seek.

Key Cryptocurrency Support Comparison:

| Feature | BYDFi | Aibit |

|---|---|---|

| Major Coins | Bitcoin, Ethereum, Ripple | Bitcoin, Ethereum, and other major coins |

| Altcoins | Multiple options available | Various altcoins supported |

| Token Types | Both established and emerging | Focus on established cryptocurrencies |

| Additional Assets | Forex pairs available | Primarily cryptocurrency-focused |

You’ll find that both platforms regularly update their supported cryptocurrencies. This helps you stay current with emerging tokens in the market.

Before signing up, it’s worth checking the most current list of supported cryptocurrencies on both exchanges. This ensures you can trade your preferred tokens without limitations.

Aibit Vs BYDFi: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and BYDFi, understanding their fee structures can help you make a better decision for your trading needs.

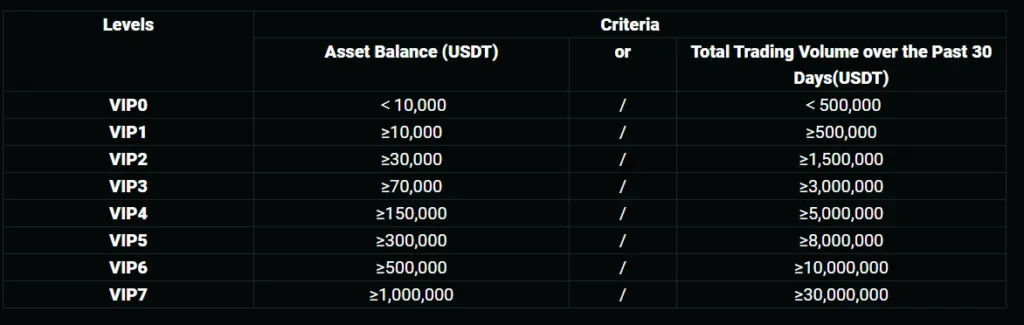

BYDFi offers competitive trading fees ranging from 0.1% to 0.3% for spot trading, depending on the cryptocurrency being traded. For futures trading, the fee structure follows a similar pattern.

For maker/taker fees, BYDFi charges around 0.02% for makers and 0.06% for takers. This makes it particularly attractive if you’re someone who provides liquidity to the market.

Aibit’s fee structure is generally comparable to other major exchanges, though specific rates aren’t provided in the search results.

Deposit and Withdrawal Fees Comparison:

BYDFi doesn’t charge deposit fees, which is a significant advantage for new traders. Withdrawal fees vary based on the cryptocurrency and network used.

| Fee Type | BYDFi | Aibit |

|---|---|---|

| Trading Fee (Spot) | 0.1%-0.3% | Not specified |

| Maker Fee | 0.02% | Not specified |

| Taker Fee | 0.06% | Not specified |

| Deposit Fee | None | Not specified |

| Withdrawal Fee | Varies by cryptocurrency | Not specified |

You should note that BYDFi appears to offer some of the lowest trading fees compared to competitors, with up to 0.3% mentioned in comparisons.

Before committing to either platform, you may want to check their official websites for the most current fee information, as cryptocurrency exchange rates can change.

Aibit Vs BYDFi: Order Types

When trading cryptocurrencies, the types of orders available can significantly impact your trading strategy. Both Aibit and BYDFi offer various order options to help you execute trades effectively.

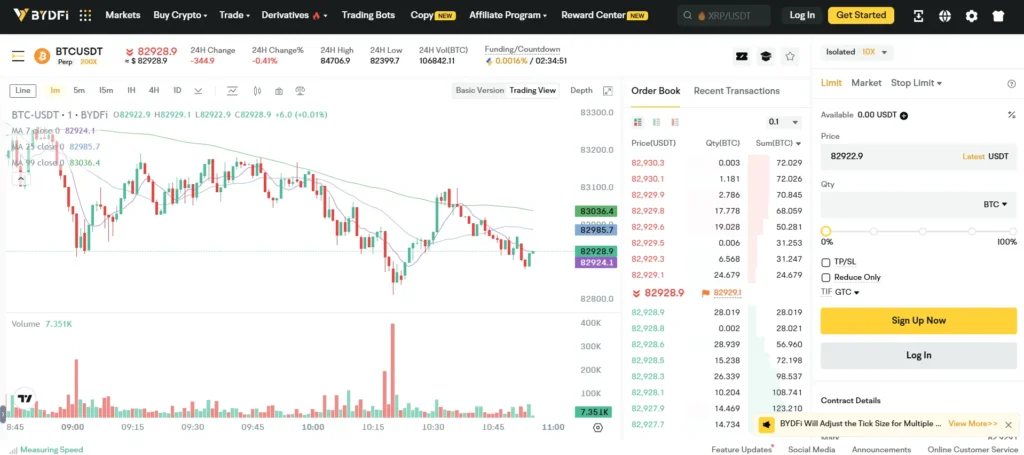

BYDFi provides traditional limit orders, allowing you to set specific price points for buying or selling assets. They also feature conditional orders that execute only when certain market conditions are met.

One standout feature of BYDFi is their trailing stop loss orders. These automatically adjust as prices move in your favor, helping protect your profits without constant monitoring.

Aibit offers standard market and limit orders for basic trading needs. Their platform also includes stop-limit orders to help manage risk in volatile market conditions.

Order Types Comparison:

| Order Type | Aibit | BYDFi |

|---|---|---|

| Market Order | ✓ | ✓ |

| Limit Order | ✓ | ✓ |

| Stop-Limit | ✓ | ✓ |

| Conditional Orders | Limited | Advanced |

| Trailing Stop Loss | ❌ | ✓ |

BYDFi’s advanced conditional orders give you more flexibility for complex trading strategies. You can set orders based on price movements that automatically execute when your conditions are met.

For new traders, BYDFi’s user-friendly platform makes navigating different order types simpler, while still providing the tools needed for sophisticated trading approaches.

Aibit Vs BYDFi: KYC Requirements & KYC Limits

When choosing between Aibit and BYDFi exchanges, understanding their KYC (Know Your Customer) policies is essential for your trading experience.

BYDFi offers flexibility with its KYC requirements. You can trade on BYDFi without completing KYC verification, which is appealing if you value privacy. However, this comes with limitations.

BYDFi KYC Limits:

- Unverified accounts: Maximum withdrawal of 0.2 BTC daily

- Verified accounts: Up to 5 BTC daily withdrawal limit

BYDFi supports users from over 150 countries, including the US and Canada, without requiring a VPN. This accessibility makes it attractive for traders in various regions.

Aibit, on the other hand, typically implements stricter KYC policies to comply with regulatory standards. You’ll likely need to complete verification before accessing full platform features.

Choosing Between Them:

If privacy and minimal verification are priorities, BYDFi might be your better option. You can start trading immediately with basic information.

For traders comfortable with providing identification and seeking higher withdrawal limits, both platforms can work well, but BYDFi’s verified tier offers substantial daily withdrawal allowances.

Remember that KYC requirements may change as regulations evolve. Always check the current policies before creating an account on either exchange.

Aibit Vs BYDFi: Deposits & Withdrawal Options

When choosing between Aibit and BYDFi, understanding their deposit and withdrawal systems is essential for managing your crypto assets effectively.

BYDFi offers a wide range of deposit methods. You can deposit cryptocurrencies directly or use fiat currencies through credit cards and debit cards. This flexibility makes it easier for new traders to get started.

For withdrawals, BYDFi charges a fixed fee for each transaction to cover transfer costs. Their fiat withdrawal options are somewhat limited, supporting only AUD and EUR currencies.

Aibit also provides cryptocurrency deposit options, but with a different fee structure and supported coin list. Their platform focuses on making the deposit process straightforward for both beginners and experienced traders.

Fee Comparison:

| Feature | Aibit | BYDFi |

|---|---|---|

| Deposit Fees | Varies by method | No fees for deposits |

| Withdrawal Fees | Fixed by currency | Fixed fee per withdrawal |

| Fiat Support | Multiple currencies | Limited to AUD/EUR for withdrawals |

One advantage of BYDFi is that they don’t charge any fees for deposits. This can save you money when frequently adding funds to your account.

Both platforms offer crypto purchasing with fiat currencies, though BYDFi stands out by supporting over 90 different fiat currencies for buying crypto, giving you more flexibility depending on your location.

Processing times vary between the platforms, with factors like verification level and payment method affecting how quickly you can access your funds.

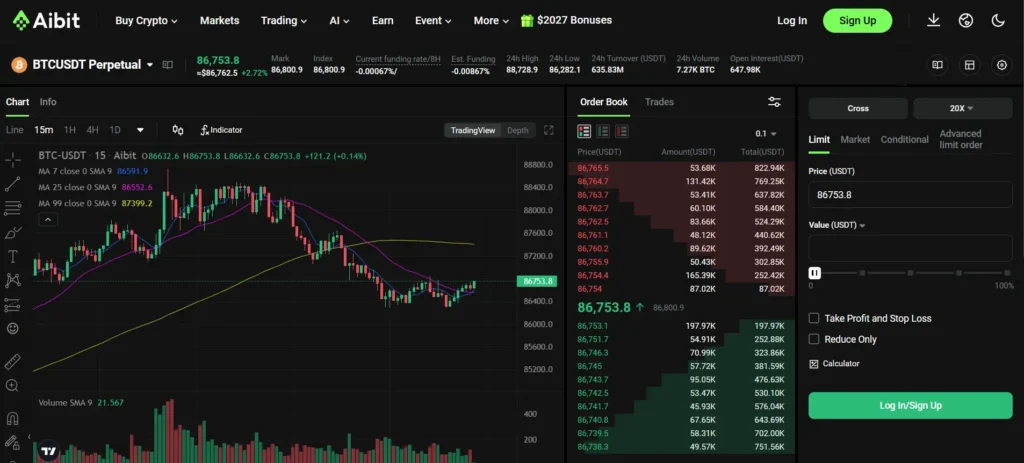

Aibit Vs BYDFi: Trading & Platform Experience Comparison

When choosing between Aibit and BYDFi, the trading experience is a key factor to consider. Both platforms offer unique features that might suit different trading styles.

BYDFi’s web-based platform stands out for its intuitive navigation and comprehensive market information. This makes it particularly welcoming for new traders who need clear information to make decisions.

One notable difference is the leverage options. BYDFi offers impressive 200x leverage for futures trading, which is higher than many competitors. This gives you more trading power with less capital, though it comes with increased risk.

Aibit provides a solid trading experience but doesn’t match BYDFi’s leverage capabilities. However, Aibit may offer a more streamlined interface depending on your preferences.

Both platforms support various order types and trading pairs. You’ll find spot trading, futures, and other investment options on each platform.

Platform Feature Comparison:

| Feature | BYDFi | Aibit |

|---|---|---|

| Maximum Leverage | 200x | Lower than BYDFi |

| User Interface | Intuitive, beginner-friendly | Streamlined |

| Mobile Trading | Available | Available |

| Market Information | Comprehensive | Standard |

BYDFi has earned a higher overall score (9.1) in comparison reviews, suggesting stronger user satisfaction with its trading experience.

The platform you choose should align with your trading goals. If you’re new to cryptocurrency trading, BYDFi’s intuitive platform might be more suitable for your needs.

Aibit Vs BYDFi: Liquidation Mechanism

Liquidations play a crucial role in cryptocurrency trading platforms. They protect exchanges from losses when traders cannot meet margin requirements.

BYDFi uses a standard liquidation formula where the liquidation price equals the entry price divided by one minus the maintenance margin. This mechanism activates when your position approaches the maintenance margin threshold.

Aibit follows a similar approach but offers slightly different liquidation parameters. Both platforms implement these mechanisms to manage risk, but the exact triggering points may vary.

Key differences to note:

| Feature | BYDFi | Aibit |

|---|---|---|

| Warning notifications | Yes | Yes |

| Partial liquidation options | Limited | Available |

| Liquidation buffer | Standard | More flexible |

BYDFi’s liquidation process can be described as “brutal for traders who are caught off guard” according to user experiences. This means you should monitor your positions carefully when trading on their platform.

Aibit offers more user-friendly liquidation features with advanced warning systems. You’ll receive notifications before approaching liquidation thresholds.

Tips to avoid liquidations on both platforms:

- Set stop-loss orders to exit positions before liquidation

- Monitor market volatility closely

- Use reasonable leverage amounts

- Maintain sufficient margin in your account

Understanding these liquidation mechanisms helps you trade more safely on both platforms. Always check the specific parameters for the assets you’re trading.

Aibit Vs BYDFi: Insurance

When comparing cryptocurrency exchanges, insurance protection is a critical factor to consider. This safety net helps protect your assets if the exchange faces hacking or other security breaches.

Aibit offers insurance coverage for digital assets stored in their hot wallets. Their insurance fund aims to protect users against potential losses from security incidents. However, the specific coverage limits aren’t clearly disclosed on their platform.

BYDFi also implements insurance measures for user protection. Based on available information, BYDFi maintains an insurance fund designed to safeguard user assets against unexpected losses. This exchange complies with financial industry regulations across more than 150 countries where it operates.

Neither exchange provides FDIC insurance, which is important to note. This differs from traditional banking protections you might be familiar with.

For maximum security, you should consider keeping only trading funds on either platform. Store long-term holdings in private wallets for added safety.

Insurance Comparison:

| Feature | Aibit | BYDFi |

|---|---|---|

| Hot Wallet Insurance | Yes | Yes |

| Cold Storage Security | Yes | Yes |

| FDIC Insurance | No | No |

| Insurance Fund | Available | Available |

| Transparent Coverage Limits | Limited information | Limited information |

Both exchanges could improve transparency about their specific insurance coverage details and limits.

Aibit Vs BYDFi: Customer Support

When choosing a crypto trading platform, good customer support can make all the difference. Both Aibit and BYDFi offer support options, but there are some key differences to consider.

BYDFi provides 24/7 customer support according to search results. This means you can get help any time of day or night, which is valuable for crypto traders who operate across different time zones.

BYDFi offers support through email and live chat channels. Users have reported that these support options are “excellent” based on testing mentioned in the search results. However, it’s worth noting that BYDFi lacks phone-based customer support.

BYDFi Support Options:

- 24/7 availability

- Email support

- Live chat

- No phone support

For Aibit, specific details about their customer support aren’t mentioned in the search results. When comparing platforms, you should check if Aibit offers similar 24/7 support and what communication channels are available.

Good customer support is crucial when you encounter trading issues or have questions about platform features. Response time and quality of assistance can significantly impact your trading experience.

Before choosing either platform, consider testing their customer service with a pre-signup question to gauge responsiveness and helpfulness.

Aibit Vs BYDFi: Security Features

When choosing between Aibit and BYDFi, security should be a top priority for your investment protection. Both platforms offer essential security measures, but with some key differences.

BYDFi implements two-factor authentication (2FA) to protect your account from unauthorized access. This adds an extra verification step beyond just your password.

The platform also utilizes cold storage solutions to keep most user assets offline and away from potential hackers. This practice significantly reduces the risk of large-scale theft.

Aibit similarly offers 2FA protection for accounts. Their security system includes regular security audits to identify and fix vulnerabilities before they can be exploited.

Key Security Features Comparison:

| Feature | Aibit | BYDFi |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| KYC Verification | ✓ | ✓ |

| Insurance Fund | Limited | Yes |

| Security Audits | Regular | Periodic |

BYDFi has implemented Know Your Customer (KYC) protocols to prevent fraud and comply with regulations. This adds a layer of protection for all users on the platform.

Both exchanges monitor transactions 24/7 for suspicious activity. You’ll receive alerts if unusual actions occur on your account.

For withdrawal security, each platform requires email confirmations. This prevents attackers from quickly removing funds even if they gain temporary access.

Is Aibit Safe & Legal To Use?

Aibit’s safety and legal status need careful consideration. The platform’s security measures protect your assets, but regulatory compliance varies by location.

Unlike BYDFi, which is registered as a Money Service Business with FinCEN and compliant with U.S. regulations, Aibit’s status in the U.S. market is less clear.

Security Features:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Regular security audits

Aibit implements know-your-customer (KYC) procedures, which helps prevent fraud and money laundering. This shows some commitment to regulatory standards.

Legal Considerations by Region:

| Region | Legal Status |

|---|---|

| United States | Check local regulations |

| Europe | Varies by country |

| Asia | Generally accessible |

You should verify whether Aibit is authorized to operate in your jurisdiction before creating an account. Regulations change frequently in the crypto space.

Some exchanges face bans in certain countries for non-compliance with financial laws. This happened with Bybit in the U.S., as noted in the search results.

Always research the current regulatory status of any exchange in your location. Using an unauthorized platform could lead to account restrictions or legal issues.

Is BYDFi Safe & Legal To Use?

BYDFi operates legally in over 150 countries and complies with financial industry regulations. The platform launched in April 2020 and has built a reputation for providing a secure trading environment.

Safety is a priority for BYDFi. The exchange implements strict security measures and audits all traders on their platform to prevent fraud and ensure a reliable trading experience.

For US-based traders, BYDFi offers a viable alternative to some restricted platforms like Bybit. This makes it a legal option if you’re trading from the United States.

The platform aims to create a safe environment where followers can profit without concerns. Their security protocols help protect your assets and personal information while trading.

When considering legality, always check if BYDFi operates in your specific country. Cryptocurrency regulations vary globally, and what’s permitted in one jurisdiction may be restricted in another.

Key safety features include:

- Regular security audits

- Compliance with financial regulations

- Trader verification processes

- Safe trading environment

BYDFi’s primary goal is providing users with an improved trading experience while maintaining security standards. This balance of user experience and safety measures helps establish trust with their customers.

Frequently Asked Questions

Traders choosing between Aibit and BYDFi often have specific concerns about features, security, and costs. These platforms differ in several important ways that might affect your trading experience.

What are the key differences in features between Aibit and BYDFi?

Aibit and BYDFi offer different trading experiences through their unique features. BYDFi provides a Q&A hub that helps users understand cryptocurrency complexities, which Aibit doesn’t have.

BYDFi also offers a physical card option that lets you access your funds more easily. This feature isn’t currently available on Aibit.

Trading interfaces differ significantly, with BYDFi focused on simplicity while Aibit offers more advanced charting tools for technical analysis.

How do Aibit and BYDFi compare in terms of security protocols?

Both platforms implement two-factor authentication and cold storage for cryptocurrency assets. However, they differ in their approach to additional security measures.

BYDFi uses multi-signature technology for wallet security, adding an extra layer of protection for your funds. Aibit focuses more on regular security audits.

Insurance policies also differ between the platforms, with variations in coverage amounts and what specific threats are protected against.

Are there significant differences in the fees structure between Aibit and BYDFi?

Trading fees on BYDFi and Aibit follow different models. BYDFi typically charges 0.1-0.2% per trade, while Aibit’s fee structure may vary based on trading volume.

Withdrawal fees differ as well, with each platform charging different amounts for moving your crypto off the exchange. These fees vary by cryptocurrency.

Deposit methods and their associated costs also show important differences that might impact your overall trading costs.

What have user reviews indicated as strengths and weaknesses of Aibit versus BYDFi?

Users frequently praise BYDFi’s educational resources and straightforward interface. The Q&A hub is specifically mentioned as helpful for navigating crypto questions.

Customer service responsiveness appears stronger on BYDFi according to many reviews. This can be crucial when you need help with trading issues.

Aibit receives better feedback regarding advanced trading features and liquidity options. Experienced traders often prefer its more sophisticated tools.

How compatible are Aibit and BYDFi with different regulatory environments?

BYDFi and Aibit operate under different regulatory frameworks. BYDFi has worked to establish compliance with various international regulations.

Geographic restrictions apply differently between the platforms. Some countries have access to one platform but not the other.

KYC (Know Your Customer) requirements vary between the two exchanges, affecting how much personal information you need to provide before trading.

Can Aibit and BYDFi be used for all levels of traders, from beginners to experts?

BYDFi offers more educational resources for beginners through its Q&A hub and straightforward interface. New traders often find it easier to navigate.

Aibit tends to appeal more to experienced traders with advanced chart analysis tools and trading options. The learning curve can be steeper.

Both platforms offer mobile apps, but they differ in functionality and user-friendliness. BYDFi’s app appears more focused on simplicity while Aibit’s includes more advanced features.

BYDFi Vs Aibit Conclusion: Why Not Use Both?

After comparing BYDFi and Aibit, you might wonder which platform is better. The truth is, both exchanges have their own strengths.

BYDFi offers a smoother user experience and is known for its combination of low fees and reliable service. It’s suitable for traders of all levels, from beginners to experienced users.

Aibit, on the other hand, has its own set of features that might appeal to different types of traders. Each platform serves different needs in the crypto trading space.

Why choose just one? Using both platforms can give you access to:

- Different trading pairs

- Varied fee structures

- Multiple liquidity pools

- Diverse trading tools

By spreading your trading across both exchanges, you can take advantage of the best features each has to offer. This strategy also helps reduce risk through diversification.

Remember to consider these factors when using either platform:

- Security measures in place

- Fee structures for your typical transactions

- Available cryptocurrencies that match your portfolio

- Trading tools that suit your strategy

You can start with smaller amounts on both platforms to test which one works better for your specific needs. This hands-on experience will be more valuable than any review.