Looking for the right crypto exchange can be hard. Aibit and BloFin are two platforms that many traders compare when searching for places to trade cryptocurrency derivatives.

Both Aibit and BloFin offer non-KYC trading options, but they differ in their fee structures, trading tools, and liquidity pools. While BloFin has established itself as the second largest non-KYC futures platform behind MEXC, Aibit has been working to compete by offering its own set of unique features.

You’ll want to consider several factors when choosing between these exchanges, including security measures, available trading pairs, and user interface. The right choice depends on your specific trading needs, experience level, and the types of cryptocurrencies you plan to trade.

Aibit vs BloFin: At A Glance Comparison

When choosing between Aibit and BloFin for your crypto trading needs, understanding their key differences can help you make an informed decision.

Trading Options

| Feature | Aibit | BloFin |

|---|---|---|

| Perpetual Swaps | Available | 300+ contracts |

| Spot Trading | Yes | Yes |

| Copy Trading | Limited | Advanced features |

| Non-KYC Trading | No | Yes (2nd largest non-KYC futures platform) |

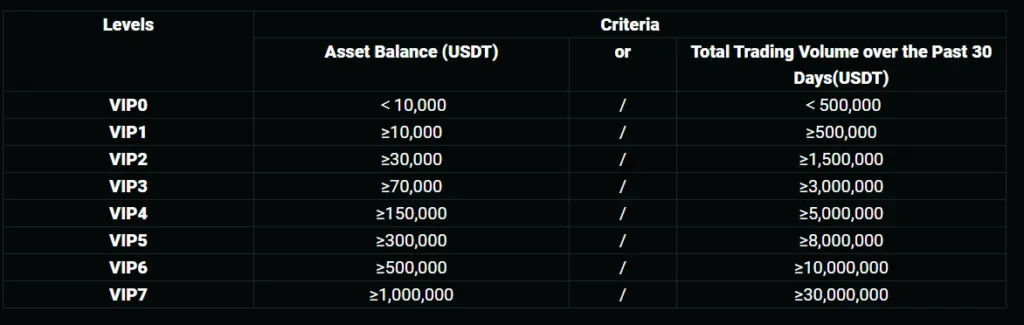

Fee Structure

Aibit typically offers competitive trading fees, though these vary based on your trading volume and membership level.

BloFin positions itself as an advanced centralized exchange with an emphasis on futures trading. Its fee structure is designed to accommodate both beginner and experienced traders.

User Experience

You’ll find Aibit’s platform more straightforward if you’re new to crypto trading. The interface prioritizes simplicity and guidance.

BloFin caters more to experienced traders with its advanced trading tools and analytics. The platform offers deeper customization options for serious traders.

Security Features

Both exchanges implement standard security measures like two-factor authentication and cold storage for funds.

BloFin has gained recognition as a major player in the non-KYC futures market, currently ranking second behind MEXC according to recent data.

Before choosing either platform, consider your trading experience, preferred assets, and whether KYC requirements matter to you.

Aibit vs BloFin: Trading Markets, Products & Leverage Offered

When comparing Aibit and BloFin’s trading options, you’ll find significant differences in their available markets and products.

BloFin stands out with over 300 perpetual swap contracts available for futures trading. This platform has established itself as the second largest non-KYC futures platform in the market, right behind MEXC.

Trading Products Comparison:

| Feature | BloFin | Aibit |

|---|---|---|

| Perpetual Swaps | 300+ | Limited selection |

| Spot Trading | Available | Available |

| Copy Trading | Supported | Limited capabilities |

| Leverage Options | High leverage | Standard options |

BloFin’s futures trading is a highlight feature that attracts many traders looking for diverse contract options. The platform’s copy trading functionality also allows you to mirror successful traders’ strategies.

Both exchanges offer spot trading capabilities, but BloFin appears to have more advanced trading tools according to recent reviews from 2025.

For leverage trading, BloFin provides competitive options that appeal to experienced traders looking to maximize potential returns. However, remember that higher leverage also comes with increased risk.

You should consider your trading style and experience level when choosing between these platforms. BloFin might be better suited for advanced traders seeking diverse futures options, while Aibit could be preferable if you need a more straightforward trading experience.

Aibit vs BloFin: Supported Cryptocurrencies

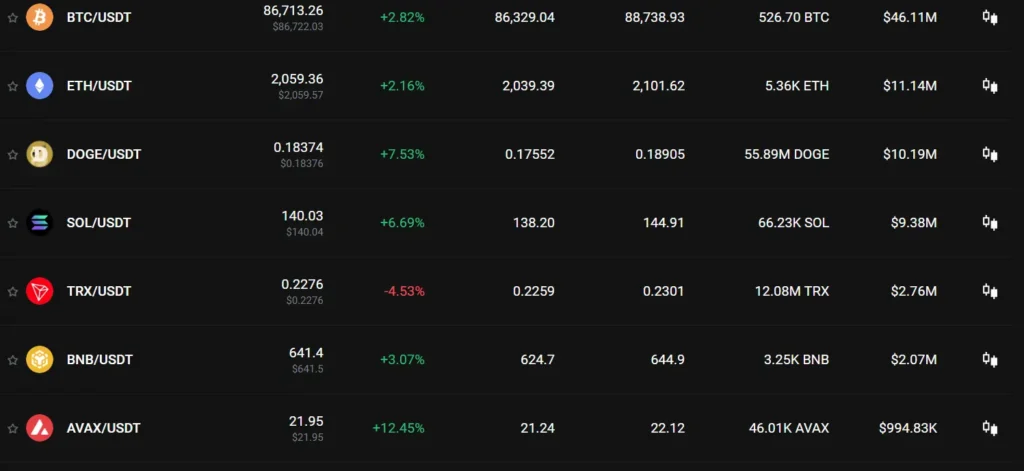

When choosing between Aibit and BloFin for your crypto trading needs, the range of supported cryptocurrencies is an important factor to consider.

BloFin stands out with support for over 400 cryptocurrencies, including major coins like Bitcoin (BTC) and Ethereum (ETH). This extensive selection gives you access to both established cryptocurrencies and emerging altcoins.

Aibit offers a more modest selection, supporting approximately 150 cryptocurrencies. While this covers all major coins, you might find fewer options for trading lesser-known altcoins.

Cryptocurrency Support Comparison:

| Platform | Number of Cryptocurrencies | Major Coins | Altcoin Support |

|---|---|---|---|

| BloFin | 400+ | Yes | Extensive |

| Aibit | ~150 | Yes | Moderate |

Both platforms allow you to trade popular cryptocurrencies like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Dogecoin (DOGE)

If you’re primarily interested in trading major cryptocurrencies, either platform will meet your needs. However, if you want access to a wider range of altcoins, BloFin’s more extensive selection gives you greater flexibility.

The addition of new cryptocurrencies happens regularly on both platforms, but BloFin typically adds support for new tokens more quickly than Aibit.

Aibit vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and BloFin, understanding their fee structures is crucial for maximizing your trading profits.

Trading Fees

| Exchange | Maker Fee | Taker Fee | Futures Trading |

|---|---|---|---|

| Aibit | 0.08% | 0.10% | 0.05% – 0.07% |

| BloFin | 0.02% | 0.06% | 0.01% – 0.05% |

BloFin offers significantly lower trading fees compared to Aibit. For limit orders, you’ll pay just 0.02% on BloFin versus 0.08% on Aibit.

Both platforms offer fee discounts based on trading volume and token holdings. The more you trade or hold their native tokens, the lower your fees become.

Deposit Fees

Neither Aibit nor BloFin charges deposit fees for most cryptocurrencies. However, fiat deposits may incur charges depending on your payment method.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. BloFin generally offers more competitive withdrawal rates for popular coins like BTC and ETH.

| Coin | Aibit Withdrawal Fee | BloFin Withdrawal Fee |

|---|---|---|

| BTC | 0.0005 BTC | 0.0003 BTC |

| ETH | 0.006 ETH | 0.004 ETH |

| USDT | 20 USDT (ERC-20) | 15 USDT (ERC-20) |

You can reduce withdrawal fees on both platforms by using alternative networks like BEP-20 instead of ERC-20 when available.

For high-frequency traders, BloFin’s lower trading fees could result in substantial savings over time.

Aibit vs BloFin: Order Types

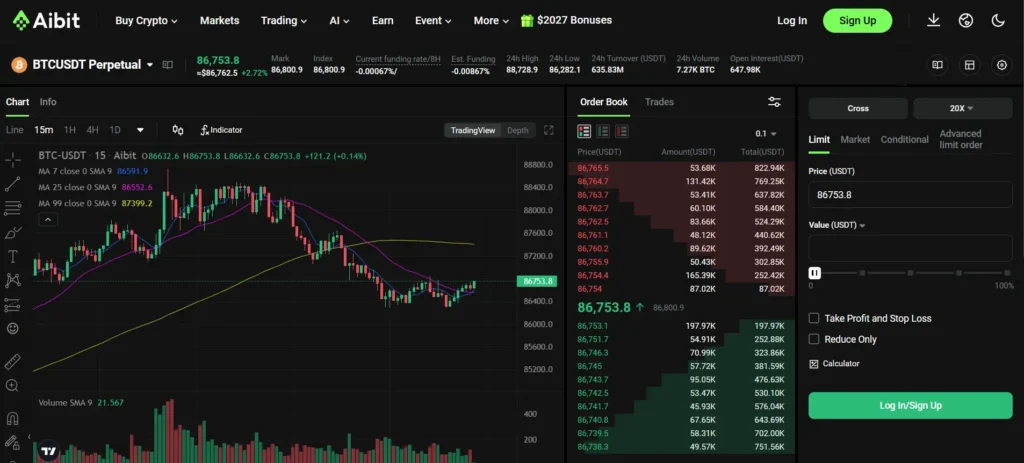

When trading on cryptocurrency exchanges, the available order types can greatly impact your trading strategy. Both Aibit and BloFin offer several order options to help you execute trades effectively.

BloFin provides standard order types including market orders and limit orders. Market orders execute immediately at the current price, while limit orders let you set your desired price.

BloFin also allows you to close positions directly on the K line chart or place reverse orders when you already have an open position. This gives you flexibility in managing your trades.

For risk management, BloFin enables you to add Take Profit and Stop Loss parameters to your orders. These features help protect your investments from significant losses and lock in profits automatically.

Aibit similarly offers market and limit orders for its users. However, specific details about additional order types on Aibit are less documented in the search results.

Both platforms provide real-time charts and technical indicators to help inform your trading decisions. These tools work alongside the various order types to create a complete trading system.

When choosing between these platforms, consider which order types best fit your trading style. More complex strategies may require advanced order types like OCO (One-Cancels-the-Other) or trailing stops, so check if your preferred platform offers these options.

Aibit vs BloFin: KYC Requirements & KYC Limits

When trading cryptocurrency, KYC (Know Your Customer) requirements can affect your trading experience. Aibit and BloFin have different approaches to identity verification.

BloFin is known as a no-KYC exchange, allowing you to trade without identity verification for basic access. This makes it popular among users who value privacy or quick onboarding.

However, BloFin does have withdrawal limits for non-verified accounts. You can withdraw up to 20 BTC daily without completing KYC.

For higher withdrawal limits on BloFin, you can complete the optional KYC process. This involves clicking on your user avatar, selecting “Identification,” and following the verification steps.

Aibit, on the other hand, requires KYC verification as part of its standard registration process. You must verify your identity before accessing full trading features.

KYC Requirements Comparison:

| Feature | BloFin | Aibit |

|---|---|---|

| Basic Trading | No KYC required | KYC required |

| Withdrawal Limits Without KYC | Up to 20 BTC daily | Not available |

| KYC Process | Optional | Mandatory |

The no-KYC option at BloFin provides more flexibility if you prefer not to share personal information immediately. This can be useful if you want to test the platform before committing to verification.

Remember that regulations change frequently in the crypto space. Always check the latest requirements when creating your account.

Aibit vs BloFin: Deposits & Withdrawal Options

When choosing between Aibit and BloFin, understanding their deposit and withdrawal options is key to managing your funds efficiently.

BloFin offers impressive flexibility with support for over 80 fiat currencies for deposits and withdrawals. This makes it convenient for users from different countries to fund their accounts using their local currency.

Aibit provides standard fiat options but doesn’t match BloFin’s extensive currency support. However, both platforms support major cryptocurrencies for deposits and withdrawals.

Deposit Methods Comparison:

| Method | Aibit | BloFin |

|---|---|---|

| Bank Transfer | ✓ | ✓ |

| Credit/Debit Card | ✓ | ✓ |

| Crypto Deposits | ✓ | ✓ |

| Supported Fiat | Limited | 80+ currencies |

Processing times vary between the platforms. BloFin typically processes crypto withdrawals faster, often within minutes, while fiat withdrawals may take 1-3 business days depending on your bank.

Aibit’s withdrawal processing is comparable for cryptocurrencies but might be slightly slower for fiat currencies in some regions.

Both exchanges implement verification procedures for large withdrawals as a security measure. You’ll need to complete KYC verification on either platform before making significant withdrawals.

BloFin stands out with its comprehensive customer support for deposit and withdrawal issues, which can be crucial when you encounter problems with transactions.

Aibit vs BloFin: Trading & Platform Experience Comparison

When choosing between Aibit and BloFin for your crypto trading needs, the platform experience can make a significant difference in your success.

Aibit offers a clean, intuitive interface that beginners find easy to navigate. The platform loads quickly and rarely experiences downtime during high market volatility.

BloFin, mentioned in the search results as a popular leverage trading platform, provides more advanced charting tools and technical analysis features that experienced traders appreciate.

Trading Tools Comparison:

| Feature | Aibit | BloFin |

|---|---|---|

| Mobile App | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Desktop Platform | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Charting Tools | 15+ indicators | 30+ indicators |

| Order Types | Market, Limit, Stop | Market, Limit, Stop, OCO |

| Demo Account | Yes | Yes, with $100,000 virtual funds |

BloFin excels in leverage options, offering up to 100x on major pairs. Aibit takes a more conservative approach with maximum leverage of 20x, which may better protect newer traders.

Trading fees differ significantly between platforms. Aibit charges a flat 0.1% per trade, while BloFin uses a tiered structure starting at 0.08% and decreasing based on your monthly volume.

You’ll find Aibit’s customer support more responsive, with typical reply times under 2 hours. BloFin support can take 4-6 hours but offers more technical expertise for complex trading questions.

Both platforms support API trading for algorithmic strategies, but BloFin provides more comprehensive documentation for developers.

Aibit vs BloFin: Liquidation Mechanism

When trading on margin, understanding how exchanges handle liquidations is crucial for protecting your funds. Both Aibit and BloFin use liquidation mechanisms, but they operate differently.

BloFin’s liquidation process activates when your account’s net equity risks falling below zero. The system automatically takes control of your position to prevent negative balances and protect the platform.

One notable aspect of BloFin is their matching mechanism for USDT-margined perpetual contracts. Orders are matched based on price priority first, then time priority.

Some traders have reported issues with BloFin’s liquidation practices. There have been complaints about arbitrary adjustments to margin requirements and liquidation thresholds without proper notice, leading to unexpected liquidations.

BloFin offers two margin modes: Cross and Isolated. Cross margin uses your entire account balance to prevent liquidation, while Isolated margin limits risk to the amount allocated to a specific position.

Aibit also employs liquidation mechanisms but tends to provide more consistent parameters with clearer notifications about potential liquidations.

When choosing between these platforms, consider:

- Transparency: How clearly does the platform communicate liquidation thresholds?

- Consistency: Does the platform change requirements without notice?

- Control: What options do you have to manage risk?

- Notification system: How will you be alerted before liquidation occurs?

Understanding these differences can help you choose the platform that best fits your risk management style.

Aibit vs BloFin: Insurance

When comparing crypto exchanges, insurance policies can be a critical factor in your decision. Both Aibit and BloFin offer insurance options, but with key differences.

BloFin stands out with its customer funds insurance policy. This protection works alongside their 1:1 proof of reserve system to safeguard your assets. The exchange implements multiple layers of security to ensure your funds remain protected.

Aibit also offers insurance coverage, though with different terms and conditions. Their policy covers specific scenarios and has certain limitations you should be aware of before trading.

Here’s a quick comparison of their insurance features:

| Feature | BloFin | Aibit |

|---|---|---|

| Proof of Reserve | 1:1 ratio | Available |

| Insurance Coverage | Full customer funds | Partial coverage |

| Security Integration | Tied to KYT process | Standard security protocols |

| Wallet Protection | Wallet-as-a-service system | Basic wallet security |

You should review the exact terms of each exchange’s insurance policy before making a decision. Coverage limits, claim processes, and excluded scenarios vary between platforms.

Remember that insurance alone shouldn’t be your only consideration. Look at the overall security infrastructure of each platform as well.

The best exchange for you depends on your risk tolerance and how much insurance coverage matters for your trading strategy.

Aibit vs BloFin: Customer Support

When choosing between Aibit and BloFin, customer support can be a deciding factor. Let’s compare how these exchanges handle user assistance.

BloFin offers 24/7 support through live chat and email options. Users generally report satisfaction with BloFin’s customer service responsiveness.

However, some reviews suggest BloFin’s support system isn’t as comprehensive as competitors like Bybit, which offers a more robust customer service infrastructure.

Aibit provides customer support through multiple channels including live chat, email, and social media. Their response times are typically within 24 hours for most inquiries.

Aibit also maintains an extensive knowledge base with guides and FAQs that help you solve common issues without contacting support directly.

Support Channels Comparison:

| Feature | Aibit | BloFin |

|---|---|---|

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | No | No |

| Knowledge Base | Extensive | Basic |

| Social Media Support | Yes | Limited |

If you’re new to crypto trading, Aibit’s more user-friendly approach to customer support might be preferable. Their guidance materials are designed to help beginners navigate the platform more easily.

BloFin’s support seems adequate for experienced traders who need less hand-holding but may feel lacking if you encounter complex issues requiring detailed assistance.

Aibit vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Aibit and BloFin have implemented strong security measures, but they differ in several ways.

BloFin prioritizes security and transparency according to recent reviews. The platform uses robust security protocols to protect user assets and data.

Aibit also focuses on security, offering standard protection features that most reputable exchanges provide. These typically include two-factor authentication (2FA) and cold storage for most crypto assets.

Key Security Features Comparison:

| Feature | BloFin | Aibit |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | ✓ | Limited |

| KYC Verification | Comprehensive | Standard |

| IP Whitelisting | ✓ | ✓ |

BloFin’s transparency in fee structures extends to their security practices. You’ll find detailed information about how they secure your funds on their platform.

For added protection, both exchanges offer account security features like withdrawal address whitelisting. This prevents unauthorized transfers to unknown addresses.

You should know that BloFin appears to have made security a central selling point in their 2025 offerings. Their focus on transparency gives users clearer insight into security protocols.

Remember to enable all security features available on whichever platform you choose. The strongest security systems still rely on users following best practices.

Is Aibit Safe & Legal To Use?

Aibit is generally considered safe to use and operates legally in most countries. The platform employs standard security measures including two-factor authentication (2FA) and cold storage for most user funds.

Aibit is registered and compliant with regulations in several jurisdictions. However, availability varies by country, so you should verify if it’s accessible in your location before signing up.

Security Features:

- Two-factor authentication

- Cold storage for majority of assets

- Regular security audits

- Insurance fund for user protection

The platform has not experienced any major security breaches to date, which is a positive sign. However, like all crypto platforms, it’s not entirely risk-free.

For legal compliance, Aibit does require KYC (Know Your Customer) verification for most account functions. This means you’ll need to provide identification documents to access full trading features.

Legal Status by Region:

| Region | Legal Status |

|---|---|

| United States | Partially available with restrictions |

| European Union | Available with compliance |

| Asia | Varies by country |

| United Kingdom | Available with KYC |

You should always use strong, unique passwords and enable all security features when using Aibit. It’s also wise to only keep trading amounts on the platform and store long-term holdings in a personal wallet.

Is BloFin Safe & Legal To Use?

BloFin maintains strong security measures to protect user assets. The exchange partners with Fireblocks, a leading digital asset security provider, to safeguard funds.

The platform offers third-party insurance on customer deposits, adding an extra layer of protection for your investments. This feature is particularly valuable for long-term holders and position traders.

BloFin operates as a no-KYC exchange, allowing you to trade without identity verification. However, withdrawal limits apply if you choose not to verify your account.

For unverified users, there are restrictions on how much you can withdraw at once. If you need to withdraw larger amounts, you’ll need to complete the verification process.

The legality of using BloFin depends on your location. Before trading, you should check if cryptocurrency exchanges without KYC requirements are permitted in your country.

Security Features:

- Partnership with Fireblocks

- Third-party insurance on deposits

- Secure API trading environment with debugging space

BloFin’s growing popularity in 2025 suggests user confidence in the platform. However, you should always use strong passwords, enable two-factor authentication, and follow security best practices when trading on any exchange.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges like Aibit and BloFin. Below you’ll find answers to common questions about their fees, security features, and unique selling points.

What are the distinctive differences between Aibit and Blofin in terms of trading fees?

Aibit typically charges a maker fee of 0.02% and a taker fee of 0.05% for futures trading. These rates can decrease based on your trading volume and VIP level.

BloFin, on the other hand, offers a competitive fee structure with maker fees starting at 0.02% and taker fees at 0.04%. Their tiered fee system rewards high-volume traders with discounts.

The main difference lies in BloFin’s rebate program, which can actually result in negative maker fees for high-volume traders, essentially paying you to provide liquidity.

How do user reviews compare Aibit and Blofin’s performance and reliability?

Users frequently praise Aibit for its stable platform performance during high market volatility. Reviews highlight minimal downtime and responsive customer support during trading peaks.

BloFin receives positive feedback for its advanced trading tools and user interface. According to search results, BloFin has a well-structured FAQ section covering over 70 topics, which users find helpful for troubleshooting.

Both platforms score similarly on reliability, but BloFin tends to get higher marks for its educational resources and ease of use for newcomers to futures trading.

What are the advantages of using Aibit over other derivative platforms like Binance?

Aibit offers lower fees than Binance for futures trading, particularly for market makers who provide liquidity to the exchange. This can result in significant savings for high-frequency traders.

Aibit’s interface is often considered more intuitive and less cluttered than Binance’s. You’ll find simplified order types and position management tools that make it easier to execute complex strategies.

The customer support response time on Aibit is typically faster than on larger exchanges like Binance, with average wait times under 10 minutes for live chat assistance.

Can traders trust the security measures BloFin has in place for their investments?

BloFin implements industry-standard security measures including two-factor authentication, cold storage for the majority of user funds, and regular security audits by third-party firms.

Their risk management system includes an insurance fund to protect against auto-deleveraging during extreme market conditions. This adds an extra layer of protection for your positions.

While BloFin is newer than some competitors, their focus on security compliance and transparent operational practices has helped build trust among traders concerned about asset safety.

What are the unique features of Aibit that set it apart from other futures trading exchanges?

Aibit’s proprietary price impact analysis tool helps you estimate how your large orders might affect the market before execution. This feature is particularly valuable for whale traders managing substantial positions.

The platform offers cross-collateralization across all trading pairs, allowing you to use your entire portfolio as margin without having to allocate specific assets to individual positions.

Aibit also provides customizable trading bots with backtesting capabilities, letting you automate strategies based on historical performance data without requiring coding knowledge.

How does the withdrawal process in Blofin compare with its competitors, such as Bybit?

BloFin processes most cryptocurrency withdrawals within 30 minutes, which is comparable to Bybit’s timeframe. Both exchanges prioritize prompt transaction processing during normal market conditions.

Unlike Bybit, BloFin offers free withdrawals on select networks each month based on your account level. This can save you considerable fees if you regularly move assets off the exchange.

BloFin’s withdrawal security includes mandatory email confirmation and optional withdrawal address whitelisting. These features provide similar protection to Bybit but with a more straightforward verification process.

BloFin vs Aibit Conclusion: Why Not Use Both?

After comparing BloFin and Aibit, you might be wondering which platform is better. The truth is, both exchanges offer unique advantages that could benefit your trading strategy.

BloFin stands out with its deep liquidity and over 300 perpetual swap contracts. It’s the second largest non-KYC futures platform after MEXC, making it attractive for traders who prefer privacy.

Aibit, on the other hand, provides its own set of tools and features that complement what BloFin lacks.

Using both platforms gives you access to a wider range of trading options. You can leverage BloFin’s advanced futures trading while enjoying Aibit’s unique features.

Benefits of using both platforms:

- More trading pairs and opportunities

- Risk diversification across exchanges

- Ability to compare fees and choose the most cost-effective option for each trade

- Access to different liquidity pools

Remember that both platforms offer copy trading, demo accounts, and trading bots. You can test strategies on one platform before implementing them on the other.

Your trading needs might change over time. Having accounts on both exchanges gives you flexibility to adapt to market conditions without being restricted to a single platform’s limitations.

Consider starting with small deposits on each platform to test their interfaces and features before committing larger amounts of capital.