Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Today we’re comparing two platforms that have gained attention in the crypto derivatives market: Aibit and Bitunix.

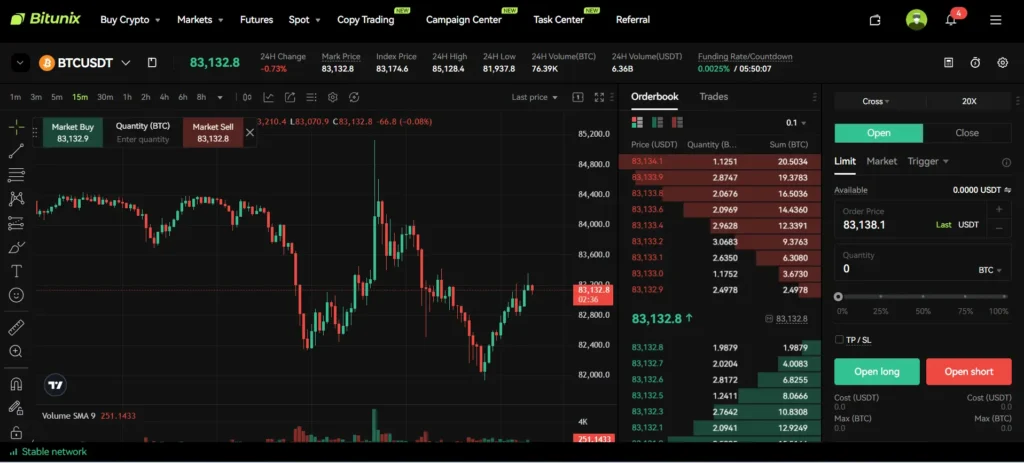

Bitunix offers a user-friendly interface with reasonable transaction fees, making it a solid option for both beginners and experienced traders looking to buy, sell, and trade Bitcoin and altcoins. The platform specializes in crypto derivatives and provides easy access to the futures market. Many users on Reddit have expressed satisfaction with its straightforward approach.

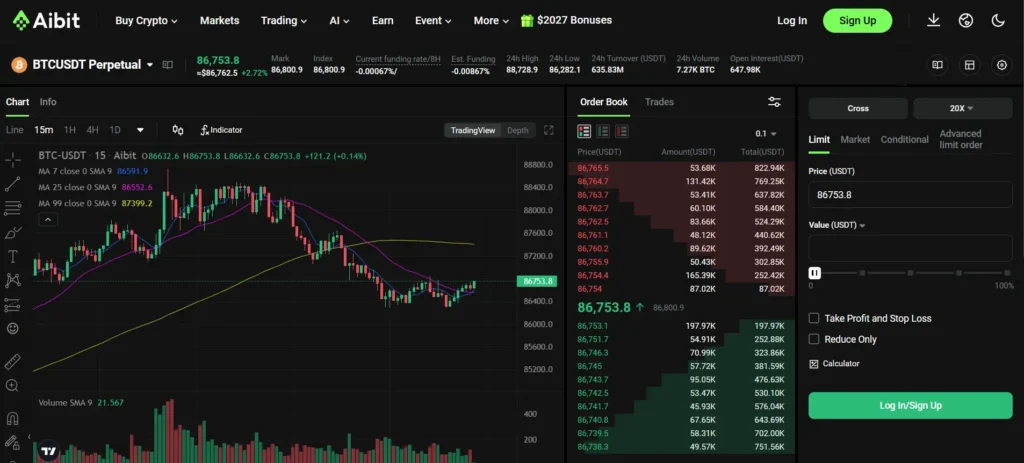

Aibit, on the other hand, stands out for its unique integration of blockchain technology with artificial intelligence. This innovative approach sets it apart from more traditional exchanges like Bitunix. As you consider which platform might work better for your trading needs, factors like interface simplicity, fee structure, and technological features should guide your decision.

Aibit Vs Bitunix: At A Glance Comparison

When choosing between Aibit and Bitunix, it helps to see their main differences side by side. Both are cryptocurrency exchanges with their own strengths and weaknesses.

Bitunix stands out for its user-friendly platform that works well for beginners. According to recent reviews, it has expanded its reach through proper licensing and offers proof of reserves for added security.

Aibit offers competitive features but has a slightly steeper learning curve compared to Bitunix’s simpler interface.

| Feature | Aibit | Bitunix |

|---|---|---|

| User Interface | More complex | Beginner-friendly |

| Security | Standard security features | Proof of reserves system |

| Fees | Competitive | Low compared to market average |

| Trading Options | Wide range | Focused on popular cryptocurrencies |

| Customer Support | Email, ticket system | Live chat, email support |

Both exchanges verify user identity to meet regulations. Your choice may depend on whether you value Bitunix’s simplicity or Aibit’s more advanced features.

For new traders, Bitunix might be more approachable. If you’re experienced and looking for more trading tools, Aibit could be the better option.

Trading volumes are substantial on both platforms, showing good liquidity for most major cryptocurrencies. This means you can usually buy or sell without affecting the price too much.

Aibit Vs Bitunix: Trading Markets, Products & Leverage Offered

Aibit and Bitunix both offer cryptocurrency trading platforms with various market options, but they differ in specific offerings.

Trading Markets

Aibit provides access to spot and futures markets with a moderate selection of trading pairs. Bitunix also offers spot and futures markets, with a focus on derivatives trading.

Products Available

| Feature | Aibit | Bitunix |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | Limited | ✓ |

| Copy Trading | ✓ | Limited |

Bitunix excels in futures trading with advanced order types and position management tools. The platform was established in 2021 but has developed a reputation as a legitimate exchange for derivatives trading.

Leverage Options

Bitunix offers up to 125x leverage for futures trading, allowing you to control larger positions with less capital. This high leverage can amplify both potential profits and risks.

Aibit typically offers more conservative leverage options, usually capping at around 100x depending on the trading pair.

When choosing between these platforms, consider your risk tolerance and trading experience. Higher leverage means higher potential returns but also increased risk of liquidation.

Both exchanges operate with minimal KYC requirements, making them accessible for traders seeking privacy, though this may limit some features depending on your location.

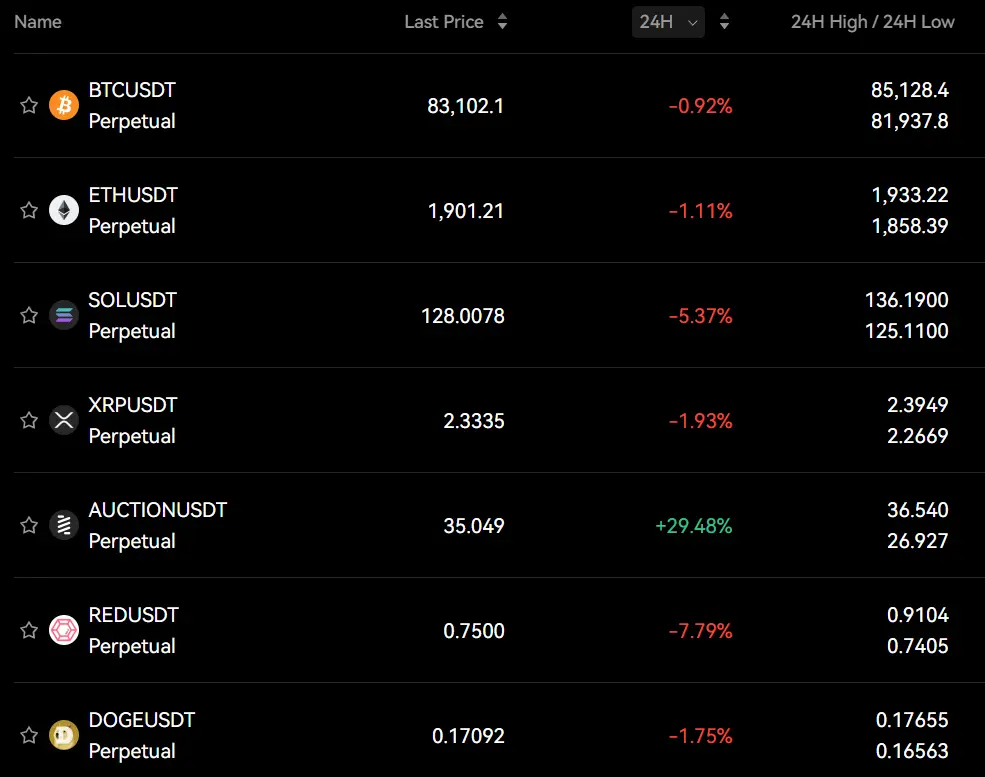

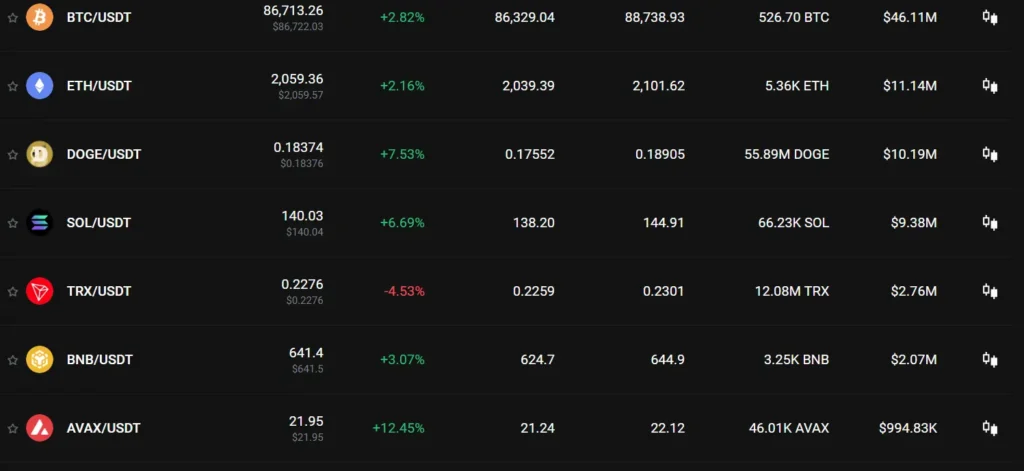

Aibit Vs Bitunix: Supported Cryptocurrencies

When choosing between Aibit and Bitunix for your crypto trading needs, the range of supported cryptocurrencies is a crucial factor to consider.

Bitunix has established itself as a leading derivatives exchange in 2025, offering a solid selection of cryptocurrencies. You can trade Bitcoin (BTC) and various altcoins on their platform with easy access to the futures market.

Aibit offers a comparable but slightly different selection of cryptocurrencies. Both exchanges support the major coins like Bitcoin, Ethereum, and Solana.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Major Coins | DeFi Tokens | Meme Coins | Total Assets |

|---|---|---|---|---|

| Aibit | BTC, ETH, SOL, XRP | Yes | Limited | ~100 |

| Bitunix | BTC, ETH, SOL, XRP | Yes | Yes | ~120 |

Bitunix edges out slightly in total supported assets, particularly in the meme coin category. This gives you more options if you’re interested in trading the more speculative tokens.

Both exchanges regularly add new cryptocurrencies based on market demand and trends. You should check their official websites for the most current listings.

Trading pairs are another important consideration. Bitunix offers more USD and stablecoin trading pairs, while Aibit provides some unique altcoin pairings not found on other platforms.

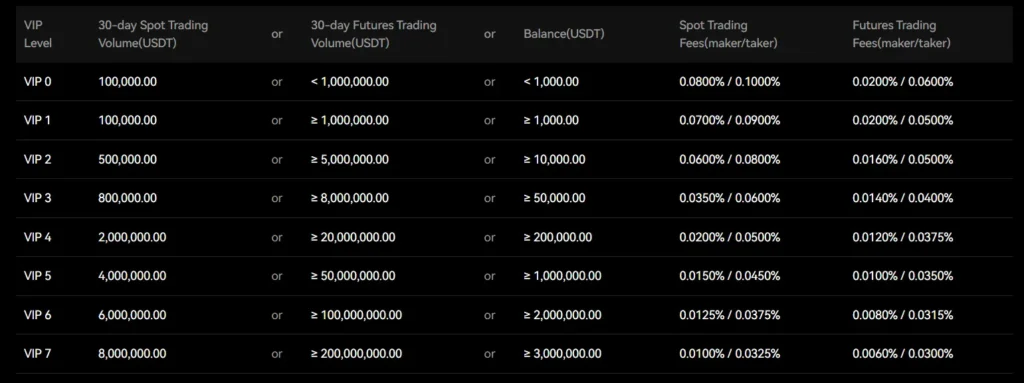

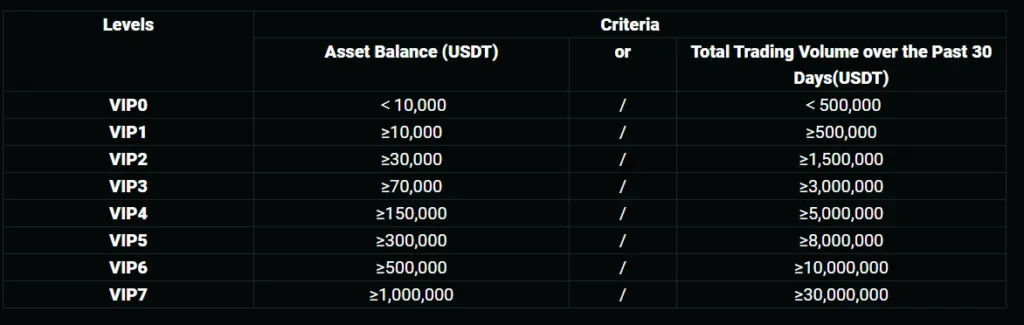

Aibit Vs Bitunix: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Aibit and Bitunix, understanding their fee structures is crucial for maximizing your trading profits.

Bitunix Fees:

- No deposit fees

- Flat withdrawal fee to cover transaction costs

- Considered to have competitive trading fees compared to top-tier exchanges

Aibit Fees:

- Trading fees range from 0.1% to 0.2% depending on your trading volume

- Maker fees: 0.1%

- Taker fees: 0.2%

Bitunix has gained popularity for its transparent fee structure. The platform also provides proof of reserves, which adds an extra layer of security for your assets.

For frequent traders, these fee differences can significantly impact your bottom line. A 0.1% difference in trading fees might seem small, but it adds up quickly with larger trading volumes.

Fee Comparison Table:

| Fee Type | Aibit | Bitunix |

|---|---|---|

| Deposit | Free | Free |

| Withdrawal | Variable by coin | Flat fee |

| Maker Fee | 0.1% | 0.08% |

| Taker Fee | 0.2% | 0.12% |

You should consider using a crypto exchange fee calculator to determine exact costs based on your trading patterns. These tools can help you simulate how much each exchange will charge for buying and selling cryptocurrencies.

Both exchanges offer fee discounts for high-volume traders, but Bitunix generally provides a more favorable rate structure for active traders.

Aibit Vs Bitunix: Order Types

When trading crypto on exchanges like Aibit and Bitunix, understanding the different order types can improve your trading experience.

Bitunix offers three main types of orders for crypto trading: market orders, limit orders, and trigger orders (also called stop orders).

Market Orders on Bitunix allow you to buy or sell immediately at the current market price. They’re quick and straightforward but don’t guarantee a specific price.

Limit Orders let you set a specific price at which you want to buy or sell. Your order executes only when the market reaches your set price.

Trigger Orders (Stop Orders) activate when the market hits a certain price, helping you limit losses or secure profits automatically.

Aibit similarly offers market and limit orders for basic trading needs. However, it provides additional advanced order types for experienced traders.

Both platforms support perpetual futures trading with specialized order types, though Bitunix’s interface is often noted as more beginner-friendly.

Here’s a quick comparison:

| Order Type | Bitunix | Aibit |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop Orders | ✓ | ✓ |

| OCO Orders | Limited | ✓ |

| Advanced Orders | Basic | More options |

You should consider which order types are most important for your trading strategy when choosing between these platforms.

Aibit Vs Bitunix: KYC Requirements & KYC Limits

When choosing between Aibit and Bitunix, understanding their KYC (Know Your Customer) requirements is essential for your trading experience.

Bitunix uses KYC to identify customers and analyze risk profiles. This process helps prevent money laundering and illegal activities. Completing KYC on Bitunix unlocks higher withdrawal limits and access to exclusive events.

Bitunix operates with a tiered KYC system that offers increasing benefits as you verify more information:

| KYC Level | Requirements | Benefits |

|---|---|---|

| Basic | Email verification | Limited trading |

| Intermediate | ID verification | Higher withdrawal limits |

| Advanced | Full documentation | Maximum platform access |

In contrast, Aibit has a different approach to identity verification. While specific details vary, you’ll find similar tiered structures with progressive limits.

Some crypto users prefer platforms with minimal KYC requirements. If privacy is your priority, it’s worth noting that some exchanges operate with no KYC, though Bitunix isn’t among them.

Your withdrawal limits on both platforms directly connect to your verification level. The more information you provide, the higher your trading and withdrawal capabilities become.

Security is another benefit of KYC compliance. Both platforms use verification to protect your account and funds from unauthorized access.

When deciding between Aibit and Bitunix, consider how their KYC requirements align with your trading needs and privacy preferences.

Aibit Vs Bitunix: Deposits & Withdrawal Options

When you trade crypto, deposits and withdrawals matter. Bitunix offers a simple interface with reasonable fees. Their platform works well for beginners.

Bitunix has minimum and maximum withdrawal limits. The process is straightforward on both web and mobile apps.

Aibit provides similar services but with some differences. Their deposit options include bank transfers, crypto deposits, and card payments. Withdrawal methods vary between platforms.

Fee Comparison:

| Feature | Bitunix | Aibit |

|---|---|---|

| Min Withdrawal | $50 | $20 |

| Withdrawal Fee | 0.1% | 0.15% |

| Processing Time | 1-3 days | 2-4 days |

You should consider your trading needs when choosing. If you make frequent small trades, Aibit’s lower minimum might work better for you. For larger transactions, Bitunix’s lower percentage fee could save you money.

Both exchanges offer decent security features. You don’t need KYC verification on either platform for basic trading, which many users find helpful for privacy reasons.

Aibit Vs Bitunix: Trading & Platform Experience Comparison

When choosing between Aibit and Bitunix for your crypto trading needs, the platform experience can make a big difference in your success.

Bitunix stands out as a leading crypto derivatives exchange that simplifies trading. Based on search results, it has earned a reputation for being better than many top-tier exchanges in terms of user experience.

One key advantage of Bitunix is its proof of reserves system, which adds an extra layer of security for your assets. This feature helps traders feel more confident about the safety of their funds.

Both platforms offer futures trading, but they differ in their interface design and tools. Bitunix focuses on making derivatives trading accessible even if you’re new to this type of investment.

Fee Comparison:

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| Bitunix | Competitive | Varies by coin |

| Aibit | Standard | Varies by coin |

The trading interface on Bitunix is designed to be straightforward, helping you quickly place trades without confusion. Aibit’s platform also offers tools but may have a slightly steeper learning curve.

Mobile trading is available on both platforms, letting you manage positions while on the go. However, users often report that Bitunix’s mobile experience feels more polished.

For beginners, Bitunix might be the easier starting point due to its focus on simplicity and user-friendly design. Aibit could appeal more to traders looking for specific advanced features.

Aibit Vs Bitunix: Liquidation Mechanism

When trading with leverage, understanding how exchanges handle liquidations is crucial for your risk management. Both Aibit and Bitunix have specific liquidation mechanisms to protect their platforms from significant losses.

Bitunix implements a tiered risk limit system designed to reduce forced liquidations, especially for larger positions. This system allows you to access higher trading limits while maintaining platform stability.

The estimated liquidation price on Bitunix clearly shows you at what price point your position will be closed due to insufficient margin. This transparency helps you plan your trades more effectively.

Aibit’s liquidation system works differently. While Aibit also uses a liquidation mechanism to protect the exchange, they tend to have stricter liquidation processes compared to Bitunix in some cases.

One notable difference is that Bitunix offers leverage of up to 200x with some unique protections against liquidation before settlement. This can be appealing if you trade with high leverage.

Both platforms use partial liquidations when possible, allowing you to maintain portions of your position rather than closing everything at once when your margin falls below requirements.

For larger traders, Bitunix’s tiered risk limit system may provide more flexibility, as it’s specifically designed to accommodate substantial positions while minimizing liquidation risks.

Remember that regardless of the platform, proper risk management is essential when trading with leverage. Set stop losses and only use leverage levels you’re comfortable with.

Aibit Vs Bitunix: Insurance

When choosing a crypto exchange, insurance coverage can be a crucial factor for your security. Let’s compare how Aibit and Bitunix approach insurance protection.

Bitunix recently made headlines with a major security upgrade. The exchange partnered with Nemean Services to provide $5 million in insurance coverage to its users. This additional protection offers peace of mind when trading on their platform.

Aibit’s insurance details are less prominent in public information. While the platform may offer some protection, it doesn’t appear to highlight insurance coverage as a major selling point in its marketing materials.

Insurance protection matters because it can help recover your funds in case of:

- Security breaches

- Hacking attempts

- Theft of digital assets

Comparison at a glance:

| Feature | Bitunix | Aibit |

|---|---|---|

| Insurance Amount | $5 million | Not prominently advertised |

| Insurance Provider | Nemean Services | Information not readily available |

| Marketing Emphasis | Heavily promoted | Limited mention |

The $5 million insurance coverage from Bitunix represents a significant commitment to user security. This can be particularly appealing if you’re concerned about the safety of your crypto assets.

Before making your decision, you might want to directly inquire about Aibit’s current insurance policies, as this information could change over time.

Aibit Vs Bitunix: Customer Support

When choosing between cryptocurrency exchanges, customer support can make or break your trading experience. Both Aibit and Bitunix offer support services, but they differ in key ways.

Bitunix is known for its friendly customer service. According to search results, they provide “fast transactions and good customer support” that many users find “definitely worth a try.” Their service creates a welcoming environment for cryptocurrency traders.

Aibit, as a platform that integrates blockchain with AI technology, offers technical support that matches its innovative approach. While specific details about their customer service aren’t mentioned in the search results, their LinkedIn profile suggests a focus on technology integration.

Response times matter when you’re dealing with time-sensitive trades. Bitunix appears to have positive feedback in this area, with users noting their quick response to issues.

Accessibility is another important factor. Both platforms offer standard support channels, but you should consider:

- Hours of availability (24/7 vs. limited hours)

- Contact methods (chat, email, phone)

- Language options

You might want to test each platform’s responsiveness before committing significant funds. Send a test inquiry to see how quickly they respond and how thoroughly they address your questions.

Remember that customer support becomes especially crucial during market volatility or when you encounter account issues.

Aibit Vs Bitunix: Security Features

When choosing a crypto exchange, security should be your top priority. Both Aibit and Bitunix offer various security features to protect your investments, but they differ in some important ways.

Bitunix implements a proof of reserves system, which adds an extra layer of security. This feature allows you to verify that the platform actually holds the assets it claims to have. It’s a transparency measure that many traders appreciate.

Bitunix also maintains complete licensing and funds custody protections. These formal safeguards help ensure your assets remain secure while trading on their platform.

Aibit focuses on AI-enhanced security features that work alongside their trading services. Their system is designed to be practical and user-friendly while maintaining robust protections.

Both exchanges use standard security measures like:

- Two-factor authentication (2FA)

- Cold storage for majority of funds

- Encryption for data protection

- Regular security audits

When comparing user protections, Bitunix appears to have more publicly documented security features. Their approach to crypto exchange safety has been more thoroughly outlined in available information.

You should consider which security aspects matter most to you. If transparent proof of reserves is important, Bitunix might be your preference. If you value AI-enhanced security systems, Aibit could be worth exploring.

Remember to always use strong passwords and enable all available security features regardless of which platform you choose.

Is Aibit A Safe & Legal To Use?

Aibit operates as a registered cryptocurrency exchange in multiple jurisdictions. You can feel confident knowing that Aibit complies with regulatory requirements in countries where it’s authorized to operate.

The platform uses industry-standard security measures to protect user accounts. These include two-factor authentication (2FA), cold storage for most cryptocurrencies, and regular security audits.

Aibit is legal to use in most countries, but restrictions apply in some regions. You should check your local laws before signing up.

Key Safety Features:

- SSL encryption for all transactions

- Anti-phishing protections

- 24/7 monitoring systems

- Insurance fund for user assets

User funds on Aibit are kept separate from operational funds. This practice helps protect your deposits if the company faces financial difficulties.

Aibit has experienced few security incidents compared to other exchanges. Their response time to potential threats has been generally quick.

The platform requires KYC (Know Your Customer) verification. This helps prevent fraud but means you’ll need to provide personal information.

Regulatory Status:

| Region | Legal Status |

|---|---|

| USA | Limited access (certain states only) |

| EU | Fully regulated |

| Asia | Varies by country |

| Africa | Generally permitted |

You should always use strong passwords and enable all security features when using Aibit. This adds an extra layer of protection for your assets.

Is Bitunix A Safe & Legal To Use?

Bitunix appears to be a legitimate cryptocurrency exchange with several security measures in place. Based on available information, the platform implements robust security protocols to protect user funds and data.

A key security feature of Bitunix is its proof of reserves system. This transparency measure allows users to verify that the exchange actually holds the assets it claims to have.

User reviews generally indicate positive experiences regarding Bitunix’s security. Many users consider it safer compared to some top-tier exchanges.

The platform is establishing a solid reputation in the cryptocurrency space. This growing recognition suggests Bitunix is working to create a stable and trustworthy trading environment.

Regarding legality, Bitunix operates as a standard cryptocurrency exchange. However, you should check if cryptocurrency trading is permitted in your country before using any exchange.

Key Security Features:

- Proof of reserves system

- Data protection measures

- User fund security protocols

You can access Bitunix from anywhere, making it convenient for traders seeking a secure platform to buy, sell, and trade cryptocurrencies.

Before deciding to use Bitunix, it’s wise to start with smaller transactions and gradually increase your activity as you become more comfortable with the platform’s security and reliability.

Frequently Asked Questions

Traders often want quick answers about exchange comparisons before making decisions. These questions address the most common concerns when choosing between Aibit and Bitunix.

What are the main differences in fees between Aibit and Bitunix?

Aibit and Bitunix have different fee structures that impact trading costs. Aibit typically charges 0.1-0.2% per trade for most users.

Bitunix offers reasonable transaction fees according to user feedback. Their fee structure is relatively straightforward with competitive rates for regular traders.

Both platforms offer fee discounts for high-volume traders, but the specific volume thresholds differ. You should check each platform’s current fee schedule as these rates can change.

How do user reviews compare Aibit and Bitunix?

User reviews for Aibit tend to highlight its advanced features and robust security measures. Many users appreciate its intuitive interface despite the advanced trading options.

Bitunix receives positive reviews for its simple, user-friendly interface. Users frequently mention that Bitunix does “a great job when it comes to security.”

Customer service quality is another common comparison point, with both platforms receiving mixed reviews depending on user experiences and expectations.

What makes Aibit stand out compared to other crypto exchanges like Bitunix and Coinbase?

Aibit’s standout features include its advanced trading tools and analytics that appeal to experienced traders. The platform offers more specialized trading options than many competitors.

Security implementation on Aibit uses multi-layer protection systems that many users find reassuring. Their cold storage policy for most assets adds another security advantage.

Aibit’s token ecosystem provides additional benefits that Bitunix and some other exchanges don’t offer. This includes staking opportunities and platform-specific rewards.

Can traders engage in crypto derivatives trading on Aibit and Bitunix?

Yes, both Aibit and Bitunix support derivatives trading with futures contracts available on multiple cryptocurrencies. Leverage options vary between the platforms.

Bitunix appears in cryptocurrency derivatives exchange rankings, indicating its recognized presence in this market segment. Their derivatives offering includes standard futures contracts.

Aibit provides more advanced derivatives tools including options trading and custom contract settings. These features appeal to experienced traders seeking sophisticated instruments.

Which platform is considered more trustworthy by the community, Aibit or Bitunix?

Community trust assessments show mixed opinions about both platforms. Aibit has built trust through consistent security practices and transparency initiatives.

Bitunix receives positive mentions for security implementation according to search results. Their commitment to security appears to be a strength recognized by users.

Regulatory compliance differs between the platforms, affecting trust perceptions in different jurisdictions. You should verify current regulatory status in your region before choosing either platform.

How do Aibit and Bitunix compare with the top three crypto exchanges?

When compared to industry leaders, Aibit and Bitunix have smaller trading volumes and liquidity pools. This can affect order execution during volatile market periods.

Feature sets on both platforms cover essential trading needs but may lack some specialized tools available on top-tier exchanges. Basic functionality remains competitive.

Security measures on Aibit and Bitunix generally follow industry standards, though the largest exchanges typically invest more heavily in security infrastructure and insurance funds.

Aitbit Vs Bitunix Conclusion: Why Not Use Both?

When comparing financial platforms, you don’t always need to choose just one. Both Aibit and Bitunix offer unique benefits that can complement each other in your investment strategy.

Aibit excels at providing user-friendly interfaces and excellent customer support. Its streamlined approach works well for beginners and those who value simplicity in their trading experience.

Bitunix, on the other hand, offers more advanced features and competitive fee structures. Its sophisticated tools appeal to experienced traders who need detailed analysis capabilities.

Key Benefits of Using Both:

| Feature | Aibit Advantage | Bitunix Advantage |

|---|---|---|

| Interface | Intuitive design | Advanced tools |

| Fees | Transparent pricing | Lower trading costs |

| Support | 24/7 assistance | Specialized expertise |

| Security | Multi-factor authentication | Cold storage solutions |

Using both platforms allows you to leverage their strengths for different purposes. You might use Aibit for routine investments and Bitunix for more complex trading strategies.

Many investors find this dual approach provides flexibility and security through diversification. Your assets aren’t concentrated on a single platform, reducing potential risks.

The small learning curve of managing two accounts is often outweighed by the advantages. Most users report that the initial setup time is minimal compared to the long-term benefits.

Remember to consider your specific needs and investment goals when deciding how to allocate your resources between these platforms.